Imperial Reports Production for 2019 First Quarter

May 01 2019 - 4:02PM

Imperial Metals Corporation (the “Company”)

(TSX:III) reports its metal production from the Red Chris and Mount

Polley mines for the 2019 first quarter was 15.41 million pounds

copper and 14,463 ounces gold.

Red Chris first quarter metal production was

13.10 million pounds copper and 8,317 ounces gold. Mill throughput

averaged 26,315 tonnes per calendar day during the first quarter,

down from the 28,783 achieved in the same quarter last year. Metal

recoveries were 73.84% copper and 48.06% gold, compared to 77.22%

copper and 47.37% gold in the comparable 2018 quarter.

The reduced throughput and recovery in the

quarter were the result of challenges with water reclaim quantity

and quality. A large portion of the available water in the Tailings

Impoundment Area became unavailable due to freezing, owing to

extreme cold temperatures. Operations were sustained by utilizing

the available free water to continue operations at a reduced rate.

The period of reduced operations extended from about February 9 to

March 28, with warming temperatures and adjusted tailings

deposition management providing sufficient water for operations to

return to normal throughput rates.

Mount Polley first quarter metal production was

2.31 million pounds copper and 6,147 ounces gold. Mill throughput

averaged 13,653 tonnes per calendar day during the first quarter.

Metal recoveries were 38.37% copper and 57.47% gold, compared to

75.67% copper and 73.75% gold in the comparable 2018 quarter.

Copper oxide percentages in the 2019 first quarter averaged 40.9%,

up substantially from the average of 13.4% in the comparable 2018

quarter. Copper oxide content negatively impacted metal recoveries

as copper oxide minerals do not respond well to flotation recovery

methods.

Extremely cold winter temperatures also affected

the Mount Polley mill throughput during the first quarter.

Freezing ore in chutes and stockpiles limited the milling

rates from the latter part of January into late February. During

February 2019, only 9,764 dry metric tonnes were treated per

calendar day milled, versus 17,531 dry metric tonnes treated during

February 2018. Warmer temperatures in March improved mill

throughput, which averaged over 16,000 tonnes per day in March and

about 18,000 tonnes per day for the first 20 days of April. Milling

of low grade stockpiles are targeted to continue to the end of May

2019, at which time the mine will be placed on care and maintenance

until there is a sustained improvement in the price of

copper.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company. The Company, through its

subsidiaries, owns the Red Chris, Mount Polley and Huckleberry

copper mines in British Columbia. Imperial also holds a 50%

interest in the Ruddock Creek lead/zinc property. Imperial

recently announced an agreement with Newcrest to sell a 70%

interest in Red Chris to Newcrest for US$806.5 million, while

retaining a 30% interest in the mine. The Company and Newcrest will

form a joint venture for the operation of the Red Chris mine going

forward, with Newcrest acting as the operator.

Company Contacts

Brian Kynoch | President |

604.669.8959 Andre Deepwell | Chief Financial

Officer | 604.488.2666 Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Cautionary Note Regarding

Forward-Looking Statements

Forward-looking statements relate to future

events or future performance and reflect Company management's

expectations or beliefs regarding future events and include, but

are not limited to, statements relating to expectations that low

grade stockpiles at Mount Polley are sufficient to maintain milling

operations until the end of May 2019 at which time the mine will be

placed on care and maintenance until there is sustained improvement

in the price of copper. In certain cases, forward-looking

statements can be identified by the use of words such as "plans",

"expects" or "does not expect", "is expected", "outlook", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others, risks related to

changes in project parameters as plans continue to be refined;

future prices of mineral resources; possible variations in ore

reserves, grade or recovery rates; accidents; dependence on key

personnel; labour pool constraints; labour disputes; availability

of infrastructure required for the development of mining projects;

delays in obtaining governmental approvals or financing; that

additional required financing may not be available to the Company

on terms acceptable to the Company or at all; counterparty risks

associated with sales of our metals; changes in general economic

conditions; increased operating and capital costs; and other risks

of the mining industry as well as those factors detailed from time

to time in the Company's interim and annual financial statements

and management's discussion and analysis to those statements, all

of which are filed and available for review on sedar.com. Although

the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking statements.

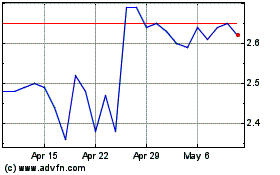

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

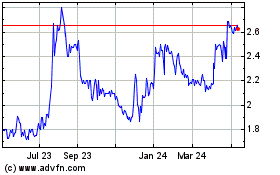

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025