Enthusiast Gaming Holdings Inc. (TSX: EGLX) (“

Enthusiast

Gaming” or the “

Company”), a leading

gaming and media company, announced today that it has received a

$20 million four-year non-revolving term loan (the “

Term

Loan”). The financing was arranged pursuant to a credit

agreement (the “

Credit Agreement”) with lenders

(the “

Lenders”) led by Beedie Investments Ltd.

(“

Beedie Capital”), which is also the

administrative and collateral agent.

“This strategic investment significantly

bolsters our financial position, providing $20 million of

additional liquidity, which will enable us to accelerate our vision

of uniting gaming enthusiasts globally and delivering exceptional

value to our partners and communities,” said Adrian Montgomery,

Interim CEO & Chairman of the board of directors (the

“Board”) of Enthusiast Gaming. “We are delighted

to partner with Beedie Capital, whose reputation and successful

history of supporting high-growth companies is unmatched.”

“With the operations of the Company now

effectively self-sustaining, we expect this extra capital to unlock

significant growth opportunities. We appreciate the support of

Beedie Capital and the Lenders, who share our confidence in the

future of Enthusiast Gaming’s business model,” said Felicia

DellaFortuna, CFO of Enthusiast Gaming.

“After a thorough evaluation of Enthusiast

Gaming’s business model, market position, and growth potential, we

are confident in their trajectory,” said David Bell, Managing

Director, Beedie Capital. “Enthusiast Gaming has successfully built

one of the largest and most engaged audiences in the gaming media

sector. We are excited to support their continued expansion and

innovation in this dynamic industry.”

Terms of the Term Loan and Warrant Issuance

The Term Loan bears interest at a fixed rate of

14.0% per annum calculated and payable monthly in arrears.

Enthusiast Gaming will have the option until January 31, 2025 to

pay the monthly interest in-kind (“PIK Interest”)

by adding accrued interest for that month to the outstanding

principal amount of the Term Loan, which PIK Interest will accrue

interest compounded monthly and be added to the outstanding

principal amount of the Term Loan. After January 31, 2025, interest

must be paid in cash for the remainder of the loan’s term to

maturity. In addition, each Lender shall be entitled, upon notice

to the Company, but subject to obtaining, if applicable, stock

exchange and/or shareholder approval, to elect to convert all or

any portion of their respective pro-rata share of the PIK Interest

into common shares of the Company (“Common

Shares”) at a price equal to the Market Price (as defined

in TSX policy) of the Common Shares immediately prior to conversion

on the Toronto Stock Exchange (“TSX”). Enthusiast

Gaming has paid Beedie Capital a commitment fee equal to 2.0% of

the total amount of the Term Loan. Subject to the terms of the

Credit Agreement, the Term Loan will have a term of four years from

the date of the close of the Term Loan and may be prepaid, subject

to certain conditions including the payment of applicable

prepayment fees.

In connection with the Term Loan, Enthusiast

Gaming has issued to the Lenders in aggregate 37,037,037 common

share purchase warrants (“Warrants”), at an

exercise price of $0.135, equal to a 15% premium to the five

consecutive trading day volume-weighted average price of the Common

Shares on July 11, 2024. The Warrants will not be listed on any

exchange. Each Warrant is exercisable to purchase one Common Share

and will expire on July 12, 2029.

While there is at least $2.5 million under the

Term Loan outstanding to Beedie Capital or if Beedie Capital owns,

directly or indirectly, 10% or more of the issued and outstanding

Common Shares of Enthusiast Gaming on a partially-diluted basis,

Beedie Capital will be entitled to have an observer attend each

meeting of Enthusiast Gaming’s Board and those of certain

subsidiaries. Should Beedie Capital own at least 10% of the issued

and outstanding Common Shares, calculated on a non-diluted basis,

it shall be entitled to nominate a representative to the Board for

the period it continues to hold at least 10% of the Common Shares.

Further, while there is at least $2.5 million under the Term Loan

outstanding to Beedie Capital or for so long as Beedie Capital

owns, directly or indirectly, 10% or more of the issued and

outstanding Common Shares of Enthusiast Gaming on a

partially-diluted basis, Beedie Capital will be entitled to a

pre-emptive right in connection with certain future equity

financings by the Company to allow it to maintain its pro-rata

ownership level in the Company determined on a partially-diluted

basis.

The Term Loan will be guaranteed by certain

Canadian and U.S. subsidiaries of the Enthusiast Gaming and secured

by a second ranking security interest over substantially all of the

assets of Enthusiast Gaming and the guarantor subsidiaries.

Proceeds from the Term Loan will be used by

Enthusiast Gaming for growth capital and working capital

purposes.

The Term Loan will be subordinated to the

Company’s existing non-revolving term facility and operating line

with its senior lender (the “Senior Lender”)

provided under an amended and restated commitment letter among the

Company, as borrower, certain Canadian and U.S. subsidiaries of the

Company, as guarantors, and the Senior Lender (the

“Existing Senior Commitment

Letter”). In connection with the Term Loan, the Company

and its guarantor subsidiaries have entered into a second amendment

of the Existing Senior Commitment Letter with the Senior Lender. In

connection with the amendment, the Senior Lender also provided the

Company with a waiver affirming the Company’s compliance with the

terms of the Existing Senior Commitment Letter.

A copy of the Credit Agreement will be available

under the Company's profile on SEDAR+ at www.sedarplus.ca.

Advisors

Canaccord Genuity Corp. acted as financial

advisor and Norton Rose Fulbright Canada LLP acted as legal counsel

to Enthusiast Gaming. Dentons Canada LLP acted as legal counsel to

Beedie Capital.

About Enthusiast Gaming

Enthusiast Gaming Holdings Inc. (TSX: EGLX) is a

leading gaming media and entertainment company, building the

largest platform for video game enthusiasts and esports fans to

connect and compete worldwide. Combining the elements of its five

core pillars: creators, content, communities, games, and

experiences, Enthusiast Gaming provides a unique opportunity for

marketers to create integrated brand solutions to connect with

coveted Gen Z and Millennial audiences. Through its proprietary mix

of digital media, content and gaming assets, Enthusiast Gaming

continues to grow its network of communities, reflecting the scale

and diversity of gaming enthusiasts today.

About Beedie Capital

Beedie Capital is a multi-strategy direct

investment platform that manages the alternative investments for

Beedie, one of the largest private companies in Western Canada. It

deploys capital using a flexible, evergreen mandate, and applies a

highly agnostic approach to the duration, structure and size of its

investments. Beedie Capital combines the strategic capabilities of

an institutional investment platform with the flexibility and

entrepreneurial mindset of a privately owned business.

Beedie Capital invests in any sector, with a

core focus on Technology, Tech-enabled Services, and Metals and

Mining, and seeks to grow its invested capital alongside the

enterprise value of its investments. For further information on

Beedie Capital, please visit www.beediecapital.com.

Contacts

Enthusiast Gaming: Felicia DellaFortuna, Chief Financial

OfficerInvestors: investor@enthusiastgaming.com Media:

press@enthusiastgaming.com

Forward Looking Statements

This news release contains certain statements

that may constitute forward-looking information under applicable

securities laws. All statements, other than those of historical

fact, which address activities, events, outcomes, results,

developments, performance or achievements that Enthusiast Gaming

anticipates or expects may or will occur in the future (in whole or

in part) should be considered forward-looking information. Often,

but not always, forward-looking information can be identified by

the use of words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or variations (including negative

variations) of such words and phrases, or statements formed in the

future tense or indicating that certain actions, events or results

“may”, “could”, “would”, “might” or “will” (or other variations of

the forgoing) be taken, occur, be achieved, or come to pass.

Forward-looking statements in this news release include, but are

not limited to statements regarding the use of proceeds of the Term

Loan, future Common Share issuances to satisfy amounts owed under

the Term Loan, future approvals of the TSX, statements regarding

Beedie Capital’s observer status and nomination rights with respect

to the Board, certain commitments and statements regarding the

Company’s obligations under the Credit Agreement, and the Company’s

strategy and expectations relating to the financial performance and

the financial results of future periods.

Forward-looking statements are based on

assumptions and analyses made by the Company in light of its

experience and its perception of historical trends, current

conditions and expected future developments, including, but not

limited to, expectations and assumptions concerning: interest and

foreign exchange rates; capital efficiencies, cost saving and

synergies; growth and growth rates; the success in the esports and

gaming media industry; the Company’s growth plan, and judgment

applied in the application of the Company’s accounting policies and

in the preparation of financial statements in accordance with

applicable financial reporting standards; uncertainties and

assumptions regarding future approvals of shareholders, the TSX or

third parties. While Enthusiast Gaming considers these assumptions

to be reasonable, based on information currently available, they

may prove to be incorrect. Readers are cautioned not to place undue

reliance on forward-looking statements. In addition,

forward-looking statements necessarily involve known and unknown

risks, including, without limitation, risks associated with general

economic conditions; adverse industry events; and future

legislative, tax and regulatory developments. Readers are cautioned

that the foregoing list is not exhaustive. For more information on

the risks, uncertainties and assumptions that could cause

anticipated opportunities and actual results to differ materially,

please refer to those factors discussed in greater detail under the

“Risk Factors” section in Enthusiast Gaming’s annual information

form for the year ended December 31, 2023, which is available under

our profile on SEDAR+ at www.sedarplus.ca. Readers are further

cautioned not to place undue reliance on forward-looking statements

as there can be no assurance that the plans, intentions or

expectations upon which they are placed will occur. Such

information, although considered reasonable by management at the

time of preparation, may prove to be incorrect and actual results

may differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement and reflect our expectations as of the

date hereof, and thus are subject to change thereafter. Enthusiast

Gaming disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

Neither the TSX nor its Regulation Services Provider (as that

term is defined in policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

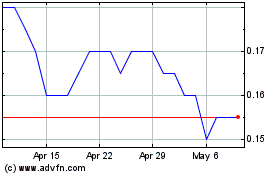

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

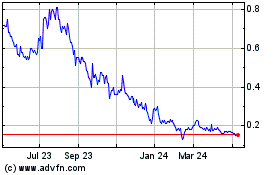

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Nov 2023 to Nov 2024