false

0001445815

0001445815

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 13, 2025

BIOXYTRAN,

INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-35027 |

|

26-2797630 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

| 75

Second Ave, Suite 605, Needham, MA |

|

02494 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

617-454-1199

(Registrant’s

telephone number, including area code)

617-494-1199

(Former

Telephone Number, if Changed Since the Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common

Stock, par value $0.001 |

|

BIXT |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review

Overview

“On

May 3, 2024, the Commission entered an order instituting settled administrative and cease-and-desist proceedings against BF Borgers CPA

PC and its sole audit partner Benjamin F. Borgers CPA (individually and together, “BF Borgers”)”.

“BF

Borgers has been denied the privilege of appearing or practicing before the Commission, issuers that have engaged BF Borgers to audit

or review financial information to be included in any Exchange Act filings to be made on or after the date of the Order will need to

engage a new qualified, independent, PCAOB-registered public accountant. For example:

| |

● |

Form

10-K filings on or after the date of the Order may not include audit reports from BF Borgers. Each fiscal year presented must be

audited by a qualified, independent, PCAOB-registered public accountant that is permitted to appear or practice before the Commission. |

| |

● |

Form

10-Q filings on or after the date of the Order may not present financial information that has been reviewed by BF Borgers. Each quarterly

period presented must be reviewed by a qualified, independent, PCAOB-registered public accountant that is permitted to appear or

practice before the Commission. |

| |

● |

Form

20-F filings on or after the date of the Order may not include audit reports from BF Borgers. Each fiscal year presented must be

audited by a qualified, independent, PCAOB-registered public accountant that is permitted to appear or practice before the Commission. |

Exchange

Act reports that were filed before the date of the Order do not necessarily need to be amended solely because of the Commission’s

entry of the Order. However, issuers should consider whether their filings may need to be amended to address any reporting deficiencies

arising from the BF Borgers engagement.”

For

more details please consult:

https://www.sec.gov/newsroom/speeches-statements/staff-statement-borgers-05032024

As

a result of this finding, the Company engaged Fruci & Associates II, PLLC (“Fruci”), PCAOB ID #

05525,

as their successor auditor in order to re-audit the Financial Statements for the years ended December 31, 2023 and 2022. Fruci’s

restated Financial Statements were disclosed in the Company’s Form 10-K/A on January 13, 2025, wherein the restatement

findings are presented under “Note 2 - Restatement of Previously Issued Financial Statements” and read

as follows:

During

the re-auditing process, the Company concluded that for shares issued pursuant to the Exchange Exemption in Rule 3(a)(9), the company

historically valued these shares at the same price as an ongoing capital raise pursuant to Section 4(a)(2) of the Securities Act and/or

Rule 506 of Regulation D promulgated under the Securities Act. In retrospect this approximation of Fair value based on the recommendations

with ASC 820 - Fair Value Measurement, was not concluded to be precise enough, and that we would need to define a more precise value

based on market price at the time of issuance. In accordance with the guidance of ASC 820 concerning for Lack of Registration Premium,

shares that are restricted for six months under SEC Rule 144 generally see a 20%–30% discount on market price. The Company has

opted for a 25% discount to the market price at the date of issuance based on the Company’s elevated volatility, and to the illiquidity

of the high number of shares issued in these transactions.

The

Company also concluded that for shares issued pursuant to the Exchange Exemption in Rule 701, the company historically valued these shares

at the weighted average market price for the period the benefit was earned. In retrospect this approximation of Fair value based on the

recommendations with ASC 820 - Fair Value Measurement, was not concluded to be precise enough, and that we would need to define a more

precise value based on market price at the time of issuance. In accordance with the guidance of ASC 820 the shares will be valued at

the market price of the day closest to the date of awarded grant.

Finally,

the Company discovered some timing issues, where the accruals had not been sufficiently allocated, or had been allocated to the incorrect

accounting period.

Therefore,

the Company, in consultation with its Audit Committee, concluded that its previously issued Financial Statements for the years ended

December 31, 2023, and 2022 (the “Affected Periods”) should be restated because of a misapplication in the guidance around

the valuation for certain of our outstanding shares of Common Stock (the “Shares”) and should no longer be relied upon.

Impact

of the Restatement

The

impact of the restatement on the balance sheets, statements of operations and statements of cash flows for the Affected Periods is presented

below. The restatement had no net impact on net cash flows from operating, investing or financing activities.

| Balance Sheet | |

As of December 31, 2023 | | |

As of December 31, 2022 | |

| | |

As

Previously Reported | | |

Restatement Adjustment | | |

As

Restated | | |

As

Previously Reported | | |

Restatement/ Adjustment | | |

As

Restated | |

| Assets | |

| | |

| | |

| | |

| | |

| | |

| |

| Adjustment to Intangibles | |

$ | — | | |

$ | 1,744 | | |

$ | 1,744 | | |

$ | — | | |

$ | — | | |

$ | — | |

| Total assets | |

| 137,638 | | |

| 1,744 | | |

| 139,382 | | |

| 370,936 | | |

| — | | |

| 370,936 | |

| Liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjustments to accounts payable | |

| | | |

| (6,369 | ) | |

| (6,369 | ) | |

| | | |

| 4,429 | | |

| 4,429 | |

| Adjustments to unissued shares | |

| | | |

| 11,631 | | |

| 11,631 | | |

| | | |

| | | |

| | |

| Total liabilities | |

| 3,249,500 | | |

| (5,262 | ) | |

| 3,244,238 | | |

| 3,663,482 | | |

| 4,429 | | |

| 3,667,911 | |

| Stockholders’ equity | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock, $0.001 par value | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Adjustment to Common Stock | |

| | | |

| (1,000 | ) | |

| (1,000 | ) | |

| | | |

| 94 | | |

| 94 | |

| Common stock, $0.001 par value | |

| 145,642 | | |

| (1,000 | ) | |

| 144,642 | | |

| 123,252 | | |

| 94 | | |

| 123,346 | |

| Adjustment to APIC | |

| | | |

| 164,731 | | |

| 164,731 | | |

| | | |

| 4,679 | | |

| 4,679 | |

| Additional paid-in capital | |

| 12,920,984 | | |

| 164,731 | | |

| 13,085,715 | | |

| 8,392,430 | | |

| 4,679 | | |

| 8,397,109 | |

| Non-controlling interest | |

| (680,886 | ) | |

| — | | |

| (680,886 | ) | |

| (590,628 | ) | |

| — | | |

| (590,628 | ) |

| Accumulated deficit | |

| (15,497,602 | ) | |

| (200,775 | ) | |

| (15,699,327 | ) | |

| (11,217,600 | ) | |

| (9,202 | ) | |

| (11,226,802 | ) |

| Total stockholders’ equity | |

| (3,111,862 | ) | |

| (37,994 | ) | |

| (3,104,856 | ) | |

| (3,292,546 | ) | |

| (4,429 | ) | |

| (3,296,975 | ) |

| Total liabilities and stockholders’ equity | |

$ | 137,638 | | |

$ | 1,744 | | |

$ | 139,382 | | |

$ | 370,936 | | |

$ | — | | |

$ | 370,936 | |

| Statement of Operations | |

As of December 31, 2023 | | |

As of December 31, 2022 | |

| | |

As

Previously Reported | | |

Restatement Adjustment | | |

As

Restated | | |

As

Previously Reported | | |

Restatement/ Adjustment | | |

As

Restated | |

| Adjustment to R&D | |

| | | |

| | | |

| | | |

| | | |

| (300,000 | ) | |

| (300,000 | ) |

| Adjustment to GNA | |

| | | |

| 19,935 | | |

| 19,935 | | |

| | | |

| (9,202 | ) | |

| (9,202 | ) |

| Loss from operations | |

| (3,820,147 | ) | |

| 19,935 | | |

| (3,800,212 | ) | |

| (2,134,112 | ) | |

| (309,202 | ) | |

| (2,436,541 | ) |

| Adjustment to other income | |

| — | | |

| — | | |

| — | | |

| — | | |

| 300,000 | | |

| 300,000 | |

| Loss of issuance | |

| — | | |

| (212,458 | ) | |

| (212,458 | ) | |

| — | | |

| — | | |

| — | |

| Total other (expense) income | |

| (550,113 | ) | |

| (212,458 | ) | |

| (762,571 | ) | |

| (523,192 | ) | |

| 300,000 | | |

| (229,965 | ) |

| Net loss | |

$ | (4,370,260 | ) | |

$ | (192,523 | ) | |

$ | (4,562,783 | ) | |

$ | (2,657,304 | ) | |

$ | (9,202 | ) | |

$ | (2,666,506 | ) |

| Net loss attributable to the non-controlling interest | |

| 90,258 | | |

| — | | |

| 90,258 | | |

| 193,372 | | |

| — | | |

| 193,372 | |

| NET LOSS ATTRIBUTABLE TO BIOXYTRAN | |

| (4,280,002 | ) | |

| (192,523 | ) | |

| (4,472,525 | ) | |

| (2,463,932 | ) | |

| (9,202 | ) | |

| (2,473,134 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per Common share, basic and diluted | |

| (0.03 | ) | |

| — | | |

| (0.03 | ) | |

| (0.02 | ) | |

| — | | |

| (0.02 | ) |

| Adjustment of average number of Common shares out-standing | |

| | | |

| (251,473 | ) | |

| (251,473 | ) | |

| | | |

| (2,427,075 | ) | |

| (2,427,075 | ) |

| Weighted average number of Common shares out-standing, basic

and diluted | |

| 134,224,825 | | |

| (251,473 | ) | |

| 133,973,352 | | |

| 115,139,380 | | |

| (2,427,075 | ) | |

| 112,712,305 | |

| Statement of Cash Flows | |

As of December 31, 2023 | | |

As of December 31, 2022 | |

| | |

As

Previously Reported | | |

Restatement Adjustment | | |

As

Restated | | |

As

Previously Reported | | |

Restatement/ Adjustment | | |

As

Restated | |

| Net loss | |

$ | (4,370,260 | ) | |

$ | (192,523 | ) | |

$ | (4,562,783 | ) | |

$ | (2,657,304 | ) | |

$ | (9,202 | ) | |

$ | (2,666,506 | ) |

| Adjustment to reconcile net loss to net cash used in operating activities | |

| — | | |

| 192,523 | | |

| 192,523 | | |

| — | | |

| 7,202 | | |

| 7,202 | |

| Net cash used in operating activities | |

| (775,375 | ) | |

| — | | |

| (775,375 | ) | |

| (1,805,670 | ) | |

| 2,000 | | |

| (1,803,670 | ) |

| Net cash used in investing activities | |

| (44,301 | ) | |

| | | |

| (44,301 | ) | |

| (32,247 | ) | |

| — | | |

| (32,247 | ) |

| Adjustment in cash investment | |

| | | |

| | | |

| | | |

| | | |

| (2,000 | ) | |

| (2,000 | ) |

| Net cash provided by financing activities | |

| 550,361 | | |

| — | | |

| 550,361 | | |

| 2,060,960 | | |

| (2,000 | ) | |

| 2,058,960 | |

| Net change in cash | |

$ | (269,315 | ) | |

$ | — | | |

$ | (269,315 | ) | |

$ | 223,043 | | |

$ | — | | |

$ | 223,043 | |

The

impact to the balance sheet dated December 31, 2023, and 2022, filed on Form 10-K on March 22, 2024, and on March

31, 2023, the valuation of for shares issued pursuant to the Exchange Exemption in Rule 3(a)(9), resulted in a $212,458 increase

to the Loss of issuance line item on December 31, 2023, and offsetting to the Additional Paid in Capital (“APIC”).

The adjustment had no impact to total stockholders’ equity at any reported balance sheet date.

The

impact to the balance sheet dated December 31, 2023, filed on Form 10-K on March 22, 2024, the valuation of for shares issued pursuant

to the Exchange Exemption in Rule 701, resulted in a $19,935 reduction to the Compensation Expense line item on December 31, 2023,

and offsetting to the Additional Paid in Capital (“APIC”). The adjustment had no impact to total stockholders’

equity at any reported balance sheet date.

In

2022 the amount of $300,000 R&D expense was reclassified to other income. The transaction had no impact to the Net

Result dated December 31, 2022, filed on Form 10-K on March 22, 2024, and on March 31, 2023.

A

private placement of $30,000 was incorrectly booked as stock subscription on December 31, 2022, rather than issued shares the

adjustment increasing the stock count at December 31, 2022, with 93,750 shares. At December 31, 2023, the stock count was

reduced with 1,000,000 shares for shares that was to be returned to treasury. The Weighted average number of Common shares out-standing,

basic and diluted was on December 31, 2022, reduced with 251,473 shares and on December 31, 2023, reduced with 2,427,075

shares.

Incorrectly

warrants forfeiture and issuance fees were classified at operational income/expense reducing the result with $4,773 at December 31, 2022,

and was offset to the Additional Paid in Capital (“APIC”). Other inconsistencies were insufficient accruals for IP and

offset against liabilities for an amount of $1,744 for the year ended December 31, 2023, and a timing issue with paid salaries and payroll

taxes, as well as insufficient allocation to accruals for legal services reduced the result with ($4,429) for the year ended

December 31, 2022, and with ($5,262) for the year ended on December 31, 2023.

Item

9.01 Financial Statements and Exhibits.

Exhibit

Number |

|

Description |

| |

|

|

| 104 |

* |

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Filed

as an exhibit hereto. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BIOXYTRAN,

INC. |

| |

|

|

| |

By: |

/s/

David Platt, Ph.D. |

| |

|

David

Platt, Ph.D., its Chief Executive Officer |

| |

|

|

| Date:

January 13, 2025 |

|

|

v3.24.4

Cover

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity File Number |

001-35027

|

| Entity Registrant Name |

BIOXYTRAN,

INC.

|

| Entity Central Index Key |

0001445815

|

| Entity Tax Identification Number |

26-2797630

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

75

Second Ave

|

| Entity Address, Address Line Two |

Suite 605

|

| Entity Address, City or Town |

Needham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02494

|

| City Area Code |

617

|

| Local Phone Number |

454-1199

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

BIXT

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

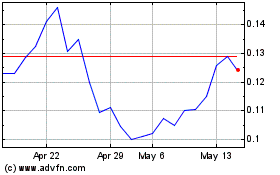

Bioxytran (QB) (USOTC:BIXT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bioxytran (QB) (USOTC:BIXT)

Historical Stock Chart

From Mar 2024 to Mar 2025