false

0001063537

0001063537

2023-12-20

2023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 20, 2023

RICEBRAN TECHNOLOGIES

(Exact Name of registrant as specified in its charter)

|

California

|

|

(State or other jurisdiction of incorporation)

|

|

0-32565

|

|

87-0673375

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

25420 Kuykendahl Rd., Suite B300

Tomball, TX

|

|

77375

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

|

|

|

(281) 675-2421

|

|

Registrant’s telephone number, including area code

|

| |

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, no par value per share

|

|

RIBT

|

|

OTC Market (Pinks)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 20, 2023, RiceBran Technologies issued a press release announcing certain financial results for the three months ended September 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Current Report on Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RICEBRAN TECHNOLOGIES

|

|

| |

|

|

|

|

Date: December 20, 2023

|

By:

|

/s/ William J. Keneally

|

|

| |

Name:

|

William J. Keneally

|

|

| |

Title:

|

Interim Chief Financial Officer and Secretary

|

|

| |

|

(Duly Authorized Officer)

|

|

Exhibit 99.1

RiceBran Technologies Reports Third Quarter 2023 Results

Board continues to review strategic initiatives and alternatives

TOMBALL, Texas, December 20, 2023 – RiceBran Technologies (OTCMKTS: RIBT) (“RiceBran” or the “Company”), an innovator in the development and manufacture of nutritional and functional ingredients derived from rice, barley and oats, today announced financial results for the third quarter ended September 30, 2023.

Eric Tompkins, Executive Chairman of RiceBran, commented, “The Board of Directors continues to advance a strategic review, with the goal of creating a more sustainable organization that can better capitalize on the benefits of a public listing and the significant carryforward tax assets that have been accumulated. The divestiture of our stabilized rice bran business during the second quarter was the first step in this ongoing process.”

Third Quarter 2023 Financial and Operational Overview

|

●

|

Revenue: Total revenue from continuing operations was $4.9 million in 3Q23, down 27% from 3Q22 due to a $1.2 million decrease related to Golden Ridge Rice Mills Inc. (“Golden Ridge”) mainly due a lack of availability of end of the season crop leading to lower volumes. The remaining $0.6 million revenue decrease at MGI Grain Incorporated, (“MGI”) was mainly due to lower commodity prices.

|

|

●

|

Gross Losses: Gross losses from continuing operations for 3Q23 were $(480,000) compared to a gross loss of $(562,000) in the third quarter of 2022, due to the rationalization of less profitable business due to the commodity supply changes noted above.

|

|

●

|

SG&A and Operating Loss: SG&A from continuing operations decreased $186,000 year-over-year due to reductions in overhead expenses, primarily staff, partially offset by increased legal costs as the Company’s Board of Directors continues to explore strategic alternatives. Loss from continuing operations before other income (expense) was $1.8 million in 3Q23, an increase of $231,000, or 13%, compared with 3Q22.

|

|

●

|

Net Loss and EPS: Net loss from continuing operations was $1.8 million, or $0.26 per share, in 3Q23 compared to $2.0 million, or $0.29 per share, in 3Q22. Net loss (including discontinued operations) was $1.8 million, or $0.26 per share, compared with a net loss of $2.0 million, or $0.38 per share in 3Q22.

|

Balance Sheet: Total cash was $466,000 at the end of 3Q23 down from $3.9 million at the end of 4Q22, after repayments of $3.0 million on the Company’s factoring, line of credit and long-term debt and finance lease liabilities.

About RiceBran Technologies

RiceBran Technologies is a specialty ingredient company focused on the development, production and marketing of products derived from traditional and ancient small grains. We create and produce products to deliver improved nutrition and ease of use, while addressing consumer demand for all natural, non-GMO and organic products. The target markets for our products include human food, animal nutrition manufacturers and retailers, as well as specialty food retailers. More information can be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”) and by visiting our website at http://www.ricebrantech.com.

Forward-Looking Statements

This press release includes statements concerning RiceBran and its future expectations, plans and prospects that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such “forward-looking statements” include, but are not limited to, statements about RiceBran’s intentions, beliefs or current expectations. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plans,” “anticipate,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these terms or other similar expressions. The forward-looking statements in this press release are based on current expectations, estimates, forecasts and projections about the industry and markets in which the Company operates and management’s beliefs and assumptions. The Company cannot guarantee that it actually will achieve the plans, intentions, expectations or guidance disclosed herein. Such forward-looking statements, and all phases of the Company’s operations, involve a number of risks and uncertainties, any one or more of which could cause actual results to differ materially from those described in its forward-looking statements. Assumptions and other information that could cause results to differ from those set forth in the forward-looking information can be found in RiceBran’s filings with the SEC, including its most recent annual report on Form 10-K and its quarterly reports on Forms 10-Q. Except as required by law, RiceBran does not undertake to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking information.

Investor Contact

Rob Fink

FNK IR

ribt@fnkir.com

646.809.4048

RiceBran Technologies

Condensed Consolidated Statements of Operations

(Unaudited) (in thousands, except share and per share amounts)

RiceBran Technologies

Consolidated Income Statement (Unaudited) (GAAP)

(in $000, except per share amounts)

| |

|

3 Months Ended

|

|

|

9 Months Ended

|

|

| |

|

9/30/23

|

|

|

9/30/22

|

|

|

9/30/23

|

|

|

9/30/22

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

4,857 |

|

|

$ |

6,637 |

|

|

$ |

16,970 |

|

|

$ |

19,209 |

|

|

Cost of Goods Sold

|

|

|

(5,337 |

) |

|

|

(7,199 |

) |

|

|

(17,484 |

) |

|

$ |

(20,192 |

) |

|

Gross Profit (Loss)

|

|

|

(480 |

) |

|

|

(562 |

) |

|

|

(514 |

) |

|

|

(983 |

) |

|

Gross Margin

|

|

|

(10 |

%) |

|

|

(8 |

%) |

|

|

(3 |

%) |

|

|

(5 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General & Admin.

|

|

|

(1,250 |

) |

|

|

(1,436 |

) |

|

|

(4,352 |

) |

|

|

(4,021 |

) |

|

Loss from continuing ops before other income (expense)

|

|

$ |

(1,730 |

) |

|

$ |

(1,998 |

) |

|

$ |

(4,866 |

) |

|

$ |

(5,004 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense

|

|

|

(124 |

) |

|

|

(118 |

) |

|

|

(450 |

) |

|

|

(334 |

) |

|

Change in FV of Derivative Warrant Liability

|

|

|

53 |

|

|

|

612 |

|

|

|

14 |

|

|

|

24 |

|

|

Other Income (Expense)

|

|

|

19 |

|

|

|

(39 |

) |

|

|

181 |

|

|

|

(106 |

) |

|

Loss From Continuing Ops Before Income Taxes

|

|

|

(1,782 |

) |

|

|

(1,543 |

) |

|

|

(5,121 |

) |

|

|

(5,420 |

) |

|

Income Taxes

|

|

|

- |

|

|

|

(8 |

) |

|

|

(11 |

) |

|

|

(20 |

) |

|

Loss From Continuing Ops

|

|

|

(1,782 |

) |

|

|

(1,551 |

) |

|

|

(5,132 |

) |

|

|

(5,440 |

) |

|

Loss From Discontinued Ops

|

|

|

- |

|

|

|

(491 |

) |

|

|

(9,009 |

) |

|

|

(739 |

) |

|

Net Loss

|

|

$ |

(1,782 |

) |

|

$ |

(2,042 |

) |

|

$ |

(14,141 |

) |

|

$ |

(6,179 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic & Diluted Loss per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing Ops

|

|

$ |

(0.26 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.77 |

) |

|

$ |

(1.03 |

) |

|

Discontinued Ops

|

|

|

- |

|

|

$ |

(0.09 |

) |

|

$ |

(1.34 |

) |

|

$ |

(0.14 |

) |

| |

|

$ |

(0.26 |

) |

|

$ |

(0.38 |

) |

|

$ |

(2.11 |

) |

|

$ |

(1.17 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Avg. Shares Outstanding (Basic & Diluted):

|

|

|

6,806 |

|

|

|

5,332 |

|

|

|

6,700 |

|

|

|

5,291 |

|

RiceBran Technologies

Condensed Consolidated Balance Sheets

(Unaudited) (in thousands, except share amounts)

RiceBran Technologies

Consolidated Balance Sheets (Unaudited)

(in $000)

| |

|

Period Ending

|

|

| |

|

9/30/23

|

|

|

12/31/22

|

|

|

Assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

$ |

466 |

|

|

$ |

3,941 |

|

|

Accounts Receivable, net

|

|

|

2,620 |

|

|

|

3,703 |

|

|

Inventories

|

|

|

514 |

|

|

|

465 |

|

|

Other Current Assets

|

|

|

515 |

|

|

|

735 |

|

|

Current assets held for sale

|

|

|

- |

|

|

|

2,224 |

|

|

Total Current Assets

|

|

$ |

4,115 |

|

|

$ |

11,068 |

|

| |

|

|

|

|

|

|

|

|

|

PP&E, Net

|

|

|

5,937 |

|

|

|

6,020 |

|

|

Operating Lease right-of-use assets

|

|

|

- |

|

|

|

77 |

|

|

Intangibles

|

|

|

295 |

|

|

|

380 |

|

|

Long-term assets held for sale

|

|

|

- |

|

|

|

9,888 |

|

|

Total Assets

|

|

$ |

10,347 |

|

|

$ |

27,433 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$ |

1,414 |

|

|

$ |

1,232 |

|

|

Commodities Payable

|

|

|

2,538 |

|

|

|

1,546 |

|

|

Accruals

|

|

|

2,573 |

|

|

|

1,584 |

|

|

Leases, Current

|

|

|

136 |

|

|

|

220 |

|

|

Debt, Current

|

|

|

3,378 |

|

|

|

6,155 |

|

|

Current liabilities held for sale

|

|

|

- |

|

|

|

540 |

|

|

Total Current Liabilities

|

|

$ |

10,039 |

|

|

$ |

11,277 |

|

| |

|

|

|

|

|

|

|

|

|

Leases, Not Current

|

|

|

434 |

|

|

|

320 |

|

|

Debt, Not Current

|

|

|

603 |

|

|

|

836 |

|

|

Derivative Warrant Liability

|

|

|

55 |

|

|

|

69 |

|

|

Long-term liabilities held for sale

|

|

|

- |

|

|

|

2,022 |

|

|

Total Liabilities

|

|

$ |

11,131 |

|

|

$ |

14,524 |

|

| |

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

75 |

|

|

|

75 |

|

|

Common Stock

|

|

|

328,999 |

|

|

|

328,551 |

|

|

Accumulated Deficit

|

|

|

(329,858 |

) |

|

|

(315,717 |

) |

|

Total Shareholders’ Equity (Deficit)

|

|

$ |

(784 |

) |

|

$ |

12,909 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity

|

|

$ |

10,347 |

|

|

$ |

27,433 |

|

v3.23.4

Document And Entity Information

|

Dec. 20, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

RICEBRAN TECHNOLOGIES

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 20, 2023

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

0-32565

|

| Entity, Tax Identification Number |

87-0673375

|

| Entity, Address, Address Line One |

25420 Kuykendahl Rd

|

| Entity, Address, Address Line Two |

Suite B300

|

| Entity, Address, City or Town |

Tomball

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77375

|

| City Area Code |

281

|

| Local Phone Number |

675-2421

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

RIBT

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001063537

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

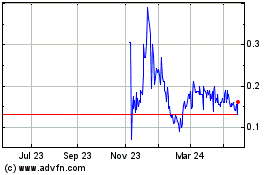

RiceBran Technologies (PK) (USOTC:RIBT)

Historical Stock Chart

From Apr 2024 to May 2024

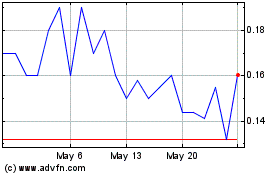

RiceBran Technologies (PK) (USOTC:RIBT)

Historical Stock Chart

From May 2023 to May 2024