TFI International Announces Renewal of Normal Course Issuer Bid

October 28 2024 - 3:05PM

TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced that the Toronto Stock Exchange (“TSX”) has approved the

renewal of TFI International’s normal course issuer bid

(“NCIB”). Under the renewed NCIB, TFI International may purchase

for cancellation a maximum of 7,918,102 common shares,

representing 10% of the 79,181,029 shares forming

TFI International’s public float as at October 21, 2024.

The shares may be purchased through the facilities of the TSX and

the New York Stock Exchange and on alternative trading systems in

Canada and the United States over the twelve-month period from

November 2, 2024 to November 1, 2025. As of

October 21, 2024, TFI International had

84,634,851 common shares issued and outstanding.

Under TFI International’s current NCIB, which

entered into effect on November 2, 2023 and which expires on

November 1, 2024, TFI International is authorized to

purchase up to 7,161,046 shares. As at October 21, 2024,

TFI International has repurchased 1,035,140 common shares at a

volume weighted average purchase price of CAD $163.0739 per

share, through the facilities of the TSX and the New York Stock

Exchange and on alternative trading systems in Canada and the

United States. All of the repurchased shares were cancelled by

TFI International.

Any shares purchased by TFI International under

the renewed NCIB will be at the market price of the shares at the

time of such purchases. The actual number of shares that may be

purchased and the timing of any such purchases will be determined

by TFI International. Any purchases made by TFI International

pursuant to the renewed NCIB will be made in accordance with the

rules and policies of the TSX or, as applicable, Rule 10b-18

under the U.S. Securities Exchange Act of 1934, as amended. TSX

rules permit TFI International to purchase daily, through TSX

facilities, a maximum of 48,861 shares under the NCIB,

representing 25% of TFI International’s average daily trading

volume of 195,445 on the TSX over the last six calendar

months, subject to an exception for a “block purchase” on the TSX

once per calendar week.

The Board of Directors of TFI International

believes that, at appropriate times, repurchasing its shares

through the NCIB represents a good use of TFI International’s

financial resources, as such action can protect and enhance

shareholder value when opportunities arise.

In connection with the renewed NCIB, TFI

International has entered into an automatic share purchase plan

with RBC Dominion Securities Inc. in order to allow for

purchases under the NCIB during TFI International’s “black-out”

periods, as permitted by the TSX Company Manual and the Securities

Act (Québec). Outside of these “black-out” periods,

TFI International may repurchase shares at its discretion.

ABOUT TFI INTERNATIONAL

TFI International Inc. is a North American

leader in the transportation and logistics industry, operating

across the United States, Canada and Mexico through its

subsidiaries. TFI International creates value for shareholders by

identifying strategic acquisitions and managing a growing network

of wholly-owned operating subsidiaries. Under the TFI International

umbrella, companies benefit from financial and operational

resources to build their businesses and increase their efficiency.

TFI International companies service the following segments:

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the

New York Stock Exchange and the Toronto Stock Exchange under the

symbol TFII. For more information, visit www.tfiintl.com.

For further information:

Alain Bédard Chairman, President and CEO TFI International

Inc. (647) 729-4079 abedard@tfiintl.com

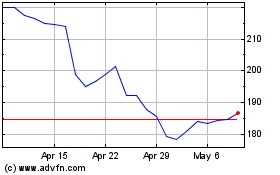

TFI (TSX:TFII)

Historical Stock Chart

From Oct 2024 to Nov 2024

TFI (TSX:TFII)

Historical Stock Chart

From Nov 2023 to Nov 2024