false

2024

FY

0000918573

0000918573

2023-04-01

2024-03-31

0000918573

2023-09-30

0000918573

2024-07-11

0000918573

2024-03-31

0000918573

2023-03-31

0000918573

us-gaap:SeriesAPreferredStockMember

2024-03-31

0000918573

us-gaap:SeriesAPreferredStockMember

2023-03-31

0000918573

us-gaap:SeriesBPreferredStockMember

2024-03-31

0000918573

us-gaap:SeriesBPreferredStockMember

2023-03-31

0000918573

2022-04-01

2023-03-31

0000918573

grve:PreferredStockSeriesAStockMember

2022-03-31

0000918573

grve:PreferredStockSeriesBStockMember

2022-03-31

0000918573

us-gaap:CommonStockMember

2022-03-31

0000918573

grve:CommonStockToBeIssuedMember

2022-03-31

0000918573

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0000918573

us-gaap:RetainedEarningsMember

2022-03-31

0000918573

2022-03-31

0000918573

grve:PreferredStockSeriesAStockMember

2023-03-31

0000918573

grve:PreferredStockSeriesBStockMember

2023-03-31

0000918573

us-gaap:CommonStockMember

2023-03-31

0000918573

grve:CommonStockToBeIssuedMember

2023-03-31

0000918573

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000918573

us-gaap:RetainedEarningsMember

2023-03-31

0000918573

grve:PreferredStockSeriesAStockMember

2022-04-01

2023-03-31

0000918573

grve:PreferredStockSeriesBStockMember

2022-04-01

2023-03-31

0000918573

us-gaap:CommonStockMember

2022-04-01

2023-03-31

0000918573

grve:CommonStockToBeIssuedMember

2022-04-01

2023-03-31

0000918573

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2023-03-31

0000918573

us-gaap:RetainedEarningsMember

2022-04-01

2023-03-31

0000918573

grve:PreferredStockSeriesAStockMember

2023-04-01

2024-03-31

0000918573

grve:PreferredStockSeriesBStockMember

2023-04-01

2024-03-31

0000918573

us-gaap:CommonStockMember

2023-04-01

2024-03-31

0000918573

grve:CommonStockToBeIssuedMember

2023-04-01

2024-03-31

0000918573

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2024-03-31

0000918573

us-gaap:RetainedEarningsMember

2023-04-01

2024-03-31

0000918573

grve:PreferredStockSeriesAStockMember

2024-03-31

0000918573

grve:PreferredStockSeriesBStockMember

2024-03-31

0000918573

us-gaap:CommonStockMember

2024-03-31

0000918573

grve:CommonStockToBeIssuedMember

2024-03-31

0000918573

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0000918573

us-gaap:RetainedEarningsMember

2024-03-31

0000918573

srt:ChiefExecutiveOfficerMember

grve:KentRodriguezMember

2020-03-29

2020-04-02

0000918573

srt:ChiefExecutiveOfficerMember

grve:KentRodriguezMember

2023-04-01

2024-03-31

0000918573

2022-06-03

0000918573

us-gaap:SeriesAPreferredStockMember

2023-04-01

2024-03-31

0000918573

grve:ConvertiblePromissoryNoteMember

grve:ThirdPartyMember

2018-01-30

0000918573

grve:ConvertiblePromissoryNoteMember

2018-01-30

0000918573

grve:ConvertiblePromissoryNoteMember

2018-01-01

2018-01-30

0000918573

grve:ConvertiblePromissoryNoteMember

2019-03-31

0000918573

grve:ConvertiblePromissoryNoteMember

grve:SettlementAgreementMember

2021-06-03

0000918573

grve:ConvertiblePromissoryNoteMember

grve:SettlementAgreementMember

2021-06-01

2021-06-03

0000918573

grve:ConvertiblePromissoryNoteMember

grve:SettlementAgreementMember

2021-04-01

2022-03-31

0000918573

grve:ConvertiblePromissoryNoteMember

grve:SettlementAgreementMember

2022-06-01

2022-06-03

0000918573

grve:ConvertiblePromissoryNote2Member

grve:ThirdPartyMember

2021-03-05

0000918573

grve:ConvertiblePromissoryNote2Member

grve:ThirdPartyMember

2021-03-01

2021-03-05

0000918573

grve:ConvertiblePromissoryNote2Member

2021-03-05

0000918573

grve:ConvertiblePromissoryNote5Member

2022-03-07

0000918573

grve:ConvertiblePromissoryNote5Member

2022-03-01

2022-03-07

0000918573

grve:ConvertiblePromissoryNote2Member

grve:SettlementAgreementMember

2023-12-01

2023-12-31

0000918573

grve:ConvertiblePromissoryNote2Member

2024-03-31

0000918573

grve:ConvertiblePromissoryNote2Member

2023-03-31

0000918573

grve:ConvertiblePromissoryNote3Member

2021-07-01

2021-07-23

0000918573

grve:ConvertiblePromissoryNote3Member

2021-07-23

0000918573

grve:ConvertiblePromissoryNote3Member

2022-12-02

2022-12-31

0000918573

grve:ConvertiblePromissoryNote3Member

2023-03-23

0000918573

grve:ConvertiblePromissoryNote3Member

2023-03-28

0000918573

grve:ConvertiblePromissoryNote3Member

2023-03-01

2023-03-29

0000918573

grve:ConvertiblePromissoryNote3Member

2022-04-01

2023-03-31

0000918573

grve:ThreeDifferentPartiesMember

2021-08-01

2021-08-05

0000918573

grve:ThreeDifferentPartiesMember

2021-08-05

0000918573

grve:ConvertiblePromissoryNote4Member

2021-10-01

0000918573

grve:ConvertiblePromissoryNote4Member

2021-09-29

2021-10-01

0000918573

grve:ConvertiblePromissoryNote4Member

2023-03-01

2023-03-31

0000918573

grve:ConvertiblePromissoryNote4Member

2023-02-22

0000918573

grve:ConvertiblePromissoryNote4Member

2023-02-01

2023-02-22

0000918573

grve:ConvertiblePromissoryNote5Member

2024-03-31

0000918573

grve:ConvertiblePromissoryNote3Member

2023-03-31

0000918573

grve:RobertHymersIIIMember

2023-04-01

2024-03-31

0000918573

grve:RobertHymersIIIMember

2024-03-31

0000918573

grve:RobertHymersMember

2023-04-01

2024-03-31

0000918573

grve:RobertHymersMember

2024-03-31

0000918573

grve:RobertHymersIIIMember

2022-04-01

2023-03-31

0000918573

grve:RobertHymersIIIMember

2023-03-31

0000918573

grve:RaiseRightLLCMember

2022-04-01

2023-03-31

0000918573

grve:RaiseRightLLCMember

2023-03-31

0000918573

grve:RobertHymersMember

2022-04-01

2023-03-31

0000918573

grve:RobertHymersMember

2023-03-31

0000918573

grve:WestworldFinancialCapitalLLCMember

2022-04-01

2023-03-31

0000918573

grve:WestworldFinancialCapitalLLCMember

2023-03-31

0000918573

us-gaap:SeriesBPreferredStockMember

2023-04-01

2024-03-31

0000918573

grve:TwoSeparatePartiesMember

2022-04-01

2022-04-08

0000918573

2022-04-01

2022-04-08

0000918573

2022-10-01

2022-10-04

0000918573

2022-10-02

2022-10-04

0000918573

2022-11-29

2022-12-01

0000918573

2022-12-01

0000918573

grve:ThreeDifferentPartiesMember

2022-11-29

2022-12-01

0000918573

2023-01-01

2023-01-31

0000918573

2023-02-01

2023-02-21

0000918573

2023-02-21

0000918573

grve:ConsultingAgreementMember

2023-04-01

2023-04-15

0000918573

grve:ConsultingAgreementMember

2023-04-15

0000918573

2023-12-01

2023-12-20

0000918573

2021-04-01

2022-03-31

0000918573

srt:MinimumMember

2022-03-31

0000918573

srt:MaximumMember

2022-03-31

0000918573

srt:MinimumMember

2021-04-01

2022-03-31

0000918573

srt:MaximumMember

2021-04-01

2022-03-31

0000918573

grve:ConvertiblePromissoryNoteMember

grve:SettlementAgreementMember

2022-06-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For the fiscal year ended March 31, 2024 |

| |

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For the transition period from _______ to _______. |

Commission file number: 000-23476

GROOVE BOTANICALS INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

84-1168832 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

Registrant’s Principal Office

310 Fourth Avenue South, Suite 7000

Minneapolis, MN 55415

Registrant’s telephone number, including area code:

(612-315-5068)

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by checkmark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No

☑

Indicate by checkmark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

No

☑

Indicate by check mark whether the registrant (1) has filed

all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted

electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☑ |

Smaller reporting company ☑ |

| Emerging Growth Company ☑ |

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. Yes ☐

☑

Indicate by check mark whether the registrant has filed a

report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under

Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit

report. ☐

If securities are registered pursuant to Section 12(b) of

the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an

error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections

are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive

officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common

stock, par value $0.001 per share (“Common Stock”), held by non-affiliates, computed by reference to the price at which the

Common Stock was last sold as of September 30, 2023, the last business day of the registrant’s most recently completed second fiscal

quarter, was approximately $4,033,145.

The number of shares of the registrant’s Common

Stock outstanding as of August 12, 2024 was 59,643,062 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

PART I

Cautionary Note Regarding Forward-Looking Statements

In addition to historical information, this Annual Report

on Form 10-K of Groove Botanicals Inc. contains “forward-looking statements.” Any statements contained herein that are not

statements of historical fact may be deemed to be forward-looking statements. In addition, any statements that refer to other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. These forward-looking statements involve significant risks and uncertainties that

could cause the actual results to differ materially from the expected results and, consequently, you should not rely on these forward-looking

statements as predictions of future events. These forward-looking statements and factors that may cause such differences include, without

limitation, future capital requirements, regulatory actions or delays and other factors that may cause actual results to be materially

different from those described or anticipated by these forward-looking statements. The foregoing list of factors is not exclusive. Readers

are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. We undertake no obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may

be required under applicable securities laws. All forward-looking statements are based upon our current expectations and various assumptions.

We believe there is a reasonable basis for our expectations and beliefs, but there can be no assurance that we will realize our expectations

or that our beliefs will prove to be correct.

There may be other factors of which we are currently unaware

or which we currently deem immaterial that may cause our actual results to differ materially from the forward-looking statements. All

forward-looking statements attributable to us or persons acting on our behalf apply only as of the date they are made and are expressly

qualified in their entirety by the cautionary statements included in this report. Except as may be required by law, we undertake no obligation

to publicly update or revise any forward-looking statement to reflect events or circumstances occurring after the date they were made

or to reflect the occurrence of unanticipated events, or otherwise.

Item 1. Business.

As used in this Annual Report on Form 10-K (this “Report”),

references to the “Company,” the “registrant,” “we,” “our” or “us” refer to

Groove Botanicals Inc. unless the context otherwise indicates.

Prior Operations

Organizational history

Groove Botanicals, Inc. (the “Company”), (formerly

known as Avalon Oil & Gas, Inc.), was originally incorporated in Colorado on April 25, 1991 under the name Snow Runner (USA), Inc.

The Company was the general partner of Snow Runner (USA) Ltd.; a Colorado limited partnership to sell proprietary snow skates under the

name “Sled Dogs” which was dissolved in August 1992. In late 1993, the Company relocated its operations to Minnesota and in

January 1994 changed our name to Snow Runner, Inc. In November 1994 we changed our name to the Sled Dogs Company. In May 1999, we changed

our state of domicile to Nevada and our name to XDOGS.COM, Inc. On July 31, 1998, the Corporation split their shares One (1) for Fifty-Four

(54). On August 24, 2000, the Corporation split their shares One (1) for Five (5) and changed our name from XDOGS.COM to XDOGS, Inc. We

changed our symbol from XDGS to XDGI. On June 22, 2005, the Corporation changed our name from XDOGS, Inc. to Avalon Oil and Gas, Inc.

We changed our symbol from XDGI to AOGS. On July 22, 2005, the Board of Directors and a majority of the Company’s shareholders approved

an amendment to our Articles of Incorporation to change the Company’s name to Avalon Oil & Gas, Inc., and to increase the authorized

number of shares of our common stock from 200,000,000 shares to 1,000,000,000 shares par value of $0.001. On May 15, 2007, the Corporation

split their shares One (1) for Twenty (20). We changed our symbol from AOGS to AOGN. On June 4, 2012, the Board of Directors approved

an amendment to our Articles of Incorporation to a reverse split of the issued and outstanding shares of Common Stock of the Corporation

(“Shares”) such that each holder of Shares as of the record date of June 4, 2012 shall receive one (1) post-split Share on

the effective date of June 4, 2012 for each three hundred (300) Shares owned. The reverse split was effective on July 23, 2012. On September

28, 2012, we held a special meeting of Avalon’s shareholders and approved an amendment to the Company’s Articles of Incorporation

such that the Company would be authorized to issue up to 200,000,000 shares of common stock. We filed an amendment with the Nevada Secretary

of State on April 10, 2013, to increase our authorized shares to 200,000,000. On July 23, 2012, the Corporation split their shares One

(1) for Three Hundred (300). On May 14, 2018, the Corporation changed our name from Avalon Oil and Gas, Inc., to Groove Botanicals, Inc.

We changed our symbol from AOGN to GRVE. On August 2, 2021, we filed a Form 15-12B to suspend our duty to file reports under sections

13 and 15(d) of the securities exchange act of 1934.

Present Operations

On September 14, 2023, we filed a registration statement on

Form 10-12g which was deemed effective by the Securities and Exchange Commission (“SEC”) on November 8, 2023.

We plan to assemble a portfolio of early-stage EV Battery

Technologies developed from Universities in Norway, Sweden and Finland, and seek grants from the State of Minnesota Department of Economic

Development to find and identify corporate partners to commercialize these technologies and ultimately produce revenues for the Company.

As the Company continues its business development and asset

acquisitions, the Company anticipates our capital needs to be between $500,000 and $5,000,000 (varying based on growth strategies).

Principal Products

We do not currently have any products. We are working to assemble

a portfolio of early-stage EV Battery Technologies.

Marketing, Sales and Customer Service

We currently are not undertaking any marketing or sales activities.

Competition

Entering the Green Energy Market is highly competitive and

there are many large companies focusing on the industry. Several small companies have entered the space and caused it to become fragmented

and the barrier for entry to the market is more complicated.

Intellectual Property

The Company does not currently own any patents or technologies

related to the EV battery industry, and the process to acquire patents and technologies can be costly, and as such, the Company is not

guaranteed to acquire any such patents.

Government and Industry Regulation

The Biden-Harris

Administration and 117th Congress have passed critical legislation that will establish U.S. leadership in electric transportation and

maintain our global competitiveness in the automotive industry. The Infrastructure

Investment and Jobs Act (https://www.congress.gov/bill/117th-congress/house-bill/3684) and the Inflation

Reduction Act (https://electrificationcoalition.org/work/federal-ev-policy/inflation-reduction-act/) are historic acts that invest hundreds of millions into the EV sector. They will bolster U.S. manufacturing

and supply chains to support the transition for both the light-duty and medium- and heavy-duty sectors.

Beginning

January 1, 2023, the Clean Vehicle Credit (CVC) provisions removed the manufacturer sales caps for vehicles sold after January 1, 2023,

expanded the scope of eligible vehicles to include both EVs and FCEVs, and required that the battery powering the vehicle has a capacity

of at least seven kilowatt-hours (kWh).

The National Highway Traffic Safety Administration

(NHTSA) established the Battery Safety Initiative for Electric Vehicles (Initiative) to coordinate research and other activities relating

to electric vehicle (EV) battery safety. The Initiative is responsible for:

| • | Collecting and analyzing

data related to EV batteries; |

| • | Examining field incidents

and conducting battery safety investigations from EV crash and non-crash events; |

| • | Researching and evaluating

EV battery health, battery management systems and cybersecurity, and high-voltage battery

charging failures and effects; and, |

| • | Investigating safety-related

battery defects. |

The NHTSA Initiative also participates in the development

of Global Technical

Regulation (GTR) No. 20 for EV Safety(PDF) (https://unece.org/fileadmin/DAM/trans/main/wp29/wp29wgs/wp29gen/wp29registry/ECE-TRANS-180a20e.pdf) which

includes battery fire safety. For more information, see the NHTSA’s Initiative (https://www.nhtsa.gov/battery-safety-initiative) website.

The Secretaries of Transportation and Energy jointly

established an EVWG to make recommendations regarding the development, adoption, and integration of light-, medium-, and heavy-duty electric

vehicles (EVs) into the transportation and energy system of the United States. The EVWG is comprised of 25 members from federal agencies,

the automotive industry, the energy industry, state and local governments, labor organizations, and the property development industry.

The EVWG will produce three reports describing the status of EV adoption, including barriers and opportunities to scale up EV adoption,

and recommendations for EV issues including EV charging station needs, manufacturing and battery costs, EV adoption for low- and moderate-income

individuals and underserved communities, and EV charging station permitting and regulatory issues. The first report must be submitted

within 18 months of the EVWG establishment, and the second and third reports each two years thereafter. Based on the EVWG reports, the

Secretaries of Transportation and Energy must jointly develop, maintain, and update an EV strategy that includes how the federal, state,

and local governments, and industry can establish quantitative transportation electrification targets, overcome barriers, provide public

EV education and awareness, identify areas of opportunity in research and development to lower EV cost and increase performance, and

expand EV charging station deployment. The Secretaries and the Working Group will use existing federal resources such as the Alternative

Fuels Data Center (https://afdc.energy.gov/), the Energy Efficient Mobility

Systems (https://www.energy.gov/eere/vehicles/energy-efficient-mobility-systems/) program, and the Clean Cities and Communities Coalition Network (https://cleancities.energy.gov).

The EVWG was established on June 8, 2022, and will terminate upon the submission of the third and final report. For more information,

see the EVWG (https://driveelectric.gov/ev-working-group/) website.

(Reference Public

Law 117-58 (https://www.congress.gov/public-laws/117th-congress) and 23 U.S. Code 151 (https://www.govinfo.gov/))

Employees

We have one full time employee, our President, Kent Rodriguez

and a part time administrative assistant. The Board retains consultants and advisors on as needed basis. They are compensated

with cash and also with the issuance of the Company’s common stock.

Research and Development

We did not have any research and development costs during

fiscal 2024 and 2023.

Property

Our corporate office is located at 310 Fourth Avenue South,

Suite 7000, Minneapolis, Minnesota 55415. This office space is rented from an unaffiliated third party on a month-to-month basis, for

a monthly rental cost of $1,200.

Recent Developments

Other Information

None

Item 1A. Risk Factors

Smaller reporting companies are not required to provide the

information required by this item.

For risks relating to our operations, see “Risk Factors”

contained in our Form 10-12g/A filed with the SEC on November 6, 2023

Item 1B. Unresolved Staff Comments

None

Item 1C. Cybersecurity

We recognize the importance of developing, implementing, and

maintaining robust cybersecurity measures to protect our information systems and protect the confidentiality, integrity, and availability

of our data. Presently our information systems are limited to databases maintained by third parties. As a result, we have limited

policies and procedures to assess, identify, and manage material risk from cybersecurity threats. We assess risks from cybersecurity threats

against our third-party information systems that may result in adverse effects on our information systems or any information residing

therein. We conduct periodic and ad-hoc assessments to identify cybersecurity threats. Presently we do not believe there are any material

threats to our systems.

Following these risk assessments, if needed, we evaluate whether

and/or how to re-design, implement, and maintain reasonable safeguards to mitigate identified risks and reasonably address any identified

gaps in existing safeguards. We do not yet have an IT manager given our limited exposure to risks, and therefore the review of our limited

systems is undertaken by our President to manage the risk assessment and mitigation process. When applicable to our corporate structure

and when we believe exposure to risks within our systems exceeds the current limited levels of exposure, we will monitor and test our

safeguards and train our employees on the implementation of such safeguards, in collaboration with human resources, IT, and management,

as available. We aim to promote a company-wide culture of cybersecurity risk management as we grow in size.

Risks from Cybersecurity Threats

As of the date of this report, we

are not aware of any cybersecurity incidents, that have had a materially adverse effect on our operations, business, results of operations,

or financial condition.

Governance

Our board of directors is responsible for monitoring and assessing

strategic risk exposure. Our board of directors administers its cybersecurity risk oversight function directly as a whole. Our President

is responsible for assessing and managing our material risks from cybersecurity threats and conducts this assessment on a regular basis,

or at least once per year.

Item 2. Properties

Our corporate office is located at 310 Fourth Avenue South,

Suite 700, Minneapolis, MN 55415. This office space is rented from an unaffiliated third party on a month-to-month basis under terms of

a verbal agreement for a monthly rental of $1,200.

Item 3. Legal Proceedings

There are no pending legal proceedings to which we are a party

or in which any director, officer or affiliate of ours, any owner of record or beneficially of more than 5% of any class of our voting

securities, or security holder is a party adverse to us or has a material interest adverse to us.

Item 4. Mine Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities.

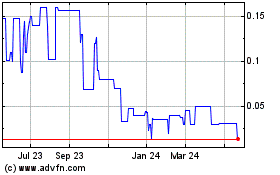

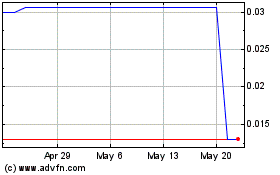

a) Market Information

Our common stock is currently quoted on the OTC market “Pink

Sheets” under the symbol GRVE. For the periods indicated, the following table sets forth the high and low bid prices per share of

common stock. The below prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily

represent actual transactions.

| Period |

High |

Low |

| Quarter ended March 31, 2024 |

.050 |

.020 |

| Quarter ended December 31, 2023 |

.127 |

.023 |

| Quarter ended September 30, 2023 |

.177 |

.035 |

| Quarter ended June 30, 2023 |

.298 |

.043 |

| Quarter ended March 31, 2023 |

.090 |

.041 |

| Quarter ended December 31, 2022 |

.060 |

.039 |

| Quarter ended September 31, 2022 |

.065 |

.036 |

| Quarter ended June 30, 2022 |

.038 |

.038 |

b) Holders

On March 31, 2024, there

are approximately 720 holders of record of our common stock.

c) Dividends

Subject to preferences

that may be applicable to any then outstanding preferred stock, the holders of common stock are entitled to receive dividends, if any,

as may be declared from time to time by our board of directors out of legally available funds. Holders of Series A Stock are entitled

to receive dividends on shares of Series A Preferred equal (on an as-converted to common stock basis) to and in the same form as dividends

actually paid on our common stock.

Series A Preferred Stock holds designations of cash dividends

at the rate of 8% of the amount per share of Series A Preferred Stock per annum in the form of “Preferred Dividends”, voting

rights on an as-converted to Common Stock basis, liquidation preferences, and conversion rights in which each share of Series A Preferred

Stock shall, upon conversion, represent 0.51% of the then “Fully-Diluted Shares Outstanding” of the Company. On January 12,

2018, our Board of Directors agreed to amend Designation of the Series A Convertible Preferred Stock be amended by changing the ratio

for conversion, in Article IV, subparagraph (a), from 0.4% to 0.51% so that upon conversion the number of shares of common stock to be

exchanged shall equal 51% of then issued and outstanding common stock. In addition, on January 12, 2018, the Company and the Series A

Holder agreed to forgive all accrued interest to date on the Series A, and to pause any accruals until April 1, 2023. The Series A Convertible

Preferred Stock carries liquidating preference, over all other classes of stock, equal to the amount paid for the stock plus any unpaid

dividends. Currently the value of the liquidation preference is $500,000, the amount of debt that the related party converted into the

preferred stock. If this Preferred Stock were to be redeemed by the holder, it would result in an aggregate of the $500,000 liquidation

preference, on a per share basis, this would equal $5,000 per share. The Company and Series A Preferred Holder agreed to forgive all accrued

interest and arrearages in preferred share dividends of Series A Preferred Stock through March 31, 2023. Dividends began to accrue on

the Series A Preferred Stock as of April 1, 2023. During the fiscal year ended March 31, 2024, the holder of the Series A preferred shares

accrued $40,000 in preferred dividends from the Series A preferred shares.

Series B Preferred Stock holds designations of being ranked

junior to the Series A Preferred Stock, cash dividends at the rate of 9% of the amount per share of Series B Preferred Stock per annum

in the form of “Preferred Dividends”, a dividend received deduction for federal income tax purposes, liquidation preferences

ranked junior to the Series A Preferred Stock, redemption of the Series B Preferred Stock by the Company at 105% of the Stated Value,

plus accrued and unpaid Dividends, if prior to the two year anniversary of the Issuance Date, or at 100% of the State Value, plus accrued

and unpaid Dividends, if on or after the two year anniversary of the Issuance Date, no voting rights, and right to notice of certain corporate

action. All accrued dividends on the Series B has been settled through March 31, 2023, and none currently remains outstanding. Dividends

began to accrue on the Series B Preferred Stock as of April 1, 2023. During the fiscal year ended March 31, 2024, the holders of the Series

B preferred shares accrued $178,468, in preferred dividends from the Series B preferred shares.

d) Securities Authorized

for Issuance Under Equity Compensation Plans

No equity compensation plan or agreements under which our

common stock is authorized for issuance has been adopted during the fiscal years ended March 31, 2024 and 2023. We have no equity compensation

plans at this time.

e) Recent Sales of Unregistered Securities

On April 8, 2022, the Company

issued 500,000 shares of common stock, 250,000 each to two separate parties, of which it had previously committed in exchange for $10,000

it had received, $5,000 from each party, received on March 22, 2022.

On April 8, 2022, the Company

issued 2,500,000 shares of common stock, of which it had previously committed in exchange for $40,000 it had received on March 23,

2022.

On October 4, 2022, the Company

issued 150,000 shares of common stock in exchange for $3,000 received.

On October 4, 2022, the Company

issued 250,000 shares of common stock in exchange for $4,963 received.

On December 1, 2022, the Company

issued 500,000 shares of common stock in exchange for consulting services. These shares were issued with an approximate value of $0.0598

per share, based on the fair market value as of their date of issuance.

On December 1, 2022, the Company issued 1,500,000 shares

of common stock to three different parties in the amounts of 1,000,000, 250,000, and 250,000, in exchange for $29,970 received.

On December 1, 2022, the Company

issued 250,000 shares of common stock in exchange for $4,970 received.

On January 31, 2023, the Company

issued 2,750,000 shares of common stock for conversion of debt.

On February 21, 2023, the

Company issued 50,000 shares of common stock for website and social media services. These shares were issued with a value of $0.08 per

share.

On April 15, 2023, the Company

issued 1,000,000 shares of common stock in exchange for consulting services. These shares were valued at $0.0783 per shares per their corresponding

consulting agreement.

On December 20, 2023, the

Company issued 1,000,000 shares of common stock in exchange for $20,000 in cash proceeds.

f) Purchases of Equity Securities by the Issuer and

Affiliated Purchasers

None.

Item 6. Reserved

Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

The following discussion and analysis

of the results of our operations and financial condition should be read in conjunction with our financial statements, and the notes to

those financial statements that are included elsewhere in this Report. All monetary figures are presented in U.S. dollars, unless otherwise

indicated.

Our Management’s Discussion

and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements

are, by their very nature, uncertain and risky. These risks and uncertainties include international, national, and local general economic

and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions;

new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations;

adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results;

change in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability

to protect technology; the risk of foreign currency exchange rate; and other risks that might be detailed from time to time in our filings

with the SEC.

Although the forward-looking statements

in this Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known

by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and

outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review

and consider the various disclosures made by us in this report as we attempt to advise interested parties of the risks and factors that

may affect our business, financial condition, and results of operations and prospects.

Results of Operations

Revenue

We have not generated any revenue since our inception and

do not expect to generate any revenue from the sale of products in the near future.

Operating Expenses

For the fiscal years ended March 31, 2024 and 2023 we had

the following operating expenses:

| | |

For the Year ended March 31, | |

| | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | |

| Selling, General and Administrative Expenses | |

$ | 73,743 | | |

$ | 75,468 | |

| Rent | |

| 18,576 | | |

| 11,796 | |

| Legal and Professional Expenses | |

| 95,962 | | |

| 58,350 | |

| Consulting Expense | |

| 78,300 | | |

| 29,900 | |

| Total operating expenses | |

$ | 266,581 | | |

$ | 175,514 | |

Total operating expenses for the year ended March 31, 2024

were $266,581 as compared to $175,514 for the year ended March 31, 2023. During the year ended March 31, 2024, the Company incurred $18,576

of rent expense, legal and professional expenses of $95,962, consulting expenses of $78,300 and $73,743 of selling, general and administrative

expenses which consisted primarily of; payroll and related costs of $48,000, advertising and promotion expenses of $416, insurance expenses

of $5,612, transfer agent expenses of $5,267 and other selling, general, and administrative expenses of $14,448. The increase was primarily

due to an increase in consulting expenses from $29,900 (2023) to $78,300 (2024) and legal and professional expenses, which increased

from$58,350 (2023) to $95,962 (2024) due to the filing of a registration statement in fiscal 2024. Rent increased from $11,796 to $18,576

and selling and general expenses decreased from $75,468 (2023) to $73,743 (2024). Selling, general and administrative expenses for the

year ended March 31, 2023 consisted primarily of; payroll and related costs of $48,000, advertising and promotion expenses of $5,393,

insurance expenses of $5,064, other selling, general, and administrative expenses of $17,369, offset by a credit to transfer and agent

fees of $358.

Other Income (Expense)

| | |

March 31, 2024 | | |

March 31, 2023 | |

| Other Income (Expense) | |

| | | |

| | |

| Amortization of Debt Discount | |

$ | — | | |

$ | (74,876 | ) |

| Change in Derivative Liability | |

| — | | |

| 95,575 | |

| Gain on Settlement of Debt | |

| 71,242 | | |

| 54,571 | |

| Interest Income (Expense) | |

| (6,750 | ) | |

| (21,662 | ) |

| Miscellaneous Other Income (Expense) | |

| — | | |

| 1,180 | |

| Total Other Income (Expense) | |

$ | 64,492 | | |

$ | 54,788 | |

Other income was $64,692 in the year ended March 31,

2024, and comprised of a gain on settlement of debt of $71,242 offset by interest expense of $6,750. Other income was $54,788 in the year

ended March 31, 2023, which included a gain as a result of a change in the value of derivative liabilities of $95,575, a gain on settlement

of debt of $54,571 and miscellaneous other income of $1,180 offset by amortization of debt discount expense of $74,876 and interest expense

of $21,662.

Net Loss

We had a net loss of $202,089 in the year ended

March 31, 2024 compared to a net loss of $120,726 in the year ended March 31, 2023. The increase to the reported loss in the current

year end is primarily due to an increase in legal and professional expenses and increased consulting fees.

Statement of Cash Flows

The following table summarizes our cash flows for the period

presented:

| | |

For the Year ended March 31, | |

| | |

2024 | | |

2023 | |

| Net cash used by operating activities | |

$ | (86,835 | ) | |

$ | (95,503 | ) |

| Net cash provided from (used by) investing activities | |

| — | | |

| — | |

| Net cash provided from financing activities | |

| 83,957 | | |

| 51,535 | |

| Decrease in cash and cash equivalents | |

$ | (2,878 | ) | |

$ | (43,968 | ) |

During the year ended March 31, 2024 we used cash of $2,878

as compared to the year ended March 31, 2024, where we used cash of $43,968.

Cash Used in Operating Activities

Cash used in operating activities for the year ended March

31, 2024 was $86,835 as compared to $95,503 used in the year ended March 31, 2023.

Cash used in operating activities for the year ended March

31, 2024 was the result of net loss of $202,089 offset by non-cash operating activities including a gain on settlement of debt of $71,242,

accrued interest of $6,750, stock issued for outside services of $78,300, accrued payroll of $48,000, changes to working capital included

an increase in prepaid expenses of $28, an increase in accounts payable and accrued liabilities of $53,418.

Cash used in operating activities for the year ended March

31, 2023 was the result of net loss of $120,726 offset by non-cash operating activities including a gain on settlement of debt of $54,571,

a change in derivative liabilities of $95,575, stock issued for outside services of $33,900, accrued payroll of $48,000, accrued interest

of $14,504, interest settled with stock of $7,158 and bad debt of $25, changes to working capital included a decrease in prepaid expenses

of $482, a decrease to accounts receivable of $226 and a decrease in accounts payable and accrued liabilities of $2,838.

Cash Provided by Investing Activities

There was no cash provided by investing activities for the

years ended March 31, 2024 and 2023.

Cash Provided by Financing Activities

| | |

March 31, 2024 | | |

March 31, 2023 | |

| Cash Flow From Financing Activities | |

| | | |

| | |

| Funds received from Related Party | |

| 104,915 | | |

| 168,000 | |

| Funds distributed to Related Party | |

| (958 | ) | |

| (9,428 | ) |

| Repayment of Outstanding Convertible Debt | |

| (40,000 | ) | |

| (54,650 | ) |

| Repayment of Outstanding Contingent Liability | |

| — | | |

| (95,350 | ) |

| Funds received for Issuance of Common Stock | |

| 20,000 | | |

| 42,963 | |

| Net Cash From Financing Activities | |

| 83,957 | | |

| 51,535 | |

During the year ended March 31, 2024, financing activities

provided cash of $124,915 as a result of related party advances of $104,915 and funds received for the issuance of common stock of $20,000

for ongoing operations, offset by funds paid to a related party of $958 and repayments of outstanding convertible debt of $40,000 for

net cash from financing activities of $83,957.

During the year ended March 31, 2023, financing activities

provided cash of $210,963 as a result of related party advances of $168,000 and funds received for the issuance of common stock of $42,963

for ongoing operations, offset by funds paid to a related party of $9,428 and repayments of outstanding convertible debt of $54,640 and

the repayment of an outstanding contingent liability of $95,350 for net cash from financing activities of $51,535.

Liquidity and Capital Resources

We are in need of additional cash resources to maintain our

operations. As of March 31, 2024 we had cash of $1,688. We are in the early stage of development and have experienced net losses to date

and have not generated revenue from operations which raises substantial doubt about our ability to continue as a going concern. There

are a number of conditions that we must satisfy before we will be able to acquire, license and acquire products and intellectual property,

not the least of which is negotiating and financing any acquisitions. We are in the process of identifying and establishing strategic

partners and technologies in order to establish a market and generate commercial orders by customers and licensing which will include

effective marketing and sales capabilities for any products. We do not currently have sufficient resources to accomplish any of these

conditions necessary for us to generate revenue and expect to incur increasing operating expenses. We will require substantial additional

funds for operations, the service of debt and to fund our business objectives. There can be no assurance that financing, whether debt

or equity, will always be available to us in the amount required at any particular time or for any particular period or, if available,

that it can be obtained on terms favorable to us. If additional funds are raised by the issuance of equity securities, such as through

the issuance and exercise of warrants, then existing stockholders will experience dilution of their ownership interest. If additional

funds are raised by the issuance of debt or other equity instruments, we may be subject to certain limitations in our operations, and

issuance of such securities may have rights senior to those of the then existing stockholders. We currently have no agreements, arrangements

or understandings with any person or entity to obtain funds through bank loans, lines of credit or any other sources.

If we do not have sufficient working capital to pay our operating

costs for the next 12 months, we will require additional funds to pay our legal, accounting and other fees associated with our Company

and our filing obligations under United States federal securities laws, as well as to pay our other accounts payable generated in the

ordinary course of our business. Once these costs are accounted for, we will focus on assembling a portfolio

of early-stage EV Battery Technologies developed by Universities in Norway, Sweden and Finland

Any failure to raise money will have the effect of delaying

the timeframes in the business plan as set forth above, and the Company may have to push back the dates of such activities.

Going Concern

The Company has incurred recurring net losses since its inception

and has raised limited capital. The Company had a net loss of $202,089 and $120,726 for the years ended March 31, 2024, and March 31,

2023, respectively. The Company’s accumulated deficit was $34,847,277 and $34,426,718 as of March 31, 2024, and March 31, 2023,

respectively. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The consolidated

financial statements do not include any adjustment relating to the recoverability and classification of liabilities that might be necessary

should the Company be unable to continue as a going concern. The Company is taking certain steps to provide the necessary capital to continue

its operations. These steps include but are not limited to: 1) focus on our new business model and 2) raising equity or debt financing.

Our auditors express substantial doubt about our ability to continue as a going concern.

Off Balance Sheet Arrangements

We currently have no off-balance sheet arrangements.

Critical Accounting Policies

The preparation of our financial statements requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On

an on-going basis, management evaluates its estimates and judgments which are based on historical experience and on various other factors

that are believed to be reasonable under the circumstances. The results of their evaluation form the basis for making judgments about

the carrying values of assets and liabilities. Actual results may differ from these estimates under different assumptions and circumstances.

Our significant accounting policies are more fully discussed in the Notes to our Financial Statements.

Use of Estimates

The preparation of consolidated

financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions

that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Specifically, such estimates were made by the

Company for the valuation of derivative liability, stock compensation and beneficial conversion feature expenses. Actual results could

differ from those estimates.

Financial Instruments

The Company's financial instruments

primarily consist of cash and cash equivalents, accounts payable and accrued liabilities, related party payables, dividends payable and

other debt. The carrying values of the Company's financial instruments approximate fair value. FASB ASC 820, Fair Value Measurements

and Disclosures ("ASC 820") establishes a framework for all fair value measurements and expands disclosures related to fair

value measurement and developments. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer

a liability in an orderly transaction between market participants at the measurement date. ASC 820 requires that assets and liabilities

measured at fair value are classified and disclosed in one of the following three categories: Level 1—Quoted market prices for

identical assets or liabilities in active markets or observable inputs; Level 2—Significant other observable inputs that can be

corroborated by observable market data; and Level 3—Significant unobservable inputs that cannot be corroborated by observable market

data. The Company believes that the carrying amounts of cash and cash equivalents, accounts payable, related party payables, accrued

dividends and debt approximate fair value based on either their short-term nature or on terms currently available to the Company in financial

markets.

Beneficial Conversion Feature

The Company measures certain

convertible debt using a nondetachable conversion feature known as a beneficial conversion feature, or BCF. A convertible instrument contains

a BCF when the conversion price is less than the fair value of the shares into which the instrument is convertible at the commitment date.

From time to time, the Company may issue convertible notes that may contain a beneficial conversion feature. A beneficial conversion feature

exists on the date a convertible note is issued when the fair value of the underlying common stock to which the note is convertible into

is in excess of the remaining unallocated proceeds of the note after first considering the allocation of a portion of the note proceeds

to the fair value of the warrants, if related warrants have been granted. The intrinsic value of the beneficial conversion feature is

recorded as a debt discount with a corresponding amount to additional paid-in capital. The debt discount is amortized to interest expense

over the life of the note using the effective interest method.

Debt Issuance Cost

Debt issuance costs incurred

in connection with the issuance of debt are capitalized and amortized to interest expense over the term of the debt using the effective

interest method. The unamortized amount is presented as a reduction of debt on the balance sheet.

In August 2020, the FASB issued ASU No. 2020-06, Debt

with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40) (“ASU

2020-06”). ASU 2020-06 simplifies the accounting for convertible debt instruments and convertible preferred stock by removing the

existing guidance in ASC 470-20 that requires entities to account for beneficial conversion features and cash conversion features in equity,

separately from the host convertible debt or preferred stock. Two methods of transition were permitted upon adoption: full retrospective

and modified retrospective. The Company has yet to adopt ASC 2020-06. The accounting impact will be a reclassification from Additional

Paid-In Capital to Retained Earnings. The Company adopted ASC 2020-06 as of April 1, 2023.

Recent Accounting Pronouncements

In November 2023, the FASB issued Accounting Standards Update

2023-07, Segment Reporting—Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which requires

incremental disclosures related to a public entity’s reportable segments. Required disclosures include, on an annual and interim

basis, significant segment expenses that are regularly provided to the chief operating decision maker (“CODM”) and included

within each reported measure of segment profit or loss, an amount for other segment items (which is the difference between segment revenue

less segment expenses and less segment profit or loss) and a description of its composition, the title and position of the CODM, and an

explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to

allocate resources. The standard also permits disclosure of more than one measure of segment profit. ASU 2023-07 is effective for fiscal

years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company does not

believe the adoption of ASU 2023-07 will have any impact on our financial statements.

In December 2023, the FASB issued Accounting Standards Update

2023-09, Improvements to Income Tax Disclosures (“ASU 2023-09”), which requires public entities on an annual

basis to (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling items that

meet a quantitative threshold (if the effect of those reconciling items is equal to or greater than 5 percent of the amount computed by

multiplying pretax income or loss by the applicable statutory income tax rate). ASU 2023-09 is effective for fiscal years beginning after

December 15, 2025. We are evaluating the impact of adopting ASU 2023-09 on our financial statements.

In March 2024, the SEC adopted the final rule under SEC Release

No. 33-11275, The Enhancement and Standardization of Climate Related Disclosures for Investors, which requires registrants

to disclose climate-related information in registration statements and annual reports. The new rules would be effective for annual reporting

periods beginning in fiscal year 2025. However, in April 2024, the SEC exercised its discretion to stay these rules pending the completion

of judicial review of certain consolidated petitions with the United States Court of Appeals for the Eighth Circuit in connection with

these rules. We are evaluating the impact the adoption of this rule, if any, may have on our financial statements.

Item 7A. Quantitative and Qualitative Disclosures about

Market Risks.

Disclosure in response

to this Item is not required for a smaller reporting company.

Item 8. Financial Statements and Supplementary Data.

The financial statements required by this Item 8 are included

in this Annual Report beginning on page F-1.

Item 9. Changes In and Disagreements with Accountants on

Accounting and Financial Disclosure.

On May 8, 2024, the Board of Directors of Groove Botanicals

Inc. (the “Company”) approved the dismissal of BF Borgers CPA PC (“BF Borgers”) as the Company’s independent

registered public accounting firm. On May 3, 2024, the Securities and Exchange Commission (the “SEC”) announced that it had

settled charges against BF Borgers that it failed to conduct audits in accordance with the standards of the Public Company Accounting

Oversight Board (the “PCAOB”). As part of the settlement, BF Borgers agreed to a permanent ban on appearing or practicing

before the SEC (the “Ban”). As a result of BF Borgers’ settlement with the SEC, the Company dismissed BF Borgers as

its independent accountant.

The reports of BF Borgers on the Company’s consolidated

financial statements for the fiscal years ended March 31, 2023 and 2022 did not contain an adverse opinion or a disclaimer of opinion

and were not qualified or modified as to uncertainty, audit scope or accounting principles other than an explanatory paragraph relating

to the Company’s ability to continue as a going concern. The Company had not yet engaged a report from BF Borgers for our fiscal

year ended March 31, 2024 as of the date of the Ban.

During the fiscal years ended March, 2023 and 2022, and through

the date of termination, May 8, 2024, there were no “disagreements” with BF Borgers on any matter of accounting principles

or practices, financial statement disclosure or auditing scope or procedure, which disagreements if not resolved to the satisfaction of

BF Borgers would have caused BF Borgers to make reference thereto in its reports on the consolidated financial statement for such years.

During the fiscal years ended March 31, 2023 and 2022, and through May 8, 2024, there have been no “reportable events” (as

defined in Item 304(a)(1)(iv) and Item 304(a)(1)(v) of Registration S-K), except for the identified material weaknesses in its internal

control over financial reporting as disclosed in the Company’s Annual Report.

The U.S. Securities and Exchange Commission (the “SEC”)

has advised that, in lieu of obtaining a letter from BF Borgers stating whether or not it agrees with the statements herein, the Company

may indicate that BF Borgers is not currently permitted to appear or practice before the SEC for reasons described in the SEC’s

Order Instituting Public Administrative and Cease-and-Desist Proceedings Pursuant to Section 8A of the Securities Act of 1933, Sections

4C and 21C of the Securities Exchange Act of 1934 and Rule 102(e) of the Commission’s Rules of Practice, Making Findings, and Imposing

Remedial Sanctions and a Cease-and-Desist Order, dated May 3, 2024.

On June 13, 2024, the Board of Directors approved

the appointment of M.S. Madhava Rao, Chartered Accountant (“Rao”) as the Company's new independent registered public

accounting firm, effective immediately, to perform independent review and audit services for the fiscal years ending March 31, 2024 and

2023. During the fiscal years ended March 31, 2024 and 2023 and through June 13, 2024, date of engagement, neither the Company, nor anyone

on its behalf, consulted Rao regarding either (i) the application of accounting principles to a specified transaction, either completed

or proposed, or the type of audit opinion that might be rendered with respect to the consolidated financial statements of the Company,

and no written report or oral advice was provided to the Company by Rao that was an important factor considered by the Company in reaching

a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a "disagreement"

(as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a “reportable event” (as that term is

defined in Item 304(a)(1)(v) of Regulation S-K).

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures (as defined in Rules 13a-15(e)

and 15d-15(e) under the Exchange Act) are controls and other procedures that are designed to ensure that information required to be disclosed

by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods

specified in the rules and forms of the SEC. Disclosure controls and procedures include, without limitation, controls and procedures designed

to ensure that information required to be disclosed in the reports that we file under the Exchange Act is accumulated and communicated

to our management, including our principal executive officer and our principal financial officer, as appropriate, to allow timely decisions

regarding required disclosure. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls

and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Due to the inherent limitations of control systems, not all misstatements may be detected. These inherent limitations include the realities

that judgments in decision-making can be faulty and that breakdowns can occur because of a simple error or mistake. Additionally, controls

can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control.

Controls and procedures can only provide reasonable, not absolute, assurance that the above objectives have been met.

As of March 31, 2024, we carried out an evaluation, with the

participation of our management, including our principal executive officer and our principal financial officer, of the effectiveness of

our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act). Based on that evaluation,

our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were not effective,

as of March 31, 2024.

Management’s Report on Internal Control Over Financial

Reporting

Our management is responsible for establishing and maintaining

adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Under

the supervision and with the participation of our management, including our principal executive officer [and principal financial officer],

we conducted an evaluation of the effectiveness, as of March 31, 2024, of our internal control over financial reporting based on the framework

in 2013 Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based

on our evaluation under this framework, our management concluded that our internal control over financial reporting was not effective

as of March 31, 2024 due to material weaknesses in our internal control over financial reporting described below.

Our internal controls are not effective for the following

reasons: (i) there is an inadequate segregation of duties consistent with control objectives as management is comprised of only one person,

the Company’s principal executive officer and principal financial officer and, (ii) the Company does not have an audit committee

with a financial expert, and thus the Company lacks the board oversight role within the financial reporting process.

In order to mitigate the foregoing material weaknesses, we

have engaged an outside accounting consultant with significant experience in the preparation of financial statements in conformity with

GAAP to assist us in the preparation of our financial statements to ensure that these financial statements are prepared in conformity

with GAAP. We will continue to monitor the effectiveness of this action and make any changes that our management deems appropriate.

We would need to hire additional staff to provide greater

segregation of duties. Currently, it is not feasible to hire additional staff to obtain optimal segregation of duties. Management will

continue to reassess this matter to determine whether improvement in segregation of duty is feasible. In addition, we would need to expand

our board to include independent members.

Going forward, we intend to evaluate our processes and procedures

and, where practicable and resources permit, implement changes in order to have more effective controls over financial reporting.

This Annual Report does not include an attestation report

of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject

to attestation by the Company’s registered public accounting firm pursuant to the exemption provided to issuers that are not “large

accelerated filers” nor “accelerated filers” under the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Changes in Internal Control over Financial Reporting

There was no change in our system of internal control over

financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) during the quarter ended March 31, 2024 that has materially

affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information

None.

Item 9C. Disclosure Regarding Foreign Jurisdictions that

Prevent Inspections.

Not applicable.

PART III.

Item 10. Directors, Executive Officers and Corporate Governance.

The following table sets forth the

name, age and position of each of our executive officers and directors as of the date of this report:

| Name |

|

Age |

|

Position |

| Kent Rodriguez |

|

66 |

|

Director, President, Treasurer, Secretary |

Background of Executive Officers and Directors

Our directors are elected for a term of one year and serve until such director’s

successor is duly elected and qualified. Each executive officer serves at the pleasure of the Board.

Kent Rodriguez

Mr. Rodriguez joined the Company as Chief Executive Officer,

Secretary, and Principal Financial Officer in May 2009. Since 1995, he has been the Managing Partner of Weyer Capital Partners, a Minneapolis-based

venture capital corporation. He has a B.A. degree in Geology from Carleton College, and an Executive MBA from the Harvard Business School.

Mr. Rodriguez is the related party who has provided funds to the Company, which are owed back to him and can be found within the Balance

Sheets and footnotes referenced throughout this filing as related party payables.

Family Relationships

There are no family relationships among any of our executive

officers or directors.

Board Composition

Our business and affairs are managed

under the direction of our board of directors, which presently consists of one member. Our current director will continue to serve as

a director until his resignation, removal or successor is duly elected.

Our certificate of incorporation

and our bylaws permit our board of directors to establish the authorized number of directors from time to time by resolution. Each director

serves until the expiration of the term for which such director was elected or appointed, or until such director’s earlier death,

resignation or removal.

Involvement in Certain Legal Proceedings

As of the filing of this Annual Report

on Form 10-K, there are no legal proceedings, and during the past ten years there have been no legal proceedings, that are material to

an evaluation of the ability or integrity of any of our directors, director nominees or executive officers.

Committees of Our Board of Directors

Our board of directors has not established

any committees.

We are not a “listed company” under SEC rules

and are therefore not required to have an audit committee comprised of independent directors.

We do not currently have a “financial expert”

within the meaning of the rules and regulations of the SEC.

The Company has no nominating or compensation committees at

this time. The entire Board participates in the nomination and audit oversight processes and considers executive and director compensation.

Given the size of the Company and its stage of development, the entire Board is involved in such decision-making processes. Thus, there

is a potential conflict of interest in that our directors and officers have the authority to determine issues concerning management compensation,

nominations, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our

executive officers or directors.

Code of Business Conduct and Ethics

The Company has not as yet adopted

a code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer or controller,

or persons performing similar functions as required by the Sarbanes-Oxley Act of 2002 due to our small size and limited resources and

because management’s attention has been focused on matters pertaining to raising capital and the operation of the business.

Risk and Compensation Policies

The Company does not have any risk

and compensation policies.

Compliance with Section 16(a)

of the Exchange Act

Section 16(a) of the Exchange Act

requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities,

to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities.

Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section

16(a) forms they file.

To our knowledge, each of Kent Rodriguez

and Douglas Barton are delinquent in filing a Form 3 report. Mr. Barton resigned from the Company’s board of directors as of July

29, 2024.

Item 11. Executive Compensation.

On an annual basis the company accrues $48,000 of wages payable,

$4,000 monthly, to its CEO Kent Rodriguez. On April 1, 2020, the Company entered into an employment agreement with its CEO which designates

monthly payments due to CEO Kent Rodriguez in the amount of $4,000 each month. This agreement shall continue for four years until March

31, 2024 and was renewed for a further term on expiry.

The following table illustrates compensation accrued to the

executive team during the fiscal years ended March 31, 2024 and 2023:

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock

awards ($) |

Option

awards ($) |

Nonequity incentive plan compensation ($) |

Nonqualified deferred compensation earnings ($) |

All other compensation ($) |

Total ($) |

| Kent Rodriguez, CEO* |

Fiscal Year ended March 31, 2024 |

$48,000 |

- |

- |

- |

- |

- |

- |

$48,000 |

| Kent Rodriguez, CEO* |

Fiscal Year ended March 31, 2023 |

$48,000 |

- |

- |

- |

- |

- |

- |

$48,000 |

*Total compensation accrued for Kent Rodriguez during each fiscal year is $48,000

total, which includes his compensation as CEO as well as Director.

Outstanding Equity Awards at Fiscal

Year-End

As of March 31, 2024, there were no outstanding equity

awards.

Director Compensation

No compensation was paid to our directors

for services rendered during the years ended March 31, 2024, and 2023.

Item 12. Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters

The following table lists, as of March 31, 2024, the number

of shares of common stock beneficially owned by (i) each person, entity or group (as that term is used in Section 13(d)(3) of the Securities

Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each of our

Named Executive Officers and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock

by our principal stockholders and management is based upon information furnished by each person using “beneficial ownership”

concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person directly

or indirectly has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power,

which includes the power to dispose or direct the disposition of the security. The person is also deemed to be a beneficial owner of any

security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may

be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which

he or she may not have any pecuniary interest. Except as noted below, each person has sole voting and investment power with respect to

the shares beneficially owned and each stockholder’s address is c/o Groove Botanicals Inc., 310

Fourth Avenue South, Suite 700, Minneapolis, MN

The following table sets forth,

as of March 31, 2024, information regarding beneficial ownership of our capital stock by:

| ● | each person, or group of affiliated persons, known by us

to beneficially own more than 5% of our common stock; |

| ● | each of our named executive officers; and |

| ● | all of our current executive officers, and directors as a

group. |

In the table below, percentage ownership

is based on 59,643,062 shares of our Common Stock issued and outstanding as of March 31, 2024.

Unless otherwise indicated, we believe

that all persons named in the table have sole voting and investment power with respect to all ordinary shares beneficially owned by them.

| Name of Beneficial

Owner | |

Number

of

Shares

Beneficially

Owned (2) | | |

Percentage

of Shares

Beneficially

Owned (2) | |

| | |

| | |

| |

| 5% or Greater Stockholders | |

| | | |

| | |

| Directors and Named Executive Officers | |

| | | |

| | |

| Kent Rodriguez, President, Secretary, Treasurer and Director | |

| 62,081,840 | (1) | |

| .5101% | |

| Douglas Barton, Director(3) | |

| 760,667 | | |

| .0128% | |

| All directors, directors nominees and executive officers as a group (2 persons): | |

| 62,842,507 | (1) | |

| .5229% | |

| (1) | This amount includes a total of 62,077,473 common shares issuable upon conversion of 100 shares of Series A Convertible Preferred

Stock and 4,367 shares of common stock issued and outstanding; |

| (2) | Fully diluted shares outstanding for purposes of calculation totals 121,720,535, including 62,077,473 common shares issuable to Kent

Rodriguez upon conversion of 100 shares of Series A Convertible Preferred Stock |

| | (3) | Mr. Barton resigned from the Company’s board of directors as of July 29,

2024. |

Securities Authorized for Issuance

under Equity Compensation Plans

None.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Policies and Procedures for Related Person Transactions

We do not currently have a formal,