- Delivered record revenue of $268M, an increase of 42% Y/Y

- Grew Direct revenue 41% Y/Y and increased Direct revenue mix by

300 bps Q/Q to 70%

- Increased Scaled Customer ARPU to $557K, a record increase of

33% Y/Y

- Generated cash flow from operating activities of $34M, an

increase of 51% Y/Y, and Free Cash Flow of $26M, an increase of 93%

Y/Y

- Raising 4Q24 revenue growth guidance to 40% Y/Y

Zeta Global (NYSE: ZETA), the AI-Powered Marketing Cloud, today

announced financial results for the third quarter ended September

30, 2024.

“The bets we made seven years ago on AI, the investment in a ‘1

of 1’ marketing platform, and our commitment to our customers’

success has resulted in record setting third-quarter financial

results, above of our previously raised guidance,” said David A.

Steinberg, Co-Founder, Chairman, and CEO of Zeta. “Our momentum can

be directly linked to the acceleration of the AI revolution where

Marketing is at the forefront. This is creating unprecedented

opportunity for disruptive technology like the Zeta Marketing

Platform, which is winning in the marketplace and winning big.”

“Our performance is best summed up by the momentum that started

in the first quarter, accelerated in the second, and continued into

the third quarter,” said Chris Greiner, Zeta’s CFO. “As a result,

we are once again raising our 2024 guidance. As we look out to

2025, we are very comfortable with where consensus revenue growth

(inclusive of 2024 political comps), Adjusted EBITDA and Free Cash

Flow estimates stand and look forward to sharing our 2025 guidance

and the details of our next long-term model, Zeta 2028, in February

next year.”

Third Quarter 2024 Highlights

- Total revenue of $268.3 million, increased 42% Y/Y, up 31% Y/Y

excluding political candidate revenue.

- Scaled Customer count increased to 475 from 468 in 2Q’24 and

440 in 3Q’23.

- Super-Scaled Customer count of 144 compared to 144 in 2Q’24 and

124 in 3Q’23.

- Quarterly Scaled Customer ARPU of $557,231, increased 33%

Y/Y.

- Quarterly Super-Scaled Customer ARPU of $1.6 million, increased

30% Y/Y.

- Direct platform revenue grew 41% Y/Y at a mix of 70% of total

revenue, compared to 67% in 2Q’24, and 70% in 3Q’23.

- GAAP cost of revenue percentage of 39%, decreased 60 basis

points Q/Q, and increased 50 basis points Y/Y.

- GAAP net loss of $17.4 million, or 6% of revenue, driven

primarily by $47.2 million of stock-based compensation. The net

loss in 3Q’23 was $43.1 million, or 23% of revenue.

- GAAP loss per share of $0.09, compared to a loss per share of

$0.27 in 3Q’23.

- Cash flow from operating activities of $34.4 million, compared

to $22.8 million in 3Q’23.

- Free Cash Flow1 of $25.7 million, compared to $13.4 million in

3Q’23.

- Repurchased $3.9 million worth of shares through our share

repurchase program.

- Adjusted EBITDA1 of $53.6 million, increased 59% Y/Y compared

to $33.7 million in 3Q’23.

- Adjusted EBITDA margin1 of 20.0%, compared to 17.9% in

3Q’23.

Guidance*

Fourth Quarter 2024

- Increasing revenue guidance to a range of $293.0 million to

$297.0 million, up $32 million at the midpoint from the prior

midpoint of guidance of $263 million. The revised guidance range

represents a year-over-year increase of 39% to 41%.

- Increasing Adjusted EBITDA guidance to a range of $64.9 million

to $66.9 million, up $6.5 million at the midpoint from the prior

midpoint of guidance of $59.4 million. The revised guidance range

represents a year-over-year increase of 45% to 49% and an Adjusted

EBITDA margin of 21.9% to 22.8%.

Full Year 2024

- Increasing revenue guidance to a range of $984.1 million to

$988.1 million, up $61 million at the midpoint from the prior

guidance $925 million. Revised guidance represents a year-over-year

increase of 35% to 36%.

- Increasing Adjusted EBITDA guidance to a range of $187.5

million to $189.5 million, up $13 million at the midpoint from the

prior guidance of $175.5 million. Revised guidance represents a

year-over-year increase of 45% to 46% and an Adjusted EBITDA margin

of 19.0% to 19.3%.

- Increasing Free Cash Flow guidance to a range of $88 million to

$92 million, up $5 million at the midpoint from the prior midpoint

of guidance of $85 million.

The details of our increased fourth quarter and full year 2024

guidance can be found in the table below and in our 3Q’24

supplemental earnings presentation, on slides 16-19, located on the

Company’s investor relations website

(https://investors.zetaglobal.com/).

1Q’24 Actuals

2Q’24 Actuals

3Q’24 Actuals

4Q’24 Guidance

Midpoint

Y/Y %

FY’24 Guidance

Midpoint

Y/Y %

Zeta excluding Political Candidate & LiveIntent Revenue

$195M

$226M

$247M

$263M

25%

$931M

28%

Political Candidate Revenue1

NM2

$1.5M

$21M

$18M

NM2

$41M

NM2

LiveIntent Revenue (stub 4Q’24 only)3

-

-

-

$14M

N/A

$14M

N/A

Total Zeta Revenue Updated Guidance

$195M

$228M

$268M

$295M

40%

$986M

35%

1) Note: Political Candidate Revenue in

2020 was $15M (3Q: $3M, 4Q: $12M) and in 2022 was $7.5M (3Q: $3.0M,

4Q: $4.5M) 2) NM: Not Material 3) LiveIntent stub period is from

10/21/24 through 12/31/24 Totals in this table were rounded to the

nearest million.

* This press release does not include a reconciliation of

forward-looking Adjusted EBITDA, Adjusted EBITDA margin, and Free

Cash Flow to forward-looking GAAP net income (loss), net income

(loss) margin, or cash flows from operating activities,

respectively, because the Company is unable, without making

unreasonable efforts, to provide a meaningful or reasonably

accurate calculation or estimation of certain reconciling items

which could be significant to the Company’s results.

Investor Conference Call and Webcast

Zeta will host a conference call today, Monday, November 11,

2024, at 4:30 p.m. Eastern Time to discuss financial results for

the third quarter 2024. A supplemental earnings presentation and a

live webcast of the conference call can be accessed from the

Company’s investor relations website

(https://investors.zetaglobal.com/) where they will remain

available for one year.

About Zeta

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow,

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence, and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world. To

learn more, go to www.zetaglobal.com.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release or during the

earnings call that are not statements of historical fact, including

statements about our fourth quarter and full year 2024 guidance,

the Zeta 2025 plan, the financial targets of Zeta 2025 and the

timing of when we will achieve the Zeta 2025 plan, the Zeta 2028

plan and timing of plan announcement, the impacts of our prior

investments on accelerating the timing of the marketing cloud

replacement cycle, our products capabilities to provide strong

investment returns to our customers, our strong competitive

position, visibility of our current and new customers, expansion of

existing customers, the capabilities of AI and Zeta’s platform, the

acceleration of the digital transformation and our business, and

the growth and expansion of AI and the Zeta Marketing Platform, are

forward-looking statements and should be evaluated as such.

Forward-looking statements include information concerning our

anticipated future financial performance, our market opportunities

and our expectations regarding our business plan and strategies.

These statements often include words such as “anticipate,”

“expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,”

“targets,” “projects,” “should,” “could,” “would,” “may,” “will,”

“forecast,” “outlook,” “guidance” and other similar expressions. We

base these forward-looking statements on our current expectations,

plans and assumptions that we have made in light of our experience

in the industry, as well as our perceptions of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances at such time.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future

performance or results.

The forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. Factors that may

materially affect such forward-looking statements include, but are

not limited to: global supply chain disruptions; macroeconomic and

industry trends and adverse developments in the debt, consumer

credit and financial services markets and other macroeconomic

factors beyond Zeta’s control; increases in our borrowing costs as

a result of changes in interest rates and other factors; the impact

of inflation on us and on our customers; potential fluctuations in

our operating results, which could make our future operating

results difficult to predict; underlying circumstances, including

cash flows, cash position, financial performance, market conditions

and potential acquisitions; prevailing stock prices, general

economic and market condition; the impact of future pandemics,

epidemics and other health crises on the global economy, our

customers, employees and business; the war in Ukraine and

escalating geopolitical tensions as a result of Russia’s invasion

of Ukraine; the escalating conflict in Israel, Gaza and in the

surrounding areas; our ability to innovate and make the right

investment decisions in our product offerings and platform; the

impact of new generative AI capabilities and the proliferation of

AI on our business; our ability to attract and retain customers,

including our scaled and super-scaled customers; our ability to

manage our growth effectively; our ability to collect and use data

online; the standards that private entities and inbox service

providers adopt in the future to regulate the use and delivery of

email may interfere with the effectiveness of our platform and our

ability to conduct business; a significant inadvertent disclosure

or breach of confidential and/or personal information we process,

or a security breach of our or our customers’, suppliers’ or other

partners’ computer systems; and any disruption to our third-party

data centers, systems and technologies. These cautionary statements

should not be construed by you to be exhaustive and the

forward-looking statements are made only as of the date of this

press release. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

If we update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect

to those or other forward-looking statements.

The fourth quarter and full year 2024 guidance provided herein

are based on Zeta’s current estimates and assumptions and are not a

guarantee of future performance. The guidance provided is subject

to significant risks and uncertainties, including the risk factors

discussed in the Company's reports on file with the Securities and

Exchange Commission (“SEC”), that could cause actual results to

differ materially. There can be no assurance that the Company will

achieve the results expressed by this guidance or the targets.

Availability of Information on Zeta’s Website and Social

Media Profiles

Investors and others should note that Zeta routinely announces

material information to investors and the marketplace using SEC

filings, press releases, public conference calls, webcasts and the

Zeta investor relations website at https://investors.zetaglobal.com

(“Investors Website”). We also intend to use the social media

profiles listed below as a means of disclosing information about us

to our customers, investors and the public. While not all of the

information that the Company posts to the Investors Website or to

social media profiles is of a material nature, some information

could be deemed to be material. Accordingly, the Company encourages

investors, the media, and others interested in Zeta to review the

information that it shares on the Investors Website and to

regularly follow our social media profile links located at the

bottom of the page on www.zetaglobal.com. Users may automatically

receive email alerts and other information about Zeta when

enrolling an email address by visiting "Investor Email Alerts" in

the "Resources" section of the Investors Website.

Social Media Profiles: www.twitter.com/zetaglobal

www.facebook.com/ZetaGlobal/ www.linkedin.com/company/zetaglobal

www.instagram.com/zetaglobal/

The Following Definitions Apply to the Terms Used Throughout

this Release, the Supplemental Earnings Presentation and Investor

Conference Call

- Direct Platform and Integrated Platform: When the Company generates

revenues entirely through the Company platform, the Company

considers it direct platform revenue. When the Company generates

revenue by leveraging its platform’s integration with third

parties, it is considered integrated platform revenue.

- Cost of revenue: Cost of revenue

excludes depreciation and amortization and consists primarily of

media and marketing costs and certain personnel costs. Media and

marketing costs consist primarily of fees paid to third-party

publishers, media owners or managers, and strategic partners that

are directly related to a revenue-generating event. We pay these

third-party publishers, media owners or managers and strategic

partners on a revenue-share, a cost-per-lead, cost-per-click, or

cost-per-thousand-impressions basis. Personnel costs included in

cost of revenues include salaries, bonuses, commissions,

stock-based compensation and employee benefit costs primarily

related to individuals directly associated with providing services

to our customers.

- Rule of 60: We define the Rule of

60 as the combination of revenue growth percentage plus Adjusted

EBITDA margin percentage adding up to 60 or more.

- Scaled Customers: We define scaled

customers as customers from which we generated at least $100,000 in

revenue on a trailing twelve-month basis. We calculate the number

of scaled customers at the end of each quarter and on an annual

basis as the number of customers billed during each applicable

period. We believe the scaled customers measure is both an

important contributor to our revenue growth and an indicator to

investors of our measurable success.

- Super-Scaled Customers: We define

super-scaled customers, which is a subset of Scaled Customers, as

customers from which we generated at least $1,000,000 in revenue on

a trailing twelve-month basis. We calculate the number of

super-scaled customers at the end of each quarter and on an annual

basis as the number of customers billed during each applicable

period. We believe the super-scaled customers measure is both an

important contributor to our revenue growth and an indicator to

investors of our measurable success.

- Scaled Customer ARPU: We calculate

the scaled customer average revenue per user (“ARPU”) as revenue

for the corresponding period divided by the average number of

scaled customers during that period. We believe that scaled

customer ARPU is useful for investors because it is an indicator of

our ability to increase revenue and scale our business.

- Super-Scaled Customer ARPU: We

calculate the super-scaled customer ARPU as revenue for the

corresponding period divided by the average number of super-scaled

customers during that period. We believe that super-scaled customer

ARPU is useful for investors because it is an indicator of our

ability to increase revenue and scale our business.

- Zeta 2025: The Zeta 2025 is a

long-term plan introduced by the Company in 2022, intended to drive

the Company’s vision to become one of the largest marketing clouds

in the industry, with targets for business, product, and industry

leadership. The financial targets of this plan are to generate in

excess of $1 billion in annual revenue with at least 20% Adjusted

EBITDA margins by 2025. In February 2023, we added an additional

financial target to the plan of Free Cash Flow with a target of at

least $110 million by 2025.

Non-GAAP Measures

In order to assist readers of our consolidated financial

statements in understanding the core operating results that our

management uses to evaluate the business and for financial planning

purposes, we describe our non-GAAP measures below. We believe these

non-GAAP measures are useful to investors in evaluating our

performance by providing an additional tool for investors to use in

comparing our financial performance over multiple periods.

- Adjusted EBITDA is a non-GAAP

financial measure defined as net loss adjusted for interest

expense, depreciation and amortization, stock-based compensation,

income tax (benefit) / provision, acquisition-related expenses,

restructuring expenses, change in fair value of warrants and

derivative liabilities, certain dispute settlement expenses, gain

on extinguishment of debt, certain non-recurring capital raise

related (including IPO) expenses, including the payroll taxes

related to vesting of restricted stock and restricted stock units

upon the completion of the IPO, and other expenses.

Acquisition-related expenses and restructuring expenses primarily

consist of professional services fees, severance and other

employee-related costs, which may vary from period to period

depending on the timing of our acquisitions and restructuring

activities and distort the comparability of the results of

operations. Change in fair value of warrants and derivative

liabilities is a non-cash expense related to periodically recording

“mark-to-market” changes in the valuation of derivatives and

warrants. Other expenses consist of non-cash expenses such as

changes in fair value of acquisition-related liabilities, gains and

losses on extinguishment of acquisition-related liabilities, gains

and losses on sales of assets and foreign exchange gains and

losses. In particular, we believe that the exclusion of stock-based

compensation, certain dispute settlement expenses and non-recurring

capital raise related (including IPO) expenses that are not related

to our core operations provides measures for period-to-period

comparisons of our business and provides additional insight into

our core controllable costs. We exclude these charges because these

expenses are not reflective of ongoing business and operating

results.

- Adjusted EBITDA margin is a

non-GAAP financial measure defined as Adjusted EBITDA divided by

the total revenues for the same period.

- Free Cash Flow is a non-GAAP

financial measure defined as cash from operating activities, less

capital expenditures and website and software development costs,

adjusted for the effect of exchange rates on cash and cash

equivalents.

Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow

provide us with useful measures for period-to-period comparisons of

our business as well as comparison to our peers. We believe that

these non-GAAP financial measures are useful to investors in

analyzing our financial and operational performance. Nevertheless

our use of Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash

Flow has limitations as an analytical tool, and you should not

consider these measures in isolation or as a substitute for

analysis of our financial results as reported under GAAP. Other

companies may calculate similarly-titled non-GAAP financial

measures differently than us, thereby limiting the usefulness of

these non-GAAP financial measures as a comparative tool. Because of

these and other limitations, you should consider our non-GAAP

measures only as supplemental to other GAAP-based financial

performance measures, including revenues and net loss.

We calculate forward-looking Adjusted EBITDA, Adjusted EBITDA

margin, and Free Cash Flow based on internal forecasts that omit

certain amounts that would be included in forward-looking GAAP net

income (loss). We do not attempt to provide a reconciliation of

forward-looking Adjusted EBITDA, Adjusted EBITDA margin, and Free

Cash Flow guidance to forward looking GAAP net income (loss), GAAP

net income (loss) margin or GAAP cash flows from operating

activities, respectively, because forecasting the timing or amount

of items that have not yet occurred and are out of our control is

inherently uncertain and unavailable without unreasonable efforts.

Further, we believe that such reconciliations would imply a degree

of precision and certainty that could be confusing to investors.

Such items could have a substantial impact on GAAP measures of

financial performance.

Condensed Unaudited

Consolidated Balance Sheets

(In thousands, except shares,

per share and par values)

As of

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

418,538

$

131,732

Accounts receivable, net of

allowance of $4,593 and $3,564 as of September 30, 2024 and

December 31, 2023, respectively

203,711

170,131

Prepaid expenses

9,699

6,269

Other current assets

1,697

1,622

Total current assets

$

633,645

$

309,754

Non-current assets:

Property and equipment, net

$

7,383

$

7,452

Website and software development

costs, net

29,377

32,124

Right-to-use assets - operating

leases, net

7,985

6,603

Intangible assets, net

43,032

48,781

Goodwill

140,919

140,905

Deferred tax assets, net

842

728

Other non-current assets

5,898

4,367

Total non-current assets

$

235,436

$

240,960

Total assets

$

869,081

$

550,714

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

58,486

$

63,572

Accrued expenses

107,658

85,455

Acquisition-related

liabilities

12,983

17,234

Deferred revenue

3,586

3,301

Other current liabilities

8,202

6,823

Total current liabilities

$

190,915

$

176,385

Non-current liabilities:

Long-term borrowings

$

196,089

$

184,147

Acquisition-related

liabilities

-

3,060

Other non-current liabilities

7,210

6,602

Total non-current liabilities

$

203,299

$

193,809

Total liabilities

$

394,214

$

370,194

Stockholders’ equity:

Class A common stock $ 0.001 per

share par value, up to 3,750,000,000 shares authorized, 205,636,909

and 188,631,432 shares issued and outstanding as of September 30,

2024 and December 31, 2023, respectively

$

205

$

189

Class B common stock $ 0.001 per

share par value, up to 50,000,000 shares authorized, 24,889,923 and

29,055,489 shares issued and outstanding as of September 30, 2024

and December 31, 2023, respectively

25

29

Additional paid-in capital

1,520,044

1,140,849

Accumulated deficit

(1,043,544

)

(958,537

)

Accumulated other comprehensive

loss

(1,863

)

(2,010

)

Total stockholders’ equity

$

474,867

$

180,520

Total liabilities and

stockholders' equity

$

869,081

$

550,714

Condensed Unaudited

Consolidated Statements of Operations and Comprehensive

Loss

(In thousands, except share

and per share amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenues

$

268,295

$

188,984

$

691,081

$

518,403

Operating expenses:

Cost of revenues (excluding

depreciation and amortization)

105,652

73,480

273,607

189,867

General and administrative

expenses

50,494

50,706

150,459

154,022

Selling and marketing

expenses

84,548

70,669

231,567

215,714

Research and development

expenses

22,807

18,062

66,407

53,924

Depreciation and amortization

12,590

13,233

39,295

37,654

Acquisition-related expenses

4,583

—

4,583

203

Restructuring expenses

-

—

-

2,845

Total operating

expenses

$

280,674

$

226,150

$

765,918

$

654,229

Loss from operations

(12,379

)

(37,166

)

(74,837

)

(135,826

)

Interest expense

1,945

2,894

7,130

8,139

Other expenses

2,851

2,436

1,958

7,138

Total other expenses

$

4,796

$

5,330

$

9,088

$

15,277

Loss before income taxes

(17,175

)

(42,496

)

(83,925

)

(151,103

)

Income tax provision

200

590

1,082

1,097

Net loss

$

(17,375

)

$

(43,086

)

$

(85,007

)

$

(152,200

)

Other comprehensive (income) /

loss:

-

Foreign currency translation

adjustment

(146

)

283

(147

)

78

Total comprehensive

loss

$

(17,229

)

$

(43,369

)

$

(84,860

)

$

(152,278

)

Net loss per share

Net loss available to common

stockholders

$

(17,375

)

$

(43,086

)

$

(85,007

)

$

(152,200

)

Basic loss per share

$

(0.09

)

$

(0.27

)

$

(0.47

)

$

(0.99

)

Diluted loss per share

$

(0.09

)

$

(0.27

)

$

(0.47

)

$

(0.99

)

Weighted average number of

shares used to compute net loss per share

Basic

187,905,129

158,055,789

179,035,728

154,262,386

Diluted

187,905,129

158,055,789

179,035,728

154,262,386

The Company recorded stock-based compensation under respective

lines of the above condensed unaudited consolidated statements of

operations and comprehensive loss:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Cost of revenues (excluding

depreciation and amortization)

$

394

$

546

$

1,164

$

2,098

General and administrative

expenses

14,709

21,223

50,336

66,221

Selling and marketing

expenses

24,894

29,266

78,391

92,933

Research and development

expenses

7,180

6,637

22,083

18,494

Total

$

47,177

$

57,672

$

151,974

$

179,746

Condensed Unaudited

Consolidated Statements of Cash Flows

(In Thousands)

Nine months ended September

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(85,007

)

$

(152,200

)

Adjustments to reconcile net loss

to net cash provided by operating activities:

Depreciation and amortization

39,295

37,654

Stock-based compensation

151,974

179,746

Deferred income taxes

(113

)

(96

)

Change in fair value of

acquisition-related liabilities

1,388

6,681

Others, net

100

1,186

Change in non-cash working

capital (net of acquisitions):

-

Accounts receivable

(34,513

)

(33,306

)

Prepaid expenses

(3,449

)

872

Other current assets

(72

)

31

Other non-current assets

(1,525

)

(607

)

Deferred revenue

282

(311

)

Accounts payable

(3,998

)

22,614

Accrued expenses and other

current liabilities

25,208

1,225

Other non-current liabilities

608

72

Net cash provided by operating

activities

90,178

63,561

Cash flows from investing

activities:

Capital expenditures

(17,458

)

(14,886

)

Website and software development

costs

(12,110

)

(12,344

)

Acquisitions and other

investments, net of cash acquired

-

(18,246

)

Net cash used for investing

activities

(29,568

)

(45,476

)

Cash flows from financing

activities:

Cash paid for acquisition-related

liabilities

(7,032

)

(8,710

)

Proceeds from credit facilities,

net of issuance cost

207,853

11,250

Issuance under employee stock

purchase plan

1,525

1,567

Exercise of options

2,982

224

Proceeds from equity capital

raise, net of issuance cost

229,327

—

Repurchase of shares

(12,252

)

(11,487

)

Repayments against the credit

facilities

(196,250

)

(11,250

)

Net cash provided by / (used

for) financing activities

226,153

(18,406

)

Effect of exchange rate changes

on cash and cash equivalents

43

7

Net increase / (decrease) in

cash and cash equivalents

286,806

(314

)

Cash and cash equivalents,

beginning of period

131,732

121,110

Cash and cash equivalents, end

of period

$

418,538

$

120,796

Supplemental cash flow

disclosures including non-cash activities:

Cash paid for interest, net

$

7,492

$

7,685

Cash paid for income taxes,

net

$

1,173

$

1,274

Liability established in

connection with acquisitions

$

1,388

$

7,670

Capitalized stock-based

compensation as website and software development costs

$

2,250

$

2,634

Shares issued in connection with

acquisitions and other agreements

$

1,792

$

1,343

Right-to-use assets

established

$

2,980

$

-

Operating lease liabilities

established

$

2,980

$

-

Non-cash consideration for

website and software development costs

$

621

$

784

Reconciliation of GAAP to Non-GAAP Financial

Measures (in thousands)

The following table reconciles adjusted EBITDA and adjusted

EBITDA margin to net loss and net loss margin, the most directly

comparable financial measure calculated and presented in accordance

with GAAP.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net loss

$

(17,375

)

$

(43,086

)

$

(85,007

)

$

(152,200

)

Net loss margin

(6.5

)%

(22.8

)%

(12.3

)%

(29.4

)%

Add back:

Stock-based compensation

47,177

57,672

151,974

179,746

Depreciation and amortization

12,590

13,233

39,295

37,654

Acquisition-related expenses

4,583

—

4,583

203

Restructuring expenses

—

—

—

2,845

Capital raise related

expenses

1,624

—

1,624

—

Interest expense

1,945

2,894

7,130

8,139

Other expenses

2,851

2,436

1,958

7,138

Income tax provision

200

590

1,082

1,097

Adjusted EBITDA

$

53,595

$

33,739

$

122,639

$

84,622

Adjusted EBITDA margin

20.0

%

17.9

%

17.7

%

16.3

%

The following table reconciles Cash Flows from Operating

Activities in the Condensed Unaudited Consolidated Statements of

Cash Flows to Free Cash Flow:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Cash Flows from Operating

Activities

$

34,402

$

22,828

$

90,178

$

63,561

Capital expenditures

(4,893

)

(5,936

)

(17,458

)

(14,886

)

Website and software development

costs

(3,898

)

(3,438

)

(12,110

)

(12,344

)

Effect of exchange rate changes

on cash and cash equivalents

121

(94

)

43

7

Free Cash Flow

$

25,732

$

13,360

$

60,653

$

36,338

_________________________________ 1 Free Cash Flow, Adjusted

EBITDA, and Adjusted EBITDA margin are not measures of financial

performance prepared in accordance with GAAP. See “Non-GAAP

Measures” for more information and, where applicable,

reconciliations to the most directly comparable GAAP financial

measures at the end of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241108773643/en/

Investor Relations Madison Serras ir@zetaglobal.com Press

Candace Dean press@zetaglobal.com

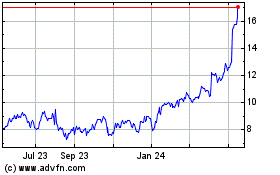

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

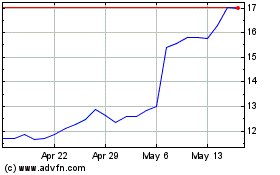

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024