Granite Real Estate Investment Trust and Granite REIT Inc. Complete Unwind of Stapled Unit Structure

October 01 2024 - 7:40AM

Business Wire

Granite Real Estate Investment Trust (“Granite REIT”) and

Granite REIT Inc. (“Granite GP”) (collectively,

“Granite”) (TSX: GRT.UN / NYSE: GRP.U) announced

today that on October 1, 2024 Granite completed the

previously-announced court-approved plan of arrangement under the

Business Corporations Act (British Columbia) (the

“Arrangement”) to replace Granite’s stapled unit structure

with a conventional REIT trust unit structure. The Arrangement was

approved by holders of Granite’s stapled units (“Stapled

Units”) (each consisting of a unit of Granite REIT (a

“Granite REIT Unit”) and a common share of Granite GP (a

“Granite GP Share”), at meetings of unitholders held on June

6, 2024 and by a final order of the Supreme Court of British

Columbia.

Under the Arrangement, (i) the two components of each Stapled

Unit were uncoupled, (ii) each Granite GP Share was automatically

exchanged for 0.001/99.999 of a Granite REIT Unit, and (iii) the

Granite REIT Units were consolidated back to the number of Stapled

Units outstanding before the exchange occurred.

As a result of and immediately following the Arrangement, each

Granite unitholder holds a number of Granite REIT Units equal to

the number of Stapled Units held prior to completion of the

Arrangement, and Granite GP has become a wholly-owned subsidiary of

Granite REIT. The Stapled Units will be delisted from the Toronto

Stock Exchange (the “TSX”) and the New York Stock Exchange

(the “NYSE”), and the Granite REIT Units will trade on the

TSX and the NYSE under the same ticker symbols “GRT.UN” and

“GRP.U”, respectively.

Additional “Early Warning” Disclosures Under Canadian Securities

Laws

Immediately before the completion of the Arrangement, Granite

REIT owned no Granite GP Shares. Immediately after the completion

of the Arrangement, Granite REIT owned 62,740,097 Granite GP

Shares, representing 100% of the outstanding Granite GP Shares.

As noted above, each Granite GP Share was acquired by Granite

REIT in return for 0.001/99.999 of a Granite REIT Unit. The closing

price of the Stapled Units (of which the value of the Granite GP

Share component is estimated to be a nominal amount) on September

30, 2024 on the TSX was $81.63 per unit, and on the NYSE was

US$61.11 per unit.

The purpose of the transaction was to complete the Arrangement

and simplify Granite’s capital structure by unwinding Granite’s

previous stapled unit structure. Granite REIT’s head office address

is 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion

Centre, Toronto, Ontario M5K 1H1. A copy of the early warning

report filed by Granite may be obtained on Granite REIT’s profile

on www.sedarplus.ca or from Granite REIT at the above address,

Attention: Andrea Sanelli, Associate Director, Legal & Investor

Services, at 647-925-7504.

ABOUT GRANITE

Granite is a Canadian-based REIT engaged in the acquisition,

development, ownership and management of logistics, warehouse and

industrial properties in North America and Europe. Granite owns 143

investment properties representing approximately 63.3 million

square feet of leasable area.

OTHER INFORMATION

Copies of financial data and other publicly filed documents

about Granite are available through the internet on the Canadian

Securities Administrators’ System for Electronic Data Analysis and

Retrieval + (SEDAR+) which can be accessed at www.sedarplus.ca and

on the United States Securities and Exchange Commission’s

Electronic Data Gathering, Analysis and Retrieval System (EDGAR)

which can be accessed at www.sec.gov.

For further information, please see our website at

www.granitereit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930675019/en/

Teresa Neto Chief Financial Officer 647-925-7560

Andrea Sanelli Associate Director, Legal & Investor Services

647-925-7504

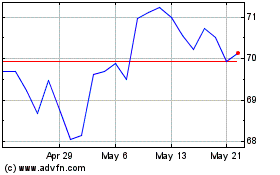

Granite Real Estate Inve... (TSX:GRT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

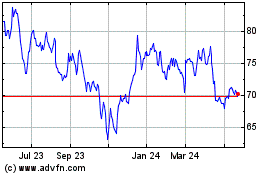

Granite Real Estate Inve... (TSX:GRT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024