Companies will take all appropriate action to

protect their legal rights

Nippon Steel Corporation ("Nippon Steel") (TSE: 5401) and United

States Steel Corporation ("U. S. Steel") (NYSE: X) today issued the

following statement on President Biden’s decision to block their

proposed transaction.

We are dismayed by President Biden’s decision

to block Nippon Steel’s acquisition of U. S. Steel, which reflects

a clear violation of due process and the law governing CFIUS.

Instead of abiding by the law, the process was manipulated to

advance President Biden’s political agenda. The President’s

statement and Order do not present any credible evidence of a

national security issue, making clear that this was a political

decision. Following President Biden’s decision, we are left with no

choice but to take all appropriate action to protect our legal

rights.

Nippon Steel and U. S. Steel are confident

that our transaction would revitalize communities that rely on

American steel, including in Pennsylvania and Indiana, provide job

security for American steelworkers, enhance the American steel

supply chain, help America’s domestic steel industry compete more

effectively with China and bolster national security. Nippon Steel

is the only partner both willing and able to make the necessary

investments – including at least $1 billion to Mon Valley Works and

approximately $300 million to Gary Works as a part of $2.7 billion

in investment that it has already committed – to protect and grow

U. S. Steel as an iconic American company for the benefit of the

communities in which it operates and the entire American steel

industry. Blocking this transaction means denying billions of

committed investment to extend the life of U. S. Steel’s aging

facilities and putting thousands of good-paying, family-sustaining

union jobs at risk. In short, we believe that President Biden has

sacrificed the future of American steelworkers for his own

political agenda. We are committed to taking all appropriate action

to protect our legal rights to allow us to deliver the agreed upon

value of $55.00 per share for U. S. Steel’s stockholders upon

closing.

Since the outset of the regulatory review

process, we have diligently and transparently engaged with CFIUS.

The record before CFIUS is abundantly clear that this transaction,

with the commitments made by Nippon Steel, would strengthen, not

weaken, national security. Yet, it is clear that the CFIUS process

was deeply corrupted by politics, and the outcome was

pre-determined, without an investigation on the merits, but to

satisfy the political objectives of the Biden White House. It is

shocking — and deeply troubling — that the U.S. government would

reject a procompetitive transaction that advances U.S. interests

and treat an ally like Japan in this way. Unfortunately, it sends a

chilling message to any company based in a U.S. allied country

contemplating significant investment in the United States.

To proactively address any concerns that

could be raised by CFIUS, Nippon Steel voluntarily committed to

various mitigation measures that would be fully enforceable by the

U.S. government, including: having a majority of the go-forward

board of directors of U. S. Steel be composed of U.S. citizens;

having three independent directors who will be approved by CFIUS;

ensuring that key positions such as CEO and CFO will be U.S.

citizens; removing any Nippon Steel involvement in trade measures

proposed by U. S. Steel; prohibiting the transfer of any production

and jobs outside the U.S.; guaranteeing that production capacity at

U. S. Steel’s facilities in Pennsylvania, Arkansas, Alabama,

Indiana and Texas would not be reduced for ten years without

approval from CFIUS; regularly reporting to CFIUS on the status of

compliance with the national security agreement; and allowing CFIUS

to send an observer to the board of directors. However, CFIUS did

not give due consideration to a single mitigation proposal offered

by the Parties, as evidenced by the absence of any written feedback

to the four robust national security agreements that the Parties

proactively offered over 100 days. We are deeply disappointed to

see President Biden’s decision today.

We would like to express our sincere

gratitude to the wide range of stakeholders in the United States

and Japan, including U. S. Steel employees, local business and

community members, government officials, and elected officials for

their tremendous cooperation and enthusiastic support for this

transaction. We will never give up on pursuing business in the U.S.

for the benefit of the U.S. domestic stakeholders. We continue to

believe that a partnership between Nippon Steel and U. S. Steel is

the best way to ensure that U. S. Steel, and particularly its

USW-represented facilities, will be able to compete and thrive well

into the future – and we will work closely with stakeholders,

including government officials from Japan and allies and partners

in the U.S., to take all appropriate action to protect our legal

rights and secure that future.

*For more information about this acquisition, please refer to

the press release on December 18, 2023. (Updated disclosure on

December 19, 2023, April 15, 2024, May 3, 2024, May 30, 2024, and

December 26,2024)

https://www.nipponsteel.com/common/secure/en/ir/library/pdf/20231218_100.pdf

For inquiries, https://www.nipponsteel.com/en/contact/ and

media@uss.com

About NSC

NSC is Japan’s largest steelmaker and one of the world’s leading

steel manufacturers. NSC has a global crude steel production

capacity of approximately 66 million tonnes and employs

approximately 100,000 people in the world. NSC’s manufacturing base

is in Japan and the company has presence in 15 additional countries

including: United States, India, Thailand, Indonesia, Vietnam,

Brazil, Mexico, Sweden, China and others. NSC established a joint

venture in the United States around 40 years ago and has focused on

building cooperative and good relationships with employees, labor

unions, suppliers, customers, and communities. As the ‘Best

Steelmaker with World-Leading Capabilities,’ NSC pursues

world-leading technologies and manufacturing capabilities and

contributes to society by providing excellent products and

services. For more information, please visit:

https://www.nipponsteel.com.

About U. S. Steel

Founded in 1901, U. S. Steel is a leading steel manufacturer.

With an unwavering focus on safety, the Company’s customer-centric

Best for All® strategy is advancing a more secure, sustainable

future for U. S. Steel and its stakeholders. With a renewed

emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products. The Company also

maintains advanced iron ore production and has an annual raw

steelmaking capability of 25.4 million net tons. U. S. Steel is

headquartered in Pittsburgh, Pennsylvania, with world-class

operations across the United States and in Central Europe. For more

information, please visit: www.ussteel.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains information regarding U. S. Steel

and Nippon Steel that may constitute “forward-looking statements,”

as that term is defined under the Private Securities Litigation

Reform Act of 1995 and other securities laws, that are subject to

risks and uncertainties. We intend the forward-looking statements

to be covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about trends, events or developments that

we expect or anticipate will occur in the future, potential changes

in the global economic environment, anticipated capital

expenditures, the construction or operation of new or existing

facilities or capabilities and the costs associated with such

matters, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However,

the absence of these words or similar expressions does not mean

that a statement is not forward-looking. Forward-looking statements

include all statements that are not historical facts, but instead

represent only U. S. Steel’s beliefs regarding future goals, plans

and expectations about our prospects for the future and other

events, many of which, by their nature, are inherently uncertain

and outside of U. S. Steel’s or Nippon Steel’s control and may

differ, possibly materially, from the anticipated events indicated

in these forward-looking statements. Management of U. S. Steel or

Nippon Steel, as applicable, believes that these forward-looking

statements are reasonable as of the time made. However, caution

should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of

the date when made. In addition, forward looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from U. S. Steel’s or Nippon Steel’s

historical experience and our present expectations or projections.

Risks and uncertainties include without limitation: the ability of

the parties to consummate the proposed transaction, on a timely

basis or at all; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

definitive agreement and plan of merger relating to the proposed

transaction (the “Merger Agreement”); litigation related to the

transaction; the risk that the parties to the Merger Agreement may

not be able to satisfy the conditions to the proposed transaction

in a timely manner or at all; risks related to disruption of

management time from ongoing business operations due to the

proposed transaction; certain restrictions during the pendency of

the proposed transaction that may impact U. S. Steel’s ability to

pursue certain business opportunities or strategic transactions;

the risk that any announcements relating to the proposed

transaction could have adverse effects on the market price of U. S.

Steel’s common stock or Nippon Steel’s common stock or American

Depositary Receipts; the risk of any unexpected costs or expenses

resulting from the proposed transaction; the risk of any litigation

relating to the proposed transaction; the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of U. S. Steel or Nippon Steel to retain customers and

retain and hire key personnel and maintain relationships with

customers, suppliers, employees, stockholders and other business

relationships and on its operating results and business generally;

and the risk the pending proposed transaction could distract

management of U. S. Steel. U. S. Steel directs readers to its Form

10-K for the year ended December 31, 2023 and Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, and the other

documents it files with the SEC for other risks associated with U.

S. Steel’s future performance. These documents contain and identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250103032160/en/

NSC Contacts Media

For inquiries, https://www.nipponsteel.com/en/contact/

Investors ir@jp.nipponsteel.com Yuichiro Kaneko /

+81-80-9022-6867 / kaneko.yc3.yuichiro@jp.nipponsteel.com Yohei

Kato / +81-80-2131-0188 / kato.rk5.yohei@jp.nipponsteel.com

General Inquiries (U.S.) Nippon Steel North America, Inc.

/ +1 (713) 654 7111

U.S. Media Contacts NSCMedia@teneo.com Robert Mead / +1

(917) 327 9828 / Robert.Mead@teneo.com Jack Coster / +1 (207) 756

4586 / Jack.Coster@teneo.com

U. S. Steel Contacts

Media Corporate Communications T- 412-433-1300 E-

media@uss.com

Kelly Sullivan / Ed Trissel Joele Frank, Wilkinson

Brimmer Katcher T- 212-355-4449

Investors Emily Chieng Investor Relations Officer

T – (412) 618-9554 E – ecchieng@uss.com

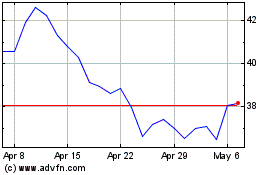

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2024 to Jan 2025

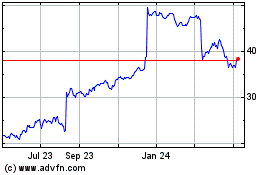

US Steel (NYSE:X)

Historical Stock Chart

From Jan 2024 to Jan 2025