Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for the three months ended

March 31, 2020, as summarized in this release and discussed in

detail in the Management’s Discussion & Analysis. The Company’s

financial results are prepared in accordance with International

Financial Reporting Standards. The reporting currency of the

Company is the Canadian (“CDN”) Dollar.

QUARTER HIGHLIGHTS

FINANCIAL

On February 20, 2019 the Company initiated a

process for the sale of the Red Chris mine and in accordance with

IFRS, the Company classified Red Chris mine as a discontinued

operation effective January 1, 2019 up until the closing of the

transaction with Newcrest on August 14, 2019. Effective August 15,

2019 the results from the Red Chris Mine are presented on a

proportionate basis relative to Imperial’s 30% ownership in the

joint venture. Unless otherwise stated, this news release only

compares the comparative quarter results from continuing operations

and excludes discontinued operations even though the Red Chris mine

is in both discontinued operations pre and post August 15,

2019.

Total revenue from continuing operations

increased to $28.0 million in the March 2020 quarter compared to

$13.8 million in the 2019 comparative quarter, an increase of $14.2

million or 102.9%. The March 2019 amount only included revenue from

the Mount Polley Mine as the revenues from the Red Chris mine was

classified in discontinued operations. However, in the 2020

quarter, the Company included its portion of the 30% interest in

the Red Chris mine. In March 2019, the revenue from discontinued

operations was $62.9 million.

In the March 2020 quarter, the Red Chris mine

(100% basis) had 4.3 concentrate shipments (2019-2.6 concentrate

shipments). Variations in revenue are impacted by the timing and

quantity of concentrate shipments, metal prices and exchange rates,

and period end revaluations of revenue attributed to concentrate

shipments where copper and gold prices will settle at a future

date.

The London Metals Exchange cash settlement

copper price per pound averaged US$2.56 in the March 2020 quarter

compared to US$2.82 in the 2019 comparative quarter. The London

Metals Exchange cash settlement gold price per troy ounce averaged

US$1,583 in the March 2020 quarter compared to US$1,304 in the 2019

comparative quarter. The average CDN/US Dollar exchange rate was

1.345 in the March 2020 quarter, 1.1% higher than the exchange rate

of 1.329 in the March 2019 quarter. In CDN Dollar terms the average

copper price in the March 2020 quarter was CDN$3.44 per pound

compared to CDN$3.75 per pound in the 2019 comparative quarter, and

the average gold price in the March 2020 quarter was CDN$2,128 per

ounce compared to CDN$1,734 per ounce in the 2019 comparative

quarter.

Revenue in the March 2020 quarter decreased by

$4.6 million due to a negative revenue revaluation as compared to a

$2.5 million positive revenue revaluation in the 2019 comparative

quarter. Revenue revaluations are the result of the copper price on

the settlement date and/or the current period balance sheet date

being higher or lower than when the revenue was initially recorded

or the copper price at the last balance sheet date and finalization

of contained metal as a result of final assays.

Net loss from continuing operations for the

March 2020 quarter was $6.2 million ($0.05 per share) compared to

net loss of $2.3 million ($0.02 per share) in the 2019 comparative

quarter. The increase in net loss of $3.9 million was primarily due

to the following factors:

- Loss from mine operations went from $2.5 million in March 2019

to $0.3 million in March 2020, a decrease in net loss of $2.2

million.

- Interest expense went from $18.4 million in March 2019 to $0.4

million in March 2020, an increase in net income of $18.0

million.

- Foreign exchange gains/losses went from a gain of $8.9 million

in March 2019 to a gain of $2.0 million in March 2020, an increase

in net loss of $6.9 million.

- Tax recovery went from $14.1 million in March 2019 to an

expense of $0.9 million in March 2020, an increase in net loss of

$15.0 million.

The average CDN/US Dollar exchange rate in the

March 2020 quarter was 1.345 compared to an average of 1.329 in the

2019 comparative quarter.

Cash flow was $2.5 million in the March 2020

quarter compared to $nil in the 2019 comparative quarter. Cash flow

is a measure used by the Company to evaluate its performance,

however, it is not a term recognized under IFRS. The Company

believes Cash flow is useful to investors and it is one of the

measures used by management to assess the financial performance of

the Company.

Capital expenditures were $11.6 million in the

March 2020 quarter, up from $0.7 million in the 2019 comparative

quarter.

At March 31, 2020, the Company has not hedged

any copper, gold or CDN/US Dollar exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the CDN/US Dollar

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

OPERATIONS

Red Chris Mine (1)

Red Chris first quarter metal production was

22.5 million pounds copper and 17,427 ounces gold, up from 21.7

million pounds copper and 12,155 ounces gold in the fourth quarter

of 2019. Imperial’s 30% portion of the first quarter

production was 6.7 million pounds copper and 5,228 ounces gold.

Gold production in the 2020 first quarter

compared to 2019 fourth quarter increased by 43% as a result of a

56% increase in gold grade (0.32 g/t to 0.50 g/t) and a 21%

improvement in gold recovery (44.5% to 55.7%), partially offset by

a reduction in mill throughput. The higher grade in the quarter was

enabled by mining of the lower benches of Phase 4. During the first

quarter, the mill throughput was capped at a lower than normal rate

as part of a water conservation plan implemented to conserve water

during the winter. With Spring melt now occurring, the cap on

through put rate has been removed.

Mining has been declared an essential service in

the province of British Columbia. The Company has been advised that

Newcrest has implemented measures that meet or exceed Canadian and

Provincial requirements in British Columbia. The Tahltan Central

Government, Iskut First Nation and Tahltan Band have agreed with

Newcrest’s implementation of a package of further measures which

proactively protect and support communities and enable Tahltan

members to support their families and communities, while helping

Red Chris to continue to operate during the COVID-19 pandemic.

Changes include alteration of the employee work schedule during the

COVID-19 pandemic to provide for longer on and off-site periods, to

decrease the amount of travel required and enable First Nation

employees increased time to self-isolate before returning to their

local communities.

|

|

Three Months Ended March 31* |

|

|

2020 |

2019 |

| Ore milled - tonnes |

1,964,226 |

2,368,337 |

| Ore milled per calendar day –

tonnes |

21,585 |

26,315 |

| Grade % - copper |

0.618 |

0.034 |

| Grade g/t - gold |

0.496 |

0.227 |

| Recovery % - copper |

83.9 |

73.84 |

| Recovery % - gold |

55.7 |

48.06 |

| Copper – 000’s pounds |

22,451 |

13,100 |

| Gold – ounces |

17,427 |

8,317 |

| Silver

– ounces |

44,549 |

22,627 |

* 100% Red Chris mine production

Two drilling programs are underway at Red Chris.

The East zone Resource Definition Programme is designed to obtain

geological, geotechnical and metallurgical data to support future

studies for underground block cave mining. The Brownfields

Exploration Programme is focused on searching for additional zones

of higher grade mineralization within the Red Chris porphyry

corridor. A total of 14,641 metres of drilling was completed

in the March 2020 quarter, contributing to a total of 29,383 metres

of drilling completed since Newcrest acquired its 70% interest in

Red Chris on August 15, 2020.

A new high grade zone has been intersected by

RC616 within the East zone, returning a partial intercept of 238

metres grading 1.5 g/t gold and 0.85% copper, including 104 metres

grading 2.7 g/t gold and 1.4% copper, and 32 metres grading 6.2 g/t

gold and 3% copper. This high grade zone has not been intersected

by previous drilling and is located 300 metres west of the high

grade zone previously intersected by RC611. This drilling confirms

the potential of finding additional discrete high grade pods of

mineralization within the East zone. Follow up drilling to define

the extent of the RC616 high grade zone is being planned.

The final results from RC611 (partial results

reported March 10, 2020) has confirmed that the hole has

intersected a broad zone of higher grade mineralization, 628 metres

grading 1.7 g/t gold and 0.91% copper that contains a discrete high

grade zone averaging more than 5 g/t gold. This zone was previously

intersected by Imperial in RC09-350 which returned an interval of

152.5 metres grading 4.12% copper and 8.83 g/t gold starting at a

depth of 540 metres. Hole RC611 was the first angled hole

intersection which has confirmed this high grade pod as being

approximately 100 metres long, 100 metres wide and 200 metres in

height. An additional 10 resource definition holes are planned to

be drilled to further understand the full potential of this zone

and search for additional high grade pods within the East zone.

Drilling continues to expand the footprint of

mineralization in the Gully zone and Far West zone. Mineralization

has been observed over a broad area 800 metres long, 800 metres

wide and over 1,000 metres vertically. The best grades within this

area, which are more than 0.5 g/t gold, are in at least five

discrete zones open in multiple directions requiring additional

follow-up drilling to determine their full extent. Results from

RC609 demonstrate the potential of the porphyry corridor, the first

test of the Far West by Newcrest and Imperial, intersecting

mineralization some 200 metres below historical drilling and is the

most westerly drill hole on the property. Significant

intercepts were released on April 29, 2020.

The Company’s share of exploration, development

and capital expenditures were $11.3 million in the March 2020

quarter compared to $9.3 million in the 2019 comparative

quarter.

Mount Polley Mine

Mount Polley mine operations were shut down in

May 2019, and the mine is on care and maintenance status pending

improvement of the economics of mining. Site personnel are

maintaining access, fire watch, and managing the collection,

treatment and discharge of site contact water.

Mount Polley has an option to earn a 100%

interest in seven mineral claims (3,331 ha), adjacent to the mine.

Three target settings occur within the optioned claims and adjacent

Mount Polley claims, including a potential northern projection of

the high-grade Quarry zone beneath a post-mineral conglomerate

unit, a partially tested glacial till covered area where regional

magnetics suggests a faulted offset of the Mount Polley Intrusive

complex, which hosts the Mount Polley orebodies, is present and

a till covered prospective area immediately east of the

Southeast zone. A deep looking IP survey, along with a soil

sampling program, was completed over the optioned claims. Drill

programs have been designed to test the targets outlined on the

optioned claims and to expand the copper and gold resource near

historic deposits, with a focus on gold rich zones.

For the quarter ending March 31, 2020, Mount

Polley incurred idle mine costs comprised of $2.8 million in

operating costs and $1.2 million in depreciation expense.

Huckleberry Mine

Huckleberry mine operations were shut down in

August 2016, and the mine is on care and maintenance status,

pending improvement of the economics of mining. Activities at the

mine site have focused on water management, snow removal,

maintenance of site infrastructure and equipment and environmental

compliance monitoring. The tailings management facilities are

actively monitored.

The Huckleberry East zone pit has historically

provided the highest grade mill feed, and the majority drilling in

the zone was only to a depth of about 300 metres, and often ended

in above cut-off grade copper mineralization. A drill program to

test the East zone at depth has been designed to test the deposit

below the historic drilling.

For the quarter ending March 31, 2020,

Huckleberry incurred idle mine costs comprised of $1.2 million in

operating costs and $0.2 million in depreciation expense.

Operations Outlook

Plans are in progress to conduct exploration

drilling at Mount Polley and Huckleberry. The restart of operations

at the site, will be dependent on metal prices, however if the

planned exploration proves successful, metal prices required for

restart may be reduced.

Earlier, we described the current impact of

COVID-19 on our business. The Company’s plans for 2020 and beyond

could be adversely impacted by the effects of the coronavirus

global pandemic. In particular, the continued spread of the

coronavirus and travel and other operating restrictions established

to curb the spread of coronavirus, could materially and adversely

impact the Company’s current plans by causing a temporary closure

of the Red Chris mine, suspending planned exploration work, causing

an economic slowdown resulting in a decrease in the demand for

copper and gold, negatively impacting copper and gold prices,

impacting the Company’s ability to transport or market the

Company’s concentrate or causing disruptions in the Company’s

supply chains.

EARNINGS AND CASH FLOW

The Company completed the sale of 70% interest

in the Red Chris mine to Newcrest on August 15, 2019. As a result,

this operation was classified as a discontinued operation effective

January 1, 2019 to August 14, 2019.

Select Quarter Financial

Information

| |

Three Months Ended March 31 |

|

expressed in thousands, except share and per share amounts |

|

|

2020 |

|

|

2019 |

|

|

Continuing Operations: |

|

|

|

|

Total revenues |

|

$ |

27,965 |

|

$ |

13,803 |

|

|

Net loss |

|

$ |

(6,210 |

) |

$ |

(2,337 |

) |

|

Net loss per share |

|

$ |

(0.05 |

) |

$ |

(0.02 |

) |

|

Diluted income (loss) per share |

|

$ |

(0.05 |

) |

$ |

(0.02 |

) |

|

Adjusted net loss (1) |

|

$ |

(5,926 |

) |

$ |

(11,389 |

) |

|

Adjusted net loss per share (1) |

|

$ |

(0.05 |

) |

$ |

(0.09 |

) |

|

Adjusted EBITDA(1) |

|

$ |

2,534 |

|

$ |

(3,566 |

) |

|

Cash flow (1)(2) |

|

$ |

2,477 |

|

$ |

25 |

|

|

Cash flow per share (1)(2) |

|

$ |

0.02 |

|

$ |

(0.00 |

) |

|

|

|

|

|

|

Discontinued Operations: |

|

|

|

|

Total revenues |

|

$ |

- |

|

$ |

62,878 |

|

|

Net income |

|

$ |

- |

|

$ |

69 |

|

|

Net income per share |

|

$ |

- |

|

$ |

0.00 |

|

|

Diluted income (loss) per share |

|

$ |

- |

|

$ |

0.00 |

|

|

Adjusted net loss (1) |

|

$ |

- |

|

$ |

(225 |

) |

|

Adjusted net loss per share (1) |

|

$ |

- |

|

$ |

(0.00 |

) |

|

Adjusted EBITDA(1) |

|

$ |

- |

|

$ |

10,553 |

|

|

Cash flow (1)(2) |

|

$ |

- |

|

$ |

10,260 |

|

|

Cash flow per share (1)(2) |

|

$ |

- |

|

$ |

0.08 |

|

|

|

|

|

|

|

Working capital (deficiency) |

|

$ |

42,311 |

|

$ |

(727,836 |

) |

|

Total assets |

|

$ |

1,061,851 |

|

$ |

1,588,745 |

|

|

Total debt (including current portion) |

|

$ |

3,762 |

|

$ |

874,329 |

|

|

(1) Refer to table under heading Non-IFRS Financial Measures

for further details. |

|

(2) Cash flow is defined as the cash flow from operations before

the net change in non-cash working capital balances, income and

mining taxes, and interest paid. Cash flow per share is defined as

Cash flow divided by the weighted average number of common shares

outstanding during the year. |

Select Items Affecting Net Income (Loss)

(presented on an after-tax basis)

| |

Three Months Ended March 31 |

|

expressed in thousands |

|

2020 |

|

|

2019 |

|

| Net loss from continuing

operations before undernoted items |

$ |

(5,529 |

) |

$ |

(9,254 |

) |

|

Interest expense |

|

(397 |

) |

|

(13,423 |

) |

|

Recovery of BC Mineral taxes including interest |

|

- |

|

|

11,288 |

|

|

Foreign exchange gain (loss) on debt |

|

(284 |

) |

|

9,052 |

|

|

Net Loss from continuing operations |

$ |

(6,210 |

) |

$ |

(2,337 |

) |

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net income, adjusted EBITDA, cash flow and cash

cost per pound of copper produced which are described in detail

below. The Company believes these measures are useful to investors

because they are included in the measures that are used by

management in assessing the financial performance of the

Company.

Adjusted net income, adjusted EBITDA, and cash

flow are not generally accepted earnings measures and should not be

considered as an alternative to net income (loss) and cash flows as

determined in accordance with IFRS. As there is no standardized

method of calculating these measures, these measures may not be

directly comparable to similarly titled measures used by other

companies.

Adjusted Net Loss and Adjusted Net Loss

per Share

Adjusted net loss from continuing operations in

the March 2020 quarter was $5.9 million ($0.05 per share) compared

to an adjusted net loss of $11.4 million ($0.09 per share) in the

2019 comparative quarter. Adjusted net income or loss shows the

financial results excluding the effect of items not settling in the

current period and non-recurring items. Adjusted net income or loss

is calculated by removing the gains or loss, resulting from

acquisition and disposal of property, mark to market revaluation of

derivative instruments not related to the current period, net of

tax, unrealized foreign exchange gains or losses on non-current

debt, net of tax.

Adjusted EBITDA

Adjusted EBITDA from continuing operations in

the March 2020 quarter was $2.5 million compared to a loss of $3.6

million in the 2019 comparative quarter. We define Adjusted EBITDA

as net income (loss) before interest expense, taxes, depletion and

depreciation, and as adjusted for certain other items.

Cash Flow and Cash Flow Per

Share

Cash flow from continuing operations in the

March 2020 quarter was $2.5 compared to $nil in the 2019

comparative quarter. Cash flow per share was $0.04 in the March

2020 quarter compared to $nil in the 2019 comparative quarter.

Cash flow and cash flow per share are measures

used by the Company to evaluate its performance however they are

not terms recognized under IFRS. Cash flow is defined as cash flow

from operations before the net change in non-cash working capital

balances, income and mining taxes, and interest paid and cash flow

per share is the same measure divided by the weighted average

number of common shares outstanding during the year.

Cash Cost Per Pound of Copper

Produced

The Company is primarily a copper producer and

therefore calculates this non-IFRS financial measure individually

for its three copper mines, Red Chris (30% share), Mount Polley and

Huckleberry, and on a composite basis for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping

charged to operations, mine and mill operating conditions, labour

and other cost inputs, transportation and warehousing costs,

treatment and refining costs, the amount of by-product and other

revenues, the US$ to CDN$ exchange rate and the amount of copper

produced.

Idle mine costs during the periods when the

Huckleberry and Mount Polley mines were not in operation have been

excluded from the cash cost per pound of copper produced.

| Calculation of Cash Cost Per Pound of Copper

Produced expressed in thousands, except cash cost per pound of

copper produced |

|

|

|

Three Months Ended March 31, 2020 |

|

|

Red |

**Mount |

|

|

Chris |

Polley |

Composite |

|

Cash cost of copper produced in US$ |

$ |

9,954 |

$ |

- |

$ |

9,954 |

|

Copper produced – pounds |

|

6,735 |

|

- |

|

6,735 |

|

Cash cost per lb copper produced in US$ |

$ |

1.48 |

$ |

- |

$ |

1.48 |

|

|

|

|

|

Three Months Ended March 31, 2019 |

|

|

*Red |

**Mount |

|

|

Chris |

Polley |

Composite |

|

Cash cost of copper produced in US$ |

$ |

35,429 |

$ |

7,069 |

$ |

42,497 |

|

Copper produced – pounds |

|

13,100 |

|

2,305 |

|

15,405 |

|

Cash cost per lb copper produced in US$ |

$ |

2.70 |

$ |

3.07 |

$ |

2.76 |

|

|

|

|

|

* The Red Chris Mine was classified as a discontinued operation

effective January 1, 2019 to August 14, 2019. Effective August 15,

2019, the results from Red Chris are presented in continuing

operations on a proportional basis relative to Imperial’s 30%

beneficial interest in the joint venture.

** The Mount Polley mine was placed on care and

maintenance on May 26, 2019.

SUBSEQUENT EVENT

On April 27, 2020 the Company announced a Normal

Course Issuer Bid to provide for purchases of its common shares to

satisfy its obligations under the Non-Management Directors’ Plan

and the Share Purchase Plan. Incorrect information with respect to

the number of shares repurchased by the Company in the previous 12

months and the related average price thereof was reported in that

News Release. The Company has corrected the information and advises

that in the previous 12 months it had repurchased 167,963 of its

outstanding common shares at an average price per share of

$2.00.

For detailed information, refer to Imperial’s

2020 First Quarter Report available on imperialmetals.com and

sedar.com.

About Imperial

Imperial is a Vancouver exploration, mine

development and operating company. The Company, through its

subsidiaries, owns a 30% interest in the Red Chris mine, and a 100%

interest in both the Mount Polley and Huckleberry copper mines in

British Columbia. Imperial also holds a 45.3% interest in the

Ruddock Creek lead/zinc property.

Company Contacts

Brian Kynoch | President |

604.669.8959Andre Deepwell | Chief Financial

Officer | 604.488.2666Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding expectations

regarding the care, maintenance and rehabilitation activities at

Mount Polley and Huckleberry, expectations and timing regarding

current and future exploration and drilling programs, expectations

regarding exploration results and metal prices required to restart

the Mount Polley and Huckleberry mines, expectations regarding

preventative measures implemented by Newcrest in response to the

COVID-19 pandemic and expectations about the future impacts of the

COVID-19 pandemic on the Company and the Company’s ability to

continue operations in lieu of the pandemic.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

release, the Company has applied certain factors and assumptions

that are based on information currently available to the Company as

well as the Company’s current beliefs and assumptions. These

factors and assumptions and beliefs and assumptions include, the

risk factors detailed from time to time in the Company’s interim

and annual financial statements and management’s discussion and

analysis of those statements, all of which are filed and available

for review on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended, many of which are beyond the Company’s

ability to control or predict. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

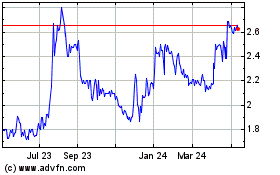

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2024 to Jan 2025

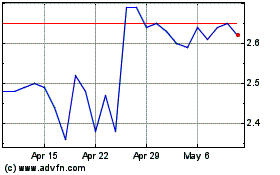

Imperial Metals (TSX:III)

Historical Stock Chart

From Jan 2024 to Jan 2025