TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced its results for the third quarter ended September 30,

2024. All amounts are shown in U.S. dollars.

“Despite soft market conditions, TFI

International performed well during quarter, generating more than

$350 million of net cash from operating activities and over $270

million of free cash flow, up 26% and 37%, respectively, over the

year-ago period,” said Alain Bédard, Chairman, President and Chief

Executive Officer. “While business conditions for US LTL are

challenging, our Logistics segment performed very well, and both

our Truckload and Canadian LTL operations have remained solid. We

were also able to reduce debt during the quarter, reducing our

leverage ratio. In the current freight environment, our talented

team remains focused on operational enhancements and tapping into

the potential of recent acquisitions, while our overarching focus

on free cash flow allows us to opportunistically invest during

weaker cycles and return significant capital to shareholders while

maintaining a strong balance sheet.”

THIRD QUARTER RESULTS

|

Financial highlights |

Three months ended |

|

Nine months ended |

|

|

|

September 30 |

|

September 30 |

|

|

(in millions of U.S. dollars, except per share

data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Total revenue |

|

2,184.6 |

|

|

1,911.0 |

|

6,319.9 |

|

5,552.5 |

|

|

Revenue before fuel surcharge |

|

1,905.3 |

|

|

1,632.9 |

|

5,478.0 |

|

4,742.8 |

|

|

Adjusted EBITDA1 |

|

357.2 |

|

|

302.5 |

|

1,005.7 |

|

867.0 |

|

|

Operating income |

|

203.3 |

|

|

200.6 |

|

563.0 |

|

559.4 |

|

|

Net cash from operating activities |

|

351.1 |

|

|

278.7 |

|

800.3 |

|

711.3 |

|

|

Net income |

|

128.0 |

|

|

133.3 |

|

338.6 |

|

373.5 |

|

|

EPS - diluted ($) |

|

1.50 |

|

|

1.54 |

|

3.97 |

|

4.28 |

|

|

Adjusted net income1 |

|

136.6 |

|

|

136.0 |

|

387.7 |

|

391.4 |

|

|

Adjusted EPS - diluted¹ ($) |

|

1.60 |

|

|

1.57 |

|

4.55 |

|

4.48 |

|

|

Weighted average number of shares ('000s) |

|

84,609 |

|

|

85,849 |

|

84,528 |

|

86,186 |

|

|

Weighted average number of diluted shares ('000s) |

|

85,123 |

|

|

86,582 |

|

85,222 |

|

87,330 |

|

|

Number of share outstanding - end of period ('000s) |

|

84,635 |

|

|

85,932 |

|

84,635 |

|

85,932 |

|

|

1 This is a non-IFRS measure. For a reconciliation, please refer to

the “Non-IFRS Financial Measures” section

below. |

|

|

|

|

|

|

|

Total revenue of $2.18 billion increased from

$1.91 billion in the prior year period and revenue before fuel

surcharge of $1.91 billion increased from $1.63 billion. The

increase is due to contributions from acquisitions partially offset

by a reduction of volumes due to a continued weaker transportation

environment and a reduction in fuel surcharge revenue.

Operating income of $203.3 million increased

from $200.6 million in the prior year period. The increase in

operating income is from business acquisitions and is partially

offset by lower volumes and $15.3 million less gain, net of

impairment, on sale of assets held for sale.

Net income of $128.0 million compared to $133.3

million in the prior year period, and net income of $1.50 per

diluted share compared to $1.54 in the prior year period. Net

income included an increase in interest expense of $21.6 million

related to the financing of the Daseke acquisition. Adjusted net

income, a non-IFRS measure, was $136.6 million, or $1.60 per

diluted share, up from $136.0 million, or $1.57 per diluted share,

the prior year period.

Total revenue increased 74% in the Truckload

segment relative to the prior year period, primarily from the

acquisition of Daseke, increased 2% for Logistics and decreased by

9% for Less-Than-Truckload. Operating income increased 44% for

Truckload and 19% for Logistics, and decreased 24% for

Less-Than-Truckload in the third quarter compared to the prior

year.

NINE-MONTH RESULTS Total

revenue of $6.32 billion increased from $5.55 billion in the prior

year period and revenue before fuel surcharge of $5.48 billion

increased from $4.74 billion. The increase is due to contributions

from acquisitions partially offset by a reduction of volumes due to

a continued weaker transportation environment and a reduction in

fuel surcharge revenue.

Operating income of $563.0 million increased

from $559.4 million in the prior year period. The increase in

operating income is from business acquisitions and is partially

offset by lower volumes and a $19.7 million restructuring charge

related to the acquisition of Daseke recorded in the Corporate

segment and $21.4 million higher gains, net of impairment, on sale

of assets held for sale in the prior year period.

Net income of $338.6 million compared to $373.5

million in the prior year period, and net income of $3.97 per

diluted share compared to $4.28 in the prior year period. Net

income included an increase in interest expense of $56.1 million

primarily related to the financing of the Daseke acquisition.

Adjusted net income, a non-IFRS measure, was $387.7 million, or

$4.55 per diluted share, compared to $391.4 million, or $4.48 per

diluted share, the prior year period.

Total revenue increased relative to the prior

year period with increases of 48% for Truckload, primarily from the

acquisition of Daseke, and 17% for Logistics, and a decrease of 4%

for Less-Than-Truckload. Operating income increased 6% for

Truckload and 32% for Logistics, and decreased 9% for

Less-Than-Truckload in the third quarter compared to the prior

year.

|

SEGMENTED RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in million of U.S. dollars) |

Three months ended September 30 |

Nine months ended September 30 |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

| Revenue

before fuel surcharge |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less-Than-Truckload* |

770.8 |

|

|

|

828.8 |

|

|

|

2,348.4 |

|

|

|

2,419.0 |

|

|

|

|

Truckload |

722.9 |

|

|

|

401.5 |

|

|

|

1,858.3 |

|

|

|

1,226.3 |

|

|

|

|

Logistics |

426.5 |

|

|

|

416.2 |

|

|

|

1,310.8 |

|

|

|

1,133.2 |

|

|

|

|

Eliminations |

(14.8 |

) |

|

|

(13.6 |

) |

|

|

(39.6 |

) |

|

|

(35.8 |

) |

|

|

|

|

1,905.3 |

|

|

|

1,632.9 |

|

|

|

5,478.0 |

|

|

|

4,742.8 |

|

|

|

|

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

| Operating

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less-Than-Truckload* |

96.0 |

|

12.5 |

% |

125.6 |

|

15.2 |

% |

290.9 |

|

12.4 |

% |

318.6 |

|

13.2 |

% |

|

Truckload |

72.2 |

|

10.0 |

% |

50.1 |

|

12.5 |

% |

197.0 |

|

10.6 |

% |

186.7 |

|

15.2 |

% |

|

Logistics |

48.7 |

|

11.4 |

% |

40.9 |

|

9.8 |

% |

139.5 |

|

10.6 |

% |

105.5 |

|

9.3 |

% |

|

Corporate |

(13.6 |

) |

|

|

(15.9 |

) |

|

|

(64.4 |

) |

|

|

(51.4 |

) |

|

|

|

|

203.3 |

|

10.7 |

% |

200.6 |

|

12.3 |

% |

563.0 |

|

10.3 |

% |

559.4 |

|

11.8 |

% |

|

Note: due to rounding, totals may differ slightly from the

sum. |

| 1 Revenue before fuel

surcharge |

| * In the second

quarter of fiscal 2024, it was determined that Package and Courier

operating segment should be aggregated with the Canadian

Less-Than-Truckload and U.S. Less-Than-Truckload operating

segments, forming the Less-Than-Truckload reportable segment.

Comparative information for Less-Than-Truckload reportable segment

has been recast to be consistent with current reportable

segments. |

| |

|

CASH FLOW Net cash flow from

operating activities was $351.1 million during Q3, an increase from

$278.7 million the prior year. This increase was due primarily to

an increase in depreciation and amortization of $39.6 million and

an increase in non-cash working capital of $35.1 million.

Net cash from investing activities increased by

$470.0 million as a result of a decrease in spending on business

acquisitions of $472.6 million.

The Company returned $33.9 million to

shareholders during the quarter through dividends and repaid $130.2

million of debt during the quarter.

DIVIDEND AND SHARE REPURCHASE

On September 16, 2024, the Board of Directors of TFI International

declared a quarterly dividend of $0.40 per outstanding common share

paid on October 15, 2024, representing a 14% increase over the

$0.35 quarterly dividend declared in Q3 2023. The annualized

dividend represents 16.8% of the trailing twelve month free cash

flow1.

On October 21, 2024, the Board of Directors

approved a quarterly dividend of $0.45 per outstanding common share

of the Company’s capital, for an expected aggregate payment of

$38.1 million to be paid on January 15, 2025, to shareholders of

record at the close of business on December 31, 2024.

The Board of Directors today approved the

renewal of TFI International’s normal course issuer bid (“NCIB”).

Under the renewed NCIB, the Company may purchase for cancellation a

maximum of 7,918,103 common shares from November 2, 2024 to

November 1, 2025. The renewed NCIB is subject to approval of the

Toronto Stock Exchange.

WEBCAST DETAILS TFI

International will host a webcast on Tuesday October 22, 2024 at

8:30 a.m. Eastern Time to discuss these results. Interested parties

can join the webcast or access the replay of the webcast via the

link accessible on the TFI website under the Presentations and

Reports section.

ABOUT TFI INTERNATIONAL TFI

International Inc. is a North American leader in the transportation

and logistics industry, operating across the United States, Canada

and Mexico through its subsidiaries. TFI International creates

value for shareholders by identifying strategic acquisitions and

managing a growing network of wholly-owned operating subsidiaries.

Under the TFI International umbrella, companies benefit from

financial and operational resources to build their businesses and

increase their efficiency. TFI International companies service the

following segments:

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the

New York Stock Exchange and the Toronto Stock Exchange under symbol

TFII. For more information, visit www.tfiintl.com.

FORWARD-LOOKING STATEMENTS The

Company may make statements in this report that reflect its current

expectations regarding future results of operations, performance

and achievements. These are “forward-looking” statements and

reflect management’s current beliefs. They are based on information

currently available to management. Words such as “may”, “might”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, “to its knowledge”, “could”, “design”, “forecast”,

“goal”, “hope”, “intend”, “likely”, “predict”, “project”, “seek”,

“should”, “target”, “will”, “would” or “continue” and words and

expressions of similar import are intended to identify these

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from historical results and those

presently anticipated or projected.

The Company wishes to caution readers not to

place undue reliance on any forward-looking statements which

reference issues only as of the date made. The following important

factors could cause the Company’s actual financial performance to

differ materially from that expressed in any forward-looking

statement: the highly competitive market conditions, the Company’s

ability to recruit, train and retain qualified drivers, fuel price

variations and the Company’s ability to recover these costs from

its customers, foreign currency fluctuations, the impact of

environmental standards and regulations, changes in governmental

regulations applicable to the Company’s operations, adverse weather

conditions, accidents, the market for used equipment, changes in

interest rates, cost of liability insurance coverage, downturns in

general economic conditions affecting the Company and its

customers, credit market liquidity, and the Company’s ability to

identify, negotiate, consummate, and successfully integrate

acquisitions. In addition, any material weaknesses in internal

control over financial reporting that are identified, and the cost

of remediation of any such material weakness and any other control

deficiencies, may have adverse effects on the Company and impact

future results.

The foregoing list should not be construed as

exhaustive, and the Company disclaims any subsequent obligation to

revise or update any previously made forward-looking statements

unless required to do so by applicable securities laws.

Unanticipated events are likely to occur. Readers should also refer

to the section “Risks and Uncertainties” at the end of the 2024 Q3

MD&A for additional information on risk factors and other

events that are not within the Company’s control. The Company’s

future financial and operating results may fluctuate as a result of

these and other risk factors.

NON-IFRS FINANCIAL MEASURES

This press release includes references to certain non-IFRS

financial measures as described below. These non-IFRS measures do

not have any standardized meanings prescribed by International

Financial Reporting Standards as issued by the international

Accounting Standards Board (IASB) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation, in

addition to, nor as a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. The terms

and definitions of the non-IFRS measures used in this press release

and a reconciliation of each non-IFRS measure to the most directly

comparable IFRS measure are provided in the exhibits.

Adjusted EBITDA: Adjusted EBITDA is calculated

as net income before finance income and costs, income tax expense,

depreciation, amortization, impairment of intangible assets,

bargain purchase gain, restructuring from business acquisitions,

and gain or loss on sale of land and buildings, assets held for

sale, sale of business, and gain or loss on disposal of intangible

assets. Management believes adjusted EBITDA to be a useful

supplemental measure. Adjusted EBITDA is provided to assist in

determining the ability of the Company to assess its

performance.

|

Adjusted EBITDA |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income |

128.0 |

|

133.3 |

|

338.6 |

|

373.5 |

|

| Net finance

costs |

40.0 |

|

21.7 |

|

114.8 |

|

57.6 |

|

| Income tax

expense |

35.3 |

|

45.5 |

|

109.6 |

|

128.3 |

|

| Depreciation

of property and equipment |

90.0 |

|

64.4 |

|

241.9 |

|

185.8 |

|

| Depreciation

of right-of-use assets |

44.9 |

|

33.8 |

|

126.0 |

|

97.2 |

|

| Amortization

of intangible assets |

18.8 |

|

15.9 |

|

55.3 |

|

43.3 |

|

| Loss on sale

of business |

- |

|

3.0 |

|

- |

|

3.0 |

|

|

Restructuring from business acquisitions |

- |

|

- |

|

19.7 |

|

- |

|

| (Gain) loss,

net of impairment, on sale of land |

|

|

|

|

|

|

|

|

|

and buildings and assets held for sale |

0.2 |

|

(15.2 |

) |

(0.3 |

) |

(21.7 |

) |

|

Adjusted EBITDA |

357.2 |

|

302.5 |

|

1,005.7 |

|

867.0 |

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

|

|

|

|

|

Adjusted net income and adjusted earnings per

share (adjusted “EPS”), basic or diluted Adjusted net income is

calculated as net income excluding amortization of intangible

assets related to business acquisitions, net change in the fair

value and accretion expense of contingent considerations, net

change in the fair value of derivatives, net foreign exchange gain

or loss, impairment of intangible assets, bargain purchase gain,

restructuring from business acquisitions, gain or loss on sale of

land and buildings and assets held for sale, impairment on assets

held for sale, gain or loss on the sale of business and directly

attributable expenses due to the disposal of the business. Adjusted

earnings per share, basic or diluted, is calculated as adjusted net

income divided by the weighted average number of common shares,

basic or diluted. The Company uses adjusted net income and adjusted

earnings per share to measure its performance from one period to

the next, without the variation caused by the impact of the items

described above. The Company excludes these items because they

affect the comparability of its financial results and could

potentially distort the analysis of trends in its business

performance. Excluding these items does not imply they are

necessarily non-recurring.

|

Adjusted net income |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

(unaudited, in millions of U.S. dollars, except per share

data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income |

128.0 |

|

133.3 |

|

338.6 |

|

373.5 |

|

| Amortization

of intangible assets related to business acquisitions |

17.5 |

|

13.1 |

|

50.5 |

|

40.6 |

|

| Net change

in fair value and accretion expense of contingent

considerations |

(6.1 |

) |

(0.3 |

) |

(6.1 |

) |

0.1 |

|

| Net foreign

exchange loss |

0.3 |

|

1.9 |

|

3.1 |

|

1.1 |

|

| Loss on sale

of business and direct attributable costs |

- |

|

3.0 |

|

- |

|

3.0 |

|

|

Restructuring from business acquisitions |

- |

|

- |

|

19.7 |

|

- |

|

|

(Gain) loss, net of impairment, on sale of land and buildings |

|

|

|

|

|

|

|

| and assets

held for sale |

0.2 |

|

(15.1 |

) |

(0.3 |

) |

(21.6 |

) |

|

Tax impact of adjustments |

(3.2 |

) |

0.1 |

|

(17.9 |

) |

(5.3 |

) |

|

Adjusted net income |

136.6 |

|

136.0 |

|

387.7 |

|

391.4 |

|

|

Adjusted earnings per share - basic |

1.61 |

|

1.58 |

|

4.59 |

|

4.54 |

|

|

Adjusted earnings per share - diluted |

1.60 |

|

1.57 |

|

4.55 |

|

4.48 |

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

|

|

|

|

|

Free cash flow: Net cash from operating

activities less additions to property and equipment plus proceeds

from sale of property and equipment and assets held for sale.

Management believes that this measure provides a benchmark to

evaluate the performance of the Company in regard to its ability to

meet capital requirements.

|

Free cash flow |

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net cash from operating activities |

351.1 |

|

278.7 |

|

800.3 |

|

711.3 |

|

| Additions to

property and equipment |

(123.7 |

) |

(120.5 |

) |

(320.1 |

) |

(280.9 |

) |

| Proceeds

from sale of property and equipment |

17.2 |

|

17.5 |

|

49.5 |

|

61.6 |

|

|

Proceeds from sale of assets held for sale |

28.0 |

|

22.7 |

|

31.4 |

|

40.1 |

|

|

Free cash flow |

272.5 |

|

198.3 |

|

561.1 |

|

532.1 |

|

|

|

|

|

|

|

|

|

|

|

Note to readers: Unaudited

condensed consolidated interim financial statements and

Management’s Discussion & Analysis are available on TFI

International’s website at www.tfiintl.com.

For further information: Alain

Bédard Chairman, President and CEO TFI International Inc.

647-729-4079 abedard@tfiintl.com

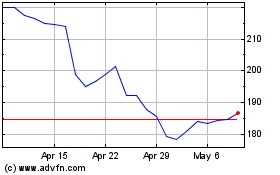

TFI (TSX:TFII)

Historical Stock Chart

From Oct 2024 to Nov 2024

TFI (TSX:TFII)

Historical Stock Chart

From Nov 2023 to Nov 2024