Imperial Closes Sale of a 70% Interest in Red Chris

August 15 2019 - 5:31PM

Imperial Metals Corporation (the “Company”)

(TSX:III) announces the closing of the previously announced sale of

a 70% interest in its Red Chris copper and gold mine in British

Columbia, Canada to Newcrest Mining Limited (“Newcrest”) (ASX: NCM)

for a final purchase price of US$804 million subject to debt and

working capital adjustments. Inclusive of the near term settlement

of some of these adjustments, Imperial received approximately

US$775 million in net cash consideration.

The Company and Newcrest have formed a joint

venture for the operation of Red Chris with Newcrest acting as

operator. The Company retains a 30% joint venture interest in the

Red Chris mine.

The Company’s President, Brian Kynoch, said: “We

are pleased to have the Red Chris mine move to this next chapter,

and to have completed this transaction with Newcrest. The

sale of a 70% interest in Red Chris to Newcrest will allow Imperial

to significantly strengthen its balance sheet, while continuing to

hold a 30% interest in a joint venture that will leverage

Newcrest’s unique technical expertise in block caving

operations. We look forward to working alongside Newcrest

with this new venture as well as the resumption of exploration

activities at Red Chris. As a result of this transaction,

Imperial will be in a much better position to create value and

opportunities for its shareholders and stakeholders.”

Newcrest’s Managing Director and CEO, Sandeep

Biswas, said: “We are delighted to have closed the Red Chris

transaction and add this operating mine to our existing low cost,

long-life portfolio. We are pleased with the highly

constructive and collaborative relationship we are developing with

the Tahltan Nation and the Government of British Columbia and look

forward to working together as we execute our forward work plan to

unlock the significant potential from Red Chris. We are

excited to establish a strong presence in British Columbia, Canada,

a quality mining jurisdiction in a country with roots in mining,

much like Australia.”

The proceeds from the sale will be used to repay

certain existing debt obligations, with remaining funds to be

utilized for working capital purposes.

Borden Ladner Gervais LLP acted as the Company’s

legal counsel and BMO Capital Markets acted as financial advisor in

connection with the transaction.

Other Projects

Imperial’s Mount Polley and Huckleberry sites

have additional exploration targets which provide opportunity to

discover additional and potentially higher-grade resources near the

existing facilities, to add to mine life and strengthen operations

when these mines reopen. This strategy worked well at Mount Polley,

when in late 2003 the high grade Northeast zone (the highest-grade

deposit at Mount Polley) was discovered while this mine was on care

and maintenance.

At the Company’s highly prospective Ruddock

Creek zinc/lead project near Clearwater, an 8,000 metre drilling

program initiated in June is expected to be completed by the end of

September 2019. This diamond drill program is focused on expanding

the Q and V zones located on the western-most edge of the five

kilometer long deposit, and is following up on results from

RD-18-V41 which intercepted 21.7 metres grading 16.99% zine and

3.44% lead, and 2.41 g/t silver in 2018 (ref: Sept 19/18).

About Imperial

Imperial is a Vancouver exploration, mine

development and operating company. The Company, through its

subsidiaries, owns a 30% interest in the Red Chris mine, and a 100%

interest in both the Mount Polley and Huckleberry copper mines in

British Columbia. Imperial also holds a 48% interest in the Ruddock

Creek lead/zinc property.

About Newcrest

Newcrest is the largest gold producer listed on

the Australian Securities Exchange and one of the world’s largest

gold mining companies. Newcrest owns and operates a portfolio of

predominantly low cost, long life mines and a strong pipeline of

brownfield and greenfield exploration projects. Newcrest’s asset

portfolio includes operating mines that use a variety of efficient

mining methods for large ore bodies, together with selective

underground mining methods to optimize high-grade epithermal

deposits.

Company Contacts

Brian Kynoch | President |

604.669.8959Andre Deepwell | Chief Financial

Officer | 604.488.2666Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

FORWARD-LOOKING STATEMENTS & RISKS

NOTICE

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding: the use of

proceeds from the sale, including repayment of debt to strengthen

the Company’s balance sheet; unlocking of significant value at Red

Chris by leveraging Newcrest’s unique technical expertise in block

caving operations or otherwise; the creation of value and

opportunities for shareholders and stakeholders; and the resumption

of exploration at Red Chris and the benefits therefrom. In making

the forward-looking statements in this release, the Company has

applied certain factors and assumptions that are based on

information currently available to the Company as well as the

Company’s current beliefs and assumptions. These factors and

assumptions and beliefs and assumptions include, among others, that

Newcrest will be able to achieve and extrapolate synergies between

its Cadia orebody in Australia and the Red Chris orebody and that

exploration will resume at Red Chris. By their very nature

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

factors include, among others, risks that Newcrest may not be able

to realize the full value potential for the Red Chris mine; risks

that Newcrest may not be able to maximize the value of Red Chris

and the opportunities in the surrounding region; risks that

synergies and similarities anticipated between Newcrest’s Cadia

orebodies and the Red Chris orebody may not be as anticipated;

exploration at Red Chris may not resume as or when expected or may

fail to realize the expected benefits; and the risk factors

detailed from time to time in the Company’s interim and annual

financial statements and management’s discussion and analysis of

those statements, all of which are filed and available for review

on SEDAR at www.sedar.com. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended, many of which are beyond the Company’s ability to control

or predict. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and all forward-looking statements in

this news release are qualified by these cautionary statements.

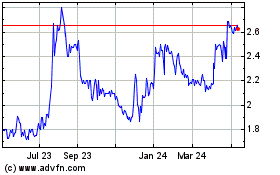

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

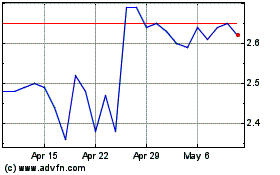

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025