Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for its fiscal year ended

December 31, 2018.

|

Select Annual Financial

Information |

Years Ended December 31 |

| expressed in

thousands, except share and per share amounts |

|

2018 |

|

|

2017 |

|

|

2016 |

|

| Total

revenues |

$360,173 |

|

$453,113 |

|

$428,218 |

|

| Net

income (loss) |

$(125,595 |

) |

$ 77,113 |

|

$(54,080 |

) |

| Net

income (loss) per share |

$ (1.06 |

) |

$ 0.82 |

|

$(0.66 |

) |

| Diluted

income (loss) per share |

$ (1.06 |

) |

$ 0.82 |

|

$(0.66 |

) |

| Adjusted

net loss (1) |

$(84,763 |

) |

$(62,626 |

) |

$(56,784 |

) |

| Adjusted

net loss per share (1) |

$(0.71 |

) |

$(0.66 |

) |

$(0.69 |

) |

| Adjusted

EBITDA(1) |

$33,268 |

|

$ 88,457 |

|

$106,624 |

|

| Working

capital deficiency |

$789,470 |

|

$238,269 |

|

$89,108 |

|

| Total

assets |

$1,573,903 |

|

$1,723,768 |

|

$1,527,778 |

|

| Total debt (including

current portion) |

$871,268 |

|

$852,378 |

|

$835,365 |

|

| Cash

flow (1)(2) |

$143,449 |

|

$88,381 |

|

$107,591 |

|

|

Cash flow per share (1)(2) |

$1.21 |

|

$0.94 |

|

$1.32 |

|

| (1) Refer to Non-IFRS Financial Measures in the

Management’s Discussion & Analysis. |

| (2) Cash flow is defined as the cash flow from

operations before the net change in non-cash working capital

balances, income and mining taxes, and interest paid. Cash

flow per share is defined as Cash flow divided by the weighted

average number of common shares outstanding during the year. |

|

Select Items Affecting Net Income (Loss)

(presented on an after-tax basis) |

Years Ended December 31 |

|

expressed in thousands |

2018 |

|

|

2017 |

|

| Net

income (loss) before undernoted items |

$(26,923 |

) |

$(6,182 |

) |

| Interest

expense |

|

(57,249 |

) |

|

(55,887 |

) |

|

Foreign exchange gain (loss) on non-current debt |

|

(36,949 |

) |

|

29,280 |

|

|

Impairment of mineral properties |

|

(79,719 |

) |

|

- |

|

|

Gain on bargain purchase of Huckleberry and revaluation of

equity investment in Huckleberry |

|

- |

|

|

109,818 |

|

|

Settlement and insurance recoveries |

|

74,949 |

|

|

- |

|

|

Gain on sale of Sterling |

|

296 |

|

|

641 |

|

| Share of loss in Huckleberry |

|

- |

|

|

(557 |

) |

| Net Income (Loss) |

$(125,595 |

) |

$77,113 |

|

Revenues decreased to $360.2 million in 2018

compared to $453.1 million in 2017, a decrease of $92.9 million or

20.5%.

Revenue from the Red Chris mine in 2018 was

$255.7 million compared to $289.1 million in 2017. Revenue from the

Mount Polley mine in 2018 was $104.4 million compared to $163.5

million in 2017. There were 12.0 concentrate shipments in 2018 from

the Red Chris mine (2017-15.0 concentrate shipments) and 3.0

concentrate shipments from the Mount Polley mine in 2018 (2017-4.7

concentrate shipments). Variations in revenue are impacted by the

timing and quantity of concentrate shipments, metal prices and

exchange rates, and period end revaluations of revenue attributed

to concentrate shipments where metal prices will settle at a future

date.

Net loss for 2018 was $125.6 million ($1.06 per

share) compared to net income of $77.1 million ($0.82 per share) in

2017. The majority of decrease in net income of $202.7

million was primarily due to the following factors:

- Loss from mine operations went from income of $19.5 million in

2017 to a loss of $33.0 million in 2018, an increase in net loss of

$52.5 million.

- Interest expense increased from $75.5 million in 2017 to $78.4

million in 2018, an increase to net loss of $2.9 million.

- Foreign exchange gain on current and non-current debt went from

a gain of $30.2 million in 2017 to a loss of $36.9 million in 2018,

an increase in net loss of $67.1 million.

- Impairment on mineral properties went from $nil in 2017 to

$109.2 million in 2018, an increase in net loss of $109.2

million.

- A gain on bargain purchase of Huckleberry and revaluation of

equity investment in Huckleberry of $109.8 million in 2017 compared

to $nil in 2018, an increase in net loss of $109.8 million.

- Rehabilitation costs of $0.2 million in 2018 compared to $5.8

million in 2017, a decrease in net loss of $5.6 million.

- Other income totalled $108.1 million in 2018 largely due to the

settlement of $106.2 million, net of costs pertaining to the August

4, 2014 tailings dam breach at the Mount Polley Mine (“Mount Polley

Breach”) compared to an expense of $0.3 million in 2017, a decrease

in net loss of $107.8 million.

- An income and mining tax recovery of $38.1 million in 2018

compared to a recovery of $10.6 million in 2017, a decrease in net

loss of $27.5 million.

The 2018 net loss included foreign exchange loss

related to changes in CDN$/US$ exchange rate of $38.4 million

compared to foreign exchange gain of $30.4 million in 2017. The

$38.4 million foreign exchange loss in 2018 is comprised of a $36.4

million loss on the Senior Notes, a $0.6 million loss on short term

loans, and a $1.4 million loss on operational items. The average

CDN$/US$ exchange rate in the 2018 was 1.296 compared to an average

of 1.298 in 2017.

Cash flow was $143.4 million in 2018 compared to

cash flow of $88.4 million in 2017. Cash flow is a measure used by

the Company to evaluate its performance, however, it is not a term

recognized under IFRS. The Company believes Cash flow is

useful to investors and it is one of the measures used by

management to assess the financial performance of the Company.

Capital expenditures were $77.0 million in 2018,

down from $92.9 million in 2017. The 2018 expenditures included

$34.8 million for tailings dam construction, $35.7 million on

equipment and components and $6.5 million for other capital

items.

At December 31, 2018 the Company had $18.6

million in cash (December 31, 2017-$51.9 million). The Company has

classified $603.6 million of its non-current debt as current at

December 31, 2018 (December 31, 2017-$213.9 million).

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net income, adjusted EBITDA, cash flow and cash

cost per pound of copper produced which are described in detail

below. The Company believes these measures are useful to investors

because they are included in the measures that are used by

management in assessing the financial performance of the

Company.

Adjusted net income, adjusted EBITDA, and cash

flow are not generally accepted earnings measures and should not be

considered as an alternative to net income (loss) and cash flows as

determined in accordance with IFRS. As there is no standardized

method of calculating these measures, these measures may not be

directly comparable to similarly titled measures used by other

companies.

Adjusted Net Loss and Adjusted Net Loss

per Share

Adjusted net loss in 2018 was $84.8 million

($0.71 per share) compared to an adjusted net loss of $62.6.million

($0.66 per share) in 2017. Adjusted net income or loss shows the

financial results excluding the effect of items not settling in the

current period and non-recurring items. Adjusted net income or loss

is calculated by removing the gains or loss, resulting from

acquisition and disposal of property, mark to market revaluation of

derivative instruments not related to the current period, net of

tax, unrealized foreign exchange gains or losses on non-current

debt, net of tax.

Adjusted EBITDA

Adjusted EBITDA in 2018 was $33.3 million

compared to $88.5 million in 2017. We define Adjusted EBITDA as net

income (loss) before interest expense, taxes, depletion and

depreciation, and as adjusted for certain other items.

Cash Flow and Cash Flow Per

Share

Cash flow in 2018 was $143.5 million compared to

$88.4 million in 2017. Cash flow per share was $1.21 in 2018

compared to $0.94 in 2017.

Cash flow and cash flow per share are measures

used by the Company to evaluate its performance however they are

not terms recognized under IFRS. Cash flow is defined as cash flow

from operations before the net change in non-cash working capital

balances, income and mining taxes, and interest paid and cash flow

per share is the same measure divided by the weighted average

number of common shares outstanding during the year.

Cash Cost Per Pound of Copper

Produced

The Company is primarily a copper producer and

therefore calculates this non-IFRS financial measure individually

for its three copper mines, Red Chris, Mount Polley and

Huckleberry, and on a composite basis for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping

charged to operations, mine and mill operating conditions, labour

and other cost inputs, transportation and warehousing costs,

treatment and refining costs, the amount of by-product and other

revenues, the US$ to CDN$ exchange rate and the amount of copper

produced. Idle mine costs during the periods when the Huckleberry

mine was not in operation have been excluded from the cash cost per

pound of copper produced.

| Calculation of Cash Cost Per Pound of

Copper Produced expressed in thousands, except cash cost per pound

of copper produced |

| |

Year Ended December 31, 2018 |

| |

Red |

Mount |

|

| Chris |

Polley |

Composite |

| Cash

cost of copper produced in US$ |

$141,223 |

$29,032 |

$170,255 |

| Copper produced –

pounds |

|

60,349 |

|

14,974 |

|

75,323 |

| Cash

cost per lb copper produced in US$ |

$2.34 |

$1.94 |

$2.26 |

| |

Year Ended December 31, 2017 |

| |

Red |

Mount |

|

| Chris |

Polley |

Composite |

| Cash cost of copper

produced in US$ |

$143,891 |

$44,183 |

$188,073 |

| Copper produced –

pounds |

|

74,636 |

|

19,071 |

|

93,707 |

| Cash cost per lb copper

produced in US$ |

$1.93 |

$2.32 |

$2.01 |

DEVELOPMENTS DURING 2018

Red Chris Mine

Fourth quarter metal production was 15.57

million pounds copper and 12,366 ounces gold, an increase of 15%

and 41% respectively from the 13.55 million pounds copper and 8,741

ounces gold produced in the third quarter of 2018. Metal recoveries

in the fourth quarter were 76.21% copper and 50.57% gold, compared

to 74.92% copper and 45.65% gold in the third quarter of 2018.

Annual recoveries for 2018 were 75.60% for copper and 47.13% for

gold.

Annual metal production for 2018 was 60.35

million pounds copper and 41,935 ounces gold, both at 97% of the

revised production targets. The mill achieved 97.4% of design

capacity, treating an average of 29,228 tonnes per calendar day.

| Annual Production

for the Years Ended December 31 |

2018 |

2017 |

|

|

| Ore milled -

tonnes |

10,668,313 |

10,378,181 |

|

|

| Ore milled per calendar

day - tonnes |

29,228 |

28,433 |

|

|

| Grade % -

copper |

0.339 |

0.413 |

|

|

| Grade g/t -

gold |

0.259 |

0.233 |

|

|

| Recovery % -

copper |

75.60 |

79.01 |

|

|

| Recovery % -

gold |

47.13 |

43.00 |

|

|

| Copper – 000’s

pounds |

60,349 |

74,636 |

|

|

| Gold – ounces |

41,935 |

33,416 |

|

|

| Silver –

ounces |

103,634 |

133,157 |

|

|

The five haul trucks from Huckleberry mine were

fully operational within the first quarter of 2018. The newly

procured electric hydraulic shovel was operational in the third

quarter of 2018.

In the third and fourth quarters of 2018, the

Company used its own resources for the construction of the tailings

impoundment area because the independent contractors constructing

the tailings impoundment area were redirected to respond to the

wildfires in the local region. This diversion of primary mine

operations hauling units to the tailings impoundment area resulted

in a lower productivity in mining operations during those

periods.

MillSlicer was installed on the SAG mill in July

2018 to improve overall control of the mill. This vibration-based

signal is in addition to the electronic ear, bearing pressure and

mill power used in controlling mill fill level. Expectations from

the increased response time of these new signals is improved

production and mill liner life.

Work was initiated on the diagnosing of the high

clay ore in the mineralized faults present in the Main zone and

East zone, with results integrated into operational recovery models

in advance of the 2019 Production Plan. Segregation of faulted

material for plant-scale batch processing of fault material

commenced in the fourth quarter of 2018, with the first planned

plant-scale ‘baseline’ run in January 2019.

Work advanced on the underground resource

conceptualization in conjunction with Golder Associates. In the

second quarter of 2018, a geotechnical hole was completed to gather

geotechnical information regarding the proposed block cave;

notably, this hole also intersected significant copper and gold

mineralization below the East zone pit. Work on a preliminary

economic assessment of the block cave potential, incorporating the

information from the geotechnical drill hole, was initiated in 2018

by Golder Associates.

In the 2018 third quarter, the management

structure at Red Chris mine was reorganized. Randall Thompson,

Imperial Vice President Operations, was appointed as Red Chris Mine

General Manager, with a mandate to direct improvements of the mine

operations.

Exploration, development and capital

expenditures were $62.9 million in 2018 compared to $57.8 million

in 2017.

Mount Polley Mine

Fourth quarter metal production was 3.18 million

pounds copper and 7,983 ounces gold. Mill throughput averaged

17,467 tonnes per calendar day during the 2018 fourth quarter.

Metal recoveries in the fourth quarter were 39.05% copper and

59.71% gold. The mill treated an average of 16,975 tonnes per

calendar day while achieving recoveries of 52.89% copper and 67.25%

gold.

Annual metal production for 2018 was 14.97

million pounds copper and 37,120 ounces gold, respectively 96% and

94% of the revised production targets.

Milling of low grade stockpiles is targeted to

continue until May 2019, at which time the mine will be placed on

care and maintenance until the economics of mining at Mount Polley

improve.

|

Annual Production for the Years Ended December 31 |

2018 |

2017 |

|

|

| Ore milled -

tonnes |

6,195,760 |

6,723,188 |

|

|

| Ore milled per calendar

day - tonnes |

16,975 |

18,420 |

|

|

| Grade % -

copper |

0.207 |

0.199 |

|

|

| Grade g/t -

gold |

0.277 |

0.322 |

|

|

| Recovery % -

copper |

52.89 |

64.53 |

|

|

| Recovery % -

gold |

67.25 |

68.93 |

|

|

| Copper – 000’s

pounds |

14,974 |

19,071 |

|

|

| Gold – ounces |

37,120 |

48,009 |

|

|

| Silver –

ounces |

33,458 |

36,626 |

|

|

Dredging of tailings, deposited in the Springer

pit in 2015-2016 to allow for restart of milling operations prior

to repair of the tailings storage facility, commenced in early

2018. Mining operations in the Cariboo pit were completed in late

2018, and the mill relied on feed from the low grade stockpiles

since that time. Dredging work in the Springer pit was suspended

for the winter.

The South Springer is an area with potential to

significantly increase mineral resource estimates. The

mineralization is under the saddle separating the Cariboo and

Springer Phase 6 pits, which presents an ideal location for

additional low stripping ratio reserves, assuming planned drilling

is positive. With the configuration of the Cariboo pit providing an

excellent platform to conduct exploration drilling, follow up on

2012 drilling is planned for a future date.

During the spring of 2018 a four hole diamond

drill program was completed totalling 953.12 m. The holes were

drilled in the Saddle area between the Springer and Cariboo pits to

confirm mineralization in this area for future mining plans. This

information has been incorporated into the mine’s block model.

In early 2018, Mount Polley was in mediation

with USW Local 1-2017 to renew a collective agreement which had

terminated December 31, 2017. Mediation efforts proved

unsuccessful, and on May 23, 2018 Mount Polley initiated a lock out

of its employees, following which unionized employees began strike

action. Following further negotiations, in August 2018

unionized employees voted 79% to accept a new three year contract,

effective as at January 1, 2018.

In November 2018, the legal action for damages

arising from the Mount Polley Breach was settled among all parties

to the action, in consideration of net payments to the Company

totaling approximately CDN$108 million. This settlement represents

compromises of disputed claims and does not constitute an admission

of liability on the part of any party to the action.

Exploration, development, and capital

expenditures were $13.3 million in 2018 compared to $27.7 million

in 2017.

Huckleberry Mine

Huckleberry mine ceased mine operations in

August 2016, and remains on care and maintenance.

A preliminary plan to restart the mine has been

developed, and will be under consideration for implementation, at

such time when the economics of mining improve. In the interim, the

Company will develop exploration programs designed to expand the

resource.

Ruddock Creek Project

The Ruddock Creek lead-zinc project is operated

by way of a joint venture with Imperial, Mitsui Mining and Smelting

Co. Ltd. and Itochu Corporation. Imperial operates the project

through its wholly owned subsidiary Ruddock Creek Mining

Corporation. Japan Oil, Gas and Metals National Corporation

agreed to fund Imperial’s share of the 2018 drill program and upon

the completion of the program has the assignable right to be vested

in an approximate 1.57% Participating Interest in the joint

venture. At that time Imperial’s interest will reduce to

approximately 48.43%.

Drill results from the first surface diamond

drill hole RD-18-V41 at the Ruddock Creek Project were reported in

September 2018 (of a planned three hole program targeting the deep

extension of the V-Zone). Results from the first surface diamond

drill hole RD-18-V41, included 21.7 m grading 16.99% zinc, 3.44%

lead and 2.41 g/t silver, which included 10.4 m grading 25.70%

zinc, 5.41% lead and 3.44 g/t silver. The drill hole targeted the

V-Zone mineralization 425 m below surface and about 300 m below the

deepest previous mineralized intercept in the zone. Drill hole

RD-18-V41 was collared near the valley floor of Oliver Creek at an

elevation of approximately 1,191 m above sea level and drilled to a

final depth of 828.8 m.

The V-Zone is located near the western edge of

the Ruddock Creek massive sulphide horizons, which have an

indicated strike length of about five km, and is approximately two

km west of the Creek Zone, the nearest zone of detailed

drilling. Little or no exploration drilling has been

conducted along the intervening section of the horizon. The V-Zone

strikes east-west and dips at about 70° to the north. The zone had

been traced with surface showings and by shallow drilling for a

horizontal distance of about 700 m, and with this recent

intersection, to a depth of approximately 425 m. Due to the

steep terrain, long nearly flat drill holes from near the valley

bottom were designed to test the zone at depth. Hole RD-18-V41 was

drilled using an underground diamond drill rig bolted to a road

accessible cliff face at an azimuth of 27° and a dip of plus 10°.

Core size was HQ to a depth of 450 m. When the core size was

reduced to NQ size, the hole was drilled to a final depth of 828.8

m.

The decision to drill test the V-Zone at such a

depth beneath the nearest intercept was supported by the highly

predictable nature of the zinc-lead mineralization intercepted in

the shallower helicopter supported surface diamond drill holes,

electromagnetic and magnetic geophysical anomalies, and a

re-interpretation of the geology. The V-Zone in hole RD-18-V41,

which was projected to be intersected at a depth of 750 m, was

intercepted at 751.5 m, confirming the anticipated predictability

of the zone at depth. The highest grades previously intersected in

the V-Zone were in holes RD-12-V38, which intercepted 17.77% zinc

and 3.72% lead over a true width of approximately 7.6 m, and

RD-12-V40, which intercepted 10.00% zinc and 1.80% lead over a true

width of approximately 10.9 m.

Drill hole RD-18-42, drilled at -10° below

RD-18-41 to a final depth of 1,003.9 m, targeted the mineralization

300 m below the intersection in hole RD-18-41, at an estimated in

hole depth of 834 m. Unfortunately, the hole intersected a late

stage pegmatite dyke or sill from a depth of 805-956 m with no

significant base metal mineralization intersected.

Drill hole RD-18-43, drilled at 0° (flat) in

between RD-18-41 and 42 to a final depth of 831.5 m, targeted the

mineralization 120 m below the intersection in hole RD-18-41 at an

estimated in hole depth of 790-800 m. The favorable calc-silicate

host rock was intersected from 747-775 m with narrow 2-10 cm,

stringer semi-massive sphalerite-galena mineralized bands

intersected but not comparable to the intersection in hole

RD-18-41. The best two intervals intersected were 6.31% zinc, 0.5%

lead and 11.0 g/t silver over 0.5 m from 751.44 m to 751.94 m,

grading 5.89% zinc and 0.04% lead over 0.5 m from 767.18 m to

767.68 m. The intervals are approximately true thickness.

SJ Geophysics completed an in-hole EM and

Magnetic survey in hole RD-18-43 but holes RD-18-41 and 42 were not

able to be surveyed due to hole conditions. The survey outlined a

significant off-hole EM and Magnetic response for such a zinc rich

system in the area of the favorable calc-silicate host and stringer

style zinc-lead mineralization.

Jim Miller-Tait, P.Geo., VP Exploration is the

designated Qualified Person as defined by National Instrument

43-101 for the exploration program, and has reviewed and approved

disclosure relating to drill hole RD-18-V41. Ruddock Creek

samples for the 2018 drilling reported were analyzed at Bureau

Veritas Mineral Laboratories in Vancouver, British Columbia. A full

QA/QC program using blanks, standards and duplicates was

completed.

Plans for further exploration of the western

edge of the massive sulphide horizons have been developed and are

being discussed with our joint venture partners.

FOURTH QUARTER RESULTS

Revenue in the fourth quarter of 2018 was $91.7

million compared to $140.5 million in 2017. Sales revenue is

recorded when title for concentrate is transferred on ship loading.

Variations in revenue are impacted by the timing and quantity of

concentrate shipments, metal prices and exchange rates, and period

end revaluations of revenue attributed to concentrate shipments

where copper and gold prices will settle at a future date along

with finalization of contained metals as a result of final

assays.

The Company recorded a net loss of $44.3 million

($0.37 per share) in the fourth quarter of 2018 compared to net

loss of $2.1 million ($0.02 per share) in the prior year quarter.

The fourth quarter of 2017 involved $35.0 million of the net income

related to the finalization of the gain on bargain purchase of

Huckleberry and revaluation of equity investment in

Huckleberry.

Expenditures for exploration and ongoing capital

projects at Mount Polley, Red Chris and Huckleberry totaled $14.2

million during the three months ended December 31, 2018 compared to

the expenditures for exploration and ongoing capital projects at

Mount Polley, Red Chris and Sterling which totaled $17.3 million in

the 2017 comparative quarter.

OUTLOOK

Corporate and Operations

At December 31, 2018 the Company had not hedged

any copper, gold or CDN$/US$ exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the CDN$/US$

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

The 2018 annual base and precious metals

production from the Red Chris and Mount Polley mines was 75.32

million pounds copper and 79,056 ounces gold.

On March 10, 2019, Imperial entered into an

agreement to sell a 70% interest in the Red Chris mine to Newcrest

for US$806.5 million in cash. Imperial and Newcrest will form a

joint venture for the operation of the Red Chris mine going

forward, with Newcrest acting as operator. This joint venture

partnership will enable Imperial to unlock significant value at Red

Chris by leveraging Newcrest’s unique technical expertise in block

caving operations. With a stronger financial position and highly

actionable path to exploiting the underground mining potential of

Red Chris, Imperial will be in a much stronger position to create

value and opportunities for its shareholders, stakeholders and the

Tahltan Nation. The closing is expected to occur in the third

quarter of 2019, with an outside date for closing of August 15,

2019.

Imperial announced on January 7, 2019 that due

to declining copper prices, Mount Polley operations would be

suspended.

Exploration

Imperial has interests in various other early

stage exploration properties, and sufficient work will be conducted

to keep these properties in good standing.

At Mount Polley, future additional diamond

drilling is planned in the vicinity of the Springer pit to infill

areas where information is lacking and additional mineralization

may be present. And, a program of ground magnetometer surveying

will continue in conjunction with targeted areas of soil sampling,

prospecting and geological mapping.

At Huckleberry, the Company will develop

exploration programs designed to expand the resource.

At Ruddock Creek, plans for further exploration

of the western edge of the massive sulphide horizons have been

developed and are being discussed with our joint venture

partners.

Development

The 2019 Red Chris production plan was developed

following an in-depth review of historic data, with key assumptions

being identified and validated against past performance. The plan

reflects a lower mining rate as compared to 2018 (105,000 tonnes

per day vs. 130,000 tonnes per day). The metal for 2019 was

estimated by a similar application of historic data for

incorporation of mill availability, throughput (tonnes per

operating hour) and recovery.

In February 2019, extreme cold temperatures

resulted in freezing of available water beyond expectations. There

was sufficient free water to maintain operations, however only at a

reduced rate (24,785 tonnes per day vs 30,000 tonnes per day). The

poor quality of the water available also had a negative impact on

copper recoveries. Operations are returning to normal, as volumes

of run-off increase, and as ice thaws with the warmer early Spring

temperatures.

At Mount Polley, extreme cold winter

temperatures impacted Mount Polley mill throughput during the

latter part of January and all of February 2019. Freezing ore in

chutes and stockpiles limited the milling rates. During February

2019, only 9,764 dry metric tonnes were treated per calendar day

milled (versus 17,531 dry metric tonnes during February 2018).

Since then, warmer Spring temperatures have helped to improve mill

throughput, however, to achieve the production targets, throughput

during April and May will need to increase.

Milling of low grade stockpiles are targeted to

continue until May 2019, at which time the mine will be placed on

care and maintenance until the economics of mining at Mount Polley

improve. There will be no impact to ongoing environmental

monitoring and remediation programs.

At Huckleberry, a preliminary plan to restart

the mine has been developed, and will be under consideration for

implementation, at such time when the economics of mining

improve.

For detailed information, refer to Imperial’s 2018 Annual Report

available on imperialmetals.com and sedar.com.

|

Earnings Announcement Conference Call

April 1, 2019 at 8:00am PDT

| 11:00pm EDT Management will discuss the

Company’s 2018 Financial Results. To participate in the earnings

announcement conference call dial toll-free 833.231.8250 (North

America) or 647.689.5116 (International). A recording of the

conference call will be available for playback until April 8, 2019

by calling 855.859.2056 (North America-toll free) playback code

5188586 |

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company. The Company, through its

subsidiaries, owns the Red Chris, Mount Polley and Huckleberry

copper mines in British Columbia. Imperial also holds a 50%

interest in the Ruddock Creek lead/zinc property. Imperial

recently announced an agreement with Newcrest to sell a 70%

interest in Red Chris to Newcrest for US$806.5 million, while

retaining a 30% interest in the mine. The Company and Newcrest will

form a joint venture for the operation of the Red Chris mine going

forward, with Newcrest acting as the operator.

Company Contacts

Brian Kynoch | President |

604.669.8959 Andre Deepwell | Chief Financial

Officer | 604.488.2666 Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Forward-Looking Information & Risks

Notice

The information in this news release provides a

summary review of the Company’s operations and financial position

as at and for the year ended December 31, 2018, and has been

prepared based on information available as at March 29, 2019.

Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking

information which are prospective in nature and reflect the current

views and/or expectations of Imperial. Often, but not always,

forward-looking information can be identified by the use of

statements such as "plans", "expects" or "does not expect", "is

expected", "scheduled", "estimates", "forecasts", "projects",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would",

"might" or "will" be taken, occur or be achieved. Such information

in this document includes, without limitation, statements

regarding: expectations that the agreement to sell a 70% interest

in the Company’s Red Chris mine to Newcrest will successfully close

and within necessary time frames, resulting in the joint venture

between the parties for the operation of the Red Chris asset going

forward, with Newcrest acting as operator; the 2019 production

targets for the Red Chris and Mount Polley mines; expectations that

Red Chris mine operations are expected to return to normal as

run-off water volumes increase due to the warmer early Spring

temperatures; expectations that milling of the low grade stockpiles

at Mount Polley will continue until May 2019, at which time that

mine will be put on care and maintenance until the economics of

mining at Mount Polley improve; consideration for implementation of

a preliminary plan to restart the Huckleberry mine at such time

when the economics of mining improve; costs and timing of current

and proposed exploration and development, including plans to

conduct future additional diamond drilling at Mount Polley in the

vicinity of the Springer pit and ground magnetometer surveying, and

plans to further explore the western edge of the massive sulphide

horizons at Ruddock Creek; production and marketing; capital

expenditures; adequacy of funds for projects and liabilities; the

receipt of necessary regulatory permits, approvals or other

consents; outcome and impact of litigation; cash flow; working

capital requirements; the requirement for additional capital;

results of operations, production, revenue, margins and earnings;

future prices of copper and gold; future foreign currency exchange

rates and impact; future accounting changes; and future prices for

marketable securities.

Forward-looking information is not based on

historical facts, but rather on then current expectations, beliefs,

assumptions, estimates and forecasts about the business and the

industry and markets in which the Company operates, including, but

not limited to, assumptions that: the agreement to sell a 70%

interest in the Company’s Red Chris mine to Newcrest will

successfully close and within necessary time frames, enabling the

Company to satisfy its debt obligations and repay its credit

facilities as they become due; the Company will have access to

capital as required and will be able to fulfill its funding

obligations as the Red Chris minority joint venture partner; the

Company will be able to advance and complete remaining planned

rehabilitation activities within expected timeframes; there will be

no significant delay or other material impact on the expected

timeframes or costs for completion of rehabilitation of the Mount

Polley mine and implementation of Mount Polley’s long term water

management plan; the Company’s initial rehabilitation activities at

Mount Polley will be successful in the long term; all required

permits, approvals and arrangements to proceed with planned

rehabilitation and Mount Polley’s long term water management plan

will be obtained in a timely manner; there will be no material

operational delays at the Red Chris mine; equipment will operate as

expected; there will not be significant power outages; there will

be no material adverse change in the market price of commodities

and exchange rates; the Red Chris mine will achieve expected

production outcomes (including with respect to mined grades and

mill recoveries and access to water as needed). Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations. We can give no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information involves known and

unknown risks, uncertainties and other factors which may cause

Imperial’s actual results, revenues, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the statements constituting

forward-looking information.

Important risks that could cause Imperial’s

actual results, revenues, performance or achievements to differ

materially from Imperial’s expectations include, among other

things: the risk that the agreement to sell a 70% interest in the

Company’s Red Chris mine to Newcrest will not successfully close

and within necessary time frames, jeopardizing the Company’s

ability to satisfy its debt obligations and repay its credit

facilities as they become due, and undermining the Company’s

ability to continue as a going concern; the risk that the Company’s

ownership of the Red Chris mine may be diluted over time should it

not have access to capital as required and will not be able to meet

its funding obligations as the Red Chris minority joint venture

partner; that additional financing that may be required may not be

available to Imperial on terms acceptable to Imperial or at all;

uncertainty regarding the outcome of sample testing and analysis

being conducted on the area affected by the Mount Polley Breach;

risks relating to the timely receipt of necessary approvals and

consents to proceed with the rehabilitation plan and Mount Polley’s

long term water management plan; risks relating to the remaining

costs and liabilities and any unforeseen longer-term environmental

consequences arising from the Mount Polley Breach; uncertainty as

to actual timing of completion of rehabilitation activities and the

implementation of Mount Polley’s long term water management plan;

risks relating to the impact of the Mount Polley Breach on

Imperial’s reputation; the quantum of claims, fines and penalties

that may become payable by Imperial and the risk that current

sources of funds are insufficient to fund liabilities; risks that

Imperial will be unsuccessful in defending against any legal claims

or potential litigation; risks of protesting activity and other

civil disobedience restricting access to the Company’s properties;

failure of plant, equipment or processes to operate in accordance

with specifications or expectations; cost escalation,

unavailability of materials and equipment, labour unrest, power

outages, and natural phenomena such as weather conditions and water

shortages negatively impacting the operation of the Red Chris mine;

changes in commodity and power prices; changes in market demand for

our concentrate; inaccurate geological and metallurgical

assumptions (including with respect to the size, grade and

recoverability of mineral reserves and resources); and other

hazards and risks disclosed within the Management’s Discussion and

Analysis for the year ended December 31, 2018, and other public

filings, which are available on Imperial’s profile at sedar.com.

For the reasons set forth above, investors should not place undue

reliance on forward-looking information. Imperial does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

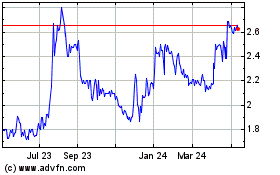

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

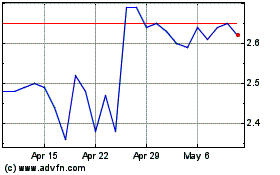

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025