false

0000704172

0000704172

2024-07-05

2024-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 5, 2024

PHI

GROUP, INC.

(n/k/a

PHILUX GLOBAL GROUP INC.‚

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

001-38255-NY |

|

90-0114535 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 2323

Main Street, Irvine, CA |

|

92614 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 714-793-9227

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Precommencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

PHIL |

|

OTC

Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provide pursuant to Section 13(a) of the Exchange Act. ☐

Section

1 – Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement

On

July 5, 2024, Dr. D’ORLEANS DE FRANCE BENEDICT CARL WILLIAM (f/k/a BEN CARL SMET), an individual, with principal residence addresses

in Schindellegi-Feusisberg, Switzerland, and in Cutsdean, Cheltenham, United Kingdom (hereinafter referred as the “Consultant”

and PHI GROUP INC. (/n/k/a PHILUX GLOBAL GROUP INC.), a corporation duly organized under the laws of the state of Nevada, and re-domiciled

under the laws of the State of Wyoming U.S.A., with registered principal business address at N 30 Gould Street, Suite R, Sheridan, WY

82801, represented by Mr. Henry D. Fahman, its Chairman and Chief Executive Officer, hereinafter referred to as “PGG or “the

Registrant,” signed a Business Development and Structuring Consultancy Agreement for the Development and Establishment of an International

Financial Center in Vietnam and agreed to undertake the followings:

RECITALS

WHEREAS,

the Company has been desirous of establishing an integrated Asian Diamond Exchange and International Financial Center in Vietnam.

WHEREAS,

the Consultant has been leading full-time a group of experts since January 2018 for the setup of the Asian Diamond Exchange (“ADE”)

in Vietnam for the Company and has entered into a separate Business Development and Structuring Consultancy Agreement with the Company

for this Asian Diamond Exchange project.

WHEREAS,

recently, the Consultant has started a structuring project, in order for the Company to set up and establish an International Financial

Center on the Thanh Da Peninsula, Ho Chi Minh City, Vietnam in conjunction with the afore-mentioned Asian Diamond Exchange project. This

will be similar as what the Consultant has established successfully for Dubai in 2002-2005 and is now incorporating the international

changes of the last two decades together with combined information and data from another leading international financial center in Europe.

NOW

THEREFORE, in consideration of the terms, promises, conditions and mutual covenants herein contained, and each intending to be legally

bound hereby, the Consultant and Company are parties to this Agreement and agree as follows:

| A. |

Business Development and Structuring Consultancy Services.

The Consultant has provided and will continue to provide the business development and structuring consulting services mentioned in

the foregoing Recitals and any other services that may be required to assist the Company to successfully plan, design, develop, establish,

and operate the International Financial Center in Vietnam. |

The

Consultant will continue to advise, assign, undertake, execute and implement, as the case may be, all the next necessary steps to be

taken to make the International Financial Center in Vietnam a success, which involves a comprehensive set of key requirements spanning

legal, regulatory, infrastructural, and strategic aspects as outlined below:

| I.

|

Legal

and Regulatory Framework |

| |

1.

|

Robust

Legal System: A transparent and reliable legal system that enforces contracts and property rights effectively. |

| |

|

|

| |

2.

|

Effective

Regulatory Environment: A regulatory framework aligned with international standards that ensures fair and efficient market operations. |

| |

|

|

| |

3.

|

Favorable

Tax Policies: Competitive tax regimes, including low corporate taxes, double taxation treaties, and incentives for foreign investors. |

| |

|

|

| |

4.

|

AML

and CTF Compliance: Strong anti-money laundering (AML) and counter-terrorist financing (CTF) measures in place, compliant with

global standards. |

| II.

|

Economic

and Financial Stability |

| |

1.

|

Macroeconomic

Stability: A stable economic environment with low inflation, sustainable public debt, and consistent economic growth. |

| |

|

|

| |

2.

|

Sound

Financial Sector: A diverse and well-regulated financial services sector, including banking, insurance, asset management, and

fintech. |

| |

|

|

| |

3.

|

Developed

Capital Markets: Liquid and efficient capital markets offering a range of investment instruments. |

| |

1.

|

High-Quality

Physical Infrastructure: Modern office spaces, reliable utilities, and efficient transportation networks. |

| |

|

|

| |

2.

|

Advanced

Technological Infrastructure: Robust IT and telecommunications infrastructure, supporting digital transactions and cybersecurity. |

| |

|

|

| |

3.

|

International

Connectivity: Excellent connectivity through international airports, seaports, and internet. |

| |

1.

|

Skilled

Workforce: Access to a highly educated and skilled workforce, particularly in finance, law, and technology. |

| |

|

|

| |

2.

|

Ongoing

Professional Development: Continuous training and development programs to keep the workforce competitive. |

| |

|

|

| |

3.

|

High

Quality of Life: High standards of living, healthcare, education, and social amenities to attract and retain international talent. |

| |

1.

|

Effective

Regulatory Bodies: Independent and efficient regulatory authorities overseeing financial activities and ensuring compliance. |

| |

|

|

| |

2.

|

Presence

of Major Financial Institutions: Establishment of key international banks, insurance companies, asset managers, and professional

services firms. |

| |

|

|

| |

3.

|

Supportive

Professional Services: Availability of legal, accounting, consulting, and other professional services. |

| VI.

|

Political

and Social Stability |

| |

1.

|

Political

Stability: A stable and predictable political environment. |

| |

|

|

| |

2.

|

Good

Governance: High levels of transparency, accountability, and ethical practices in both public and private sectors. |

| |

|

|

| |

3.

|

Cultural

Openness: A welcoming environment for international businesses and professionals, promoting diversity and inclusivity. |

| VII.

|

Strategic

Positioning |

| |

1.

|

Global

Integration: Active participation in international financial networks and adherence to global financial standards. |

| |

|

|

| |

2.

|

Market

Access: Easy access to regional and international markets. |

| |

|

|

| |

3.

|

Effective

Branding and Promotion: Strong marketing strategies to position the IFC as a leading global financial hub. |

| VIII.

|

Risk

Management and Compliance |

| |

1.

|

Robust

Risk Management: Comprehensive risk management frameworks to handle financial, operational, and systemic risks. |

| |

|

|

| |

2.

|

Compliance

Mechanisms: Efficient systems to ensure adherence to local and international regulations and standards. |

| IX.

|

Innovation

and Sustainability |

| |

1.

|

Commitment

to Sustainability: Policies promoting environmental sustainability and green finance. |

| |

|

|

| |

2.

|

Encouragement

of Innovation: Support for fintech and financial innovation through regulatory sandboxes and incentives. |

| X.

|

International

Relations |

| |

1.

|

Bilateral

and Multilateral Agreements: Strategic treaties and agreements to facilitate international trade and investment. |

| |

|

|

| |

2.

|

Strong

Diplomatic Relations: Maintaining robust diplomatic ties with key global economies and financial centers. |

| B.

|

Purpose

of Engagement. The Company is desirous of achieving the above-mentioned objectives to enable it to implement its business plan.

The engagement will be on an exclusive basis. |

| |

|

| C.

|

Term

of Engagement/Termination. The term of our engagement hereunder shall be for a period of two (2) years (“Engagement Period”)

commencing the date of the signing of this Agreement. However, it is both Parties’ intention and commitment to complete this

undertaking within six (6) months of the effective date and after the Free Economic Zone on Thanh Da Island, Ho Chi Minh City, subject

to satisfaction of mutual and financial obligations by both Parties. |

During

the term of this agreement:

| |

1.

|

The

Company will have the right to terminate (the “Termination”) the Consulting Service Agreement by providing 60 days prior

written notice to Consultant. |

| |

|

|

| |

2.

|

The

Consultant will have the right to terminate the Consulting Service Agreement by providing 60 days prior written notice to Company. |

| D.

|

Role

of Consultant. Consultant will act as the Company’s exclusive Consultant with respect to the scope of services mentioned

in the Recitals and Article A above. |

| |

|

| E.

|

Compensation

and Payment. Both parties agree that the Company shall pay the Consultant a total of Fifteen Million U.S. Dollars (USD 15,000,000)

for the services that have been rendered in the Recitals appertaining exclusively to the establishing of the aforementioned International

Financial Center on Thanh Da Island as set forth in Article A above. The schedule of compensation payments shall be mutually agreed

upon by both Parties by private agreement. |

Once

the Company has effectuated all budgeting and all financial requirements and obligations, the ongoing process will effectively materialize,

and the Consultant then shall transfer the entire IFC venture to the Company.

The

Parties hereto have executed this Business Development and Structuring Consultancy Agreement for the Development and Establishment of

an International Financial Center in Vietnam by their authorized representatives as of the date first above written. This Agreement shall

be effective upon signing and shall terminate in writing by the Parties.

The

foregoing description of the nature and essential points of the Business Development and Structuring Consultancy Agreement for the Development

and Establishment of an International Financial Center in Vietnam dated July 5, 2024 between Dr. D’ORLEANS DE FRANCE BENEDICT CARL

WILLIAM (f/k/a BEN CARL SMET) and PHI Group, Inc. (n/k/a Philux Global Group Inc.) is qualified in its entirety by reference to the full

text of said Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

SECTION

9 – FINANCIAL STATEMENTS AND EXHBITS

Item

9.01 Financial Statements and Exhibits

The

following is a complete list of exhibit(s) filed as part of this Report.

Exhibit

number(s) correspond to the number(s) in the exhibit table of Item 601 of Regulation S-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

July 9, 2024

PHI

GROUP, INC.

(a/k/a

Philux Global Group, Inc.) |

|

| (Registrant) |

|

| |

|

| By:

|

/s/

Henry D. Fahman |

|

| |

Henry

D. Fahman |

|

| |

Chairman

and CEO |

|

Exhibit

10.1

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

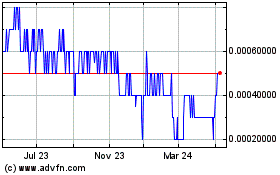

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Jan 2025 to Feb 2025

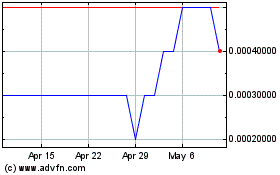

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Feb 2024 to Feb 2025