Starcore Reports Loss for First Quarter of 2013

December 14 2012 - 1:47PM

Marketwired

Starcore International Mines Ltd. (TSX:SAM) (the "Company") has

filed the results for the first quarter ended October 31, 2012 for

the Company and its mining operations. The full version of the

Company's Financial Statements and Management's Discussion and

Analysis can be viewed on the Company's website at

www.starcore.com, or SEDAR at www.sedar.com. All financial

information is prepared in accordance with IFRS and all dollar

amounts are expressed in thousands of Canadian dollars unless

otherwise indicated.

Three months ended October 31, 2012 First Quarter

Highlights:

-- The mine experienced significant metallurgical recovery problems over

the last two quarters due to ore characteristics in one of the ore zones

and to water quality;

-- Over the current quarter, gold recovery averaged only 69% and at the

same time, ore grades were lowered to an average of 2.01 g/t;

-- The mine, however, produced sufficient tonnage, compared to prior

periods, to increase production of metal where possible;

-- As a result of the above, the Company only produced 3,900 equivalent

ounces ("EqOz") of gold;

-- We have fixed the recovery problems as of mid October and gold recovery

has subsequently improved to over 75%;

-- November production is estimated at 1,598 EqOz at a grade of 2.37 g/t of

gold and 17 g/t of silver with recoveries of 75% and 55%, respectively,

on over 25,300 tonnes of ore;

-- As a result of the above issues, mined ore revenues were only $6.5

million, compared to $10.6 million in mined ore revenues during the

comparative prior year period.

-- Mine operating cash costs were $1,073EqOz compared to $548EqOz in the

comparative period and $724EqOz for the prior fiscal year ended July 31,

2012, due mainly to lower metal production and to higher mine

preparation and exploration costs coupled with generally higher global

price increases in consumables used in gold production;

-- Earnings from mining operations were $1.25 million compared to $7.32

million in the comparative prior year period.

-- Other total expenses of $1,597 include financing costs of $427,

management fees and salaries of $455 and deferred income tax expense of

$311. Included in these expenses are $266 of non-cash share based

compensation expense;

-- Loss for the period was $346 compared to earnings of $3.2 million during

the comparative prior year period. Basic and diluted loss per share was

$0.0, compared to $0.03 and $0.02, respectively, in the comparative

period in the previous year;

-- Cash flows from operations were $2.0 million, compared to $6.0 million

during the comparative prior year period. Cash decreased to $1.7 million

at October 31, 2012 after investing $838 in mine development, plant and

assets and repaying $2.8 million of the loan;

"The Company has endured a difficult few months of poor mine

production due to production issues which have largely been

resolved. We expect to return to historical production levels with

improved recovery and ore grade over the next few quarters and to

improve cash flows so as to pursue our exploration objectives with

a view to finding more reserves, as previously stated," said Robert

Eadie, Executive Chairman and CEO of the Company.

About Starcore

Starcore is engaged in exploring, extracting and processing gold

and silver through its wholly-owned subsidiary, Compania Minera

Pena de Bernal, S.A. de C.V., which owns the San Martin mine in

Queretaro, Mexico. The Company is a public reporting issuer on the

Toronto Stock Exchange. The Company is also engaged in owning,

acquiring, exploiting, exploring and evaluating mineral properties,

and either joint venturing or developing these properties further.

The Company has interests in properties which are exclusively

located in Mexico.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained herein may constitute

forward-looking statements and are made pursuant to the provisions

of Canadian securities laws. Forward-looking statements are

statements which relate to future events. Such statements include

estimates, forecasts and statements as to management's expectations

with respect to, among other things, business and financial

prospects, financial multiples and accretion estimates, future

trends, plans, strategies, objectives and expectations, including

with respect to production, exploration drilling, reserves and

resources, exploitation activities and events or future operations.

In some cases, you can identify forward-looking statements by

terminology such as "may", "should", "expects", "plans,

"anticipates", believes", "estimates", "predicts", "potential", or

"continue" or the negative of these terms or other comparable

terminology. These statements are only predictions and involve

known and unknown risks, uncertainties and other factors that may

cause our or our industry's actual results, level of activity,

performance or achievements to be materially different from any

future results, levels of activity, performance, or achievements

expressed or implied by these forward-looking statements. While

these forward-looking statements, and any assumptions upon which

they are based, are made in good faith and reflect our current

judgment regarding the direction of our business, actual results

will almost always vary, sometimes materially, from any estimates,

predictions, projections, assumptions or other future performance

suggestions herein. Except as required by applicable law, the

Company does not intend to update any forward-looking statements to

conform these statements to actual results.

ON BEHALF OF STARCORE INTERNATIONAL MINES LTD.

Gary Arca, Chief Financial Officer and Director

The Toronto Stock Exchange has not reviewed nor does it accept

responsibility for the adequacy or accuracy of this press

release.

Contacts: Starcore International Mines Ltd. Gary Arca Chief

Financial Officer and Director 1-604-602-4935 or Toll Free:

1-866-602-4935 1-604-602-4936 (FAX)info@starcore.com

www.starcore.com

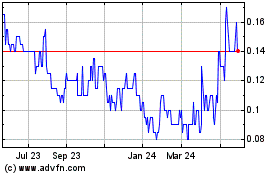

Starcore International M... (TSX:SAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

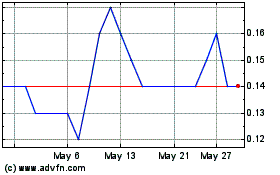

Starcore International M... (TSX:SAM)

Historical Stock Chart

From Feb 2024 to Feb 2025