Asserts President Trump’s February 7th

Remarks Make it Abundantly Clear a Sale to Nippon is Dead and Will

Not be Resurrected: “I Didn't Want it Purchased”

Believes the Board Must Cease Fruitless

Lobbying and Wasteful Litigation in Favor of Immediately Collecting

the $565 Million Termination Fee Owed by Nippon

Deems it Irresponsible for the Board to

Allow David Burritt, a Conflicted and Failed CEO, to Continue

Wasting Time by Pursuing an Unlikely Investment from Nippon

Highlights That

Independent Slate and Steel Industry Legend Alan Kestenbaum Are

Ready to Lead Multibillion-Dollar Capital Investment Program to

Revitalize the Company

Ancora Holdings Group, LLC (collectively with its affiliates,

“Ancora” or “we”), a diversified investment firm that oversees

approximately $10 billion in assets, today issued the below letter

to the Board of Directors (the “Board”) of United States Steel

Corporation (NYSE: X) (“U.S. Steel” or the “Company”) following

President Donald J. Trump’s recent comments that reaffirm his

opposition to a sale of the Company to Nippon Steel Corporation

(“Nippon”). A full copy of President Trump’s remarks can be found

here.

To obtain important updates from Ancora, visit

www.MakeUSSteelGreatAgain.com.

***

February 10, 2025

United States Steel Corporation 600 Grant Street Pittsburgh, PA

15219 Attn: The Board

Dear Members of the Board,

As we told you in our January 27th public letter, the sale to

Nippon is dead. President Trump’s remarks on Friday should confirm

– once and for all – that the sale has no chance of being

resurrected. We applaud his steadfast commitments to protecting

U.S. Steel and reviving America’s industrial and manufacturing

industries. The Board now must decide if it stands with

shareholders or if it still stands with failed Chief Executive

Officer David Burritt, who appears to have driven the Company off a

cliff in pursuit of his $72 million transaction-related payday.

If the Board intends to prove that it is truly aligned with

shareholders, rather than the merger arbitrage funds who favored

Mr. Burritt’s poor gamble on Nippon, it should take the following

steps:

- Immediately terminate the merger agreement and collect the $565

million breakup fee from Nippon;

- Immediately end the exorbitantly expensive deal-related

advocacy and withdraw from the litigation filed with Nippon,

and;

- Finally engage with Ancora, which has offered the Board a

viable catalyst for a turnaround in Alan Kestenbaum, who oversaw

the legendary turnaround at Stelco after U.S. Steel bankrupted the

business.

Our slate of independent director candidates and Mr. Kestenbaum

are prepared to lead a multibillion-dollar capital investment

program focused on reinvigorating the legacy blast furnaces at Mon

Valley and Gary Works while using the proceeds from the breakup fee

to offset upfront capital needs. We are offering the Company access

to a world-class Chief Executive Officer, an experienced set of

director candidates and a clear path to revitalizing the business.

This not only represents the best value proposition put forth by

any domestic party at this time, but it far exceeds what can be

offered by Nippon at this point.

If you opt to continue ignoring us and narrowly focus on what we

expect to be elusive investments from Nippon, we will assume you

are aligned with Mr. Burritt. Under this scenario, we will take all

necessary actions to break the Company’s culture of entrenchment

and prevent the wasting of shareholders’ capital. Long-term

investors do not want any more of their money wasted simply because

Mr. Burritt and his arbitrageur friends hold losing lottery

tickets.

Negotiating an investment from a foreign competitor like Nippon

could take months. This is time that U.S. Steel cannot afford to

misallocate based on the Company’s own statements. If there is no

buyout premium to be paid, the Board should hire a real leader,

like Mr. Kestenbaum, to negotiate on behalf of the long-term

stakeholders of the Company, as opposed to Mr. Burritt who has

seemed more concerned with preserving a change of control payment

than collecting the much-needed breakup fee. Keep in mind, Mr.

Burritt has irreparably destroyed the Company’s relationship with

its union workers, and that contract comes up in the near future.

It is almost unfathomable to envision a scenario in which Mr.

Burritt can successfully execute a new labor agreement that would

be mutually beneficial for shareholders and workers.

In closing, it is time for U.S. Steel to get back to business

and focus on leveraging President Trump’s pending tariffs as a

tailwind for a turnaround. The only thing standing in the way is

Mr. Burritt and his focus on securing a massive golden parachute at

all costs. It is only a matter of time until the Company’s shares

begin to reflect the fact that a busted deal has left investors

with a failed and visionless leader in Mr. Burritt. We urge you, as

fiduciaries, to engage with us before there is any permanent

impairment of value at U.S. Steel.

Regards,

Fredrick D. DiSanto

James Chadwick

Chairman and Chief Executive Officer

President

Ancora Holdings Group, LLC

Ancora Alternatives LLC

***

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated

investment advisory, wealth management, retirement plan services

and insurance solutions to individuals and institutions across the

United States. The firm is a long-term supporter of union labor and

has a history of working with union groups and public pension plans

to deliver long-term value. Ancora’s comprehensive service offering

is complemented by a dedicated team that has the breadth of

expertise and operational structure of a global institution, with

the responsiveness and flexibility of a boutique firm. For more

information about Ancora, please visit https://ancora.net.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ancora Catalyst Institutional, LP (“Ancora

Catalyst Institutional”), together with the other

participants named herein, intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities

and Exchange Commission (“SEC”) to be

used to solicit votes for the election of Ancora Catalyst

Institutional’s slate of highly-qualified director nominees at the

2025 annual meeting of stockholders of United States Steel

Corporation, a Delaware corporation (the “Company”).

ANCORA CATALYST INSTITUTIONAL STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY

MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL

BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT

HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY

SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT

CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE

DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation are

expected to be Ancora Catalyst Institutional, Ancora Bellator Fund,

LP (“Ancora Bellator”), Ancora

Catalyst, LP (“Ancora Catalyst”),

Ancora Merlin Institutional, LP (“Ancora

Merlin Institutional”), Ancora Merlin, LP (“Ancora Merlin”), Ancora Alternatives LLC,

(“Ancora Alternatives”), Ancora

Holdings Group, LLC (“Ancora

Holdings”), Fredrick D. DiSanto, Jamie Boychuk, Robert P.

Fisher, Jr., Dr. James K. Hayes, Alan Kestenbaum, Roger K. Newport,

Shelley Y. Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof, Ancora Catalyst Institutional directly

beneficially owns 121,589 shares of common stock, par value $1.00

per share (the “Common Stock”), of the

Company, 100 shares of which are held in record name. As of the

date hereof, Ancora Bellator directly beneficially owns 62,384

shares of Common Stock. As of the date hereof, Ancora Catalyst

directly beneficially owns 12,831 shares of Common Stock. As of the

date hereof, Ancora Merlin Institutional directly beneficially owns

123,075 shares of Common Stock. As of the date hereof, Ancora

Merlin directly beneficially owns 11,165 shares of Common Stock. As

the investment advisor and general partner to each of Ancora

Catalyst Institutional, Ancora Bellator, Ancora Catalyst, Ancora

Merlin Institutional, Ancora Merlin and certain separately managed

accounts (the “Ancora Alternatives

SMAs”), Ancora Alternatives may be deemed to beneficially

own the 121,589 shares of Common Stock beneficially owned directly

by Ancora Catalyst Institutional, 12,831 shares of Common Stock

beneficially owned directly by Ancora Catalyst, 62,384 shares of

Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock

beneficially owned directly by Ancora Merlin and 137,453 shares of

Common Stock held in the Ancora Alternatives SMAs. As the sole

member of Ancora Alternatives, Ancora Holdings may be deemed to

beneficially own the 121,589 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 12,831 shares of

Common Stock owned directly by Ancora Catalyst, 62,384 shares of

Common Stock beneficially owned directly by Ancora Bellator,

123,075 shares of Common Stock beneficially owned directly by

Ancora Merlin Institutional, 11,165 shares of Common Stock

beneficially owned directly by Ancora Merlin, and 137,453 shares of

Common Stock held in the Ancora Alternatives SMAs. As the Chairman

and Chief Executive Officer of Ancora Holdings, Mr. DiSanto may be

deemed to beneficially own the 121,589 shares of Common Stock

beneficially owned directly by Ancora Catalyst Institutional,

12,831 shares of Common Stock owned directly by Ancora Catalyst,

62,384 shares of Common Stock beneficially owned directly by Ancora

Bellator, 123,075 shares of Common Stock beneficially owned

directly by Ancora Merlin Institutional, 11,165 shares of Common

Stock beneficially owned directly by Ancora Merlin, and 137,453

shares of Common Stock held in the Ancora Alternatives SMAs. As of

the date hereof, Messrs. Boychuk, Fisher, Kestenbaum, Newport,

Thomas, and Urban, Dr. Hayes and Ms. Simms do not beneficially own

any shares of Common Stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210016755/en/

Longacre Square Partners LLC Charlotte Kiaie / Ashley

Areopagita, 646-386-0091 ckiaie@longacresquare.com /

aareopagita@longacresquare.com

Saratoga Proxy Consulting LLC John Ferguson / Joseph Mills,

212-257-1311 info@saratogaproxy.com

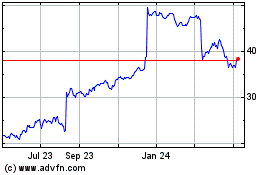

US Steel (NYSE:X)

Historical Stock Chart

From Jan 2025 to Feb 2025

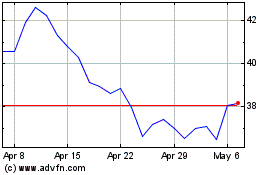

US Steel (NYSE:X)

Historical Stock Chart

From Feb 2024 to Feb 2025