Enthusiast Gaming Holdings Inc. (“Enthusiast Gaming” or the

“Company”) (TSX: EGLX), a leading gaming media and

entertainment company, today announced financial results for the

three months ended June 30, 2024 (“Q2 2024”).

"In Q2, we delivered

on our commitment to establish a stable financial footing and

create a clear pathway to scalable profits. We’ve also delivered

significant strength to our balance sheet, adding $20 million of

liquidity through our debt financing to fund growth. We completed

the outsourcing of our ad tech stack through our partnership with

Playwire, a decision that has already resulted in significant

performance improvements across our network. We’ve established an

efficient and scalable operating model that has positioned us for

substantial profitability improvements throughout the second half

of 2024. Meanwhile, alongside all of these advancements, we have

also reached the finish line on our path to profitability, in a

quarter where we remained impacted by seasonal headwinds and did

not have the benefit of any of our tentpole events or

partnerships,” said Adrian Montgomery, Board Chair and Interim CEO

of Enthusiast Gaming.

“It is safe to say

this is the turning point,” continued Mr. Montgomery. “We look out

across a number of catalysts that we have in place to drive top

line growth in the second half of the year, each of which is poised

to amplify our profitability across our lean operating model and

record gross margins. On top of traditional second half seasonal

lifts, we’ve invested in our direct seller base, doubling the

number of sellers in market in Q3 2024 versus the previous quarter;

we have Season 3 of our tentpole program, NFL Tuesday Night Gaming,

in September, along with the launch of our newest sports league

partnership with the NHL; we anticipate strong organic growth in

our web properties through long-awaited expansion releases in major

game titles covered by our flagship properties; and we have the

return of PocketGamer events in Helsinki and Jordan, all alongside

a number of other growth drivers across our portfolio. Each of

these elements builds on our solid Q2 baseline, setting the stage

for a series of increasingly strong quarters. With this renewed

momentum, I am more confident than ever that we are just getting

started."

Financial Highlights for Q2

2024

- Revenue of $14.7 million, compared

to $42.6 million in Q2 2023, with the vast majority of the decline

being attributable to the strategic deprioritization of low margin

video platform revenue.

- Gross profit of $9.7 million,

compared to $15.0 million in Q2 2023, with gross margin expanding

to 66.2% from 35.2% in the year ago period.

- Operating expenses of $11.6

million, a $13.0 million year-over-year decrease from $24.6 million

in Q2 2023 as a result of strategic initiatives taken to establish

an efficient and scalable operating model in March 2024.

- Adjusted EBITDA loss of $0.4

million, a $3.0 million improvement compared to $3.4 million in Q2

2023, and a $1.4 million improvement compared to $1.8 million in Q1

2024.

- Net loss and comprehensive loss of

$2.9 million in Q2 2024 compared to $12.4 million in Q2 2023.

Business Highlights for Q2

2024

- The Company secured $20 million of

additional funding by way of a four-year non-revolving term loan,

strengthening its balance sheet and providing significant growth

capital, with the financing closing on July 12, 2024.

- The Company amplified its focus on

its highly engaged communities, increasing unique visitors across

its web properties by approximately 30% in Q2 2024 relative to the

year ago period, leading to an increase in overall time spent

across its web properties of 26% year-over-year, in each case

according to Comscore.

- The Company’s focus on owned and

operated web properties yielded a 71% increase year-over-year in

RPM in Q2 2024, following the outsourcing of its ad tech to

Playwire, which began in mid-May 2024 and was substantially

completed in June 2024.

- The Company made a number of

expansions to its product and entertainment offerings, including

U.GG’s expansion into Helldivers 2 and Swarm (a new League of

Legends game mode), Icy Veins’ expansion into Zenless Zone Zero and

World of Warcraft’s Cataclysm Classic, The Sims Resource adding VIP

curated Bundles and free trials for paid subscribers, and

Luminosity hosting multiple invitational events featuring Smash and

Rocket League for sponsors including Amazon Prime and Kroger

Gaming.

- The Company announced the extension

of its NFL Tuesday Night Gaming partnership for a third season and

launched its first special episode for Season 3 on July 23rd

achieving over 60,000 watch hours and counting.

- The Company signed a partnership

with the National Hockey League to launch NHL Puck ‘N Play which

will commence in Q4 2024, adding another flagship product to our

direct sales offering and opening doors to a roster of major

existing NHL sponsors.

“We feel confident in the strategic decisions we

made to improve profitability in 2024 by focusing on higher gross

margin revenue lines coupled with a lower cost structure,” said

Felicia DellaFortuna, CFO of Enthusiast Gaming. “This was further

punctuated by delivering a strengthened balance sheet in July 2024

as well as significant growth in engagement of its communities in

Q2 2024.”

Second Quarter 2024 Results

Comparison

Revenue was $14.7 million in Q2 2024, a 65%

decrease compared to $42.6 million in Q2 2023. Media and Content

revenue was $10.6 million in Q2 2024, a 71% decrease from $36.9

million in Q2 2023. The Company’s strategic decision to

de-prioritize the lower margin video platform revenue accounted for

$19.5 million of the $26.3 million reduction. Direct Sales (the

majority of which is included in media and content revenue)

decreased from $8.7 million in Q2 2023 to $4.1 million in Q2 2024

mainly due to a lower number of ramped sellers than the year ago

period, contributing $4.6 million to the decline in revenue.

Esports and Entertainment revenue showed a decrease in Q2 2024 at

$1.0 million relative to $1.7 million in Q2 2023 mainly due to the

timing of certain events. Subscription revenue decreased from $4.0

million in Q2 2023 to $3.1 million in Q2 2024 mainly due to the

sale of certain non-core, non-profitable assets in April 2024.

Gross profit was $9.7 million in Q2 2024, a 35%

decrease compared to $15.0 million in Q2 2023. Gross margin

increased to 66.2% in Q2 2024 from 35.2% in Q2 2023.

Adjusted EBITDA loss was $0.4 million in Q2 2024

compared to an Adjusted EBITDA loss of $3.4 million in Q2 2023.

Net loss was $2.9 million, or $(0.02) per share,

in Q2 2024, compared to $12.4 million, or $(0.07) per share, in Q2

2023.

Investor Conference Call

Management will host a conference call and

webcast on Wednesday, August 14, 2024, at 5 p.m. ET to review and

discuss its Q2 2024 results. Conference call details:

- Dial-in: 1-800-717-1738 or ‘Call

me’ link: https://emportal.ink/4cJQ1Yp

- Live webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1679160&tp_key=70e22f4748

A replay will be available on Enthusiast

Gaming’s website at enthusiastgaming.com/investors.

Supplemental Information

Enthusiast Gaming’s financial statements and

management discussion and analysis (“MD&A”) are available at

www.sedarplus.ca and enthusiastgaming.com/investors. All amounts

are in Canadian dollars.

About Enthusiast Gaming

Enthusiast Gaming is a leading gaming media and

entertainment company, building the largest platform for video game

enthusiasts and esports fans to connect and compete worldwide.

Combining the elements of its five core pillars: creators, content,

communities, games, and experiences, Enthusiast Gaming provides a

unique opportunity for marketers to create integrated brand

solutions to connect with coveted Gen Z and Millennial audiences.

Through its proprietary mix of digital media, content and gaming

assets, Enthusiast Gaming continues to grow its network of

communities, reflecting the scale and diversity of gaming

enthusiasts today.

Forward-Looking Statements

This news release contains certain statements

that may constitute forward-looking information under applicable

securities laws. All statements, other than those of historical

fact, which address activities, events, outcomes, results,

developments, performance or achievements that Enthusiast Gaming

anticipates or expects may or will occur in the future (in whole or

in part) should be considered forward-looking information. Often,

but not always, forward-looking information can be identified by

the use of words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or variations (including negative

variations) of such words and phrases, or statements formed in the

future tense or indicating that certain actions, events or results

“may”, “could”, “would”, “might” or “will” (or other variations of

the forgoing) be taken, occur, be achieved, or come to pass.

Forward-looking statements in this news release include, but are

not limited to, statements regarding trends in certain financial

and operating metrics of the Company, and expectations relating to

the financial performance and the financial results of future

periods.

Forward-looking statements are based on

assumptions and analyses made by the Company in light of its

experience and its perception of historical trends, current

conditions and expected future developments, including, but not

limited to, expectations and assumptions concerning: interest and

foreign exchange rates; capital efficiencies, cost saving and

synergies; growth and growth rates; the success in the esports and

gaming media industry; the Company’s growth plan, and judgment

applied in the application of the Company’s accounting policies and

in the preparation of financial statements in accordance with

applicable financial reporting standards. While Enthusiast Gaming

considers these assumptions to be reasonable, based on information

currently available, they may prove to be incorrect. Readers are

cautioned not to place undue reliance on forward-looking

statements. In addition, forward-looking statements necessarily

involve known and unknown risks, including, without limitation,

risks associated with general economic conditions; adverse industry

events; and future legislative, tax and regulatory developments.

Readers are cautioned that the foregoing list is not exhaustive.

For more information on the risks, uncertainties and assumptions

that could cause anticipated opportunities and actual results to

differ materially, please refer to the public filings of Enthusiast

Gaming which are available on SEDAR+ at www.sedarplus.ca. Readers

are further cautioned not to place undue reliance on

forward-looking statements as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Such information, although considered reasonable by

management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement and reflect our

expectations as of the date hereof, and thus are subject to change

thereafter. Enthusiast Gaming disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

Non-GAAP Measures

This press release references certain non-GAAP

measures, including Adjusted EBITDA, as described below. These

non-GAAP measures are not recognized measures under GAAP and do not

have a standardized meaning prescribed by GAAP and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those GAAP measures by providing further

understanding of the Company’s results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of the

Company’s financial information reported under IFRS.

The Company uses non-GAAP measures including:

“EBITDA”, which is defined as earnings before

interest, taxes, depreciation and amortization. Enthusiast Gaming

calculates EBITDA using gross margin less total operating expenses

plus share-based compensation, amortization and depreciation and

annual general meeting legal and advisory costs; and,

“Adjusted EBITDA”, which is defined as EBITDA

plus severance and other non-recurring public costs. Non-recurring

costs include items such as annual Nasdaq listing fees and

directors and officers (“D&O”) liability insurance specific to

the Company’s former listing on Nasdaq.

Neither the Toronto Stock Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the exchange)

accepts responsibility for the adequacy or accuracy of this

release.

| Enthusiast

Gaming Holdings Inc. |

| Condensed

Consolidated Interim Statements of Loss and Comprehensive

Loss |

| For the three

and six months ended June 30, 2024 and 2023 |

| (Unaudited -

Expressed in Canadian Dollars) |

| |

|

|

|

|

For the

three months ended |

|

For the six

months ended |

| |

|

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenue |

|

$ |

14,704,634 |

|

$ |

42,598,769 |

|

$ |

38,032,873 |

|

$ |

85,478,735 |

|

| |

Cost of sales |

|

|

4,974,098 |

|

|

27,616,077 |

|

|

14,226,178 |

|

|

53,730,485 |

|

| |

Gross margin |

|

|

9,730,536 |

|

|

14,982,692 |

|

|

23,806,695 |

|

|

31,748,250 |

|

| |

Operating expenses |

|

|

|

|

|

|

|

|

|

| |

|

Professional

fees |

|

|

345,530 |

|

|

690,063 |

|

|

898,088 |

|

|

1,143,399 |

|

| |

|

Consulting

fees |

|

|

477,109 |

|

|

1,595,468 |

|

|

1,929,345 |

|

|

2,903,952 |

|

| |

|

Advertising

and promotion |

|

|

243,556 |

|

|

938,613 |

|

|

723,360 |

|

|

2,394,724 |

|

| |

|

Office and

general |

|

|

580,681 |

|

|

1,930,338 |

|

|

1,575,079 |

|

|

4,222,121 |

|

| |

|

Salaries and

wages |

|

|

5,413,206 |

|

|

9,932,310 |

|

|

13,759,507 |

|

|

19,139,334 |

|

| |

|

Technology

support, web development and content |

|

|

2,836,032 |

|

|

4,156,966 |

|

|

7,104,691 |

|

|

9,452,990 |

|

| |

|

Esports

player, team and game expenses |

|

|

568,051 |

|

|

645,715 |

|

|

1,177,163 |

|

|

1,281,162 |

|

| |

|

Foreign

exchange loss |

|

|

35,599 |

|

|

22,851 |

|

|

141,534 |

|

|

137,408 |

|

| |

|

Share-based

compensation |

|

|

377,777 |

|

|

1,788,490 |

|

|

(1,620,480 |

) |

|

2,918,821 |

|

| |

|

Amortization

and depreciation |

|

|

715,967 |

|

|

2,886,075 |

|

|

1,431,461 |

|

|

6,224,098 |

|

| |

Total operating expenses |

|

|

11,593,508 |

|

|

24,586,889 |

|

|

27,119,748 |

|

|

49,818,009 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Other expenses (income) |

|

|

|

|

|

|

|

|

|

| |

|

Investment

in associates impairment |

|

|

26,497 |

|

|

- |

|

|

26,497 |

|

|

- |

|

| |

|

Other

long-term asset impairment |

|

|

1,098,506 |

|

|

- |

|

|

1,098,506 |

|

|

- |

|

| |

|

Share of net loss (income) from investment in associates and joint

ventures |

|

6,477 |

|

|

(106,277 |

) |

|

(18,905 |

) |

|

66,170 |

|

| |

|

Interest and

accretion |

|

|

563,310 |

|

|

605,385 |

|

|

1,186,524 |

|

|

1,215,725 |

|

| |

|

(Gain) loss

on revaluation of deferred payment liability |

|

|

(46,468 |

) |

|

374,101 |

|

|

(63,368 |

) |

|

202,077 |

|

| |

|

Gain on sale

of assets held for sale |

|

|

(344,852 |

) |

|

- |

|

|

(344,852 |

) |

|

- |

|

| |

|

Loss on

disposal of property and equipment |

|

|

25,997 |

|

|

- |

|

|

25,997 |

|

|

- |

|

| |

|

Loss on

modification of long-term debt |

|

|

397,058 |

|

|

- |

|

|

397,058 |

|

|

- |

|

| |

|

Interest income |

|

|

(396 |

) |

|

(1,514 |

) |

|

(5,449 |

) |

|

(62,721 |

) |

| |

Net loss before income taxes |

|

|

(3,589,101 |

) |

|

(10,475,892 |

) |

|

(5,615,061 |

) |

|

(19,491,010 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Income taxes |

|

|

|

|

|

|

|

|

|

| |

|

Current tax

expense |

|

|

24,554 |

|

|

22,279 |

|

|

127,137 |

|

|

225,771 |

|

| |

|

Deferred tax expense (recovery) |

|

|

(200,377 |

) |

|

(281,579 |

) |

|

(27,173 |

) |

|

(763,489 |

) |

| |

Net loss for the period |

|

|

(3,413,278 |

) |

|

(10,216,592 |

) |

|

(5,715,025 |

) |

|

(18,953,292 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Other comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

| |

Items that may be reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

| |

|

Foreign

currency translation adjustment |

|

|

479,575 |

|

|

(2,141,800 |

) |

|

1,465,701 |

|

|

(2,135,249 |

) |

| |

Net loss and comprehensive loss for the

period |

|

$ |

(2,933,703 |

) |

$ |

(12,358,392 |

) |

$ |

(4,249,324 |

) |

$ |

(21,088,541 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Net loss per share, basic and diluted |

|

$ |

(0.02 |

) |

$ |

(0.07 |

) |

$ |

(0.04 |

) |

$ |

(0.12 |

) |

| |

Weighted average number of common shares |

|

|

|

|

|

|

|

|

|

| |

|

outstanding, basic and diluted |

|

|

155,721,839 |

|

|

152,171,249 |

|

|

155,699,940 |

|

|

151,970,362 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Enthusiast Gaming Holdings

Inc. |

|

|

|

|

Condensed Consolidated Interim Statements of Financial

Position |

|

|

|

|

As of June 30, 2024 and December 31,

2023 |

|

|

|

|

(Unaudited - Expressed in Canadian Dollars) |

|

|

|

| |

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

| |

|

|

|

|

|

|

|

|

| |

ASSETS |

|

|

|

|

|

|

| |

Current |

|

|

|

|

|

|

| |

|

Cash |

|

$ |

2,160,540 |

|

$ |

6,851,966 |

|

|

| |

|

Trade and

other receivables |

|

|

12,498,506 |

|

|

31,502,732 |

|

|

| |

|

Income tax

receivable |

|

|

98,065 |

|

|

31,251 |

|

|

| |

|

Prepaid

expenses |

|

|

1,129,808 |

|

|

1,820,144 |

|

|

| |

Total current assets |

|

|

15,886,919 |

|

|

40,206,093 |

|

|

| |

Non-current |

|

|

|

|

|

|

| |

|

Property and

equipment |

|

|

185,756 |

|

|

124,640 |

|

|

| |

|

Right-of-use

assets |

|

|

1,050,543 |

|

|

1,441,149 |

|

|

| |

|

Investment

in associates and joint ventures |

|

|

278 |

|

|

2,888,730 |

|

|

| |

|

Long-term

portion of prepaid expenses |

|

|

188,455 |

|

|

182,108 |

|

|

| |

|

Intangible

assets |

|

|

81,431,598 |

|

|

85,421,227 |

|

|

| |

|

Goodwill |

|

|

106,868,938 |

|

|

105,868,081 |

|

|

| |

Total assets |

|

$ |

205,612,487 |

|

$ |

236,132,028 |

|

|

| |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

| |

Current |

|

|

|

|

|

|

| |

|

Accounts

payable and accrued liabilities |

|

$ |

25,671,337 |

|

$ |

47,101,272 |

|

|

| |

|

Contract

liabilities |

|

|

3,465,082 |

|

|

6,078,950 |

|

|

| |

|

Income tax

payable |

|

|

77,018 |

|

|

274,924 |

|

|

| |

|

Current

portion of long-term debt |

|

|

21,894,730 |

|

|

21,888,597 |

|

|

| |

|

Current portion of deferred payment liability |

|

- |

|

|

82,231 |

|

|

| |

|

Current

portion of lease liabilities |

|

|

665,803 |

|

|

740,212 |

|

|

| |

|

Current

portion of other long-term debt |

|

|

13,007 |

|

|

9,668 |

|

|

| |

Total current liabilities |

|

|

51,786,977 |

|

|

76,175,854 |

|

|

| |

Non-current |

|

|

|

|

|

|

| |

|

Long-term portion of deferred payment liability |

|

2,098,507 |

|

|

2,083,262 |

|

|

| |

|

Long-term

portion of lease liabilities |

|

|

634,774 |

|

|

938,845 |

|

|

| |

|

Other

long-term debt |

|

|

145,018 |

|

|

140,613 |

|

|

| |

|

Deferred tax

liability |

|

|

14,100,341 |

|

|

14,076,780 |

|

|

| |

Total liabilities |

|

$ |

68,765,617 |

|

$ |

93,415,354 |

|

|

| |

|

|

|

|

|

|

|

|

| |

Shareholders' Equity |

|

|

|

|

|

|

| |

|

Share

capital |

|

|

452,994,596 |

|

|

444,474,076 |

|

|

| |

|

Contributed

surplus |

|

|

25,736,189 |

|

|

35,877,189 |

|

|

| |

|

Accumulated

other comprehensive income |

|

|

8,667,677 |

|

|

7,201,976 |

|

|

| |

|

Deficit |

|

|

(350,551,592 |

) |

|

(344,836,567 |

) |

|

| |

Total shareholders' equity |

|

|

136,846,870 |

|

|

142,716,674 |

|

|

| |

Total liabilities and shareholders' equity |

|

$ |

205,612,487 |

|

$ |

236,132,028 |

|

|

| |

|

|

|

|

|

|

|

|

|

Enthusiast Gaming Holdings Inc. |

|

|

|

|

|

|

Condensed Consolidated Interim Statements of Cash

Flows |

|

|

|

|

|

|

For the six months June 30, 2024 and 2023 |

|

|

|

|

|

|

(Unaudited - Expressed in Canadian Dollars) |

|

|

|

|

|

| |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

| |

Cash

flows from operating activities |

|

|

|

|

|

| |

Net loss for

the period |

|

$ |

(5,715,025 |

) |

$ |

(18,953,292 |

) |

| |

Items not

affecting cash: |

|

|

|

|

|

| |

Investment in associates impairment |

|

|

26,497 |

|

|

- |

|

| |

Other long-term asset impairment |

|

|

1,098,506 |

|

|

- |

|

| |

Amortization and depreciation |

|

|

1,431,461 |

|

|

6,224,098 |

|

| |

Share-based compensation |

|

|

(1,620,480 |

) |

|

2,918,821 |

|

| |

Accretion |

|

|

(31,188 |

) |

|

137,327 |

|

| |

Deferred tax expense (recovery) |

|

|

(27,173 |

) |

|

(763,489 |

) |

| |

Share of net (income) loss from investment in associates and joint

ventures |

(18,905 |

) |

|

66,170 |

|

| |

Gain on sale of assets held for sale |

|

|

(344,852 |

) |

|

- |

|

| |

(Gain) loss on revaluation of deferred payment liability |

|

|

(63,368 |

) |

|

202,077 |

|

| |

Foreign exchange (gain) loss |

|

|

(463,931 |

) |

|

24,480 |

|

| |

Loss on disposal of property and equipment |

|

|

25,997 |

|

|

- |

|

| |

Gain on settlement of accounts payable |

|

|

(622,413 |

) |

|

- |

|

| |

Loss on modification of long-term debt |

|

|

397,058 |

|

|

- |

|

| |

Provisions |

|

|

4,166 |

|

|

165,145 |

|

| |

Changes in

working capital: |

|

|

|

|

|

| |

Changes in trade and other receivables |

|

|

19,982,340 |

|

|

5,108,139 |

|

| |

Changes in prepaid expenses |

|

|

843,787 |

|

|

736,371 |

|

| |

Changes in accounts payable and accrued liabilities |

|

|

(20,543,835 |

) |

|

2,974,533 |

|

| |

Changes in contract liabilities |

|

|

(2,124,657 |

) |

|

(477,981 |

) |

| |

Changes in income tax receivable and payable |

|

|

136,207 |

|

|

594,894 |

|

| |

Income tax paid |

|

|

(400,927 |

) |

|

(114,502 |

) |

| |

Net cash used in operating activities |

|

|

(8,030,735 |

) |

|

(1,157,209 |

) |

| |

|

|

|

|

|

|

| |

Cash

flows from investing activities |

|

|

|

|

|

| |

Proceeds

from sale of assets held for sale |

|

|

2,693,339 |

|

|

- |

|

| |

Distribution from investment in associates, net of adjustments |

|

1,416,830 |

|

|

- |

|

| |

Repayment of

deferred payment liability |

|

|

(85,700 |

) |

|

(844,350 |

) |

| |

Acquisition

of intangible assets |

|

|

- |

|

|

(27,488 |

) |

| |

Acquisition

of property and equipment |

|

|

(115,815 |

) |

|

(17,156 |

) |

| |

Net cash from (used in) investing activities |

|

|

3,908,654 |

|

|

(888,994 |

) |

| |

|

|

|

|

|

|

| |

Cash

flows from financing activities |

|

|

|

|

|

| |

Proceeds

from long-term debt, net of transaction costs |

|

|

1,520,877 |

|

|

- |

|

| |

Repayment of

long-term debt |

|

|

(1,769,118 |

) |

|

(2,176,470 |

) |

| |

Repayment of

other long-term debt |

|

|

(3,002 |

) |

|

(6,775 |

) |

| |

Lease

payments |

|

|

(465,179 |

) |

|

(439,184 |

) |

| |

Net cash used in financing activities |

|

|

(716,422 |

) |

|

(2,622,429 |

) |

| |

|

|

|

|

|

|

| |

Foreign

exchange effect on cash |

|

|

147,077 |

|

|

(5,096 |

) |

| |

Net change

in cash |

|

|

(4,691,426 |

) |

|

(4,673,728 |

) |

| |

Cash, beginning of period |

|

|

6,851,966 |

|

|

7,415,516 |

|

| |

Cash, end of period |

|

$ |

2,160,540 |

|

$ |

2,741,788 |

|

| |

|

|

|

|

|

|

|

Enthusiast Gaming Holdings Inc. |

|

|

|

|

|

|

|

|

|

EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

| For the three

and six months ended June 30, 2024 and 2023 |

|

|

| (Unaudited - Expressed

in Canadian Dollars) |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the six months ended |

|

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross margin |

$ |

9,730,536 |

|

$ |

14,982,692 |

|

$ |

23,806,695 |

|

$ |

31,748,250 |

|

| |

Operating expenses |

|

(11,593,508 |

) |

|

(24,586,889 |

) |

|

(27,119,748 |

) |

|

(49,818,009 |

) |

| |

Share-based compensation |

|

377,777 |

|

|

1,788,490 |

|

|

(1,620,480 |

) |

|

2,918,821 |

|

| |

Amortization and depreciation |

|

715,967 |

|

|

2,886,075 |

|

|

1,431,461 |

|

|

6,224,098 |

|

| |

EBITDA |

|

(769,228 |

) |

|

(4,929,632 |

) |

|

(3,502,072 |

) |

|

(8,926,840 |

) |

| |

Severance |

|

121,430 |

|

|

995,563 |

|

|

705,628 |

|

|

1,056,548 |

|

| |

Listing fees

& D&O insurance specific to the Company's Nasdaq

listing |

|

240,935 |

|

|

530,117 |

|

|

619,970 |

|

|

1,411,355 |

|

| |

Adjusted EBITDA |

|

(406,863 |

) |

|

(3,403,952 |

) |

|

(2,176,474 |

) |

|

(6,458,937 |

) |

Contacts

Enthusiast Gaming: Felicia DellaFortuna, Chief Financial Officer

Investors: investor@enthusiastgaming.com

Media: press@enthusiastgaming.com

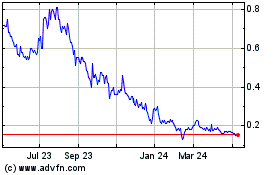

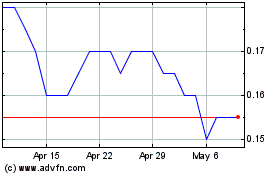

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Dec 2023 to Dec 2024