false

0001605331

0001605331

2025-02-21

2025-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February

21, 2025

AB International

Group Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55979 |

37-1740351 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

144

Main Street,

Mt. Kisco, NY |

10549 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (914) 202-3108

|

______________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry into a Material Definitive Agreement.

On February 21, 2025, the Company entered a Securities Purchase Agreement

(the “Securities Purchase Agreement”) with Anyone Pictures Limited (“APL”), whereby APL agreed to purchase 2,000,000,000

shares of common stock in the Company at $0.00015 per share for a total of $300,000.

The foregoing description of the Securities Purchase Agreement does not

purport to be complete and is qualified in its entirety by reference to the full text of the form of the document, which is attached as

Exhibit 10.1 to this Current Report on Form 8-K, and is hereby incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K

is incorporated by reference into this Item 3.02.

The securities were not registered under the Securities Act, but qualified

for exemption under Section 4(a)(2) and/or Regulation D of the Securities Act. The securities were exempt from registration under Section

4(a)(2) of the Securities Act because the issuance of such securities by the Company did not involve a “public offering,”

as defined in Section 4(a)(2) of the Securities Act, due to the insubstantial number of persons involved in the transaction, size of the

offering, manner of the offering and number of securities offered. The Company did not undertake an offering in which it sold a high number

of securities to a high number of investors. In addition, the Investors had the necessary investment intent as required by Section 4(a)(2)

of the Securities Act since the Investors agreed to, and received, the securities bearing a legend stating that such securities are restricted

pursuant to Rule 144 of the Securities Act. This restriction ensures that these securities would not be immediately redistributed into

the market and therefore not be part of a “public offering.” Based on an analysis of the above factors, the Company has met

the requirements to qualify for exemption under Section 4(a)(2) of the Securities Act.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AB International Group Corp.

/s/ Chiyuan Deng

Chiyuan Deng

Chief Executive Officer and Chief Financial Officer

Date: February 25, 2025

STOCK

PURCHASE AGREEMENT

AB

INTERNATIONAL GROUP CORP.

THIS STOCK PURCHASE AGREEMENT

(the “Agreement”) is entered into by and among AB International Group Corp., a Nevada corporation (the “Company”)

whose address is 144 Main Street Mount Kisco, NY 10549 USA and ANYONE PICTURES LIMITED (“Purchaser”), a Hong Kong Company

whose address is Suite 604 Po Lung Centre, 11 Wang Chiu Road, Kowloon Bay, Hong Kong.

WHEREAS:

The Purchaser desires

to purchase shares (“Shares”) of securities of the Company in accordance with the terms and conditions set forth herein.

The Company desires to

issue and sell Shares to the Purchaser in accordance with the terms and conditions set forth herein.

THEREFORE, IT IS AGREED AS FOLLOWS

Each share shall consist of

one share of the common stock of the Company

The purchase price per share

(“Purchase Price”), payable in US Dollars, shall be USD0.00015 per share.

The Purchaser shall

pay the Purchase Price per Share multiplied by that number of Shares Purchased by wire transfer of immediately available funds to the

Company

WIRE

INSTRUCTIONS:

| ACCOUNT

NAME |

AB

CINEMAS NY, INC. |

| BANK

NAME |

CATHAY

BANK |

| BANK

ADDRESS |

4128

TEMPLE CITY BLVD. ROSEMEAD, CA 91770 |

| BANK

OFFICER |

|

| BANK

TELEPHONE |

(212)9184519 |

| BANK

FAX |

|

| SWIFT

CODE |

XXXXXXX |

| IBAN

/ ABA ROUTING |

|

INTERNATIONAL ACH / RTN

NUMBER |

|

| ACCOUNT

NUMBER |

XXXXXXXXX |

| SPECIAL

WIRE INSTRUCTIONS OR |

|

Five (5) business

days subsequent to receipt of payment of the Purchase Price the Company shall issue to the Purchaser that number of Shares purchased

| 5. | Purchaser’s Representations and

Warranties |

| (a) | As

of the date hereof, the Purchaser is purchasing the Shares for its own account and not with

a present view towards the public sale or distribution thereof, except pursuant to sales

registered or exempted from |

registration under the Securities

Act of 1933, as amended (the “Act”).

| (b) | The

Purchaser is an “accredited investor” as that term is defined in Rule 501(a)

of Regulation D promulgated under the Act |

| (c) | The

Purchaser and its advisors, if any, have been, furnished with all materials relating to the

business, finances and operations of the Company and materials relating to the offer and

sale of the Shares which have been requested by the Purchaser or its advisors. Notwithstanding

the foregoing, the Company has not disclosed to the Purchaser any material nonpublic information

and will not disclose such information unless such information is disclosed to the public

prior to such disclosure to the Purchaser. |

| (d) | Purchaser

has the requisite power and authority to enter into and perform its obligations under this

Agreement without the consent, approval or authorization of, or obligation to notify, any

person, entity or governmental agency which consent has not been obtained. |

| (e) | The

execution, delivery and performance of this Agreement by Purchaser does not and shall not

constitute Purchaser’s breach of any statute or regulation or ordinance of any governmental

authority, and shall not conflict with or result in a breach of or default under any of the

terms, conditions, or provisions of any order, writ, injunction, decree, contract, agreement,

or instrument to which the Purchaser is a party, or by which Purchaser is or may be bound. |

| 6. | Company’s representations and warranties |

(a)

Company is a corporation duly organized, validly existing and in good standing under the

laws of the state its incorporation and has the requisite corporate power and authority to enter into and perform its obligations under

this Agreement without the consent, approval or authorization of, or obligation to notify, any person, entity or governmental agency

which consent has not been obtained.

(b)

The execution, delivery and performance of this Agreement by Company does not and shall not

constitute Company’s breach of any statute or regulation or ordinance of any governmental authority, and shall not conflict with

or result in a breach of or default under any of the terms, conditions, or provisions of any order, writ, injunction, decree, contract,

agreement, or instrument to which the Company is a party, or by which Company is or may be bound.

| 7. | Restricted Securities Acknowledgement |

Purchaser

acknowledges that any securities issued pursuant to this Agreement that shall not be registered pursuant to the Securities Act of 1933

shall constitute “restricted securities” as that term is defined in Rule 144 promulgated under the Act, and shall contain

the following restrictive legend:

“THESE

SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR SECURITIES LAWS OF ANY STATE

AND MAY NOT BE OFFERED, SOLD, ASSIGNED, PLEDGED, TRANSFERRED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE ACT OR SUCH LAWS

AND, IF REQUESTED BY THE COMPANY, UPON DELIVERY OF AN OPINION OF COUNSEL REASONABLY

SATISFACTORY TO THE COMPANY THAT THE PROPOSED TRANSFER IS EXEMPT FROM THE ACT OR SUCH LAWS.”

This Agreement constitutes

a final written expression of all the terms of the Agreement between the parties regarding the subject matter hereof, are a complete

and exclusive statement of those terms, and supersedes all prior and contemporaneous Agreements, understandings, and representations

between the parties.

| 9. | Governing Law, Venue, Waiver of Jury Trial |

All questions concerning

the construction, validity, enforcement and interpretation of this Agreement shall be governed by and construed and enforced in accordance

with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party hereby irrevocably

submits to the exclusive jurisdiction of the state and federal courts sitting in Nevada for the adjudication of any dispute hereunder

or in connection herewith or with any transaction contemplated hereby or discussed herein and hereby irrevocably waives, and agrees not

to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that

such suit, action or proceeding is improper or inconvenient venue for such proceeding. If either party shall commence an action or proceeding

to enforce any provisions of this Agreement, then the prevailing party in such action or proceeding shall be reimbursed by the other

party for its attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such

action or proceeding.

IN WITNESS WHEREOF, the parties

have hereunto executed this Agreement on the 21st day of February 2025.

The Company:

AB INTERNATIONAL GROUP CORP.

/s/ Chiyuan Deng

By: Chiyuan Deng, CEO

Date: February 21, 2025

Purchaser:

ANYONE PICTURES LIMITED

/s/ Heidi Liu

By: Heidi Liu, Financial Manager

Date: February 21, 2025

Number of Shares

Purchased: 2,000,000,000

Total Purchase Price:

USD$300,000.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

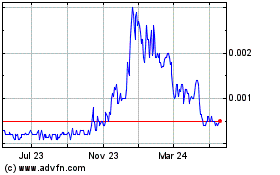

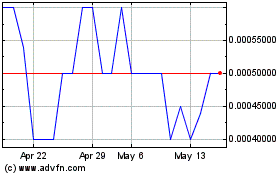

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

AB (PK) (USOTC:ABQQ)

Historical Stock Chart

From Mar 2024 to Mar 2025