Crew Energy Inc. (TSX: CR, OTCQB: CWEGF) (“Crew” or the “Company”),

a growth-oriented natural gas weighted producer operating

exclusively in the world-class Montney play in northeast British

Columbia, is pleased to confirm the Q3 sale of our Lloydminster

heavy oil asset representing the final step of our strategic

transition to a pure-play Montney producer, and provide an

operational update highlighted by recent drilling success and

production volumes of 30,000 boe

1 per day based on

net field sales estimates.

Sharpening our Focus on the Montney with

the Sale of Lloydminster

Late in Q3, Crew completed the sale of our

Lloydminster heavy oil operations (the “Transaction”) for gross

cash proceeds of $10.3 million, representing the streamlining of

our asset base. Through this Transaction, approximately 1,050

boe1 per day of primarily heavy oil production was

divested from the portfolio. While the Lloydminster volumes

represented approximately 4% of Crew’s total production volumes,

they contributed approximately 19% to our corporate operating costs

which are anticipated to decline by approximately $0.70 per boe and

improve margins. Given Lloydminster previously represented Crew’s

most emission-intensive asset, we will have removed 46% of Crew’s

direct 2020 GHG emissions (Scope 1) and anticipate the Company’s

total GHG emissions intensity will be reduced significantly going

forward, putting Crew on a path to reach our emissions reduction

goals earlier than anticipated. Divesting of these assets sets the

stage for Crew to streamline operations and improve efficiencies

going forward while reducing our overall Asset Retirement

Obligation (“ARO”) liabilities by nearly 40%, representing

approximately $34.5 million associated with 609 gross (539 net)

wellbores.

This successful completion of the Transaction

enables Crew to focus entirely on the world-class Montney play, and

improves our environmental impact, positively contributing to the

Company’s environmental, social and governance (“ESG”) goals. Our

team is in a stronger position to enhance value as we focus Crew’s

resources fully to the Montney, where we have the greatest

potential to generate returns and secure long-term sustainability.

With this divestment, Crew would like to thank the dedicated

Lloydminster heavy oil team for their hard work and support over

the past 10 years, and particularly through the sale process. We

wish to recognize their contributions to Crew’s culture and

leadership in upholding our commitment to safety, evidenced by

achieving three years without a recordable injury at

Lloydminster.

Natural Gas Production at New Highs

Crew is also very pleased to confirm that after

the impact of the Lloydminster sale, our current production volumes

have recently reached 30,000 boe1 per day with

record net natural gas sales production of 149 mmcf per day based

on field estimates. This level of natural gas production is the

highest ever realized by the Company, being produced into a very

strong commodity price environment, and reflects the success of

Crew’s drilling program to date in 2021. This robust production

performance is partly driven by volumes coming on stream from the

seven wells on our 1-8 pad within the Greater Septimus area, along

with our 4-17 land tenure retention pad at Groundbirch.

Positive Results at

Groundbirch

At the 4-17 pad, three wells were completed

during Q3,2021 and are currently producing at restricted rates of

approximately 32 mmcf of raw gas per day. These wells have been

producing for 18 days and will continue to clean-up prior to a

two-week period during which volumes will be shut-in while

permanent production facilities are installed. The successful

validation of this test pad, along with the evaluation of two

distinct zones within the Montney, represent strategically

important milestones for Crew given that these drilling results are

expected to be the foundation for development of a new core area at

Groundbirch. Based on a combination of production and pressure test

data, we believe that these wells have the potential to be the most

prolific gas wells the Company has drilled to date. Crew owns over

70,000 net acres of contiguous land in the Greater Groundbirch area

and has an additional five well authorization permits at the 4-17

pad to follow up on the success of the first three wells. We expect

that at least two additional zones in the Montney are potentially

prospective at Groundbirch and we are currently advancing plans to

test those zones in the future.

Record Production at West

Septimus

In addition to realizing positive drilling and

field operations results, our West Septimus gas processing facility

recently achieved a new throughput record of 125 mmcf per day with

working interest sales of 115 mmcf per day (119 mmcf gross) and a

nameplate capacity of 120 mmcf per day of sales gas. These strong

volumes are a direct result of incremental production added from

the Company’s new 1-8 pad along with our 4-17 pad at Groundbirch.

Concurrent with these wells coming on-stream and in light of the

West Septimus facility being close to capacity, Crew has made

infrastructure modifications that allow volumes from the 4-17 pad

to flow to, and be processed at, our Septimus gas processing

facility, which currently has approximately 40 mmcf per day of

excess capacity. This will accommodate new production from the

five-well 4-21 pad at West Septimus that is scheduled to begin

producing in mid-December.

Although we are drilling an additional five

wells, Crew is maintaining previous capital expenditures guidance

of $150 to $170 million and average production guidance of between

26,000 and 28,000 boe1 per day for 2021. We intend to build on the

momentum realized to date, with plans to drill 26 and complete 21

wells (compared to our previous guidance of drilling and completing

21 wells) by the end of 2021, and to carry forward ten drilled and

uncompleted wells into 2022. During the first quarter of 2022, we

plan to complete and bring these ten wells onto production through

the Septimus gas processing facility. In addition, Crew has

available capacity on three major export pipelines to facilitate

the transportation to markets of our growing natural gas

production.

The Company anticipates releasing our Q3 2021

results for the three and nine months ended September 30, 2021

after market close on November 4th, 2021. For further information

about Crew Energy and our upcoming events, please visit our website

at www.crewenergy.com.

Advisories

Forward-Looking Information and

Statements

This news release contains certain

forward–looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" “forecast” and similar

expressions are intended to identify forward-looking information or

statements. In particular, but without limiting the foregoing, this

news release contains forward-looking information and statements

pertaining to the following: the ability to execute on its

development plan as described herein; 2021 annual capital budget

and production ranges and associated drilling and completion plans

including the timing thereof and associated guidance; production

estimates and timing of new production; estimates of processing

capacity and requirements; anticipated reductions in GHG emissions;

anticipated reductions in our operating costs post Transaction; the

potential of our Groundbirch area to be a core area of future

development and the potential for at least two additional zones to

be developed; infrastructure investment plans; and the timing of

capital projects.

The internal projections, expectations, or

beliefs underlying our Board approved 2021 capital budget and

associated guidance, are subject to change in light of the impact

of the COVID-19 pandemic, and any related actions taken by

businesses and governments, ongoing results, prevailing economic

circumstances, commodity prices, and industry conditions and

regulations. Crew's financial outlook and guidance provides

shareholders with relevant information on management's expectations

for results of operations, excluding any potential acquisitions or

dispositions, for such time periods based upon the key assumptions

outlined herein. Readers are cautioned that events or circumstances

could cause capital plans and associated results to differ

materially from those predicted and Crew's guidance for 2021 and

beyond may not be appropriate for other purposes. Accordingly,

undue reliance should not be placed on same.

In addition, forward-looking statements or

information are based on a number of material factors, expectations

or assumptions of Crew which have been used to develop such

statements and information but which may prove to be incorrect.

Although Crew believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue

reliance should not be placed on forward-looking statements because

Crew can give no assurance that such expectations will prove to be

correct. In addition to other factors and assumptions which may be

identified herein, assumptions have been made regarding, among

other things: that Crew will continue to conduct its operations in

a manner consistent with past operations; results from drilling and

development activities consistent with past operations; the quality

of the reservoirs in which Crew operates and continued performance

from existing wells; the continued and timely development of

infrastructure in areas of new production; the accuracy of the

estimates of Crew’s reserve volumes; certain commodity price and

other cost assumptions; continued availability of debt and equity

financing and cash flow to fund Crew’s current and future plans and

expenditures; the impact of increasing competition; the general

stability of the economic and political environment in which Crew

operates; the general continuance of current industry conditions;

the timely receipt of any required regulatory approvals; the

ability of Crew to obtain qualified staff, equipment and services

in a timely and cost efficient manner; drilling results; the

ability of the operator of the projects in which Crew has an

interest in to operate the field in a safe, efficient and effective

manner; the ability of Crew to obtain financing on acceptable

terms; field production rates and decline rates; the ability to

replace and expand oil and natural gas reserves through

acquisition, development and exploration; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Crew to secure adequate product transportation; future

commodity prices; currency, exchange and interest rates; regulatory

framework regarding royalties, taxes and environmental matters in

the jurisdictions in which Crew operates; and the ability of Crew

to successfully market its oil and natural gas products.

The forward-looking information and statements

included in this news release are not guarantees of future

performance and should not be unduly relied upon. Such information

and statements, including the assumptions made in respect thereof,

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to defer materially from

those anticipated in such forward-looking information or statements

including, without limitation: the continuing and uncertain impact

of COVID-19; changes in commodity prices; changes in the demand for

or supply of Crew's products, the early stage of development of

some of the evaluated areas and zones the potential for variation

in the quality of the Montney formation; interruptions,

unanticipated operating results or production declines; changes in

tax or environmental laws, royalty rates; climate change

regulations, or other regulatory matters; changes in development

plans of Crew or by third party operators of Crew's properties,

increased debt levels or debt service requirements; inaccurate

estimation of Crew's oil and gas reserve volumes; limited,

unfavourable or a lack of access to capital markets; increased

costs; a lack of adequate insurance coverage; the impact of

competitors; and certain other risks detailed from time-to-time in

Crew's public disclosure documents (including, without limitation,

those risks identified in this news release and Crew's Annual

Information Form).

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Crew does not assume any obligation to publicly

update or revise any of the included forward-looking statements or

information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

laws.

Preliminary Financial

Information

The Company's expectations for Q3 2021 and year

end are based on, among other things, Crew's preliminary financial

results for the three months ended September 30, 2021. Crew's

financial results for the three months ended September 30, 2021

have not yet been finalized or approved by its board of directors

and as such, such estimates and guidance are subject to the same

limitations and risks as discussed under Forward-Looking

Information and Statements set out above.

Supplemental Information Regarding

Product Types

The following is intended to provide the product

type composition for each of the boe/d production figures provided

herein:

Corporate Production Volume

Breakdown

|

|

Crude Oil1 |

Natural gas liquids2 |

Condensate |

Conventional Natural gas |

Total (boe/d) |

|

Lloydminster heavy oil production |

98 |

% |

0 |

|

0 |

|

2 |

% |

1,050 |

|

Recent production level |

0.4 |

% |

8 |

% |

9 |

% |

83 |

% |

30,000 |

|

2021 Annual Average |

5 |

% |

10 |

% |

10 |

% |

75 |

% |

26,000-28,000 |

Notes:(1) Crude oil is comprised primarily of

Heavy crude oil, with an immaterial portion of Light and Medium

crude oil.(2) Excludes condensate volumes which have been

reported separately.

Test Results and Initial Production

("IP") Rates

A pressure transient analysis or well-test

interpretation has not been carried out and thus certain of the

test results provided herein should be considered to be preliminary

until such analysis or interpretation has been completed. Test

results and initial production rates disclosed herein, particularly

those short in duration, may not necessarily be indicative of long

term performance or of ultimate recovery. Sales gas used herein

reflects natural gas sales based on historical gas processing

shrinkage and condensate and ngl yields.

BOE and MMCFE Conversions

Barrel of oil equivalents or BOEs may be

misleading, particularly if used in isolation. A BOE conversion

ratio of 6 mcf: 1 bbl is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different than the energy equivalency

of 6:1, utilizing the 6:1 conversion ratio may be misleading as an

indication of value.

About Crew

Crew is a growth-oriented oil and natural gas

producer, committed to pursuing sustainable per share growth

through a balanced mix of financially and socially responsible

exploration and development complemented by strategic acquisitions.

The Company’s operations are primarily focused in the vast Montney

resource, situated in northeast British Columbia, and include a

large contiguous land base. Greater Septimus along with Groundbirch

and the light oil area at Tower in British Columbia offer

significant development potential over the long-term. The Company

has access to diversified markets with operated infrastructure and

access to multiple pipeline egress options. Crew adheres to safe

and environmentally responsible operations while remaining

committed to sound ESG practices that underpin Crew’s fundamental

business tenets. Crew’s common shares are listed for trading on the

Toronto Stock Exchange (“TSX”) under the symbol “CR” and on the

OTCQB in the US under the symbol “CWGEF”.

FOR DETAILED INFORMATION, PLEASE

CONTACT:

|

Dale Shwed, President and CEO |

Phone: (403) 266-2088 |

|

John Leach, Executive Vice President and CFO |

Email: investor@crewenergy.com |

1 See table in the Advisories for production breakdown by

product type as defined in NI 51-101.

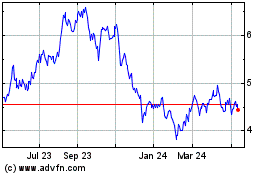

Crew Energy (TSX:CR)

Historical Stock Chart

From Dec 2024 to Jan 2025

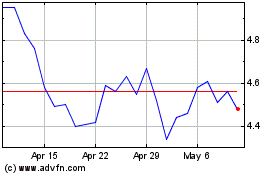

Crew Energy (TSX:CR)

Historical Stock Chart

From Jan 2024 to Jan 2025