Imperial Extends Credit Facilities and Refinances US$98.455 Million of its Senior Unsecured Notes

March 14 2019 - 9:33PM

Imperial Metals Corporation (the "Company")

(TSX:III) announces that it has obtained extensions regarding the

maturity date of a number of its credit facilities as follows:

- The Senior Credit Facility maturity date has been extended from

March 15, 2019 to September 5, 2019.

- The Second Lien Credit Facility maturity date has been extended

from March 15, 2019 to September 9, 2019.

- The Bridge Loan maturity date has been extended from March 15,

2019 to September 11, 2019.

- The Junior Credit Facility maturity date has been extended from

March 15, 2019 to September 12, 2019.

The Company also announces that it has agreed to

refinance US$98,445,000 of its 7% US$325 million Senior Unsecured

Notes due March 15, 2019 (the “Senior Notes”). The Company

has requested that Edco Capital Corporation (“Edco”), and Edco has

agreed, to subscribe for US$98,445,000 of additional Senior Notes

(principal amount of US$1,000 each) on the same terms and

conditions as the existing Senior Notes. Such funding will enable

the Company to repay an equal dollar amount of the principal of the

Senior Notes that are payable in full Friday March 15, 2019, being

US$98,445,000. The remaining existing holders of Senior Notes in

the principal amount of US$226,555,000 have agreed, as has Edco in

respect to the additional Senior Notes, to extend the maturity date

of the Senior Notes until September 15, 2019. The refinancing and

extension of the maturity date of the Senior Notes, as described,

is a requirement to achieve the loan extensions set out above.

As Edco is a related party of the Company, the

issue of additional Senior Notes to Edco is a related party

transaction. Accordingly, the transaction was considered and

unanimously approved by the directors of the Company who are

independent of Edco and its affiliates and who do not own any of

the Senior Notes (the “Independent Directors”), and by the full

Board of Directors of the Company after considering both legal and

financial advice from external advisors.

The Independent Directors and the full Board of

Directors both unanimously concluded that the Company could utilize

existing exemptions from formal valuation requirements and minority

vote requirements of applicable related party transaction

securities rules on the basis of the serious financial difficulty

facing the Company in the interim period pending completion of the

previously announced transaction with Newcrest Mining Limited

(“Newcrest”). The Newcrest asset purchase and joint venture

transaction, which is subject to a number of closing conditions,

when completed will permit the Company to repay the Senior Notes as

well as the other above mentioned credit facilities in full. The

Independent Directors and the full Board of Directors also

unanimously concluded that the Company could also rely on another

exemption from the minority vote requirement as the additional

Senior Notes represent non convertible indebtedness being issued to

Edco on commercially reasonable terms that are not less

advantageous to the Company than arms length third party terms.

---

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company. The Company, through its

subsidiaries, owns the Red Chris, Mount Polley and Huckleberry

copper mines in British Columbia. Imperial also holds a 50%

interest in the Ruddock Creek lead/zinc property. Imperial

recently announced an agreement with Newcrest to sell a 70%

interest in Red Chris to Newcrest for US$806.5 million, while

retaining a 30% interest in the mine. The Company and Newcrest will

form a joint venture for the operation of the Red Chris mine going

forward, with Newcrest acting as the operator.

Company Contacts

Brian Kynoch |

President | 604.669.8959 Andre

Deepwell | Chief Financial

Officer | 604.488.2666 Sabine

Goetz | Shareholder

Communications | 604.488.2657 |

investor@imperialmetals.com

Forward-Looking Information and Risks

Notice

Forward-looking statements relate to future

events or future performance and reflect Company management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements regarding extensions of the maturity

dates obtained for the Senior Credit Facility, the Second Lien

Credit Facility, the Bridge Loan, the Senior Notes and the Junior

Credit Facility the completion of the joint venture transaction

with Newcrest, the completion of the issue of additional Senior

Notes to Edco and various contemplated repayments of the Senior

Notes and other credit facilities. By their very nature

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

factors include, among others, risk factors detailed from time to

time in the Company’s interim and annual financial statements and

management’s discussion and analysis of those statements, all of

which are filed and available for review

on sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking statements.

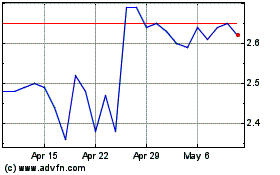

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

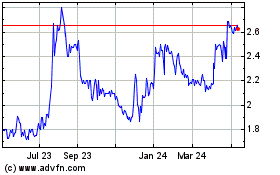

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025