Gibson Energy Announces Closing of $350 Million Note Offering and Redemption of its 2026 Notes

November 12 2024 - 3:59PM

Gibson Energy Inc. (TSX:GEI) (“Gibson” or the “Company”) announced

today that it has closed the previously announced offering of $350

million of 4.45% senior unsecured notes maturing on November 12,

2031 (the “Notes”).

The Notes have been assigned ratings of “BBB–”

by S&P Global Ratings and “BBB (low)” with a “Stable” trend by

DBRS Morningstar.

Gibson used the net proceeds from the offering

as well as cash on hand to fund the redemption of all of its

outstanding $350 million aggregate principal amount of its 5.80%

medium term notes due July 2026 at the redemption price of par plus

accrued and unpaid interest thereon to, but excluding, the date of

redemption.

The Notes were offered in Canada on a private

placement and agency basis through a syndicate of agents led by RBC

Capital Markets and CIBC Capital Markets, as well as BMO Capital

Markets, in reliance upon exemptions from the prospectus

requirements under applicable securities laws.

This news release does not constitute an offer

to sell or the solicitation of an offer to buy the Notes in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful. The Notes have not been approved or disapproved by any

regulatory authority. The Notes have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended, or any securities laws of any state of the United States

and may not be offered, sold or delivered in the United States or

to, or for the account or benefit of, United States persons.

About Gibson Gibson is a

leading liquids infrastructure company with its principal

businesses consisting of the storage, optimization, processing, and

gathering of liquids and refined products. Headquartered in

Calgary, Alberta, the Company’s operations are located across North

America, with core terminal assets in Hardisty and Edmonton,

Alberta, Ingleside and Wink, Texas, and a facility in Moose Jaw,

Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information, visit

www.gibsonenergy.com.

Forward-Looking

StatementsCertain statements contained in this press

release constitute forward-looking information and statements

(collectively, “forward-looking statements”). All statements other

than statements of historical fact are forward-looking statements.

The use of any of the words “anticipate”, “plan”, “contemplate”,

“continue”, “estimate”, “expect”, “intend”, “propose”, “might”,

“may”, “will”, “shall”, “project”, “should”, “could”, “would”,

“believe”, “predict”, “forecast”, “pursue”, “potential” and

“capable” and similar expressions are intended to identify forward

looking statements. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. No assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this press release should

not be unduly relied upon. These statements speak only as of the

date of this press release. The Company does not undertake any

obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, the risks and

uncertainties described in “Forward-Looking Information” and “Risk

Factors” included in the Company’s Annual Information Form and

Management’s Discussion and Analysis, each dated February 20, 2024,

as filed on SEDAR+ and available on the Gibson website at

http://www.gibsonenergy.com.

For further information, please contact:

Investor Relations: (403)

776-3077investor.relations@gibsonenergy.com

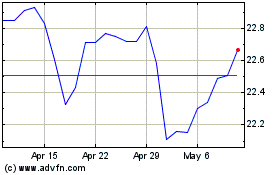

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Jan 2025 to Feb 2025

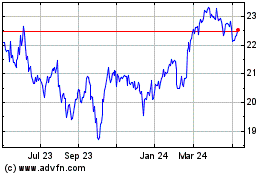

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Feb 2024 to Feb 2025