SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

Index

| Company Information |

|

| Capital Structure |

1 |

| Parent Company Financial Interim Accounting Information |

|

| Statement of Financial Position - Assets |

2 |

| Statement of Financial Position - Liabilities |

3 |

| Interim Income Statement |

4 |

| Interim Statement of Comprehensive Income |

5 |

| Interim Statement of Cash Flows |

6 |

| Interim Statement of Changes in Shareholders’ Equity |

7 |

| Interim Statement of Added Value |

9 |

| Consolidated Interim Financial Statements |

|

| Statement of Financial Position - Assets |

10 |

| Statement of Financial Position - Liabilities |

11 |

| Interim Income Statement |

12 |

| Interim Statement of Comprehensive Income |

13 |

| Interim Statement of Cash Flows |

14 |

| Interim Statement of Changes in Shareholders’ Equity |

15 |

| Interim Statement of Added Value |

17 |

| Notes to the Financial Statements |

18 |

| Reports and Statements |

|

| Independent Auditors’ Report |

65 |

| Statement of Directors on Interim Accounting Information |

67 |

| Statement of Directors on Auditor's Report |

68 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

Company Information / Capital Structure

|

Number of Shares

(Units) |

Current Period

9/30/2024 |

|

| Paid-in Capital |

|

|

| Common |

1,326,093,947 |

|

| Preferred |

0 |

|

| Total |

1,326,093,947 |

|

| Treasury Shares Acquired |

|

|

| Common |

0 |

|

| Preferred |

0 |

|

| Total |

0 |

|

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Financial Statement - Statement of Financial Position -Assets |

| (R$ thousand) |

| |

| Account Code |

Description |

09/30/2024 |

12/31/2023 |

| 1 |

Total Assets |

63,228,878 |

60,462,818 |

| 1.01 |

Current Assets |

15,077,359 |

13,769,870 |

| 1.01.01 |

Cash and Cash Equivalents |

1,472,672 |

2,270,070 |

| 1.01.02 |

Financial Investments |

1,012,994 |

1,524,709 |

| 1.01.02.01 |

Financial Investments Measured a Fair Value Through Profit or Loss |

984,893 |

1,493,204 |

| 1.01.02.01.03 |

Financial Investments Measured a Fair Value Through Profit or Loss – Usiminas’ Shares |

984,893 |

1,493,204 |

| 1.01.02.03 |

Financial Investments at Amortized Cost |

28,101 |

31,505 |

| 1.01.03 |

Trade Receivables |

1,641,020 |

1,870,367 |

| 1.01.04 |

Inventory |

7,017,344 |

6,168,584 |

| 1.01.06 |

Recoverable Taxes |

847,842 |

855,663 |

| 1.01.08 |

Other Current Assets |

3,085,487 |

1,080,477 |

| 1.01.08.03 |

Others |

3,085,487 |

1,080,477 |

| 1.01.08.03.03 |

Derivative Financial Instruments |

- |

12,122 |

| 1.01.08.03.04 |

Prepaid Expenses |

182,494 |

248,688 |

| 1.01.08.03.06 |

Dividends Receivable |

2,625,583 |

562,938 |

| 1.01.08.03.07 |

Others |

277,410 |

256,729 |

| 1.02 |

Non-Current Assets |

48,151,519 |

46,692,948 |

| 1.02.01 |

Long-Term Assets |

12,077,503 |

10,545,374 |

| 1.02.01.03 |

Financial Investments at Amortized Cost |

125,306 |

111,350 |

| 1.02.01.07 |

Deferred Taxes |

4,846,366 |

3,213,410 |

| 1.02.01.10 |

Other Non-Current Assets |

7,105,831 |

7,220,614 |

| 1.02.01.10.03 |

Recoverable Taxes |

1,845,270 |

1,820,866 |

| 1.02.01.10.04 |

Judicial Deposits |

202,967 |

210,833 |

| 1.02.01.10.05 |

Prepaid Expenses |

43,000 |

64,659 |

| 1.02.01.10.06 |

Receivable from Related Parties |

4,188,576 |

3,889,117 |

| 1.02.01.10.07 |

Others |

826,018 |

1,235,139 |

| 1.02.02 |

Investments |

26,992,722 |

27,800,877 |

| 1.02.02.01 |

Equity Interest |

26,856,617 |

27,663,116 |

| 1.02.02.02 |

Investment Property |

136,105 |

137,761 |

| 1.02.03 |

Property, Plant and Equipment |

9,022,257 |

8,288,815 |

| 1.02.03.01 |

Property, Plant and Equipment in Operation |

7,567,724 |

7,468,574 |

| 1.02.03.02 |

Right of Use in Leases |

40,113 |

6,067 |

| 1.02.03.03 |

Property, Plant and Equipment in Progress |

1,414,420 |

814,174 |

| 1.02.04 |

Intangible Assets |

59,037 |

57,882 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

|

Parent Company Interim Financial Statement - Statement of Financial Position

–

Liabilities |

| (R$ thousand) |

|

|

|

| Account Code |

Description |

09/30/2024 |

12/31/2023 |

| 2 |

Total Liabilities |

63,228,878 |

60,462,818 |

| 2.01 |

Current Liabilities |

14,888,262 |

15,031,033 |

| 2.01.01 |

Payroll and Related Taxes |

241,012 |

172,098 |

| 2.01.02 |

Trade Payables |

3,822,473 |

3,976,931 |

| 2.01.03 |

Taxes Obligations |

199,907 |

175,576 |

| 2.01.04 |

Current Debt |

6,416,850 |

5,588,464 |

| 2.01.05 |

Other Payables |

4,188,249 |

5,102,736 |

| 2.01.05.02 |

Others |

4,188,249 |

5,102,736 |

| 2.01.05.02.01 |

Dividends and Interest on Capital Payable |

5,740 |

5,230 |

| 2.01.05.02.04 |

Advances from Customers |

324,853 |

277,764 |

| 2.01.05.02.09 |

Trade Payables – Forfaiting |

2,957,294 |

3,980,003 |

| 2.01.05.02.10 |

Lease Liabilities |

10,796 |

6,523 |

| 2.01.05.02.11 |

Other Payables |

889,566 |

833,216 |

| 2.01.06 |

Provisions |

19,771 |

15,228 |

| 2.01.06.01 |

Provision for Tax, Social Security, Labor and Civil Risks |

19,771 |

15,228 |

| 2.02 |

Non-Current Liabilities |

34,922,276 |

27,931,110 |

| 2.02.01 |

Current Debt |

22,641,102 |

18,102,841 |

| 2.02.02 |

Other Payables |

1,472,232 |

848,817 |

| 2.02.02.02 |

Others |

1,472,232 |

848,817 |

| 2.02.02.02.03 |

Advances from Customers |

551,497 |

709,495 |

| 2.02.02.02.06 |

Derivative Financial Instruments |

68,176 |

- |

| 2.02.02.02.07 |

Lease Liabilities |

29,881 |

476 |

| 2.02.02.02.08 |

Trade Payables |

94,916 |

11,184 |

| 2.02.02.02.09 |

Other Payables |

727,762 |

127,662 |

| 2.02.04 |

Provisions |

10,808,942 |

8,979,452 |

| 2.02.04.01 |

Provision for Tax, Social Security, Labor and Civil Risks |

350,996 |

312,180 |

| 2.02.04.02 |

Other Provisions |

10,457,946 |

8,667,272 |

| 2.02.04.02.03 |

Provision for Environmental Liabilities and Decommissioning of Assets |

150,587 |

160,968 |

| 2.02.04.02.04 |

Pension and Healthcare Plan |

513,180 |

481,118 |

| 2.02.04.02.05 |

Provision for Losses on Investments |

9,794,179 |

8,025,186 |

| 2.03 |

Shareholders’ Equity |

13,418,340 |

17,500,675 |

| 2.03.01 |

Paid-up Capital |

10,240,000 |

10,240,000 |

| 2.03.02 |

Capital Reserves |

32,720 |

32,720 |

| 2.03.04 |

Earnings Reserves |

5,121,236 |

6,071,236 |

| 2.03.04.01 |

Legal Reserve |

1,158,925 |

1,158,925 |

| 2.03.04.02 |

Statutory Reserve |

3,962,311 |

4,912,311 |

| 2.03.05 |

Accumulated Earnings (Losses) |

(1,958,817) |

- |

| 2.03.08 |

Other Comprehensive Income |

(16,799) |

1,156,719 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Income Statement |

| (R$ thousand) |

|

| Account Code |

Description |

Accumulated of the Current Period 07/01/2024 to 09/30/2024 |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 07/01/2023 to 09/30/2023 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 3.01 |

Net Operating Revenue |

5,073,830 |

13,945,349 |

4,613,663 |

13,961,806 |

| 3.02 |

Cost of Goods Sold and Services Rendered |

(4,758,178) |

(13,313,207) |

(4,516,482) |

(13,218,969) |

| 3.03 |

Gross Profit |

315,652 |

632,142 |

97,181 |

742,837 |

| 3.04 |

Operating (Expenses)/Income |

(310,106) |

(1,333,437) |

32,747 |

(611,167) |

| 3.04.01 |

Selling Expenses |

(210,872) |

(624,542) |

(197,941) |

(593,908) |

| 3.04.02 |

General and Administrative Expenses |

(91,003) |

(282,179) |

(80,533) |

(217,154) |

| 3.04.04 |

Other Operating Income |

32,646 |

135,453 |

(20,288) |

(7,748) |

| 3.04.05 |

Other Operating Expenses |

(223,849) |

(668,327) |

(96,672) |

(1,198,684) |

| 3.04.06 |

Equity Results in Associate Companies |

182,972 |

106,158 |

428,181 |

1,406,327 |

| 3.05 |

Income Before Financial Results and Income Taxes |

5,546 |

(701,295) |

129,928 |

131,670 |

| 3.06 |

Financial Results |

(1,167,198) |

(2,126,000) |

(549,814) |

(1,883,384) |

| 3.06.01 |

Financial Income |

96,378 |

431,365 |

67,137 |

331,013 |

| 3.06.02 |

Financial Expenses |

(1,263,576) |

(2,557,365) |

(616,951) |

(2,214,397) |

| 3.06.02.01 |

Foreign Exchange, net |

(310,529) |

(40,902) |

104,325 |

(132,145) |

| 3.06.02.02 |

Financial Expenses |

(953,047) |

(2,516,463) |

(721,276) |

(2,082,252) |

| 3.07 |

Income Before Income Taxes |

(1,161,652) |

(2,827,295) |

(419,886) |

(1,751,714) |

| 3.08 |

Income Tax and Social Contribution |

321,315 |

868,478 |

265,406 |

854,441 |

| 3.08.01 |

Current |

- |

- |

(2,346) |

179,100 |

| 3.08.02 |

Deferred |

321,315 |

868,478 |

267,752 |

675,341 |

| 3.09 |

Net Income from Continuing Operations |

(840,337) |

(1,958,817) |

(154,480) |

(897,273) |

| 3.11 |

Net Income/(Loss) for the Period |

(840,337) |

(1,958,817) |

(154,480) |

(897,273) |

| 3.99 |

Income per Share |

|

|

|

|

| 3.99.01 |

Basic Income per Share |

|

|

|

|

| 3.99.01.01 |

Ordinary Shares |

(0.63369) |

(1.47713) |

(0.11649) |

(0.67663) |

| 3.99.02 |

Diluted Income per Share |

|

|

|

|

| 3.99.02.01 |

Ordinary Shares |

(0.63369) |

(1.47713) |

(0.11649) |

(0.67663) |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Statement of Comprehensive Income |

| (R$ thousand) |

| Account Code |

Description |

Accumulated of the Current Period 07/01/2024 to 09/30/2024 |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 07/01/2023 to 09/30/2023 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 4.01 |

Net Income/(Loss) for the Period |

(840,337) |

(1,958,817) |

(154,480) |

(897,273) |

| 4.02 |

Other Comprehensive Income |

447,968 |

(971,137) |

(550,424) |

798,878 |

| 4.02.01 |

Actuarial Gains (Losses) on Defined Benefits Plans, net |

41 |

(1,297) |

6,218 |

7,560 |

| 4.02.04 |

Cumulative Translation Adjustments for the Period |

73,465 |

452,670 |

24,382 |

(173,711) |

| 4.02.11 |

Gains/(Losses) on Cash Flow Hedge, net - Recognized on Shareholders' Equity |

312,401 |

(1,476,000) |

(412,890) |

476,649 |

| 4.02.13 |

Gains/(Losses) on Cash Flow Hedge, net - Reclassified to Profit and Losses |

771 |

(7,987) |

1,151 |

240,886 |

| 4.02.15 |

Gains/(Losses) on Cash Flow Hedge, net - Share of Other Comprehensive Income of Equity-Accounted Investments |

61,290 |

61,477 |

(169,285) |

247,494 |

| 4.03 |

Comprehensive Income for the Period |

(392,369) |

(2,929,954) |

(704,904) |

(98,395) |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Statement of Cash Flows |

| (R$ thousand) |

| Account Code |

Description |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 6.01 |

Net cash provided by operating activities |

(925,154) |

689,607 |

| 6.01.01 |

Cash provided by operating activities |

(175,473) |

(370,145) |

| 6.01.01.01 |

Net income for the period |

(1,958,818) |

(897,273) |

| 6.01.01.02 |

Interest on loans and borrowings paid |

1,307,125 |

1,303,753 |

| 6.01.01.03 |

Interest on loans and borrowings granted |

(165,671) |

(184,796) |

| 6.01.01.04 |

Depreciation, amortization and depletion |

983,338 |

871,377 |

| 6.01.01.05 |

Equity Results in Associate Companies |

(99,504) |

(1,406,327) |

| 6.01.01.06 |

Deferred Taxes |

(868,478) |

(675,341) |

| 6.01.01.08 |

Provision for tax, social security, labor, civil and environmental risks |

43,359 |

(79,992) |

| 6.01.01.09 |

Foreign exchange, net |

80,674 |

600,634 |

| 6.01.01.10 |

Updated shares – fair value through profit or loss |

542,108 |

105,438 |

| 6.01.01.12 |

Write-off and Estimated Losses net of Reversal |

- |

659 |

| 6.01.01.13 |

Allowance for credit loss on trade and other receivables, net |

(10,381) |

12,156 |

| 6.01.01.14 |

Charges on lease liabilities |

1,233 |

897 |

| 6.01.01.15 |

Provision for consumption and services |

(28,600) |

10,539 |

| 6.01.01.18 |

Dividends receveid from Usiminas |

(44,912) |

(51,152) |

| 6.01.01.19 |

Other Provisions |

43,054 |

19,283 |

| 6.01.02 |

Decrease/(increase) in assets and decrease/(increase) in liabilities |

(749,681) |

1,059,752 |

| 6.01.02.01 |

Trade receivables - third parties |

(168,781) |

439 |

| 6.01.02.02 |

Trade receivables - related party |

716,897 |

73,131 |

| 6.01.02.03 |

Inventory |

(937,038) |

1,592,293 |

| 6.01.02.04 |

Other receivables from related parties |

1,153,746 |

1,977,499 |

| 6.01.02.05 |

Recoverable Taxes |

(16,581) |

(27,816) |

| 6.01.02.06 |

Judicial Deposits |

7,866 |

20,831 |

| 6.01.02.07 |

Cash received on settlement of derivatives, net |

(16,757) |

15,918 |

| 6.01.02.09 |

Trade Payables |

18,237 |

330,555 |

| 6.01.02.10 |

Trade Payables – Forfaiting |

(1,022,709) |

(2,626,734) |

| 6.01.02.11 |

Payroll and related taxes |

68,918 |

60,730 |

| 6.01.02.12 |

Taxes Obligations |

21,062 |

(204,343) |

| 6.01.02.14 |

Payables to related parties |

54,248 |

22,549 |

| 6.01.02.16 |

Interest paid |

(1,158,345) |

(1,002,965) |

| 6.01.02.17 |

Interest received |

1,391 |

2,271 |

| 6.01.02.18 |

Advances from Customers |

- |

783,181 |

| 6.01.02.19 |

Others |

528,165 |

42,213 |

| 6.02 |

Net cash used in investing activities |

(1,932,904) |

(1,502,741) |

| 6.02.01 |

Decrease (increase) in investments in investees |

(143,953) |

(223,134) |

| 6.02.02 |

Acquisition of PP&E, intangible assets and investment properties |

(1,643,683) |

(1,128,242) |

| 6.02.08 |

Intercompany loans granted |

(138,603) |

(172,933) |

| 6.02.09 |

Intercompany loans received |

3,888 |

3,888 |

| 6.02.11 |

Financial investments, net |

(10,553) |

17,680 |

| 6.03 |

Net cash used in financing activities |

2,060,660 |

(62,804) |

| 6.03.01 |

Loans and borrowings from third parties |

3,585,289 |

6,173,886 |

| 6.03.02 |

Transactions cost - borrowings and financing |

(47,584) |

(48,999) |

| 6.03.03 |

Loans and borrowings from related parties |

2,487,558 |

153,864 |

| 6.03.04 |

Repayment of leases |

(2,166,531) |

(8,300) |

| 6.03.05 |

Repayment of principal from third parties' debt |

(839,238) |

(3,374,823) |

| 6.03.06 |

Repayment of principal from related parties' debt |

(949,389) |

(744,185) |

| 6.03.07 |

Dividends and interest on capital paid to CSN's shareholdes |

(9,445) |

(2,214,247) |

| 6.05 |

Increase (decrease) in cash and cash equivalents |

(797,398) |

(875,938) |

| 6.05.01 |

Cash and cash equivalents in the beginning of the period e end of the period |

2,270,070 |

2,839,405 |

| 6.05.02 |

Cash and equivalents at the end of the period |

1,472,672 |

1,963,467 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Statement of Changes in Shareholders’ Equity - 01/01/2024 to 09/30/2024 |

| (R$ thousand) |

|

|

|

|

|

| Account

Code |

Description |

Paid-up

Capital |

Capital

Reserve, Granted Options and Treasury Shares |

Earnings

Reserve |

Retained

Earnings (Accumulated Losses) |

Other

Comprehensive Income |

Shareholders’

Equity |

| 5.01 |

Balance

at the Beginning of the Period |

10,240,000 |

32,720 |

6,071,236 |

- |

1,156,719 |

17,500,675 |

| 5.02 |

Prior

Year Adjustment |

- |

- |

- |

- |

- |

- |

| 5.03 |

Adjusted

Opening Balances |

10,240,000 |

32,720 |

6,071,236 |

- |

1,156,719 |

17,500,675 |

| 5.04 |

Capital

Transaction with Shareholders |

- |

- |

(950,000) |

- |

(202,381) |

(1,152,381) |

| 5.05 |

Total

Comprehensive Income |

- |

- |

- |

(1,958,817) |

(971,137) |

(2,929,954) |

| 5.05.01 |

Net

Income/(Loss) for the Period |

- |

- |

- |

(1,958,817) |

- |

(1,958,817) |

| 5.05.02 |

Other

Comprehensive Income |

- |

- |

- |

- |

(971,137) |

(971,137) |

| 5.05.02.04 |

Translation

Adjustments |

- |

- |

- |

- |

452,670 |

452,670 |

| 5.05.02.06 |

Actuarial

Gains/(Losses) on Pension Plan, net of Taxes |

- |

- |

- |

- |

(1,297) |

(1,297) |

| 5.05.02.07 |

(Loss)

/ Gain on Cash Flow Hedge Accounting, net of Taxes |

- |

- |

- |

- |

(1,422,510) |

(1,422,510) |

| 5.06 |

Changes

in Shareholders' Equity |

- |

- |

- |

- |

- |

- |

| 5.07 |

Balance

at the End of the Period |

10,240,000 |

32,720 |

5,121,236 |

(1,958,817) |

(16,799) |

13,418,340 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Statement of Changes in Shareholders’ Equity - 01/01/2023 to 09/30/2023 |

| Account

Code |

Description |

Paid-up

Capital |

Capital

Reserve, Granted Options and Treasury Shares |

Earnings

Reserve |

Retained

Earnings (Accumulated Losses) |

Other

Comprehensive Income |

Shareholders’

Equity |

| 5.01 |

Balance

at the Beginning of the Period |

10,240,000 |

32,720 |

8,988,442 |

- |

228,305 |

19,489,467 |

| 5.02 |

Prior

Year Adjustment |

- |

- |

- |

- |

- |

- |

| 5.03 |

Adjusted

Opening Balances |

10,240,000 |

32,720 |

8,988,442 |

- |

228,305 |

19,489,467 |

| 5.04 |

Capital

Transaction with Shareholders |

- |

- |

(1,614,000) |

- |

(14,544) |

(1,628,544) |

| 5.04.06 |

Dividends |

- |

- |

(1,614,000) |

- |

- |

(1,614,000) |

| 5.04.08 |

(Loss)

/ gain on the percentage change in investments |

- |

- |

- |

- |

(14,544) |

(14,544) |

| 5.05 |

Total

Comprehensive Income |

- |

- |

- |

(897,273) |

798,878 |

(98,395) |

| 5.05.01 |

Net

Income/(Loss) for the Period |

- |

- |

- |

(897,273) |

- |

(897,273) |

| 5.05.02 |

Other

Comprehensive Income |

- |

- |

- |

- |

798,878 |

798,878 |

| 5.05.02.04 |

Translation

Adjustments |

- |

- |

- |

- |

(173,711) |

(173,711) |

| 5.05.02.06 |

Actuarial

Gains/(Losses) on Pension Plan, net of Taxes |

- |

- |

- |

- |

7,560 |

7,560 |

| 5.05.02.07 |

(Loss)

/ Gain on Cash Flow Hedge Accounting, net of Taxes |

- |

- |

- |

- |

965,029 |

965,029 |

| 5.06 |

Changes

in Shareholders' Equity |

- |

- |

- |

- |

- |

- |

| 5.07 |

Balance

at the End of the Period |

10,240,000 |

32,720 |

7,374,442 |

(897,273) |

1,012,639 |

17,762,528 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Parent Company Interim Statement of Added Value |

| (R$ thousand) |

| Account Code |

Description |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 7.01 |

Revenues |

16,860,309 |

16,838,916 |

| 7.01.01 |

Sales of Products and Rendering of Services |

16,815,727 |

16,839,075 |

| 7.01.02 |

Other Revenues |

64,624 |

(6,225) |

| 7.01.04 |

Allowance (Reversal) for Expect Credit Losses |

(20,042) |

6,066 |

| 7.02 |

Inputs Acquired from Third Parties |

(12,030,585) |

(15,996,013) |

| 7.02.01 |

Cost of Sales and Services |

(10,953,809) |

(14,958,584) |

| 7.02.02 |

Materials, Electric Power, Outsourcing and Other |

(985,134) |

(979,656) |

| 7.02.03 |

Impairment / Reversals of Assets |

(91,642) |

(57,773) |

| 7.03 |

Gross Added Value |

4,829,724 |

842,903 |

| 7.04 |

Retentions |

(982,697) |

(870,757) |

| 7.04.01 |

Depreciation, Amortization and Depletion |

(982,697) |

(870,757) |

| 7.05 |

Net Added Value Produced |

3,847,027 |

(27,854) |

| 7.06 |

Transferred Added Value |

27,623 |

1,998,589 |

| 7.06.01 |

Share of Profit of Equity-Accounted Investments |

106,158 |

1,406,327 |

| 7.06.02 |

Financial Income |

(76,946) |

331,013 |

| 7.06.03 |

Others |

(1,589) |

261,249 |

| 7.06.03.01 |

Other and Exchange Gains |

(1,589) |

261,249 |

| 7.07 |

Total Added Value to be Distributed |

3,874,650 |

1,970,735 |

| 7.08 |

Distribution of Added Value |

3,874,650 |

1,970,735 |

| 7.08.01 |

Employee Compensation |

1,212,092 |

580,788 |

| 7.08.01.01 |

Salaries |

924,172 |

452,375 |

| 7.08.01.02 |

Fringe Benefits |

235,635 |

103,876 |

| 7.08.01.03 |

Unemployment Benefits (FGTS) |

52,285 |

24,537 |

| 7.08.02 |

Taxes, Fees and Contributions |

2,568,236 |

(192,103) |

| 7.08.02.01 |

Federal |

1,315,100 |

(368,913) |

| 7.08.02.02 |

State |

1,253,136 |

176,810 |

| 7.08.03 |

Return on Third-Party Capital |

2,053,140 |

2,479,323 |

| 7.08.03.01 |

Interest |

1,619,426 |

1,787,347 |

| 7.08.03.02 |

Rental Expenses |

5,674 |

3,676 |

| 7.08.03.03 |

Others |

428,040 |

688,300 |

| 7.08.04 |

Return on Shareholders' Equity |

(1,958,818) |

(897,273) |

| 7.08.04.03 |

Retained Earnings / (Losses) for the Period |

(1,958,818) |

(897,273) |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Statement of Financial Position - Assets |

| (R$ thousand) |

|

| Account Code |

Description |

09/30/2024 |

12/31/2023 |

| 1 |

Total Assets |

96,877,650 |

91,529,720 |

| 1.01 |

Current Assets |

34,892,551 |

33,077,700 |

| 1.01.01 |

Cash and Cash Equivalents |

18,452,408 |

16,046,218 |

| 1.01.02 |

Financial Investments |

1,028,389 |

1,533,004 |

| 1.01.02.01 |

Financial Investments Measured a Fair Value Through Profit or Loss |

984,893 |

1,493,204 |

| 1.01.02.01.03 |

Financial Investments Measured a Fair Value Through Profit or Loss – Usiminas’ Shares |

984,893 |

1,493,204 |

| 1.01.02.03 |

Financial Investments at Amortized Cost |

43,496 |

39,800 |

| 1.01.03 |

Trade Receivables |

2,318,282 |

3,269,764 |

| 1.01.04 |

Inventory |

10,534,183 |

9,557,578 |

| 1.01.06 |

Recoverable Taxes |

1,972,299 |

1,744,074 |

| 1.01.08 |

Other Current Assets |

586,990 |

927,062 |

| 1.01.08.03 |

Others |

586,990 |

927,062 |

| 1.01.08.03.03 |

Derivative Financial Instruments |

- |

32,211 |

| 1.01.08.03.04 |

Prepaid Expenses |

247,274 |

417,115 |

| 1.01.08.03.06 |

Dividends Receivable |

182,459 |

106,747 |

| 1.01.08.03.07 |

Others |

157,257 |

370,989 |

| 1.02 |

Non-Current Assets |

61,985,099 |

58,452,020 |

| 1.02.01 |

Long-Term Assets |

16,383,703 |

14,544,950 |

| 1.02.01.03 |

Financial Investments at Amortized Cost |

152,941 |

251,299 |

| 1.02.01.05 |

Inventory |

1,694,983 |

1,412,103 |

| 1.02.01.07 |

Deferred Taxes |

6,838,970 |

5,033,634 |

| 1.02.01.10 |

Other Non-Current Assets |

7,696,809 |

7,847,914 |

| 1.02.01.10.03 |

Recoverable Taxes |

2,509,938 |

2,537,423 |

| 1.02.01.10.04 |

Judicial Deposits |

644,658 |

491,882 |

| 1.02.01.10.05 |

Prepaid Expenses |

55,772 |

83,556 |

| 1.02.01.10.06 |

Receivable from Related Parties |

3,632,180 |

3,451,991 |

| 1.02.01.10.07 |

Others |

854,261 |

1,283,062 |

| 1.02.02 |

Investments |

5,988,806 |

5,443,131 |

| 1.02.02.01 |

Equity Interest |

5,785,779 |

5,237,177 |

| 1.02.02.02 |

Investment Property |

203,027 |

205,954 |

| 1.02.03 |

Property, Plant and Equipment |

29,194,687 |

27,927,458 |

| 1.02.03.01 |

Property, Plant and Equipment in operation |

23,332,121 |

22,827,542 |

| 1.02.03.02 |

Right of Use in Leases |

780,832 |

674,786 |

| 1.02.03.03 |

Property, Plant and Equipment in Progress |

5,081,734 |

4,425,130 |

| 1.02.04 |

Intangible Assets |

10,417,903 |

10,536,481 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Statement of Financial Position - Liabilities |

| (R$ thousand) |

|

| |

|

| Account Code |

Description |

09/30/2024 |

12/31/2023 |

| 2 |

Total Liabilities |

96,877,650 |

91,529,720 |

| 2.01 |

Current Liabilities |

26,105,856 |

25,017,103 |

| 2.01.01 |

Payroll and Related Taxes |

638,270 |

469,247 |

| 2.01.02 |

Trade Payables |

7,234,414 |

7,739,520 |

| 2.01.03 |

Taxes Obligations |

615,382 |

864,609 |

| 2.01.04 |

Current Debt |

9,373,625 |

7,613,367 |

| 2.01.05 |

Other Payables |

8,198,981 |

8,294,360 |

| 2.01.05.02 |

Others |

8,198,981 |

8,294,360 |

| 2.01.05.02.01 |

Dividends and Interest on Capital Payable |

578,337 |

80,624 |

| 2.01.05.02.04 |

Advances from Customers |

2,863,654 |

2,063,509 |

| 2.01.05.02.07 |

Derivative Financial Instruments |

- |

936,027 |

| 2.01.05.02.09 |

Trade Payables – Forfaiting |

3,727,054 |

4,209,434 |

| 2.01.05.02.10 |

Lease Liabilities |

212,829 |

137,638 |

| 2.01.05.02.11 |

Other Payables |

817,107 |

867,128 |

| 2.01.06 |

Provisions |

45,184 |

36,000 |

| 2.01.06.01 |

Provision for Tax, Social Security, Labor and Civil Risks |

45,184 |

36,000 |

| 2.02 |

Non-Current Liabilities |

55,536,778 |

46,827,779 |

| 2.02.01 |

Current Debt |

42,258,036 |

37,245,708 |

| 2.02.02 |

Other Payables |

9,951,183 |

6,438,492 |

| 2.02.02.02 |

Others |

9,951,183 |

6,438,492 |

| 2.02.02.02.03 |

Advances from Customers |

8,363,265 |

5,144,623 |

| 2.02.02.02.06 |

Derivative Financial Instruments |

80,722 |

60,468 |

| 2.02.02.02.07 |

Lease Liabilities |

646,193 |

596,123 |

| 2.02.02.02.08 |

Trade Payables |

98,137 |

31,060 |

| 2.02.02.02.09 |

Other Payables |

762,866 |

606,218 |

| 2.02.03 |

Deferred Taxes Assets |

364,818 |

304,002 |

| 2.02.04 |

Provisions |

2,962,741 |

2,839,577 |

| 2.02.04.01 |

Provision for Tax, Social Security, Labor and Civil Risks |

1,336,110 |

1,306,870 |

| 2.02.04.02 |

Other Provisions |

1,626,631 |

1,532,707 |

| 2.02.04.02.03 |

Provision for Environmental Liabilities and Decommissioning of Assets |

1,077,316 |

1,018,805 |

| 2.02.04.02.04 |

Pension and Healthcare Plan |

549,315 |

513,902 |

| 2.03 |

Shareholders’ Equity |

15,235,016 |

19,684,838 |

| 2.03.01 |

Paid-up Capital |

10,240,000 |

10,240,000 |

| 2.03.02 |

Capital Reserves |

32,720 |

32,720 |

| 2.03.04 |

Earnings Reserves |

5,121,236 |

6,071,236 |

| 2.03.04.01 |

Legal Reserve |

1,158,925 |

1,158,925 |

| 2.03.04.02 |

Statutory Reserve |

3,962,311 |

4,912,311 |

| 2.03.05 |

Accumulated Earnings (Losses) |

(1,958,817) |

- |

| 2.03.08 |

Other Comprehensive Income |

(16,799) |

1,156,719 |

| 2.03.09 |

Earnings Attributable to the Non-Controlling Interests |

1,816,676 |

2,184,163 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

Consolidated Interim Income Statement

(R$ thousand)

| Account Code |

Description |

Accumulated of the Current Period 07/01/2024 to 09/30/2024 |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 07/01/2023 to 09/30/2023 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 3.01 |

Net Operating Revenue |

11,066,589 |

31,661,321 |

11,125,028 |

33,432,829 |

| 3.02 |

Cost of Goods Sold and Services Rendered |

(8,332,916) |

(23,747,585) |

(8,319,723) |

(25,138,859) |

| 3.03 |

Gross Profit |

2,733,673 |

7,913,736 |

2,805,305 |

8,293,970 |

| 3.04 |

Operating (Expenses)/Income |

(1,952,192) |

(4,935,811) |

(1,157,787) |

(4,924,967) |

| 3.04.01 |

Selling Expenses |

(1,492,210) |

(4,054,126) |

(984,689) |

(2,725,144) |

| 3.04.02 |

General and Administrative Expenses |

(216,443) |

(647,360) |

(190,550) |

(552,220) |

| 3.04.04 |

Other Operating Income |

105,569 |

683,639 |

101,539 |

142,711 |

| 3.04.05 |

Other Operating Expenses |

(471,813) |

(1,232,268) |

(214,858) |

(2,049,896) |

| 3.04.06 |

Equity Results in Associate Companies |

122,705 |

314,304 |

130,771 |

259,582 |

| 3.05 |

Income Before Financial Results and Income Taxes |

781,481 |

2,977,925 |

1,647,518 |

3,369,003 |

| 3.06 |

Financial Results |

(1,931,588) |

(4,551,506) |

(1,223,475) |

(3,599,011) |

| 3.06.01 |

Financial Income |

273,672 |

992,638 |

205,490 |

799,324 |

| 3.06.02 |

Financial Expenses |

(2,205,260) |

(5,544,144) |

(1,428,965) |

(4,398,335) |

| 3.06.02.01 |

Foreign Exchange, net |

(384,620) |

(558,602) |

(50,092) |

(377,350) |

| 3.06.02.02 |

Financial Expenses |

(1,820,640) |

(4,985,542) |

(1,378,873) |

(4,020,985) |

| 3.07 |

Income Before Income Taxes |

(1,150,107) |

(1,573,581) |

424,043 |

(230,008) |

| 3.08 |

Income Tax and Social Contribution |

399,237 |

120,437 |

(333,249) |

(218,448) |

| 3.08.01 |

Current |

1,427 |

(896,289) |

(569,846) |

(828,108) |

| 3.08.02 |

Deferred |

397,810 |

1,016,726 |

236,597 |

609,660 |

| 3.09 |

Net Income from Continuing Operations |

(750,870) |

(1,453,144) |

90,794 |

(448,456) |

| 3.11 |

Consolidated net Income for the Year |

(750,870) |

(1,453,144) |

90,794 |

(448,456) |

| 3.11.01 |

Earnings Attributable to the Controlling Interests |

(840,337) |

(1,958,817) |

(154,480) |

(897,273) |

| 3.11.02 |

Earnings it Attributable to the Non-Controlling Interests |

89,467 |

505,673 |

245,274 |

448,817 |

| 3.99 |

Income per Share |

|

|

|

|

| 3.99.01 |

Basic Income per Share |

|

|

|

|

| 3.99.01.01 |

Ordinary Shares |

(0.63369) |

(1.47713) |

(0.11649) |

(0.67663) |

| 3.99.02 |

Diluted Income per Share |

|

|

|

|

| 3.99.02.01 |

Ordinary Shares |

(0.63369) |

(1.47713) |

(0.11649) |

(0.67663) |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Interim Statement of Comprehensive Income |

| Account Code |

Description |

Accumulated of the Current Period 07/01/2024 to 09/30/2024 |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 07/01/2023 to 09/30/2023 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 4.01 |

Consolidated net Income for the Period |

(750,870) |

(1,453,144) |

90,794 |

(448,456) |

| 4.02 |

Other Comprehensive Income |

463,527 |

(955,529) |

(593,351) |

861,761 |

| 4.02.01 |

Actuarial Gains (Losses) on Defined Benefits Plans, net |

40 |

(1,295) |

6,265 |

7,616 |

| 4.02.04 |

Cumulative Translation Adjustments for the Period |

73,466 |

452,670 |

24,382 |

(173,711) |

| 4.02.10 |

Gains/(Losses) on Cash Flow Hedge, net - Recognized on Shareholders' Equity |

312,401 |

(1,476,000) |

(412,890) |

476,649 |

| 4.02.12 |

Gains/(Losses) on Cash Flow Hedge, net - Reclassified to Profit and Losses |

772 |

(7,987) |

1,151 |

240,886 |

| 4.02.15 |

Gains/(Losses) on Cash Flow Hedge, net - Share of Other Comprehensive Income of Equity-Accounted Investments |

76,848 |

77,083 |

(212,259) |

310,321 |

| 4.03 |

Consolidated Comprehensive Income for the Period |

(287,343) |

(2,408,673) |

(502,557) |

413,305 |

| 4.03.01 |

Earnings Attributable to the Controlling Interests |

(392,369) |

(2,929,954) |

(704,904) |

(98,395) |

| 4.03.02 |

Earnings it Attributable to the Non-Controlling Interests |

105,026 |

521,281 |

202,347 |

511,700 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Interim Statement of Cash Flows |

|

(R$ thousand)

|

|

|

| Account Code |

Description |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 6.01 |

Net cash provided by operating activities |

5,102,490 |

5,638,487 |

| 6.01.01 |

Cash provided by operating activities |

4,782,847 |

4,298,744 |

| 6.01.01.01 |

Earnings attributable to the controlling interests |

(1,958,720) |

(897,273) |

| 6.01.01.02 |

Earnings attributable to the non-controlling interests |

505,673 |

448,817 |

| 6.01.01.03 |

Interest on loans and borrowings paid |

2,924,941 |

2,610,719 |

| 6.01.01.04 |

Interest on loans and borrowings granted |

(119,777) |

(138,961) |

| 6.01.01.05 |

Depreciation, amortization and depletion |

2,797,924 |

2,481,877 |

| 6.01.01.06 |

Equity Results in Associate Companies |

(314,304) |

(259,582) |

| 6.01.01.07 |

Deferred Taxes |

(1,016,726) |

(609,660) |

| 6.01.01.08 |

Provision for tax, social security, labor, civil and environmental risks |

32,628 |

(140,947) |

| 6.01.01.09 |

Foreign exchange, net |

1,326,769 |

628,360 |

| 6.01.01.11 |

Updated shares – fair value through profit or loss |

508,311 |

105,438 |

| 6.01.01.12 |

Charges on lease liabilities |

73,876 |

58,740 |

| 6.01.01.13 |

Accrued for consumption and services |

(88,991) |

11,879 |

| 6.01.01.14 |

Write-off and Estimated Losses net of Reversal |

- |

5,039 |

| 6.01.01.15 |

Allowance for credit loss on trade and other receivables, net |

58,556 |

71,690 |

| 6.01.01.16 |

Dividends receveid from Usiminas |

(45,063) |

(51,181) |

| 6.01.01.17 |

net gain from sale of equity interest |

- |

(92,438) |

| 6.01.01.19 |

Others |

97,750 |

66,227 |

| 6.01.02 |

Decrease/(increase) in assets and decrease/(increase) in liabilities |

319,643 |

1,339,743 |

| 6.01.02.01 |

Trade receivables - third parties |

586,625 |

222,967 |

| 6.01.02.02 |

Trade receivables - related party |

(2,911) |

51,776 |

| 6.01.02.03 |

Inventory |

(1,204,709) |

1,611,304 |

| 6.01.02.04 |

Dividends received |

45,063 |

51,181 |

| 6.01.02.05 |

Recoverable Taxes |

35,082 |

(312,232) |

| 6.01.02.06 |

Judicial Deposits |

(150,354) |

26,847 |

| 6.01.02.08 |

Trade Payables |

(644,274) |

441,152 |

| 6.01.02.09 |

Trade Payables – Forfaiting |

(482,380) |

(2,715,495) |

| 6.01.02.10 |

Payroll and related taxes |

165,977 |

139,663 |

| 6.01.02.11 |

Taxes Obligations |

(516,748) |

(166,917) |

| 6.01.02.13 |

Payables to related parties |

(22,066) |

(70,048) |

| 6.01.02.14 |

Advances from Customers |

4,445,402 |

5,131,618 |

| 6.01.02.15 |

Interest paid |

(2,794,212) |

(2,376,367) |

| 6.01.02.16 |

Receipt/(Payment) of Cash Flow Hedge Operations and derivative transactions |

(49,618) |

(661,970) |

| 6.01.02.19 |

Other Liabilities |

908,766 |

(33,736) |

| 6.02 |

Net cash used in investing activities |

(3,435,874) |

(2,820,912) |

| 6.02.01 |

Cash received from Acquisition of investments in Topázio and Santa Ana |

(32,000) |

- |

| 6.02.02 |

Decrease (increase) in investments in investees |

- |

(251,321) |

| 6.02.03 |

Acquisition of PP&E, intangible assets and investment properties |

(3,435,772) |

(2,845,982) |

| 6.02.11 |

Intercompany loans granted |

(71,531) |

(101,912) |

| 6.02.13 |

Financial investments, net of redemption |

94,661 |

257,380 |

| 6.02.14 |

Intercompany loans and interest received |

8,768 |

6,160 |

| 6.02.15 |

Receipt of sale of equity interest |

- |

114,763 |

| 6.03 |

Net cash used in financing activities |

848,131 |

458,578 |

| 6.03.01 |

Loans and borrowings from third parties |

7,903,465 |

9,912,186 |

| 6.03.03 |

Transactions cost - borrowings |

(89,929) |

(168,708) |

| 6.03.05 |

Repayment of principal from third parties' debt |

(5,181,446) |

(6,401,408) |

| 6.03.06 |

Repayment of leases |

(223,959) |

(163,388) |

| 6.03.07 |

Dividends and interest on capital paid to CSN's shareholdes |

(1,232,931) |

(2,720,104) |

| 6.03.08 |

Share repurchase |

(327,069) |

- |

| 6.04 |

Exchange rate on translating cash and cash equivalents |

(108,557) |

35,111 |

| 6.05 |

Increase (decrease) in cash and cash equivalents |

2,406,190 |

3,311,264 |

| 6.05.01 |

Cash and cash equivalents in the beginning of the period e end of the period |

16,046,218 |

11,991,356 |

| 6.05.02 |

Cash and equivalents at the end of the period |

18,452,408 |

15,302,620 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Interim Statement of Changes in Shareholders’ Equity - 01/01/2024 to 09/30/2024 |

| (R$ thousand) |

|

|

|

|

|

| Account Code |

Description |

Paid-up

Capital |

Capital

Reserve, Granted Options and Treasury Shares |

Earnings

Reserve |

Retained

Earnings (Accumulated Losses) |

Other

Comprehensive Income |

Shareholders’

Equity |

Non-Controlling

Interests |

Shareholders’

Equity |

| 5.01 |

Balance at the Beginning of the Period |

10,240,000 |

32,720 |

6,071,236 |

- |

1,156,719 |

17,500,675 |

2,184,163 |

19,684,838 |

| 5.02 |

Prior Year Adjustment |

- |

- |

- |

- |

- |

- |

- |

- |

| 5.03 |

Adjusted Opening Balances |

10,240,000 |

32,720 |

6,071,236 |

- |

1,156,719 |

17,500,675 |

2,184,163 |

19,684,838 |

| 5.04 |

Capital Transaction with Shareholders |

- |

- |

(950,000) |

- |

(202,381) |

(1,152,381) |

(888,769) |

(2,041,150) |

| 5.05 |

Total Comprehensive Income |

- |

- |

- |

(1,958,817) |

(971,137) |

(2,929,954) |

521,281 |

(2,408,673) |

| 5.05.01 |

Net Income/(Loss) for the Period |

- |

- |

- |

(1,958,817) |

- |

(1,958,817) |

505,673 |

(1,453,144) |

| 5.05.02 |

Other Comprehensive Income |

- |

- |

- |

- |

(971,137) |

(971,137) |

15,608 |

(955,529) |

| 5.05.02.04 |

Translation Adjustments |

- |

- |

- |

- |

452,670 |

452,670 |

- |

452,670 |

| 5.05.02.06 |

Actuarial Gains/(Losses) on Pension Plan, net of Taxes |

- |

- |

- |

- |

(1,297) |

(1,297) |

2 |

(1,295) |

| 5.05.02.07 |

(Loss) / Gain on Cash Flow Hedge Accounting, net of Taxes |

- |

- |

- |

- |

(1,422,510) |

(1,422,510) |

15,606 |

(1,406,904) |

| 5.06 |

Changes in Shareholders' Equity |

- |

- |

- |

- |

- |

- |

- |

- |

| 5.07 |

Balance at the End of the Period |

10,240,000 |

32,720 |

5,121,236 |

(1,958,817) |

(16,799) |

13,418,340 |

1,816,675 |

15,235,015 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Interim Statement of Changes in Shareholders’ Equity - 01/01/2023 to 09/30/2023 |

| (R$ thousand) |

|

|

|

|

| Account Code |

Description |

Paid-up

Capital |

Capital

Reserve, Granted Options and Treasury Shares |

Earnings

Reserve |

Retained

Earnings (Accumulated Losses) |

Other

Comprehensive Income |

Shareholders’

Equity |

Non-Controlling

Interests |

Shareholders’

Equity |

| 5.01 |

Balance at the Beginning of the Period |

10.240.000 |

32.720 |

8.988.442 |

- |

228.305 |

19.489.467 |

2.326.577 |

21.816.044 |

| 5.02 |

Prior Year Adjustment |

- |

- |

- |

- |

- |

- |

- |

- |

| 5.03 |

Adjusted Opening Balances |

10.240.000 |

32.720 |

8.988.442 |

- |

228.305 |

19.489.467 |

2.326.577 |

21.816.044 |

| 5.04 |

Capital Transaction with Shareholders |

- |

- |

-1.614.000 |

- |

-14.544 |

-1.628.544 |

-499.960 |

-2.128.504 |

| 5.04.04 |

Treasury Shares Acquired |

- |

- |

- |

- |

- |

- |

-1.637 |

-1.637 |

| 5.04.06 |

Dividends |

- |

- |

-1.614.000 |

- |

- |

-1.614.000 |

-441.749 |

-2.055.749 |

| 5.04.07 |

Interest on Equity |

- |

- |

- |

- |

- |

- |

-56.574 |

-56.574 |

| 5.04.08 |

(Loss)/gain on the percentage change in investments |

- |

- |

- |

- |

-14.544 |

-14.544 |

- |

-14.544 |

| 5.05 |

Total Comprehensive Income |

- |

- |

- |

-897.273 |

798.878 |

-98.395 |

511.700 |

413.305 |

| 5.05.01 |

Net Income/(Loss) for the Period |

- |

- |

- |

-897.273 |

- |

-897.273 |

448.817 |

-448.456 |

| 5.05.02 |

Other Comprehensive Income |

- |

- |

- |

- |

798.878 |

798.878 |

62.883 |

861.761 |

| 5.05.02.04 |

Translation Adjustments |

- |

- |

- |

- |

-173.711 |

-173.711 |

- |

-173.711 |

| 5.05.02.06 |

(Loss) / Gain on Cash Flow Hedge Accounting, net of Taxes |

- |

- |

- |

- |

965.029 |

965.029 |

62.827 |

1.027.856 |

| 5.05.02.07 |

Actuarial Gains/(Losses) on Pension Plan, net of Taxes |

- |

- |

- |

- |

7.560 |

7.560 |

56 |

7.616 |

| 5.06 |

Changes in Shareholders' Equity |

- |

- |

- |

- |

- |

- |

- |

- |

| 5.07 |

Balance at the End of the Period |

10.240.000 |

32.720 |

7.374.442 |

-897.273 |

1.012.639 |

17.762.528 |

2.338.317 |

20.100.845 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

| Consolidated Interim Statement of Added Value |

| (R$ thousand) |

| Account Code |

Description |

Accumulated of the Current Period 01/01/2024 to 09/30/2024 |

Accumulated of the Previous Period 01/01/2023 to 09/30/2023 |

| 7.01 |

Revenues |

36,078,166 |

37,912,075 |

| 7.01.01 |

Sales of Products and Rendering of Services |

35,992,315 |

37,903,134 |

| 7.01.02 |

Other Revenues |

114,608 |

4,013 |

| 7.01.04 |

Allowance (Reversal) for Expect Credit Losses |

(28,757) |

4,928 |

| 7.02 |

Inputs Acquired from Third Parties |

(21,488,402) |

(28,105,660) |

| 7.02.01 |

Cost of Sales and Services |

(17,094,775) |

(23,837,315) |

| 7.02.02 |

Materials, Electric Power, Outsourcing and Other |

(4,348,443) |

(3,937,626) |

| 7.02.03 |

Impairment / Reversals of Assets |

(45,184) |

(330,719) |

| 7.03 |

Gross Added Value |

14,589,764 |

9,806,415 |

| 7.04 |

Retentions |

(2,793,741) |

(2,476,095) |

| 7.04.01 |

Depreciation, Amortization and Depletion |

(2,793,741) |

(2,476,095) |

| 7.05 |

Net Added Value Produced |

11,796,023 |

7,330,320 |

| 7.06 |

Transferred Added Value |

1,477,198 |

1,505,794 |

| 7.06.01 |

Equity Results in Associate Companies |

314,304 |

259,582 |

| 7.06.02 |

Financial Income |

484,327 |

799,324 |

| 7.06.03 |

Others |

678,567 |

446,888 |

| 7.07 |

Total Added Value to be Distributed |

13,273,221 |

8,836,114 |

| 7.08 |

Distribution of Added Value |

13,273,221 |

8,836,114 |

| 7.08.01 |

Employee Compensation |

3,134,308 |

2,143,381 |

| 7.08.01.01 |

Salaries |

2,496,916 |

1,686,085 |

| 7.08.01.02 |

Fringe Benefits |

498,535 |

362,749 |

| 7.08.01.03 |

Unemployment Benefits (FGTS) |

138,857 |

94,547 |

| 7.08.02 |

Taxes, Fees and Contributions |

5,859,443 |

2,293,925 |

| 7.08.02.01 |

Federal |

3,088,265 |

1,525,321 |

| 7.08.02.02 |

State |

2,756,526 |

721,873 |

| 7.08.02.03 |

Municipal |

14,652 |

46,731 |

| 7.08.03 |

Return on Third-Party Capital |

5,732,615 |

4,847,264 |

| 7.08.03.01 |

Interest |

3,564,450 |

3,241,810 |

| 7.08.03.02 |

Rental Expenses |

18,212 |

2,041 |

| 7.08.03.03 |

Others |

2,149,953 |

1,603,413 |

| 7.08.04 |

Return on Shareholders' Equity |

(1,453,145) |

(448,456) |

| 7.08.04.03 |

Retained Earnings / (Losses) for the Period |

(1,958,818) |

(897,273) |

| 7.08.04.04 |

Non-Controlling Interests in Retained Earnings |

505,673 |

448,817 |

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

NOTES TO THE FINANCIAL STATEMENTS

(In thousands of reais, unless otherwise indicated)

| 1. | DESCRIPTION OF BUSINESS ACTIVITIES |

Companhia Siderúrgica Nacional (“CSN”,

also referred to as “Company” or “Parent company”), is a publicly held company that was incorporated on April

9, 1941, under the laws of the Federative Republic of Brazil (Companhia Siderúrgica Nacional, its subsidiaries, joint ventures,

joint operations and associates are herein collectively referred to as the "Group”). The Company’s registered office

is located in São Paulo, SP, Brazil.

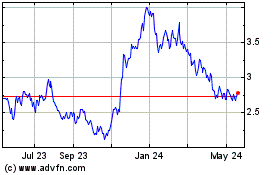

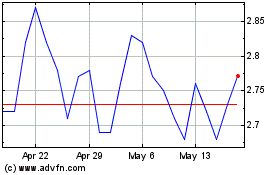

CSN is listed on the São Paulo Stock Exchange

(B3 S.A. - Brasil, Bolsa, Balcão) and on the New York Stock Exchange (“NYSE”) and reports its financial information

to the Brazilian (“CVM”) and U.S. Securities and Exchange Commission (“SEC”).

The Group's main operating activities are divided into

five 5 market segments as follows:

The Company’s main industrial facility is the Presidente

Vargas Steelworks (“UPV”), located in the city of Volta Redonda, State of Rio de Janeiro. The steel market segment consolidates

all operations related to the production, distribution, and sale of flat and long steel, metallic containers and galvanized steel. In

addition to its facilities in Brazil, CSN maintains commercial operations in the United States and operations in Portugal and Germany

as part of efforts to expand its market presence and provide excellent services to end consumers. The steel produced by CSN is used in

home appliances, civil construction, packaging and automobile industry.

The Company’s subsidiary CSN Mineração

S.A. (“CSN Mineração”) produces iron ore in the cities of Congonhas, Belo Vale and Ouro Preto, in the State

of Minas Gerais.The Company’s mining activities also include tin exploration in the state of Rondônia conducted by CSN's subsidiary

Estanho de Rondônia S.A. (“ERSA”) that seeks to meet demand at UPV. Surpluses of this raw material are sold to subsidiaries

and third parties.

CSN’s iron ore is primarily sold in the international

market, particularly in Europe and Asia. The prices charged in these markets are historically cyclical and subject to significant fluctuations

over short periods of time, influenced by factors such as global demand, strategies adopted by the major steel producers, and foreign

exchange rates. These factors are beyond the Company’s control. Ore is transported by rail to the Terminal de Carvão e Minérios

(“Coal and Minerals Terminal) located at the Port of Itaguaí (“TECAR”), a solid bulk terminal. TECAR is one of

the four terminals that comprise the Itaguai Port, located in the State of Rio de Janeiro. From TECAR, iron ore is delivered to customers

around the world. Coal and coke are also imported through this terminal through the provision of services by CSN Mineração

to CSN.

As a pioneer in the use of technologies that allow tailings

generated during the iron ore production process to be stacked, the Company has maintained a complete structure for tailings filtration

since January 2020, which allows for the dry stacking of materials. Tailings are disposed of in geotechnically controlled piles in areas

exclusively designated for stacking, thereby avoiding the use of tailings dams.

As a result of these measures, the decommissioning of

dams has been a natural progression with regards to processing filtered tailings. Our mining dams are certified and comply with current

legislation.

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

CSN entered the cement market to leverage the synergy

between this activity and its existing business activities. The Company’s cement production unit located adjacent to the UPV facilities,

in Volta Redonda, RJ. The plant produces CP-III type cement using slag produced through UPV's blast furnaces. Exploration of limestone

and dolomite is also carried out at the Arcos, MG unit to meet the needs of the steel industry and the cement plant, as well as the production

of clinker at the same unit.

On August 31, 2021, the subsidiary CSN Cimentos S.A.

(“CSN Cimentos”) acquired control of Elizabeth Cimentos S.A. and Elizabeth Mineração Ltda., which operate in

Brazil’s Northeast region, particularly in Paraíba and Pernambuco. On May 1, 2022, Elizabeth Mineração was

merged into CSN Cimentos.

On September 9, 2021, CSN Cimentos entered into an Agreement

for the Sale and Purchase of the Shares in LafargeHolcim (Brasil) S.A. as part of the acquisition of 100% of the shares issued by LafargeHolcim

(Brasil) S.A. (“LafargeHolcim”). On September 6, 2022, all shares issued by LafargeHolcim S.A. were the acquired by the Company,

and the trade name LafargeHolcim was changed to "CSN Cimentos Brasil S.A.", which came under the control of CSN Cimentos. The

Company's main activities include production, industrial operations and the trade of cement, lime, mortar, minerals, and metals in general

and provision of complementary products for civil construction, in natura with industrial plants, warehouses and branches across the country.

On August 31, 2023, the a Special Shareholders’

Meeting approved the merger of CSN Cimentos into CSN Cimentos Brasil, together with the consequent transfer of all assets (movable and

immovable), rights and obligations, in accordance with the terms of the “Agreement and Justification for the Incorporation of CSN

Cimentos S.A. by CSN Cimentos Brasil S.A.”. As a result, CSN Cimentos was rendered extinct, its shares were canceled and, as a replacement,

its shareholders received shares in CSN Cimentos Brasil. All activities carried out by CSN Cimentos are now performed by CSN Cimentos

Brasil. The Valuation Report for CSN Cimentos' equity as of June 30, 2023 was used as a basis for defining a capital increase in CSN Cimentos

Brasil in the amount of R$ 2,383,276.

Railroads:

CSN maintains ownership interests in three railroad companies:

MRS Logística S.A. (“MRS”), which manages Rede Ferroviária Federal S.A.’s (“RFFSA”) former

Southeast Railway System, Transnordestina Logística S.A. (“TLSA”) and FTL - Ferrovia Transnordestina Logística

S.A. (“FTL”), which holds a concession to operate the former RFFSA’s Northeast Railway System in the States of Maranhão,

Piauí, Ceará, Rio Grande do Norte, Paraíba, Pernambuco, Alagoas – the railway spans the States of Maranhão,

Piauí, Ceará, Rio Grande do Norte, Paraíba, Pernambuco, and Alagoas. Key routes include the São Luís

to Altos, Altos to Fortaleza, Fortaleza to Sousa, Sousa to Recife/Jorge Lins, Recife/Jorge Lins to Salgueiro, Jorge Lins to Propriá,

Paula Cavalcante to Cabedelo, Itabaiana to Macau (Network I) lines, and TLSA is responsible for stretches between Eliseu Martins-Trindade,

Trindade-Salgueiro, Salgueiro-Missão Velha and Missão Velha-Pecém (Network II), which are currently under construction.

Ports:

The Company operates in the State of Rio de Janeiro,

through its subsidiary Sepetiba Tecon S.A., Container Terminal (“TECON”) and through its subsidiary CSN Mineração,

TECAR, both of which are located at the Itaguaí Port. Established in the harbor of Sepetiba, the above-mentioned port benefits

from highway, railroad, and maritime access.

TECON handles the movement and storage of containers,

vehicles, steel products, general cargo, and other items, and TECAR manages the loading and unloading of solid bulk ships, as well as

the storage and distribution (road and rail) of coal, coke, petroleum coke, clinker, zinc concentrate, sulfur, iron ore and other bulk

intended for the maritime market, which supports both the Company’s operations and those of various customers.

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

Since energy supply is fundamental to CSN’s production

process, the Company maintains electricity generation assets aimed at mitigating costs and enhancing competitiveness.

On June 30, 2022, the Company's subsidiaries, CSN Cimentos

and CSN Energia S.A. ("CSN Energia"), acquired Santa Ana Energética S.A. (“Santa Ana”), as well as Topázio

Energética S.A. ("Topázio") and, indirectly, Brasil Central Energia Ltda. ("BCE"), a subsidiary of Topázio,

under the terms of the Share Purchase Agreement entered into on April 8, 2022 with Brookfield Americas Infrastructure (Brazil Power) Fundo

de Investimento em Participações Multiestratégia, a private equity fund managed by Brookfield Brasil Asset Management

Investimentos Ltda.

On October 7, 2022, the subsidiaries CSN Mineração

and CSN Energia S.A. acquired 100% of the shares issued by Companhia Energética Chapecó – CEC, holder of the concession

for the Quebra-Queixo Hydroelectric Power Plant (“Chapecó”), in accordance with the Agreement for the Purchase and

Sale of Shares and Other Covenants and the Private Instrument for the Assignment of Rights and Obligations, which were signed on July

1, 2022 and July 25, 2022, respectively.

In the same year, the Company, through its subsidiary

Companhia Florestal do Brasil S.A. (“CFB”), acquired Eletrobrás' 32.74% stake in Companhia Estadual de Energia Elétrica

- CEEE-G (“CEEE-G”), in the context of the privatization of the CEEE Group by the Rio Grande do Sul State Government. On February

21, 2024, a Special Shareholders’ Meeting was after the settlement of the post-OPA Auction, in which CFB redeemed and canceled 98,375

shares, 41,896 of which were shares of common stock of common stock and 56,479 were shares of preferred stock issued by CEEE-G. As a result

of this transaction this, CFB came to hold 100% of CEEE-G’s share capital.

Management understands that the Company holds adequate

resources for continuing its operations. Accordingly, the Company's interim financial information for the period ended September 30, 2024,

has been prepared on a going concern basis.

| 2. | BASIS OF PREPARATION AND STATEMENT OF COMPLIANCE |

| 2.a) | Statement of compliance |

The consolidated and individual interim financial information

(“interim financial information”) have been prepared and are presented in accordance with the accounting practices adopted

in Brazil, issued by the Brazilian Accounting Pronouncements Committee (“CPC”) and approved by the Brazilian Securities and

Exchange Commission (“CVM”) and the Brazilian Federal Accounting Council (“CFC”), and in accordance with the International

Financial Reporting Standards (“IFRS”) issued by the International Accounting Standard Board (“IASB”). These reports

exclusively disclose all relevant interim financial information and only include data used by the Company's management in its activities.

Consolidated interim financial information are identified as “Consolidated” and the parent company's individual interim financial

information are identified as “Parent Company”.

| 2.b) | Basis of presentation |

These interim financial statements were prepared based on historical cost and were

adjusted to reflect: (i) the fair value measurement of certain financial assets and liabilities (including derivative instruments), as

well as pension plan assets; and (ii) impairment losses. Whenever IFRS and CPCs allows for the option between cost or another measurement

criterion, the cost of acquisition criterion was used.

The preparation of these interim financial statements

requires Management to use certain accounting estimates, judgments, and assumptions that affect the application of accounting policies

and amounts reported on the balance sheet date of assets, liabilities, income, and expenses may differ from actual future results. The

assumptions used are based on history and other factors considered relevant and are reviewed by the Company’s management.

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

This interim financial information has been prepared

and is presented in accordance with CPC 21 (R1) - “Interim Financial Reporting” and IAS 34 - “Interim Financial Reporting”,

consistently with the standards issued by the CVM. This interim financial information does not include the entirety of established requirements

for annual or full financial statements and, accordingly, must be read in conjunction with the Company’s financial statements for

the year ended December 31, 2023.

The new standards adopted for fiscal years beginning

on or after January 1, 2024, are described in Note 2.e.

As result, the following explanatory notes are not repeated

in this interim financial information either due to redundancy or materiality in relation to those previously presented in the annual

financial statements:

Note 2d - Accounting policies

Note 9b - Additional information on operating subsidiaries

headquartered in Brazil and overseas

Note 11a – Goodwill impairment test

Note 17b – Sensitivity analysis of deferred income

tax and social security contributions

Note 18 - Tax instalments

Note 21a - Transactions with controlling shareholders

Note 21c - Other unconsolidated related parties

Note 29 - Employee benefits

Note 30 - Commitments

Note 31 - Insurance

These consolidated financial statements were approved

by the Company’s Board of Directors on November 12, 2024.

| 2.c) | Functional currency and presentation currency |

The accounting records included in the interim financial

statements for each of the Company’s subsidiaries are measured using the currency of the principal economic environment in which

each subsidiary operates (“functional currency”). Consolidated and parent company interim financial statements are presented

in Brazilian reals (BRL), which is the Company’s functional and reporting currency.

Foreign currency transactions are translated into the

functional currency using the exchange rates prevailing on the transaction or valuation dates, under which the items are remeasured. The

balances of asset and liability accounts are converted using the exchange rate on the balance sheet date. As of September 30, 2024, US$

1.00 was equivalent to BRL 5.4481 (compared to BRL 4.8413 on December 31, 2023) and € 1.00 was equivalent to BRL 6.0707 (compared

to BRL 5.3516 on December 31, 2023), according to rates obtained from the Central Bank of Brazil’s website.

| 2.d) | Statement of added value |

Pursuant to Federal

Law 11.638/07, the presentation of the statement of added value is required for all publicly held companies. These statements were prepared

in accordance with CPC 09 – Statement of Added Value. IFRS does not require presentation of this statement; therefore, it is presented

as additional information for IFRS’s purposes.

| 2.e) | Adoption of new requirements, standards, amendments and

interpretations |

New requirements, standards,

amendments and interpretations that came into force for fiscal years starting on January 1, 2024, include:

• Amendment to

IFRS 16 – Lease Liability on Sale and Leaseback;

• Amendments to

IAS 1 – Classification of Liabilities as "Current" or "Non-Current";

• Amendments to

IAS 7 and IFRS 7 – Disclosures on forfaiting operations.

Quarterly Financial Information – September 30, 2024 – Companhia Siderúrgica Nacional (CONVENIENCE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |  |

| | |

The Company did not

identify significant impacts in relation to these changes that altered its disclosures in terms of the adoption and interpretation of

these rules, with the exception to amendments to IAS 7 and IFRS 7. These amendments result from the addition of items 44F and 44H to Technical

Pronouncement CPC 03 (R2) – Cash Flow Statements, which provide greater detail on forfaiting operations as disclosed in explanatory

note 15.a. Suppliers - Forfaiting).

| 3. | CASH AND CASH EQUIVALENTS |

| |

|

|

Consolidated |

|

|

|

Parent company |

| |

09/30/2024 |

|

12/31/2023 |

|

09/30/2024 |

|

12/31/2023 |

| Cash in banking institutions and in hand |

|

|

|

|

|

|

|

| In Brazil |

987,638 |

|

103,383 |

|

62,299 |

|

73,819 |

| Abroad |

11,950,945 |

|

10,797,192 |

|

179,088 |

|

140,400 |

| |

12,938,583 |

|

10,900,575 |

|

241,387 |

|

214,219 |

| |

|

|

|

|

|

|

|

| Financial investments |

|

|

|

|

|

|

|

| In Brazil |

4,339,452 |

|

4,227,916 |

|

1,229,758 |

|

2,052,232 |

| Abroad |

1,174,373 |

|

917,727 |

|

1,527 |

|

3,619 |

| |

5,513,825 |

|

5,145,643 |

|

1,231,285 |

|

2,055,851 |

| |

18,452,408 |

|

16,046,218 |

|

1,472,672 |

|

2,270,070 |

Our investments primarily consist of private and public

securities for which the respective yields are tied to variation in Interbank Deposit Certificates (CDI) and repo operations backed by

National Treasury Notes, respectively. The Company invests a portion of these funds through exclusive investment funds that have been

consolidated under this interim financial information.

Financial resources available abroad and that are held

in dollars and euros are invested in private securities, at banks considered by Management to be first-rate and are remunerated at fixed

rates.

| |

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

Parent company |

| |

|

Current |

|

Non-current |

|

Current |

|

Non-current |

| |

|

09/30/2024 |

|

12/31/2023 |

|

09/30/2024 |

|

12/31/2023 |

|

09/30/2024 |

|

12/31/2023 |

|

09/30/2024 |

|

12/31/2023 |

| Investments (1) |

|

43,496 |

|

39,800 |

|

27,635 |

|

139,949 |

|

28,101 |

|

31,505 |

|

|

|

|

| Usiminas shares (2) |

|

984,893 |

|

1,493,204 |

|

|

|

|

|

984,893 |

|

1,493,204 |

|

|

|

|

| Bonds (3) |

|

|

|

|

|

125,306 |

|

111,350 |

|

|

|

|

|

125,306 |

|

111,350 |

| |

|

1,028,389 |

|

1,533,004 |

|

152,941 |

|

251,299 |

|