Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced results for its fourth quarter and year

ended December 31, 2024. “Our occupied and leased area

remained steady for the third consecutive quarter, and our urban

workspace portfolio continued to outperform in terms of occupancy

and rent growth in all urban submarkets other than Vancouver,” said

Cecilia Williams, President & CEO. “With demand rising in our

cities and across our three workspace formats, we expect to

increase our occupied and leased area and propel rent growth over

the course of 2025.”

Operations

Allied’s portfolio is comprised of three urban

workspace formats. Allied Heritage is a format created through the

adaptive re-use of light industrial structures for office use above

grade and retail use at grade. The buildings are inherently

distinctive, clustered in the urban core and generally low-rise.

Allied Modern is a format created specifically for office use. The

buildings are generally mid- to high-rise, clustered in the urban

core and distinctive by virtue of design, integration with heritage

structure and/or integration with the different elements of

mixed-use, amenity-rich urban neighbourhoods. Located primarily in

Toronto, Allied Flex is a limited format for buildings that Allied

intends to redevelop comprehensively within a five-to 10-year

period. Because of the near-term transformation of these buildings,

Allied can make workspace in them available profitably and on more

flexible than normal terms for users.

Utilization of, and demand for, Allied's

workspace continued to strengthen in the fourth quarter. In the

Montréal, Calgary and Vancouver rental portfolios, demand for

Allied Heritage was most pronounced. In the Toronto rental

portfolio, demand was strong across all three formats.

Allied conducted 255 lease tours in its rental

portfolio in the fourth quarter. Its occupied and leased area at

the end of the quarter was 85.9% and 87.2%, respectively. Allied

renewed 69% of the leases maturing in the quarter, much closer to

its normal level of 70% to 75%.

Allied leased a total of 571,298 square feet of

GLA in the fourth quarter, 527,978 square feet in its rental

portfolio and 43,320 square feet in its development portfolio. Of

the 527,978 square feet Allied leased in its rental portfolio,

84,724 square feet were vacant, 212,834 square feet were maturing

in the quarter and 230,420 square feet were maturing after the

quarter. 56,077 square feet of the vacant space leased in the

quarter involved expansion by existing users, a long-standing trend

in Allied's rental portfolio that appears to be regaining

momentum.

Average in-place net rent per occupied square

foot continued its steady improvement, ending the fourth quarter at

$25.41. Allied continued to achieve rent increases on renewal in

the fourth quarter (up 2.0% ending-to-starting base rent and up

5.9% average-to-average base rent).

2024 Acquisitions and Non-Core Property

Sales

“We remain committed to our vision, mission and

core strategy,” said Michael Emory, Founder & Executive Chair.

“Given our confidence in the future of Canada’s major cities, we’ll

continue to grow our business with a view to serving

knowledge-based organizations ever more comprehensively and

successfully over time.”

In 2024, Allied acquired three triple-A urban

properties for $677 million -- 400 West Georgia Street in

Vancouver, the remaining 50% interest in 19 Duncan Street in

Toronto and an additional 16.7% interest in the residential

component of TELUS Sky (now known as “Calgary House”), bringing its

ownership to 50%. The aggregate acquisition price was below

development and replacement cost.

- 400 West Georgia is comprised of

340,846 square feet of office GLA, 6,546 square feet of retail GLA

and 163 underground parking stalls. The property is 82% leased to

Deloitte, Apple, Northeastern University, Spaces, RBC, a local café

and a local restaurant, all with a weighted-average lease term of

11 years. Completed in late 2023, the property is designated LEED

Platinum.

- 19 Duncan is comprised of 149,230

square feet of office GLA, 3,570 square feet of retail GLA, 464

rental-residential units, related common areas and facilities, 25

underground commercial parking stalls and 106 underground

residential parking stalls. The office component is fully leased to

Thomson Reuters with a weighted-average lease term of 8.6 years.

The lease-up of the residential component is underway and is

expected to be completed in early 2026. With the office component

completed in late 2023 and the residential component (known as

“Toronto House”) to be completed shortly, the property is designed

to, and applying for designation as, LEED Gold.

- Calgary House is comprised of 326

rental-residential units, related common areas and 176 underground

parking stalls. The property is 91.8% leased. Completed in late

2020, the property is designated LEED Gold.

Allied paid for the three triple-A urban

properties by (i) converting loans receivable of $232 million into

equity and (ii) incurring $445 million of short-term, variable-rate

debt on 400 West Georgia and 19 Duncan. Allied has since replaced

the debt on 400 West Georgia with a first mortgage of $180 million

at 5.25% per annum for a term of five and one-half years. Allied

has since sold seven lower-yielding, non-core properties -- four in

Montréal, one in Toronto, one in Ottawa and one in Calgary -- for

$229 million, which was allocated to debt repayment in the fourth

quarter.

In Management’s view, the temporary contraction

in cashflow per unit resulting from the acquisition of 400 West

Georgia and 19 Duncan represents an investment in the future, one

that will drive earnings and value growth on completion of lease-up

by 2026. Management is also of the view that the two properties are

important in meaningfully augmenting the Allied Modern format in

two of Canada’s most important urban office markets.

2024 Balance-Sheet

Management

By the end of 2024, Allied

(i) reduced the amount drawn on its $800 million

unsecured revolving operating facility to nil, affording it

considerable liquidity going into 2025,

(ii) reduced short-term, variable rate debt to

$153 million, representing 3.5% of its total debt,

(iii) had a total debt ratio(1) of 41.7% and

(iv) had net debt as a multiple of annualized

adjusted EBITDA(1) of 10.8x.

Allied is committed to maintaining and

ultimately improving its access to the debt capital markets and

will continue to manage its balance sheet accordingly.

Outlook

Allied is experiencing steady demand for urban

workspace, urban rental-residential space and urban amenity space,

as well as strong and quantifiable engagement among users of space

in its portfolio generally. Management expects this to underpin

growth in same-asset NOI(1) in 2025 of approximately 2%. With the

higher overall interest cost flowing from the 2024 acquisitions,

Management expects FFO(1) and AFFO(1) per unit to contract in 2025

by approximately 4%.

Allied’s specific operating goals for year-end

2025 are as follows:

(i) to have reached occupied and leased area of

at least 90%;

(ii) to have sold lower-yielding, non-core

properties, primarily in Montréal, Calgary, Edmonton and Vancouver,

for at least $300 million and at or above IFRS value, with

allocation of proceeds to debt repayment;

(iii) to have fully monetized its loan

receivable secured by 150 West Georgia Street in Vancouver with

allocation of proceeds to debt repayment; and

(iv) to have net debt as a multiple of annualized

adjusted EBITDA below 10x, despite an expected temporary increase

in the first quarter of

2025._____________________________________________________________________________(1)

This is a non-GAAP measure. FFO per unit and AFFO per unit exclude

condominium-related items, financing prepayment costs, and the

mark-to-market adjustment on unit-based compensation. Refer to the

Non-GAAP Measures section below.Financial

Measures

The following tables summarize GAAP financial

measures for the three months and years ended December 31,

2024, and 2023:

| |

For the three months ended December 31 |

|

(in thousands except for % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Continuing operations |

|

|

|

|

|

Rental revenue |

$ |

155,120 |

|

$ |

150,898 |

|

$ |

4,222 |

|

|

2.8 |

% |

|

Property operating costs |

$ |

(70,737 |

) |

$ |

(69,029 |

) |

$ |

(1,708 |

) |

|

(2.5 |

)% |

|

Operating income |

$ |

84,383 |

|

$ |

81,869 |

|

$ |

2,514 |

|

|

3.1 |

% |

|

Interest income |

$ |

10,393 |

|

$ |

18,749 |

|

$ |

(8,356 |

) |

|

(44.6 |

)% |

|

Interest expense |

$ |

(31,743 |

) |

$ |

(30,265 |

) |

$ |

(1,478 |

) |

|

(4.9 |

)% |

|

General and administrative expenses

(1) |

$ |

(8,374 |

) |

$ |

(6,729 |

) |

$ |

(1,645 |

) |

|

(24.4 |

)% |

|

Condominium marketing expenses |

$ |

(17 |

) |

$ |

(89 |

) |

$ |

72 |

|

|

80.9 |

% |

|

Amortization of other assets |

$ |

(388 |

) |

$ |

(381 |

) |

$ |

(7 |

) |

|

(1.8 |

)% |

|

Transaction costs |

$ |

(1,586 |

) |

$ |

(167 |

) |

$ |

(1,419 |

) |

|

(849.7 |

)% |

|

Net income (loss) from joint venture |

$ |

105 |

|

$ |

(14,131 |

) |

$ |

14,236 |

|

|

100.7 |

% |

|

Fair value loss on investment properties and investment

properties held for sale |

$ |

(346,035 |

) |

$ |

(494,571 |

) |

$ |

148,536 |

|

|

30.0 |

% |

|

Fair value gain (loss) on Exchangeable LP

Units |

$ |

36,254 |

|

$ |

(26,571 |

) |

$ |

62,825 |

|

|

236.4 |

% |

|

Fair value loss on derivative instruments |

$ |

(644 |

) |

$ |

(27,054 |

) |

$ |

26,410 |

|

|

97.6 |

% |

|

Net loss and comprehensive loss from continuing

operations |

$ |

(257,652 |

) |

$ |

(499,340 |

) |

$ |

241,688 |

|

|

48.4 |

% |

|

Net loss and comprehensive loss from discontinued

operations |

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

— |

% |

|

Net loss and comprehensive loss |

$ |

(257,652 |

) |

$ |

(499,340 |

) |

$ |

241,688 |

|

|

48.4 |

% |

|

|

|

|

|

|

(1) For the three months ended December 31,

2024, general and administrative expenses increased by $1,645 or

24.4% from the comparable period. This was primarily due to the

change in the mark-to-market adjustments on unit-based compensation

of $1,618. The mark-to-market adjustment on unit-based compensation

is added back in the calculation of FFO as defined in REALPAC's

"Funds From Operations (FFO) & Adjusted Funds From Operations

(AFFO) for IFRS" issued in January 2022.

| |

For the year ended December 31 |

|

(in thousands except for % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Continuing operations |

|

|

|

|

|

Rental revenue |

$ |

592,040 |

|

$ |

563,980 |

|

$ |

28,060 |

|

|

5.0 |

% |

|

Property operating costs |

$ |

(263,566 |

) |

$ |

(246,949 |

) |

$ |

(16,617 |

) |

|

(6.7 |

)% |

|

Operating income |

$ |

328,474 |

|

$ |

317,031 |

|

$ |

11,443 |

|

|

3.6 |

% |

|

Interest income |

$ |

45,069 |

|

$ |

53,605 |

|

$ |

(8,536 |

) |

|

(15.9 |

)% |

|

Interest expense |

$ |

(116,467 |

) |

$ |

(107,073 |

) |

$ |

(9,394 |

) |

|

(8.8 |

)% |

|

General and administrative expenses

(1) |

$ |

(24,333 |

) |

$ |

(23,577 |

) |

$ |

(756 |

) |

|

(3.2 |

)% |

|

Condominium marketing expenses |

$ |

(134 |

) |

$ |

(538 |

) |

$ |

404 |

|

|

75.1 |

% |

|

Amortization of other assets |

$ |

(1,538 |

) |

$ |

(1,499 |

) |

$ |

(39 |

) |

|

(2.6 |

)% |

|

Transaction costs |

$ |

(1,722 |

) |

$ |

(167 |

) |

$ |

(1,555 |

) |

|

(931.1 |

)% |

|

Net income (loss) from joint venture |

$ |

1,842 |

|

$ |

(15,622 |

) |

$ |

17,464 |

|

|

111.8 |

% |

|

Fair value loss on investment properties and investment

properties held for sale |

$ |

(557,569 |

) |

$ |

(772,652 |

) |

$ |

215,083 |

|

|

27.8 |

% |

|

Fair value gain on Exchangeable LP Units |

$ |

35,782 |

|

$ |

28,696 |

|

$ |

7,086 |

|

|

24.7 |

% |

|

Fair value loss on derivative instruments |

$ |

(13,675 |

) |

$ |

(8,535 |

) |

$ |

(5,140 |

) |

|

(60.2 |

)% |

|

Impairment of residential inventory |

$ |

(38,259 |

) |

$ |

(15,376 |

) |

$ |

(22,883 |

) |

|

(148.8 |

)% |

|

Net loss and comprehensive loss from continuing

operations |

$ |

(342,530 |

) |

$ |

(545,707 |

) |

$ |

203,177 |

|

|

37.2 |

% |

|

Net income and comprehensive income from discontinued

operations |

$ |

— |

|

$ |

124,991 |

|

$ |

(124,991 |

) |

|

(100.0 |

)% |

|

Net loss and comprehensive loss |

$ |

(342,530 |

) |

$ |

(420,716 |

) |

$ |

78,186 |

|

|

18.6 |

% |

|

|

|

|

|

|

(1) For the year ended December 31, 2024,

general and administrative expenses increased by $756 or 3.2% from

the comparable period primarily due to the change in mark-to-market

adjustments on unit-based compensation of $387. The mark-to-market

adjustment on unit-based compensation is added back in the

calculation of FFO as defined in REALPAC's "Funds From Operations

(FFO) & Adjusted Funds From Operations (AFFO) for IFRS" issued

in January 2022.

The following table summarizes other financial

measures as at December 31, 2024, and 2023:

| |

As at December 31 |

|

(in thousands except for per unit and % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Investment properties

(1) |

$ |

9,448,363 |

|

$ |

9,387,032 |

|

$ |

61,331 |

|

|

0.7 |

% |

|

Unencumbered investment properties

(2) |

$ |

7,817,543 |

|

$ |

8,757,510 |

|

$ |

(939,967 |

) |

|

(10.7 |

)% |

|

Total Assets

(1) |

$ |

10,603,979 |

|

$ |

10,609,285 |

|

$ |

(5,306 |

) |

|

(0.1 |

)% |

|

Cost of PUD as a % of GBV

(2) |

|

10.1 |

% |

|

11.6 |

% |

|

— |

|

|

(1.5 |

)% |

|

NAV per unit

(3) |

$ |

41.25 |

|

$ |

45.60 |

|

$ |

(4.35 |

) |

|

(9.5 |

)% |

|

Debt

(1) |

$ |

4,403,375 |

|

$ |

3,659,611 |

|

$ |

743,764 |

|

|

20.3 |

% |

|

Total indebtedness ratio

(2) |

|

41.7 |

% |

|

34.7 |

% |

|

— |

|

|

7.0 |

% |

|

Annualized Adjusted EBITDA

(2) |

$ |

393,404 |

|

$ |

410,488 |

|

$ |

(17,084 |

) |

|

(4.2 |

)% |

|

Net debt as a multiple of Annualized Adjusted

EBITDA

(2) |

|

10.8x |

|

|

8.2x |

|

|

2.6x |

|

|

— |

|

|

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - three months

trailing

(2) |

|

2.3x |

|

|

2.9x |

|

|

(0.6x |

) |

|

— |

|

|

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - twelve months

trailing

(2) |

|

2.4x |

|

|

2.5x |

|

|

(0.1x |

) |

|

— |

|

(1) This measure is presented on an IFRS

basis.(2) This is a non-GAAP measure and includes the results of

the continuing operations and the discontinued operations. Refer to

the Non-GAAP Measures section below. (3) Prior to Allied's

conversion to an open-end trust, net asset value per unit ("NAV per

unit") was calculated as total equity as at the corresponding

period ended, divided by the actual number of Units and class B

limited partnership units of Allied Properties Exchangeable Limited

Partnership ("Exchangeable LP Units") outstanding at period end.

With Allied's conversion to an open-end trust on June 12, 2023, NAV

per unit is calculated as total equity plus the value of

Exchangeable LP Units as at the corresponding period ended, divided

by the actual number of Units and Exchangeable LP Units. The

rationale for including the value of Exchangeable LP Units is

because they are economically equivalent to Units, receive

distributions equal to the distributions paid on the Units and are

exchangeable, at the holder's option, for Units.

Non-GAAP Measures

Management uses financial measures based on

International Financial Reporting Standards ("IFRS" or "GAAP") and

non-GAAP measures to assess Allied's performance. Non-GAAP measures

do not have any standardized meaning prescribed under IFRS, and

therefore, should not be construed as alternatives to net income or

cash flow from operating activities calculated in accordance with

IFRS. Refer to the Non-GAAP Measures section on page 17 of the

MD&A as at December 31, 2024, available on

www.sedarplus.ca, for an explanation of the composition of the

non-GAAP measures used in this press release and their usefulness

for readers in assessing Allied's performance. Such explanation is

incorporated by reference herein.

The following tables summarize non-GAAP

financial measures for the three months and years ended

December 31, 2024, and 2023:

| |

For the three months ended December 31 |

|

(in thousands except for per unit and % amounts)(1) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Adjusted EBITDA |

$ |

98,351 |

|

$ |

102,622 |

|

$ |

(4,271 |

) |

|

(4.2 |

)% |

|

Same Asset NOI - rental portfolio |

$ |

74,128 |

|

$ |

74,584 |

|

$ |

(456 |

) |

|

(0.6 |

)% |

|

Same Asset NOI - total portfolio |

$ |

82,446 |

|

$ |

81,287 |

|

$ |

1,159 |

|

|

1.4 |

% |

|

FFO |

$ |

72,395 |

|

$ |

85,460 |

|

$ |

(13,065 |

) |

|

(15.3 |

)% |

|

FFO per unit (diluted) |

$ |

0.518 |

|

$ |

0.611 |

|

$ |

(0.093 |

) |

|

(15.2 |

)% |

|

FFO pay-out ratio |

|

86.9 |

% |

|

73.6 |

% |

|

— |

|

|

13.3 |

% |

|

AFFO |

$ |

64,274 |

|

$ |

78,306 |

|

$ |

(14,032 |

) |

|

(17.9 |

)% |

|

AFFO per unit (diluted) |

$ |

0.460 |

|

$ |

0.560 |

|

$ |

(0.100 |

) |

|

(17.9 |

)% |

|

AFFO pay-out ratio |

|

97.9 |

% |

|

80.3 |

% |

|

— |

|

|

17.6 |

% |

|

All amounts below are excluding condominium-related items,

financing prepayment costs, and the mark-to-market adjustment on

unit-based compensation: |

|

FFO |

$ |

74,747 |

|

$ |

85,765 |

|

$ |

(11,018 |

) |

|

(12.8 |

)% |

|

FFO per unit (diluted) |

$ |

0.535 |

|

$ |

0.614 |

|

$ |

(0.079 |

) |

|

(12.9 |

)% |

|

FFO pay-out ratio |

|

84.1 |

% |

|

73.3 |

% |

|

— |

|

|

10.8 |

% |

|

AFFO |

$ |

66,626 |

|

$ |

78,611 |

|

$ |

(11,985 |

) |

|

(15.2 |

)% |

|

AFFO per unit (diluted) |

$ |

0.477 |

|

$ |

0.562 |

|

$ |

(0.085 |

) |

|

(15.1 |

)% |

|

AFFO pay-out ratio |

|

94.4 |

% |

|

80.0 |

% |

|

— |

|

|

14.4 |

% |

(1) These non-GAAP measures include the results

of the continuing operations and the discontinued operations

(except for Same Asset NOI - rental portfolio, which only includes

continuing operations).

| |

For the year ended December 31 |

|

(in thousands except for per unit and % amounts)(1) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Adjusted EBITDA |

$ |

389,239 |

|

$ |

416,019 |

|

$ |

(26,780 |

) |

|

(6.4 |

)% |

|

Same Asset NOI - rental portfolio |

$ |

283,893 |

|

$ |

291,325 |

|

$ |

(7,432 |

) |

|

(2.6 |

)% |

|

Same Asset NOI - total portfolio |

$ |

328,638 |

|

$ |

321,500 |

|

$ |

7,138 |

|

|

2.2 |

% |

|

FFO |

$ |

303,278 |

|

$ |

332,578 |

|

$ |

(29,300 |

) |

|

(8.8 |

)% |

|

FFO per unit (diluted) |

$ |

2.170 |

|

$ |

2.380 |

|

$ |

(0.210 |

) |

|

(8.8 |

)% |

|

FFO pay-out ratio |

|

83.0 |

% |

|

75.6 |

% |

|

— |

|

|

7.4 |

% |

|

AFFO |

$ |

272,906 |

|

$ |

304,181 |

|

$ |

(31,275 |

) |

|

(10.3 |

)% |

|

AFFO per unit (diluted) |

$ |

1.953 |

|

$ |

2.176 |

|

$ |

(0.223 |

) |

|

(10.2 |

)% |

|

AFFO pay-out ratio |

|

92.2 |

% |

|

82.7 |

% |

|

— |

|

|

9.5 |

% |

|

All amounts below are excluding condominium-related items,

financing prepayment costs, and the mark-to-market adjustment on

unit-based compensation: |

|

FFO |

$ |

303,806 |

|

$ |

332,622 |

|

$ |

(28,816 |

) |

|

(8.7 |

)% |

|

FFO per unit (diluted) |

$ |

2.174 |

|

$ |

2.380 |

|

$ |

(0.206 |

) |

|

(8.7 |

)% |

|

FFO pay-out ratio |

|

82.8 |

% |

|

75.6 |

% |

|

— |

|

|

7.2 |

% |

|

AFFO |

$ |

273,434 |

|

$ |

304,225 |

|

$ |

(30,791 |

) |

|

(10.1 |

)% |

|

AFFO per unit (diluted) |

$ |

1.956 |

|

$ |

2.177 |

|

$ |

(0.221 |

) |

|

(10.2 |

)% |

|

AFFO pay-out ratio |

|

92.0 |

% |

|

82.7 |

% |

|

— |

|

|

9.3 |

% |

|

|

|

|

|

|

(1) These non-GAAP measures include the results of

the continuing operations and the discontinued operations (except

for Same Asset NOI - rental portfolio, which only includes

continuing operations).

The following tables reconcile the non-GAAP

measures to the most comparable IFRS measures for the three months

and years ended December 31, 2024, and 2023. These terms do

not have any standardized meaning prescribed under IFRS and may not

be comparable to similarly titled measures presented by other

publicly traded entities.

The following table reconciles Allied's net loss

and comprehensive loss to Adjusted EBITDA, a non-GAAP measure, for

the three months and years ended December 31, 2024, and

2023.

| |

Three months ended |

|

Year ended |

|

|

December 31, 2024 |

December 31, 2023 |

|

December 31, 2024 |

December 31, 2023 |

|

Net loss and comprehensive loss for the period |

$ |

(257,652 |

) |

$ |

(499,340 |

) |

|

$ |

(342,530 |

) |

$ |

(420,716 |

) |

|

Interest expense |

|

31,743 |

|

|

30,265 |

|

|

|

116,467 |

|

|

111,506 |

|

|

Amortization of other assets |

|

431 |

|

|

381 |

|

|

|

1,742 |

|

|

1,499 |

|

|

Amortization of improvement allowances |

|

9,300 |

|

|

7,698 |

|

|

|

37,753 |

|

|

32,116 |

|

|

Impairment of residential inventory |

|

— |

|

|

— |

|

|

|

38,259 |

|

|

15,376 |

|

|

Transaction costs |

|

1,666 |

|

|

167 |

|

|

|

1,802 |

|

|

13,413 |

|

|

Fair value loss on investment properties and investment properties

held for sale (1) |

|

346,639 |

|

|

509,610 |

|

|

|

557,960 |

|

|

683,480 |

|

|

Fair value (gain) loss on Exchangeable LP Units |

|

(36,254 |

) |

|

26,571 |

|

|

|

(35,782 |

) |

|

(28,696 |

) |

|

Fair value loss on derivative instruments |

|

644 |

|

|

27,054 |

|

|

|

13,675 |

|

|

8,535 |

|

|

Mark-to-market adjustment on unit-based compensation |

|

1,834 |

|

|

216 |

|

|

|

(107 |

) |

|

(494 |

) |

|

Adjusted EBITDA (2) |

$ |

98,351 |

|

$ |

102,622 |

|

|

$ |

389,239 |

|

$ |

416,019 |

|

(1) Includes Allied's proportionate share of the

equity accounted investment's fair value loss on investment

properties of $604 and $391 for the three months and year ended

December 31, 2024, respectively (December 31, 2023 -

$15,039 and $19,677, respectively).(2) The Adjusted EBITDA for the

year ended December 31, 2023 includes the Urban Data Centre

segment which was classified as a discontinued operation from Q4

2022 until its disposition in August 2023.

The following table reconciles operating income to

net operating income, a non-GAAP measure, for the three months and

years ended December 31, 2024, and 2023.

| |

Three months ended |

Year ended |

| |

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

|

|

Operating income, IFRS basis |

$ |

84,383 |

|

$ |

81,869 |

|

$ |

328,474 |

|

$ |

317,031 |

|

|

Add: investment in joint venture |

|

818 |

|

|

903 |

|

|

2,477 |

|

|

4,032 |

|

|

Operating income, proportionate basis |

$ |

85,201 |

|

$ |

82,772 |

|

$ |

330,951 |

|

$ |

321,063 |

|

|

Amortization of improvement allowances (1)(2) |

|

9,300 |

|

|

7,698 |

|

|

37,753 |

|

|

31,790 |

|

|

Amortization of straight-line rent (1)(2) |

|

(1,702 |

) |

|

(3,361 |

) |

|

(7,600 |

) |

|

(9,074 |

) |

|

NOI from continuing operations |

$ |

92,799 |

|

$ |

87,109 |

|

$ |

361,104 |

|

$ |

343,779 |

|

|

NOI from discontinued operations |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

33,452 |

|

|

Total NOI |

$ |

92,799 |

|

$ |

87,109 |

|

$ |

361,104 |

|

$ |

377,231 |

|

(1) Includes Allied's proportionate share of the

equity accounted investment of the following amounts for the three

months and year ended December 31, 2024: amortization

improvement allowances of $189 and $778, respectively

(December 31, 2023 - $169 and $660, respectively,) and

amortization of straight-line rent of $(38) and $(190),

respectively (December 31, 2023 - $(43) and $(190),

respectively). (2) Excludes the Urban Data Centre segment which was

classified as a discontinued operation from Q4 2022 until its

disposition in August 2023. For the three months and year ended

December 31, 2023, the Urban Data Centre segment's

amortization of improvement allowances was $nil and $326,

respectively and the amortization of straight-line rent was $nil

and $(695), respectively.

Same Asset NOI, a non-GAAP measure, is measured as

the net operating income for the properties that Allied owned and

operated for the entire duration of both the current and

comparative period.

| |

Three months ended |

Change |

| |

December 31, 2024 |

|

December 31, 2023 |

|

$ |

|

|

% |

|

|

Rental Portfolio - Same Asset NOI |

$ |

74,128 |

|

$ |

74,584 |

|

$ |

(456 |

) |

|

(0.6 |

)% |

|

Assets Held for Sale - Same Asset NOI |

|

2,280 |

|

|

2,810 |

|

|

(530 |

) |

|

(18.9 |

) |

|

Rental Portfolio and Assets Held for Sale - Same Asset

NOI |

$ |

76,408 |

|

$ |

77,394 |

|

$ |

(986 |

) |

|

(1.3 |

%) |

|

Development Portfolio - Same Asset NOI

(1) |

|

6,038 |

|

|

3,893 |

|

|

2,145 |

|

|

55.1 |

|

|

Total Portfolio - Same Asset NOI |

$ |

82,446 |

|

$ |

81,287 |

|

$ |

1,159 |

|

|

1.4 |

% |

|

Acquisitions (2) |

|

5,326 |

|

|

— |

|

|

5,326 |

|

|

|

Dispositions |

|

1,322 |

|

|

3,426 |

|

|

(2,104 |

) |

|

|

Development fees and corporate items |

|

3,705 |

|

|

2,368 |

|

|

1,337 |

|

|

|

Total NOI |

$ |

92,799 |

|

$ |

87,109 |

|

$ |

5,690 |

|

|

6.5 |

% |

(1) Includes Allied's 50% interest in 19

Duncan.(2) Includes 100% of 400 West Georgia, Allied's incremental

50% interest in 19 Duncan, and Allied's incremental 16.7% interest

in the residential component of TELUS Sky acquired in 2024.

| |

Year ended |

Change |

| |

December 31, 2024 |

|

December 31, 2023 |

|

$ |

|

% |

|

|

Rental Portfolio - Same Asset NOI |

$ |

283,893 |

|

$ |

291,325 |

|

$ |

(7,432 |

) |

|

(2.6 |

)% |

|

Assets Held for Sale - Same Asset NOI |

|

9,761 |

|

|

11,898 |

|

|

(2,137 |

) |

|

(18.0 |

) |

|

Rental Portfolio and Assets Held for Sale - Same Asset

NOI |

$ |

293,654 |

|

$ |

303,223 |

|

$ |

(9,569 |

) |

|

(3.2 |

%) |

|

Development Portfolio - Same Asset NOI

(1) |

|

34,984 |

|

|

18,277 |

|

|

16,707 |

|

|

91.4 |

|

|

Total Portfolio - Same Asset NOI |

$ |

328,638 |

|

$ |

321,500 |

|

$ |

7,138 |

|

|

2.2 |

% |

|

Acquisitions (2) |

|

12,990 |

|

|

— |

|

|

12,990 |

|

|

|

Dispositions |

|

9,672 |

|

|

47,582 |

|

|

(37,910 |

) |

|

|

Lease terminations |

|

28 |

|

|

221 |

|

|

(193 |

) |

|

|

Development fees and corporate items |

|

9,776 |

|

|

7,928 |

|

|

1,848 |

|

|

|

Total NOI |

$ |

361,104 |

|

$ |

377,231 |

|

$ |

(16,127 |

) |

|

(4.3 |

%) |

(1) Includes Allied's 50% interest in 19 Duncan.(2)

Includes 100% of 400 West Georgia, Allied's incremental 50%

interest in 19 Duncan, and Allied's 16.7% interest in the

residential component of TELUS Sky acquired in 2024.

The following tables reconcile Allied's net loss

and comprehensive loss from continuing operations to FFO, FFO

excluding condominium-related items, financing prepayment costs,

and the mark-to-market adjustment on unit-based compensation, AFFO,

and AFFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation, which are non-GAAP measures, for the three months and

years ended December 31, 2024, and 2023.

| |

Three months ended |

|

|

December 31, 2024 |

|

December 31, 2023 |

|

Change |

|

Net loss and comprehensive loss from continuing operations |

$ |

(257,652 |

) |

$ |

(499,340 |

) |

$ |

241,688 |

|

|

Net loss and comprehensive loss from discontinued operations |

|

— |

|

|

— |

|

|

— |

|

|

Adjustment to fair value of investment properties and investment

properties held for sale |

|

346,035 |

|

|

494,571 |

|

|

(148,536 |

) |

|

Adjustment to fair value of Exchangeable LP Units |

|

(36,254 |

) |

|

26,571 |

|

|

(62,825 |

) |

|

Adjustment to fair value of derivative instruments |

|

644 |

|

|

27,054 |

|

|

(26,410 |

) |

|

Transaction costs |

|

1,586 |

|

|

167 |

|

|

1,419 |

|

|

Incremental leasing costs |

|

2,640 |

|

|

2,302 |

|

|

338 |

|

|

Amortization of improvement allowances |

|

9,111 |

|

|

7,529 |

|

|

1,582 |

|

|

Amortization of property, plant and equipment (1) |

|

98 |

|

|

103 |

|

|

(5 |

) |

|

Distributions on Exchangeable LP Units |

|

5,314 |

|

|

10,983 |

|

|

(5,669 |

) |

|

Adjustments relating to joint venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

604 |

|

|

15,039 |

|

|

(14,435 |

) |

|

Amortization of improvement allowances |

|

189 |

|

|

169 |

|

|

20 |

|

|

Transaction costs |

|

80 |

|

|

— |

|

|

80 |

|

|

Interest expense(2) |

|

— |

|

|

312 |

|

|

(312 |

) |

|

FFO |

$ |

72,395 |

|

$ |

85,460 |

|

$ |

(13,065 |

) |

|

Condominium marketing costs |

|

17 |

|

|

89 |

|

|

(72 |

) |

|

Financing prepayment costs |

|

501 |

|

|

— |

|

|

501 |

|

|

Mark-to-market adjustment on unit-based compensation |

|

1,834 |

|

|

216 |

|

|

1,618 |

|

|

FFO excluding condominium-related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

74,747 |

|

$ |

85,765 |

|

$ |

(11,018 |

) |

|

|

|

|

|

|

FFO |

$ |

72,395 |

|

$ |

85,460 |

|

$ |

(13,065 |

) |

|

Amortization of straight-line rent |

|

(1,664 |

) |

|

(3,318 |

) |

|

1,654 |

|

|

Regular leasing expenditures |

|

(3,357 |

) |

|

(1,565 |

) |

|

(1,792 |

) |

|

Regular and recoverable maintenance capital expenditures |

|

(1,214 |

) |

|

(616 |

) |

|

(598 |

) |

|

Incremental leasing costs (related to regular leasing

expenditures) |

|

(1,847 |

) |

|

(1,612 |

) |

|

(235 |

) |

|

Adjustment relating to joint venture: |

|

|

|

|

Amortization of straight-line rent |

|

(38 |

) |

|

(43 |

) |

|

5 |

|

|

Regular leasing expenditures |

|

(1 |

) |

|

— |

|

|

(1 |

) |

|

AFFO |

$ |

64,274 |

|

$ |

78,306 |

|

$ |

(14,032 |

) |

|

Condominium marketing costs |

|

17 |

|

|

89 |

|

|

(72 |

) |

|

Financing prepayment costs |

|

501 |

|

|

— |

|

|

501 |

|

|

Mark-to-market adjustment on unit-based compensation |

|

1,834 |

|

|

216 |

|

|

1,618 |

|

|

AFFO excluding condominium-related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

66,626 |

|

$ |

78,611 |

|

$ |

(11,985 |

) |

|

|

|

|

|

|

Weighted average number of units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

|

Per unit - basic and diluted |

|

|

|

|

FFO |

$ |

0.518 |

|

$ |

0.611 |

|

$ |

(0.093 |

) |

|

FFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.535 |

|

$ |

0.614 |

|

$ |

(0.079 |

) |

|

AFFO |

$ |

0.460 |

|

$ |

0.560 |

|

$ |

(0.100 |

) |

|

AFFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.477 |

|

$ |

0.562 |

|

$ |

(0.085 |

) |

| |

|

|

|

|

Pay-out Ratio |

|

|

|

|

FFO |

|

86.9 |

% |

|

73.6 |

% |

|

13.3 |

% |

|

FFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

84.1 |

% |

|

73.3 |

% |

|

10.8 |

% |

|

AFFO |

|

97.9 |

% |

|

80.3 |

% |

|

17.6 |

% |

|

AFFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

94.4 |

% |

|

80.0 |

% |

|

14.4 |

% |

(1) Property, plant and equipment relates to

owner-occupied property.(2) This amount represents interest expense

on Allied's joint venture investment in TELUS Sky and is not

capitalized under IFRS, but is allowed as an adjustment under

REALPAC's definition of FFO in "Funds From Operations (FFO) &

Adjusted Funds From Operations (AFFO) for IFRS" issued in January

2022. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were reclassified

from non-controlling interests in equity to liabilities in the

consolidated financial statements on Allied's conversion to an

open-end trust on June 12, 2023.

| |

Year ended |

|

|

December 31, 2024 |

|

December 31, 2023 |

|

Change |

|

Net loss and comprehensive loss from continuing operations |

$ |

(342,530 |

) |

$ |

(545,707 |

) |

$ |

203,177 |

|

|

Net income and comprehensive income from discontinued

operations |

|

— |

|

|

124,991 |

|

|

(124,991 |

) |

|

Adjustment to fair value of investment properties and investment

properties held for sale |

|

557,569 |

|

|

663,803 |

|

|

(106,234 |

) |

|

Adjustment to fair value of Exchangeable LP Units |

|

(35,782 |

) |

|

(28,696 |

) |

|

(7,086 |

) |

|

Adjustment to fair value of derivative instruments |

|

13,675 |

|

|

8,535 |

|

|

5,140 |

|

|

Impairment of residential inventory |

|

38,259 |

|

|

15,376 |

|

|

22,883 |

|

|

Transaction costs |

|

1,722 |

|

|

13,413 |

|

|

(11,691 |

) |

|

Incremental leasing costs |

|

10,487 |

|

|

9,184 |

|

|

1,303 |

|

|

Amortization of improvement allowances |

|

36,975 |

|

|

31,456 |

|

|

5,519 |

|

|

Amortization of property, plant and equipment (1) |

|

398 |

|

|

405 |

|

|

(7 |

) |

|

Distributions on Exchangeable LP Units |

|

21,256 |

|

|

18,068 |

|

|

3,188 |

|

|

Adjustments relating to joint venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

391 |

|

|

19,677 |

|

|

(19,286 |

) |

|

Amortization of improvement allowances |

|

778 |

|

|

660 |

|

|

118 |

|

|

Transaction costs |

|

80 |

|

|

— |

|

|

80 |

|

|

Interest expense (2) |

|

— |

|

|

1,413 |

|

|

(1,413 |

) |

|

FFO |

$ |

303,278 |

|

$ |

332,578 |

|

$ |

(29,300 |

) |

|

Condominium marketing costs |

|

134 |

|

|

538 |

|

|

(404 |

) |

|

Financing prepayment costs |

|

501 |

|

|

— |

|

|

501 |

|

|

Mark-to-market adjustment on unit-based compensation |

|

(107 |

) |

|

(494 |

) |

|

387 |

|

|

FFO excluding condominium-related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

303,806 |

|

$ |

332,622 |

|

$ |

(28,816 |

) |

|

|

|

|

|

|

FFO |

$ |

303,278 |

|

$ |

332,578 |

|

$ |

(29,300 |

) |

|

Amortization of straight-line rent |

|

(7,410 |

) |

|

(9,579 |

) |

|

2,169 |

|

|

Regular leasing expenditures |

|

(10,760 |

) |

|

(7,187 |

) |

|

(3,573 |

) |

|

Regular and recoverable maintenance capital expenditures |

|

(4,664 |

) |

|

(5,011 |

) |

|

347 |

|

|

Incremental leasing costs (related to regular leasing

expenditures) |

|

(7,340 |

) |

|

(6,430 |

) |

|

(910 |

) |

|

Adjustment relating to joint venture: |

|

|

|

|

Amortization of straight-line rent |

|

(190 |

) |

|

(190 |

) |

|

— |

|

|

Regular leasing expenditures |

|

(8 |

) |

|

— |

|

|

(8 |

) |

|

AFFO |

$ |

272,906 |

|

$ |

304,181 |

|

$ |

(31,275 |

) |

|

Condominium marketing costs |

|

134 |

|

|

538 |

|

|

(404 |

) |

|

Financing prepayment costs |

|

501 |

|

|

— |

|

|

501 |

|

|

Mark-to-market adjustment on unit-based compensation |

|

(107 |

) |

|

(494 |

) |

|

387 |

|

|

AFFO excluding condominium-related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

273,434 |

|

$ |

304,225 |

|

$ |

(30,791 |

) |

|

|

|

|

|

|

Weighted average number of units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

|

Per unit - basic and diluted |

|

|

|

|

FFO |

$ |

2.170 |

|

$ |

2.380 |

|

$ |

(0.210 |

) |

|

FFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

2.174 |

|

$ |

2.380 |

|

$ |

(0.206 |

) |

|

AFFO |

$ |

1.953 |

|

$ |

2.176 |

|

$ |

(0.223 |

) |

|

AFFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

1.956 |

|

$ |

2.177 |

|

$ |

(0.221 |

) |

| |

|

|

|

|

Pay-out Ratio |

|

|

|

|

FFO |

|

83.0 |

% |

|

75.6 |

% |

|

7.4 |

% |

|

FFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

82.8 |

% |

|

75.6 |

% |

|

7.2 |

% |

|

AFFO |

|

92.2 |

% |

|

82.7 |

% |

|

9.5 |

% |

|

AFFO excluding condominium-related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

92.0 |

% |

|

82.7 |

% |

|

9.3 |

% |

(1) Property, plant and equipment relates to

owner-occupied property.(2) This amount represents interest expense

on Allied's joint venture investment in TELUS Sky and is not

capitalized under IFRS, but is allowed as an adjustment under

REALPAC's definition of FFO in "Funds From Operations (FFO) &

Adjusted Funds From Operations (AFFO) for IFRS" issued in January

2022. (3) The weighted average number of units includes Units and

Exchangeable LP Units. The Exchangeable LP Units were reclassified

from non-controlling interests in equity to liabilities in the

consolidated financial statements on Allied's conversion to an

open-end trust on June 12, 2023.

Cautionary Statements

This press release may contain forward-looking

statements with respect to Allied, its operations, strategy,

financial performance and condition, and the assumptions underlying

any of the foregoing. These statements generally can be identified

by the use of forward-looking words such as “forecast”, “goals”,

“outlook”, “may”, “will”, “expect”, “estimate”, “anticipate”,

“intends”, “believe”, “assume”, “plans” or “continue” or the

negative thereof or similar variations. The forward-looking

statements in this press release are not guarantees of future

results, operations or performance and are based on estimates and

assumptions that are subject to risks and uncertainties, including

those described under “Risks and Uncertainties” in Allied’s Annual

MD&A, which is available at www.sedarplus.ca. Those risks and

uncertainties include risks associated with financing and interest

rates, access to capital, general economic conditions and joint

arrangements and partnerships. Allied’s actual results and

performance discussed herein could differ materially from those

expressed or implied by such statements. These cautionary

statements qualify all forward-looking statements attributable to

Allied and persons acting on its behalf. All forward-looking

statements speak only as of the date of this press release and,

except as required by applicable law, Allied has no obligation to

update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Cecilia C. WilliamsPresident & Chief Executive

Officer(416) 977-9002cwilliams@alliedreit.com

Nanthini MahalingamSenior Vice President &

Chief Financial Officer(416) 977-9002nmahalingam@alliedreit.com

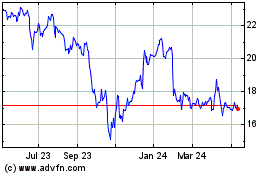

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

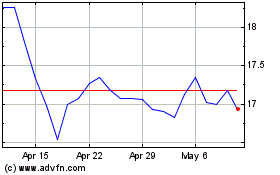

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025