IBEX Technologies Inc. (TSX VENTURE: IBT), today reported its

financial results for the second quarter ended January 31, 2009.

Solely for the convenience of the reader, selected financial

results expressed in Canadian dollars on the financial statements,

have been translated into U.S. dollars at the January 31, 2009

month-end rate C$1.00 equals US$ 0.8155. This translation should

not be construed as an application of the recommendations relating

to the accounting for foreign currency translation, but rather as

supplemental information for the reader.

HIGHLIGHTS FOR THE QUARTER:

- Sales increased 81% vs. year ago and 64% vs. previous

quarter.

- Net earnings increased 230 % vs. year ago.

- Fifth consecutive profitable quarter since restructuring in

Spring 2008

- Working capital increased 11% vs. previous quarter

"IBEX had an excellent first half" said Paul Baehr, IBEX CEO.

"driven by real sales growth and by a favourable exchange rate, as

well as some one-time gains and rigorous cost control"

FINANCIAL RESULTS FOR THE SECOND QUARTER

Sales for the quarter ended January 31, 2009 totaled $995,557

(US$811,877) an increase of 81% as compared to $549,217 for the

same period in the prior year, and representing an increase of 64%

vs. the previous quarter.

Sales of enzymes increased by 93% vs. the previous year, and by

57% vs. the previous quarter. The Company believes that most of

this increase traces to continued strong demand for the point of

care disposables sold by IBEX customers, but some of the increase

may be due to timing differences when compared to last year.

Sales of arthritis assays decreased by 25% vs. year ago, but

increased 97% vs. the previous quarter, due to the influence in the

year-ago quarter of a large clinical-trial related shipment, that

will not be repeated this year.

Net earnings for the quarter ended January 31, 2009 were

$289,110 (US$235,769), or $0.01 per share, compared to net earnings

of $87,527, or $0.00 per share, for the same period year ago, an

increase of 230%.

Net earnings for the second quarter declined 14% versus the

first quarter (despite a significant increase in sales), tracing to

swings in the recording of foreign exchange. The first quarter

benefited from a $211,619 gain in foreign exchange, while the

current quarter recorded a foreign exchange loss of $43,002.

Excluding the foreign exchange swings, net earnings were up

$179,052 (117%) versus the first quarter.

Expenses during the quarter increased 16% vs. year-ago and 23%

vs. the previous quarter. This increase is mainly attributable to

the increase in the level of business activity.

Cash, Cash Equivalents, and Marketable Securities increased 10%

during the quarter to $1,848,936. The Company's working capital was

$2,390,884 as at the end of the second quarter ended January 31,

2009 and up from $2,163,018 as at the end of the prior quarter

ending October 31, 2008.

Financial Summary for the quarters ending

--------------------------------------------------------------------------

January 31, 2009 January 31, 2008

Revenues $995,557 $549,217

Earning Before Interests,

Tax, Depreciation & Amortization $296,413 $83,618

Depreciation & Amortization $16,818 $17,732

Net Profit $289,110 $87,527

Profit per Share $0.01 $0.00

Cash, Cash Equivalents &

Marketable Securities $1,848,936 $1,066,369

Working Capital $2,390,884 $1,338,625

Outstanding shares at report date

(Common Shares) 24,703,244 24,703,244

LOOKING FORWARD

IBEX has been successful in bringing its existing business to

profitability and is now turning its attention to pursuing growth

opportunities, including further growing its base business, and

maximizing shareholder value through strategic initiatives with

companies where increased market strength and synergies might be

obtained.

While the Company expects the second half of Fiscal 2009 to be

profitable, it will not benefit from the same level of foreign

exchange gains, nor will it see the same level of sales (the second

quarter was an exceptionally good quarter, the fourth quarter is

typically the smallest quarter).

ABOUT IBEX

The Company manufactures and markets a series of proprietary

enzymes (heparinases and chondroitinases) for use in pharmaceutical

research by our customers, as well Heparinase I, which is used in

many leading hemostasis monitoring devices.

IBEX also manufactures and markets a series of arthritis assays

which are widely used in pharmaceutical research by our customers.

These assays are based on the discovery and increasing role of a

number of specific molecular biomarkers associated with collagen

synthesis and degradation.

For more information, please visit the Company's web site at

www.ibex.ca.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release

Safe Harbor Statement

All of the statements contained in this news release, other than

statements of fact that are independently verifiable at the date

hereof, are forward-looking statements. Such statements, based as

they are on the current expectations of management, inherently

involve numerous risks and uncertainties, known and unknown. Some

examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry,

changes in the regulatory environment in the jurisdictions in which

IBEX does business, stock market volatility, fluctuations in costs,

and changes to the competitive environment due to consolidation or

otherwise. Consequently, actual future results may differ

materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or

obligation to update these statements.

Contacts: IBEX Technologies Inc. Paul Baehr President & CEO

514-344-4004 x 143

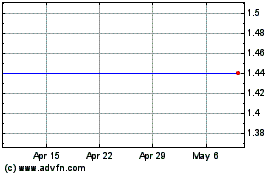

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

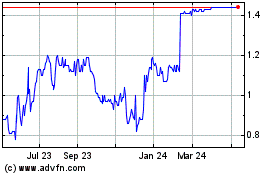

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Feb 2024 to Feb 2025