false

--12-31

Q3

0001568969

0001568969

2023-01-01

2023-09-30

0001568969

2023-11-14

0001568969

2023-09-30

0001568969

2022-12-31

0001568969

2023-07-01

2023-09-30

0001568969

2022-07-01

2022-09-30

0001568969

2022-01-01

2022-09-30

0001568969

us-gaap:PreferredStockMember

2022-12-31

0001568969

us-gaap:CommonStockMember

2022-12-31

0001568969

APYP:StockPayablesMember

2022-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001568969

us-gaap:RetainedEarningsMember

2022-12-31

0001568969

us-gaap:ParentMember

2022-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2022-12-31

0001568969

us-gaap:PreferredStockMember

2023-01-01

2023-09-30

0001568969

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001568969

APYP:StockPayablesMember

2023-01-01

2023-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001568969

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001568969

us-gaap:ParentMember

2023-01-01

2023-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-09-30

0001568969

us-gaap:PreferredStockMember

2023-09-30

0001568969

us-gaap:CommonStockMember

2023-09-30

0001568969

APYP:StockPayablesMember

2023-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001568969

us-gaap:RetainedEarningsMember

2023-09-30

0001568969

us-gaap:ParentMember

2023-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-09-30

0001568969

us-gaap:PreferredStockMember

2021-12-31

0001568969

us-gaap:CommonStockMember

2021-12-31

0001568969

APYP:StockPayablesMember

2021-12-31

0001568969

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001568969

us-gaap:RetainedEarningsMember

2021-12-31

0001568969

us-gaap:ParentMember

2021-12-31

0001568969

us-gaap:NoncontrollingInterestMember

2021-12-31

0001568969

2021-12-31

0001568969

us-gaap:PreferredStockMember

2022-01-01

2022-09-30

0001568969

us-gaap:CommonStockMember

2022-01-01

2022-09-30

0001568969

APYP:StockPayablesMember

2022-01-01

2022-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-09-30

0001568969

us-gaap:RetainedEarningsMember

2022-01-01

2022-09-30

0001568969

us-gaap:ParentMember

2022-01-01

2022-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-09-30

0001568969

us-gaap:PreferredStockMember

2022-09-30

0001568969

us-gaap:CommonStockMember

2022-09-30

0001568969

APYP:StockPayablesMember

2022-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001568969

us-gaap:RetainedEarningsMember

2022-09-30

0001568969

us-gaap:ParentMember

2022-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-09-30

0001568969

2022-09-30

0001568969

us-gaap:PreferredStockMember

2023-06-30

0001568969

us-gaap:CommonStockMember

2023-06-30

0001568969

APYP:StockPayablesMember

2023-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001568969

us-gaap:RetainedEarningsMember

2023-06-30

0001568969

us-gaap:ParentMember

2023-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-06-30

0001568969

2023-06-30

0001568969

us-gaap:PreferredStockMember

2023-07-01

2023-09-30

0001568969

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001568969

APYP:StockPayablesMember

2023-07-01

2023-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001568969

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001568969

us-gaap:ParentMember

2023-07-01

2023-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2023-07-01

2023-09-30

0001568969

us-gaap:PreferredStockMember

2022-06-30

0001568969

us-gaap:CommonStockMember

2022-06-30

0001568969

APYP:StockPayablesMember

2022-06-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001568969

us-gaap:RetainedEarningsMember

2022-06-30

0001568969

us-gaap:ParentMember

2022-06-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-06-30

0001568969

2022-06-30

0001568969

us-gaap:PreferredStockMember

2022-07-01

2022-09-30

0001568969

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001568969

APYP:StockPayablesMember

2022-07-01

2022-09-30

0001568969

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001568969

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001568969

us-gaap:ParentMember

2022-07-01

2022-09-30

0001568969

us-gaap:NoncontrollingInterestMember

2022-07-01

2022-09-30

0001568969

us-gaap:SeriesAPreferredStockMember

APYP:BorisMolchadskyMember

2021-07-02

2021-07-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-01

2021-08-02

0001568969

APYP:StockExchangeAgreementMember

APYP:SleepXLtdMember

2021-08-02

0001568969

APYP:SleepXLtdMember

2023-09-30

0001568969

2023-06-01

2023-11-30

0001568969

APYP:NexenseTechnologiesLTDMember

2021-12-31

0001568969

APYP:NexenseTechnologiesLTDMember

2023-01-01

2023-09-30

0001568969

APYP:TanoomaLtdMember

us-gaap:NoncontrollingInterestMember

2020-12-31

0001568969

APYP:TanoomaLtdMember

us-gaap:NoncontrollingInterestMember

2023-09-30

0001568969

APYP:EvergreenVentureCapitalLLCMember

2021-08-21

2021-08-22

0001568969

APYP:EvergreenVentureCapitalLLCMember

2023-09-30

0001568969

APYP:EvergreenVentureCapitalLLCMember

2021-08-22

0001568969

APYP:EvergreenVentureCapitalLLCMember

2023-01-01

2023-09-30

0001568969

APYP:OldCLAMember

2023-01-01

2023-09-30

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001568969

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0001568969

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0001568969

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0001568969

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0001568969

2022-01-01

2022-12-31

0001568969

APYP:OldCLAMember

srt:MaximumMember

2023-01-01

2023-09-30

0001568969

APYP:OldCLAMember

srt:MinimumMember

2023-01-01

2023-09-30

0001568969

APYP:OldCLAMember

2022-01-01

2022-12-31

0001568969

APYP:OldCLAMember

2023-09-30

0001568969

APYP:OldCLAMember

2022-12-31

0001568969

srt:MinimumMember

2023-09-30

0001568969

srt:MaximumMember

2023-09-30

0001568969

srt:MinimumMember

2022-12-31

0001568969

srt:MaximumMember

2022-12-31

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2023-09-30

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2023-09-30

0001568969

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001568969

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0001568969

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-31

0001568969

srt:MinimumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001568969

srt:MaximumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0001568969

srt:MinimumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001568969

srt:MaximumMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001568969

APYP:MeasurementInputCommomMarketValueMember

2023-09-30

0001568969

APYP:MeasurementInputCommomMarketValueMember

2022-12-31

0001568969

APYP:WarrantOneMember

2022-12-31

0001568969

APYP:WarrantOneMember

srt:MinimumMember

2022-12-31

0001568969

APYP:WarrantTwoMember

2022-12-31

0001568969

APYP:WarrantTwoMember

srt:MaximumMember

2022-12-31

0001568969

APYP:WarrantThreeMember

2022-12-31

0001568969

APYP:WarrantThreeMember

srt:MinimumMember

2022-12-31

0001568969

APYP:WarrantFourMember

2022-12-31

0001568969

APYP:WarrantFourMember

srt:MaximumMember

2022-12-31

0001568969

APYP:WarrantOneMember

2023-09-30

0001568969

APYP:WarrantOneMember

srt:MinimumMember

2023-09-30

0001568969

APYP:WarrantTwoMember

2023-09-30

0001568969

APYP:WarrantTwoMember

srt:MaximumMember

2023-09-30

0001568969

2021-07-01

2021-07-01

0001568969

2022-01-01

2022-01-01

0001568969

srt:MinimumMember

2023-01-01

2023-09-30

0001568969

srt:MaximumMember

2023-01-01

2023-09-30

0001568969

2021-07-01

0001568969

srt:MinimumMember

2022-01-01

0001568969

srt:MaximumMember

2022-01-01

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2023-01-01

2023-09-30

0001568969

APYP:ChiefFinancialOfficerAndAdvisorMember

2022-01-01

2022-09-30

0001568969

APYP:RonMeklerMember

2023-01-01

2023-01-01

0001568969

APYP:RonMeklerMember

2023-01-01

0001568969

APYP:AdiShemerMember

2023-02-01

2023-02-01

0001568969

APYP:AdiShemerMember

2023-02-01

0001568969

2023-03-31

0001568969

APYP:InvestorTwoMember

2023-01-01

2023-03-31

0001568969

APYP:CRMCampaignsMember

2023-05-01

2023-05-01

0001568969

APYP:ConsultantMember

2023-06-01

2023-06-01

0001568969

2023-06-17

2023-06-18

0001568969

2023-07-01

2023-07-01

0001568969

2023-07-01

0001568969

APYP:MrPoratMember

us-gaap:SubsequentEventMember

2023-12-30

2023-12-31

0001568969

srt:ChiefExecutiveOfficerMember

2023-07-06

2023-07-07

0001568969

srt:ChiefExecutiveOfficerMember

2023-07-07

0001568969

srt:ChiefExecutiveOfficerMember

2023-07-05

2023-07-07

0001568969

us-gaap:InvestorMember

2023-06-01

2023-06-30

0001568969

us-gaap:InvestorMember

2023-06-30

0001568969

APYP:CommonStockPurchaseWarrantsMember

2023-06-30

0001568969

us-gaap:WarrantMember

2023-06-30

0001568969

APYP:InvestorTwoMember

2023-06-01

2023-06-30

0001568969

2023-06-01

2023-06-30

0001568969

us-gaap:SeriesAPreferredStockMember

2023-07-25

2023-07-26

0001568969

2023-06-25

2023-06-26

0001568969

us-gaap:SeriesAPreferredStockMember

2023-08-16

2023-08-16

0001568969

2023-08-16

2023-08-16

0001568969

us-gaap:SubsequentEventMember

2023-10-07

2023-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:ILS

APYP:Integer

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

MARK

ONE

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the Quarterly Period ended September 30, 2023; or

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for

the transition period from ________ to ________

Commission

File Number: 000-55403

APPYEA,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

46-1496846 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| 16

Natan Alterman St, Gan Yavne, Israel |

|

|

| (Address

of principal executive offices) |

|

Zip

Code |

(800)

674-3561

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 14, 2023, there were outstanding 284,122,657 shares of the registrant’s common stock, par value $0.0001 per share.

APPYEA,

INC.

Form

10-Q

September

30, 2023

APPYEA

INC. AND ITS SUBSIDIARIES

CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

AS

OF SEPTEMBER 30, 2023

INDEX

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

APPYEA

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

dollars in thousands)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 156 | | |

| 60 | |

| Other accounts receivables | |

| 37 | | |

| 19 | |

| | |

| | | |

| | |

| Inventory Advance | |

| 7 | | |

| - | |

| Total current assets | |

| 200 | | |

| 79 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Property and equipment, net | |

| 2 | | |

| 2 | |

| Intangible assets, net | |

| 142 | | |

| 124 | |

| Total non-current assets | |

| 144 | | |

| 126 | |

| | |

| | | |

| | |

| Total assets | |

| 344 | | |

| 205 | |

| | |

| | | |

| | |

| LIABILITIES AND DEFICIENCY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade payables | |

| 65 | | |

| 67 | |

| Other accounts payable and related party payables | |

| 595 | | |

| 340 | |

| Short-term loans from related party | |

| 78 | | |

| 80 | |

| Convertible loans from related party | |

| - | | |

| 36 | |

| Convertible loans | |

| 781 | | |

| 693 | |

| Convertible loans at fair value | |

| 1,925 | | |

| 1,528 | |

| Financial liability at fair value | |

| 183 | | |

| 24 | |

| | |

| | | |

| | |

| Total liabilities | |

| 3,627 | | |

| 2,768 | |

| | |

| | | |

| | |

| DEFICIENCY | |

| | | |

| | |

| AppYea Inc. Stockholders’ Deficiency: | |

| | | |

| | |

| Convertible preferred stock, $0.0001 par value | |

| - | | |

| - | |

| Common stock, $0.0001 par value | |

| 26 | | |

| 21 | |

| Stock Payables | |

| 468 | | |

| 27 | |

| Additional Paid in Capital | |

| 2,833 | | |

| 1,912 | |

| Accumulated deficit | |

| (6,596 | ) | |

| (4,509 | ) |

| | |

| | | |

| | |

| Total AppYea Inc. stockholders’ deficiency | |

| (3,269 | ) | |

| (2,549 | ) |

| Non-controlling interests | |

| (14 | ) | |

| (14 | ) |

| | |

| | | |

| | |

| Total Deficiency | |

| (3,283 | ) | |

| (2,563 | ) |

| | |

| | | |

| | |

| Total liabilities and deficiency | |

| 344 | | |

| 205 | |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S.

dollars in thousands)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the period of

three months ended

September 30, | | |

For the period of

nine months ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Unaudited | | |

Unaudited | |

| | |

| | |

| | |

| | |

| |

| Research and development expenses | |

| 34 | | |

| 31 | | |

| 50 | | |

| 73 | |

| Sales and marketing | |

| 47 | | |

| 1 | | |

| 49 | | |

| 12 | |

| General and administrative expenses | |

| 261 | | |

| 513 | | |

| 1,128 | | |

| 1,592 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (342 | ) | |

| (545 | ) | |

| (1,227 | ) | |

| (1,677 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of convertible loans and warrant liability | |

| (712 | ) | |

| (119 | ) | |

| (451 | ) | |

| 1,004 | |

| Financial income (expenses), net | |

| (402 | ) | |

| (19 | ) | |

| (409 | ) | |

| (65 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,456 | ) | |

| (683 | ) | |

| (2,087 | ) | |

| (738 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss attributable to AppYea Inc. | |

| (1,456 | ) | |

| (683 | ) | |

| (2,087 | ) | |

| (738 | ) |

| Loss per Common Share | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| - | | |

| - | | |

| - | | |

| - | |

| Weighted Average number of Common Shares Outstanding basic and diluted | |

| 242,243,536 | | |

| 220,730,798 | | |

| 234,943,286 | | |

| 219,350,536 | |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Preferred Stock | | |

Common Stock | | |

Stock | | |

Additional Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance as of January 1, 2023 | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 27 | | |

| 1,912 | | |

| (4,509 | ) | |

| (2,549 | ) | |

| (14 | ) | |

| (2,563 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share issuance upon conversion of convertible notes | |

| | | |

| | | |

| 19,390,359 | | |

| 1 | | |

| - | | |

| 241 | | |

| | | |

| 242 | | |

| | | |

| 242 | |

| CLA - change of classification | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 66 | | |

| | | |

| 66 | | |

| | | |

| 66 | |

| Share issuance upon conversion of preferred stock | |

| (29,201 | ) | |

| - | | |

| 43,801,500 | | |

| 4 | | |

| - | | |

| (4 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Issuance of shares to service providers | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 441 | | |

| - | | |

| - | | |

| 441 | | |

| - | | |

| 441 | |

| Issuance of shares | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 618 | | |

| - | | |

| 618 | | |

| - | | |

| 618 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,087 | ) | |

| (2,087 | ) | |

| - | | |

| (2,087 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2023 | |

| 270,799 | | |

| - | | |

| 284,122,657 | | |

| 26 | | |

| 468 | | |

| 2,833 | | |

| (6,596 | ) | |

| (3,269 | ) | |

| (14 | ) | |

| (3,283 | ) |

| | |

Preferred Stock | | |

Common Stock | | |

Stock | | |

Additional Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance as of January 1, 2022 | |

| 300,000 | | |

| - | | |

| 218,246,326 | | |

| 21 | | |

| - | | |

| 768 | | |

| (3,205 | ) | |

| (2,416 | ) | |

| (14 | ) | |

| (2,430 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of shares to service providers | |

| - | | |

| - | | |

| 2,484,472 | | |

| - | | |

| - | | |

| 80 | | |

| - | | |

| 80 | | |

| - | | |

| 80 | |

| Stock payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 35 | | |

| | | |

| - | | |

| 35 | | |

| - | | |

| 35 | |

| Issuance of shares | |

| | | |

| | | |

| 200,000 | | |

| | | |

| (13 | ) | |

| 13 | | |

| | | |

| | | |

| | | |

| | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 775 | | |

| - | | |

| 775 | | |

| - | | |

| 775 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (738 | ) | |

| (738 | ) | |

| - | | |

| (738 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2022 | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 22 | | |

| 1,636 | | |

| (3,943 | ) | |

| (2,264 | ) | |

| (14 | ) | |

| (2,278 | ) |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY

(U.S.

dollars in thousands except share data)

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Preferred Stock | | |

Common Stock | | |

Stock | | |

Additional Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance as of July 1, 2023 | |

| 300,000 | | |

| - | | |

| 240,321,157 | | |

| 22 | | |

| 74 | | |

| 2,716 | | |

| (5,140 | ) | |

| (2,328 | ) | |

| (14 | ) | |

| (2,342 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| CLA - change of classification | |

| | | |

| | | |

| | | |

| | | |

| - | | |

| 66 | | |

| | | |

| 66 | | |

| | | |

| 66 | |

| Share issuance upon conversion of preferred stock | |

| (29,201 | ) | |

| - | | |

| 43,801,500 | | |

| 4 | | |

| - | | |

| (4 | ) | |

| - | | |

| - | | |

| - | | |

| 0 | |

| Stock payables | |

| - | | |

| - | | |

| - | | |

| | | |

| 394 | | |

| - | | |

| - | | |

| 394 | | |

| - | | |

| 394 | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 55 | | |

| | | |

| 55 | | |

| | | |

| 55 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| (1,456 | ) | |

| (1,456 | ) | |

| | | |

| (1,456 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2023 | |

| 270,799 | | |

| - | | |

| 284,122,657 | | |

| 26 | | |

| 468 | | |

| 2,833 | | |

| (6,596 | ) | |

| (3,269 | ) | |

| (14 | ) | |

| (3,283 | ) |

| | |

Preferred Stock | | |

Common Stock | | |

Stock | | |

Additional Paid in | | |

Accumulated | | |

| | |

Non-controlling | | |

Total | |

| | |

Number | | |

Amount | | |

Number | | |

Amount | | |

Payables | | |

Capital | | |

Deficit | | |

Total | | |

interests | | |

Deficiency | |

| | |

Unaudited | |

| Balance as of July 1, 2022 | |

| 300,000 | | |

| | | |

| 220,730,798 | | |

| 21 | | |

| 28 | | |

| 1,356 | | |

| (3,260 | ) | |

| (1,855 | ) | |

| (14 | ) | |

| (1869 | ) |

| Balance | |

| 300,000 | | |

| | | |

| 220,730,798 | | |

| 21 | | |

| 28 | | |

| 1,356 | | |

| (3,260 | ) | |

| (1,855 | ) | |

| (14 | ) | |

| (1869 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of shares | |

| - | | |

| - | | |

| 200,000 | | |

| - | | |

| (13 | ) | |

| 13 | | |

| - | | |

| | | |

| - | | |

| | |

| Stock payables | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7 | | |

| | | |

| - | | |

| 7 | | |

| - | | |

| 7 | |

| Share based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 267 | | |

| - | | |

| 267 | | |

| - | | |

| 267 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (683 | ) | |

| (683 | ) | |

| - | | |

| (683 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of September 30, 2022 | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 22 | | |

| 1,636 | | |

| (3,943 | ) | |

| (2,264 | ) | |

| (14 | ) | |

| (2,278 | ) |

| Balance | |

| 300,000 | | |

| - | | |

| 220,930,798 | | |

| 21 | | |

| 22 | | |

| 1,636 | | |

| (3,943 | ) | |

| (2,264 | ) | |

| (14 | ) | |

| (2,278 | ) |

APPYEA

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S.

dollars in thousands)

| | |

2023 | | |

2022 | |

| | |

For The nine Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| | |

Unaudited | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

| (2,087 | ) | |

| (738 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 18 | | |

| 18 | |

| Share based compensation | |

| 650 | | |

| 877 | |

| Change in fair value of convertible loans and warrant liability and financial expenses | |

| 778 | | |

| (939 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Other current assets | |

| (18 | ) | |

| (9 | ) |

| Accounts payable | |

| 272 | | |

| 91 | |

| Accounts payables – related party | |

| (22 | ) | |

| 195 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (410 | ) | |

| (505 | ) |

| | |

| | | |

| | |

| Cash flows from Investing activities: | |

| | | |

| | |

| Research and development expenses

capitalization | |

| (36 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash used by investing activities | |

| (36 | ) | |

| - | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds on account of Stock Payables | |

| 417 | | |

| 13 | |

| Proceeds from convertible Note received less issuance expenses | |

| 141 | | |

| 368 | |

| Issuance of warrants measured at FV | |

| - | | |

| 9 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 558 | | |

| 390 | |

| | |

| | | |

| | |

| Effect of foreign exchange on cash and cash equivalents | |

| (17 | ) | |

| (9 | ) |

| Change in cash and cash equivalents | |

| 95 | | |

| (124 | ) |

| Cash and cash equivalents at beginning of period | |

| 60 | | |

| 206 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

| 156 | | |

| 82 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

1 - GENERAL

AppYea,

Inc. (“AppYea”, “the Company”, “we” or “us”) was incorporated in the State of South Dakota

on November 26, 2012 to engage in the acquisition, purchase, maintenance and creation of mobile software applications. The Company is

in the development stage with no significant revenues and no operating history. On November 1, 2021 the Company was redomiciled in the

State of Nevada.

The

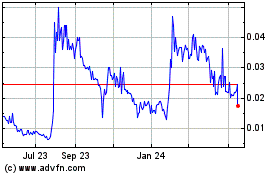

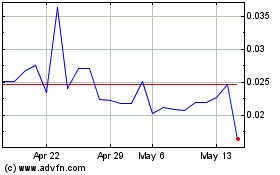

Company’s common stock is traded on the OTC Markets, QB tier, under the symbol “APYP”.

Reverse

merger

In

anticipation of the reverse merger described below, on July 2, 2021, Boris Molchadsky a majority shareholder of the Company, acquired

in a private transaction from the former majority shareholder two hundred and twenty-five thousand (225,000) Shares of Series A Preferred

Stock of the Company. The Series A Preferred Shares have the right to vote at 1,000 to 1 as shares of common stock and are convertible

at a rate of 1,500 to 1 as shares of common stock of the Company. The acquisition of the Preferred Shares provided Boris Molchadsky control

of a majority of the Company’s voting equity capital.

On

August 2, 2021, the Company entered into a stock exchange agreement with SleepX Ltd., a company formed under the laws of the State of

Israel (“SleepX”) and controlled by the majority shareholder of AppYea, Pursuant to the agreement, the outstanding equity

capital consisting of 1,724 common shares of SleepX was exchanged for 174,595,634 shares of common stock of the Company, based on the

agreement that determined that to SleepX shareholders will be issued common shares in the amount that will result in them holding 80%

of the common shares issued of AppYea. As a result, SleepX became a wholly owned subsidiary of the Company. On December 31, 2021, the

terms of the agreement were fulfilled; however, the issuance of the shares to SleepX shareholders, due to administrative matters, was

completed in March 2022 after the Company completed a reverse stock split. The shares that were issued are represented in the 2021 financial

statements.

SleepX

is an Israeli research and development company that has developed a unique product for monitoring and treating sleep apnea and snoring.

The technology is protected by several international patents and, subject to raising working capital, of which no assurance can be provided,

the Company plans to start serial production in Q4 2023. The Company will focus on further development and commercialization of the products.

Its strategy will include continued investment in research and development and new initiatives in sales and marketing.

SleepX

has incorporated, together with an unrelated third party, a privately held company under the laws of the State of Israel named Ta-nooma

Ltd. (“Ta-nooma”). Ta-nooma has developed sleeping monitoring technology for which patent applications were filed and has

no revenue from operation. Since its incorporation and as of the financial statements date, SleepX holds 66.7% of the voting interest

of Ta-nooma.

In

addition to SleepX, the Company has four wholly owned subsidiaries with no active operations.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

1 - GENERAL (cont.)

Financial

position

The

financial statements are presented on a going concern basis. The Company has not yet generated any material revenues, has suffered

recurring losses from operations and is dependent upon external sources for financing its operations. As of September 30, 2023, and

December 31, 2022, the Company has a stockholders’ deficiency of $3,269,000

and $2,549,000,

respectively. Between June and November 2023, the Company raised proceeds of $523,569 from the private placement of its securities. The Company

intends to continue to finance its operating activities by raising capital. There are no assurances that the Company will be

successful in obtaining an adequate level of financing needed for its long-term research and development activities on commercially

reasonable terms or at all. If the Company will not have sufficient liquidity resources, the Company may not be able to continue the

development of its product candidates or may be required to implement cost reduction measures and may be required to delay part of

its development programs. These matters, among others, raise substantial doubt about the Company’s ability to continue as a going concern.

The

financial statements do not include any adjustments for the values of assets and liabilities and their classification may be necessary

in the event that the Company is no longer able to continue its operations as a “going concern”.

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES

The

interim financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America

(“U.S. GAAP”). The interim financial statements do not include a full disclosure as required in annual financial statements

and should be read with the annual financial statements of the Company as of December 31, 2022. The accounting policies implemented in

the interim financial statements is consistent with the accounting policies implemented in the annual financial statements as of December

31, 2022, except of the following accounting pronouncement adopted by the company.

Recently

Issued Accounting Pronouncements

In

August 2020, the FASB issued ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives

and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40)” (“ASU 2020-06”), which is intended to

address issues identified as a result of the complexity associated.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES (cont.)

with

applying GAAP for certain financial instruments with characteristics of liabilities and equity. For convertible instruments, ASU 2020-06

reduces the number of accounting models for convertible debt instruments and convertible preferred stocks, and enhances information transparency

by making targeted improvements to the disclosures for convertible instruments and earnings-per-share guidance on the basis of feedback

from financial statement users. ASU 2020-06 is effective for fiscal years, and interim periods in those fiscal years, beginning after

December 15, 2023 (effective January 1, 2024) for smaller reporting companies. The Company is determining the adoption of this new accounting

guidance and the effect on its consolidated financial statements throughout the period until implementation.

Use

of Estimates in Preparation of Financial Statements

The

preparation of consolidated financial statements in conformity with U.S. GAAP accounting principles requires management to make estimates

and assumptions. The Company’s management believes that the estimates, judgments, and assumptions used are reasonable based upon

information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements, and the reported amounts

of expenses during the reporting period. Actual results could differ from those estimates.

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS

| |

A. |

Short-term loans from related parties |

During

2021, SleepX borrowed from Nexense an aggregate amount of $47,623. According to the agreement, the loan shall be repaid in the event

that the Company’s profits are sufficient to repay the aggregate loan amount and upon such terms and in such installments as shall

be determined by the Board. The loan shall bear interest at an annual rate equal to the minimum rate approved by applicable law in Israel

(2.9% in 2023).

During

2020, the minority shareholder of Ta-nooma loaned Ta-nooma NIS 115,725. The loan does not carry any interest expense and the repayment

terms have yet to be determined. As of September 30, 2023, the loan balance amounted to NIS 115,725 ($30,263).

| |

B. |

Convertible loans from related party |

On

August 22, 2021 Evergreen Venture Partners LLC (“Evergreen”), owned by Douglas O. McKinnon, principle stockholder of the

Company, agreed to advance to the Company up to $265,000 in tranches under the terms of an 18 month unsecured promissory note. The related

party has advanced to the Company $25,000 funds under the Note. Under the terms of the note, which bears interest at a rate of 8% per

annum, the note holder can convert the note into shares of common stock at 35% discount to the highest daily trading price over the 10

days’ preceding conversion but in any event not less than $0.10 per share. The note contains standard events of default. During

the quarter Evergreen sold the note to non-related party investors (Note 6-N).

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

3 - RELATED PARTY BALANCES AND TRANSACTIONS (cont.)

| |

C. |

Balances with related parties |

SCHEDULE

OF BALANCE WITH RELATED PARTIES

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

In U.S. dollars in thousands | |

| | |

| |

| Liabilities: | |

| | | |

| | |

| Employees and payroll accruals | |

| 205 | | |

| 268 | |

| Related party payables | |

| 198 | | |

| 140 | |

| Short term loan | |

| 78 | | |

| 80 | |

| Convertible loan | |

| - | | |

| 36 | |

| |

D. |

Transactions with related parties |

SCHEDULE

OF TRANSACTION WITH RELATED PARTIES

| | |

2023 | | |

2022 | |

| | |

Nine months ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

In U.S. dollars in thousands | |

| Expenses: | |

| | | |

| | |

| Management fee to the Company’s CEO | |

| 129 | | |

| 84 | |

| Salaries and related cost *) | |

| 667 | | |

| 896 | |

| Salaries and related cost | |

| 667 | | |

| 896 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS

The

following table summarizes fair value measurements by level as of September 30, 2023 and December 31, 2022 measured at fair value on

a recurring basis:

SCHEDULE OF FAIR VALUE RECURRING BASIS

| December 31, 2022 | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

In U.S. dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Convertible Loans | |

| - | | |

| - | | |

| 2,257 | | |

| 2,257 | |

| Financial liability | |

| | | |

| - | | |

| 24 | | |

| 24 | |

| September 30, 2023 | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

In U.S. dollars in thousands | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| None | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Convertible Loans | |

| - | | |

| - | | |

| 1,925 | | |

| 1,925 | |

| Financial liability | |

| | | |

| - | | |

| 183 | | |

| 183 | |

The

Convertible Loans changes consist of the following as of September 30, 2023 and December 31, 2022:

SCHEDULE OF CONVERTIBLE LOANS AT FAIR VALUE

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

Convertible Loans at Fair Value | |

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

$000 | |

| Opening Balance | |

| 2,257 | | |

| 2,492 | |

| Additional convertible loans (a) | |

| 153 | | |

| 526 | |

| Repayment of convertible loan (b) | |

| - | | |

| (18 | ) |

| Conversion of convertible loan (c) | |

| (243 | ) | |

| - | |

| Decrease of Notes purchased (Note 6k) | |

| (530 | ) | |

| - | |

| Change in fair value of convertible loans liability through profit or loss | |

| 288 | | |

| (743 | ) |

| Closing balance | |

| 1,925 | | |

| 2,257 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

estimated fair values of the Convertible loans were measured according to the Monte Carlo Model using the following assumptions:

SCHEDULE OF FAIR VALUES OF WARRANTS AND CONVERTIBLE LOAN ASSUMPTION USED

| | |

As of | | |

As of | |

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Expected term (in years) | |

| 0.75-1.26 | | |

| 0.5 | |

| Expected average (Monte Carlo) volatility | |

| 199 | % | |

| 169 | % |

| Expected dividend yield | |

| - | | |

| - | |

| Risk-free interest rate | |

| 5.4%-5.5% | | |

| 4.8 | % |

| WACC | |

| 29 | % | |

| 30 | % |

The

following table summarizes information relating to outstanding and exercisable warrants as of December 31, 2022:

SUMMARIZES RELATING TO OUTSTANDING AND EXERCISABLE WARRANTS

| Warrants Outstanding and Exercisable | | |

| |

Number of

Warrants | | |

Weighted Average

Remaining

Contractual life

(in years) | | |

Weighted Average

Exercise Price | | |

Valuation as of

December 31, 2022 | |

| | 300,000 | | |

| 2.9 | | |

| 0.043 | | |

$ | 11,351 | |

| | 300,000 | | |

| 3.35 | | |

| 0.043 | | |

$ | 11,679 | |

| | 8,334 | | |

| 2.9 | | |

| 0.6 | | |

$ | 230 | |

| | 32,500 | | |

| 3.35 | | |

| 0.6 | | |

$ | 992 | |

The

following table summarizes information relating to outstanding and exercisable warrants as of September 30, 2023:

| Warrants Outstanding and Exercisable | | |

| |

Number of

Warrants | | |

Weighted Average

Remaining

Contractual life

(in years) | | |

Weighted Average Exercise

Price | | |

Valuation as of September 30,

2023 | |

| | 8,334 | | |

| 2.16 | | |

| 0.6 | | |

$ | 23 | |

| | 32,500 | | |

| 2.61 | | |

| 0.6 | | |

$ | 116 | |

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

4 - CONVERTIBLE LOANS AND WARRANTS (cont.)

The

estimated fair values of the Warrants were measured according to the data as follows:

SCHEDULE OF FAIR VALUES OF WARRANTS AND CONVERTIBLE LOAN ASSUMPTION USED

| | |

As of | | |

As of | |

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Expected term | |

| 2.16-2.61 | | |

| 2.9-3.35 | |

| Expected average volatility | |

| 172%-174% | | |

| 179 | % |

| Expected dividend yield | |

| - | | |

| - | |

| Risk-free interest rate | |

| 4.54%-4.72% | | |

| 4.09%-4.15% | |

| Common Stock Market Value | |

$ | 0.0263 | | |

$ | 0.043 | |

*600,000 options were cancelled (Note 6K)

NOTE

5 - STOCK BASED COMPENSATION

| |

A. |

The table below depicts the number of options granted to consultants

and employees: |

SCHEDULE OF NUMBER OF OPTIONS GRANTED

| | |

Number of | | |

Weighted average

exercise price | |

| | |

Nine months ended

September 30, 2023 | |

| | |

Number of | | |

Weighted average

exercise price | |

| | |

options | | |

in USD | |

| | |

| | |

| |

| Options outstanding at January 1, 2023 | |

| 10,246,284 | | |

$ | 0.0001 | |

| Options granted during the period | |

| 37,770,029 | | |

$ | 0.0001 | |

| Options outstanding at the end of period | |

| 48,016,313 | | |

$ | 0.0001 | |

| Options exercisable at the end of period | |

| 13,183,291 | | |

$ | 0.0001 | |

| |

B. |

The estimated fair values of the options granted to directors and employees were measured using Black and Scholes Model based on the

following assumptions: |

SCHEDULE OF FAIR VALUE OF OPTIONS

| Grant date | |

July 1, 2021 | | |

January 2022 | | |

Q1-Q3’2023 | |

| Vesting period | |

| 2 years | | |

| 2 years | | |

| 0.25-3 years | |

| Expected average volatility | |

| 187.7 | % | |

| 187.7 | % | |

| 172%-187.7% | |

| Expected dividend yield | |

| - | | |

| - | | |

| - | |

| Common Stock Value | |

$ | 0.76 | | |

$ | 0.01-$0.08 | | |

$ | 0.009-$0.015 | |

| Risk-free interest rate | |

| 0.3 | % | |

| 1.81 | % | |

| 3.39%-3.98% | |

For

the Nine months ended September 30, 2023 and 2022 the company recognized expenses, to such options, in the amount of $618,000 and $507,000,

respectively. The expense is non-cash stock-based compensation expense resulting from options awards to our Chief Financial Officer and

advisors. The expense represents the aggregate grant date fair value for the option awards granted and vested during the fiscal years

presented, determined in accordance with FASB ASC Topic 718.

APPYEA

INC.

NOTES

TO THE FINANCIAL STATEMENTS

NOTE

6 - SIGNIFICANT EVENTS DURING THE PERIOD

| |

A- |

On January 1, 2023, Ron Mekler was appointed to the board of directors

of the Company. For his services he was granted stock option to purchase 500,000

of the Company’s common stock, valued at $21,498. Upon

grant, the options vest as follows: (i) 50% following 12 months on the first anniversary of the appointment and (ii) the balance of

shares of Common Stock, in four (4) consecutive fiscal quarters, beginning with the quarter ending March 31, 2024. The options

are exercisable at a per share exercise price of $0.0001

and shall otherwise be subject to the other terms and conditions specified in an Option Grant Agreement to be entered into between

Mr. Mekler and the Company. |

| |

|

|

| |

B- |

On February 1, 2023, the Company engaged with Adi Shemer as a board

advisor. For his services he was granted stock option to purchase 1,000,000

of the Company’s common stock, valued at $20,498. Upon

grant, the options vest as follows: (i) 33% on the 12 month anniversary of the appointment and (ii) the balance of shares of Common

Stock, in eight (8) consecutive fiscal quarters, beginning with the quarter ending April 31, 2024. The options are

exercisable at a per share exercise price of $0.0001

and shall otherwise be subject to the other terms and conditions specified in a Stock Option Agreement to be entered into

between Mr. Shemer and the Company. |

| |

|

|

| |

C- |

During the first quarter of 2023, the Company signed an

amendment with an existing holder of a Convertible Note in the amount of $437,190 (“CLA”)

with the

following terms: (i) the note was amended so that the fixed conversion price is $0.022, (ii) the principal amount of the Note was

increased by $7,500, (iii) if any portion of the balance due under the Note remains outstanding on April 30, 2023, an extension fee

equal to 15% of such outstanding balance was to be added to it, (iv) the Maturity Date with respect to all outstanding amounts

advanced under the Note was amended to July 31, 2023 and (v) several sale limitations on trading during the period beginning on the

effective date of the agreement and ending on the amended maturity date were instituted. The warrant exercise price was adjusted

accordingly.

The

CLA was purchased by a third party during the third quarter and terms were changed

according to Note 6-K. |

| |

|

|

| |

D- |

On May 1, 2023, the Company engaged a consultant for management of CRM

system and marketing campaigns. In consideration, the consultant was granted stock options to purchase 500,000

of the Company’s common stock, valued at $7,489. Up

on grant, the options vest as follows: (i) 33% following 12 months anniversary of the appointment and (ii) the balance of shares of

Common Stock, in eight (8) consecutive quarters, beginning with the quarter ending April 30, 2024. The option is exercisable, for a

period of 2 years after reaching full vesting, at a per share exercise price of $0.0001 and shall otherwise be subject to the other

terms and conditions specified in a Stock Option Agreement to be entered into between the consultant and the Company. |

| |

|

|

| |

E- |

On June 1, 2023, the Company engaged a consultant for its digital

marketing effort. For his services the consultant was granted stock options to purchase 500,000

of the Company’s common stock, valued at $5,414. Upon

grant, the options vest on a monthly basis over a period of 3 months from grant. The option is exercisable for a period of two

years following vesting, at a per share exercise price of $0.0001 and shall otherwise be subject to the other terms and conditions

specified in a Stock Option Agreement to be entered into between the consultant and the Company. |

| |

F- |

On June 14, 2023, SleepX Ltd, the Company’s subsidiary,

was granted a patent (US20150119741A1) by the United States Patent and Trademark Office, titled: “Apparatus and Method for Diagnosing

Sleep Quality.” The patent extends through February 2036, and provides broad coverage in the field of sleep monitoring. |

| |

|

|

| |

G- |

On June 18 2023, the holders of the majority (the “Majority

Holders”) of the Company outstanding convertible Preferred Series A Shares par value $0.0001 per share (the “Preferred Shares”)

agreed to provide that each Preferred Share shall have voting rights equal to 3,000 shares of the Company’s Common Stock which

may be voted at any meeting or any action of the Company shareholders at which the holders of the Common Stock are entitled to participate. |

| |

|

|

| |

H- |

In connection with Note 6-K, the holder of the Additional Third-Party

Note agreed to extend the maturity date of such note to June 30, 2024 and to not convert such note during such period. In consideration

thereof, the Company agreed with the holder that in the event that on June 30, 2024 the preceding 90 day VWAP is less than $0.04 (the

“90 day VWAP”), then the Company will issue to the holder additional shares of the Company’s common stock where the

number of shares is determined by quotient of the spread below $0.04 times seven million shares divided by the 90 day VWAP. |

| |

|

|

| |

I- |

On July 1, 2023, the

company granted Asaf Porat, the Company CFO, stock options to purchase 10,237,740

of the Company’s common stock, valued at $92,102,

exercisable through July 2033 at a per share exercise price of $0.0001

per share. Upon grant, the Options vest over a period of 24 months, on a monthly basis. The option is exercisable at a per

share exercise price of $0.0001 and

shall otherwise be subject to the other terms and conditions specified in a Stock Option Agreement between Mr. Porat and the

Company. In addition, subject to the investment in the company, Mr. Porat shall be entitled to an additional 14,500,000

common shares on December 31, 2023. |

| |

|

|

| |

J- |

On July 7, 2023, the Board appointed Adi Shemer as Chief Executive Officer (“CEO”) of the Company, effective immediately. Mr.

Shemer has been working with the Company since February 2023 as a consultant. In connection with his appointment as CEO, Mr. Shemer and

the Company’s subsidiary SleepX, Ltd. entered into an Employment Agreement (the “Agreement”) setting forth the terms

of his employment and compensation. Under the Agreement, Mr. Shemer is entitled to monthly salary of 40,000 NIS (equivalent to $10,810

as of the date of this report), of which the payment of 20,000 NIS is deferred until such time as the Company raises at least $1 million

in aggregate proceeds from the private placement of its securities. Under the Agreement, Mr. Shemer is also entitled to the following:

(i) Manager’s Insurance under Israeli law to which SleepX contributes amounts equal to (a) 8-1/3 percent for severance payments,

and 6.5%, or up to 7.5% (including disability insurance) designated for premium payment (and Mr. Shemer contributes an additional 6%)

of each monthly salary payment, and (b) 7.5% of his salary (with Mr. Shemer contributing an additional 2.5%) to an education fund, a

form of deferred compensation program established under Israeli law. Either Mr. Shemer or SleepX is entitled to terminate the employment

at any time upon 30 days prior notice. |

| |

|

|

| |

|

Under

the Agreement, Mr. Shemer was awarded options under the Company’s employee stock option plan for 11,500,000 shares of the

Company’s common stock at a per share exercise price of $0.0001, vesting over a period of 30 months, on a quarterly basis,

beginning with the quarter ending September 30, 2023, provided that Mr. Shemer continues in the employ of SleepX and continues to

provide CEO services to the Company. At the end of the 30-month period, Mr. Shemer is entitled to options for an additional

11,500,000 shares at the same exercise price provided he has been in the continuous employ of SleepX. The options are exercisable

through July 2033. In connection with the consulting services rendered prior to his appointment as CEO, he was awarded options for

1,000,000 shares of the Company’s common stock, exercisable through July 2033 at a per share exercise price of $0.0001 per

share, all of which have vested. |

| |

K- |

In June 2023, the Company

entered into a Subscription Agreement (the “Subscription Agreement”) with qualified investors (the

“Investor”), pursuant to which the Company agreed to issue and sell (the “Offering”) up to an aggregate of 135,000,000

shares of the Company’s common stock par value $0.0001

per share (the “Common Stock”) at a per share purchase price of $0.01,

and Common Stock purchase warrants, exercisable for a two year period from the date of issuance, to purchase up to an additional 135,000,000

shares of Common Stock at a per share exercise price of $0.04

(the “Warrants”). The subscription agreement was closed on July 19, 2023. As of September 30, 2023, the Company received

aggregate gross proceeds of $406,494

from the Investor, which entitles him to 40,649,400

shares and warrants. No assurance can be provided that the Investors will provide additional investments. |

| |

|

|

| |

|

The

subscription proceeds are being used by the Company to complete the IOS design and development of its biofeedback snoring treatment

wristband (the “Snoring Treatment Device”) as well as general corporate matters and readying for commercialization of

the Snoring Treatment Device. |

| |

|

|

| |

|

The Investor and other unaffiliated

entities (collectively, the “Purchasers’) purchased from Leonite Fund LP and Diagonal Lending LLC outstanding convertible

promissory notes issued by the Company. Following the purchase of these outstanding notes, the Purchasers and the company agreed to amend

the terms of the notes to extend the maturity date of each note to December 31, 2024, and to amend the conversion price thereof to $0.00561

(in the case of note purchased from Leonite Funding LP) and $0.005 (in the case of the note purchased from Diagonal Lending LLC). In

addition, the Purchasers agreed to not convert the notes purchased until the earlier of June 30, 2024, and such time as the Purchasers

complete the purchase of an additional outstanding promissory note issued by the Company to an unrelated third party in the aggregate

amount of $720,000 (the

“Additional Third Party Note”). As a result of the change in the conversion price the company changed the classification of the loans from fair value to cost basis. The conversion component of these

loans has not yet been recorded in Equity in view of the fact that these loans cannot be converted as of the date of the financial statements. |

| |

|

|

| |

|

In

connection with the purchase from Leonite of the Note by the Purchasers, the 600,000 Warrants previously issued to Leonite were

cancelled. The decrease in the warrant liability was

recorded to financial income on the profit and loss statement.

|

| |

|

|

| |

L- |

On July 25, 2023, SleepX

Ltd, the Company’s subsidiary, was granted a patent (US 11672472 B2) by the United States Patent and Trademark Office,

titled: “Methods and systems for estimation of obstructive sleep apnea severity in wake subjects by multiple speech

analyses.” The patent extends through December 2038, and provides broad coverage in the field of sleep monitoring. |

| |

|

|

| |

M- |

On July 26, 2023, Mr. Boris Molchadsky sold 2,334 Series A

convertible preferred stocks, for a total amount of $70,000. |

| |

|

|

| |

N- |

On August 16, 2023, the aforementioned purchasers completed

the purchase of 67,068 Series A convertible preferred stocks and the purchase of a related party note. The Purchasers agreed to amend

the terms of the note, to extend the maturity date to December 31, 2024, and to amend the conversion price thereof to $0.005. |

NOTE

7 - SUBSEQUENT EVENTS

| |

A- |

On October 7th, 2023, “Iron Swords” war broke out

in Israel (“The war”). As a result, the scope of economic and business activity in the country decreased. The company relies

on foreign suppliers for manufacturing, marketing and shipment of products, and as such, doesn’t see any implication on the Company’s

operations. Future product development made in Israel is likely to slow down. The Company is continuing to regularly follow developments

on the matter and will continue to examine the effects on its operations. |

| |

|

|

| |

B- |

At the end of October, the company wired to its wristband manufacturer

the completion of the cost for manufacturing the first serial wristband units. The wristbands shall be delivered at the end of November

and shipped to customers during December. |

| |

|

|

| |

C- |

Following Note 6-K, the company received after the end of the

3rd quarter an additional aggregated $117,075 under the subscription agreement. |

| |

|

|

| |

D- |

During November 2023, the

Company was notified of a lawsuit that was originally filed on August, 2022, in the Tel Aviv Magistrate’s Court against our

Chairman and majority shareholder, Boris Molchadsky, G.P.I.S Ltd., an entity controlled by Mr. Molchadsky, Nexsense, Inc. (the

former shareholder of SleePX Ltd.) and SleepX, Ltd., our subsidiary (collectively, the “Defendants”) [Civil lawsuit

number 25441-08-22]. The suit was filed by a fund operating out of Israel. A copy of the claim was served to the defendants only six

months after it was submitted to court, on February 21, 2023. The lawsuit is based on the alleged breach of partnership and loan

agreements as well as other related allegations, including violation of agreements reached in a mediation proceeding that took place

in 2015. On July 24, 2023, the Defendants (except for Nexsense, Inc.) filed a statement of defense, denying the allegations and

argued that the claim should be dismissed, due to the statute of limitations, lack of cause of action, lack of jurisdiction, delay

in filing the claim, and respecting SleepX, also due to the lack of legal rivalry between SleepX and the plaintiff. |

| |

|

|

| |

|

Recently,

the Magistrate’s Court in Tel Aviv accepted the request regarding lack of material jurisdiction, and the claim was then transferred

to the economic department of the District Court in Tel Aviv. |

| |

|

|

| |

|

The

first preliminary hearing has been scheduled for February 14, 2024. The Company and its legal consultants concluded that they cannot,

at this stage, know the effects, if any, of these actions on its subsidiary SleepX and / or the Company, and accordingly, no provision was recorded. |

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-looking

Statements

This

Quarterly Report on Form 10-Q contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and other Federal securities laws, and is subject to the safe-harbor created by such Act and laws. In some cases, you can

identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“potential” or “continue,” the negative of such terms, or other variations thereon or comparable terminology.

The statements herein and their implications are merely predictions and therefore inherently subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause actual results, performance levels of activity, or our achievements, or industry results

to be materially different from those contemplated by the forward-looking statements. Except as required by law, we undertake no obligation

to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events. Further information on potential factors that could affect

our business is described under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December

31, 2022 as filed with the Securities and Exchange Commission, or the SEC, on September 30, 2023/ As used in this quarterly report, the

terms “we”, “us”, “our”, the “Company” and “AppYea” mean AppYea, Inc. and

our wholly-owned subsidiaries Sleepx LTD and Ta-Nooma LTD unless otherwise indicated or as otherwise required by the context.

Overview

AppYea,

Inc. is a digital health company, focused on the development of accurate wearable monitoring solutions to treat sleep apnea and snoring

and fundamentally improve quality of life.

Our

solutions are based on our proprietary intellectual property portfolio comprised of Artificial Intelligence (AI) and sensing technologies

for the tracking, analysis, and diagnosis of vital signs and other physical parameters during sleep time, offering extreme accuracy at

affordable cost.

AI

is a broad term generally used to describe conditions where a machine mimics “cognitive” functions associated with human

intelligence, such as “learning” and “problem solving. Basic AI includes machine learning, where a machine uses algorithms

to parse data, learn from it, and then make a determination or prediction about a given phenomenon. The machine is “trained”

using large amounts of data and algorithms that provide it with the ability to learn how to perform the task.

General

Background

Snoring

is a general disorder caused due to repetitive collapsing and narrowing of the upper airway. Individuals with snoring problems are at

increased risk of accidental injury, depression and anxiety, heart disease and stroke. Currently available treatments include surgical

and non-surgical devices.

According

to Fior Markets, a market intelligence company, the Global Anti-Snoring Treatment Market is expected to grow from USD 4.3 billion in

2020 to USD 8.6 billion by 2028, with a 9.07% CAGR between 2021 and 2028. While North America had the largest market share of 28.12%

in 2020, Asia-Pacific region is witnessing significant growth due to the increasing prevalence of obesity and sedentary lifestyles in

emerging economies.

Currently

available anti-snoring devices consist mainly of oral appliances that are recommended for use by patients suffering from snoring or obstructive

sleep apnea. These appliances are put before sleep and have a simple function of pushing either the lower jaw or the tongue forward.

This keeps the epiglottis parted from the uvula and prevents the snoring sound created by the vibration of soft tissues of palate.

Sleep

apnea is a severe sleep condition in which individuals frequently stop breathing in their sleeping, this leads to insufficient oxygen

supply to the brain and the rest of the body which, in turn may lead to critical problems. There are three main types of apnea: (i) Obstructive

Sleep Apnea (“OSA”), the most common form caused by the throat muscles relaxing during sleep; (ii) Central sleep apnea, which

occurs when the brain doesn’t send the proper signals to the muscles that control the breathing; and (iii) complex sleep apnea

syndrome, which occurs when an individual suffers from both OSA and central sleep apnea. While OSA is a common disorder in the elderly

population, affecting approximately 13 to 32% of people aged over 65, sleep apnea can occur at any age and affects approximately 25%

of men and nearly 10% of women.

In

2020, North America dominated the sleep apnea device market, as it accounted for 49% of the revenue, the global market size was valued

at USD 3.7 billion and is expected to expand by 6.2% CAGR, according to a report by Grand View Research Inc., reaching USD 6.1 billion

by 2028.

The

global sleep apnea and snoring market is driven in large part by solutions that can be applied in at home-settings or healthcare settings,

as these tools will drive decisions regarding specific treatments and the associated outlays. However, despite advances in medical imaging

and other diagnostic tools, misdiagnosis remains a common occurrence. We believe that improved diagnoses and outcomes are achievable

through the adoption of AI-based decision support tools.

Our

Products and Product Candidates

Our

initial focus is on the development of supporting solutions utilizing our proprietary platform. Our current business plan focuses on

two principal devices and an App currently in development:

AppySleep

– Biofeedback snoring treatment wristband, combined with the AppySleep App.

This

wristband uses unique algorithms designed by SleepX combined with sensors to monitor physiological parameters during sleep. Based on

real time reactions, the wristband will vibrate, when necessary, in order to decrease the snoring and regulate breathing by gently bringing

the user to a lighter sleep and thus ceasing the snoring event.

The

AppySleep product is currently in serial manufacturing stage.

AppySleep

PRO – is a wristband for the treatment of sleep apnea using biofeedback in combination with AppySleep PRO app. The unique algorithms

of AppySleep PRO, combined with the wristband sensors, monitor sleep apnea events and additional physiological parameters during sleep,

and when necessary, the wristband vibrates according to real time events, in order to decrease and cease sleep apnea events.

AppySleep

LAB – Is a medical application, available for downloading on a smartphone, and used to monitor breathing patterns in the sleep

and identify sleep apnea episodes without direct contact to the user.

During

the 3rd quarter of 2023 we filed a Trademark request application for the registration of AppySleep and changed its

products names from DreamIT, SleepX PRO, and DreamIT PRO, to AppySleep, AppySleep LAB, and AppySleep PRO, respectively.

Recent

Developments

We

started manufacturing our wristband for the Android App during November 2023, and we expect it would be delivered to our pre-ordered

customers during December 2023.

In

addition, following our capital raise in June-July 2023, we have recharged our development efforts and are currently focusing on the

development of our new IOS & Android App version of AppySleep which we anticipate releasing to the market during the first quarter

of 2024. The new App will be cloud based with newly added features that we believe will improve its diagnostic abilities.

We

are finalizing our marketing materials and landing pages, and we plan to start intensive marketing efforts for our product during December

2023.

We

continue to expand our patent portfolio in purpose of increasing our advantage versus other sleep monitoring companies which aren’t

treating snoring and obstructive sleep apnea.

The

License Agreement