First lawsuit filed in U.S. Court of Appeals

for the District of Columbia Circuit challenging violation of the

Constitutional guarantee of due process and statutory procedural

requirements, as well as unlawful political influence, and asking

the court to set aside the CFIUS review process and President

Biden’s blocking order

Second lawsuit filed in U.S. District Court for

the Western District of Pennsylvania against Cleveland-Cliffs,

Cliffs’ CEO Lourenco Goncalves, and USW President David McCall for

their illegal and coordinated actions aimed at preventing the

transaction and attempting to undermine U. S. Steel’s ability to

compete and Nippon Steel’s ability to provide American-made steel

to American consumers

Determined that these legal actions are the

necessary path toward closing the transaction and delivering shared

success for U. S. Steel employees, communities, shareholders, and

customers

Nippon Steel Corporation ("Nippon Steel") (TSE: 5401), together

with its wholly owned subsidiary Nippon Steel North America, Inc.

(“NSNA”), and United States Steel Corporation ("U. S. Steel")

(NYSE: X) (together with Nippon Steel, the “Companies”) today

jointly filed two lawsuits to remedy the ongoing illegal

interference with Nippon Steel’s acquisition of U. S. Steel (the

“Transaction”).

The Companies today commented on the litigation:

“From the outset of the process, both Nippon Steel and U. S.

Steel have engaged in good faith with all parties to underscore how

the Transaction will enhance, not threaten, United States national

security, including by revitalizing communities that rely on

American steel, bolstering the American steel supply chain, and

strengthening America’s domestic steel industry against the threat

from China. Nippon Steel is the only partner both willing and able

to make the necessary investments – including no less than $1

billion to Mon Valley Works and approximately $300 million to Gary

Works as part of the $2.7 billion committed – to protect and grow

U. S. Steel for the benefit of employees, the communities in which

it operates, and the entire American steel industry. Today’s legal

actions demonstrate Nippon Steel’s and U. S. Steel’s continued

commitment to completing the Transaction – despite political

interference with the CFIUS process and the racketeering and

monopolistic conspiracies of Cleveland-Cliffs and USW President

David McCall – for the benefit of all stakeholders, including U. S.

Steel’s shareholders, who will receive the agreed upon $55.00 per

share upon the Transaction closing. We remain confident that the

Transaction is the best path forward to secure the future of U. S.

Steel – and we will vigorously defend our rights to achieve this

objective.”

The litigation brought by the Companies will establish that:

- President Biden ignored the rule of law to gain favor with the

United Steel, Paper and Forestry, Rubber, Manufacturing, Energy,

Allied Industrial and Service Workers International Union (“USW”)

and support his political agenda;

- As a result of President Biden’s undue influence to advance his

political agenda, the Committee on Foreign Investment in the United

States (“CFIUS” or the “Committee”) failed to conduct a good faith,

national security-focused regulatory review process, depriving

Nippon Steel and U. S. Steel of their rightful opportunity for fair

consideration of the Transaction; and

- Cleveland-Cliffs Inc. (“Cliffs”), in collusion with the

leadership of the USW, has sought to prevent the Transaction from

closing and any party other than Cliffs from acquiring U. S. Steel,

and to otherwise injure U. S. Steel’s ability to compete, all as

part of a broader illegal campaign to monopolize the domestic steel

markets.

The litigation involves two cases:

- First, U. S. Steel, Nippon Steel, and NSNA (in such capacity,

collectively, the “Petitioners”) filed a petition (“Petition”) in

the United States Court of Appeals for the District of Columbia

Circuit (“Court”) challenging the violation by President Biden and

CFIUS of the Petitioners’ constitutional due process and statutory

rights; CFIUS’s failure to review the Transaction on national

security grounds; and President Biden’s subsequent order (the

“Order”) blocking it for purely political reasons which are

irrelevant to, and are to the detriment of, United States national

security. The Petition asks the Court to set aside the unlawful

CFIUS review process and President Biden’s accompanying Order, and

to instruct CFIUS to conduct a new review of the Transaction that

is consistent with Petitioners’ due process rights and its own

statutory obligations.

- Second, U. S. Steel, Nippon Steel, and NSNA filed a complaint

(“Complaint”) and motion for a preliminary injunction and for an

expedited hearing in the United States District Court for the

Western District of Pennsylvania against Cliffs, Cliffs’ CEO

Lourenco Goncalves, and USW President David McCall for engaging in

a coordinated series of anticompetitive and racketeering activities

illegally designed to prevent any party other than Cliffs from

acquiring U. S. Steel as part of an illegal campaign to monopolize

critical domestic steel markets. The Complaint seeks an injunction

preventing Cliffs, Mr. Goncalves, and Mr. McCall from engaging in

further collusive and anticompetitive behavior, and to impose

substantial monetary damages for their conduct.

These legal actions are necessary to protect Nippon Steel’s and

U. S. Steel’s right to proceed with their Transaction, free from

illegal and improper political and anticompetitive interference.

Given the obstruction thus far that prevented closing the

Transaction, Nippon Steel and U. S. Steel intend to press ahead

with both the Petition and Complaint as swiftly as practicable and

are pursuing both cases on an expedited basis.

Nippon Steel and U. S. Steel are confident that the Companies

have strong cases and will rightfully close the Transaction and

deliver $55.00 per share for U. S. Steel’s stockholders.

* * * * *

Additional Detail Regarding the

Litigation

The CFIUS Petition

As set forth in the Petition, President Biden’s Order is the

culmination of a months-long campaign to subvert and exploit the

United States’ national security apparatus for the purpose of

keeping a promise made by the President and his advisors to the USW

leadership, including Mr. McCall, who endorsed President Biden, and

then Vice President Harris, in the November presidential election.

The Petition details the core facts underlying the clear

constitutional and statutory violations committed by President

Biden and CFIUS, including that:

- President Biden publicly announced his plan to block the

Transaction in March 2024, which was before CFIUS even began its

formal review, in order to curry favor with the USW leadership in

Pennsylvania in his bid for reelection.

- Senior USW leadership stated at the time that President Biden

had “personal[ly] assur[ed]” them that he “has our backs” in

opposing the Transaction. Less than one week after President Biden

publicly announced his plan to block the Transaction, the USW

endorsed him for reelection.

- At an April 2024 campaign stop at the USW’s headquarters in

Pittsburgh, President Biden said U. S. Steel “should remain a

totally American company, American owned, American operated by

American steelworkers.” He then offered a guarantee: “[T]hat’s

going to happen. I promise you.”

- The first time CFIUS formally identified any purported national

security concerns was when it sent the Petitioners a 17-page letter

– which was riddled with factual inaccuracies and parroted key

talking points from USW leadership, including Mr. McCall – on the

Saturday afternoon of Labor Day weekend, demanding a response only

one business day later (notwithstanding the general regulatory

requirement that parties be granted three business days to

respond). While the Petitioners were working to meet that deadline,

President Biden appeared at a campaign rally for Vice President

Harris (who by then had replaced President Biden as the nominee) in

Pittsburgh alongside Mr. McCall, during which Vice President Harris

doubled down on President Biden’s position that U. S. Steel should

remain “American owned and American operated.”

- After a public uproar when it was rumored that President Biden

was set to block the Transaction based on this maneuver, and

following extensive advocacy from the Petitioners, CFIUS agreed to

extend its review period, which meant the review and investigation

would conclude after the U.S. presidential election. But in late

September, President Biden confirmed that he had not “changed [his]

mind” about blocking the Transaction, and, just a few days later,

Vice President Harris confirmed her view that “U. S. Steel needs to

remain a U.S. company.”

- In October, members of the Biden Administration – led by

Ambassador Katherine Tai, the U.S. Trade Representative and a

voting member of CFIUS – participated in a private tour and

fireside chat with Cliffs CEO Goncalves and USW leadership at a

Cliffs facility in Pittsburgh. During that event, Mr. Goncalves

parroted President Biden’s promise that he “has the backs of the

workers” – the same words President Biden had used in announcing

and reiterating his opposition to the Transaction – and Ambassador

Tai promised to continue her push for “worker-centered trade

policy.” Then, less than a week before Election Day, President

Biden appointed Mr. McCall to serve as an advisor to Ambassador

Tai, the very same U.S. Trade Representative who had already cozied

up to Cliffs and the USW, which was followed – the next day – by

Mr. McCall’s USW expressing “confiden[ce] that our elected leaders

will . . . take action to block this deal.”

- Over the course of the fall, the Petitioners submitted three

draft National Security Agreements (each, an “NSA”) to CFIUS in a

good faith effort to address the Committee’s purported concerns.

But the professional, non-partisan staff at CFIUS was told not to

offer counterproposals and was not permitted even to engage in any

substantive discussions about entering into such an agreement –

even though counterproposals from government representatives and

substantive discussions are routine in the CFIUS process. The

Committee had the draft NSA for more than 90 days before referring

the matter to President Biden, and during that time, the

Petitioners never received a single written comment. It is clear

that the review process was being manipulated so that its outcome

would support President Biden’s predetermined decision. That cannot

be, and is not, the due process to which parties before CFIUS are

entitled.

- Rather than allowing staff to engage, and with just nine days

to go before their review deadline of December 23, CFIUS sent –

again on a Saturday afternoon – another 27-page, error-riddled

letter that did nothing but parrot implausible and inaccurate USW

talking points.

- Then, after a final listening-only, no-questions meeting with

the Petitioners in December, which was attended by USW members who

spoke in support of the Transaction, CFIUS referred the Transaction

to President Biden, saying that the Committee was unable to reach a

consensus recommendation. By making the referral, CFIUS enabled the

President to live up to his promise to the USW and block the

Transaction before leaving the White House.

- The Petitioners submitted a fourth draft of their proposed NSA

to President Biden and CFIUS on December 30, guaranteeing that

production capacity at U. S. Steel’s facilities in Pennsylvania,

Arkansas, Alabama, Indiana, and Texas would not be reduced for ten

years without approval from CFIUS; allowing CFIUS to send an

observer to U. S. Steel’s board of directors to monitor compliance

with the NSA; and ensuring that U. S. Steel had sufficient

resources to pursue trade actions against unfairly traded imports.

Neither President Biden nor CFIUS responded to the Petitioners or

otherwise addressed why these guarantees were insufficient to

resolve their purported concerns.

In short, rather than engaging in a good-faith, politically

neutral review and investigation of the Transaction for national

security concerns, CFIUS engaged in a process that was designed to

reach a predetermined result: supporting President Biden’s

political decision – made and announced in March without any

consideration of national security – to block the Transaction to

support his political agenda. The Petitioners have requested that

this illegal and improper conduct be set aside on multiple legal

grounds, including that President Biden and CFIUS have deprived the

Petitioners of their rights to due process under the Fifth

Amendment of the U.S. Constitution; violated the requirements of

the Defense Production Act, the law that governs CFIUS reviews; and

exceeded the limited authority vested in them by the Defense

Production Act, which requires CFIUS and the President to make

decisions based on national security considerations, not political

ones.

Moreover, Japan is a longstanding ally of the United States,

and, in fact, no transaction involving a Japan-based company of any

kind has ever been blocked by the President on national security

grounds. Nor have other acquisitions of American steel facilities

ever been blocked, even when the acquiring entities were located in

countries that posed a direct national security threat to the

United States, such as Russia.

Nippon Steel and U. S. Steel are disappointed to see such a

clear and improper exploitation of the country’s national security

apparatus in an effort to help win an election and repay political

favors. Nippon Steel and U. S. Steel are entitled to a fair process

and have been left with no choice but to challenge the decision and

the process leading to it in court. Nippon Steel and U. S. Steel

continue to believe in the sanctity and fairness of the American

legal system, which is why the Companies hope and believe the

Petition will be reviewed impartially and will result in a just

outcome.

The Petition names as respondents Joseph R. Biden, in his

official capacity as President of the United States, CFIUS, Janet

L. Yellen, in her official capacity as Secretary of the Treasury

and Chairperson of CFIUS, and Merrick B. Garland, in his official

capacity as United States Attorney General.

The Cliffs-Goncalves-McCall

Complaint

As set forth in the Complaint, U. S. Steel and Nippon Steel also

believe that Cliffs, Mr. Goncalves, and Mr. McCall entered into an

illegal agreement to subvert the Transaction in order to allow

Cliffs to monopolize key North American steel markets critical to

the American economy and its consumers. The illegal agreement is

part of a “merge or murder” strategy by which Cliffs has sought to

force an anticompetitive merger with U. S. Steel or severely weaken

it as a competitor. The anticompetitive and unlawful actions were

brazen and obvious – consisting of public lies, pressure tactics,

and an illegal antitrust conspiracy – as detailed in the

Complaint:

- On July 28, 2023, Cliffs, led by Mr. Goncalves, made an

unsolicited bid to buy U. S. Steel. Six days later, Cliffs

attempted to bully U. S. Steel into a deal by informing U. S. Steel

that Cliffs had reached an agreement with the USW to only endorse

Cliffs’ bid and actively obstruct a transaction with anyone

else.

- After U. S. Steel announced that it would undertake a formal

review process for bids, Cliffs and Mr. Goncalves repeatedly and

falsely stated that the USW could legally veto a bid. This claim

was confirmed to be false by a Board of Arbitration decision in

September 2024.

- Cliffs’ bid – which consisted of 50% cash and 50% stock – was

plainly inferior to Nippon Steel’s higher all-cash offer that posed

none of the obvious antitrust concerns plaguing Cliffs’ bid. Of the

more than 50 participants in the formal review process, Nippon

Steel was the only buyer who committed to maintaining U. S. Steel

as a standalone integrated steel company. Moreover, a merger with

Nippon Steel promised an injection of innovation and capital that

would immediately enhance U. S. Steel’s ability to compete with

Cliffs and the vitality of the North American steel markets. On

December 17, 2023, the U. S. Steel board unanimously approved the

Transaction and announced it the next day.

- After the Transaction was announced, Cliffs, Mr. Goncalves and

Mr. McCall immediately launched a public smear campaign to

undermine the deal and weaken U. S. Steel. Cliffs, Mr. Goncalves,

and Mr. McCall made false statements that Nippon Steel would not

honor its commitments to the USW, despite the fact that Nippon

Steel promised to do so in written agreements enforceable not just

by the USW, but the United States government as well. As Mr. McCall

made clear in a February 2024 phone interview, “I want to kill

this deal.” Mr. Goncalves falsely stated that U. S. Steel was

anti-union, and other Cliffs executives falsely claimed that Nippon

Steel would not invest in unionized plants, despite Nippon Steel’s

public commitments to do so and its track record at other

USW-represented facilities. Cliffs and Mr. Goncalves even

trafficked in xenophobic stereotypes about foreign investors.

- Mr. Goncalves repeatedly boasted of his improper influence over

the CFIUS process, claiming responsibility for President Biden’s

opposition (detailed in the Petition) to the Transaction and

stating that, “[T]his is not going to be a process. CFIUS is just

cover for a President to kill a deal.” Cliffs, Mr. Goncalves, and

Mr. McCall also engaged in false and fraudulent statements intended

to improperly influence the outcome of the CFIUS process and

President Biden’s decision to block the Transaction.

- Despite U. S. Steel stockholders’ overwhelming vote to approve

the Transaction and despite the Board of Arbitration decision

rejecting the USW’s challenge to it, Cliffs, Mr. Goncalves, and Mr.

McCall persisted in their conspiracy to thwart the Transaction and

force a deal with Cliffs. Mr. Goncalves continued to publicly

denigrate the Transaction and state that Cliffs was the only

possible buyer. For his part, Mr. McCall repeatedly stonewalled

Nippon Steel’s outreach, even as pro-Transaction sentiment grew

among USW members, and his public statements disingenuously implied

engagement.

- Cliffs’ anticompetitive and monopolistic goals have been

evident throughout its smear campaign. To note just one example,

Cliffs’ Senior Vice President of Finance told Cliffs’ investors

that killing the Transaction would result in “less competition” and

“one less competitor pushing down prices.” Mr. Goncalves himself

has repeatedly made similar statements, bragging on a 2023FY

earnings call that Cliffs was the sole U.S. supplier of certain

electrical steel and stating: “[T]hat’s why we push prices up. We

go until we can’t go no more.” If this illegal campaign succeeds,

the American economy and American consumers will face significant

harm as a result of a reduction in competition in key steel

markets.

The Complaint asserts antitrust claims under Sections 1 and 2 of

the Sherman Act, violations of the Racketeer Influenced and Corrupt

Organizations (RICO) Act, and tortious interference claims and

seeks injunctions and substantial damages, which could amount to

billions of dollars, against Cliffs, Mr. Goncalves, and Mr.

McCall.

###

*For more information about this acquisition, please refer to

the press release on December 18, 2023. (Updated disclosure on

December 19, 2023, April 15, 2024, May 3, 2024, May 30, 2024, and

December 26, 2024)

https://www.nipponsteel.com/common/secure/en/ir/library/pdf/20231218_100.pdf

For inquiries, https://www.nipponsteel.com/en/contact/ and

media@uss.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains information regarding U. S. Steel

and Nippon Steel that may constitute “forward-looking statements,”

as that term is defined under the Private Securities Litigation

Reform Act of 1995 and other securities laws, that are subject to

risks and uncertainties. We intend the forward-looking statements

to be covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about trends, events or developments that

we expect or anticipate will occur in the future, potential changes

in the global economic environment, anticipated capital

expenditures, the construction or operation of new or existing

facilities or capabilities and the costs associated with such

matters, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. Forward-looking statements

include all statements that are not historical facts, but instead

represent only U. S. Steel’s beliefs regarding future goals, plans

and expectations about our prospects for the future and other

events, many of which, by their nature, are inherently uncertain

and outside of U. S. Steel’s or Nippon Steel’s control and may

differ, possibly materially, from the anticipated events indicated

in these forward-looking statements. Management of U. S. Steel or

Nippon Steel, as applicable, believes that these forward-looking

statements are reasonable as of the time made. However, caution

should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of

the date when made. In addition, forward looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from U. S. Steel’s or Nippon Steel’s

historical experience and our present expectations or projections.

Risks and uncertainties include without limitation: the ability of

the parties to consummate the proposed transaction, on a timely

basis or at all; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

definitive agreement and plan of merger relating to the proposed

transaction (the “Merger Agreement”); risks arising from

transaction-related litigation, either brought by or against the

parties; the risk that the parties to the Merger Agreement may not

be able to satisfy the conditions to the proposed transaction in a

timely manner or at all; risks related to disruption of management

time from ongoing business operations due to the proposed

transaction and related litigation; certain restrictions during the

pendency of the proposed transaction that may impact U. S. Steel’s

ability to pursue certain business opportunities or strategic

transactions; the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of U. S. Steel’s common stock or Nippon Steel’s common stock or

American Depositary Receipts; the risk of any unexpected costs or

expenses resulting from the proposed transaction; the risk that the

proposed transaction and its announcement could have an adverse

effect on the ability of U. S. Steel or Nippon Steel to retain

customers and retain and hire key personnel and maintain

relationships with customers, suppliers, employees, stockholders

and other business relationships and on its operating results and

business generally; and the risk the pending proposed transaction

could distract management of U. S. Steel. U. S. Steel directs

readers to its Form 10-K for the year ended December 31, 2023 and

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, and the other documents it files with the SEC for other risks

associated with U. S. Steel’s future performance. These documents

contain and identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250105426670/en/

NSC Contacts Media For

inquiries, https://www.nipponsteel.com/en/contact/

Investors ir@jp.nipponsteel.com Yuichiro Kaneko /

+81-80-9022-6867 / kaneko.yc3.yuichiro@jp.nipponsteel.com Yohei

Kato / +81-80-2131-0188 / kato.rk5.yohei@jp.nipponsteel.com

General Inquiries (U.S.) Nippon Steel North America, Inc.

/ +1 (713) 654 7111

U.S. Media Contacts NSCMedia@teneo.com Robert Mead / +1

(917) 327 9828 / Robert.Mead@teneo.com Jack Coster / +1 (207) 756

4586 / Jack.Coster@teneo.com

U. S. Steel Contacts Media

Corporate Communications T – 412-433-1300 E – media@uss.com

Kelly Sullivan / Ed Trissel Joele Frank, Wilkinson

Brimmer Katcher T – 212-355-4449

Investors Emily Chieng Investor Relations Officer T –

(412) 618-9554 E – ecchieng@uss.com

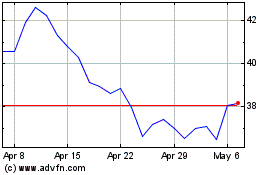

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2024 to Jan 2025

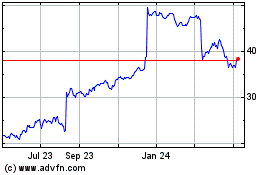

US Steel (NYSE:X)

Historical Stock Chart

From Jan 2024 to Jan 2025