Imperial Provides Update on Mount Polley 2023 Production

January 17 2024 - 5:06PM

Imperial Metals Corporation (“Imperial”) (TSX:III)

reports that 2023 metal production from Mount Polley was 30.145

million pounds of copper and 41,834 ounces of gold. The mine

achieved the low end of its target of 30–33 million pounds for

copper production and exceeded the high end of its target of 35-40

thousand ounces for gold production.

Red Chris production will be released when the

reconciled information is received from Newmont Corporation

(“Newmont”).

Mount Polley Mine

During the fourth quarter 1,567,491 tonnes of

ore were treated (up 44.6% compared to Q4 2022), this increase is

partially due to improved plant availability of 88.3% (up 22% from

Q4 2022). During the quarter 8.348 million pounds copper (up 120.5%

from Q4 2022) and 10,349 ounces gold (up 48.0% from Q4 2022) were

produced.

With the damaged third ball mill returned to

service in October, the November mill throughput averaged 19,609

tonnes per day, and from December 20th to 30th mill throughput

averaged 20,076 tonnes per day. With all the mills operational the

plant is nearing historic throughput highs and achieving better

availability while maintaining strong copper and gold

recoveries.

Approximately 2/3 of the tailings stored in the

Springer Pit had been removed by year end and the remaining

tailings are expected to be removed by the end of the first quarter

2024.

|

Mount Polley Mine Production |

Three Months Ended December 31 |

|

Year Ended December 31 |

|

|

2023 |

2022 |

|

2023 |

2022* |

|

Ore milled - tonnes |

1,567,491 |

1,084,016 |

|

5,948,239 |

2,068,830 |

|

Ore milled per calendar day - tonnes |

17,038 |

11,783 |

|

16,297 |

11,244 |

|

Grade % - copper |

0.302 |

0.230 |

|

0.287 |

0.214 |

|

Grade g/t - gold |

0.286 |

0.325 |

|

0.311 |

0.306 |

|

Recovery % - copper |

79.9 |

68.9 |

|

80.0 |

63.5 |

|

Recovery % - gold |

71.8 |

61.8 |

|

70.4 |

59.4 |

|

Copper – 000’s pounds |

8,348 |

3,786 |

|

30,145 |

6,206 |

|

Gold – ounces |

10,349 |

6,995 |

|

41,834 |

12,078 |

*production from restart of operations in late

June to December 31, 2022

The 2024 production target for Mount Polley is

34–37 million pounds copper and 37-41 thousand ounces gold.

Red Chris Update

Newmont completed the acquisition of Newcrest

Mining Limited during the fourth quarter of 2023 and holds 70%

interest in the Red Chris mine. Newmont noted, in a presentation,

that considerations for 2024 include “Taking time to assess

and integrate the Newcrest assets; thoughtful approach to

longer-term view”. Newmont has since taken over the block

cave Feasibility Study with further details to be released by

Imperial when the information is received from Newmont. Newmont’s

reserve and resource estimates are expected to be released along

with Newmont’s 2023 year-end results. Being a US listed issuer, the

Newmont reserve and resource statement for Red Chris mine and will

be reported in line with SEC reporting standards, not NI 43-101

standards.

During the quarter, diamond drill rigs continued

to explore at Red Chris. Diamond drilling was focused in the East

Zone block cave area gathering geological and geotechnical

information.

Block Cave development continues with the second

ventilation raise bore expected to be on schedule for completion

within the first half of 2024. The ramp is now more than halfway to

the extraction level elevation.

Brian Kynoch, P.Eng., Imperial’s President has

reviewed the disclosures contained in this news release and is the

designated Qualified Person as defined by National Instrument

43-101 (“NI 43-101”).

About ImperialImperial is a

Vancouver based exploration, mine development and operating company

with holdings that include the Mount Polley mine (100%), the

Huckleberry mine (100%), and the Red Chris mine (30%). Imperial

also holds a portfolio of 23 greenfield exploration properties in

British Columbia.

Imperial ContactsBrian Kynoch

| President | 604.669.8959Darb

Dhillon | Chief Financial Officer

| 604.488.2658

Cautionary Note Regarding

Forward-Looking StatementsCertain information contained in

this news release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Imperial

management’s expectations or beliefs regarding future events and

include, but are not limited to statements regarding: expected gold

head grades; meeting production targets; production expectations

for Red Chris and Mount Polley mine production; exploration at Red

Chris; Imperial’s expectations and timing with respect to current

and planned drilling programs at Red Chris, including plans with

respect to the completion of the Feasibility Study; potential

change in strategy of the current and planned drilling programs at

Red Chris; and the expected completion of the first ventilation

raise bore at the Red Chris mine.

In certain cases, forward-looking statements can

be identified by the use of words such as “plans”, “expects” or

“does not expect”, “is expected”, “is targeted”, “targets”,

“outlook”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved" or the negative of these

terms or comparable terminology. By their very nature

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Imperial to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements.

In making the forward-looking statements in this

news release, Imperial has applied certain factors and assumptions

that are based on information currently available to Imperial as

well as Imperial’s current beliefs and assumptions. These factors

and assumptions and beliefs and assumptions include, the risk

factors detailed from time to time in Imperial’s interim and annual

financial statements and management’s discussion and analysis of

those statements, all of which are filed and available for review

on SEDAR+ at www.sedarplus.com. Although Imperial has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended, many of which are beyond Imperial’s ability to control or

predict. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward

looking statements and all forward-looking statements in this news

release are qualified by these cautionary statements.

imperialmetals.com

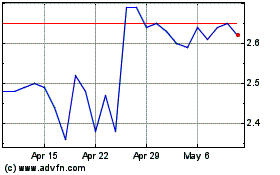

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

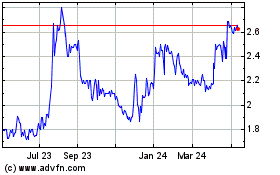

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024