Gibson Energy Inc. (“Gibson” or the “Company”) is pleased to

announce the extension and amendment of a long-term contract at its

Gateway Terminal (“Gateway” or the “Terminal”) with an existing

customer that refreshes the initial contract term, with further

renewal options beyond that date. The extension includes

contracting additional loading windows and increasing contracted

capacity per loading window, resulting in fixed Gateway revenue

from this customer increasing by approximately 40%. Gibson has also

sanctioned dredging at Gateway, to be completed in early 2025,

which will enable customers to load 10%+ more volume, the maximum

allowable in Corpus Christi, directly on Very Large Crude Carriers

and Suezmax vessels thereby reducing customer shipping time and

cost.

“Today’s announcement marks a significant

milestone for Gibson as we deliver upon our key Gateway acquisition

objectives,” said Curtis Philippon, President & Chief Executive

Officer. “It is exciting to see our original customers renewing and

expanding their position while welcoming new customers at the

Terminal, demonstrating the strong demand for Gateway’s attractive

export capabilities. Customer demand, combined with excellent

operational performance and the benefits of capital improvements,

including the Cactus II connection and dredging projects, has

Gibson on track to achieve our previously provided guidance on

EBITDA growth earlier than anticipated. We now expect Gateway to

achieve its EBITDA run rate growth target of 15 – 20% by Q4

2025.”

Growth Capital GuidanceThe

Company also announced its 2025 growth capital guidance of up to

$150 million, including $100 million of growth capital to be

deployed predominantly at Gateway, and the remainder focused on

other projects at and around other Gibson facilities currently

being assessed in a disciplined manner.

Gibson would also note that it has completed its

assessment of the previously announced Waste-to-Energy Project

proposal and has reached a negative final investment decision.

Replacement Capital

GuidanceGibson’s Board of Directors approved the

allocation of $60 million of replacement capital expenditures,

including $20 million of capital related to turnarounds at both the

Moose Jaw facility and select terminal assets.

Cost Focus CampaignGibson has

also commenced an ambitious cost focus campaign to decrease costs

on a run rate basis by the end of 2025 by greater than $25 million

to ensure the Company is efficient and competitive, and well

positioned for growth moving forward. To date, approximately $5

million of savings have already been realized.

Funding PositionWith this

capital budget, Gibson is fully-funded and expects to remain within

its Financial Governing Principles with the benefit of growing

stable Infrastructure cash flows in 2025. At the end of the third

quarter of 2024, the Company's Net Debt to Adjusted EBITDA ratio(1)

of 3.2x was just below the midpoint of its 3.0x – 3.5x target range

and its Dividend Payout ratio(1) of 65% was below its 70% – 80%

target range.

“We will remain focused on the disciplined

deployment of growth capital in 2025, as well as adhering to our

key governing principles and capital allocation philosophy”, said

Sean Brown, Senior Vice President and Chief Financial Officer. “We

expect to deploy up to $200 million between growth capital and

share repurchases. With a growth capital program of $100 to $150

million, anticipated repurchases are between $50 and $100 million

in 2025.”About Gibson Gibson is a leading liquids

infrastructure company with its principal businesses consisting of

the storage, optimization, processing, and gathering of liquids and

refined products. Headquartered in Calgary, Alberta, the Company’s

operations are located across North America, with core terminal

assets in Hardisty and Edmonton, Alberta, Ingleside and Wink,

Texas, and a facility in Moose Jaw, Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information, visit

www.gibsonenergy.com.

(1) Net debt to adjusted EBITDA

ratio and dividend payout ratio are non-GAAP financial ratios. See

the “Specified Financial Measures” section of this release.

Forward-Looking

StatementsCertain statements contained in this press

release constitute forward-looking information and statements

(collectively, forward-looking statements) including, but not

limited to, statements concerning Gibson's expectations of growth

capital expenditures and replacement capital expenditures in 2025

and the location and use of such deployment, Gibson's ability to

sanction projects that are in support of such expenditures and the

timing thereof, Gibson's ability to grow Infrastructure cashflows

throughout 2025, adherence to Gibson's current governing principles

and capital allocation philosophy, Gibson's share repurchase

program and expectation to repurchase shares in 2025, Gibson’s

expectations regarding the return of capital to shareholders, the

timing thereof and conditions upon which Gibson would do so, the

forecast operating and financial results of Gibson, where

applicable, the resulting commercial capabilities of the dredging

project and Cactus II connection project, Gibson’s cost reduction

capabilities and ability to realize cost reductions and

expectations and targets for EBITDA, cash flows, distributable cash

flow, debt and Net Debt to Adjusted EBITDA and Dividend Payout

ratios. All statements other than statements of historical fact are

forward-looking statements. The use of any of the words

‘‘anticipate’’, ‘‘plan’’, ‘‘contemplate’’, ‘‘continue’’,

‘‘estimate’’, ‘‘expect’’, ‘‘intend’’, ‘‘propose’’, ‘‘might’’,

‘‘may’’, ‘‘will’’, ‘‘shall’’, ‘‘project’’, ‘‘should’’, ‘‘could’’,

‘‘would’’, ‘‘believe’’, ‘‘predict’’, ‘‘forecast’’, ‘‘pursue’’,

‘‘potential’’ and ‘‘capable’’ and similar expressions are intended

to identify forward-looking statements. The forward-looking

statements reflect Gibson's beliefs and assumptions with respect

to, among other things, future market conditions, the accuracy of

financial and operational projections of Gibson, Gibson's future

operating and financial results, ability to meet growth capital and

replacement capital expenditure targets, continued adherence to

Gibson's governing principles and capital allocation philosophy,

the ability to place incremental infrastructure projects into

service and the timing thereof and the ability to return capital to

shareholders and the timing thereof. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including, without

limitation, risks inherent to Gibson's business generally and risks

relating to historical and future financial results as it relates

to Gibson's financial condition or results. No assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this press release should

not be unduly relied upon. These statements speak only as of the

date of this press release. The Company does not undertake any

obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, the risks and

uncertainties described in “Forward-Looking Information” and “Risk

Factors” included in the Company's Annual Information Form and

Management's Discussion and Analysis (“MD&A”), each dated

February 20, 2024 and the Company’s MD&A for the three and nine

months ended September 30, 2024 and 2023, each as filed on SEDAR+

and available on the Gibson website at

www.gibsonenergy.com.

Specified Financial

MeasuresThis press release refers to certain financial

measures that are not determined in accordance with GAAP, including

non-GAAP financial measures and non-GAAP financial ratios. Readers

are cautioned that non-GAAP financial measures and non-GAAP

financial ratios do not have standardized meanings prescribed by

GAAP and, therefore, may not be comparable to similar measures

presented by other entities. Management considers these to be

important supplemental measures of the Company’s performance and

believes these measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in industries with similar capital structures.

For further details on these specified financial

measures, including relevant reconciliations, see the "Specified

Financial Measures" section of the Company’s MD&A for the three

and nine months ended September 30, 2024 and 2023, which is

incorporated by reference herein and is available on Gibson's

SEDAR+ profile at www.sedarplus.ca and

Gibson's website at www.gibsonenergy.com.

a) Adjusted

EBITDANoted below is the reconciliation to the most

directly comparable GAAP measures of the Company’s segmented and

consolidated adjusted EBITDA for the three and nine months ended

September 30, 2024, and 2023:

|

Three months ended September 30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

|

2023 |

2024 |

2023 |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Segment profit |

150,271 |

|

137,727 |

14,183 |

17,900 |

— |

|

— |

|

164,454 |

|

155,627 |

|

| Unrealized (gain)

loss on derivative financial instruments |

(1,553 |

) |

740 |

25 |

6,059 |

— |

|

— |

|

(1,528 |

) |

6,799 |

|

|

General and administrative |

— |

|

— |

— |

— |

(13,004 |

) |

(14,258 |

) |

(13,004 |

) |

(14,258 |

) |

| Adjustments to

share of profit from equity accounted investees |

1,166 |

|

1,432 |

— |

— |

— |

|

— |

|

1,166 |

|

1,432 |

|

|

Executive transition costs |

— |

|

— |

— |

— |

251 |

|

— |

|

251 |

|

— |

|

| Renewable power

purchase agreement |

— |

|

— |

— |

— |

(175 |

) |

— |

|

(175 |

) |

— |

|

|

Adjusted EBITDA |

149,884 |

|

139,899 |

14,208 |

23,959 |

(12,928 |

) |

(14,258 |

) |

151,164 |

|

149,600 |

|

|

Nine months ended September 30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

2023 |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Segment profit |

446,566 |

336,483 |

69,391 |

|

123,962 |

|

— |

|

— |

|

515,957 |

|

460,445 |

|

| Unrealized loss (gain) on

derivative financial instruments |

3,746 |

740 |

(1,884 |

) |

(6,872 |

) |

— |

|

— |

|

1,862 |

|

(6,132 |

) |

|

General and administrative |

— |

— |

— |

|

— |

|

(51,920 |

) |

(38,677 |

) |

(51,920 |

) |

(38,677 |

) |

| Adjustments to share of profit

from equity accounted investees |

4,071 |

4,293 |

— |

|

— |

|

— |

|

— |

|

4,071 |

|

4,293 |

|

|

Executive transition costs |

— |

— |

— |

|

— |

|

10,665 |

|

— |

|

10,665 |

|

— |

|

| Renewable power purchase

agreement |

— |

— |

— |

|

— |

|

(175 |

) |

— |

|

(175 |

) |

— |

|

|

Other |

— |

— |

— |

|

— |

|

— |

|

218 |

|

— |

|

218 |

|

|

Adjusted EBITDA |

454,383 |

341,516 |

67,507 |

|

117,090 |

|

(41,430 |

) |

(38,459 |

) |

480,460 |

|

420,147 |

|

b) Distributable Cash

Flow

The following is a reconciliation of distributable

cash flow from operations to its most directly comparable GAAP

measure, cash flow from operating activities:

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

Cash flow from operating activities |

404,794 |

|

190,015 |

|

531,178 |

|

419,254 |

|

|

Adjustments: |

|

|

|

|

|

Changes in non-cash working capital and taxes paid |

(258,264 |

) |

(61,420 |

) |

(64,620 |

) |

(14,921 |

) |

|

Replacement capital |

(13,023 |

) |

(12,876 |

) |

(24,260 |

) |

(25,702 |

) |

|

Cash interest expense, including capitalized interest |

(34,045 |

) |

(32,290 |

) |

(102,405 |

) |

(65,677 |

) |

|

Acquisition and integration costs (1) |

— |

|

19,959 |

|

1,371 |

|

19,959 |

|

|

Executive transition costs |

7,433 |

|

— |

|

10,665 |

|

— |

|

|

Lease payments |

(8,144 |

) |

(8,575 |

) |

(24,178 |

) |

(26,268 |

) |

|

Current income tax |

(10,582 |

) |

(1,860 |

) |

(23,633 |

) |

(23,800 |

) |

|

Distributable cash flow |

88,169 |

|

92,953 |

|

304,118 |

|

282,845 |

|

(1) Acquisition and integration

costs adjusted on an incurred basis.

c) Dividend Payout

Ratio

|

Twelve months ended

September 30, |

|

|

|

2024 |

|

2023 |

|

|

Distributable cash flow |

407,063 |

|

371,305 |

|

|

Dividends declared |

263,050 |

|

226,755 |

|

|

Dividend payout ratio |

65 |

% |

61 |

% |

d) Net Debt to Adjusted

EBITDA Ratio

|

Twelve months ended

September 30, |

|

|

|

2024 |

|

2023 |

|

|

|

|

|

|

Current and long-term debt |

2,528,454 |

|

2,645,904 |

|

|

Lease liabilities |

50,246 |

|

67,862 |

|

|

Less: unsecured hybrid notes |

(450,000 |

) |

(450,000 |

) |

|

Less: cash and cash equivalents |

(55,584 |

) |

(54,464 |

) |

|

|

|

|

|

Net debt |

2,073,116 |

|

2,209,302 |

|

|

Adjusted EBITDA |

650,141 |

|

557,481 |

|

|

Net debt to adjusted EBITDA ratio |

3.2 |

|

4.0 |

|

For further information, please

contact:

Investor Relations: (403)

776-3077investor.relations@gibsonenergy.com

Media Relations:(403) 476-6334

communications@gibsonenergy.com

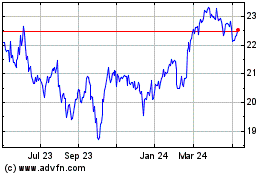

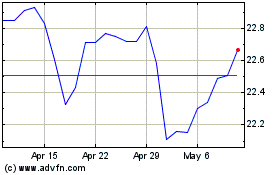

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Feb 2024 to Feb 2025