TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced its results for the second quarter ended June 30, 2024.

All amounts are shown in U.S. dollars.

“TFI International again posted very solid

results despite soft market conditions, with year-over-year growth

in revenues and operating income across all our business segments,”

said Alain Bédard, Chairman, President and Chief Executive Officer.

“Our performance was driven by the impressive execution by our

team, including at the recently acquired Daseke operations where

integration work is already off to a strong start. In addition,

we’re executing well within US LTL, with continued improvements in

tonnage, weight per shipment and revenue per shipment. We’re

pleased with our consolidated net cash from operating activities of

nearly $250 million and our free cash flow of more than $150

million, both up significantly over the past year. This strong cash

flow is key in our ability to create value through strategic

investment, regardless of market conditions, while returning excess

capital to shareholders whenever possible.”

SECOND QUARTER RESULTS

|

Financial highlights |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(in millions of U.S. dollars, except per share

data) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Total revenue |

|

2,264.5 |

|

|

1,791.3 |

|

|

|

4,135.4 |

|

|

3,641.4 |

|

|

Revenue before fuel surcharge |

|

1,961.1 |

|

|

1,549.5 |

|

|

|

3,572.6 |

|

|

3,109.9 |

|

|

Adjusted EBITDA1 |

|

380.1 |

|

|

300.3 |

|

|

|

648.5 |

|

|

564.5 |

|

|

Operating income |

|

208.1 |

|

|

192.4 |

|

|

|

359.7 |

|

|

358.8 |

|

|

Net cash from operating activities |

|

248.5 |

|

|

200.4 |

|

|

|

449.2 |

|

|

432.5 |

|

|

Net income |

|

117.8 |

|

|

128.2 |

|

|

|

210.6 |

|

|

240.2 |

|

|

EPS - diluted ($) |

|

1.38 |

|

|

1.47 |

|

|

|

2.47 |

|

|

2.74 |

|

|

Adjusted net income1 |

|

145.6 |

|

|

138.9 |

|

|

|

251.1 |

|

|

255.4 |

|

|

Adjusted EPS - diluted1 ($) |

|

1.71 |

|

|

1.59 |

|

|

|

2.95 |

|

|

2.92 |

|

|

Weighted average number of shares ('000s) |

|

84,500 |

|

|

86,135 |

|

|

|

84,487 |

|

|

86,357 |

|

|

Weighted average number of diluted shares ('000s) |

|

85,124 |

|

|

87,125 |

|

|

|

85,247 |

|

|

87,537 |

|

|

Number of share outstanding - end of period ('000s) |

|

84,604 |

|

|

85,801 |

|

|

|

84,487 |

|

|

86,357 |

|

|

1 This is a non-IFRS measure. For a reconciliation, please refer to

the “Non-IFRS Financial Measures” section

below. |

| |

Total revenue of $2.26 billion increased from

$1.79 billion in the prior year period and revenue before fuel

surcharge of $1.96 billion increased from $1.55 billion in the

prior year period. The increase is due to contributions from

acquisitions partially offset by a reduction of volumes due to a

continued weaker transportation environment and a reduction in fuel

surcharge revenue.

Operating income of $208.1 million increased

from $192.4 million in the prior year period. The increase in

operating income is from business acquisitions and is partially

offset by lower volumes and a $19.7 million restructuring charge

related to the acquisition of Daseke recorded in the Corporate

segment.

Net income of $117.8 million compared to $128.2

million in the prior year period, and net income of $1.38 per

diluted share compared to $1.47 in the prior year period. The net

income included a $19.7 million restructuring charge and an

increase in interest expense of $24.0 million related to the

financing of the Daseke acquisition. Adjusted net income, a

non-IFRS measure, was $145.6 million, or $1.71 per diluted share,

up from $138.9 million, or $1.59 per diluted share, the prior year

period.

Total revenue increased in all segments relative

to the prior year period with increases of 1% for

Less-Than-Truckload, 78% for Truckload, primarily from the

acquisition of Daseke, and 24% for Logistics. Operating income

increased 2% for Less-Than-Truckload, 26% for Truckload and 54% for

Logistics in the second quarter compared to the prior year.

SIX-MONTH RESULTS Total revenue

of $4.14 billion increased from $3.64 billion in the prior year

period and revenue before fuel surcharge of $3.57 billion increased

from $3.11 billion in the prior year period. The increase is due to

contributions from acquisitions partially offset by a reduction of

volumes due to a continued weaker transportation environment and a

reduction in fuel surcharge revenue.

Operating income of $359.7 million increased

from $358.8 million in the prior year period. The increase in

operating income is from business acquisitions and is partially

offset by lower volumes and a $19.7 million restructuring charge

related to the acquisition of Daseke recorded in the Corporate

segment.

Net income of $210.6 million compared to $240.2

million in the prior year period, and net income of $2.47 per

diluted share compared to $2.74 in the prior year period. The net

income included a $19.7 million restructuring charge and an

increase in interest expense of $34.5 million primarily related to

the financing of the Daseke acquisition. Adjusted net income, a

non-IFRS measure, was $251.1 million, or $2.95 per diluted share,

compared to $255.4 million, or $2.92 per diluted share, the prior

year period.

Total revenue increased relative to the prior

year period with increases of 35% for Truckload, primarily from the

acquisition of Daseke, and 25% for Logistics, and a decrease of 2%

for Less-Than-Truckload. Operating income increased 1% for

Less-Than-Truckload and 41% for Logistics, and decreased 9% for

Truckload in the second quarter compared to the prior year.

|

SEGMENTED RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in million of U.S. dollars) |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

$ |

|

|

|

| Revenue

before fuel surcharge |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less-Than-Truckload* |

794.2 |

|

|

|

|

787.7 |

|

|

|

|

1,577.7 |

|

|

|

|

1,590.2 |

|

|

|

|

Truckload |

737.7 |

|

|

|

|

410.7 |

|

|

|

|

1,135.4 |

|

|

|

|

824.8 |

|

|

|

|

Logistics |

442.4 |

|

|

|

|

361.8 |

|

|

|

|

884.3 |

|

|

|

|

717.0 |

|

|

|

|

Eliminations |

(13.1 |

) |

|

|

|

(10.7 |

) |

|

|

|

(24.8 |

) |

|

|

|

(22.2 |

) |

|

|

|

|

1,961.1 |

|

|

|

|

1,549.5 |

|

|

|

|

3,572.6 |

|

|

|

|

3,109.9 |

|

|

|

|

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

| Operating

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less-Than-Truckload* |

109.9 |

|

|

13.8 |

% |

|

107.8 |

|

|

13.7 |

% |

|

194.9 |

|

|

12.4 |

% |

|

193.0 |

|

|

12.1 |

% |

|

Truckload |

83.3 |

|

|

11.3 |

% |

|

66.2 |

|

|

16.1 |

% |

|

124.8 |

|

|

11.0 |

% |

|

136.7 |

|

|

16.6 |

% |

|

Logistics |

50.6 |

|

|

11.4 |

% |

|

32.9 |

|

|

9.1 |

% |

|

90.8 |

|

|

10.3 |

% |

|

64.6 |

|

|

9.0 |

% |

|

Corporate |

(35.7 |

) |

|

|

|

(14.4 |

) |

|

|

|

(50.8 |

) |

|

|

|

(35.5 |

) |

|

|

|

|

208.1 |

|

|

10.6 |

% |

|

192.4 |

|

|

12.4 |

% |

|

359.7 |

|

|

10.1 |

% |

|

358.8 |

|

|

11.5 |

% |

|

Note: due to rounding, totals may differ slightly from the

sum. |

| * In the second

quarter of fiscal 2024, it was determined that Package and Courier

operating segment should be aggregated with the Canadian

Less-Than-Truckload and U.S. Less-Than-Truckload operating

segments, forming the Less-Than-Truckload reportable segment.

Comparative information for Less-Than-Truckload reportable segment

has been recast to be consistent with current reportable

segments. |

| |

CASH FLOW Net cash flow from

operating activities was $248.5 million during Q2, an increase from

$200.4 million the prior year. This increase was due primarily to

an increase in depreciation and amortization of $44.4 million,

$22.0 million fewer payments of provisioned amounts, and $13.8

million lower cash taxes, partially offset by a decrease in

non-cash working capital of $25.8 million.

Net cash from investing activities decreased by

$895.1 million as a result of an increase in spending on business

acquisitions of $775.0 million, $85.7 million less proceeds from

sale of investments, and an increase in net capital expenditures of

$34.8 million.

The Company returned $67.5 million to

shareholders during the quarter through dividends and share

repurchases.

On June 17, 2024, the Board of Directors of TFI

International declared a quarterly dividend of $0.40 per

outstanding common share paid on July 15, 2024, representing a 14%

increase over the $0.35 quarterly dividend declared in Q2 2023. The

annualized dividend represents 18.5% of the trailing twelve month

free cash flow1.

WEBCAST DETAILS TFI

International will host a webcast on Friday, July 26, 2024 at 8:30

a.m. Eastern Time to discuss these results. Interested parties can

join the webcast or access the replay of the webcast via the link

accessible on the TFI website under the Presentations and Reports

section.

ABOUT TFI INTERNATIONAL TFI

International Inc. is a North American leader in the transportation

and logistics industry, operating across the United States, Canada

and Mexico through its subsidiaries. TFI International creates

value for shareholders by identifying strategic acquisitions and

managing a growing network of wholly-owned operating subsidiaries.

Under the TFI International umbrella, companies benefit from

financial and operational resources to build their businesses and

increase their efficiency. TFI International companies service the

following segments:

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the

New York Stock Exchange and the Toronto Stock Exchange under symbol

TFII. For more information, visit www.tfiintl.com.

FORWARD-LOOKING STATEMENTS The

Company may make statements in this report that reflect its current

expectations regarding future results of operations, performance

and achievements. These are “forward-looking” statements and

reflect management’s current beliefs. They are based on information

currently available to management. Words such as “may”, “might”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, “to its knowledge”, “could”, “design”, “forecast”,

“goal”, “hope”, “intend”, “likely”, “predict”, “project”, “seek”,

“should”, “target”, “will”, “would” or “continue” and words and

expressions of similar import are intended to identify these

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from historical results and those

presently anticipated or projected.

The Company wishes to caution readers not to

place undue reliance on any forward-looking statements which

reference issues only as of the date made. The following important

factors could cause the Company’s actual financial performance to

differ materially from that expressed in any forward-looking

statement: the highly competitive market conditions, the Company’s

ability to recruit, train and retain qualified drivers, fuel price

variations and the Company’s ability to recover these costs from

its customers, foreign currency fluctuations, the impact of

environmental standards and regulations, changes in governmental

regulations applicable to the Company’s operations, adverse weather

conditions, accidents, the market for used equipment, changes in

interest rates, cost of liability insurance coverage, downturns in

general economic conditions affecting the Company and its

customers, credit market liquidity, and the Company’s ability to

identify, negotiate, consummate, and successfully integrate

acquisitions. In addition, any material weaknesses in internal

control over financial reporting that are identified, and the cost

of remediation of any such material weakness and any other control

deficiencies, may have adverse effects on the Company and impact

future results.

The foregoing list should not be construed as

exhaustive, and the Company disclaims any subsequent obligation to

revise or update any previously made forward-looking statements

unless required to do so by applicable securities laws.

Unanticipated events are likely to occur. Readers should also refer

to the section “Risks and Uncertainties” at the end of the 2024 Q1

MD&A for additional information on risk factors and other

events that are not within the Company’s control. The Company’s

future financial and operating results may fluctuate as a result of

these and other risk factors.

NON-IFRS FINANCIAL MEASURES

This press release includes references to certain non-IFRS

financial measures as described below. These non-IFRS measures do

not have any standardized meanings prescribed by International

Financial Reporting Standards as issued by the international

Accounting Standards Board (IASB) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation, in

addition to, nor as a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. The terms

and definitions of the non-IFRS measures used in this press release

and a reconciliation of each non-IFRS measure to the most directly

comparable IFRS measure are provided in the exhibits.

Adjusted EBITDA: Adjusted EBITDA is calculated

as net income before finance income and costs, income tax expense,

depreciation, amortization, impairment of intangible assets,

bargain purchase gain, restructuring from business acquisitions,

and gain or loss on sale of land and buildings, assets held for

sale, sale of business, and gain or loss on disposal of intangible

assets. Management believes adjusted EBITDA to be a useful

supplemental measure. Adjusted EBITDA is provided to assist in

determining the ability of the Company to assess its

performance.

|

Adjusted EBITDA |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Net income |

|

117.8 |

|

|

128.2 |

|

|

|

210.6 |

|

|

240.2 |

|

| Net finance

costs |

|

47.4 |

|

|

18.7 |

|

|

|

74.7 |

|

|

35.9 |

|

| Income tax

expense |

|

42.9 |

|

|

45.5 |

|

|

|

74.3 |

|

|

82.8 |

|

| Depreciation

of property and equipment |

|

87.5 |

|

|

62.3 |

|

|

|

152.0 |

|

|

121.4 |

|

| Depreciation

of right-of-use assets |

|

45.8 |

|

|

32.0 |

|

|

|

81.1 |

|

|

63.4 |

|

| Amortization

of intangible assets |

|

19.3 |

|

|

13.9 |

|

|

|

36.5 |

|

|

27.4 |

|

|

Restructuring from business acquisition |

|

19.7 |

|

|

- |

|

|

|

19.7 |

|

|

- |

|

| Gain on sale

of assets held for sale |

|

(0.3 |

) |

|

(0.3 |

) |

|

|

(0.5 |

) |

|

(6.6 |

) |

|

Adjusted EBITDA |

|

380.1 |

|

|

300.3 |

|

|

|

648.5 |

|

|

564.5 |

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

|

|

|

|

| |

Adjusted net income and adjusted earnings per

share (adjusted “EPS”), basic or diluted Adjusted net income is

calculated as net income excluding amortization of intangible

assets related to business acquisitions, net change in the fair

value and accretion expense of contingent considerations, net

change in the fair value of derivatives, net foreign exchange gain

or loss, impairment of intangible assets, bargain purchase gain,

restructuring from business acquisitions, gain or loss on sale of

land and buildings and assets held for sale, impairment on assets

held for sale, gain or loss on the sale of business and directly

attributable expenses due to the disposal of the business. Adjusted

earnings per share, basic or diluted, is calculated as adjusted net

income divided by the weighted average number of common shares,

basic or diluted. The Company uses adjusted net income and adjusted

earnings per share to measure its performance from one period to

the next, without the variation caused by the impact of the items

described above. The Company excludes these items because they

affect the comparability of its financial results and could

potentially distort the analysis of trends in its business

performance. Excluding these items does not imply they are

necessarily non-recurring.

|

Adjusted net income |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(unaudited, in millions of U.S. dollars, except per share

data) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Net income |

|

117.8 |

|

|

128.2 |

|

|

|

210.6 |

|

|

240.2 |

|

| Amortization

of intangible assets related to business acquisitions |

|

17.1 |

|

|

14.8 |

|

|

|

33.1 |

|

|

27.4 |

|

| Net change

in fair value and accretion expense of contingent

considerations |

|

0.0 |

|

|

0.4 |

|

|

|

0.1 |

|

|

0.4 |

|

| Net foreign

exchange loss (gain) |

|

1.5 |

|

|

(0.4 |

) |

|

|

2.8 |

|

|

(0.8 |

) |

|

Restructuring from business acquisitions |

|

19.7 |

|

|

- |

|

|

|

19.7 |

|

|

- |

|

| Gain, net of

impairment, on sale of land and buildings and assets held for

sale |

|

(0.3 |

) |

|

(0.3 |

) |

|

|

(0.5 |

) |

|

(6.5 |

) |

|

Tax impact of adjustments |

|

(10.3 |

) |

|

(3.7 |

) |

|

|

(14.7 |

) |

|

(5.3 |

) |

|

Adjusted net income |

|

145.6 |

|

|

138.9 |

|

|

|

251.1 |

|

|

255.4 |

|

|

Adjusted earnings per share - basic |

|

1.72 |

|

|

1.61 |

|

|

|

2.97 |

|

|

2.96 |

|

|

Adjusted earnings per share - diluted |

|

1.71 |

|

|

1.59 |

|

|

|

2.95 |

|

|

2.92 |

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

|

|

|

|

| |

Free cash flow: Net cash from operating

activities less additions to property and equipment plus proceeds

from sale of property and equipment and assets held for sale.

Management believes that this measure provides a benchmark to

evaluate the performance of the Company in regard to its ability to

meet capital requirements.

|

Free cash flow |

Three months ended June 30 |

|

Six months ended June 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net cash from operating activities |

|

248.5 |

|

|

200.4 |

|

|

449.2 |

|

|

432.5 |

|

| Additions to

property and equipment |

|

(118.9 |

) |

|

(84.2 |

) |

|

(196.4 |

) |

|

(160.4 |

) |

| Proceeds

from sale of property and equipment |

|

19.6 |

|

|

19.5 |

|

|

32.3 |

|

|

44.2 |

|

|

Proceeds from sale of assets held for sale |

|

2.2 |

|

|

2.4 |

|

|

3.4 |

|

|

17.5 |

|

|

Free cash flow |

|

151.4 |

|

|

138.1 |

|

|

288.6 |

|

|

333.8 |

|

|

|

Note to readers: Unaudited

condensed consolidated interim financial statements and

Management’s Discussion & Analysis are available on TFI

International’s website at www.tfiintl.com.

For further information: Alain

Bédard Chairman, President and CEO TFI International Inc.

647-729-4079 abedard@tfiintl.com

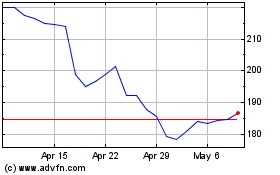

TFI (TSX:TFII)

Historical Stock Chart

From Nov 2024 to Dec 2024

TFI (TSX:TFII)

Historical Stock Chart

From Dec 2023 to Dec 2024