Canacol Energy Ltd. Announces the Closing of a US $75 Million Senior Secured Term Loan

September 03 2024 - 9:08PM

Canacol Energy Ltd. (“Canacol” or the “Corporation”) (TSX: CNE;

OTCQX: CNNEF; BVC: CNEC) is pleased to announce that, on September

3, 2024, it entered into a committed 24 month US $75 million senior

secured term loan facility (the “Facility”) with Macquarie Group

(“Macquarie”).

The initial draw on funding is expected to be US

$50 million, with a further commitment of US $25 million available

for a twelve month period should certain production metrics be met.

The Facility bears an annual interest rate of SOFR + 8.0% on drawn

amounts and 2.4% on undrawn amounts during the commitment period.

The Corporation expects to enter a SOFR hedging agreement with

Macquarie fixing the interest rate. The Facility matures on

September 3, 2026, and has a twelve month principal payment grace

period. No prepayments may be made during the first twelve months.

The Facility is secured by all material assets of the

Corporation.

Covenants on the Facility have been largely

harmonized with the Corporation’s existing covenants on its 2028

senior unsecured notes and its senior unsecured revolving credit

facility which matures in February 2027.

As of June 30, 2024, the Corporation had US $43

million of cash, and a leverage ratio of 2.69x being well inside of

its existing leverage ratio covenants of 3.25x (incurrence) and

3.5x (maintenance).

Canacol intends on using the proceeds of the

Facility for general corporate purposes.

In connection with the Facility, Macquarie will

be issued 1,888,448 common share purchase warrants (the

“Warrants”), with each Warrant entitling Macquarie to purchase one

common share of the Corporation at an exercise price equal to the

five (5) day volume weighted average trading price of the common

shares ending on the date hereof. The Warrants will expire three

(3) years after the date of issuance. The Warrants remain subject

to the final approval of the Toronto Stock Exchange.

The entire Credit and Guarantee Agreement will

be posted on www.sedarplus.ca

Gas Sales Update

Realized contractual natural gas sales (which

are gas produced, delivered, and paid for) averaged approximately

161 million standard cubic feet per day (“MMscfpd”) during July,

2024, and approximately 167 MMscfpd during August, 2024.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNE.C,

respectively.

Forward-Looking Information and Statements

- This

press release contains certain forward-looking statements within

the meaning of applicable securities law. Forward-looking

statements are frequently characterized by words such as “plan”,

“expect”, “project”, “target”, “intend”, “believe”, “anticipate”,

“estimate” and other similar words, or statements that certain

events or conditions “may” or “will” occur, including without

limitation statements relating to estimated production rates from

the Corporation’s properties and intended work programs and

associated timelines. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are

made and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

The Corporation cannot assure that actual results will be

consistent with these forward looking statements. They are made as

of the date hereof and are subject to change and the Corporation

assumes no obligation to revise or update them to reflect new

circumstances, except as required by law. Information and guidance

provided herein supersedes and replaces any forward looking

information provided in prior disclosures. Prospective investors

should not place undue reliance on forward looking statements.

These factors include the inherent risks involved in the

exploration for and development of crude oil and natural gas

properties, the uncertainties involved in interpreting drilling

results and other geological and geophysical data, fluctuating

energy prices, the possibility of cost overruns or unanticipated

costs or delays and other uncertainties associated with the oil and

gas industry. Other risk factors could include risks associated

with negotiating with foreign governments as well as country risk

associated with conducting international activities, and other

factors, many of which are beyond the control of the Corporation.

Other risks are more fully described in the Corporation’s most

recent Management Discussion and Analysis (“MD&A”) and Annual

Information Form, which are incorporated herein by reference and

are filed on SEDAR at www.sedar.com. Average production figures for

a given period are derived using arithmetic averaging of

fluctuating historical production data for the entire period

indicated and, accordingly, do not represent a constant rate of

production for such period and are not an indicator of future

production performance. Detailed information in respect of monthly

production in the fields operated by the Corporation in Colombia is

provided by the Corporation to the Ministry of Mines and Energy of

Colombia and is published by the Ministry on its website; a direct

link to this information is provided on the Corporation’s

website.

For more information please

contact:Investor RelationsSouth America:

+571.621.1747 IR-SA@canacolenergy.comGlobal:

+1.403.561.1648

IR-GLOBAL@canacolenergy.comhttp://www.canacolenergy.com

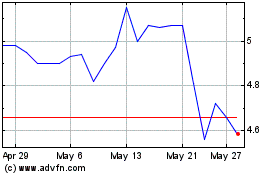

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

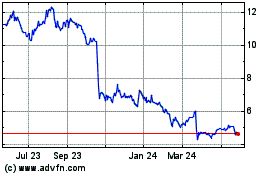

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Feb 2024 to Feb 2025