Gibson Energy Inc. (TSX:GEI) ("Gibson" or the "Company") announced

today its financial and operating results for the three and six

months ended June 30, 2024.

"We are pleased to announce another strong

quarter, driven by a new high water mark for our Infrastructure

segment and solid Marketing performance in line with guidance,"

said Steve Spaulding, President and Chief Executive Officer.

"Furthermore, subsequent to the quarter, we announced the extension

of a long-term contract at our Gateway Terminal with an investment

grade global E&P company which achieved our overarching

commercial objectives related to contract term and rate, enhancing

the strength and stability of our cash flows, and positioning us

for continued success.”

“In addition to the milestones achieved during

the second quarter, we were also pleased to announce Curtis

Philippon as President & Chief Executive Officer,” said Jim

Estey, Chair of the Board. “On behalf of the Board, I would like to

thank Steve Spaulding for his contributions to Company and welcome

Curtis to Gibson. We are looking forward to this next chapter under

Curtis’ leadership as we continue to enhance and expand upon our

successful infrastructure strategy.”

Financial Highlights:

-

Revenue of $3,233 million in the second quarter, a $620 million or

24% increase relative to the second quarter of 2023, primarily due

to higher revenues within the Marketing segment driven by increased

volume and commodity prices and the revenue contribution from the

Gateway Terminal

-

Infrastructure adjusted EBITDA(1) of $153 million in the second

quarter, a $60 million or 64% increase from the second quarter of

2023, primarily driven by the contribution from the Gateway

Terminal and impact of a $17 million provision for environmental

remediation obligations recognized in the comparative period

-

Marketing adjusted EBITDA(1) of $20 million in the second quarter,

a $15 million or 43% decrease from the second quarter of 2023, due

to weaker contributions from both Refined Products and Crude

Marketing

-

Adjusted EBITDA(1) on a consolidated basis of $159 million in the

second quarter, a $43 million or 38% increase over the second

quarter of 2023, as a result of the factors described above

- Net

income of $63 million in the second quarter, a $11 million or 22%

increase over the second quarter of 2023, primarily due to higher

adjusted EBITDA(1) as noted above, partially offset by higher

finance costs, depreciation and amortization expenses

-

Distributable cash flow(1) of $101 million in the second quarter, a

$19 million or 23% increase from the second quarter of 2023, as a

result of higher adjusted EBITDA(1), partially offset by higher

finance costs

-

Dividend payout ratio(2) on a trailing twelve-month basis of 63%,

below the Company’s 70% – 80% target

- Net

debt to adjusted EBITDA ratio(2) at June 30, 2024 of 3.5x, which is

within the Company’s 3.0x – 3.5x target range, notwithstanding

adjusted EBITDA(1) including eleven months from the Gateway

Terminal

Strategic Developments and

Highlights:

- On July 15, 2024, Gibson announced

the extension of a long-term contract with an investment grade

global E&P company at its Gateway Terminal which further

enhanced the quality of the Company's cash flows, as well as the

sanction of a connection to the Cactus II Pipeline, providing

customers with access to up to approximately 700,000 barrels per

day of incremental supply

- On July 2, 2024, the Company

announced the appointment of Curtis Philippon as the President and

Chief Executive Officer, effective August 29, 2024

- On April 22, 2024, the Company

amended its revolving credit facility and extended the maturity

date from February 2028 to April 2029

- The Company released its 2023

sustainability report and began its renewable energy power purchase

agreement, with Capstone Infrastructure Corporation and Sawridge

First Nation, which is expected to meet over 50% of Gibson's annual

electricity needs over the period

(1) Adjusted EBITDA and distributable cash flow

are non-GAAP financial measures. See the “Specified Financial

Measures” section of this release.(2) Net debt to adjusted EBITDA

ratio and dividend payout ratio are non-GAAP financial ratios. See

the “Specified Financial Measures” section of this release.

Management’s Discussion and Analysis and

Financial Statements The 2024 second quarter Management’s

Discussion and Analysis and unaudited Condensed Consolidated

Financial Statements provide a detailed explanation of Gibson’s

financial and operating results for the three months and six months

ended June 30, 2024, as compared to the three months and six months

ended June 30, 2023. These documents are available at

www.gibsonenergy.com and on SEDAR+ at

www.sedarplus.ca.

Earnings Conference Call & Webcast

DetailsA conference call and webcast will be held to

discuss the 2024 second quarter financial and operating results at

7:00am Mountain Time (9:00am Eastern Time) on Tuesday, July 30,

2024.

To register for the call, view dial-in numbers,

and obtain a dial-in PIN, please access the following URL:

-

https://register.vevent.com/register/BIc293a55e89b6461e9cb3818cc587f8db

Registration at least five minutes prior to the

conference call is recommended.

This call will also be broadcast live on the

Internet and may be accessed directly at the following URL:

-

https://edge.media-server.com/mmc/p/su4p7ugq

The webcast will remain accessible for a

12-month period at the above URL.

Supplementary InformationGibson

has also made available certain supplementary information regarding

the 2024 second quarter financial and operating results, available

at www.gibsonenergy.com.

About Gibson Gibson is a

leading liquids infrastructure company with its principal

businesses consisting of the storage, optimization, processing, and

gathering of liquids and refined products. Headquartered in

Calgary, Alberta, the Company's operations are located across North

America, with core terminal assets in Hardisty and Edmonton,

Alberta, Ingleside, Texas, and a facility in Moose Jaw,

Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information, visit

www.gibsonenergy.com.

Forward-Looking

StatementsCertain statements contained in this press

release constitute forward-looking information and statements

(collectively, forward-looking statements) including, but not

limited to, statements concerning Gibson's ability to enter into

contracts for the Gateway Terminal, the construction and completion

of additional tankage and the retirement of Gibson’s President and

Chief Executive Officer and the replacement and transition of this

role. All statements other than statements of historical fact are

forward-looking statements. The use of any of the words

‘‘anticipate’’, ‘‘plan’’, ‘‘contemplate’’, ‘‘continue’’,

‘‘estimate’’, ‘‘expect’’, ‘‘intend’’, ‘‘propose’’, ‘‘might’’,

‘‘may’’, ‘‘will’’, ‘‘shall’’, ‘‘project’’, ‘‘should’’, ‘‘could’’,

‘‘would’’, ‘‘believe’’, ‘‘predict’’, ‘‘forecast’’, ‘‘pursue’’,

‘‘potential’’ and ‘‘capable’’ and similar expressions are intended

to identify forward looking statements. The forward-looking

statements reflect Gibson's beliefs and assumptions with respect

to, among other things, Gibson’s ability to enter into contracts

for the Gateway Terminal, the construction and completion of

additional tankage and the retirement of Gibson’s President and

Chief Executive Officer and the replacement and transition of this

role. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. No assurance can be given that these

expectations will prove to be correct and such forward-looking

statements included in this press release should not be unduly

relied upon. These statements speak only as of the date of this

press release. The Company does not undertake any obligations to

publicly update or revise any forward-looking statements except as

required by securities law. Actual results could differ materially

from those anticipated in these forward-looking statements as a

result of numerous risks and uncertainties including, but not

limited to, the risks and uncertainties described in

“Forward-Looking Information” and “Risk Factors” included in the

Company's Annual Information Form and Management's Discussion and

Analysis, each dated February 20, 2024, as filed on SEDAR+ and

available on the Gibson website at

www.gibsonenergy.com.

For further information, please contact:

Investor Relations: (403)

776-3077investor.relations@gibsonenergy.com

Media Relations:(403) 476-6334

communications@gibsonenergy.com

Specified Financial

Measures

This press release refers to certain financial

measures that are not determined in accordance with GAAP, including

non-GAAP financial measures and non-GAAP financial ratios. Readers

are cautioned that non-GAAP financial measures and non-GAAP

financial ratios do not have standardized meanings prescribed by

GAAP and, therefore, may not be comparable to similar measures

presented by other entities. Management considers these to be

important supplemental measures of the Company’s performance and

believes these measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in industries with similar capital structures.

For further details on these specified financial

measures, including relevant reconciliations, see the "Specified

Financial Measures" section of the Company’s MD&A for the three

and six months ended June 30, 2024 and 2023, which is incorporated

by reference herein and is available on Gibson's SEDAR+ profile at

www.sedarplus.ca and Gibson's website at

www.gibsonenergy.com.

a) Adjusted

EBITDA

Noted below is the reconciliation to the most

directly comparable GAAP measures of the Company’s segmented and

consolidated adjusted EBITDA for the three and six months ended

June 30, 2024, and 2023:

|

Three months ended June 30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

|

|

|

| Segment profit |

150,632 |

92,185 |

35,827 |

34,231 |

— |

— |

186,459 |

126,416 |

| Unrealized loss (gain) on

derivative financial instruments |

1,150 |

— |

(16,126) |

150 |

— |

— |

(14,976) |

150 |

| General and

administrative |

— |

— |

— |

— |

(16,996) |

(12,502) |

(16,996) |

(12,502) |

| Adjustments to share of profit

from equity accounted investees |

1,424 |

1,426 |

— |

— |

— |

— |

1,424 |

1,426 |

| Executive transition

costs |

— |

|

— |

— |

3,279 |

— |

3,279 |

— |

|

Other |

— |

— |

— |

— |

— |

218 |

— |

218 |

|

Adjusted EBITDA |

153,206 |

93,611 |

19,701 |

34,381 |

(13,717) |

(12,284) |

159,190 |

115,708 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Six months ended June

30, |

Infrastructure |

Marketing |

Corporate and Adjustments |

Total |

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

|

|

|

| Segment profit |

296,295 |

198,756 |

55,208 |

106,062 |

— |

— |

351,503 |

304,818 |

| Unrealized loss (gain) on

derivative financial instruments |

5,299 |

— |

(1,909) |

(12,931) |

— |

— |

3,390 |

(12,931) |

| General and

administrative |

— |

— |

— |

— |

(38,916) |

(24,419) |

(38,916) |

(24,419) |

| Adjustments to share of profit

from equity accounted investees |

2,905 |

2,861 |

— |

— |

— |

— |

2,905 |

2,861 |

| Executive transition

costs |

— |

— |

— |

— |

10,414 |

— |

10,414 |

— |

|

Other |

— |

— |

— |

— |

— |

218 |

— |

218 |

|

Adjusted EBITDA |

304,499 |

201,617 |

53,299 |

93,131 |

(28,502) |

(24,201) |

329,296 |

270,547 |

| |

Three months ended June 30, |

|

($ thousands) |

2024 |

2023 |

|

|

|

|

| Net Income |

63,332 |

52,026 |

| |

|

|

| Income tax expense |

19,177 |

16,139 |

| Depreciation, amortization,

and impairment charges |

43,732 |

28,091 |

| Finance costs, net |

36,337 |

11,716 |

| Unrealized (gain) loss on

derivative financial instruments |

(14,976) |

150 |

| Corporate unrealized gain on

derivative financial instruments (1) |

(835) |

— |

| Stock based compensation |

5,347 |

4,743 |

| Acquisition and integration

costs |

66 |

— |

| Adjustments to share of profit

from equity accounted investees |

1,424 |

1,426 |

| Corporate foreign exchange

loss and other |

2,307 |

1,417 |

|

Executive transition costs |

3,279 |

— |

|

Adjusted EBITDA |

159,190 |

115,708 |

| |

Six months ended June

30, |

|

($ thousands) |

2024 |

2023 |

|

|

|

|

| Net Income |

103,821 |

140,277 |

| |

|

|

| Income tax expense |

31,632 |

43,186 |

| Depreciation, amortization,

and impairment charges |

87,163 |

56,246 |

| Finance costs, net |

71,740 |

30,135 |

| Unrealized (gain) loss on

derivative financial instruments |

3,390 |

(12,931) |

| Corporate unrealized gain on

derivative financial instruments (1) |

8,641 |

— |

| Stock based compensation |

10,411 |

8,889 |

| Acquisition and integration

costs |

1,371 |

— |

| Adjustments to share of profit

from equity accounted investees |

2,905 |

2,861 |

| Corporate foreign exchange

loss and other |

(2,192) |

1,884 |

|

Executive transition costs |

10,414 |

— |

|

Adjusted EBITDA |

329,296 |

270,547 |

b) Distributable Cash

Flow

The following is a reconciliation of

distributable cash flow from operations to its most directly

comparable GAAP measure, cash flow from operating activities:

| |

Three months ended June 30, |

Six months ended June 30, |

|

($ thousands) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

| Cash flow from

operating activities |

(66,449) |

69,712 |

126,384 |

229,239 |

| Adjustments: |

|

|

|

|

|

Changes in non-cash working capital and taxes paid |

219,722 |

51,378 |

193,644 |

46,499 |

|

Replacement capital |

(6,865) |

(7,491) |

(11,237) |

(12,826) |

|

Cash interest expense, including capitalized interest |

(34,482) |

(16,588) |

(68,360) |

(33,387) |

|

Acquisition and integration costs (1) |

66 |

— |

1,371 |

— |

|

Executive transition costs |

3,232 |

— |

3,232 |

— |

|

Lease payments |

(8,000) |

(8,121) |

(16,034) |

(17,693) |

|

Current income tax |

(5,739) |

(6,399) |

(13,051) |

(21,940) |

|

Distributable cash flow |

101,485 |

82,491 |

215,949 |

189,892 |

|

Twelve months ended June 30, |

|

($ thousands) |

2024 |

2023 |

|

|

|

|

| Cash flow from

operating activities |

472,001 |

505,968 |

| Adjustments: |

|

|

|

Changes in non-cash working capital and taxes paid |

139,711 |

58,644 |

|

Replacement capital |

(34,339) |

(27,239) |

|

Cash interest expense, including capitalized interest |

(135,106) |

(65,447) |

|

Acquisition and integration costs (1) |

23,413 |

— |

|

Executive transition costs |

3,232 |

— |

|

Lease payments |

(34,237) |

(32,970) |

|

Current income tax |

(22,828) |

(45,913) |

|

Distributable cash flow |

411,847 |

393,043 |

c) Dividend Payout

Ratio

|

Twelve months ended June

30, |

|

|

2024 |

2023 |

|

Distributable cash flow |

411,847 |

393,043 |

| Dividends declared |

259,364 |

217,490 |

|

Dividend payout ratio |

63% |

55% |

d) Net Debt To Adjusted

EBITDA Ratio

| |

Twelve months ended June

30, |

|

|

2024 |

2023 |

|

|

|

|

| Long-term debt |

2,742,549 |

1,642,367 |

| Lease liabilities |

55,362 |

63,092 |

| Less: unsecured hybrid

debt |

(450,000) |

(250,000) |

| Less:

cash and cash equivalents |

(48,994) |

(55,215) |

|

|

|

|

| Net debt |

2,298,917 |

1,400,244 |

|

Adjusted EBITDA |

648,577 |

557,294 |

|

Net debt to adjusted EBITDA ratio |

3.5 |

2.5 |

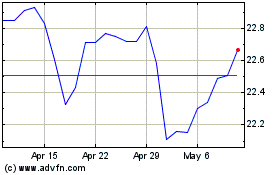

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Jan 2025 to Feb 2025

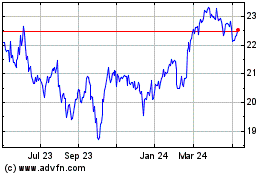

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Feb 2024 to Feb 2025