Gibson Energy Inc. (TSX:GEI) ("Gibson" or the "Company") announced

today its financial and operating results for the three and nine

months ended September 30, 2024.

"Gibson delivered strong results in the third quarter, driven by

the continued strength and stability of our Infrastructure segment,

which now represents over 85% of our business, and saw 2024 record

third party crude volumes at our Edmonton Terminal in the third

quarter, driven by deliveries onto the Trans Mountain Expansion

pipeline," said Curtis Philippon, President and Chief Executive

Officer. "Since joining Gibson in August, I have had the

opportunity to visit all of our operations. Gibson's critical

energy infrastructure spans from touching one in four barrels

produced in Western Canada to exporting Permian & Eagle Ford

barrels through one of the largest crude export terminals in the

United States. It is impressive to see firsthand our asset base and

meet the passionate talented teams that support it."

Financial Highlights:

- Revenue of $2,900 million in the third quarter, a $325 million

or 10% decrease relative to the third quarter of 2023, due to lower

revenues within the Marketing segment driven by Crude Marketing

sales volume

- Infrastructure adjusted EBITDA(1) of $150 million in the third

quarter, a $10 million or 7% increase from the third quarter of

2023, primarily driven by a full quarter of contribution from the

Gateway Terminal

- Marketing adjusted EBITDA(1) of $14 million in the third

quarter, a $10 million or 41% decrease from the third quarter of

2023, due to lower contributions from the Refined Products business

resulting from compressed refining margins and the Crude Marketing

business due to fewer opportunities

- Adjusted EBITDA(1) on a consolidated basis of $151 million in

the third quarter, a $2 million or 1% increase over the third

quarter of 2023, as higher Infrastructure adjusted EBITDA(1) offset

lower Marketing results

- Net income of $54 million in the third quarter, a $33 million

or 161% increase over the third quarter of 2023, primarily due to

one-time transaction and finance costs incurred in relation to the

acquisition of the Gateway Terminal in the comparative period, and

the factors noted above, partially offset by higher depreciation,

amortization, income tax expense and foreign exchange losses

- Distributable cash flow(1) of $88 million in the third quarter,

a $5 million or 5% decrease from the third quarter of 2023,

primarily due to higher current income tax expense

- Dividend payout ratio(2) on a trailing twelve-month basis of

65%, below the Company’s 70% – 80% target

- Net debt to adjusted EBITDA ratio(2) at September 30, 2024 of

3.2x, within the Company’s 3.0x – 3.5x target

Strategic Developments and

Highlights:

- On July 15, 2024, Gibson announced the extension of a long-term

contract with an investment grade global E&P company at its

Gateway Terminal which further enhanced the quality of the

Company's cash flows, as well as the sanction of a connection to

the Cactus II Pipeline, providing customers with access to up to

approximately 700,000 barrels per day of incremental supply

(1) Adjusted EBITDA and distributable cash flow are non-GAAP

financial measures. See the “Specified Financial Measures” section

of this release.(2) Net debt to adjusted EBITDA ratio and dividend

payout ratio are non-GAAP financial ratios. See the “Specified

Financial Measures” section of this release.

Management’s Discussion and Analysis and

Financial Statements The 2024 third quarter Management’s

Discussion and Analysis and unaudited Condensed Consolidated

Financial Statements provide a detailed explanation of Gibson’s

financial and operating results for the three months and nine

months ended September 30, 2024, as compared to the three months

and nine months ended September 30, 2023. These documents are

available at www.gibsonenergy.com and on SEDAR+ at

www.sedarplus.ca.

Earnings Conference Call & Webcast

DetailsA conference call and webcast will be held to

discuss the 2024 third quarter financial and operating results at

7:00am Mountain Time (9:00am Eastern Time) on Wednesday, October

30, 2024.

To register for the call, view dial-in numbers,

and obtain a dial-in PIN, please access the following URL:

-

https://register.vevent.com/register/BI8b79360578cc46d3a6aabe55e0f464a2

Registration at least five minutes prior to the

conference call is recommended.

This call will also be broadcast live on the

Internet and may be accessed directly at the following URL:

-

https://edge.media-server.com/mmc/p/jr9r7jgb

The webcast will remain accessible for a

12-month period at the above URL.

Supplementary InformationGibson has also made

available certain supplementary information regarding the 2024

third quarter financial and operating results, available at

www.gibsonenergy.com.

About Gibson Gibson is a

leading liquids infrastructure company with its principal

businesses consisting of the storage, optimization, processing, and

gathering of liquids and refined products. Headquartered in

Calgary, Alberta, the Company's operations are located across North

America, with core terminal assets in Hardisty and Edmonton,

Alberta, Ingleside, Texas, and a facility in Moose Jaw,

Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information, visit

www.gibsonenergy.com.

Forward-Looking StatementsCertain statements

contained in this press release constitute forward-looking

information and statements (collectively, forward-looking

statements). All statements other than statements of historical

fact are forward-looking statements. The use of any of the words

‘‘anticipate’’, ‘‘plan’’, ‘‘contemplate’’, ‘‘continue’’,

‘‘estimate’’, ‘‘expect’’, ‘‘intend’’, ‘‘propose’’, ‘‘might’’,

‘‘may’’, ‘‘will’’, ‘‘shall’’, ‘‘project’’, ‘‘should’’, ‘‘could’’,

‘‘would’’, ‘‘believe’’, ‘‘predict’’, ‘‘forecast’’, ‘‘pursue’’,

‘‘potential’’ and ‘‘capable’’ and similar expressions are intended

to identify forward looking statements. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking statements. No assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this press release should

not be unduly relied upon. These statements speak only as of the

date of this press release. The Company does not undertake any

obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, the risks and

uncertainties described in “Forward-Looking Information” and “Risk

Factors” included in the Company's Annual Information Form and

Management's Discussion and Analysis, each dated February 20, 2024,

as filed on SEDAR+ and available on the Gibson website at

www.gibsonenergy.com.

For further information, please contact:

Investor Relations: (403)

776-3077investor.relations@gibsonenergy.com

Media Relations:(403) 476-6334

communications@gibsonenergy.com

Specified Financial

Measures

This press release refers to certain financial

measures that are not determined in accordance with GAAP, including

non-GAAP financial measures and non-GAAP financial ratios. Readers

are cautioned that non-GAAP financial measures and non-GAAP

financial ratios do not have standardized meanings prescribed by

GAAP and, therefore, may not be comparable to similar measures

presented by other entities. Management considers these to be

important supplemental measures of the Company’s performance and

believes these measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in industries with similar capital structures.

For further details on these specified financial

measures, including relevant reconciliations, see the "Specified

Financial Measures" section of the Company’s MD&A for the three

and nine months ended September 30, 2024 and 2023, which is

incorporated by reference herein and is available on Gibson's

SEDAR+ profile at www.sedarplus.ca and Gibson's

website at www.gibsonenergy.com.

a) Adjusted EBITDA

Noted below is the reconciliation to the most

directly comparable GAAP measures of the Company’s segmented and

consolidated adjusted EBITDA for the three and nine months ended

September 30, 2024, and 2023:

|

Three months ended September 30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Segment profit |

150,271 |

|

137,727 |

|

14,183 |

|

17,900 |

|

— |

|

— |

|

164,454 |

|

155,627 |

|

| Unrealized (gain) loss on

derivative financial instruments |

(1,553 |

) |

740 |

|

25 |

|

6,059 |

|

— |

|

— |

|

(1,528 |

) |

6,799 |

|

| General and

administrative |

— |

|

— |

|

— |

|

— |

|

(13,004 |

) |

(14,258 |

) |

(13,004 |

) |

(14,258 |

) |

| Adjustments to share of profit

from equity accounted investees |

1,166 |

|

1,432 |

|

— |

|

— |

|

— |

|

— |

|

1,166 |

|

1,432 |

|

| Executive transition

costs |

— |

|

|

|

— |

|

|

|

251 |

|

|

251 |

|

— |

|

| Renewable power purchase

agreement |

— |

|

— |

|

— |

|

— |

|

(175 |

) |

— |

|

(175 |

) |

— |

|

|

Other |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Adjusted EBITDA |

149,884 |

|

139,899 |

|

14,208 |

|

23,959 |

|

(12,928 |

) |

(14,258 |

) |

151,164 |

|

149,600 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Nine months ended

September 30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Segment profit |

446,566 |

|

336,483 |

|

69,391 |

|

123,962 |

|

— |

|

— |

|

515,957 |

|

460,445 |

|

| Unrealized loss (gain) on

derivative financial instruments |

3,746 |

|

740 |

|

(1,884 |

) |

(6,872 |

) |

— |

|

— |

|

1,862 |

|

(6,132 |

) |

| General and

administrative |

— |

|

— |

|

— |

|

— |

|

(51,920 |

) |

(38,677 |

) |

(51,920 |

) |

(38,677 |

) |

| Adjustments to share of profit

from equity accounted investees |

4,071 |

|

4,293 |

|

— |

|

— |

|

— |

|

— |

|

4,071 |

|

4,293 |

|

| Executive transition

costs |

— |

|

— |

|

— |

|

— |

|

10,665 |

|

— |

|

10,665 |

|

— |

|

| Renewable power purchase

agreement |

— |

|

— |

|

— |

|

— |

|

(175 |

) |

— |

|

(175 |

) |

— |

|

|

Other |

— |

|

— |

|

— |

|

— |

|

— |

|

218 |

|

— |

|

218 |

|

|

Adjusted EBITDA |

454,383 |

|

341,516 |

|

67,507 |

|

117,090 |

|

(41,430 |

) |

(38,459 |

) |

480,460 |

|

420,147 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended September 30, |

|

|

($ thousands) |

2024 |

|

2023 |

|

| |

|

|

| Net Income |

53,916 |

|

20,633 |

|

| |

|

|

| Income tax expense |

14,573 |

|

7,678 |

|

| Depreciation, amortization,

and impairment charges |

44,289 |

|

38,542 |

|

| Finance costs, net |

32,545 |

|

50,222 |

|

| Unrealized (gain) loss on

derivative financial instruments |

(1,528 |

) |

6,799 |

|

| Corporate unrealized (gain)

loss on derivative financial instruments (1) |

(1,934 |

) |

430 |

|

| Stock based compensation |

4,747 |

|

6,455 |

|

| Acquisition and integration

costs |

— |

|

19,959 |

|

| Adjustments to share of profit

from equity accounted investees |

1,166 |

|

1,432 |

|

| Corporate foreign exchange

loss (gain) and other |

3,139 |

|

(2,550 |

) |

|

Executive transition costs |

251 |

|

— |

|

|

Adjusted EBITDA |

151,164 |

|

149,600 |

|

| |

|

|

|

|

| |

Nine months ended September

30, |

|

|

($ thousands) |

2024 |

|

2023 |

|

| |

|

|

|

| Net Income |

157,737 |

|

160,910 |

|

| |

|

|

|

| Income tax expense |

46,205 |

|

50,864 |

|

| Depreciation, amortization,

and impairment charges |

131,452 |

|

94,788 |

|

| Finance costs, net |

104,285 |

|

80,357 |

|

| Unrealized loss (gain) on

derivative financial instruments |

1,862 |

|

(6,132 |

) |

| Corporate unrealized loss

(gain) on derivative financial instruments (1) |

6,707 |

|

430 |

|

| Stock based compensation |

15,158 |

|

15,344 |

|

| Acquisition and integration

costs |

1,371 |

|

19,959 |

|

| Adjustments to share of profit

from equity accounted investees |

4,071 |

|

4,293 |

|

| Corporate foreign exchange

loss (gain) and other |

947 |

|

(666 |

) |

|

Executive transition costs |

10,665 |

|

— |

|

|

Adjusted EBITDA |

480,460 |

|

420,147 |

|

| |

|

|

|

|

b) Distributable Cash

Flow

The following is a reconciliation of

distributable cash flow from operations to its most directly

comparable GAAP measure, cash flow from operating activities:

| |

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

|

|

|

| Cash flow from

operating activities |

404,794 |

|

190,015 |

|

531,178 |

|

419,254 |

|

| Adjustments: |

|

|

|

|

|

Changes in non-cash working capital and taxes paid |

(258,264 |

) |

(61,420 |

) |

(64,620 |

) |

(14,921 |

) |

|

Replacement capital |

(13,023 |

) |

(12,876 |

) |

(24,260 |

) |

(25,702 |

) |

|

Cash interest expense, including capitalized interest |

(34,045 |

) |

(32,290 |

) |

(102,405 |

) |

(65,677 |

) |

|

Acquisition and integration costs (1) |

— |

|

19,959 |

|

1,371 |

|

19,959 |

|

|

Executive transition costs |

7,433 |

|

— |

|

10,665 |

|

— |

|

|

Lease payments |

(8,144 |

) |

(8,575 |

) |

(24,178 |

) |

(26,268 |

) |

|

Current income tax |

(10,582 |

) |

(1,860 |

) |

(23,633 |

) |

(23,800 |

) |

|

Distributable cash flow |

88,169 |

|

92,953 |

|

304,118 |

|

282,845 |

|

| |

|

|

|

|

|

|

|

|

|

Twelve months ended September 30, |

|

|

($ thousands) |

2024 |

|

2023 |

|

| |

|

|

| Cash flow from

operating activities |

686,780 |

|

489,312 |

|

| Adjustments: |

|

|

|

Changes in non-cash working capital and taxes paid |

(57,133 |

) |

47,812 |

|

|

Replacement capital |

(34,486 |

) |

(32,559 |

) |

|

Cash interest expense, including capitalized interest |

(136,861 |

) |

(81,966 |

) |

|

Acquisition and integration costs (1) |

3,454 |

|

19,959 |

|

|

Executive transition costs |

10,665 |

|

— |

|

|

Lease payments |

(33,806 |

) |

(34,035 |

) |

|

Current income tax |

(31,550 |

) |

(37,218 |

) |

|

Distributable cash flow |

407,063 |

|

371,305 |

|

| |

|

|

|

|

c) Dividend Payout Ratio

|

Twelve months ended September

30, |

|

|

|

2024 |

|

2023 |

|

| Distributable cash flow |

407,063 |

|

371,305 |

|

| Dividends declared |

263,050 |

|

226,755 |

|

|

Dividend payout ratio |

65 |

% |

61 |

% |

| |

|

|

|

|

d) Net

Debt To Adjusted EBITDA Ratio

| |

Twelve months ended September

30, |

|

|

|

2024 |

|

2023 |

|

| |

|

|

| Current and long-term

debt |

2,528,454 |

|

2,645,904 |

|

| Lease liabilities |

50,246 |

|

67,862 |

|

| Less: unsecured hybrid

debt |

(450,000 |

) |

(450,000 |

) |

| Less:

cash and cash equivalents |

(55,584 |

) |

(54,464 |

) |

| |

|

|

| Net debt |

2,073,116 |

|

2,209,302 |

|

|

Adjusted EBITDA |

650,141 |

|

557,481 |

|

|

Net debt to adjusted EBITDA ratio |

3.2 |

|

4.0 |

|

| |

|

|

|

|

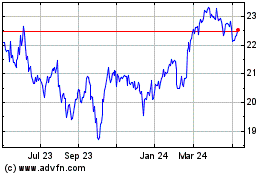

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Dec 2024 to Jan 2025

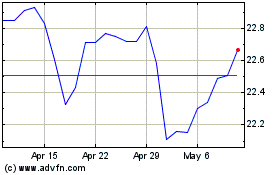

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Jan 2024 to Jan 2025