SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

| RESULTS 3Q24 |

| | |

São Paulo, November 12 , 2024 - Companhia

Siderúrgica Nacional (“CSN”) (B3: CSNA3) (NYSE: SID) announces its results for the third quarter of 2024 (3Q24)

in Reais, with its consolidated financial statements in accordance with the accounting practices adopted in Brazil issued by the Accounting

Pronouncements Committee ("CPC"), approved by the Brazilian Securities and Exchange Commission ("CVM") and the Federal

Accounting Council ("CFC") and in accordance with the International Financial Reporting Standards ("IFRS") issued

by the International Accounting Standards Board ("IASB").

The comments address the Company's consolidated results

for the third quarter of 2024 (3Q24) and the comparisons are for the second quarter of 2024 (2Q24) and the third quarter of 2023 (2Q23).

The dollar exchange rate was R$ 5.01 on 09/30/2023; R$ 5.59 on 06/30/2023 and R$ 5.44 on 09/30/2024.

3Q24 Operational and Financial

Highlights

| | |

For more information, visit our website: https://ri.csn.com.br/ | 2 |

| RESULTS 3Q24 |

| | |

Consolidated Table - Highlights

Consolidated Results

| · | Net Revenue totaled

R$11,066.6 million in 3Q24, representing a growth of 1.7% compared to the previous quarter and mainly reflecting the improvement in the

steel segment, which managed to show solid commercial activity during the period. When analyzing the other segments of the Group, revenue

performance was not higher only due to commodity prices, as operationally CSN was able to achieve historic sales records in both mining

and cement. |

| · | Cost of Goods Sold (COGS)

totaled R$ 8,332.9 million in the third quarter, 5.6% higher than in the previous quarter, reflecting the higher level of business

activity during the period, with a solid increase in product sales volumes in all operating segments. |

| · | Gross profit in 3Q24

reached R$2.7 billion with a gross margin of 24.7%, representing a 2.8 p.p. drop from 2Q24. This decline in profitability is a direct

result of lower prices, particularly in the mining sector. |

| · | Selling, general, and administrative

expenses totaled R$1,708.6 million in 3Q24, representing a 7.6% increase from the previous quarter and a 45.4% increase from the same

period last year. |

| · | The Other Operating Income

and Expenses group was negative by R$366.2 million in 3Q24, reversing the positive result of the previous quarter that had been strongly

impacted by iron ore hedging operations. In this sense and given the current momentum of the iron ore prices, CSN did not carry out any

new operations in the second half of the year. |

| · | The Financial Result

was negative at R$1,931.6 million in 3Q24, which represents an increase of 29.2% in relation to 2Q24, still impacted by the effect of

the exchange rate devaluation that ends up increasing the cost of debt in dollars. Additionally, the financial result was pressured by

the negative effect of the devaluation of Usiminas shares. |

| | |

For more information, visit our website: https://ri.csn.com.br/ | 3 |

| RESULTS 3Q24 |

| | |

| · | The Equity Result was

positive at R$123.0 million in 3Q24, an increase of 25.6% compared to the previous quarter. This was driven by strong performance from

MRS in recent quarters and the positive impact of improved market conditions in the steel industry on Panatlântica's results. |

| · | In the third quarter of 2024,

CSN recorded a Net Loss of R$750.9 million, representing a 237.3% decrease from the previous quarter. This decline was driven by

a combination of lower operating income and higher financial expenses, as well as the positive impact of iron ore hedging operations in

the second quarter of 2024. This combination more than offset the positive effect of the IR/CS reversal due to the increase in deferred

tax recognition in the period. |

Adjusted EBITDA

| · | In the third quarter of 2024,

the company's Adjusted EBITDA was R$2,284.0 million, with an adjusted EBITDA margin of 19.7%. This represents a 3.5 p.p. decrease

from the previous quarter. This performance reflects exclusively the worsening price of iron ore, which ended up offsetting a very strong

quarter in commercial terms, with record sales in mining and cement, in addition to the 9% growth in domestic steel sales. In other words, the quarter

demonstrated that CSN has made consistent progress in optimizing its operations, with increased production, sales, and reduced costs.

The issue lies outside the company's control, namely international prices, particularly in mining, where Chinese demand for the product

is uncertain. However, the robust commercial performance in the period demonstrates that CSN is well-positioned to maintain its strong

results. Furthermore, the steel segment has shown consistent signs of improvement, even though margins remain tight, in another quarter

of recovery. |

| | |

For more information, visit our website: https://ri.csn.com.br/ | 4 |

| RESULTS 3Q24 |

| | |

Adjusted EBITDA (R$ million) and

Adjusted EBITDA Margin (%)

¹ The Adjusted EBITDA Margin is calculated by

dividing Adjusted EBITDA by Adjusted Net Revenue, which takes into account CSN Mineração's 100% stake in consolidation and

37.49% in MRS.

Adjusted Cash Flow

Adjusted Cash Flow in 3Q24 was negative at R$986.0

million, representing an improvement over the previous quarter. However, this result remains negative, reflecting a decline in operating

performance, an increase in financial expenses, higher disbursements for income tax, and a higher level of investments.

3Q24 Adjusted Cash Flow¹ (R$ million)

¹ The concept of adjusted cash flow is calculated

from Adjusted EBITDA, subtracting EBITDA of Jointly Controlled Companies, CAPEX, Income Tax, Financial Result and changes in Assets and

Liabilities², excluding the effect of the Glencore advance.

² Adjusted Working Capital is made up of the

variation in Net Working Capital, plus the variation in long-term asset and liability accounts and disregarding the net variation in Income

Tax and Social Security.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 5 |

| RESULTS 3Q24 |

| | |

Indebtedness

On September 30, 2024, consolidated net debt reached

R$ 35,164 million, with the leverage indicator measured by the Net Debt/EBITDA LTM ratio reaching 3.34x. This represents a reduction of

2 basis points compared to the previous quarter, a movement in line with all efforts made throughout the quarter regarding cash management

and increasing cash and cash equivalents, which ended up more than offsetting the negative impact on cash flow in the quarter. This reduction

also demonstrates CSN's ongoing commitment to reducing its level of indebtedness. The recent sale of a significant stake in CSN Mineração

not only exemplifies this commitment but also illustrates the numerous avenues available within the group for recycling capital. Furthermore,

CSN continued to adhere to its policy of maintaining a substantial cash reserve, which reached R$ 19,322.0 billion during this period.

¹Net

Debt / EBITDA: Debt is calculated using the final dollar of each period and net debt and EBITDA are calculated using the average dollar

of the period.

CSN remains very active in its objective of extending

the amortization term, focusing on long-term operations and the local capital market. Among the main movements in 3Q24, the Company carried

out fundraising with amortization flows between 2027 and 2029.

Amortization Schedule (R$ Billion)

¹ IFRS: consider stake in MRS (37.49%).

² Gross Debt/Management Net Debt considers stake in MRS (37.49%),

without accrued interest.

3 Average time after completion of the Liability Management

Plan.

FX Exposure

The net foreign exchange

exposure accumulated in the consolidated balance sheet for the 3Q24 was US$1,026.0 million, as shown in the table below, in line with

the Company's policy of minimizing the impact of exchange rate volatility on results. CSN's hedge accounting strategy aligns the projected

flow of exports in dollars with future debt maturities in the same currency. Consequently, the fluctuations in the value of the dollar-denominated

debt are recorded as a temporary adjustment

to shareholders' equity and are subsequently reflected in the income statement when the dollar revenues from these exports are recognized.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 6 |

| RESULTS 3Q24 |

| | |

Investments

In the 3Q24, R$1,309.3 million was invested, an amount

in line with the previous quarter and 10% higher than the amount invested in the same period of 2023. The mining segment stood out, with

the progress of the physical construction of P15, as well as the continuity of the investments made since last year in the steel industry

to increase the efficiency of the melting shop, sintering and the modernization of the entire operations at UPV.

CAPEX (R$ Million)

Net Working Capital

Net Working Capital applied to the business amounted

to R$ 1,471.0 million in 3Q24, a significant improvement from the negative result of the previous quarter, reflecting the increase in

the Inventories line, in line with the strong production seen during the period, as well as the reduction in the Suppliers line.

The calculation of net working capital applied to

the business excludes the advance on prepayment contracts, as shown in the table below:

| | |

For more information, visit our website: https://ri.csn.com.br/ | 7 |

| RESULTS 3Q24 |

| | |

¹ Other NWC Assets: Considers

advances and other accounts receivable.

² Other NWC Liabilities:

Considers other accounts payable, dividends payable, taxes paid in installments and other provisions.

³ Inventories: Does not

take into account the effect of the provision for inventory losses. Warehouse stock balances are not taken into account when calculating

the SME.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 8 |

| RESULTS 3Q24 |

| | |

Business Segments Results

| | |

For more information, visit our website: https://ri.csn.com.br/ | 9 |

| RESULTS 3Q24 |

| | |

Steel Results

The World Steel Association

(WSA) reports that global crude steel production reached 1,394.1 million tons (Mt) from January to September 2024, representing a 1.9%

decline compared to the same period in 2023. This reversed the growth that had been observed until mid-year, resulting from a greater

slowdown in North American production (down 3.9%), along with lower production in Asia and Oceania (down 2.5%) and Russia (down 2.5%).

China, which accounted

for 55.1% of total global production in 9M24, recorded a 3.6% decline in production compared to the same period in 2023. This is

indicative of weak domestic demand for steel. This decline has been more pronounced over the past three months, prompting concern

among local authorities and prompting the introduction of new stimulus packages, such as those announced at the end of September, in

order to try to regain momentum in the real estate

sector. Conversely, the decline in Chinese steel production has been less severe than anticipated, with output sustained by other sectors,

including the automotive industry and manufacturing, as well as higher export volumes.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 10 |

| RESULTS 3Q24 |

| | |

In

contrast, India, Turkey, and Brazil demonstrated growth in production compared to the same period in 2023, with volumes reaching 110.3

thousand tons (+5.8%), 27.9 thousand tons (+13.8%), and 25.2 million tons (+4.4%), respectively.

Brazilian

steel production continues to grow at a rapid pace, driven by the operational normalization of local producers and increased consumption

of steel by sectors such as the automotive industry, construction, agricultural machinery, and infrastructure projects.

Furthermore, in October,

the Executive Management Committee (Gecex), Camex's collegiate executive body, approved the implementation of a provisional anti-dumping

duty on exports from China to Brazil of tin-plated and chrome-plated metal sheets for a range of NCMs. The provisional duties will be

applied for a period of up to six months in the form of a specific rate fixed in US dollars per ton. This should make local producers

more competitive, increasing the pace of production for these products.

OPERATIONAL AND SALES PERFORMANCE

CSN's steel production is

on a path of sustained recovery, reaching 995,000 tons in the most recent quarter—the highest level since 3Q22. This represents

a 12.7% growth compared to the previous quarter and a 7.9% growth compared to the same period last year. This growth follows the scheduled

maintenance stoppages carried out in the sintering area of the Presidente Vargas Plant (UPV) in 2Q24, which reinforces the normalization

and efficiency with the resumption of work.

In line with the upward

trajectory observed throughout the year, rolled steel production reached 917,000 tons, representing the highest result since 3Q21. This

marks a 10.6% growth when compared to the previous quarter and a 9.8% growth when compared to the same period in 2023. Despite undergoing

scheduled maintenance in 3Q24, long steel production remained stable, reaching 58,000 tons.

Sales Volume – 3Q24 (thousand tons) –

Steel Industry

| | |

For more information, visit our website: https://ri.csn.com.br/ | 11 |

| RESULTS 3Q24 |

| | |

Total sales in 3Q24 reached 1,166.3 thousand tons,

representing a 3.8% increase compared to the second quarter and a 10.5% increase compared to the same period in 2023. When analyzing

the behavior in the different markets, it is clear that the domestic market was the main driver of this increase, with 866.5 thousand

tons of steel products sold this quarter, representing an 8.6% increase over the previous quarter and a 16.0% growth compared to 3Q23.

This demonstrates not only the effectiveness of the commercial strategy but also the resumption of industrial activity with higher steel

consumption. In the foreign market, sales reached 299.8 thousand tons in 3Q24, a notable increase of 10.5% compared to the same period

last year, with 5.1 thousand tons exported directly. Additionally, 294.7 thousand tons were sold by subsidiaries abroad, with 90.2 thousand

tons sold by LLC, 140.4 thousand tons sold by SWT, and 64.0 thousand tons sold by Lusosider.

In terms of total sales volume, the Distribution

segment was the main highlight in 3Q24, with a 1.3 p.p. increase compared to the volume sold in the previous quarter, reaching 32.6% of

total volume. Conversely, the Steel Packing segment (6.5%) experienced the greatest decline in sales due to seasonal factors and heightened

commercial activity compared to other segments. In the year-on-year comparison, notable recoveries were observed in General Industry and

Distribution, while declines were seen in Construction and Steel Packing.

According to ANFAVEA (the National Association of

Motor Vehicle Manufacturers), the production of vehicles in 3Q24 reached 736,300 units, representing a 19.0% increase compared to the

same period last year. As previously highlighted in earlier releases, ANFAVEA anticipates growth in vehicle sales for the year 2024, driven

by the production of heavy vehicles, which for the third consecutive quarter demonstrated growth of over 3.5%.

When looking at data from the Brazilian Steel Institute

(IABr), crude steel production in the first nine months of 2024 reached 25.2 Mton, representing a 4.4% increase over the same period in

2023. Apparent consumption reached 19.6 Mton, representing an 8.4% increase year-on-year. The Steel Industry Confidence Indicator (ICIA)

for September reached 63.8 points, a notable increase and well above the 50-point threshold. This reflects a significant improvement in

confidence regarding the domestic market outlook for the coming months.

IBGE data indicates that the production of household

appliances for the month of September 2024 increased by 17.5% compared to the previous year. This reinforces the resumption of the white

goods sector after poor performances seen in 2022 and 2023.

·

Net revenues in the steel sector reached R$6,041.3

million in 3Q24, an 8.1% increase from the previous quarter as a consequence of the exceptional commercial performance achieved during

this period. The average price in 3Q24 increased by 3.5% compared to 2Q24, driven by a 12.3% growth in the average price in the foreign

market during the same period. Conversely, the average price in the domestic market demonstrated minimal fluctuation, with the adjustments

made in July being offset by a decrease in the product mix during the same period.

·

In turn, The Slab Cost in 3Q24 reached R$3,365.93/t,

representing a 5.2% decline from the previous quarter and a 5.5% reduction when compared to 3Q23. This outcome was driven by a notable

dilution of fixed costs and a reduction in raw material costs.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 12 |

| RESULTS 3Q24 |

| | |

Adjusted EBITDA reached R$389 million

in 3Q24, representing a 19.7% increase from the previous quarter and an Adjusted EBITDA Margin of 6.4%, or 0.6 p.p. higher than in

2Q24. In comparison to the previous year, the increase is even more significant, with the EBITDA margin expanding by 3.0 p.p. This reinforces

the gradual recovery that the segment has been experiencing throughout this year, with increased production, stronger sales, and lower

slab costs. Furthermore, when we consider the robust forecast for steel consumption this year and factor in the more favorable price trend

and efficiency gains, we conclude that the environment for the coming quarters is much more favorable, indicating a consistent recovery

in profitability and bringing margins closer to the company's historical averages.

Adjusted EBITDA and Adjusted Margin

EBITDA (R$ Million and %)

Mining Results

The third quarter is historically a seasonally

strong time in terms of iron ore supply, and this year was no different, with low rainfall in Brazil and increased volumes in other countries,

which contributed to a solid pace of seaborne volumes. However, this growth in supply was not matched by demand, with a decline in steel

production in China and, consequently, an increase in stocks at the ports, exerting downward pressure on the price of iron ore during

this period. While the price was close to the marginal cost of production for several producers at times during the quarter, the lack

of greater predictability for the Chinese economy prevented more solid advances for the commodity. The situation changed in the last

few days of the quarter with the announcement of new stimulus packages by the Chinese government, which resulted in a price recovery.

In this context, the average price of iron ore was US$ 99.69/dmt (Platts, Fe62%, N. China), representing a 10.8% decline from the average

for 2Q24 (US$ 111.81/dmt) and a 12.6% decline from the average for 3Q23 (US$ 114.03/dmt).

| | |

For more information, visit our website: https://ri.csn.com.br/ | 13 |

| RESULTS 3Q24 |

| | |

In the third quarter of 2024, the BCI-C3 maritime

route (Tubarão-Qingdao) recorded an average of US$26.67/t, representing a 3.3% increase compared to the previous quarter. This

dynamic follows the same trend observed in recent quarters, with an increase in demand for capesize vessels due to higher export volumes

of bauxite in Guinea and iron ore in Brazil, Ukraine, and Australia.

Total Production – Mining (Thousand

tons)

| · | Iron Ore Production (including

purchases from third parties) reached a volume of 11,437.8 thousand tons in 3Q24, representing a 9.7% increase compared to the second

quarter of 2024 but a 1.3% reduction compared to the volume recorded in 3Q23. As previously stated, the year-on-year decline is a direct

result of the reduced volume of iron ore purchases from third parties, which aligns with the strategy adopted for this year of prioritizing

margin over volume. However, an analysis of the volume of own production revealed that this year's result was the highest ever recorded

in CSN's history, which demonstrates the improved operational performance the Company has achieved this year. |

Sales Volume – Mining (Thousand tons)

| | |

For more information, visit our website: https://ri.csn.com.br/ | 14 |

| RESULTS 3Q24 |

| | |

| · | Sales volume reached

11,884.0 thousand tons in 3Q24, a 10.1% increase from the second quarter of 2024, which is in line with seasonality and the operational

improvement that has been recorded each quarter. When compared to the third quarter of 2023, sales demonstrated a 2.1% growth, even with

a reduction in purchases from third parties. This represents the highest level of shipments in the company's history, approaching 12 million

tons. |

| · | Adjusted Net Revenue for

3Q24 amounted to R$2,989.2 million, representing a 10.5% decrease from the second quarter of the year. This decline was due to a reduction

in iron ore prices, which offset the increase in volume. Unit net revenue was US$ 45.90 per ton in 3Q24, representing a 21.7% decrease

from 2Q24, as a result of the downward trend in the average price of iron ore and a greater demerit of the exported product, which aligns

with the high Chinese demand for lower-quality ores. |

| · | Mining's Cost of Goods

Sold for the period totaled R$2,094.2 million, representing a 4.8% increase on the previous quarter. This was due to the higher sales

volume. C1 costs reached US$ 19.2/t in 3Q24, a decrease of 9.4% from the previous quarter. This is due to a combination of factors,

including the dilution of fixed costs, exchange rate fluctuations and lower port expenses. |

| · | Adjusted EBITDA reached

R$1,122.8 million in 3Q24, with a quarterly Adjusted EBITDA Margin of 37.6%, representing a reduction of 9.9 p.p. compared to the

previous quarter. This lower profitability is the exclusive consequence of the drop in price realization, given that the period was marked

by exceptional results, including record-setting production and sales volumes, as well as a C1 cost below USD 20/t. |

Build-up Adjusted EBITDA (R$ Million)

Cement Results

The National Union of the Cement Industry (SNIC)

reports that the real estate market remains strong in the second half of the year, particularly in the Minha Casa, Minha Vida segment

(a federal government program). There has been an 86.7% increase in launches compared to the second half of 2023 and a 65.9% increase

compared to the first half of the year. Considering these developments, consumer confidence has been on the rise since June, becoming

a crucial factor in offsetting the population's high indebtedness, rising default rates, and the resumption of interest rate increases.

Despite this, cement sales have increased by 3.8% between January and September in comparison to the same period in 2023, reaching 48.7

million tons. In September, the volume reached 5.8 million tons, representing a 10.4% increase compared to the same month in 2023.

In the case of CSN, the performance was consistent

with the company's strategy of expanding into new markets. CSN has made significant advances in its logistics and distribution capabilities,

with an increasingly larger and more efficient logistics model and distribution centers. As a result, the company achieved new historical

records in production and sales, with total commercial activity reaching 3,650.0 Kton sold. This represents an increase of 1.1% in relation

to the previous quarter and 11.8% in relation to the same period in 2023.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 15 |

| RESULTS 3Q24 |

| | |

Sales Volume – Cement (Thousand tons)

| · | Net revenue reached

R$1,272.0 million in 3Q24, representing a 2.7% increase compared to the previous quarter. This growth is attributed to an increase in

sales volume, which offset the continued pressure on pricing during the period. |

| · | In 3Q24, cement COGS

increased by 6.9% compared to the previous quarter, reflecting the typical seasonal fluctuations in commercial activity and higher raw

material costs. |

| · | As a result, Adjusted EBITDA

increased by 1.0% compared to the previous quarter, reaching R$349.8 million in 3Q24 with an EBITDA margin of 27.5%. This represents stability

in relation to the previous quarter and reinforces the operational excellence that CSN has achieved in this segment, with margins much

higher than the industry average. |

Energy Results

Net revenue reached R$151.4 million in

3Q24, representing a significant growth of 47.3% compared to 2Q24. Meanwhile, Adjusted EBITDA was R$60.6 million, with an Adjusted

EBITDA Margin of 40.0%, representing a margin expansion of 26.5 p.p. compared to the previous quarter. All this increase in revenue

and profitability is a consequence of the resumption of operational activities after the climate event in Rio Grande do Sul, as well as

the solid increase in energy tariffs due to the driest period experienced in the country throughout this quarter.

Logistics Results

In the latest quarter of positive results, the Logistics segment achieved

a 3.8% growth in Adjusted EBITDA in 3Q24 when compared to 2Q24 and a 0.9% growth when compared to the previous year, reaching R$429.1

million. The Adjusted EBITDA Margin decreased slightly by 1.2 p.p. to 48.1% in 3Q24.

Railway Logistics generated net revenue of R$793.1 million in 3Q24, with

an Adjusted EBITDA of R$384.1 million and an Adjusted EBITDA Margin of 48.4%. In comparison with the second quarter of 2024,

revenue increased by 4.2%, with Adjusted EBITDA 0.9% lower.

In the Port Logistics segment, Sepetiba Tecon handled 304,000 tons of

steel products, 41,000 containers, 34,000 tons of general cargo, and 171,000 tons of bulk cargo in 3Q24. In comparison with the same

period in the previous year, the company increased its shipments, resulting in a 25.0% increase in Net Revenue from the port segment,

reaching R$98.9 million. The Adjusted EBITDA was also positively impacted, reaching R$45.1 million in 3Q24, with an Adjusted

EBITDA Margin of 45.6%, or 13.5 p.p. higher than in 3Q23.

| | |

For more information, visit our website: https://ri.csn.com.br/ | 16 |

| RESULTS 3Q24 |

| | |

ESG – Environmental, Social & Governance

ESG PERFOMANCE – GRUPO CSN

Since the beginning of 2023, CSN has adopted

a new format for disclosing its ESG actions and performance, making its performance in ESG indicators available on an individualized

basis. The new model allows stakeholders to have quarterly access to key results and indicators and to monitor them in an effective and

even more agile way. Access can be made through the results center of CSN's IR website: ttps://ri.csn.com.br/informacoes-financeiras/central-de-resultados/.

The information included in this release has

been selected based on its relevance and materiality to the company. Quantitative indicators are presented in comparison with the period

that best represents the metric for monitoring them. Thus, some are compared with the same quarter of the previous year, and others with

the average of the previous period, ensuring a comparison based on seasonality and periodicity. In addition, it is important to highlight

that the ESG Performance Report also incorporates the performance indicators of CSN Cimentos' new assets, acquired in 2022, so that some

absolute indicators will undergo significant changes when compared to the previous period.

More detailed historical data on CSN's performance

and initiatives can be found in the 2023 Integrated Report, released in May 2024 (https://esg.csn.com.br/nossa-empresa/relatorio-integrado-gri).

The review of ESG indicators occurs annually for the closing of the Integrated Report, so the information contained in the quarterly releases

is subject to adjustments resulting from this process.

It is also possible to monitor CSN's ESG performance

in an agile and transparent manner, on our website, through the following electronic address: https://esg.csn.com.br.

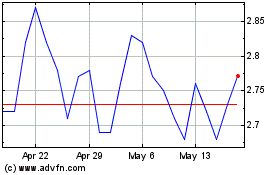

Capital Markets

In the thrid quarter of 2024, CSN's shares

demonstrated minimal fluctuation, while the Ibovespa exhibited a 6.4% growth. The average daily volume (CSNA3) traded on B3 was R$83.7

million in the third quarter of 2024. On the New York Stock Exchange (NYSE), the company's American Depositary Receipts (ADRs) saw a 3.9%

increase in 3Q24, while the Dow Jones index rose by 8.3%. The average daily trading volume of ADRs on the NYSE in 3Q24 was US$3.7 million.

| |

3Q24 |

| No.

of shares in thousands |

|

1,326,094 |

| Market

Value |

|

|

| Closing

Price (R$/share) |

|

12.89 |

| Closing

Price (US$/ADR) |

|

2.39 |

| Market

Value (R$ million) |

|

17,093 |

| Market

Value (US$ million) |

|

3,169 |

| Change

over the period |

|

|

| CSNA3

(BRL) |

|

-0.2% |

| SID

(USD) |

|

+3.9% |

| Ibovespa

(BRL) |

|

+6.4% |

| Dow

Jones (USD) |

|

+8.3% |

| Volume |

|

|

| Daily

average (thousand shares) |

|

6,931 |

| Daily

average (R$ thousand) |

|

83,671 |

| Daily

average (thousand ADRs) |

|

1,689 |

| Daily

average (US$ thousand) |

|

3,713 |

Source:

Bloomberg

|

|

|

| |

|

|

|

| | |

For more information, visit our website: https://ri.csn.com.br/ | 17 |

| RESULTS 3Q24 |

| | |

Earnings Conference Call:

3Q24

Results Presentation Webcast Investor Relations Team

Conference

call in Portuguese with simultaneous translation into English November 13th, 2024 11:30 a.m. (Brasília time) 09:30 a.m. (New

York time) Webinar: click here |

Antonio Marco Campos Rabello - CFO and IR Executive Director

Pedro Gomes de Souza (pedro.gs@csn.com.br)

Mayra Favero Celleguin (mayra.celleguin@csn.com.br)

|

Some of the statements contained herein are forward-looking

statements that express or imply expected results, performance or events. These outlooks include future results that may be influenced

by historical results and by the statements made under 'Outlook'. Actual results, performance and events may differ materially from the

assumptions and outlook and involve risks such as: general and economic conditions in Brazil and other countries; interest rate and exchange

rate levels; protectionist measures in the US, Brazil and other countries; changes in laws and regulations; and general competitive factors

(on a global, regional or national basis).

|

| | |

For more information, visit our website: https://ri.csn.com.br/ | 18 |

| RESULTS 3Q24 |

| | |

INCOME STATEMENT

Corporate Law – In Thousands of Reais

| | |

For more information, visit our website: https://ri.csn.com.br/ | 19 |

| RESULTS 3Q24 |

| | |

BALANCE SHEET

Corporate Law – In Thousands of Reais

| | |

For more information, visit our website: https://ri.csn.com.br/ | 20 |

| RESULTS 3Q24 |

| | |

CASH FLOW STATEMENT

Corporate Law – In Thousands of Reais

| | |

For more information, visit our website: https://ri.csn.com.br/ | 21 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 12, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Antonio Marco Campos Rabello

|

| |

Antonio Marco Campos Rabello

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

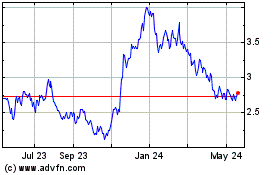

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Feb 2025 to Mar 2025

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Mar 2025