Cielo Waste Solutions Corp. (TSXV:CMC; OTCQB:CWSFF)

(

“Cielo” or the

“Company”), a

company fueling renewable change, is pleased to announce that it

proposes to undertake a non-brokered private placement offering of

unsecured convertible debenture units of the Company (collectively,

the "

Convertible Debenture Units") at a price of

$1,000 per Convertible Debenture Unit for targeted gross proceeds

of up to $2,870,000 (the "

Private Placement").

Cielo had previously announced and completed a

private placement offering of convertible debenture units on the

same terms for gross proceeds of up to $5 million, raising gross

proceeds of $2.14 million (the “Prior Offering”).

The Company closed the Prior Offering to comply with the policies

of the TSXV Venture Exchange (the “Exchange”),

which required that the Prior Offering be completed by May 31,

2024. The Company paused financing efforts throughout the month of

June to allow for the completion of the binding letter of intent

between Cielo and Rocky Mountain Clean Fuels Inc.

(“RMCFI”), announced on June 12, 2024 (the

“Proposed Acquisition”) and now intends to resume

financing efforts on the same terms as the Prior Offering to raise

gross proceeds of up of $5 million when combining the gross

proceeds of the current Private Placement and the Prior

Offering.

Convertible Debenture Unit

Offering

Each Convertible Debenture Unit will be

comprised of: (i) one unsecured convertible debenture (each, a

"Convertible Debenture") in the principal amount

of $1,000.00 (the "Principal Amount") convertible

into common shares of the Company (the "Common

Shares" and each such Common Share, a "Conversion

Share"); and (ii) 2,500 detachable share purchase warrants

(each, a "Warrant") exercisable into Common Shares

(each such Common Share, a “Warrant Share”). The

minimum subscription amount will be C $20,000.

The Principal Amount of the Debentures, together

with any accrued and unpaid interest, will mature and become due

and payable in cash on the date that is 24 months from the date of

issue of the Convertible Debenture Units (“Issue

Date”), subject to earlier conversion or redemption (the

"Maturity Date"). The Principal Amount owing under

the Debentures will accrue interest from the date of issuance at

12.0% per annum on a 30/360 calendar basis, payable every six (6)

months in cash, except the first payment will be made in November

2024 and will consist of interest accrued from and including the

Issue Date. As the Convertible Debentures will be unsecured debt

obligations of the Company, each Convertible Debenture will rank

subordinate to all secured debt obligations of the Company.

The Principal Amount may be converted, for no

additional consideration, into Conversion Shares at the option of

the holder of a Convertible Debenture (each, a

“Holder”) at any time after the Issue Date at a

conversion price (the “Conversion Price”) of $0.40

per Conversion Share. However, the Company may force the conversion

of the Convertible Debentures (the “Forced

Conversion”), at the Conversion Price, in the event that

the volume weighted average price of the Common Shares on the

Exchange is greater than C $1.00 for any ten (10) consecutive

trading days. In the event of a Forced Conversion, the Company will

provide notice to Holders by issuing a news release announcing the

details of the Forced Conversion, including the date upon which the

Forced Conversion will occur. In addition, the principal amount of

the Convertible Debentures may be redeemed by the Company at any

time without penalty.

Each Warrant will entitle the holder thereof to

purchase one Warrant Share at a price of $0.70 per Warrant Share

for a period of 24 months from the Issue Date. However, the Company

may accelerate the expiry of the Warrants (the “Warrant

Term Acceleration”) in the event that the volume weighted

average price of the Common Shares on the Exchange is greater

than C $1.00 for any ten (10) consecutive trading days. In the

event of a Warrant Term Acceleration, the Company will provide

notice to holders of the Warrants by issuing a news release

announcing the details of the Warrant Term Acceleration, including

the accelerated expiry date of the Warrants.

The Company anticipates using the net proceeds

of the Private Placement for the continued advancement of its

existing renewable fuel projects in Carseland, Alberta (the

“Carseland Project”) and the completion of the

Proposed Acquisition, as well as for general working capital and

corporate growth purposes.

The Company intends to close the Private

Placement in one or more tranches throughout June and July 2024.

Completion of the Private Placement is subject to the receipt of

all required regulatory approvals, as applicable, including the

approval of the Exchange. Finder's fees of cash and/or

non-transferrable warrants may be paid in connection with the

Private Placement in accordance with applicable laws. The

Debentures and Warrants, as well as Conversion Shares and Warrant

Shares, will be subject to a statutory hold period expiring on the

date that is four months and one day after the corresponding Issue

Date.

Shares for Debt Completed with Renewable

U Energy Inc.

Further to the news release issued on June 12,

2024, the Company confirms the closing of a shares for debt

transaction with Renewable U Energy Inc. (“Renewable

U”). The Company issued 6,440,677 common shares of Cielo

(the “Repayment Shares”) to Renewable U at a price

of $0.295 per share. The Repayment Shares are subject to a hold

period expiring on October 12, 2024.

None of the securities offered in the

Private Placement have been or will be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be

unlawful.

ABOUT CIELO

Cielo Waste Solutions Corp. is fueling renewable

change with a mission to be a leader in the wood

by-product-to-fuels industry by using environmentally friendly,

economically sustainable and market-ready technologies. The process

and technology does not use food as feedstock as we are proudly

advancing our non-food derived model based on our exclusive licence

in Canada for patented Enhanced Biomass to Liquids (EBTL™) and

Biomass Gas to Liquids (BGTL™) technologies and related

intellectual property, along with an exclusive licence in the US

for creosote and treated wood waste, including abundant railway tie

feedstock. We have assembled a diverse portfolio of projects across

geographic regions and secured the ability to leverage the

expertise of proven industry leaders. Cielo is committed to the

goal of producing renewable fuels from wood by-products that

contribute to a cleaner fuel source and generating positive returns

for our shareholders. Cielo shares are listed on the TSX Venture

Exchange (“TSXV”) under the symbol “CMC,” as well

as on the OTC Markets under the symbol “CWSFF.”

For further information please contact:

Cielo Investor Relations

Ryan Jackson,

CEO

Phone: (403)

348-2972

Email:

investors@cielows.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as “forward-looking statements”)

within the meaning of applicable Canadian securities laws. All

statements other than statements of present or historical fact are

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

“anticipate”, “achieve”, “could”, “believe”, “plan”, “intend”,

“objective”, “continuous”, “ongoing”, “estimate”, “outlook”,

“expect”, “may”, “will”, “project”, “should” or similar words,

including negatives thereof, suggesting future outcomes.

Forward-looking statements are subject to both

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of the Company, that may cause the

actual results, level of activity, performance, or achievements of

the Company to be materially different from those expressed or

implied by such forward looking statements. Forward-looking

statements and information are based on plans, expectations and

estimates of management at the date the information is provided and

are subject to certain factors and assumptions. Cielo is making

forward looking statements, with respect to, but not limited to:

the Private Placement and the terms thereof, including the targeted

gross proceeds, the use of proceeds, the minimum subscription

amount, the timing of closing, the terms of the Convertible

Debenture Units, including the Convertible Debentures and Warrants,

the hold period applicable to the securities to be issued under the

Private Placement, finder fees to be paid in connection with the

Private Placement, the Forced Conversion and the Warrant Expiry

Acceleration, including the notice/announcements to be made in

connection therewith; the location of the Carseland Project; and

the hold period of the Repayment Shares.

Investors should continue to review and consider

information disseminated through news releases and filed by the

Company on SEDAR+. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause the Company’s actual

performance and results to differ materially from any projections

of future performance or results expressed or implied by such

forward-looking statements. Any forward-looking statements are made

as of the date hereof and, except as required by law, the Company

assumes no obligation to publicly update or revise such statements

to reflect new information, subsequent or otherwise.

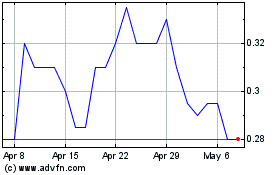

Cielo Waste Solutions (TSXV:CMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cielo Waste Solutions (TSXV:CMC)

Historical Stock Chart

From Mar 2024 to Mar 2025