0001816017false00018160172025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 10, 2025 |

SPIRE GLOBAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-39493 |

85-1276957 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8000 Towers Crescent Drive Suite 1100 |

|

Vienna, Virginia |

|

22182 |

(Address of principal executive offices) |

|

(Zip code) |

|

Registrant’s telephone number, including area code: (202) 301-5127 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value of $0.0001 per share |

|

SPIR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Maritime Transaction

As previously disclosed, on February 10, 2025, Spire Global, Inc. (the “Company”) filed a complaint in the Delaware Court of Chancery against Kpler Holding SA, a Belgian corporation (“Buyer”), seeking a grant of specific performance ordering Buyer to satisfy its obligations under the Share Purchase Agreement between the Company and Buyer with respect to the sale of the Company’s maritime business (the “Purchase Agreement”) and to consummate the closing in accordance with the terms of the Purchase Agreement (the “Delaware Action”). In the Delaware Action, the Company also requests a declaratory judgment declaring that Buyer has breached its obligations under the Purchase Agreement and is not excused from performing its obligations under the Purchase Agreement, including proceeding with the closing. On February 11, 2025, Buyer filed to remove the Delaware Action to the United States District Court for the District of Delaware.

There is no assurance as to what action the Delaware Court of Chancery or the United States District Court for the District of Delaware will take with respect to the proceeding initiated by the Company and there is no assurance as to whether or not the transactions contemplated by the Purchase Agreement (the “Transactions”) will be consummated on the terms contemplated or at all. Whether or not the Transactions are consummated as required, the Company reserves all of its rights under the Purchase Agreement and in law and equity, including the right to seek damages and other remedies from Buyer. The amount of any damages which may be sought or obtained from Buyer cannot be determined at this time.

The foregoing summary of the Delaware Action is qualified in its entirety by reference to the complaint filed in the Delaware Action, a redacted copy of which is filed with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

The Company announces material information to the public about the Company, its products and services and other matters through a variety of means, including filings with the SEC, press releases, public conference calls, webcasts, the investor relations section of its website (www.ir.spire.com), its X account (@SpireGlobal), its Bluesky account (@spire.com) and its LinkedIn page in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

Forward Looking Statements

This report contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or the Company’s anticipated financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “seek” or “continue” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans or intentions. Statements about the Transactions, including with respect to whether and when the Transactions may occur, the potential consequences of the Transactions, the potential future relationships contemplated by the Purchase Agreement, and the Delaware Action are forward-looking statements.

The Company cautions you that the foregoing list may not contain all of the forward-looking statements made in this report. You should not rely upon forward-looking statements as predictions of future events. Factors that may cause future results to differ materially from the Company’s current expectations include, among other things, (1) risks related to the consummation of the Transactions, including the risks that (a) the proposed Transactions may not be consummated within the anticipated time period, or at all, (b) the Buyer may continue to refuse to consummate the

Transactions notwithstanding the Company’s belief that all of the conditions to closing contained in the Purchase Agreement have been satisfied or could be satisfied, (c) the Delaware Court of Chancery (or United States District Court for the District of Delaware) may not provide any or all of the relief sought, (d) all or part of Buyer’s financing may not become available and (e) the risk that regulatory impediments to closing may arise; (2) the nature, cost and outcome of litigation and other legal proceedings; (3) the risk that the Transactions may involve further unexpected costs, liabilities or delays; (4) the effects that any termination of the Purchase Agreement may have on the Company or its business, including the risks that the Company stock price may decline significantly if the Transactions are not completed; (5) the effects that the announcement or pendency of the Transactions, or developments with respect thereto, including the failure to close, may have on the Company and its business, including the risks that as a result (a) the Company’s business, operating results or stock price may suffer, (b) the Company’s current plans and operations may be disrupted, (c) the Company’s ability to retain or recruit key employees may be adversely affected, (d) the Company’s business relationships (including, customers, data providers, and other suppliers) may be adversely affected, or (e) time and attention of Company personnel may be diverted from other important matters; (6) the effect of limitations that the Purchase Agreement places on the Company’s ability to operate its business during the pendency of the Transactions; (7) the risk that the Transactions may involve unexpected costs, liabilities or delays; (8) other economic, business, competitive, legal, regulatory, and/or tax factors; (9) the Company’s future financial results and any further delay in the filing of required periodic reports, (10) risks that Blue Torch Finance LLC (“Blue Torch”) may take actions available to it as collateral agent under the Financing Agreement with Blue Torch, as administrative agent and collateral agent, and certain lenders, including accelerating the maturity of the indebtedness thereunder, (11) risks related to the Company’s failure to comply with the New York Stock Exchange (“NYSE”) listing standards, including a risk that the NYSE may not agree to extend the deadline by which the Company’s Quarterly Report on 10-Q for the quarter ended June 30, 2024 must be filed, (12) risks regarding the Company’s ability to raise additional capital through the issuance of equity or debt securities (including securities convertible or exchangeable for equity) or incurrence of debt, (13) risks regarding the Company’s ability to delay, limit, reduce, or terminate certain commercial efforts, seek waivers of or amendments to contractual obligations or pursue merger, disposition or other strategies and (14) the other risk factors affecting the Company described under “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this report. The Company cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

Neither the Company nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Moreover, the forward-looking statements made in this report relate only to expectations as of the date on which the statements are made. The Company undertakes no obligation to update any forward-looking statements made in this report to reflect events or circumstances after the date of this report or to reflect new information or the occurrence of unanticipated events, except as required by law. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and you should not place undue reliance on the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SPIRE GLOBAL, INC.

Date: February 14, 2025 By: _/s/ Theresa Condor_______________________

Name: Theresa Condor

Title: Chief Executive Officer

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

SPIRE GLOBAL, INC.,

Plaintiff,

v.

KPLER HOLDING SA,

Defendant.

)

)

) C.A. No. 2025- -

)

) REDACTED PUBLIC VERSION

)

)

)

)

VERIFIED COMPLAINT

Plaintiff Spire Global, Inc. (“Spire”), by and through its undersigned counsel, hereby files this Verified Complaint against Kpler Holding SA (“Kpler”). Upon knowledge as to itself and information and belief as to all other matters, Spire alleges the following:

NATURE OF THE ACTION

1.Spire files this action to hold Kpler to its contractual obligations under the November 13, 2024 Share Purchase Agreement (the “SPA”) to acquire Spire’s maritime business (as defined in the SPA, the “Business”). The parties entered into the SPA after a highly competitive sales process. The SPA gives Kpler a right to avoid closing only in limited circumstances, none of which have occurred here. In addition, the SPA includes a “hell-or-high-water” provision obligating Kpler to take any and all actions necessary to eliminate each and every regulatory impediment to

closing. Kpler’s willingness to include this provision and assume all regulatory risk was a key reason Spire selected Kpler over other competing bidders.

2.Following execution of the SPA, Spire worked diligently to satisfy all conditions to closing, and all conditions to closing had been satisfied or could be satisfied as of January 17, 2025. While Kpler initially participated in the pre-closing steps required under the SPA, Kpler reversed course shortly before closing was set to occur.

3.On January 17, 2025, Spire informed Kpler that closing would occur on January 24, 2025. On January 24, 2025, Spire’s counsel reiterated to Kpler’s counsel that “Spire still intends and remains ready, willing and able to close today as scheduled.” Kpler failed to consummate the closing on that day without justification. Kpler has not identified any unmet condition to closing, nor does the SPA give Kpler the option to delay closing once all closing conditions have been met. Kpler’s conduct plainly violates the SPA and entitles Spire to injunctive relief compelling Kpler to honor its contractual obligations and consummate the transaction.

4.In discussions and correspondence around the intended closing date, Kpler has raised certain pretextual reasons why it believes closing cannot proceed. These purported justifications fail to excuse Kpler’s conduct. First, Kpler has

attempted to hold up the closing over its ongoing negotiations with a third-party data

supplier to the Business (the “Supplier”). In its pre-signing offer letter, Kpler

Kpler’s successful completion of its negotiations with Supplier was not a condition to closing, so Kpler’s bargaining with a third party does not excuse its obligations under the bargain it already struck with Spire.

5.After the parties signed the SPA and announced the transaction,

does not trigger a Material Adverse Effect (“MAE”) or render Spire’s representations regarding the Business and its existing contracts inaccurate.

6.The definition of an MAE is limited to any event that currently “is” having a materially adverse effect on the Business, and expressly excludes effects “resulting directly or indirectly from the announcement, execution or delivery of the Agreement or the pendency or consummation of the Transactions, including any

disruption in (or loss of) supplier, service provider, partner or similar relationships.”

Ex. 1 (SPA) at Ex. A.

Moreover, Spire’s representations that no unresolved notices of breach or default have been received is limited to the time of signing—not closing—and intended to avoid precisely the type of scenario where a party attempts to use as an excuse for not

closing.

7.In any event, after Kpler threatened to delay closing over the various purported issues with Supplier,

.

8.Second, instead of using best efforts to take “any and all actions” necessary to remove any regulatory impediment to closing as required under the hell- or-high-water provision (id. § 6.1; see also Ex. 2 at Schedule 6.1(c)), Kpler has

.

9.Kpler has attempted to justify its refusal to close based on

.

The SPA is clear that the only orders that can prevent closing are those that have been issued by a relevant governmental entity, remain outstanding as of the time of closing, and actually prevent the parties from consummating the transaction. No such order had been issued at the time of closing, nor has any such order been issued since.

10.Kpler’s apparent buyer’s remorse does not excuse its obligations to complete the closing. Kpler cannot manufacture obstacles to closing through its own refusal to and foot-dragging to avoid working through the regulatory process.

11.Spire and Kpler expressly agreed that “irreparable damage for which

monetary damages, even if available, would not be an adequate remedy, would occur

in the event that the Parties do not perform their obligations under the provisions of this Agreement,” and Spire “shall be entitled to an injunction or injunctions, specific performance, or other equitable relief” to prevent breaches of the SPA and to compel Kpler to consummate the transaction. Ex. 1 (SPA) § 12.13.

12.Equitable relief is necessary here to prevent irreparable harm to Spire.

Kpler’s failure and continued refusal to consummate the transaction create uncertainty and delay that harm Spire and expose the company to adverse effects on its business operations.

13.Accordingly, Spire requests an order of specific performance requiring Kpler to fulfill its obligations under the SPA and consummate the closing in accordance with the terms of the SPA. Spire also requests declaratory judgment declaring that Kpler has breached its obligations under the SPA and is not excused from performing its obligations under the SPA, including proceeding with the closing.

THE PARTIES

14.Plaintiff Spire is a Delaware corporation headquartered in Vienna, Virginia. Spire owns and operates one of the world’s largest constellations of commercial satellites, which it uses to track maritime, aviation and weather patterns. Spire supplies space-based data and analytics that offer its customers unique

insights, including, for example, government entities responsible for monitoring

risks such as extreme weather events and wildfire risk. Spire’s common stock is publicly listed on the New York Stock Exchange under the ticker “SPIR.”

15.Defendant Kpler is a Belgian corporation headquartered in Brussels, Belgium. Kpler is a data and analytics firm that offers global trade intelligence on commodities, energy, financial markets, and shipping & transportation.

JURISDICTION, VENUE AND GOVERNING LAW

16.This Court has subject matter jurisdiction over this action under 10 Del.

C. § 341, 8 Del. C. § 111(a), and 6 Del. C. § 2708.

17.Venue is proper before this Court. Under the SPA, each party “irrevocably and unconditionally consents and submits to the exclusive jurisdiction and venue of the state and federal courts located in Delaware.” Ex. 1 (SPA) § 12.15.

18.The SPA is governed by Delaware law. Id.

FACTUAL ALLEGATIONS

I.Kpler Pursues Spire’s Maritime Business

19.On August 14, 2024, Spire disclosed to the SEC that it had been reviewing its accounting practices and procedures with respect to revenue recognition as to certain contracts and determined that certain of its previously issued financial statements need to be restated to adjust the timing of when revenue is recognized under these contracts. See Ex. 3 (8/27/24 8-K).

20.On August 20, 2024, Spire received an unsolicited letter of intent from

Kpler, proposing the acquisition by Kpler of Spire’s maritime business, which provides analytics insights for the maritime and commodity markets, including vessel data for ship tracking and situational awareness solutions. In response to the letter, Spire directed its investment banker to commence an auction process. The auction process was competitive, with multiple bidders submitting proposals on attractive terms.

21.Another bidder emerged with a superior offer, which Kpler was initially unwilling to match. Spire’s investment banker notified Kpler on October 21, 2024 that Spire would be abandoning discussions with Kpler and moving forward with another bidder.

22.The next day, on October 22, 2024, Kpler sent a confidential offer (the “Offer Letter”) that

See Ex. 4 (10/22/2024 Offer Letter).

23.Ultimately, based on Kpler’s commitment to provide certainty of closing despite regulatory risks, Kpler’s willingness to manage any risks associated with Supplier without any closing condition, and Kpler’s commitment to do

everything necessary to timely close the transaction despite any regulatory impediments, Spire elected to enter into a transaction with Kpler.

24.On November 13, 2024, Spire announced that it had entered into an agreement for the sale of the Business to Kpler and anticipated a closing in the first quarter of 2025. The announcement further noted that Spire intended to use the proceeds from the transaction to retire all of its outstanding debt, which would “mitigate[] risk by removing the most significant external financial pressures,” and to invest in near-term growth opportunities. See Ex. 5 (11/13/24 Press Release).

25.The terms of the transaction are governed by the SPA executed on November 13, 2024.

26.Under the SPA, at closing, Spire and its applicable subsidiaries will transfer all equity interests in the Business and certain related assets to Kpler or its applicable subsidiaries, and Kpler will pay $233,500,000, subject to customary adjustments, and enter into agreements pursuant to which Kpler will pay an additional $7,500,000. See Ex. 1 (SPA) §§ 1.2, 2.1, 2.3.

27.The SPA requires Kpler to use “best efforts” and to cooperate with Spire “to take, or cause to be taken, all actions, and to do, or cause to be done, all

things necessary, appropriate or desirable to make or cause to be made the

appropriate filings and submissions required to” meet all regulatory requirements for the transaction. Id. § 6.1(a).

28.In addition, Kpler expressly agreed to “use best efforts, and to take any and all actions necessary, to eliminate each and every impediment that is asserted by

[a] relevant Governmental Entity under the Specified Laws so as to enable the Parties to consummate the Transactions promptly and, in any event, prior to the End Date,” i.e., November 13, 2025. Id. § 6.1(c), Ex. A.

29.Schedule 6.1(c) further specifies

Ex. 2 (SPA Disclosure Schedules) at Schedule 6.1(c).

30.This “hell-or-high-water” provision was a highly negotiated, key provision of the SPA. Kpler’s willingness to assume any regulatory risk related to the transaction was a key reason why Spire selected Kpler over other competing bidders.

B. Interim Operating Covenants

31.The SPA includes customary covenants regarding Spire’s conduct of the Business between signing and closing. See Ex. 1 (SPA) § 6.3. Spire may not, without Kpler’s consent, enter into any settlement or compromise agreement involving monetary damages in excess of $15,000 or imposing equitable relief on the Business. Kpler’s consent to any agreement exceeding these restrictions shall not, however, be “unreasonably withheld, conditioned or delayed”:

During the Pre-Closing Period, except . . . with Buyer Parent’s consent (which shall not be unreasonably withheld, conditioned or delayed) . . . neither Seller Parent nor the Target Companies shall with respect to the Business:

. . .

(n) waive, release, assign, compromise, commence, settle or agree to settle any Legal Proceeding, other than waivers, releases, compromises or settlements in the ordinary course of business that (i) involve only the payment of monetary damages not in excess of $15,000 individually or $500,000 in the aggregate if paid by any Target Company or where the payment is paid prior to the Closing or is paid by any Person other than such Target Company and (ii) do not include the imposition of equitable relief on, or the admission of wrongdoing by, any Target Company[.]

Id. § 6.3(n).

C. Closing Conditions

32.The SPA includes limited, customary conditions to closing in Sections 8 and 9 of the SPA. Section 8.1 requires that Spire’s representations and warranties, including its representations and warranties regarding the divested Business, be true and correct as of the closing, except to the extent the representations are made as of an earlier date, and except where the failure of such representations and warranties to be true and correct would not constitute an MAE. Id. § 8.1. Section 8.4 requires that “there shall not have occurred any Material Adverse Effect” since the SPA had been executed. Id. § 8.4.

33.“Material Adverse Effect” is narrowly defined as: “any effect that is materially adverse to the assets, Liabilities, financial condition or existing business,

of the Business (taken as a whole).” Id. at Ex. A. It does not extend to events that in the future could or would be reasonably expected to result in an MAE.

34.The SPA is explicit that the following events, among others, do not constitute an MAE:

(c) any adverse effect resulting from changes in regulatory, legislative or political conditions in the United States or any other country or region in the world, except to the extent such change in regulatory, legislative or political condition has a materially disproportionate effect on the Business as compared to any of the other companies in the Business’s industry, in which case only the incremental disproportionate adverse impact may be taken into account in determining whether there has occurred a Material Adverse Effect

. . .

(e) any adverse effect resulting directly or indirectly from the announcement, execution or delivery of the Agreement or the pendency or consummation of the Transactions, including any disruption in (or loss of) supplier, service provider, partner or similar relationships or any loss of employees

. . .

(i) any adverse effect resulting directly or indirectly from any breach by Buyer Parent of any provision of this Agreement or the taking of any other action by Buyer Parent

Id.

35.Spire also made customary representations and warranties regarding the Business in Section 3 of the SPA. Section 3.10(b) states that, as of the date of signing, i.e., November 13, 2024:

With respect to each Material Contract listed in Section 3.10(a) of the Disclosure Schedule: (i) such Material Contract is with respect to each party thereto other than a Seller Party, binding and enforceable against such party in accordance with its terms, subject to (A) Laws of general application relating to bankruptcy, insolvency and the relief of debtors, and (B) rules of Law governing specific performance, injunctive relief and other equitable remedies; and (ii) no Target Company is in material breach or material default of such Material Contract or, with the giving of notice or the giving of notice and passage of time without a cure would be, in material breach or material default of such Material Contract, and to Seller Parent’s Knowledge, no other party to such Material Contract is in material breach or material default of such Material Contract. No Seller Party has received unresolved written notice as of the date hereof of (i) any material default under any Material Contract or (ii) the intention of any Person to terminate any Material Contract or materially modify the terms thereof. Seller Parent has delivered or otherwise made available to Buyer Parent a true and complete copy of each such Material Contract.

Id. § 3.10(b).

36.The SPA gives Spire the right to designate the date of the closing, which would occur no later than five business days after “the satisfaction or waiver of all conditions set forth in Section 8 and Section 9 (other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions at the Closing) or such other date or time as the Parties mutually agree in writing.” SPA § 1.4.

D. Termination

37.The circumstances in which Kpler can terminate the transaction are narrowly circumscribed. Either party generally may terminate the SPA after the End

Date if the transaction has not closed by that date. Kpler can also terminate the SPA if the transaction has been permanently enjoined by a governmental entity or if Spire has materially breached the SPA. Specifically, the SPA provides for termination prior to closing:

(c)by either [Kpler] or [Spire], if a Governmental Entity shall have issued a final and nonappealable order having the effect of permanently restraining, enjoining or otherwise prohibiting the Transactions; provided, that a Party shall not be permitted to terminate this Agreement pursuant to this Section 10.1(c) if such Party did not use commercially reasonable efforts to have such order vacated prior to its becoming final and nonappealable;

(d)by [Kpler], if [Spire] shall have materially breached or materially failed to perform any of its representations, warranties, covenants or agreements contained in this Agreement, which material breach or failure to perform (i) would give rise to the failure of a condition set forth in Section 8.1 or Section 8.2 and (ii) cannot be or has not been cured within 30 calendar days following receipt by [Spire] of written notice of such material breach or failure to perform;

Id. § 10.1.

E. Specific Performance

38.Kpler and Spire agreed that specific performance would be available as a remedy to force the parties to perform their carefully negotiated obligations. Specifically, Section 12.13 of the SPA provides that:

The Parties agree that irreparable damage for which monetary damages, even if available, would not be an adequate remedy, would occur in the event that the Parties do not perform their obligations under the provisions of this Agreement in accordance with its specified terms or

otherwise breach such provisions. The Parties acknowledge and agree

that (a) the Parties shall be entitled to an injunction or injunctions, specific performance, or other equitable relief to prevent breaches of this Agreement and to enforce specifically the terms and provisions hereof … without proof of damages or otherwise, this being in addition to any other remedy to which they are entitled under this Agreement or at law or in equity and (b) the right of specific performance is an integral part of the Transactions and without that right, none of the Seller Parties or Buyer Parent would have entered into this Agreement. The right to specific enforcement hereunder shall include the right of [Spire] to cause [Kpler] to purchase the Purchased Equity and to consummate the other Transactions, on the terms and subject to the conditions set forth in this Agreement.

Id. § 12.13.

39.Section 12.13 of the SPA also states that, “Each of the Parties agrees that it will not oppose the granting of an injunction, specific performance and other equitable relief on the basis that the other Parties have an adequate remedy at law or an award of specific performance is not an appropriate remedy for any reason at law or equity.” Id.

40.Finally, in the event of a dispute between the parties to enforce the SPA, “the prevailing Party . . . shall be entitled to receive a reasonable sum for its attorneys’ fees and all other reasonable costs and expenses incurred” in litigating such a dispute. Id. § 12.6.

III.Kpler Refuses to Close the Transaction in Breach of the SPA

41.Following execution of the SPA, Spire worked diligently to satisfy all conditions to closing. Kpler initially endeavored to meet the closing conditions and to work through all necessary regulatory processes.

42.On January 17, 2025, Kpler received the required clearance under the United Kingdom National Security and Investment Act of 2021, the last unmet condition to closing. Thus, as a result of the parties’ mutual efforts, all of the conditions set forth in Sections 8 and 9 of the SPA (other than those conditions that by their nature were to be satisfied at closing) were satisfied as of that date.

43.Representatives of Spire and Kpler met on January 17, 2025 to confirm that the requisite closing conditions had been satisfied and to designate Friday, January 24, 2025 as the “Closing Date” in accordance with the procedures set forth in Section 1.4 of the SPA. Kpler confirmed it would be taking the necessary steps to fund the purchase price on such date.

44.On January 20, 2025, the parties held a call to coordinate final preparations for closing. During that call, Kpler expressed concern about the progress of its negotiations with Supplier, which had requested additional concessions from Kpler

. On that call, Spire confirmed that these

developments did not affect its ability or willingness to certify the satisfaction of applicable conditions on the expected Closing Date.

45.Spire was ready, willing and able to go forward with the closing on January 24, 2025, and Kpler was contractually obligated to close on that date. Nonetheless, Kpler reversed course and declined to close on January 24, 2025 in breach of the SPA.

IV.Kpler’s Pretextual Reasons for Failing to Close Do Not Excuse Its Breach of the SPA

46.Kpler has offered two purported justifications for its breach of the SPA and refusal to close: (i) Kpler’s ongoing but unresolved renegotiation of the Supplier Agreement and

; and (ii) regulatory developments

. Neither after-the-fact excuse precludes the parties from proceeding with the closing, nor do they permit Kpler to ignore its contractual obligations.

A.Kpler’s Desire to Renegotiate the Supplier Agreement and

Do Not

Prevent Kpler from Closing

47.From the outset of the bidding process, Kpler

. Ex. 4

(10/22/2024 Offer Letter). Nonetheless, in the months following signing, Kpler has not entered into a final agreement on renegotiated terms, and has pointed to the lack of a finally executed agreement as a reason to delay the closing. The fact that Kpler has not signed an agreement with Supplier in no way prevents Kpler from honoring its obligations under the SPA. Kpler did not make a successful renegotiation of the Supplier Agreement a condition to closing. And, in any event, Spire understands that Kpler and Supplier have since concluded renegotiations and Supplier is ready to sign an acceptable revised agreement. Thus, there is no impediment to closing from the fact that Kpler has not yet signed a renegotiated Supplier Agreement.

48.Kpler has also pointed to

.

49.After the parties announced the signing of the SPA,

.

does not preclude a closing under the SPA. The representation in Section 3.10(b) regarding “Material Contracts” applies only if Spire or its applicable subsidiary “is” in material breach or material default, or “would be” in material breach or material default of such a contract given notice or absent cure. Ex. 1 (SPA)

§ 3.10(b).

In addition, the representation in Section 3.10(b) regarding any unresolved written notice of material default or a third-party’s intention to terminate a “Material Contract” applies only as of the date of the SPA, i.e., November 13, 2024.

In any event, an inaccuracy in a representation does not result in a failure of the closing condition in Section 8.1 unless the inaccuracy would constitute an MAE.

51.Importantly, does not constitute an MAE. Under the SPA, an MAE is limited to “any effect that is materially adverse” to the Business. Id. at Ex. A (emphasis added). This definition excludes any effects that could be or would be reasonably expected to be materially adverse to the

Business in the future. Moreover, the MAE definition expressly excludes “any

adverse effect resulting directly or indirectly from the announcement, execution or delivery of the Agreement or the pendency or consummation of the Transactions, including any disruption in (or loss of) supplier, service provider, partner or similar relationships or any loss of employees.” Id.

, is exactly the type of post-announcement event that is exempted from the MAE definition.

52.In any event, after Kpler threatened to delay closing over

The SPA is clear that Kpler’s consent to a settlement or compromise agreement “shall not be unreasonably withheld, conditioned or delayed.” Id. § 6.3.

Moreover, raising potential hurdles to closing and then scuttling its resolution is precisely the type of action by Kpler that does not and cannot give rise to an MAE. To the extent the pendency of this dispute constitutes an adverse effect, it has resulted “directly or indirectly from any breach by [Kpler] of any provision of this Agreement or the taking of any other action by [Kpler]” and is therefore not an MAE. Id. Kpler’s attempt to nonetheless use

as an excuse to avoid closing is meritless.

B. The Pending Does Not Prevent a Closing

54.As a second purported justification for failing to close, Kpler has pointed to

55.Section 8.3 is clear that the only scenario in which a governmental order can create an unmet closing condition is if such order “shall have been issued . . . and remain[s] in effect.” Ex. 1 (SPA) § 8.3 (emphasis added).

on January 24, 2025—after closing should have and would have occurred but for Kpler’s breach. Thus, even if the presented an obstacle to closing, that obstacle did not even exist as of the time when the parties should have closed.

Only a temporary restraining order, preliminary or permanent injunction, or other order “preventing the consummation” of the transaction can result in an unmet closing condition. Id. § 8.3 (emphasis added).

Kpler is obligated to use “best efforts” and take “any and all actions” to eliminate regulatory impediments for the transaction (id. § 6.1(c); see also Ex. 2 at Schedule 6.1(c)), yet

Kpler has instead used potential regulatory hurdles as an excuse for not consummating the closing.

59.In communications between the parties following the Closing Date,

Kpler has only vaguely averred that consummating the transaction

would be potentially inconsistent with the terms of the SPA without identifying any closing condition that would be unmet as a result of the

. For good reason, as no such condition exists. And while Kpler has suggested that Spire may be in breach of Section 8.3, that provision only applies to orders or injunctions issued prior to closing that prevent the parties from actually completing the closing.

60.Rather than work through the regulatory process and take “any and all actions” to eliminate regulatory impediments as is Kpler’s burden under the SPA,

Kpler has instead attempted to use the

as leverage against Spire. Kpler’s attempt to turn the

into an unmet closing condition is irreconcilable with the SPA’s terms.

V.Kpler’s Breach Has Caused Irreparable Damage to Spire

61.Because of Kpler’s breach and the uncertainty it has generated, Spire faces irreparable harm. Kpler stipulated in the SPA that “irreparable damage for which monetary damages, even if available, would not be an adequate remedy,

would occur in the event that the Parties do not perform their obligations under the

provisions of this Agreement in accordance with its specified terms or otherwise breach such provisions.” Ex. 1 (SPA) § 12.13.

62.Kpler’s actions to avoid consummating the deal create uncertainty and delay that harm Spire and expose the company to adverse effects on its business operations. Kpler’s failure to close has caused significant confusion and disruption among Spire employees, who are more likely to be poached by Spire’s competitors as a result of Kpler’s delay. Kpler’s delay and the resulting uncertainty have also damaged the Business’s relationship with its customers and suppliers.

63.As a result of the restatement process initiated in August 2024, Spire has triggered a default with its lender and been forced to negotiate waivers and amendments to its financing agreement. A key reason for Spire to execute the transaction was to retire its outstanding debt, which would mitigate risk by removing the most significant external financial pressures on the business. Spire remains subject to that risk for as long as Kpler continues to delay the closing. Spire is also continuing to incur expense related to the restatement process, which it needs to pay off using the proceeds from the sale of the Business.

64.The restatement process has further prevented Spire from accessing the capital markets to finance its operations. Selling the Business is one of Spire’s few remaining financing strategies and key to finalizing the restatement process and

transforming Spire’s cost structure and operating model. Kpler’s failure to

consummate the transaction threatens to derail this process and significantly impair Spire’s enterprise value and ability to finance its operations.

65.Kpler’s continued failure to close could also subject Spire to external stock market pressure. Spire has communicated to investors that it anticipates closing the transaction in Q1 2025. Failing to consummate the transaction within that time may lead to speculation that the transaction may not close at all.

66.Prompt remedial action in the form of specific performance and injunctive relief is warranted.

COUNT I

(Breach of Contract – Specific Performance & Injunction)

67.Spire repeats and incorporates by reference the allegations above as if fully set forth herein.

68.The SPA is a valid and enforceable contract between Spire and Kpler.

69.Spire has fully performed all of its obligations under the SPA to date, and is ready, willing, and able to continue so performing.

70.All of the conditions set forth in Sections 8 and 9 of the SPA have been satisfied or are expected to be satisfied at the closing.

71.Kpler has breached the SPA by, among other things, violating Sections 1.2, 1.4, 2.3, 6.1, and Schedule 6.1(c).

72.The SPA provides that “irreparable damage for which monetary

damages, even if available, would not be an adequate remedy, would occur in the event that the Parties do not perform their obligations under the provisions of this Agreement in accordance with its specified terms or otherwise breach such provisions.” Ex. 1 (SPA) § 12.13. The parties further agreed that each party “shall be entitled to an injunction or injunctions, specific performance, or other equitable relief, to prevent breaches of this Agreement and to enforce specifically the terms and provisions hereof,” and “the right of specific performance is an integral part of the Transactions” and “shall include the right of Seller Parent to cause Buyer Parent to purchase the Purchased Equity and to consummate the other Transactions, on the terms and subject to the conditions set forth in this Agreement.” Id. The parties further agreed not to “oppose the granting of an injunction, specific performance and other equitable relief on the basis that the other Parties have an adequate remedy at law or an award of specific performance is not an appropriate remedy for any reason at law or equity.” Id.

73.Spire has suffered and will continue to suffer irreparable harm as a result of Kpler’s breaches.

74.Spire has no adequate remedy at law.

COUNT II

(Declaratory Judgment)

75.Spire repeats and incorporates by reference the allegations above as if fully set forth herein.

76.This Court has authority to issue a declaratory judgment under 10

Del. C. § 6501.

77.A valid and justiciable controversy exists between Spire and Kpler because Kpler has failed to perform its obligations under the SPA, including its obligations to close the transaction.

78.Spire seeks a declaration that,

a.Section 1.2 required Kpler to acquire the Business from Spire at and as of the closing date;

b.Section 1.4 required Kpler to close on its purchase of the Business from Spire on the closing date of January 24, 2025;

c.Section 2.3 required Kpler to make certain payments to Spire as part of Kpler’s acquisition of the Business on the closing date; and

d.Section 6.1 and Schedule 6.1(c) required Kpler to use “best efforts” and to take “any and all actions necessary” to eliminate any regulatory impediments to closing.

79.Spire also seeks a declaration from this Court that

a.all conditions to closing under the SPA have been satisfied;

b.Kpler has not acquired the Business, as required under the SPA, including Sections 1.2, 1.4, or 2.3;

c.Kpler has not exercised “best efforts” to remove all regulatory impediments to closing, as required under Section 6.1 and Schedule 6.1(c); and

d.Kpler is not excused from performing the obligations imposed by the SPA, including Sections 1.2, 1.4, 2.3, 6.1, and Schedule 6.1(c).

PRAYER FOR RELIEF

WHEREFORE, Spire respectfully requests that the Court enter judgment and relief against Defendant, as follows:

A.Granting all relief requested in this Complaint to the extent permitted under the SPA;

B.Ordering Defendant to specifically perform its obligations under the SPA and consummate the closing in accordance with the terms of the SPA;

C.Granting such injunctive relief as is necessary to enforce the decree of specific performance;

D.Declaring that (i) Kpler has breached its obligations under the SPA,

including its obligations to close the transaction and to use its best efforts to resolve any regulatory impediment to the transaction; (ii) Kpler has failed to prove that the Business has experienced a Material Adverse Effect; (iii) all conditions to closing under the SPA have been satisfied; and (iv) Kpler is not excused from performing its obligations under the SPA, including its obligations to proceed with closing.

E.Awarding costs, attorneys’ fees and such other relief in accordance with the terms of the SPA; and

F.Granting Spire such other and further relief as the Court deems just and proper.

OF COUNSEL:

SIMPSON THACHER & BARTLETT LLP

Jonathan K. Youngwood (pro hac vice

forthcoming)

Meredith Karp (pro hac vice

forthcoming)

Jacob Lundqvist (pro hac vice

forthcoming)

Nora C. Hood (pro hac vice

forthcoming)

425 Lexington Avenue New York, NY 10017

(212) 455-2000

FAEGRE DRINKER BIDDLE & REATH LLP

/s/ Oderah C. Nwaeze Oderah C. Nwaeze (#5697) Angela Lam (#6431)

222 Delaware Avenue, Suite 1410

Wilmington, DE 19801

(302) 467-4200

oderah.nwaeze@faegredrinker.com angela.lam@faegredrinker.com

Attorneys for Plaintiff

Dated: February 10, 2025

v3.25.0.1

Document And Entity Information

|

Feb. 10, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 10, 2025

|

| Entity Registrant Name |

SPIRE GLOBAL, INC.

|

| Entity Central Index Key |

0001816017

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39493

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-1276957

|

| Entity Address, Address Line One |

8000 Towers Crescent Drive

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

Vienna

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22182

|

| City Area Code |

202

|

| Local Phone Number |

301-5127

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Class A common stock, par value of $0.0001 per share

|

| Trading Symbol |

SPIR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

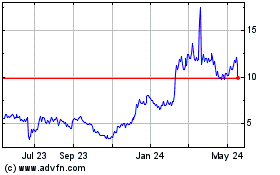

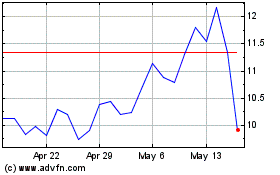

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Spire Global (NYSE:SPIR)

Historical Stock Chart

From Feb 2024 to Feb 2025