Sangdong Construction Timeline

Update

Almonty Industries Inc. (“Almonty” or the

“Company”) (TSX: AII / ASX: AII / OTCQX: ALMTF / Frankfurt:

ALI) is pleased to announce the closing of its private placement to

Directors of Almonty, existing shareholders and other insiders of

2,852,251 common shares at CDN$0.94 per share and 1,428,571 Units

at US$0.70 per Unit to raise gross proceeds of approximately US$3.3

million (“Placement”). Each Unit of the 1,428,571 units will

be comprised of one common share and one-half share purchase

warrant with each whole warrant being exercisable at a price of

US$0.84 for 24 months from closing.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220511006147/en/

UPDATED SANGTON TUNGSTEN MINE TIMELINE

(Graphic: Business Wire)

The use of proceeds of this Placement will be to pay the

Plansee/GTP fees, of which the upfront cash portion of US$3.0

million has now been paid.

PLANSEE/GTP SATISFACTION OF CONDITIONS PRECEDENT

The Company is pleased to advise that it has executed a

Conditions Precedent Letter with Plansee/GTP whereby both parties

have agreed that Almonty has satisfied the conditions precedents

required by Plansee/GTP to enable financial closing of the KfW

US$75.1 million finance facility. They key terms of the Conditions

Precedent Letter are:

- Payment of GTP Obligations of US$3.0 million– paid in cash from

the proceeds of the Placement.

- Within 120 calendar days of the financial closing of the

project financing, Almonty remitting the Outstanding Balance owing

of approximately US$1.8 million. In the event that the Outstanding

Balance is not paid within 120 calendar days of the financial

closing of the Project Financing, Almonty will satisfy any

remaining portion of the Outstanding Balance by issuing common

shares in Almonty to Plansee/GTP, at a price per share equal to the

closing market price of Almonty’s common shares on the trading day

prior to issuance.

Now that Plansee/GTP have signed the satisfaction of Conditions

Precedent letter, KfW IPEX–Bank will now move to internal sign off.

Almonty expects by Friday May 21st that KfW IPEX–Bank will confirm

financial close at which point the drawdown of the US$75.1 million

will begin.

SANGDONG AND COMPANY UPDATE

Almonty President and CEO, Mr Lewis Black, said:

“The Company would like to take the opportunity of updating the

shareholders on the current status at site in Korea and the

Tungsten market generally. What is important is to highlight that

the Company placed orders for all of the long lead time equipment,

both milling and flotation last year in 2021, prior to the

drawdown. This enabled us to capture pricing and delivery times on

significantly more favourable terms than if ordered today.

However, delivery dates have been extended by 2 months with

global shipping delays being the main issue, but it will not delay

work at the site as we have merely adjusted our schedule to bring

forward areas that are manufactured or planned in South Korea and

pushed installation of imported items not yet in country to

compensate for the shipping delays. On the back of this, we have

updated our commissioning date toward the end of Q2 2023. Given our

continuing push to save costs to counter ongoing inflation on

certain consumable/building items and the delays in shipping, the

Company feels this delay is warranted and justified.

On our latest analysis of total cost escalation has resulted in

a maximum of 5% price increase which is comfortably absorbed by our

15% contingency built into the project cost. Currently this

increase stands at 4.75%. We intend to reduce that by looking at

areas where we can save further money. I would also like to add

that energy costs in South Korea have risen approximately 8% but is

not expected to rise further as prices are set by the State through

KEPCO. Nuclear and renewables account for more than 35% of South

Korea’s energy platform.

As for energy costs in Portugal at our Panasquiera mine, we have

fixed our forward price for the next 2 years at which is now at a

reduction on our 2021 price and saves the mine approx. EUR560,000

per year. This is approximately 60% below current Portuguese energy

market prices. Production continues to be stable in Portugal. We

are now ready for drawdown as we enter the accelerated construction

phase in South Korea.”

UPDATED SANGTON TUNGSTEN MINE TIMELINE

DIRECTOR SHARE SALE

The Company advises that on April 14, 2022, Mr Lewis Black sold

300,000 common shares in Almonty to cover a capital gains tax

liability. The common shares were crossed to an existing long term

holder of Almonty. After the sale, Mr Lewis Black remains one of

the largest shareholders in the Company with 11,032,895 common

shares (direct) and 13,893,920 common shares (indirect) which

represents approximately 11.91% of the Company, and confirms that

there are no further sales planned at this time.

For and on behalf of the board of Almonty Industries

Inc.

About Almonty

The principal business of Toronto, Canada-based Almonty

Industries Inc. is the mining, processing and shipping of tungsten

concentrate from its Los Santos Mine in western Spain and its

Panasqueira mine in Portugal as well as the development of its

Sangdong tungsten mine in Gangwon Province, South Korea and the

development of the Valtreixal tin/tungsten project in north western

Spain. The Los Santos Mine was acquired by Almonty in September

2011 and is located approximately 50 kilometres from Salamanca in

western Spain and produces tungsten concentrate. The Panasqueira

mine, which has been in production since 1896, is located

approximately 260 kilometres northeast of Lisbon, Portugal, was

acquired in January 2016 and produces tungsten concentrate. The

Sangdong mine, which was historically one of the largest tungsten

mines in the world and one of the few long-life, high-grade

tungsten deposits outside of China, was acquired in September 2015

through the acquisition of a 100% interest in Woulfe Mining Corp.

Almonty owns 100% of the Valtreixal tin-tungsten project in north-

western Spain. Further information about Almonty’s activities may

be found at www.almonty.com and under Almonty’s profile at

www.sedar.com.

Legal Notice

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law and therefore

persons in such jurisdictions into which this announcement is

released, published or distributed should inform themselves about

and observe such restrictions.

Neither the TSX nor its Regulation Services Provider (as that

term is defined in the policies of the TSX) accepts responsibility

for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

When used in this press release, the words “estimate”,

“project”, “belief”, “anticipate”, “intend”, “expect”, “plan”,

“predict”, “may” or “should” and the negative of these words or

such variations thereon or comparable terminology are intended to

identify forward-looking statements and information. These

statements and information are based on management’s beliefs,

estimates and opinions on the date that statements are made and

reflect Almonty’s current expectations.

Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of Almonty

to be materially different from those expressed or implied by such

forward-looking statements, including but not limited to: any

specific risks relating to fluctuations in the price of ammonium

para tungstate (“APT”) from which the sale price of Almonty’s

tungsten concentrate is derived, actual results of mining and

exploration activities, environmental, economic and political risks

of the jurisdictions in which Almonty’s operations are located and

changes in project parameters as plans continue to be refined,

forecasts and assessments relating to Almonty’s business, credit

and liquidity risks, hedging risk, competition in the mining

industry, risks related to the market price of Almonty’s shares,

the ability of Almonty to retain key management employees or

procure the services of skilled and experienced personnel, risks

related to claims and legal proceedings against Almonty and any of

its operating mines, risks relating to unknown defects and

impairments, risks related to the adequacy of internal control over

financial reporting, risks related to governmental regulations,

including environmental regulations, risks related to international

operations of Almonty, risks relating to exploration, development

and operations at Almonty’s tungsten mines, the ability of Almonty

to obtain and maintain necessary permits, the ability of Almonty to

comply with applicable laws, regulations and permitting

requirements, lack of suitable infrastructure and employees to

support Almonty’s mining operations, uncertainty in the accuracy of

mineral reserves and mineral resources estimates, production

estimates from Almonty’s mining operations, inability to replace

and expand mineral reserves, uncertainties related to title and

indigenous rights with respect to mineral properties owned directly

or indirectly by Almonty, the ability of Almonty to obtain adequate

financing, the ability of Almonty to complete permitting,

construction, development and expansion, challenges related to

global financial conditions, risks related to future sales or

issuance of equity securities, differences in the interpretation or

application of tax laws and regulations or accounting policies and

rules and acceptance of the TSX of the listing of Almonty shares on

the TSX.

Forward-looking statements are based on assumptions management

believes to be reasonable, including but not limited to, no

material adverse change in the market price of ammonium para

tungstate (APT), the continuing ability to fund or obtain funding

for outstanding commitments, expectations regarding the resolution

of legal and tax matters, no negative change to applicable laws,

the ability to secure local contractors, employees and assistance

as and when required and on reasonable terms, and such other

assumptions and factors as are set out herein. Although Almonty has

attempted to identify important factors that could cause actual

results, level of activity, performance or achievements to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results, level of activity,

performance or achievements not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will prove to be accurate and even if events or results described

in the forward-looking statements are realized or substantially

realized, there can be no assurance that they will have the

expected consequences to, or effects on, Almonty. Accordingly,

readers should not place undue reliance on forward-looking

statements and are cautioned that actual outcomes may vary.

Investors are cautioned against attributing undue certainty to

forward-looking statements. Almonty cautions that the foregoing

list of material factors is not exhaustive. When relying on

Almonty’s forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Almonty has also assumed that material factors will not cause

any forward-looking statements and information to differ materially

from actual results or events. However, the list of these factors

is not exhaustive and is subject to change and there can be no

assurance that such assumptions will reflect the actual outcome of

such items or factors.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS

RELEASE REPRESENTS THE EXPECTATIONS OF ALMONTY AS OF THE DATE OF

THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER

SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-

LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF

ANY OTHER DATE. WHILE ALMONTY MAY ELECT TO, IT DOES NOT UNDERTAKE

TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS

REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220511006147/en/

For further information: Lewis Black Chairman, President

and CEO Telephone: +1 647 438-9766 Email: info@almonty.com

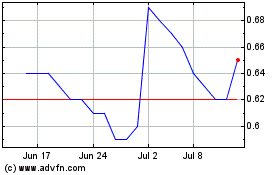

Almonty Industries (TSX:AII)

Historical Stock Chart

From Oct 2024 to Nov 2024

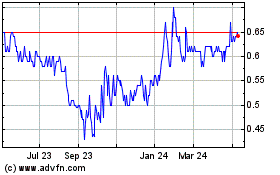

Almonty Industries (TSX:AII)

Historical Stock Chart

From Nov 2023 to Nov 2024