(All metal prices reported in USD)

- Bolivar’s improved operating performance resulted in a 69% and

130% increase in copper equivalent production over Q3 2022 and Q4

2021, respectively.

- A measured and progressive approach to reach full operating

capacity at Yauricocha continues, following the mudslide in Q3

2022.

- Consolidated 2022 copper equivalent production decreased 29%

compared to 2021 due to lower production at Yauricocha resulting

from the suspension of mining operations and lower grades across

all metals, except for gold.

Sierra Metals Inc. (TSX: SMT) (“Sierra Metals” or

the “Company”) reports fourth quarter and full year 2022 production

results. Results are from Sierra Metals’ three underground mines in

Latin America: The Yauricocha polymetallic mine in Peru, the

copper-producing Bolivar mine and the silver-producing Cusi mine in

Mexico.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230126005881/en/

Truck being loaded at Bolivar Rom Pad

headed to Concentrate Plant (Photo: Business Wire)

Ernesto Balarezo, Interim CEO of Sierra Metals, commented on a

challenging 2022 for the Company, “Early in the year, Yauricocha’s

throughput and grades were hindered by a shortage of mine and

service personnel due to the COVID-19 pandemic, as well as

permitting restrictions. In the third quarter, production was

halted due to the tragic mudslide event followed by a road

blockade. The mine’s throughput in Q4 declined by 43% when compared

to Q3 and 45% when compared to the same quarter last year. While

recovery toward Yauricocha’s full production potential continues,

safety remains our highest priority. To lead this initiative,

Sierra Metals has hired a Vice President, Health & Safety.

At Bolivar, progress in reducing the significant backlog in

drilling and mine development that arose during the pandemic was

delayed throughout the first half of the year, due to setbacks

encountered during the installation of critical infrastructure.

These delays were compounded in Q3 by unexpected flooding,

negatively affecting production during most of the quarter.

However, the Company achieved meaningfully improved performance

during Q4 due to infrastructure upgrades in pumping and

ventilation, which created improved conditions required to support

the advancement of the mine’s preparation and development. A 19%

increase in throughput along with improved head grades in all

metals resulted in a 69% increase in copper equivalent pounds

produced when compared to Q3 2022. When compared to Q4 2021,

throughput increased by 19% and copper equivalent production

increased by 130%.

Mr. Balarezo concluded, “I am encouraged by the production

improvements during the fourth quarter. Our primary goal in the new

year is to ramp up production at Yauricocha, stabilize production

at Bolivar and optimize Cusi’s production. We are committed to

ensuring operations run safely, efficiently and effectively with

efforts to streamline processes and reduce inefficiencies where

possible. Consistent with the Company’s efforts, the Special

Committee of the Board of Directors is continuing to diligently

pursue its strategic review process.”

Consolidated Production

Results

Consolidated Production Year Ended December 31, Q4

2022 Q3 2022 % Var. Q4 2021 % Var.

2022

2021

% Var.

Tonnes processed (t)

494,980

561,906

-12%

590,057

-16%

2,287,797

2,902,220

-21%

Daily throughput

5,657

6,422

-12%

6,743

-16%

6,537

8,292

-21%

Silver production (000 oz)

570

669

-15%

805

-29%

2,581

3,527

-27%

Copper production (000 lb)

6,170

6,299

-2%

6,071

2%

27,127

31,757

-15%

Lead production (000 lb)

2,071

3,878

-47%

6,011

-66%

13,498

30,816

-56%

Zinc production (000 lb)

6,367

10,815

-41%

14,913

-57%

38,100

79,281

-52%

Gold Production (oz)

3,411

2,199

55%

1,863

83%

10,155

9,572

6%

Copper equivalent pounds (000's)(1)

14,073

16,637

-15%

17,841

-21%

64,218

89,926

-29%

(1) Copper equivalent pounds were

calculated using the following realized prices:

Q4 2022 - $21.21/oz Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb,

$1,730/oz Au.

Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au.

Q4 2021 - $23.41/oz Ag, $4.40/lb Cu, $1.55/lb Zn, $1.06/lb Pb,

$1,795/oz Au.

FY 2022 - $21.77/oz Ag, $3.99/lb Cu,

$1.59/lb Zn, $0.98/lb Pb, $1,802/oz Au.

FY 2021 - $25.21/oz Ag, $4.23/lb Cu,

$1.37/lb Zn, $1.00/lb Pb, $1,796/oz Au.

Consolidated quarterly throughput during Q4 2022 was 494,980

tonnes, a decrease of 12% when compared to Q3 2022, mainly due to

the 43% decline in throughput at Yauricocha compared to Q3 2022. As

a result, consolidated copper equivalent production also declined

by 15% when compared to Q3 2022.

While a 19% increase in throughput during Q4 2022 at the Bolivar

Mine, combined with higher grades in all metals, provided a 69%

increase in copper equivalent production over the prior quarter, it

was not enough to offset the decline in production at Yauricocha.

When compared to Q4 2021, a 16% decrease in consolidated throughput

resulted in a 21% decrease in consolidated copper equivalent

production.

When comparing 2022 to 2021, a 21% decrease in consolidated

throughput provided a 29% decrease in copper equivalent pounds

produced.

Yauricocha Mine, Peru

Throughput from the Yauricocha Mine during Q4 2022 was 152,586

tonnes, a 43% decline when compared to the previous quarter due to

the reduced mining activity following the mudslide incident and the

community blockade that led to the suspension of mining operations

late in the third quarter. As the progressive restart to operations

continues, mining activity was limited to an average daily

throughput of 1,744 tonnes during Q4 2022.

When compared to Q4 2021, a 45% decrease in throughput at

Yauricocha, combined with lower head grades for all metals,

provided for a 56% decrease in copper equivalent pounds produced.

Yauricocha’s annual throughput was 1,053,980 tonnes, representing a

16% decrease when compared to the 2021 annual production.

The discovery of the higher-grade Fortuna zone during Q2 2022

was expected to help alleviate the challenges presented by

regulatory requirements, which currently limit mineable areas at

Yauricocha. However, plans to reap the full benefits of the new

zone were delayed, due to the tragic mudslide in September 2022

that significantly limited the mine’s production capacity for the

remainder of the year.

Production of all metals declined when compared to full year

2021. While copper grades increased by 9% and gold grades were

in-line, compared to 2021, these could not make up for the 16%

reduction in throughput and a 21%, 45% and 38% decrease in silver,

lead and zinc grades, respectively. Yauricocha’s annual copper

equivalent production decreased by 34% when compared to 2021.

A summary of production from the Yauricocha Mine for Q4 and Full

Year 2022 is provided below:

Yauricocha Production Year Ended December 31,

Q4 2022

Q3 2022

% Var.

Q4 2021

% Var.

2022

2021

% Var.

Tonnes processed (t)

152,586

269,057

-43%

277,531

-45%

1,053,980

1,256,847

-16%

Daily throughput

1,744

3,075

-43%

3,172

-45%

3,011

3,591

-16%

Silver grade (g/t)

42.25

47.61

-11%

51.34

-18%

43.49

55.01

-21%

Copper grade

0.66%

0.77%

-14%

0.82%

-20%

0.81%

0.74%

9%

Lead grade

0.63%

0.72%

-13%

1.03%

-39%

0.65%

1.18%

-45%

Zinc grade

2.21%

2.16%

2%

2.82%

-22%

1.99%

3.23%

-38%

Gold Grade (g/t)

0.41

0.41

0%

0.53

-23%

0.48

0.48

0%

Silver recovery

64.35%

62.27%

3%

72.26%

-11%

62.01%

77.21%

-20%

Copper recovery

72.57%

77.30%

-6%

76.44%

-5%

76.55%

72.92%

5%

Lead recovery

82.18%

83.60%

-2%

86.55%

-5%

79.92%

88.76%

-10%

Zinc recovery

85.69%

84.28%

2%

86.53%

-1%

81.94%

88.59%

-8%

Gold Recovery

21.63%

20.79%

4%

20.24%

7%

20.98%

21.03%

0%

Silver production (000 oz)

134

256

-48%

331

-60%

913

1,716

-47%

Copper production (000 lb)

1,621

3,514

-54%

3,836

-58%

14,541

14,856

-2%

Lead production (000 lb)

1,749

3,579

-51%

5,430

-68%

12,216

29,113

-58%

Zinc production (000 lb)

6,367

10,815

-41%

14,913

-57%

38,100

79,281

-52%

Gold Production (oz)

439

743

-41%

957

-54%

3,418

4,059

-16%

Copper equivalent pounds (000's)(1)

5,471

10,794

-49%

12,567

-56%

39,185

59,470

-34%

(1) Copper equivalent pounds were calculated using the

following realized prices:

Q4 2022 - $21.21/oz Ag, $3.63/lb Cu,

$1.37/lb Zn, $0.95/lb Pb, $1,730/oz Au.

Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au.

Q4 2021 - $23.41/oz Ag, $4.40/lb Cu,

$1.55/lb Zn, $1.06/lb Pb, $1,795/oz Au.

FY 2022 - $21.77/oz Ag, $3.99/lb Cu,

$1.59/lb Zn, $0.98/lb Pb, $1,802/oz Au.

FY 2021 - $25.21/oz Ag, $4.23/lb Cu,

$1.37/lb Zn, $1.00/lb Pb, $1,796/oz Au.

Bolivar Mine, Mexico

The Bolivar Mine processed 270,313 tonnes during Q4 2022, a 19%

increase compared to Q3 2022. Higher throughput, due to improved

ventilation and advancement in the mine’s development and

preparation, combined with higher grades in all metals, generated a

69% increase in copper equivalent production when compared to the

previous quarter. When compared to Q4 2021, throughput at Bolivar

was also 19% higher. A meaningfully improved 92.7% copper recovery

rate during the quarter, combined with a substantial improvement in

grades for copper, silver and gold, by 49%, 39% and 355%,

respectively, resulted in a 130% increase in copper equivalent

production, when compared to Q4 2021.

Annual throughput at Bolivar was 941,910 tonnes, representing a

30% decrease when compared to 2021. While the mine’s production

showed an improvement during the final quarter of the year, it

could not make up for the operational and production issues

experienced earlier in the year. Bolivar's annual copper equivalent

production declined by 24% when compared to 2021.

A summary of production for the Bolivar Mine for Q4 and Full

Year 2022 is provided below:

Bolivar Production Year Ended December 31, Q4

2022 Q3 2022 % Var. Q4 2021 % Var.

2022

2021

% Var.

Tonnes processed (t)

270,313

227,669

19%

227,722

19%

941,910

1,349,602

-30%

Daily throughput

3,089

2,602

19%

2,603

19%

2,691

3,856

-30%

Copper grade

0.82%

0.60%

37%

0.55%

49%

0.67%

0.72%

-7%

Silver grade (g/t)

13.25

12.14

9%

9.52

39%

12.29

15.49

-21%

Gold grade (g/t)

0.50

0.27

85%

0.11

355%

0.30

0.16

88%

Copper recovery

92.70%

92.05%

1%

80.79%

15%

90.48%

79.28%

14%

Silver recovery

81.43%

79.95%

2%

82.34%

-1%

82.39%

81.95%

1%

Gold recovery

64.52%

64.67%

0%

78.32%

-18%

64.81%

68.88%

-6%

Copper production (000 lb)

4,549

2,785

63%

2,235

104%

12,586

16,901

-26%

Silver production (000 oz)

93

71

31%

57

63%

305

551

-45%

Gold production (oz)

2,801

1,267

121%

634

342%

5,943

4,751

25%

Copper equivalent pounds (000's)(1)

6,432

3,799

69%

2,800

130%

16,931

22,207

-24%

(1) Copper equivalent pounds were calculated using the

following realized prices:

Q4 2022 - $21.21/oz Ag, $3.63/lb Cu,

$1.37/lb Zn, $0.95/lb Pb, $1,730/oz Au.

Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au.

Q4 2021 - $23.41/oz Ag, $4.40/lb Cu,

$1.55/lb Zn, $1.06/lb Pb, $1,795/oz Au.

FY 2022 - $21.77/oz Ag, $3.99/lb Cu,

$1.59/lb Zn, $0.98/lb Pb, $1,802/oz Au.

FY 2021 - $25.21/oz Ag, $4.23/lb Cu,

$1.37/lb Zn, $1.00/lb Pb, $1,796/oz Au.

Cusi Mine, Mexico

The Cusi Mine processed 72,081 tonnes of ore during Q4 2022,

representing an 11% increase over the previous quarter as mining

resumed in the area where flooding occurred earlier in the year.

The increased throughput helped offset the impact of lower grades

and a lower silver and gold recovery rate during the quarter.

Silver production remained flat when compared to Q3 2022 with a 1%

decline in silver equivalent production.

When compared to Q4 2021, a 15% decrease in throughput, combined

with a 4%, 19% and 36% decrease in silver, gold and lead grades,

respectively, resulted in a 20% decrease in silver equivalent

ounces produced. The decline in throughput and grades during Q4

2022, when compared to the same quarter of 2021, is attributable to

the successful mining of higher-grade ore from the NE system during

Q4 2021, which was an area of focus prior to the flooding event at

Cusi. There was no ore processed from the NE system in Q4 2022.

Annual throughput at Cusi Mine in 2022 was 291,907 tonnes or 1%

lower than 2021. In addition to higher silver grades, crushing and

grinding improvements at the plant have helped enhance silver and

gold recovery, resulting in an 8% increase in silver equivalent

production when compared to 2021.

A summary of production for the Cusi Mine for Q4 and Full Year

2022 is provided below:

Cusi Production Year Ended December 31,

Q4 2022

Q3 2022

% Var.

Q4 2021

% Var.

2022

2021

% Var.

Tonnes processed (t)

72,081

65,180

11%

84,804

-15%

291,907

295,771

-1%

Daily throughput

824

745

11%

969

-15%

834

845

-1%

Silver grade (g/t)

171.34

187.44

-9%

179.07

-4%

170.01

159.74

6%

Gold grade (g/t)

0.17

0.19

-11%

0.21

-19%

0.18

0.18

0%

Lead grade

0.25%

0.26%

-4%

0.39%

-36%

0.25%

0.32%

-22%

Silver recovery (flotation)

86.44%

87.24%

-1%

85.52%

1%

85.28%

82.98%

3%

Gold recovery (lixiviation)

44.56%

48.28%

-8%

47.29%

-6%

46.73%

45.05%

4%

Lead recovery

81.51%

80.70%

1%

80.69%

1%

79.39%

81.78%

-3%

Silver production (000 oz)

343

342

0%

417

-18%

1,363

1,260

8%

Gold production (oz)

171

189

-10%

272

-37%

794

762

4%

Lead production (000 lb)

322

299

8%

581

-45%

1,282

1,703

-25%

Silver equivalent ounces (000's)(1)

372

374

-1%

465

-20%

1,487

1,382

8%

(1) Silver equivalent ounces were calculated using the

following realized prices:

Q4 2022 - $21.21/oz Ag, $3.63/lb Cu,

$1.37/lb Zn, $0.95/lb Pb, $1,730/oz Au.

Q3 2022 - $19.26/oz Ag, $3.51/lb Cu,

$1.49/lb Zn, $0.90/lb Pb, $1,730/oz Au.

Q4 2021 - $23.41/oz Ag, $4.40/lb Cu,

$1.55/lb Zn, $1.06/lb Pb, $1,795/oz Au.

FY 2022 - $21.77/oz Ag, $3.99/lb Cu,

$1.59/lb Zn, $0.98/lb Pb, $1,802/oz Au.

FY 2021 - $25.21/oz Ag, $4.23/lb Cu,

$1.37/lb Zn, $1.00/lb Pb, $1,796/oz Au.

Strategic Review Process

The Company announced, on October 18, 2022, the formation of a

Special Committee and the initiation of a strategic review process.

The mandate of the Special Committee, comprised of its independent

directors, includes exploring, reviewing and considering options to

optimize the operations of the Company and possible financing,

restructuring and strategic options in the best interests of the

Company. The Special Committee continues to diligently execute this

process with financial advisors led by CIBC Capital Markets.

Quality Control

Américo Zuzunaga, FAusIMM (Mining Engineer) is a Qualified

Person under National Instrument 43-101 – Standards of Disclosure

for Mineral Projects.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company with

Green Metal exposure including copper production and base metal

production with precious metals byproduct credits, focused on the

production and development of its Yauricocha Mine in Peru, and

Bolivar and Cusi Mines in Mexico. The Company is focused on

increasing production volume and growing mineral resources. The

Company also has large land packages at all three mines with

several prospective regional targets providing longer-term

exploration upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals

| Facebook: SierraMetalsInc | LinkedIn: Sierra Metals

Inc | Instagram: sierrametals

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 16,

2022 for its fiscal year ended December 31, 2021 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005881/en/

Investor Relations Sierra Metals Inc. Tel: +1 (416)

366-7777 Email: info@sierrametals.com

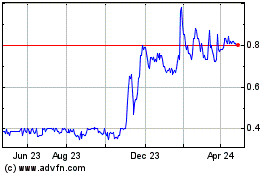

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Feb 2025 to Mar 2025

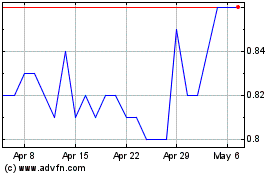

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Mar 2024 to Mar 2025