Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) announced today the

Toronto Stock Exchange (“TSX”) has approved the renewal of the

company’s normal course issuer bid (“NCIB”) to purchase up to

136,717,741 common shares during the 12-month period commencing

November 9, 2022 and ending November 8, 2023.

Cenovus’s renewal of its share buyback program is consistent

with the company’s capital allocation framework, which supports

enhancing value for investors by returning cash to shareholders,

generating strong returns on capital investment and deleveraging

its balance sheet. Cenovus believes there are times when the market

price of its common shares may not fully reflect the underlying

value of its business and future prospects. Depending on the

trading price of its common shares and other relevant factors, the

company believes purchasing common shares represents an attractive

investment opportunity and is in the best interest of Cenovus and

its shareholders.

Cenovus’s prior NCIB for the purchase of up to 146,451,823

common shares is set to expire on November 8, 2022. As at November

3, 2022, Cenovus repurchased an aggregate of 117,993,150 common

shares at a weighted-average price of $21.19 per common share,

excluding brokerage fees, under its prior NCIB. Purchases were made

on the open market through the facilities of the TSX, New York

Stock Exchange (“NYSE”) and/or alternative trading systems in

Canada and the United States.

The number of shares authorized for purchase under the NCIB

renewal represents 10% of Cenovus's public float, as defined by the

TSX, as of October 27, 2022. On October 27, 2022 Cenovus had

1,919,040,290 common shares outstanding. Purchases will be made on

the open market through the facilities of the TSX, NYSE and/or

alternative trading systems in Canada and the United States at

market prices prevailing at the time of acquisition or such other

price as may be permitted by securities laws, including Rule 10b-18

under the U.S. Securities Exchange Act of 1934, as amended, or any

exemptions therefrom.

Cenovus has also entered into an automatic share purchase plan

(“ASPP”), with RBC Dominion Securities Inc. as its designated

broker, allowing it to purchase common shares under the NCIB when

the company would ordinarily not be permitted to purchase shares

due to regulatory restrictions and customary self-imposed blackout

periods. Pursuant to the ASPP, Cenovus will provide instructions

during non-blackout periods to its designated broker, which may not

be varied or suspended during the blackout period. Purchases by

Cenovus's designated broker will be in accordance with stock

exchange rules, applicable securities laws and the terms of the

ASPP. All purchases made under the ASPP are included in computing

the number of common shares purchased under the NCIB. The ASPP has

been pre-cleared, as required by the TSX.

The actual number of common shares that may be purchased under

the NCIB and the timing of any such purchases will be determined by

Cenovus. The average daily trading volume through the facilities of

the TSX during the most recently completed six-month period was

6,623,094 common shares. Consequently, daily purchases through the

facilities of the TSX will be limited to 1,655,733 common shares,

which is equal to 25% of the average daily trading volume, other

than block purchase exceptions. Purchases over the NYSE will be

made in compliance with the volume limitations in Rule 10b-18 in

relation to average daily trading volume and block trades. All

common shares acquired by Cenovus under the NCIB will be

cancelled.

Advisory Forward-looking

Information This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to as “forward-looking information”) within

the meaning of applicable securities legislation, including the

U.S. Private Securities Litigation Reform Act of 1995, about

Cenovus’s current expectations, estimates and projections about the

future of the company, based on certain assumptions made in light

of experiences and perceptions of historical trends. Although

Cenovus believes that the expectations represented by such

forward-looking information are reasonable, there can be no

assurance that such expectations will prove to be correct.

Forward-looking information in this news release is identified

by words such as “will” or similar expressions and includes

suggestions of future outcomes, including, but not limited to,

statements about the renewal of Cenovus’s share buyback program

under the NCIB, the timing, methods and quantity of any purchases

of common shares under the NCIB and cancelling Cenovus common

shares under such program.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally.

Readers are cautioned that other events or circumstances,

although not listed above, could cause Cenovus’s actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward-looking statements.

For additional information regarding Cenovus’s material risk

factors, the assumptions made, and risks and uncertainties which

could cause actual results to differ from the anticipated results,

refer to “Risk Management and Risk Factors” and “Advisory” in

Cenovus’s Management Discussion and Analysis for the periods ended

December 31, 2021 and September 30, 2022, and to the risk factors,

assumptions and uncertainties described in other documents Cenovus

files from time to time with securities regulatory authorities in

Canada (available on SEDAR at sedar.com, on EDGAR at sec.gov and

Cenovus’s website at cenovus.com).

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts:

|

Investors |

Media |

| Investor Relations general

line403-766-7711 |

Media Relations general

line403-766-7751 |

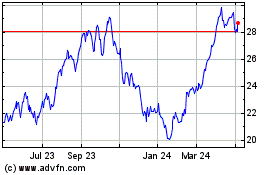

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

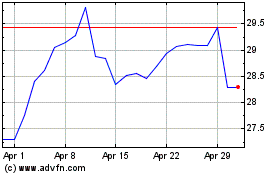

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Nov 2023 to Nov 2024