Aecon Group Inc. (TSX: ARE) (“Aecon” or the “Company”) today

reported results for the second quarter of 2024.

“With backlog of $6.2 billion and strong demand

for Aecon’s services including recurring revenue programs, Aecon is

well-positioned to achieve further revenue growth over the next few

years,” said Jean-Louis Servranckx, President and Chief Executive

Officer, Aecon Group Inc. “The recent Coastal GasLink Pipeline

settlement along with the additional write-downs on legacy projects

in the second quarter are anticipated to lead to improved

profitability and margin predictability as the remaining three

projects move closer to substantial completion. We are focused on

embracing new growth opportunities linked to the energy transition

and opportunities in select U.S. and international markets, while

continuing to pursue and deliver the majority of our work in

established markets and under more collaborative project delivery

models.”

HIGHLIGHTSAll quarterly

financial information contained in this news release is

unaudited.

- Revenue for the

three months ended June 30, 2024 of $854 million was $313 million,

or 27%, lower compared to the same period in 2023.

- Adjusted

EBITDA(1)(2) of $(153.5) million for the three months ended June

30, 2024 (Adjusted EBITDA margin(3) of (18.0%) compared to Adjusted

EBITDA of $16.7 million (Adjusted EBITDA margin of 1.4%) in the

same period in 2023.

- Net loss of

$(123.9) million (diluted loss per share of $1.99) for the three

months ended June 30, 2024 compared to net profit of $28.2 million

(diluted earnings per share of $0.38) in the same period in

2023.

- On June 28,

2024, Aecon announced that SA Energy Group (a general partnership

of Aecon Construction Group Inc. and Robert B. Somerville Co. Ltd.)

and Coastal GasLink Pipeline Limited Partnership, by its general

partner Coastal GasLink Pipeline Ltd., reached an amicable and

mutually agreeable global settlement to resolve their dispute fully

and finally over the construction of Sections 3 and 4 of the

Coastal GasLink Pipeline Project in British Columbia. The

settlement agreement is not an admission of liability by either

party and the parties have mutually released their respective

claims in the arbitration, thereby avoiding the expense, burden and

uncertainty associated with arbitration. The terms of the

settlement agreement are expected to result in no further cash

impacts to Aecon. From an accounting perspective, Aecon recognized

in its consolidated financial results a non-recurring charge of

$127 million in both the second quarter and first six months of

2024 ($nil in both the second quarter and first six months of 2023)

related to the construction of Sections 3 and 4 of the Coastal

GasLink Pipeline Project.

- Certain large

fixed price legacy projects being performed by joint ventures in

which Aecon is a participant (see Section 13 “Risk Factors” of the

Company’s June 30, 2024 Management’s Discussion and Analysis

(“MD&A”) which is available on the Company’s profile on SEDAR+

(www.sedarplus.ca), are being negatively impacted due to additional

costs for which the joint ventures assert that the owners are

contractually responsible, including for, among other things,

unforeseeable site conditions, third party delays, impacts of

COVID-19, supply chain disruptions, and inflation related to labour

and materials. In the three months ended June 30, 2024, Aecon

recognized an operating loss of $110 million from these three

legacy projects compared to an operating loss of $81.3 million in

the same period in 2023. Based on the information currently

available, Aecon believes the potential for future additional

financial risks to Aecon, if any, through to completion of the

remaining three legacy projects should not exceed $125 million to

the end of 2025.

- Reported backlog

at June 30, 2024 of $6,186 million compared to backlog of

$6,851 million at June 30, 2023. New contract awards of $766

million were booked in the second quarter of 2024 compared to

$2,016 million in the same period in 2023.

- Subsequent to

quarter-end, on July 2, 2024, Aecon announced that its subsidiary,

Aecon Utilities Group Inc., acquired a majority interest in Xtreme

Powerline Construction, an electrical distribution utility

contractor headquartered in Michigan for a base purchase price of

approximately US$73 million, with potential for additional

contingent proceeds.

- Aecon’s Board of

Directors has authorized a Normal Course Issuer Bid (“NCIB”) to

purchase for cancellation up to 5% of the issued and outstanding

common shares, or approximately 3.1 million common shares of Aecon,

subject to the approval of the Toronto Stock Exchange (the “TSX”).

Aecon intends to file a notice of intention with the TSX in this

regard.

CONSOLIDATED FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

$ millions (except per

share amounts) |

|

June 30 |

|

June 30 |

|

|

|

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

853.8 |

|

|

$ |

1,166.9 |

|

$ |

1,700.4 |

|

|

$ |

2,274.1 |

|

|

|

|

Gross profit |

|

(137.9 |

) |

|

|

45.1 |

|

|

(75.1 |

) |

|

|

112.0 |

|

|

|

|

Marketing, general and

administrative expense |

|

(48.2 |

) |

|

|

(43.1 |

) |

|

(100.3 |

) |

|

|

(97.3 |

) |

|

|

|

Income from projects accounted

for using the equity method |

|

11.6 |

|

|

|

4.8 |

|

|

13.8 |

|

|

|

8.0 |

|

|

|

|

Other income |

|

28.0 |

|

|

|

70.1 |

|

|

29.7 |

|

|

|

82.7 |

|

|

|

|

Depreciation and amortization |

|

(19.8 |

) |

|

|

(21.2 |

) |

|

(38.6 |

) |

|

|

(44.2 |

) |

|

|

|

Operating profit (loss) |

|

(166.3 |

) |

|

|

55.6 |

|

|

(170.5 |

) |

|

|

61.2 |

|

|

|

|

Finance income |

|

2.1 |

|

|

|

1.8 |

|

|

5.3 |

|

|

|

3.2 |

|

|

|

|

Finance

cost |

|

(6.6 |

) |

|

|

(16.1 |

) |

|

(12.2 |

) |

|

|

(33.1 |

) |

|

|

|

Profit (loss) before income taxes |

|

(170.8 |

) |

|

|

41.3 |

|

|

(177.4 |

) |

|

|

31.4 |

|

|

|

|

Income

tax (expense) recovery |

|

46.9 |

|

|

|

(13.1 |

) |

|

47.4 |

|

|

|

(12.6 |

) |

|

|

|

Profit (loss) |

$ |

(123.9 |

) |

|

$ |

28.2 |

|

$ |

(130.0 |

) |

|

$ |

18.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

margin(4) |

|

(16.2 |

)% |

|

|

3.9 |

% |

|

(4.4 |

)% |

|

|

4.9 |

% |

|

|

|

MG&A as a percent

of

revenue(4) |

|

5.6 |

% |

|

|

3.7 |

% |

|

5.9 |

% |

|

|

4.3 |

% |

|

|

|

Adjusted

EBITDA(2) |

$ |

(153.5 |

) |

|

$ |

16.7 |

|

$ |

(120.7 |

) |

|

$ |

41.3 |

|

|

|

|

Adjusted EBITDA

margin(3) |

|

(18.0 |

)% |

|

|

1.4 |

% |

|

(7.1 |

)% |

|

|

1.8 |

% |

|

|

|

Operating

margin(4) |

|

(19.5 |

)% |

|

|

4.8 |

% |

|

(10.0 |

)% |

|

|

2.7 |

% |

|

|

|

Earnings (loss) per

share – basic |

$ |

(1.99 |

) |

|

$ |

0.46 |

|

$ |

(2.09 |

) |

|

$ |

0.30 |

|

|

|

|

Earnings (loss) per

share – diluted |

$ |

(1.99 |

) |

|

$ |

0.38 |

|

$ |

(2.09 |

) |

|

$ |

0.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog (at end of

period) |

|

|

|

|

|

$ |

6,186 |

|

|

$ |

6,851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This press release presents

certain non-GAAP and supplementary financial measures, as well as

non-GAAP ratios to assist readers in understanding the Company's

performance (GAAP refers to Canadian Generally Accepted Accounting

Principles). Further details on these measures and ratios are

included in the “Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press

release.(2) This is a non-GAAP financial measure. Refer

to the “Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial

measure.(3) This is a non-GAAP ratio. Refer to the

“Non-GAAP and Supplementary Financial Measures” section of this

press release for more information on each non-GAAP

ratio.(4) This is a supplementary financial measure.

Refer to the “Non-GAAP and Supplementary Financial Measures”

section of this press release for more information on each

supplementary financial measure.

Revenue for the three months ended June 30, 2024

of $854 million was $313 million, or 27%, lower compared to the

second quarter of 2023. In the Construction segment, revenue was

$288 million lower driven by decreases in industrial ($205

million), urban transportation solutions ($87 million), and civil

operations ($63 million), partially offset by higher revenue in

nuclear ($63 million) and utilities ($4 million). In the

Concessions segment, revenue was $25 million lower for the three

months ended June 30, 2024 primarily due to the use of the equity

method of accounting in 2024 for Aecon’s 50.1% retained interest in

the Bermuda International Airport concessionaire (“Skyport”)

following the sale of a 49.9% interest in Skyport in the third

quarter of 2023.

Operating loss of $166.3 million for the three

months ended June 30, 2024 compares to an operating profit of $55.6

million in the same period in 2023 for a decrease in operating

profit of $221.9 million. The decrease in operating profit was

largely due to lower quarter-over-quarter gross profit in the

second quarter of 2024 of $183.0 million compared to the same

period in 2023. In the Construction segment, gross profit decreased

by $167.9 million largely from an increase in negative gross profit

related to four fixed price legacy projects of $155.7 million

compared to the second quarter of 2023. In the second quarter of

2024, Aecon recorded a charge of $127.0 million related to the

Coastal GasLink Pipeline Project and an additional aggregate charge

of $110.0 million related to the three remaining legacy projects,

compared to negative gross profit on the four fixed price legacy

projects of $81.3 million in the second quarter of 2023. The charge

recorded this quarter represents Aecon’s current estimates of

future expected costs required to achieve substantial completion on

the remaining three legacy projects.

Aecon believes the estimates underpinning its

current positions on the projects to be accurate as of today,

however, additional risks exist if assumptions, estimates, and

circumstances change. Given the progress achieved to date and based

on the information currently available, Aecon believes the

potential for future additional financial risks to Aecon, if any,

through to completion of the remaining three legacy projects should

not exceed $125 million to the end of 2025.

These four fixed price legacy projects are

discussed in Section 5 “Recent Developments” and Section 10.2

“Contingencies” in the Company’s June 30, 2024 MD&A, and

Section 13 “Risk Factors” in the 2023 Annual MD&A.

Other than the impact of these fixed price

legacy projects in the second quarter, lower gross profit in the

balance of the Construction segment was primarily due to lower

gross profit in urban transportation solutions. In the Concessions

segment, gross profit decreased by $14.8 million, primarily from

the use of the equity method of accounting in 2024 for Aecon’s

50.1% retained interest in Skyport following the sale of a 49.9%

interest in this project in the third quarter of 2023.

Contributing to the decrease in operating profit

in the second quarter of 2024 was lower other income of $42.1

million compared to the same period in 2023. The decrease was due

to lower gains on the sale of property, buildings, and equipment of

$21.7 million compared to the second quarter of 2023. In addition,

gains on the sale of Aecon Transportation East (“ATE”) decreased by

$25.5 million quarter-over-quarter (an initial gain of $38.0

million in the second quarter of 2023 compared to a further gain of

$12.5 million in the second quarter of 2024 from incremental

proceeds earned in 2024). Foreign exchange gains also decreased in

the quarter by $1.0 million. These decreases were partially offset

by a $5.9 million gain from incremental proceeds earned in the

second quarter of 2024 related to the partial sale of Skyport that

occurred in 2023), and by a fair value remeasurement gain $0.2

million in the quarter.

Reported backlog at June 30, 2024 of $6,186

million compares to backlog of $6,157 million at December 31, 2023

and $6,851 million at June 30, 2023. New contract awards of $766

million were booked in the second quarter in 2024 compared to

$2,016 million in the same period in 2023.

REPORTING SEGMENTS

Aecon reports its financial performance on the

basis of two segments: Construction and Concessions, which are

described in the Company’s June 30, 2024 Management’s Discussion

and Analysis (“MD&A”).

CONSTRUCTION SEGMENT

Financial Highlights

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

$

millions |

|

June 30 |

|

|

June 30 |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

851.5 |

|

|

$ |

1,139.4 |

|

|

$ |

1,695.3 |

|

|

$ |

2,229.9 |

|

|

|

|

Gross

profit |

$ |

(136.8 |

) |

|

$ |

31.1 |

|

|

$ |

(73.2 |

) |

|

$ |

93.3 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

(172.6 |

) |

|

$ |

(4.4 |

) |

|

$ |

(144.9 |

) |

|

$ |

17.9 |

|

|

|

|

Operating profit

(loss) |

$ |

(185.0 |

) |

|

$ |

(7.5 |

) |

|

$ |

(177.5 |

) |

|

$ |

8.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

margin(3) |

|

(16.1 |

)% |

|

|

2.7 |

% |

|

|

(4.3 |

)% |

|

|

4.2 |

% |

|

|

|

Adjusted EBITDA

margin(2) |

|

(20.3 |

)% |

|

|

(0.4 |

)% |

|

|

(8.5 |

)% |

|

|

0.8 |

% |

|

|

|

Operating

margin(3) |

|

(21.7 |

)% |

|

|

(0.7 |

)% |

|

|

(10.5 |

)% |

|

|

0.4 |

% |

|

|

|

Backlog (at end of

period) |

|

|

|

|

|

|

$ |

6,081 |

|

|

$ |

6,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure.

Refer to the “Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial

measure.(2) This is a non-GAAP ratio. Refer to the “Non-GAAP

and Supplementary Financial Measures” and “Reconciliations and

Calculations” sections of this press release for more information

on each non-GAAP ratio.(3) This is a supplementary financial

measure. Refer to the “Non-GAAP and Supplementary Financial

Measures” section of this press release for more information on

each supplementary financial measure.

Revenue in the Construction segment for the

three months ended June 30, 2024 of $851 million was $288 million,

or 25%, lower compared to the same period in 2023. Revenue was

lower in industrial operations ($205 million) driven primarily by

decreased activity on mainline pipeline work following the

achievement of substantial completion on a large project in the

third quarter of 2023, which offset a higher volume of field

construction work primarily at wastewater treatment facilities in

western Canada. In urban transportation solutions, revenue was

lower ($87 million) primarily from a decrease in light rail transit

(“LRT”) work in Ontario and Québec as three of these LRT projects

near completion. Lower revenue in civil operations ($63 million)

was driven by a lower volume of major projects work, largely

related to the substantial completion of a large hydroelectric

project in western Canada in 2023, and from a lower volume of

roadbuilding construction work primarily in eastern Canada as a

result of the sale of ATE in the second quarter of 2023 ($20

million). Partially offsetting these decreases was higher revenue

in nuclear operations ($63 million) from an increased volume of

refurbishment work at nuclear generating stations located in

Ontario, and in utilities operations ($4 million) from a higher

volume of electrical transmission and battery energy storage system

work, partially offset by a lower volume of telecommunications and

gas distribution work.

Operating loss in the Construction segment of

$185.0 million in the three months ended June 30, 2024 compares to

an operating loss of $7.5 million in the same period in 2023, for a

decrease in operating profit of $177.5 million. The largest driver

of the decrease in operating profit was negative gross profit from

the four fixed price legacy projects of $237.0 million in the

second quarter of 2024 compared to negative gross profit on the

four fixed price legacy projects of $81.3 million in the second

quarter of 2023, for a net negative quarter-over-quarter impact on

operating profit of $155.7 million. These four fixed price legacy

projects are discussed in Section 5 “Recent Developments” and

Section 10.2 “Contingencies” in the Company’s June 30, 2024

MD&A, and Section 13 “Risk Factors” in the 2023 Annual

MD&A. In addition to the impact of these fixed price legacy

projects in the second quarter, lower operating profit in the

balance of the Construction segment was primarily the result of

lower gross profit in urban transportation solutions from rail

electrification work, and from lower gains on the sale of property,

buildings, and equipment ($3.9 million) in the quarter.

Construction backlog at June 30, 2024 was $6,081

million, which was $671 million lower than the same time last year.

Backlog decreased period-over-period in nuclear ($295 million),

utilities ($132 million), urban transportation solutions ($123

million), civil ($82 million), and industrial operations ($39

million). New contract awards totaled $763 million in the second

quarter of 2024 compared to $1,990 million in the same period last

year.

CONCESSIONS SEGMENT

Financial Highlights

|

|

|

|

Three months ended |

|

|

Six months ended |

|

|

|

$

millions |

|

June 30 |

|

|

June 30 |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

2.3 |

|

|

$ |

27.3 |

|

$ |

5.2 |

|

|

$ |

44.3 |

|

|

|

Gross

profit |

$ |

(1.1 |

) |

|

$ |

13.7 |

|

$ |

(1.7 |

) |

|

$ |

18.4 |

|

|

|

Income from projects

accounted for using the equity method |

$ |

11.9 |

|

|

$ |

4.8 |

|

$ |

14.1 |

|

|

$ |

8.3 |

|

|

|

Adjusted

EBITDA(1) |

$ |

29.5 |

|

|

$ |

27.6 |

|

$ |

47.1 |

|

|

$ |

42.6 |

|

|

|

Operating

profit |

$ |

16.8 |

|

|

$ |

14.4 |

|

$ |

17.9 |

|

|

$ |

16.8 |

|

|

|

Backlog (at end of

period) |

|

|

|

|

|

|

$ |

105 |

|

|

$ |

99 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure. Refer to the

“Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial measure.

Aecon currently holds a 50.1% interest in

Skyport, the concessionaire responsible for the Bermuda airport’s

operations, maintenance, and commercial functions, and the entity

that will manage and coordinate the overall delivery of the Bermuda

International Airport Redevelopment Project over a 30-year

concession term that commenced in 2017. Aecon’s participation in

Skyport is accounted for using the equity method. On September 20,

2023, Aecon sold a 49.9% interest in Skyport to Connor, Clark &

Lunn Infrastructure with Aecon retaining the management contract

for the airport. Prior to this transaction, Aecon’s participation

in Skyport was 100% consolidated and, as such, was accounted for in

the consolidated financial statements by reflecting, line by line,

the assets, liabilities, revenue and expenses of Skyport. Aecon’s

concession participation in the Eglinton Crosstown LRT, Finch West

LRT, Gordie Howe International Bridge, Waterloo LRT, and the GO

Expansion On-Corridor Works projects are joint ventures that are

also accounted for using the equity method.

For the three months ended June 30, 2024,

revenue in the Concessions segment of $2.3 million was $25 million

lower compared to the same period in 2023. Lower revenue in the

period was primarily due to lower reported revenue from Skyport due

to the commencement of the equity method of accounting for the

project following the above noted sale of a 49.9% interest in

Skyport in the third quarter of 2023.

Operating profit in the Concessions segment of

$16.8 million for the three months ended June 30, 2024 improved by

$2.4 million. Operating profit related to the Bermuda International

Airport project was higher driven by one-time recoveries of $5.9

million in 2024 and an incremental gain on sale of $5.9 million

reported in 2024 related to additional proceeds earned from the

2023 partial sale of Skyport. Operating results from Skyport in

2024 were also impacted by the sale of a 49.9% interest in Skyport

in the third quarter of 2023 and from the use of the equity method

of accounting in 2024 where operating results for Aecon’s interest

in Skyport were reported net of financing costs and income taxes,

which contributed to lower period-over-period operating profit

results from the ongoing operations at Skyport. Operating profit in

the segment was also impacted by a decrease in management and

development fees from the balance of the concessions

operations.

Except for Operations and Maintenance

(“O&M”) activities under contract for the next five years and

that can be readily quantified, Aecon does not include in its

reported backlog expected revenue from concession agreements. As

such, while Aecon expects future revenue from its concession

assets, no concession backlog, other than from such O&M

activities for the next five years, is reported.

DIVIDENDAecon’s Board of

Directors approved its next quarterly dividend of 19 cents per

share. The dividend will be paid on October 2, 2024 to shareholders

of record as of September 20, 2024.

OUTLOOK Aecon’s goal is to

build a resilient company through a balanced and diversified work

portfolio across sectors, markets, geographies, project types,

sizes, and delivery models while enhancing critical execution

capabilities and project selection to play to its strengths. With

backlog of $6.2 billion at the end of the second quarter of 2024,

recurring revenue programs continuing to see robust demand, and a

strong bid pipeline, Aecon believes it is positioned to achieve

further revenue growth commencing in 2025 and over the next few

years and is focused on achieving improved profitability and margin

predictability.

In the Construction segment, demand for Aecon’s

services across Canada continues to be strong. Development phase

work is ongoing in consortiums in which Aecon is a participant to

deliver the long-term GO Expansion On-Corridor Works project, the

Scarborough Subway Extension Stations, Rail and Systems project,

and the Darlington New Nuclear Project, all in Ontario, and the

Contrecoeur Terminal Expansion project in-water works in Quebec.

These projects are being delivered using progressive design-build

or alliance models and each project is expected to move into the

construction phase in 2025. The GO Expansion On-Corridor Works

project also includes an operations and maintenance component over

a 23-year term commencing January 1, 2025. None of the anticipated

work from these four significant long-term progressive design-build

projects is yet reflected in backlog.

In the Concessions segment, there are a number

of opportunities to add to the existing portfolio of Canadian and

international concessions in the next 12 to 24 months, including

projects with private sector clients that support a collective

focus on sustainability and the transition to a net-zero economy as

well as private sector development expertise and investment to

support aging infrastructure, mobility, connectivity, and

population growth. The GO Expansion On-Corridor Works project noted

above and the Oneida Energy Storage project, a consortium in which

Aecon Concessions is an equity partner that will deliver a 250

megawatt / 1,000 megawatt-hour energy storage facility near

Nanticoke Ontario, are examples of the role Aecon’s Concessions

segment is playing in developing, operating, and maintaining assets

related to this transition. In addition, in the first quarter of

2024, an Aecon-led consortium was selected by the U.S. Virgin

Islands Port Authority to redevelop the Cyril E. King Airport in

St. Thomas and the Henry E. Rohlsen Airport in St. Croix under a

collaborative Design, Build, Finance, Operate and Maintain

Public-Private Partnership model.

Global and Canadian economic conditions

impacting inflation, interest rates, and overall supply chain

efficiency have stabilized, and these factors have largely been and

will continue to be reflected in the pricing and commercial terms

of the Company’s recent and prospective project awards and bids.

However, certain ongoing joint venture projects that were bid some

years ago have experienced impacts related, in part, to those

factors, that will require satisfactory resolution of claims with

the respective clients. Results have been negatively impacted by

these four legacy projects in recent periods, undermining positive

revenue and profitability trends in the balance of Aecon’s

business. Until these projects are complete and related claims have

been resolved, there is a risk that this could also occur in future

periods – see Section 5 “Recent Developments” and Section 10.2

“Contingencies” in the Company’s MD&A, and Section 13 “Risk

Factors” in the 2023 Annual MD&A regarding the risk on certain

large fixed price legacy projects entered into in 2018 or earlier

by joint ventures in which Aecon is a participant. However, the

recent Coastal GasLink Pipeline settlement along with the

additional write-downs on the fixed price legacy projects in the

second quarter of 2024 are anticipated to lead to improved

profitability and margin predictability especially as the remaining

three projects move closer to substantial completion.

Revenue in 2024 will be impacted by the three

strategic transactions completed in 2023, the substantial

completion of several large projects in 2023, the four legacy

projects, and the five major projects currently in the development

phase by consortiums in which Aecon is a participant being

delivered using the progressive design-build or alliance models

which are expected to move into the construction phase in 2025. The

completion and satisfactory resolution of claims on the remaining

three legacy projects with the respective clients remains a

critical focus for the Company and its partners, while the

remainder of the business continues to perform as expected,

supported by the strong level of backlog, and the strong demand

environment for Aecon’s services, including recurring revenue

programs.

CONSOLIDATED RESULTS

The consolidated results for the three and six months ended June

30, 2024 and 2023 are available at the end of this news

release.

CONSOLIDATED BALANCE SHEET

|

|

|

|

June 30 |

|

|

December 31 |

| $

thousands |

|

|

2024 |

|

|

2023 |

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

499,386 |

|

$ |

645,784 |

| Other current assets |

|

|

1,836,375 |

|

|

1,827,472 |

| Property, plant and

equipment |

|

|

304,883 |

|

|

251,899 |

| Other long-term assets |

|

|

499,438 |

|

|

470,473 |

| Total

Assets |

|

$ |

3,140,082 |

|

$ |

3,195,628 |

| |

|

|

|

|

|

|

| Current portion of long-term

debt - recourse |

|

$ |

39,046 |

|

$ |

42,608 |

| Preferred Shares of Aecon

Utilities |

|

|

158,150 |

|

|

157,110 |

| Other current liabilities |

|

|

1,692,789 |

|

|

1,583,549 |

| Long-term debt - recourse |

|

|

104,831 |

|

|

106,770 |

| Other long-term

liabilities |

|

|

226,167 |

|

241,265 |

| |

|

|

|

|

|

|

| Equity |

|

|

919,099 |

|

|

1,064,326 |

| Total Liabilities and

Equity |

|

$ |

3,140,082 |

|

$ |

3,195,628 |

CONFERENCE CALL

A conference call and live webcast has been

scheduled for 9 a.m. (Eastern Time) on Thursday, July 25, 2024. A

live webcast of the conference call can be accessed using this link

and will be available at www.aecon.com/InvestorCalendar.

Participants can also dial-in to the conference call and

pre-register using this link. After registering, an email will be

sent, including dial-in details and a unique access code required

to join the live call. Please ensure you have registered at least

15 minutes prior to the conference call time.

An accompanying presentation of the second

quarter 2024 financial results will also be available after market

close on July 24, 2024 at www.aecon.com/investing. For those unable

to attend, a replay will be available within one hour following the

live webcast and conference call at the same webcast link

above.

ABOUT AECON

Aecon Group Inc. (TSX: ARE) is a North American

construction and infrastructure development company with global

experience. Aecon delivers integrated solutions to private and

public-sector clients through its Construction segment in the

Civil, Urban Transportation, Nuclear, Utility and Industrial

sectors, and provides project development, financing, investment,

management, and operations and maintenance services through its

Concessions segment. Join our online community on X, LinkedIn,

Facebook, and Instagram @AeconGroupInc.

For further

information:

Adam BorgattiSVP, Corporate Development and Investor

Relations416-297-2600ir@aecon.com

Nicole CourtVice President, Corporate

Affairs416-297-2600corpaffairs@aecon.com

NON-GAAP AND SUPPLEMENTARY FINANCIAL

MEASURES

The press release presents certain non-GAAP and

supplementary financial measures, as well as non-GAAP ratios to

assist readers in understanding the Company’s performance (“GAAP”

refers to Generally Accepted Accounting Principles under IFRS).

These measures do not have any standardized meaning and therefore

are unlikely to be comparable to similar measures presented by

other issuers and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP.

Throughout this press release, the following

terms are used, which do not have a standardized meaning under

GAAP.

Non-GAAP Financial Measures

A non-GAAP financial measure: (a) depicts the

historical or expected future financial performance, financial

position or cash flow of the Company; (b) with respect to its

composition, excludes an amount that is included in, or includes an

amount that is excluded from, the composition of the most

comparable financial measure presented in the primary consolidated

financial statements; (c) is not presented in the financial

statements of the Company; and (d) is not a ratio.

Non-GAAP financial measures presented and discussed in this

press release are as follows:

- “Adjusted EBITDA”

represents operating profit (loss) adjusted to exclude depreciation

and amortization, the gain (loss) on sale of assets and

investments, and net income (loss) from projects accounted for

using the equity method, but including “Equity Project EBITDA” from

projects accounted for using the equity method (refer to the

“Reconciliations and Calculations” section of this press release

for a quantitative reconciliation to the most comparable financial

measure).

- “Equity Project

EBITDA” represents Aecon’s proportionate share of the

earnings or losses from projects accounted for using the equity

method before depreciation and amortization, finance income,

finance cost and income tax expense (recovery) (refer to the

“Reconciliations and Calculations” section of this press release

for a quantitative reconciliation to the most comparable financial

measure).

Management uses the above non-GAAP financial

measures to analyze and evaluate operating performance. Aecon also

believes the above financial measures are commonly used by the

investment community for valuation purposes, and are useful

complementary measures of profitability, and provide metrics useful

in the construction industry. The most directly comparable measures

calculated in accordance with GAAP are operating profit and profit

(loss) attributable to shareholders.

Primary Financial

Statements

Primary financial statement means any of the

following: the consolidated balance sheets, the consolidated

statements of income, the consolidated statements of comprehensive

income, the consolidated statements of changes in equity, and the

consolidated statements of cash flows.

Key financial measures presented in the primary

financial statements of the Company and discussed in this press

release are as follows:

- “Gross profit”

represents revenue less direct costs and expenses. Not included in

the calculation of gross profit are marketing, general and

administrative expense (“MG&A”), depreciation and amortization,

income (loss) from projects accounted for using the equity method,

other income (loss), finance income, finance cost, income tax

expense (recovery), and non-controlling interests.

- “Operating profit

(loss)” represents the profit (loss) from operations,

before finance income, finance cost, income tax expense (recovery),

and non-controlling interests.

The above measures are presented in the

Company’s consolidated statements of income and are not meant to be

a substitute for other subtotals or totals presented in accordance

with GAAP, but rather should be evaluated in conjunction with such

GAAP measures.

- “Backlog” (Remaining

Performance Obligations) means the total value of work

that has not yet been completed that: (a) has a high certainty of

being performed as a result of the existence of an executed

contract or work order specifying job scope, value and timing; or

(b) has been awarded to Aecon, as evidenced by an executed binding

letter of intent or agreement, describing the general job scope,

value and timing of such work, and where the finalization of a

formal contract in respect of such work is reasonably assured.

Operations and maintenance (“O&M”) activities are provided

under contracts that can cover a period of up to 30 years. In order

to provide information that is comparable to the backlog of other

categories of activity, Aecon limits backlog for O&M activities

to the earlier of the contract term and the next five years.

Remaining Performance Obligations, i.e. Backlog,

is presented in the notes to the Company’s annual consolidated

financial statements and is not meant to be a substitute for other

amounts presented in accordance with GAAP, but rather should be

evaluated in conjunction with such GAAP measures.

Non-GAAP Ratios

A non-GAAP ratio is a financial measure

presented in the form of a ratio, fraction, percentage or similar

representation, and that has a non-GAAP financial measure as one of

its components and is not disclosed in the financial statements of

the Company.

A non-GAAP ratio presented and discussed in this

press release is as follows:

- “Adjusted EBITDA

margin” represents Adjusted EBITDA as a percentage of

revenue.

Management uses the above non-GAAP ratio to

analyze and evaluate operating performance. The most directly

comparable measures calculated in accordance with GAAP are gross

profit margin and operating margin.

Supplementary Financial

Measures

A supplementary financial measure: (a) is, or is

intended to be, disclosed on a periodic basis to depict the

historical or expected future financial performance, financial

position or cash flow of the Company; (b) is not presented in the

financial statements of the Company; (c) is not a non-GAAP

financial measure; and (d) is not a non-GAAP ratio.

Key supplementary financial measures presented

in this press release are as follows:

- “Gross profit

margin” represents gross profit as a percentage of

revenue.

- “Operating margin”

represents operating profit (loss) as a percentage of revenue.

- “MG&A as a percent of

revenue” represents marketing, general and administrative

expense as a percentage of revenue.

RECONCILIATIONS AND

CALCULATIONS

Set out below is the calculation of Adjusted

EBITDA by segment for the three and six months ended June 30, 2024

and 2023:

|

$ millions |

|

|

|

Three months ended June 30, 2024 |

Six months ended June 30, 2024 |

|

|

|

|

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit (loss) |

$ |

(185.0 |

) |

$ |

16.8 |

|

$ |

1.8 |

|

$ |

(166.4 |

) |

$ |

(177.5 |

) |

$ |

17.9 |

|

$ |

(10.8 |

) |

$ |

(170.4 |

) |

|

|

|

Depreciation

and amortization |

|

19.5 |

|

|

0.1 |

|

|

0.3 |

|

|

19.9 |

|

|

38.1 |

|

|

0.1 |

|

|

0.4 |

|

|

38.6 |

|

|

|

|

(Gain) on sale

of assets |

|

(9.9 |

) |

|

(5.9 |

) |

|

(12.5 |

) |

|

(28.3 |

) |

|

(11.0 |

) |

|

(5.9 |

) |

|

(12.5 |

) |

|

(29.4 |

) |

|

|

|

(Income) loss

from projects accounted for using the equity method |

|

0.3 |

|

|

(11.9 |

) |

|

- |

|

|

(11.6 |

) |

|

0.2 |

|

|

(14.1 |

) |

|

- |

|

|

(13.9 |

) |

|

|

|

Equity Project

EBITDA(1) |

|

2.5 |

|

|

30.4 |

|

|

- |

|

|

32.9 |

|

|

5.4 |

|

|

49.1 |

|

|

- |

|

|

54.5 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

(172.6 |

) |

$ |

29.5 |

|

$ |

(10.4 |

) |

$ |

(153.5 |

) |

$ |

(144.9 |

) |

$ |

47.1 |

|

$ |

(22.9 |

) |

$ |

(120.7 |

) |

|

|

$ millions |

|

|

|

Three months ended June 30, 2023 |

Six months ended June 30, 2023 |

|

|

|

|

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit (loss) |

$ |

(7.5 |

) |

$ |

14.4 |

|

$ |

48.8 |

|

$ |

55.6 |

|

$ |

8.7 |

|

$ |

16.8 |

|

$ |

35.8 |

|

$ |

61.2 |

|

|

|

|

Depreciation

and amortization |

|

15.1 |

|

|

5.6 |

|

|

0.5 |

|

|

21.3 |

|

|

32.1 |

|

|

11.3 |

|

|

0.8 |

|

|

44.2 |

|

|

|

|

(Gain) on sale

of assets |

|

(13.8 |

) |

|

- |

|

|

(55.8 |

) |

|

(69.6 |

) |

|

(26.1 |

) |

|

- |

|

|

(55.8 |

) |

|

(81.9 |

) |

|

|

|

(Income) loss

from projects accounted for using the equity method |

|

0.1 |

|

|

(4.8 |

) |

|

- |

|

|

(4.8 |

) |

|

0.3 |

|

|

(8.3 |

) |

|

- |

|

|

(8.0 |

) |

|

|

|

Equity Project

EBITDA(1) |

|

1.7 |

|

|

12.5 |

|

|

- |

|

|

14.2 |

|

|

2.9 |

|

|

22.9 |

|

|

- |

|

|

25.8 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

(4.4 |

) |

$ |

27.6 |

|

$ |

(6.5 |

) |

$ |

16.7 |

|

$ |

17.9 |

|

$ |

42.6 |

|

$ |

(19.2 |

) |

$ |

41.3 |

|

|

(1) This is a non-GAAP financial measure. Refer

to the “Non-GAAP and Supplementary Financial Measures” section in

this press release for more information on each non-GAAP financial

measure.Set out below is the calculation of Equity Project EBITDA

by segment for the three and six months ended June 30, 2024 and

2023:

|

$ millions |

|

|

|

|

Three months ended June 30, 2024 |

|

Six months ended June 30, 2024 |

|

|

|

Aecon's proportionate share of projects accounted for using

the equity method (1) |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit |

$ |

2.5 |

$ |

26.5 |

$ |

- |

$ |

29.0 |

$ |

5.4 |

$ |

41.5 |

$ |

- |

$ |

46.9 |

|

|

|

Depreciation and amortization |

|

- |

|

3.9 |

|

- |

|

3.9 |

|

- |

|

7.6 |

|

- |

|

7.6 |

|

|

|

Equity Project

EBITDA(2) |

$ |

2.5 |

$ |

30.4 |

$ |

- |

$ |

32.9 |

$ |

5.4 |

$ |

49.1 |

$ |

- |

$ |

54.5 |

|

|

$ millions |

|

|

|

|

Three months ended June 30, 2023 |

|

Six months ended June 30, 2023 |

|

|

|

Aecon's proportionate share of projects accounted for using

the equity method (1) |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit |

$ |

1.6 |

$ |

12.5 |

$ |

- |

$ |

14.1 |

$ |

2.7 |

$ |

22.9 |

$ |

- |

$ |

25.6 |

|

|

|

Depreciation and amortization |

|

0.1 |

|

- |

|

- |

|

0.1 |

|

0.2 |

|

- |

|

- |

|

0.2 |

|

|

|

Equity Project

EBITDA(2) |

$ |

1.7 |

$ |

12.5 |

$ |

- |

$ |

14.2 |

$ |

2.9 |

$ |

22.9 |

$ |

- |

$ |

25.8 |

|

(1) Refer to Note 10 “Projects Accounted for

Using the Equity Method” in June 30, 2024 interim condensed

consolidated financial statements(2) This is a non-GAAP financial

measure. Refer to the “Non-GAAP and Supplementary Financial

Measures” section in this press release for more information on

each non-GAAP financial measure.STATEMENT ON

FORWARD-LOOKING INFORMATION

The information in this press release includes

certain forward-looking statements which may constitute

forward-looking information under applicable securities laws. These

forward-looking statements are based on currently available

competitive, financial, and economic data and operating plans but

are subject to known and unknown risks, assumptions and

uncertainties. Forward-looking statements may include, without

limitation, statements regarding the operations, business,

financial condition, expected financial results, performance,

prospects, ongoing objectives, strategies and outlook for Aecon,

including statements regarding: expectations regarding the

financial risks and impact of the remaining three fixed price

legacy projects, the expected timelines of such projects and the

application of critical accounting estimates in respect of the

remaining three fixed price legacy projects, and the information in

respect of such joint ventures under review and assessment in

respect of the application of such critical accounting estimates;

backlog and estimated duration; the impact of certain contingencies

on Aecon (see: Section 10.2 “Contingencies” in the Company’s June

30, 2024 MD&A); the uncertainties related to the

unpredictability of global economic conditions; its belief

regarding the sufficiency of its current liquidity position

including sufficiency of its cash position, unused credit capacity,

and cash generated from its operations; its strategy of seeking to

differentiate its service offering and execution capability and the

expected results therefrom; its efforts to maintain a conservative

capital position; expectations regarding future revenue growth and

the impact therefrom; expectations regarding profitability and

margin predictability; expectations regarding the pipeline of

opportunities available to Aecon; statements regarding the various

phases of projects for Aecon; its strategic focus on projects

linked to decarbonization, energy transition and sustainability,

and the opportunities arising therefrom; communities sharing in the

benefits and opportunities associated with Aecon’s work, including

commitments to publish information with respect to reconciliation

and targets including Indigenous suppliers; expectations regarding

ongoing recovery in travel through Bermuda International Airport in

2024 and opportunities to add to the existing portfolio of Canadian

and international concessions in the next 12 to 24 months; Oaktree

Capital Management, L.P.’s (“Oaktree”) investment in Aecon

Utilities Group Inc. (“Aecon Utilities”), the expected benefits

thereof and results therefrom, including the acceleration of growth

of Aecon Utilities in Canada and the U.S.; the anticipated use of

proceeds from the investment; the expansion of Aecon Utilities’

geographic reach and range of services in the U.S; the potential

for additional contingent proceeds payable under the Aecon

Utilities acquisition of a majority interest in Xtreme Powerline

Construction (“Xtreme”); the ability of Aecon Utilities and Xtreme

to integrate successfully following the acquisition, the expansion

in the U.S. utility services market and driving continued growth in

priority markets; and the effective collaboration with Xtreme

management. Forward-looking statements may in some cases be

identified by words such as “will,” “plans,” “schedule,”

“forecast,” “outlook,” “completing,” “mitigating,” “potential,”

“possible,” “maintain,” “seek,” “cost savings,” “synergies,”

“strategy,” “goal,” “indicative,” “may,” “could,” “might,” “can,”

"believes," "expects," "anticipates," “aims,” “assumes,” “upon,”

“commences,” "estimates," "projects," "intends," “prospects,”

“targets,” “occur,” “continue,” "should" or the negative of these

terms, or similar expressions. In addition to events beyond Aecon's

control, there are factors which could cause actual or future

results, performance, or achievements to differ materially from

those expressed or inferred herein including, but not limited to:

the risk of not being able to drive a higher margin mix of business

by participating in more complex projects, achieving operational

efficiencies and synergies, and improving margins; the risk of not

being able to meet contractual schedules and other performance

requirements on large, fixed priced contracts; the risks associated

with a third party’s failure to perform; the risk of not being able

to meet its labour needs at reasonable costs; possibility of gaps

in insurance coverage; the risk of not being able to address any

supply chain issues which may arise and pass on costs of supply

increases to customers; the risks associated with international

operations and foreign jurisdiction factors; the risk of not being

able, through its joint ventures, to enter into implementation

phases of certain projects following the successful completion of

the relevant development phase; the risk of not being able to

execute its strategy of building strong partnerships and alliances;

the risk of not being able to execute its risk management strategy;

the risk of not being able to grow backlog across the organization

by winning major projects; the risk of not being able to maintain a

number of open, recurring, and repeat contracts; the risk of not

being able to accurately assess the risks and opportunities related

to its industry’s transition to a lower-carbon economy; the risk of

not being able to oversee, and where appropriate, respond to known

and unknown environmental and climate change-related risks,

including the ability to recognize and adequately respond to

climate change concerns or public, governmental, and other

stakeholders’ expectations on climate matters; the risk of not

being able to meet its commitment to meeting its greenhouse gas

emissions reduction, Board diversity or Indigenous supplier

targets; the risks of nuclear liability; the risks of cyber

interruption or failure of information systems; the risks

associated with the strategy of differentiating its service

offerings in key end markets; the risks associated with undertaking

initiatives to train employees; the risks associated with the

seasonal nature of its business; the risks associated with being

able to participate in large projects; the risks associated with

legal proceedings to which it is a party; the ability to

successfully respond to shareholder activism; the risk that Aecon

will not realize the opportunities presented by a transition to a

net-zero economy; risks associated with future pandemics, epidemics

and other health crises and Aecon’s ability to respond to and

implement measures to mitigate the impact of such pandemics or

epidemics; the risk that the strategic partnership with Oaktree

will not realize the expected results and may negatively impact the

existing business of Aecon Utilities; the risk that Aecon Utilities

will not realize the anticipated balance sheet flexibility with the

completion of the investment; the risk that Aecon Utilities will

not realize opportunities to expand its geographic reach and range

of services in the U.S; the risk of costs or difficulties related

to the integration of Aecon Utilities and Xtreme being greater than

expected; the risk of the anticipated benefits and synergies from

the acquisition not being fully realized or taking longer than

expected to realize; the risk of being unable to retain key

personnel, including Xtreme management; the risk of being unable to

maintain relationships with customers, suppliers or other business

partners of Xtreme; and statements with respect to the approval of

the NCIB by the TSX, the timing and size of the NCIB, the number of

common shares that can be purchased under the NCIB and Aecon’s

current and future plans, expectations and intentions with respect

to the NCIB, and various other risk factors described in Aecon’s

filings with the securities regulatory authorities, which are

available under Aecon’s profile on SEDAR+ (www.sedarplus.ca),

including the risk factors described in Section 13 - “Risk Factors”

in Aecon's 2023 Management’s Discussion and Analysis for the fiscal

year ended December 31, 2023 and our Management’s Discussion and

Analysis for the fiscal quarter ended June 30, 2024 and in other

filings made by Aecon with the securities regulatory authorities in

Canada.

These forward-looking statements are based on a

variety of factors and assumptions including, but not limited to

that: none of the risks identified above materialize, there are no

unforeseen changes to economic and market conditions and no

significant events occur outside the ordinary course of business

and assumptions regarding the outcome of the outstanding claims in

respect of the remaining three fixed price legacy projects being

performed by joint ventures in which Aecon is a participant. These

assumptions are based on information currently available to Aecon,

including information obtained from third-party sources. While the

Company believes that such third-party sources are reliable sources

of information, the Company has not independently verified the

information. The Company has not ascertained the validity or

accuracy of the underlying economic assumptions contained in such

information from third-party sources and hereby disclaims any

responsibility or liability whatsoever in respect of any

information obtained from third-party sources.

Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which

they are made and Aecon undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

| |

| CONSOLIDATED

STATEMENTS OF INCOMEFOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023 |

| (in thousands of

Canadian dollars, except per share amounts) |

| |

|

For the three months ended |

For the six months ended |

| |

|

June 30 |

|

|

June 30 |

|

June 30 |

|

|

June 30 |

|

| |

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

853,779 |

|

|

$ |

1,166,918 |

|

$ |

1,700,371 |

|

|

$ |

2,274,073 |

|

| Direct costs and

expenses |

|

|

(991,686 |

) |

|

|

(1,121,775 |

) |

|

(1,775,492 |

) |

|

|

(2,162,097 |

) |

| Gross

profit |

|

|

(137,907 |

) |

|

|

45,143 |

|

|

(75,121 |

) |

|

|

111,976 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Marketing, general and administrative expense |

|

|

(48,227 |

) |

|

|

(43,105 |

) |

|

(100,302 |

) |

|

|

(97,343 |

) |

| Depreciation and amortization |

|

|

(19,784 |

) |

|

|

(21,241 |

) |

|

(38,627 |

) |

|

|

(44,165 |

) |

| Income from projects accounted for using the equity method |

|

|

11,555 |

|

|

|

4,750 |

|

|

13,848 |

|

|

|

8,037 |

|

| Other income |

|

|

28,046 |

|

|

|

70,093 |

|

|

29,704 |

|

|

|

82,729 |

|

| Operating profit

(loss) |

|

|

(166,317 |

) |

|

|

55,640 |

|

|

(170,498 |

) |

|

|

61,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Finance income |

|

|

2,138 |

|

|

|

1,757 |

|

|

5,297 |

|

|

|

3,175 |

|

| Finance cost |

|

|

(6,572 |

) |

|

|

(16,127 |

) |

|

(12,244 |

) |

|

|

(33,051 |

) |

| Profit (loss)

before income taxes |

|

|

(170,751 |

) |

|

|

41,270 |

|

|

(177,445 |

) |

|

|

31,358 |

|

| Income tax recovery

(expense) |

|

|

46,857 |

|

|

|

(13,062 |

) |

|

47,434 |

|

|

|

(12,588 |

) |

|

Profit (loss) for the period |

|

$ |

(123,894 |

) |

|

$ |

28,208 |

|

$ |

(130,011 |

) |

|

$ |

18,770 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share |

|

$ |

(1.99 |

) |

|

$ |

0.46 |

|

$ |

(2.09 |

) |

|

$ |

0.30 |

|

| Diluted earnings (loss) per share |

|

$ |

(1.99 |

) |

|

$ |

0.38 |

|

$ |

(2.09 |

) |

|

$ |

0.28 |

|

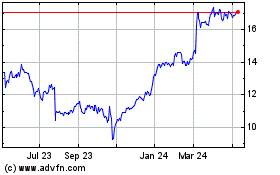

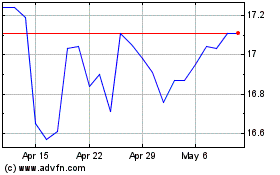

Aecon (TSX:ARE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aecon (TSX:ARE)

Historical Stock Chart

From Nov 2023 to Nov 2024