Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for the three months ended

March 31, 2024.

QUARTER HIGHLIGHTS

FINANCIAL

Adjusted EBITDA increased by $4.4 million to

$10.3 million in Q1 2024 compared to $5.9 million in Q1 2023.

Total revenue was $84.6 million in the March

2024 quarter compared to $92.7 million in the 2023 comparative

quarter.

In the March 2024 quarter, Mount Polley mine had

1.3 concentrate shipments (2023-1.4 concentrate shipments). The Red

Chris mine (100% basis) had 4.0 concentrate shipments (2023-2.4

concentrate shipments).

Variations in revenue are impacted by the timing

and quantity of concentrate shipments, metal prices and exchange

rates, and period end revaluations of revenue attributed to

concentrate shipments where copper and gold prices will settle at a

future date.

The London Metals Exchange cash settlement

copper price per pound averaged US$3.83 in the March 2024 quarter

compared to US$4.05 in the 2023 comparative quarter. The LBMA

(London Bullion Market Association) cash settlement gold price per

troy ounce averaged US$2,072 in the March 2024 quarter compared to

US$1,888 in the 2023 comparative quarter. The average US/CDN Dollar

exchange rate was 1.349 in the March 2024 quarter, 0.22% lower than

the exchange rate of 1.352 in the March 2023 quarter. In CDN Dollar

terms the average copper price in the March 2024 quarter was

CDN$5.17 per pound compared to CDN$5.48 per pound in the 2023

comparative quarter, and the average gold price in the March 2024

quarter was CDN$2,795 per ounce compared to CDN$2,553 per ounce in

the 2023 comparative quarter.

A negative revenue revaluation in the March 2024

quarter was $(0.2) million as compared to a $5.9 million of

positive revenue revaluation in the 2023 comparative quarter.

Revenue revaluations are the result of the metal price on the

settlement date and/or the current period balance sheet date being

higher or lower than when the revenue was initially recorded or the

metal price at the last balance sheet date and finalization of

contained metal as a result of final assays.

Net loss for the March 2024 quarter was $9.2

million ($0.06 per share) compared to net loss of $7.3 million

($0.05 per share) in the 2023 comparative quarter. The increase in

net loss of $1.9 million was primarily due to the following

factors:

- Loss from mine

operations was $1.5 million in March 2024 quarter, which is an

improvement of $0.1 million in comparison to a loss of $1.6 million

in March 2023 comparative quarter.

- Idle mine cost

went from $2.1 million in March 2023 to $1.9 million in the March

2024 quarter.

- Interest expense

increased from $6.0 million in March 2023 to $10.5 million in March

2024, increasing net loss by $4.5 million.

- Tax recovery

went from $4.4 million in March 2023 to $6.6 million in March 2024,

decreasing net loss by $2.2 million.

The average US/CDN Dollar exchange rate in the

March 2024 quarter was 1.349 compared to an average of 1.352 in the

2023 comparative quarter.

Capital expenditures including leases were $36.2

million in the March 2024 quarter, an increase of $11.9 million

from $24.3 million in the 2023 comparative quarter. The March 2024

quarter expenditures included $16.5 million in exploration, $7.3

million on stripping costs, $2.9 million for tailings dam

construction and $9.5 million of other capital.

At March 31, 2024, the Company had not hedged

any copper, gold or US/CDN Dollar exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the US/CDN Dollar

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

OPERATIONS

During the quarter ended March 31, 2024,

Imperial’s consolidated metal production was 12.35 million pounds

copper (Q1 2023-10.16 million pounds copper) and 12,861 ounces gold

(Q1 2023-13,129 ounces gold).

Mount Polley Mine

Mount Polley metal production for the first

quarter of 2024 was 7,355,191 pounds copper and 10,009 ounces gold,

compared to 8,347,899 pounds copper and 10,349 ounces gold produced

during the fourth quarter of 2023. Mill throughput was up 20.3%,

with 1.67 million tonnes being treated compared with 1.39 million

tonnes treated in the first quarter of 2023. Copper production in

the first quarter 2024 was up by 10.1% because of the increase in

throughput which offset lower grade and recovery compared to first

quarter of 2023.

Tailing removal from the Springer Pit were 84%

completed at the end of March 2024 and are expected to be

completely removed by early May 2024. Stripping for Phase 5

pushback of the Springer pit mined approximately 1.7 million tonnes

of waste by the end of March 2024.

|

|

Three Months EndedMarch 312024 |

|

Three Months EndedMarch 312023 |

|

|

Ore milled - tonnes |

1,671,505 |

|

1,389,636 |

|

|

Ore milled per calendar day - tonnes |

18,368 |

|

15,440 |

|

|

Grade % - copper |

0.25 |

|

0.27 |

|

|

Grade g/t - gold |

0.28 |

|

0.31 |

|

|

Recovery % - copper |

79.4 |

|

81.1 |

|

|

Recovery % - gold |

66 |

|

71.5 |

|

|

Copper - 000’s pounds |

7,355 |

|

6,678 |

|

|

Gold - ounces |

10,009 |

|

9,980 |

|

|

|

|

|

|

|

At Mount Polley, a diamond drilling program

started on March 3, 2024 which focused on two goals. The first is

to test for mineralization around the perimeter of the planned

Springer pit where there are gaps in the 3-dimensional

mineralization model. The second goal is to follow-up on last

year’s successful drilling in the Springer zone by filling gaps in

the drilling of the zone and by continuing to test the zone at

depth. The first two drill holes of this program have been

completed and the third is in progress. About 1,800 metres of

drilling were completed by the end of the quarter.

Exploration, development, and capital

expenditures in the first quarter of 2024 were $15.8 million

compared to $4.8 million in the 2023 comparative quarter.

Red Chris Mine

Red Chris production (100%) for the first

quarter of 2024 was 16,660,225 pounds copper and 9,507 ounces gold

compared to 11,589,689 pounds copper and 10,496 ounces gold during

the same quarter of 2023.

In the 2024 first quarter, Red Chris copper

production was up 44% compared to the same quarter in 2023 and down

9% for gold compared to the same quarter of 2023. The increase in

copper production was a result of a 33% increase in copper grade

(0.431% vs 0.325%) and an 8% increase in recovery (83.4% vs.

77.4%). The drop in gold production in the first quarter 2024 was

the result of lower gold grade (0.263 g/t gold vs 0.311 g/t gold)

being treated compared to the same quarter last year.

Imperial’s 30% portion of Red Chris mine for the

first quarter of 2024 was 4,998,000 pounds copper and 2,852 ounces

gold.

|

100% Red Chris mine production |

Three Months EndedMarch 312024 |

|

Three Months EndedMarch 312023 |

|

|

Ore milled - tonnes |

2,100,354 |

|

2,090,772 |

|

|

Ore milled per calendar day - tonnes |

23,081 |

|

23,231 |

|

|

Grade % - copper |

0.43 |

|

0.32 |

|

|

Grade g/t - gold |

0.26 |

|

0.31 |

|

|

Recovery % - copper |

83.4 |

|

77.4 |

|

|

Recovery % - gold |

53.6 |

|

50.2 |

|

|

Copper - 000’s pounds |

16,660 |

|

11,590 |

|

|

Gold - ounces |

9,507 |

|

10,496 |

|

|

|

Imperial’s 30% share of exploration,

development, and capital expenditures were $20.4 million in the

March 2024 quarter compared to $19.4 million in the 2023

comparative quarter.

Block Cave Decline and Drilling Progress

The underground development has continued with

total of 9,220 metres (including all vent drives) completed. The

decline to access the extraction level (Nagha decline) had advanced

4,372 metres as of March 31, 2024. Development work on the

conveyor declines advanced 1,541 metres on legs two and three

by quarter end.

Huckleberry Mine

Huckleberry operations ceased in August 2016 and

the mine remains on care and maintenance status.

Site personnel continue to focus on maintaining

site access, water management, maintenance of site infrastructure

and equipment, and mine permit compliance. Work is also planned in

2024 to investigate and update the tailings facility design for

Huckleberry.

For the March 2024 quarter, Huckleberry incurred

idle mine costs comprised of $1.7 million in operating costs and

$0.3 million in depreciation expense compared to $1.8 million in

operating cost and $0.3 million in depreciation expense in the

comparable quarter of 2023.

TECHNICAL INFORMATION

The technical and scientific information related

to the Company’s mineral projects has been reviewed and approved by

Brian Kynoch, P.Eng., President of Imperial Metals, and a

designated Qualified Person as defined by NI 43-101.

Jim Miller-Tait, P.Geo. Vice President

Exploration with Imperial Metals, is the designated Qualified

Person as defined by National Instrument 43-101 for the Red Chris,

Mount Polley and Huckleberry mines exploration programs.

EARNINGS AND CASH FLOW

Select Quarter Financial

Information

|

|

|

Three Months Ended March 31 |

|

|

expressed in thousands of dollars, except share and per share

amounts |

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Operations: |

|

|

|

|

|

|

|

|

Total revenues |

$84,568 |

|

|

$92,664 |

|

|

|

|

Net loss |

$(9,165 |

) |

|

$(7,253 |

) |

|

|

|

Net loss per share |

$(0.06 |

) |

|

$(0.05 |

) |

|

|

|

Diluted loss per share |

$(0.06 |

) |

|

$(0.05 |

) |

|

|

|

Adjusted net loss (1) |

$(9,165 |

) |

|

$(7,255 |

) |

|

|

|

Adjusted net loss per share (1) |

$(0.06 |

) |

|

$(0.05 |

) |

|

|

|

Adjusted EBITDA(1) |

$10,279 |

|

|

$5,923 |

|

|

|

|

Cash earnings (1)(2) |

$10,301 |

|

|

$5,404 |

|

|

|

|

Cash earnings per share (1)(2) |

$0.06 |

|

|

$0.03 |

|

|

|

Working capital (deficiency) |

$(159,132 |

) |

|

$(88,980 |

) |

|

|

Total assets |

$1,426,794 |

|

|

$1,316,087 |

|

|

|

Total debt (including current portion)(3) |

$359,551 |

|

|

$227,761 |

|

|

|

(1) |

Refer to Non-IFRS Financial Measures for further details. |

|

|

(2) |

Cash earnings is defined as the cash flow from operations before

the net change in non-cash working capital balances, incomeand

mining taxes, and interest paid. Cash earnings per share is defined

as cash earnings divided by the weighted averagenumber of common

shares outstanding during the year. |

|

|

(3) |

Total debt consists of banker’s acceptances, convertible and

non-convertible debentures, loans and leases. |

|

|

|

|

NON-IFRS FINANCIAL MEASURES

The Company reports on four non-IFRS financial

measures: adjusted net loss, adjusted EBITDA, cash earnings and

cash cost per pound of copper produced, which are described in

detail below. The Company believes these measures are useful to

investors because they are included in the measures that are used

by management in assessing the financial performance of the

Company.

Adjusted net loss, adjusted EBITDA, cash

earnings and cash cost per pound of copper are not standardized

financial measures under IFRS and might not be comparable to

similar financial measures disclosed by other issuers.

Adjusted Net Loss and Adjusted Net Loss

Per Share

Adjusted net loss is derived from operating net

loss by removing the gains or loss, resulting from acquisition and

disposal of property, mark to market revaluation of derivative

instruments not related to the current period, net of tax,

unrealized foreign exchange gains or losses on long term debt, net

of tax and other non-recurring items. Adjusted net loss in the

March 2024 quarter was $9.2 million ($0.06 per share) compared to

an adjusted net loss of $7.3 million ($0.05 per share) in the 2023

comparative quarter. We believe that the presentation of Adjusted

Net Loss helps investors better understand the results of our

normal operating activities and the ongoing cash generating

potential of our business.

Adjusted EBITDA

Adjusted EBITDA in the March 2024 quarter was

$10.3 million compared to $5.9 million in the 2023 comparative

quarter. We define Adjusted EBITDA as net income (loss) before

interest expense, taxes, depletion, and depreciation, and as

adjusted for certain other items.

Cash Earnings and Cash Earnings Per

Share

Cash earnings in the March 2024 quarter was

$10.3 million compared to $5.4 million in the 2023 comparative

quarter. Cash earnings per share was $0.06 in the March 2024

quarter compared to $0.03 in the 2023 comparative quarter.

Cash earnings and cash earnings per share are

measures used by the Company to evaluate its performance; however,

they are not terms recognized under IFRS. We believe that the

presentation of cash earnings and cash earnings per share is

appropriate to provide additional information to investors about

how well the Company can earn cash to pay its debts and manage its

operating expenses and investment. Cash earnings is defined as cash

flow from operations before the net change in non-cash working

capital balances, income and mining taxes paid, and interest paid.

Cash earnings per share is the same measure divided by the weighted

average number of common shares outstanding during the year.

Cash Cost Per Pound of Copper Produced

Management uses this non-IFRS financial measure

to monitor operating costs and profitability. The Company is

primarily a copper producer and therefore calculates this non-IFRS

financial measure individually for its two operating copper mines,

Mount Polley and Red Chris (30% share), and on a composite basis

for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced.

|

Calculation of Cash Cost Per Pound of Copper

Producedexpressed in thousands, except cash cost per pound

of copper produced |

Three Months Ended March 31, 2024 |

|

|

|

Mount Polley |

|

Red Chris |

|

Composite |

|

|

Cash cost of copper produced in US$ |

$12,559 |

|

$20,945 |

|

$33,504 |

|

|

Copper produced – 000’s pounds |

7,355 |

|

4,998 |

|

12,353 |

|

|

Cash cost per lb copper produced in US$ |

$1.71 |

|

$4.19 |

|

$2.71 |

|

|

|

|

|

expressed in thousands, except cash cost per pound of copper

produced |

Three Months Ended March 31, 2023 |

|

|

|

Mount Polley |

|

Red Chris |

|

Composite |

|

|

Cash cost of copper produced in US$ |

$16,229 |

|

$19,683 |

|

$35,912 |

|

|

Copper produced – 000’s pounds |

6,678 |

|

3,477 |

|

10,155 |

|

|

Cash cost per lb copper produced in US$ |

$2.43 |

|

$5.66 |

|

$3.54 |

|

|

|

|

For detailed information, refer to Imperial’s

2024 First Quarter Management’s Discussion and Analysis available

on imperialmetals.com and sedarplus.ca.About

Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb S. Dhillon | Chief Financial

Officer | 604.669.8959

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, specific statements regarding the

Company’s expectations with respect to completion of the removal of

tailings from the Springer Pit by early May 2024; plans to complete

the diamond drilling program, including, but not limited to, the

filling of gaps in the drilling of the Springer Zone by drilling to

test the zone at depth; plans to investigate and update the

Huckleberry mine tailings facility design in 2024; and more general

statements regarding the Company’s expectations with respect to its

business and operations; metal pricing and demand; fluctuation of

revenues; progress and advancement of the Red Chris block cave

decline; metal production guidance and estimates; and expectations

regarding the usefulness of non-IFRS financial measures including

adjusted net income (loss), adjusted EBITDA, cash earnings and cash

cost per pound of copper.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

news release, the Company has applied certain factors and

assumptions that are based on information currently available to

the Company as well as the Company’s current beliefs and

assumptions. These factors and assumptions and beliefs and

assumptions include, the risk factors detailed from time to time in

the Company’s interim and annual financial statements and

management’s discussion and analysis of those statements, and the

risk factors detailed in the Company’s Annual Information Form, all

of which are filed and available for review on SEDAR+ at

sedarplus.ca. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended, many of which are beyond the Company’s ability to control

or predict. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and all forward-looking statements in

this news release are qualified by these cautionary statements.

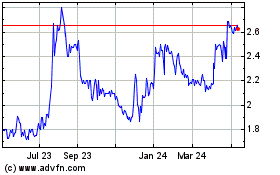

Imperial Metals (TSX:III)

Historical Stock Chart

From Feb 2025 to Mar 2025

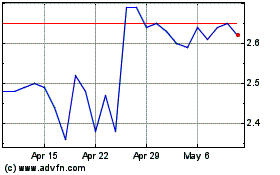

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Mar 2025