UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

TENDER

OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

SIDECHANNEL,

INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer)

Warrants

to Purchase Common Stock with an Exercise Price of $1.00

Warrants

to Purchase Common Stock with an Exercise Price of $0.36

Warrants

to Purchase Common Stock with an Exercise Price of $0.18

(Title

of Class of Securities)

N/A

(CUSIP

Number of Warrants)

Ryan

Polk

Chief

Financial Officer

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Phone:

(508) 925-0114

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Michael

E. Storck, Esq. Paul J. Schulz, Esq. Lippes Mathias LLP

50

Fountain Plaza, Suite 1700

Buffalo,

New York 14202

(716)

853-5100

CALCULATION

OF FILING FEE

Transaction

valuation* $1.1 million; Amount of filing fee* $112

*

Estimated for purposes of calculating the amount of the filing fee only. SideChannel, Inc. (“SideChannel” or the “Company”)

is offering to holders of certain of its warrants, as more fully described herein, the opportunity to exchange such warrants for shares

of the Company’s common stock, par value $0.001 per share (“Shares” or “Common Stock”) by tendering (i)

six (6) warrants with an exercise price of $0.36 in exchange for one (1) share of our Common Stock, and (ii) four (4) warrants with an

exercise price of $1.00 or $0.18, as the case may be, in exchange for one (1) share of our Common Stock. The amount of the filing fee

assumes that all outstanding warrants that are the subject of the offer will be exchanged and is calculated pursuant to Rule 0-11(b)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The transaction value was determined assuming that

all warrants to purchase SideChannel’s Common Stock eligible to participate in the Offer are exchanged, and that the approximately

12,602,770 shares issued as a result of the Offer have an aggregate value of $1.1 million calculated based on the average of the low

and high trading price on August 16, 2023 which was $0.08.

The

amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $110.20 per million dollars

of the transaction valuation.

| ☐ | Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the

filing with which the offsetting fee was previously paid. Identify the previous filing by

registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously

Paid: N/A |

Filing Party:

N/A |

| Form or Registration No.:

N/A |

Date Filed: N/A |

| ☐ | Check

the box if the filing relates solely to preliminary communications made before the commencement

of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐

|

third-party

tender offer subject to Rule 14d-1. |

| |

☒

|

issuer

tender offer subject to Rule 13e-4. |

| |

☐

|

going-private

transaction subject to Rule 13e-3. |

| |

☐

|

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

SCHEDULE

TO

This

Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by SideChannel, Inc., a Delaware corporation (the “Company”

or “SideChannel”). This Schedule TO relates to the offer by the Company to holders of certain of the Company’s outstanding

warrants (the “Warrants”). The offer is made upon the terms and subject to the conditions set forth in the Company’s

offer to exchange, dated August 21, 2023 (the “Offer to Exchange”), and in the related Offer to Exchange materials which

are filed as Exhibits (a)(1)(A), (a)(1)(B), (a)(1)(C), (a)(1)(D) and (a)(1)(E) to this Schedule TO (which the Offer to Exchange and related

Offer to Exchange materials, as amended or supplemented from time to time, collectively constitute the “Offer Materials”).

This is an Offer for all or none of the Warrants. The Offer is subject to the requirement that all Warrants must be tendered by all eligible

holders of the Warrants.

The

69,281,020 Warrants subject to our Offer to Exchange consist of (i) warrants to purchase an aggregate of 5,398,966 Shares issued to certain

designees of Paulson Investment Company, LLC (“Paulson”) in 2018 with a ten-year term and with an exercise price of $1.00

(“2018 Paulson Warrants”), (ii) warrants to purchase an aggregate of 8,332,439 Shares that were issued to certain designees

of Paulson in 2021 with a ten-year term and that had an exercise price of $0.18 (“2021 Paulson Warrants”); and (iii) warrants

to purchase an aggregate of 55,549,615 Shares issued to certain investors in 2021 with a five-year term and with an exercise price of

$0.36 (“2021 Investor Warrants”). The 2018 Paulson Warrants and the 2021 Paulson warrants are sometimes herein collectively

referred to as the “Paulson Warrants.” Under the Offer to Exchange, the holders of the Paulson Warrants will be entitled

to receive one (1) share of Common Stock for each four (4) Paulson Warrants exchanged (“Paulson Exchange Ratio”), and (ii)

the holders of the Investor Warrants will be entitled to receive one (1) share of Common Stock for each six (6) Investor Warrants exchanged

(“Investor Exchange Ratio”). The “Offer Period” is the period commencing on August 21, 2023 and ending at 5:00

p.m., Eastern Time, on September 19, 2023, or such later date to which the Company may extend the Offer (the “Expiration Date”).

If all of the Warrants are tendered, the Company will issue approximately 12,602,770 Shares. The Paulson Exchange Ratio and the Investor

Exchange Ratio were selected by the Company in order to provide the holders of the Warrants with an incentive to exchange the Warrants.

This

Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended. Information

set forth in the Offer to Exchange is incorporated by reference in response to Items 1 through 13 of this Schedule TO, except those parts

of items as to which information is specifically provided herein.

Item

1. Summary Term Sheet.

The

information set forth under the heading “Summary” in the Offer to Exchange, attached hereto as Exhibit (a)(1)(A), is incorporated

herein by reference.

Item

2. Subject Company Information.

The

name of the subject company and the filing person is SideChannel, Inc., a Nevada corporation. Its principal executive offices are located

at 146 Main Street, Suite 405, Worcester, MA 01608. The Company’s telephone number is (508) 925-0114.

As

of June 30, 2023, the Company has a total of 76,383,520 warrants to purchase shares of Common Stock outstanding (“Outstanding Warrants”).

Of the Outstanding Warrants, 69,281,020 warrants are subject to the Offer. Each 2018 Paulson Warrant is currently exercisable for one

share of our common stock for an exercise price of $1.00. Each 2021 Paulson Warrant is currently exercisable for one share of our common

stock for an exercise price of $0.18. Each 2021 Investor Warrant is currently exercisable for one share of our common stock for an exercise

price of $0.36. If all of the Warrants are tendered, the Company will issue approximately 12,602,770 Shares.

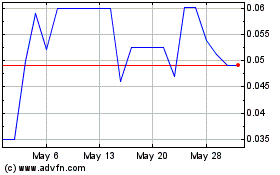

| (c) | Trading

Market and Price. |

There

is no trading market for the Warrants. However, the Common Stock trades under the symbol SDCH on the OTCQB Venture Market. The information

set forth in the Offer to Exchange under “The Offer, Section 4. Price Range of Shares” is incorporated herein by reference.

Our

Common Stock is considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Exchange

Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on

NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons

other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that

they make an individualized written suitability determination for the purchaser and receive the purchaser’s consent prior to the

transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection

with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny

stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the

ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions

on transferring “penny stocks” and as a result, investors in the common stock may have their ability to sell their shares

of the common stock impaired.

Item

3. Identity and Background of Filing Person.

The

Company is the subject company and the filing person. The business address and telephone number of the Company are set forth under Item

2(a) above.

The

names of the executive officers and directors of the Company who are persons specified in Instruction C to Schedule TO are set forth

below. The business address for each such person is 146 Main Street, Suite 405, Worcester, MA 01608. The business telephone number for

each such person is (508) 925-0114.

| Name |

|

Position |

| Anthony

Ambrose |

|

Director |

| Brian

Haugli |

|

Chief

Executive Officer, Director |

| Deborah

MacConnel |

|

Director,

Chairwoman |

| Ryan

Polk |

|

Chief

Financial Officer |

| Kevin

Powers |

|

Director |

| Hugh

Regan, Jr. |

|

Director |

Item

4. Terms of the Transaction.

The

information set forth in the Offer to Exchange under Sections 1 through 11 of “The Offer” is incorporated herein by reference.

The

following description of our Common Stock is a summary and does not purport to be complete. It is subject to and qualified in its entirety

by reference to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), and our Amended and Restated

Bylaws (the “Bylaws”), each of which are incorporated by reference as exhibits to our Annual Report on Form 10-K filed December

20, 2022. We encourage you to read our Certificate of Incorporation, Bylaws, and the applicable provisions of the Delaware General Corporation

Law for additional information.

Our

authorized capital shares consist of 681,000,000 shares of Common Stock, $0.001 par value per share. As of June 30, 2023, there were

212,765,780 shares of Common Stock issued and outstanding. Holders of Common Stock are entitled to one vote per share on all matters

voted on by the stockholders, including the election of directors. Our Certificate of Incorporation and Bylaws do not provide for cumulative

voting in the election of directors.

Holders

of our Common Stock are entitled to receive dividends, if any, as may be declared from time to time by the Board of Directors in its

discretion out of funds legally available for the payment of dividends. However, our Board of Directors has no present intention to pay

any dividends to holders of our Common Stock.

In

the event of our liquidation, the holders of our Common Stock will be entitled to share ratably in any distribution of our assets after

payment of all debts and other liabilities and the preferences payable to holders of shares of Preferred Stock then outstanding, if any.

Our

Certificate of Incorporation authorizes the issuance of 10,0000,000 undesignated shares of Preferred Stock and permits our Board of Directors

to issue Preferred Stock with rights, powers, prerogatives or preferences that could impede the success of any attempt to change control

of the Company. For example, our Board of Directors, without stockholder approval, may create or issue Preferred Stock with conversion

rights that could adversely affect the voting power of the holders of our Common Stock as well as rights to such Preferred Stock, in

connection with implementing a stockholder rights plan. This provision may be deemed to have a potential anti-takeover effect, because

the issuance of such Preferred Stock may delay or prevent a change of control of the Company. Furthermore, shares of Preferred Stock,

if any are issued, may have other rights, including economic rights, senior to Common Stock, and, as a result, the issuance thereof could

depress the market price of our Common Stock.

Our

Articles of Incorporation and the Bylaws do not provide holders of our Common Stock cumulative voting rights in the election of directors.

The absence of cumulative voting could have the effect of preventing stockholders holding a minority of our shares of Common Stock from

obtaining representation on our Board of Directors or the assumption of control by a holder of a large block of our stock or the removal

of incumbent management.

In

the event of our liquidation, the holders of our Common Stock will be entitled to share ratably in any distribution of our assets after

payment of all debts and other liabilities and the preferences payable to holders of shares of Preferred Stock then outstanding, if any.

Our

Certificate of Incorporation does not provide appraisal rights to the holders of our Common Stock.

The

Offer will increase retained earnings and decrease additional paid-in-capital. The Offer will not materially affect our consolidated

statement of operations nor our statement of cash flows.

No

directors or officers hold any warrants subject to the Offer.

Item

5. Past Contracts, Transactions, Negotiations and Arrangements.

| (a) | Agreements

Involving the Subject Company’s Securities. |

The

information set forth in the Offer to Exchange under “The Offer, Section 7. Transactions and Agreements Concerning the Company’s

Securities” is incorporated herein by reference.

Item

6. Purposes of the Transaction and Plans or Proposals.

The

information set forth in the Offer to Exchange under “The Offer, Section 3.C. Purpose of the Offer” is incorporated herein

by reference.

| (b) | Uses

of Securities Acquired. |

The

securities will be retired.

No

plans or proposals described in this Schedule TO or in any materials sent to the holders of the Warrants in connection with the Offer

relate to or would result in the conditions or transactions described in Regulation M-A, Items 1006(c)(1)-(10), except as follows: (i)

(a) the exchange of every six (6) Paulson Warrants pursuant to the Offer will result in the acquisition by the exchanging holder of one

(1) Share of the Company, and (b) the exchange of every four (4) Investor Warrants pursuant to the Offer will result in the acquisition

by the exchanging holder of one (1) Share of the Company; and (ii) at the Company’s Annual Meeting of Stockholders held on February

15, 2023, SideChannel’s stockholders granted discretionary authority to our Board of Directors to combine outstanding shares of

our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range

of 2-to-1 to a maximum of a 100-1 combination, with the exact ratio to be determined by our Board of Directors in its sole discretion;

and to effect the reverse stock split, if at all, within two years of the date the proposal is approved by stockholders. The Board of

Directors has not yet determined what if any action will be taken pursuant to this reverse-split authorization.

Item

7. Source and Amount of Funds or Other Consideration.

No

funds will be paid by the Company to exchanging Warrant holders in connection with the Offer. The Company will use funds on hand to pay

the other expenses of consummating the Offer. The Company will use newly issued Shares or Shares held in treasury, if any, to effect

the Offer.

Not

applicable because there is no financing.

Not

applicable because no funds are being borrowed for the Offer to Exchange.

Item

8. Interest in Securities of the Subject Company.

No

directors or officers hold any warrants subject to the Offer.

| (b) | Securities

transactions. |

The

Company has not engaged in any transactions in the Warrants required to be disclosed in this Item 8(b).

Item

9. Person/Assets, Retained, Employed, Compensated or Used.

| (a) |

Solicitations or Recommendations. |

The

Company has not retained a solicitation agent for the tender offer.

The

Company will use the services of its officers and employees to solicit holders of the Warrants to participate in the Offer without additional

compensation. The Board of Directors has not made any recommendation.

Item

10. Financial Statements

| (a) |

Financial Information. |

The

Company incorporates by reference the Company’s financial statements that were filed in Part II, Item 8 of its Annual Report on

Form 10-K filed with the SEC on December 20 2022. Additionally, the Company incorporates by reference the Company’s unaudited financial

statements that were filed in Part I, Item 1 of its Quarterly Reports on Form 10-Q filed with the SEC on February 9, 2023, May 9, 2023,

and August 9, 2023 respectively.

The

full text of the Quarterly Reports on Form 10-Q and the Annual Report on Form 10-K, as well as the other documents the Company has filed

with the SEC prior to, or will file with the Commission subsequent to, the filing of this Tender Offer Statement on Schedule TO, can

be accessed electronically on the SEC’s website at www.sec.gov. Copies of our SEC filings are also available without charge

upon written request addressed to SideChannel, Inc., at 146 Main Street, Suite 405, Worcester, MA 01608, attn.: Corporate Secretary .

Our telephone number is: (508) 925-0114.

Our

book value as of June 30, 2023 was approximately $7.8 million or approximately $0.04 per share. Book value per share represents our total

assets less total liabilities, divided by the number of shares of common stock outstanding as of June 30, 2023.

Our

tangible book value as of June 30, 2023 was approximately $1.5 million or approximately $0.01 per share. Tangible book value per share

represents our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of June 30,

2023.

Item

11. Additional Information.

| (a) | Agreements,

Regulatory Requirements and Legal Proceedings. |

| (1) | Except

as set forth in Items 8 and 9 above, there are no present or proposed contracts, arrangements,

understandings or relationships between the Company and its executive officers, directors

or affiliates relating, directly or indirectly, to the Offer. |

| (2) | Except

for the requirements of applicable U.S. federal and state securities laws, the Company knows

of no regulatory requirements to be complied with or approvals to be obtained by the Company

in connection with the Offer. |

| (3) | There

are no applicable anti-trust laws implicated in the Offer to Exchange. |

| (4) | The

margin requirements of Section 7 of the Securities Exchange Act of 1934, as amended, and

the applicable regulations are inapplicable. |

| (b) | Other

Material Information. |

The

information set forth in the Offer to Exchange and the related Letters of Transmittal, copies of which are filed as Exhibits (a)(l)(A),

(a)(l)(B), (a)(1)(C), (a)(1)(D), and (a)(1)(E) hereto, respectively, is incorporated herein by reference.

The

information set forth in the sections of the Offer to Exchange titled “Summary Term Sheet,” “Risk Factors,” “The

Offer—Section 11. Additional Information; Miscellaneous,” is incorporated herein by reference. The Company will amend this

Schedule TO to include documents that it may file with the SEC after the date of the Offer to Exercise and Exchange pursuant to Sections

13(a), 13(c) or 14 of the Securities Exchange Act of 1934, as amended, and prior to the expiration of the Offer, to the extent required

by Rule 13e-4(d)(2) of the Securities Exchange Act of 1934, as amended.

Item

12. Exhibits.

| Exhibit |

|

Description |

| (a)(1)(A) |

|

Offer to Exchange Common Stock for Certain Outstanding Warrants.* |

| (a)(1)(B) |

|

Letter of Transmittal for the Paulson Warrants.* |

| (a)(1)(C) |

|

Letter of Transmittal for the Investor Warrants.* |

| (a)(1)(D) |

|

Notice of Withdrawal for the Paulson Warrants.* |

| (a)(1)(E) |

|

Notice of Withdrawal for the Investor Warrants.* |

| (a)(1)(F) |

|

Letter from the Chief Financial Officer of the Company to the Holders of Warrants |

| (a)(1)(G) |

|

Warrant Exchange Offer Webinar

Presentation* |

| (a)(1)(H) |

|

Executed Letter of Transmittal

Confirmation* |

| (a)(5)(A) |

|

Part II, Item 8 of Annual Report on Form 10-K for the year ended September 30, 2022, filed with the SEC on December 20, 2022 and incorporated herein by reference. |

| (a)(5)(B) |

|

Part I, Item I of Quarterly Report on Form 10-Q for the quarter ended December 31, 2022, filed with the SEC on February 9, 2023 and incorporated herein by reference. |

| (a)(5)(C) |

|

Part I, Item I of Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 9, 2023 and incorporated herein by reference. |

| (a)(5)(D) |

|

Part I, Item I of Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 9, 2023 and incorporated herein by reference. |

| (d)(1) |

|

Form of $1.00 Warrant with Ten Year Term Issued in 2018.* |

| (d)(2) |

|

Form of $0.18 Warrant with Ten Year Term Issued in 2021.* |

| (d)(3) |

|

Form of $0.36 Warrant with Five Year Term Issued in 2021.* |

107 |

|

Filing Fee Table* |

*

Filed herewith.

Item

13. Information Required by Schedule 13e-3.

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| SIDECHANNEL,

INC. |

|

|

| |

|

|

| Date:

August 25, 2023 |

By: |

/s/

Ryan Polk |

| |

Name: |

Ryan

Polk |

| |

Title: |

Chief

Financial Officer |

Exhibit

99(a)(1)(A)

OFFER

TO EXCHANGE COMMON STOCK

FOR

CERTAIN OUTSTANDING WARRANTS OF

SIDECHANNEL,

INC.

AUGUST

21, 2023

THE

OFFER PERIOD AND YOUR RIGHT TO WITHDRAW WARRANTS THAT YOU TENDER WILL EXPIRE AT 5:00 P.M., EASTERN TIME, ON SEPTEMBER 19, 2023, UNLESS

THE OFFER PERIOD IS EXTENDED. THE COMPANY MAY EXTEND THE OFFER PERIOD AT ANY TIME. THIS IS AN OFFER FOR ALL OR NONE OF THE WARRANTS SUBJECT

TO THE OFFER.

THE

OFFER IS BEING MADE SOLELY UNDER THIS OFFER LETTER AND THE RELATED LETTERS OF TRANSMITTAL TO ALL HOLDERS OF CERTAIN WARRANTS DESCRIBED

HEREIN. THE OFFER IS NOT BEING MADE TO, NOR WILL TENDERS BE ACCEPTED FROM OR ON BEHALF OF, HOLDERS OF WARRANTS RESIDING IN ANY U.S. STATE

IN WHICH THE MAKING OF THE OFFER OR ACCEPTANCE THEREOF WOULD NOT BE IN COMPLIANCE WITH THE SECURITIES, BLUE SKY OR OTHER LAWS OF SUCH

U.S. STATE.

SideChannel,

Inc. which is referred to in this Offer to Exchange as “we”, “us”, “our”, “SideChannel”

or the “Company” is making an offer, upon the terms and conditions in this Offer to Exchange and the related Letters

of Transmittal (which together constitute the “Offer”), to holders of certain of the Company’s outstanding warrants

more particularly described below (the “Warrants”) to receive an aggregate of approximately 12,602,770 shares

of the Company’s common stock, par value $0.001 per share (“Common Stock” or “Shares”).

The

warrants subject to our Offer to Exchange consist of (i) warrants to purchase an aggregate of 5,398,966 Shares issued to certain

designees of Paulson Investment Company, LLC (“Paulson”) in 2018 with a ten-year term and with an exercise price of

$1.00 (“2018 Paulson Warrants”), (ii) warrants to purchase an aggregate of 8,332,439 Shares that were issued

to certain designees of Paulson in 2021 with a ten-year term and with an exercise price of $0.18 (“2021 Paulson Warrants”).

and (iii) warrants to purchase an aggregate of 55,549,615 Shares issued to certain investors in 2021 with a five-year term and

with an exercise price of $0.36 (“2021 Investor Warrants”) The 2018 Paulson Warrants and the 2021 Paulson Warrants

are sometimes herein collectively referred to as the “Paulson Warrants.” Under this Offer to Exchange, the holders

of the Paulson Warrants will be entitled to receive one (1) share of Common Stock for each four (4) Paulson Warrants exchanged and (ii)

the holders of the Investor Warrants will be entitled to receive one (1) share of Common Stock for each six (6) Investor Warrants exchanged.

The Paulson Warrants and the Investor Warrants are sometimes referred to herein collectively as the “Warrants”.

Each

of the foregoing offers are for all outstanding warrants of each class. All warrants in each class must be tendered for the Offer to

Exchange to close, subject to SideChannel’s right to waive the requirement. The “Offer Period” is the period commencing

on August 21, 2023 and ending at 5:00 p.m., Eastern Time, on September 19, 2023, or such later date to which the Company

may extend the Offer (the “Expiration Date”). If all of the Warrants are tendered, the Company will issue approximately

12,602,770 Shares.

Our

Shares trade on the OTCQB, under the symbol SDCH. On August 17, 2023, the last reported closing sales price for the Shares was $0.07

per share.

No

scrip or fractional shares will be issued. Warrants may only be exchanged for whole shares. Holders of Warrants who would otherwise have

been entitled to receive fractional shares will, after aggregating all such fractional shares of such holder, receive the number of shares

as rounded up to the nearest whole share. Holders continue to be entitled to exercise their Warrants on a cash basis, as applicable,

during the Offer Period in accordance with the terms of such Warrant until the expiration date of such Warrant.

This

Offer is for all or none of the Paulson Warrants and all or none the Investor Warrants and is subject to the condition that all of the

Paulson Warrants and all of the Investor Warrants must be tendered for the Offer to close, which SideChannel may waive. If you elect

to tender Paulson Warrants or Investor Warrants in response to the Offer, please follow the instructions in this Offer to Exchange and

the related documents, including the applicable Letter of Transmittal. If you elect to exercise your Warrants on a cash basis in accordance

with their terms, please follow the instructions for exercise included in the Warrants.

If

you tender Warrants, you may withdraw your tendered Warrants before the Expiration Date and retain them on their terms by following the

instructions herein.

Investing

in the Shares involves a high degree of risk. See the “Risk Factors” section of this Offer to Exchange for a discussion of

information that you should consider before tendering Warrants in the Offer.

The

Offer will commence on August 21, 2023 (the date the materials relating to the Offer are first sent to the Warrant holders) and end on

the Expiration Date. Only the Paulson Warrants and the Investor Warrants are subject to the Offer.

A

detailed discussion of our Offer to Exchange Common Stock for the Warrants is contained in this Offer to Exchange. Holders of the Paulson

Warrants and the Investor Warrants are strongly encouraged to read this entire package of materials, and the publicly-filed information

about the Company referenced herein, before deciding regarding the Offer.

THE

COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES (EACH AS

DEFINED BELOW) MAKES ANY RECOMMENDATION WHETHER YOU SHOULD EXCHANGE YOUR WARRANTS. EACH HOLDER OF A WARRANT MUST MAKE HIS, HER OR ITS

OWN DECISION WHETHER TO TENDER ALL OF HIS, HER OR ITS WARRANTS.

WE

HAVE NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION ON OUR BEHALF AS TO WHETHER OR NOT YOU SHOULD PARTICIPATE IN THE OFFER TO EXCHANGE.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS DOCUMENT.

Neither

the Securities and Exchange Commission (The “SEC”) nor any state securities commission, bureau or authority has approved

or disapproved of this transaction or passed upon the fairness or merits of this transaction or the accuracy or adequacy of the information

contained in this Offer to Exchange. Any representation to the contrary is a criminal offense.

IMPORTANT

PROCEDURES

If

you want to tender all of your Warrants, you must:

| ● | complete

and sign the Letter of Transmittal applicable to the Warrants you are tendering (Paulson

Warrants or Investor Warrants) according to its instructions, and deliver the Letter of Transmittal,

together with any other documents required by the Letter of Transmittal, to the Company. |

If

you want to tender your Warrants, but your other required documents cannot be delivered to the Company before the Expiration date of

the Offer, then you can still tender your Warrants if you comply with the procedures described in Section 2.

TO

TENDER YOUR WARRANTS, YOU MUST CAREFULLY FOLLOW THE PROCEDURES DESCRIBED IN THIS OFFER LETTER, THE LETTER OF TRANSMITTAL APPLICABLE TO

YOUR TYPE OF WARRANTS AND THE OTHER DOCUMENTS DISCUSSED HEREIN RELATED TO THE OFFER. NO SCRIP OR FRACTIONAL SHARES WILL BE ISSUED. WARRANTS

MAY ONLY BE EXCHANGED FOR WHOLE SHARES.

Holders

of warrants who would otherwise have been entitled to receive fractional shares will, after aggregating all such fractional shares of

such holder, receive the number of shares as rounded up to the nearest whole share.

If

you have any questions or need assistance, you should contact SideChannel, Inc. You may request additional copies of this Offer to Exchange

and the Letter of Transmittal from the Company. The Company may be reached at:

The

address of the Company is:

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Email:

accounting@sidechannel.com

Phone:

(508) 925-0114

TABLE

OF CONTENTS

| SUMMARY |

1 |

| |

|

|

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS |

4 |

| |

|

|

| RISK FACTORS |

5 |

| |

|

|

| THE OFFER |

7 |

| |

|

|

| 1. |

GENERAL

TERMS |

7 |

| |

|

|

| 2. |

PROCEDURE

FOR TENDERING WARRANTS |

9 |

| |

|

|

| 3. |

BACKGROUND

AND PURPOSE OF THE OFFER |

14 |

| |

|

|

| 4. |

PRICE

RANGE OF SHARES |

16 |

| |

|

|

| 5. |

SOURCE

AND AMOUNT OF FUNDS |

17 |

| |

|

|

| 6. |

FEES

AND EXPENSES |

17 |

| |

|

|

| 7. |

TRANSACTIONS

AND AGREEMENTS CONCERNING THE WARRANTS |

17 |

| |

|

|

| 8. |

FINANCIAL

INFORMATION REGARDING THE COMPANY |

18 |

| |

|

|

| 9. |

EXTENSIONS;

AMENDMENTS; CONDITIONS; TERMINATION; PLANS |

18 |

| |

|

|

| 10. |

MATERIAL

U.S. FEDERAL INCOME TAX CONSEQUENCES |

20 |

| |

|

|

| 11. |

ADDITIONAL

INFORMATION; MISCELLANEOUS |

22 |

SUMMARY

The

following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Offer to Exchange. An investment

in our Shares involves risks. You should carefully consider the information provided under the heading “Risk Factors.”

| |

A. |

The

Company - SideChannel, Inc., a Delaware corporation. Our principal executive offices are located at 146 Main Street, Suite 405,

Worcester, MA 01608. |

| |

|

|

| |

B. |

The

Warrants - As of June 30, 2023, the Company has a total of 69,281,020 warrants

to purchase shares of Common Stock outstanding (“Outstanding Warrants”).

Of the Outstanding Warrants, 69,281,020 warrants are subject to the Offer, namely:

(i) warrants to purchase an aggregate of 5,398,966 Shares issued to certain designees

of Paulson Investment Company, LLC (“Paulson”) in 2018 with a ten-year

term and with an exercise price of $1.00 (“2018 Paulson Warrants”), (ii)

warrants to purchase an aggregate of 8,332,439 Shares issued to certain designees

of Paulson in 2021 with a ten-year term and that had an exercise price of $0.18 (“2021

Paulson Warrants”), and (iii) warrants to purchase an aggregate of 55,549,615

Shares that were issued to certain investors in 2021 with a five-year term and with an

exercise price of $0.36 (“2021 Investor Warrants”). The 2018 Paulson Warrants

and the 2021 Paulson Warrants are sometimes herein collectively referred to as the “Paulson

Warrants.” The 2021 Investor Warrants and the Paulson Warrants are sometimes referred

to herein collectively as the “Warrants”. By their terms, the Warrants

will expire on dates varying from April 7, 2026 to April 18, 2031.

Only

the Paulson Warrants and the Investor Warrants are eligible to be tendered for exchange in this Offer. |

| |

|

|

| |

C. |

Market

Price of the Shares - Our Shares trade on the OTCQB, under the symbol SDCH . On August 17, 2023, the last reported

closing sales price for the Shares was $0.7 per share. |

| |

|

|

| |

D. |

The

Offer - After the closing of the Offer, (i) the holders who have tendered their 2021

Investor Warrants will be entitled to receive one (1) share of Common Stock for each six

(6) Investor Warrants tendered for exchange (“Investor Exchange Ratio”),

and (ii) the holders who have tendered their Paulson Warrants will be entitled to receive

one (1) share of Common Stock for each four (4) Paulson Warrants tendered for exchange (“Paulson

Exchange Ratio”).

|

The

Paulson Exchange Ratio and the Investor Exchange Ratio were selected by the Company in order to provide the holders of the Warrants with

an incentive to exchange the Warrants. The “Offer Period” is the period commencing on August 21, 2023 and ending at

5:00 p.m., Eastern Time, on September 19, 2023, or such later date to which the Company may extend the Offer (the “Expiration

Date”). This is an all or none offer pursuant to which all Warrants of all three classes outstanding are required be tendered

subject to SideChannel’s reserved right to waive this requirement.

If

all of the Warrants are tendered as required, the Company will issue approximately 12,602,770 Shares. A holder must tender all

or none of the Warrants they hold to participate in the Offer. Warrants may only be exchanged for whole shares. Holders continue to be

entitled to exercise their Warrants on a cash basis during the Offer Period in accordance with the terms of the Warrant. See Section

1, “General Terms”.

| |

E. |

Reasons

for the Offer - The Offer is being made to all holders of certain classes of Warrants. The purpose of the Offer is to (i) remove

impediments to effectively engaging the capital markets caused by certain terms in the Warrants (ii) reduce the aggregate number

of warrants outstanding, and (iii) increase the number of Shares in the market. See Section 3.C., “Background and Purpose of

the Offer— Purpose of the Offer.” |

| |

|

|

| |

F. |

Expiration

Date of Offer - The Expiration Date is 5:00 p.m., Eastern Time, on September 19, 2023, or such date to which we may extend the

Offer. All Warrants and related paperwork must be received by the Company by this time, as instructed herein. See Section 9, “Extensions;

Amendments; Conditions; Termination; Plans.” |

| |

|

|

| |

G. |

Withdrawal

Rights - If you tender your Warrants and change your mind, you may withdraw your tendered Warrants at any time until the Expiration

Date, as described in greater detail in Section 2 herein. See Section 2.B., “Withdrawal Rights.” |

| |

|

|

| |

H. |

Participation

by Officers and Directors - No directors or officers hold any warrants subject to the Offer (see Section 3.D., “Background

and Purpose of the Offer—Interests of Directors and Officers”). |

| |

I. |

Conditions

of the Offer - The conditions of the Offer are that no action or event shall have occurred, no action shall have been taken,

and no statute, rule, regulation, judgment, order, stay, decree or injunction shall have been promulgated, enacted, entered or enforced

applicable to the Offer or the exchange of Warrants for Shares under the Offer by or before any court or governmental regulatory

or administrative agency, authority or tribunal of competent jurisdiction, including, without limitation, taxing authorities, that

challenges the making of the Offer or the exchange of Warrants for Shares under the Offer or would reasonably be expected to, directly

or indirectly, prohibit, prevent, restrict or delay consummation of, or would reasonably be expected to otherwise adversely affect

in any material manner, the Offer or the exchange of Warrants for Shares under the Offer, and that all of the Warrants of each class

of Warrants must be tendered; however, the Company may waive this condition in its discretion if all Warrants are not tendered by

the Expiration Date. |

| |

|

|

| |

J. |

Termination

- We may terminate the Offer if the Conditions of the Offer are not satisfied prior to the Expiration Date. See Section 9, “Extensions;

Amendments; Conditions; Termination.” |

| |

|

|

| |

K. |

Fractional

Shares - No scrip or fractional shares will be issued. Warrants may only be exchanged for whole shares. Holders of Warrants who

would otherwise have been entitled to receive fractional shares will, after aggregating all such fractional shares of such holder,

receive the number of shares as rounded up to the nearest whole share. See Section 1.B., “General Terms—Partial Tender

Permitted.” |

| |

|

|

| |

L. |

Board

of Directors’ Recommendation - Our Board of Directors has approved the Offer. However, none of the Company, its directors,

officers or employees makes any recommendation as to whether to tender Warrants. You must make your own decision as to whether to

tender some or all of your Warrants. See Section 1.C., “General Terms—Board Approval of the Offer; No Recommendation;

Holder’s Own Decision.” |

| |

|

|

| |

M. |

Solicitation

Agent - The Company has not retained a solicitation agent for the Exchange Offer. |

| |

|

|

| |

N. |

How

to Tender Warrants - To tender your Warrants, you must complete the actions described

herein under Section 2 before the Offer expires. You may also contact the Company or your

broker for assistance. The contact Information for the Company is SideChannel, Inc., 146

Main Street, Suite 405, Worcester, MA 01608, Phone: (508) 925-0114.

See

Section 2, “Procedure for Tendering Warrants.” |

| |

O. |

Certain

Material U.S. Federal Tax Consequences - In general, if you exchange your Warrants for Shares pursuant to the Offer, we believe

no gain or loss should be recognized on the exchange for United States federal income tax purposes. Holders are urged to consult

their personal tax advisors concerning the tax consequences of an exchange pursuant to the Offer based on their particular circumstances.

For a general discussion of certain tax considerations, see Section 10, “Material U.S. Federal Income Tax Consequences.” |

| |

|

|

| |

P. |

Further

Information - Please direct questions or requests for assistance, or for additional copies of this Offer to Exchange, Letter

of Transmittal or other materials, in writing, to the Company at SideChannel, Inc., 146 Main Street, Suite 405, Worcester, MA 01608,

Email accounting@sidechannel.com, Phone: (508) 925-0114. See Section 11, “Additional Information; Miscellaneous.” |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Offer to Exchange contains forward-looking statements. Forward-looking statements are those that predict or describe future events or

trends and that do not relate solely to historical matters. You can generally identify forward-looking statements as statements containing

the words “believe,” “expect,” “may,” “anticipate,” “intend,” “estimate,”

“project,” “plan,” “assume,” “potential,” “could,” “should,”

or other similar expressions, or negatives of those expressions, although not all forward-looking statements contain these identifying

words. All statements contained or incorporated by reference in this Offer to Exchange regarding our future strategy, future operations,

projected financial position, estimated future revenues, projected costs, future prospects, the future of our industries and results

that might be obtained by pursuing management’s current plans and objectives are forward-looking statements.

You

should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown

risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based

on the information currently available to us and speak only as of the date on the cover of this Offer to Exchange, or, in the case of

forward-looking statements in documents incorporated by reference, as of the date of the date of the filing of the document that includes

the statement. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they

may affect us. Over time, our actual results, performance or achievements will likely differ from the anticipated results, performance

or achievements that are expressed or implied by our forward-looking statements, and such difference might be significant and materially

adverse to our security holders. Except with respect to our obligation to provide amendments for material changes to this Offer to Exchange

during the duration of the Offer, we do not undertake and specifically disclaim any obligation to update any forward-looking statements

or to publicly announce the results of any revisions to any statements to reflect new information or future events or developments.

We

have identified some of the important factors that could cause future events to differ from our current expectations and they are described

in this Offer to Exchange under the caption “Risk Factors,” below, and elsewhere in this Offer to Exchange which you should

review carefully. Please consider our forward-looking statements in light of those risks as you read this Offer to Exchange.

RISK

FACTORS

An

investment in our Shares involves a high degree of risk. You should carefully consider each of the risks described below, together with

all of the other information set forth elsewhere on this Offer to Exchange and the risks and other information described in our annual

report on Form 10-K filed on December 20, 2022 and our subsequently filed quarterly reports on Form 10-Q. Additional risks and uncertainties

not presently known to the Company or that the Company currently deems immaterial also may impair our business operations. If any of

the matters identified as potential risks materialize, our business could be harmed. In that event, the trading price of our Common Stock

could decline.

There

is no guarantee that your decision whether to tender your Warrants in the Offer will put you in a better future economic position.

We

can give no assurance as to the price at which a stockholder may be able to sell our Common Stock in the future following the completion

of the Offer. If you choose to tender your Warrants in the Offer, certain future events may cause an increase in our Common Stock price

and may result in receiving fewer shares of Common Stock now than you might receive from future warrant exercises had you not agreed

to exchange your Warrants. Similarly, if you do not tender your Warrants in the Offer, you will continue to bear the risk of ownership

of your Warrants after the closing of the Offer, which includes the expiration of the Warrants by their own terms, and there can be no

assurance that you can sell your Warrants (or exercise them for Common Stock) in the future at a higher price than would have been obtained

by participating in the Offer. You should consult your own individual tax and/or financial advisor for assistance on how this may affect

your individual situation.

There

is no assurance that the Offer will be successful.

There

is no assurance that all of the Warrants will be tendered in the Offer or that the Company will exercise its right to waive that requirement.

Moreover, there is no assurance that the price of our Common Stock will increase. The price of our Common Stock and the decision of any

investors to make an equity investment in the Company are based on numerous material factors, of which our Warrant overhang is only one.

Eliminating or significantly reducing our Warrant overhang will not generate any capital for our Company.

If

the holders of all of our Warrants accept the Offer, we will issue them additional shares of Common Stock. The issuance of additional

Common Stock upon the exchange of tendered Warrants will dilute our existing stockholders as well as our future stockholders. The issuance

will dilute the percentage ownership interests in the Company of other stockholders.

The

market price of our Common Stock will fluctuate, and it may adversely affect Warrant holders who tender their Warrants for Common Stock.

The

market price of our Shares will fluctuate between the date the Offer is commenced, the Expiration Date of the Offer and the date on which

Shares are issued to tendering Warrant holders. Accordingly, the market price of Shares upon settlement of the Offer could be less than

the price at which the Warrants could be sold or the price of our Common Stock when the Warrants were tendered. The Company does not

intend to re-adjust the Paulson Exchange Ratio or the Investor Exchange Ratio of Shares based on any fluctuation in the price of our

Shares.

The

value of the Shares that you receive may fluctuate.

We

are offering Shares for validly tendered Warrants. The price of our Shares may fluctuate widely in the future. If the market price of

our Shares declines, the value of the Shares you will receive in exchange for your Warrants will decline. The trading value of our Shares

could fluctuate depending upon any number of factors, including those specific to us and those that influence the trading prices of equity

securities generally, many of which are beyond our control.

The

number of Shares outstanding as a result of the Offer may depress the price of the Common Stock.

As

a result of this Offer, the number of Shares outstanding and trading will materially increase. This could adversely affect the prevailing

market price of the Shares. As a result, holders may not be able to sell the Shares at or above their purchase price and it may impair

the Company’s ability to raise capital through future sales of Common Stock or other equity securities.

No

rulings or opinions have been received as to the tax consequences of the Offer to holders of Warrants.

The

tax consequences that will result to a Warrant holder that participates in the Offer are not well defined by the existing authorities.

No ruling of any governmental authority and no opinion of counsel has been issued or rendered on these matters. Warrant holders must

therefore rely on the advice of their own tax advisors in assessing these matters. For a general discussion of certain tax considerations,

see Section 10, “Material U.S. Federal Income Tax Consequences.”

Our

Common Stock is deemed a “Penny Stock” and, as a result, holders of our Common Stock may have their ability to sell their

Shares of the Common Stock impaired.

Our

Common Stock is considered a “penny stock” subject to the requirements of Rule 15g-9, promulgated under the Exchange Act

of 1934, as amended (“Exchange Act”). “Penny Stock” is generally defined as any equity security not traded

on an exchange or quoted on NYSE or Nasdaq that has a market price of less than $5.00 per share. Under such rule, broker-dealers who

recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice

requirements, including making an individualized written suitability determination for the purchaser and obtaining the purchaser’s

consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure

in connection with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny

stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the

ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions

on transferring “penny stocks” and as a result, investors in the common stock may have their ability to sell their shares

of the common stock impaired.

THE

OFFER

Risks

of Participating In the Offer

Participation

in the Offer involves a number of risks, including, but not limited to, the risks identified in “Risk Factors” above. Holders

should carefully consider these risks and are urged to speak with their personal financial, investment and/or tax advisors as necessary

before deciding whether to participate in the Offer. In addition, the Company strongly encourages you to read this Offer to Exchange

in its entirety and review the documents referred to in “Risk Factors,” above as well, including the risks and other information

described in our annual report on Form 10-K filed on December 20, 2022 and our subsequently filed quarterly reports on Form 10-Q .

Subject

to the terms and conditions of the Offer, the Company is making an offer to the holders of certain of our Warrants to tender their Warrants

in exchange for Shares of our Common Stock. The Warrants subject to our Offer to Exchange consist of three classes of Warrants, namely

(i) warrants to purchase an aggregate of 5,298,966 Shares issued to certain designees of Paulson Investment Company, LLC (“Paulson”)

in 2018 with a ten-year term and with an exercise price of $1.00 (“2018 Paulson Warrants”), (ii) warrants to purchase

an aggregate of 8,332,439 Shares issued to certain designees of Paulson in 2021 with a ten-year term and that had an exercise

price of $0.18 (“2021 Paulson Warrants”), and (iii) warrants to purchase an aggregate of 55,549,615 Shares

that were issued to certain investors in 2021 with a five-year term and with an exercise price of $0.36 (“2021 Investor Warrants”).

The 2018 Paulson Warrants and the 2021 Paulson Warrants are sometimes herein collectively referred to as the “Paulson Warrants”

and the Paulson Warrants and the 2021 Investor Warrants are sometimes herein collectively referred to herein as the “Warrants”.

Under this Offer to Exchange, (i) the holders of the Investor Warrants will be entitled to receive one (1) share of Common Stock for

each six (6) Investor Warrants exchanged (“Investor Exchange Ratio”), and (ii) the holders of the Paulson Warrants will be

entitled to receive one (1) share of Common Stock for each four (4) Paulson Warrants exchanged (“Paulson Exchange Ratio”).

The “Offer Period” is the period commencing on August 21, 2023 and ending at 5:00 p.m., Eastern Time, on September

19, 2023, or such later date to which the Company may extend the Offer (the “Expiration Date”).

This

Offer is an all or none offer, and holders must tender all their Warrants to participate. The Offer is subject to the condition that

all warrants in all three classes of Warrants, namely all the 2018 Paulson Warrants, all the 2021 Paulson Warrants and all the Investor

Warrants must be tendered for exchange for the Offer to close, subject to the Company’s reserved right to waive the requirement

and close the Offer. Warrants may only be exchanged for whole shares. No scrip or fractional shares will be issued. Holders of Warrants

who would otherwise have been entitled to receive fractional shares will, after aggregating all such fractional shares of such holder,

receive the number of shares as rounded up to the nearest whole share. Holders continue to be entitled to exercise their Warrants on

a cash basis during the Offer Period in accordance with the terms of the Warrant.

If

you elect to tender Warrants in response to the Offer, please follow the instructions in this Offer to Exchange and the related documents,

including the Letter of Transmittal applicable to their type of Warrant.

If

you tender your Warrants, you may withdraw your tendered Warrants before the Expiration Date and retain them on their terms by following

the instructions herein.

This

Offer to Exchange is made pursuant to the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended

(the “Securities Act”).

The

Offer will only be open for a period beginning on August 21, 2023 and ending on the Expiration Date. The Company expressly reserves the

right, in its sole discretion, at any time or from time to time, to extend the period of time during which the Offer is open. There can

be no assurance, however, that the Company will exercise its right to extend the Offer.

| B. | Partial

Tender Not Permitted |

This

is an all or none Offer. If you choose to participate in the Offer, you must tender all of your Warrants pursuant to the terms of the

Offer. Although the Company has reserved the right to waive this condition, there can be no assurance that the Company will in fact waive

this condition if all eligible Warrants are not tendered.

HOLDERS

MAY ALSO BE ENTITLED TO EXERCISE THEIR WARRANTS ON A CASH BASIS DURING THE OFFER PERIOD IN ACCORDANCE WITH THE TERMS OF THE WARRANT,

RATHER THAN TENDERING THEM FOR EXCHANGE.

| C. | Board

Approval of the Offer; No Recommendation; Holder’s Own Decision |

THE

COMPANY’S BOARD OF DIRECTORS HAS APPROVED THE OFFER. HOWEVER, NONE OF THE COMPANY, ITS DIRECTORS, OFFICERS OR EMPLOYEES MAKES ANY

RECOMMENDATION AS TO WHETHER TO TENDER WARRANTS. EACH HOLDER OF A WARRANT MUST MAKE HIS, HER OR ITS OWN DECISION AS TO WHETHER TO TENDER

SOME OR ALL OF HIS, HER OR ITS WARRANTS.

| D. | Extensions

of the Offer |

The

Company expressly reserves the right, in its sole discretion, and at any time or from time to time, to extend the period of time during

which the Offer is open. There can be no assurance, however, that the Company will exercise its right to extend the Offer. If the Company

extends the Offer, it will give notice of such extension by press release or other public announcement no later than 9:00 a.m., Eastern

Time, on the next business day after the previously scheduled Expiration Date of the Offer.

| 2. | PROCEDURE

FOR TENDERING WARRANTS |

| A. | Procedures

for Tendering Warrants |

You

do not have to participate in the Offer. If you decide not to participate in the Offer, you do not need to do anything, and your Warrants

will remain outstanding until they expire or are exercised in accordance with their terms.

To

participate in the Offer, you must properly complete, sign and date the Letter of Transmittal pertaining to your type of Warrant (Paulson

Warrant or Investor Warrant) and mail or otherwise deliver to the Company the applicable Letter of Transmittal and your Warrants so that

the Company receives them no later than 5:00 P.M., Eastern Time, on the Expiration Date (or such later date and time if we extend the

Offer), at the address set forth in the Letter of Transmittal. The Company will accept email delivery of the Letter of Transmittal and

Indemnification at accounting@sidechannel.com.

The

applicable Letter of Transmittal must be executed by the record holder of the tendered Warrants. However, if the signature is by a trustee,

executor, administrator, guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative

capacity, the signer’s full title and proper evidence of the authority of such person to act in such capacity must be indicated

on the Letter of Transmittal.

If

you do not submit a Letter of Transmittal for your Warrants prior to the Expiration Date of the Offer, or if you submit an incomplete

or incorrectly completed Letter of Transmittal, you will be considered to have rejected the Offer to Exchange.

THE

METHOD OF DELIVERY OF WARRANTS, THE APPLICABLE LETTER OF TRANSMITTAL AND ALL OTHER REQUIRED DOCUMENTS TO THE COMPANY IS AT THE ELECTION,

EXPENSE AND RISK OF THE HOLDER. IT IS RECOMMENDED THAT HOLDERS ALLOW SUFFICIENT TIME TO ASSURE DELIVERY TO THE COMPANY BEFORE THE EXPIRATION

DATE.

You

may change your election and withdraw your tendered Warrants only if you properly complete, sign and date the Withdrawal Form included

with the Offer and mail, email or otherwise deliver the Withdrawal Form to us so that we receive it no later than 5:00 P.M., Eastern

Time, on the Expiration Date, Attention: SideChannel, Inc., 146 Main Street, Suite 405, Worcester, MA 01608. You may also withdraw your

tendered Warrants pursuant to Rule 13e-4(f)(2)(ii) under the Exchange Act, if they have not been accepted by us for payment within 40

business days from the commencement of the Offer. Delivery of the Withdrawal Form by facsimile or email will not be accepted.

The

Withdrawal Form must be executed by the record holder of the Warrants to be withdrawn. However, if the signature is by a trustee, executor,

administrator, guardian, attorney-in-fact, officer of a corporation or another person acting in a fiduciary or representative capacity,

the signer’s full title and proper evidence of the authority of such person to act in such capacity must be indicated on the Withdrawal

Form.

Withdrawals

of Warrants may not be rescinded. Any Warrants properly withdrawn will thereafter be deemed not to have been validly tendered for purposes

of the Offer. However, withdrawn Warrants may be re-tendered by again following one of the procedures described in the Offer at any time

prior to the Expiration Date.

ALL

QUESTIONS AS TO THE FORM AND VALIDITY (INCLUDING TIME OF RECEIPT) OF ANY NOTICE OF WITHDRAWAL WILL BE DETERMINED BY THE COMPANY, IN ITS

REASONABLE DISCRETION, WHOSE DETERMINATION WILL BE FINAL AND BINDING. NONE OF THE COMPANY OR ANY OTHER PERSON WILL BE UNDER ANY DUTY

TO GIVE NOTIFICATION OF ANY DEFECTS OR IRREGULARITIES IN ANY NOTICE OF WITHDRAWAL OR INCUR ANY LIABILITY FOR FAILURE TO GIVE ANY SUCH

NOTIFICATION.

THE

METHOD OF DELIVERY OF YOUR WITHDRAWAL FORM TO THE COMPANY IS AT THE ELECTION, EXPENSE AND RISK OF THE HOLDER. INSTEAD OF DELIVERY BY

MAIL, IT IS RECOMMENDED THAT HOLDERS USE AN OVERNIGHT, HAND DELIVERY SERVICE, OR ELECTRONIC DELIVERY AND THE DELIVERY WILL BE DEEMED

MADE ONLY WHEN ACTUALLY RECEIVED OR CONFIRMED BY THE COMPANY. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ASSURE DELIVERY TO THE

COMPANY BEFORE THE EXPIRATION DATE.

| C. | Determination

of Validity; Rejection of Warrants; Waiver of Defects; No Obligation to Give Notice of Defects |

We

will determine, in our discretion, all questions as to form, validity, including time of receipt, eligibility and acceptance of any tender

of Warrants or withdrawal of tendered Warrants. Our determination of these matters will be final and binding on all parties. We may reject

any or all tenders of or withdrawals of tendered Warrants that we determine are not in appropriate form or that we determine are unlawful

to accept or not timely made. Otherwise, we expect to accept all properly and timely tendered Warrants which are not validly withdrawn.

We may waive, as to all eligible Warrant holders, any defect or irregularity in any tender with respect to any particular Warrant. Any

waiver granted as to one Warrant holder will be afforded to all holders of Warrants. We may also waive any of the conditions of the Offer

in our reasonable discretion, so long as such waiver is made with respect to all Warrant holders. No tender of Warrants or withdrawal

of tendered Warrants will be deemed to have been properly made until all defects or irregularities have been cured by the tendering Warrant

holder or waived by us. NEITHER WE NOR ANY OTHER PERSON IS OBLIGATED TO GIVE NOTICE OF ANY DEFECTS OR IRREGULARITIES IN TENDERS OR

WITHDRAWALS, AND NO ONE WILL BE LIABLE FOR FAILING TO GIVE NOTICE OF ANY DEFECTS OR IRREGULARITIES.

| D. | Acceptance

of Warrants; Issuance of Common Stock |

The

Offer is scheduled to expire at 5:00 P.M., Eastern Time, on the Expiration Date, September 19, 2023, (subject to our right to extend

the Offer). Upon the terms and subject to the conditions of the Offer, we expect, upon the expiration of the Offer, to:

| ● | accept

for exchange Warrants properly tendered and not validly withdrawn pursuant to the Offer;

and |

| ● | issue

Common Stock in exchange for tendered Warrants pursuant to the Offer, rounding the number

of shares to which such holder is entitled, after aggregating all fractions, up to the next

whole number of shares. |

If

you elect to tender your Warrants pursuant to the Offer and you do so according to the procedures described herein, you will have accepted

the Offer. Our acceptance of your outstanding Warrants for tender in the Offer will form a binding agreement between you and us upon

the terms and subject to the conditions of the Offer upon the expiration of the Offer. A tender of Warrants made pursuant to any method

of delivery set forth herein will also constitute an acknowledgement by the tendering Warrant holder that regardless of any action that

we take with respect to any applicable tax related to the Offer and the disposition of Warrants, such Warrant holder acknowledges that

the ultimate liability for all tax is and remains his, her or its sole responsibility. In that regard, a tender of Warrants authorizes

us to withhold such Shares of Common Stock as may be necessary to cover any applicable tax payable by a tendering Warrant holder.

If

you elect not to participate in the Offer, your Warrants will remain outstanding until they expire or are exercised by their original

terms.

Our

Common Stock is considered a “penny stock”, and subject to the requirements of Rule 15g-9, promulgated under the Exchange

Act of 1934, as amended. “Penny stock” is generally defined as any equity security not traded on an exchange or quoted on

NASDAQ that has a market price of less than $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons

other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that

they make an individualized written suitability determination for the purchaser and receive the purchaser’s consent prior to the

transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection

with any trades involving a stock defined as a penny stock.

The

required penny stock disclosures include the required delivery, prior to any transaction, of a disclosure schedule explaining the penny

stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the

ability of purchasers to sell their securities in the secondary market. In addition, various state securities laws impose restrictions

on transferring “penny stocks” and as a result, investors in the common stock may have their ability to sell their shares

of the common stock impaired.

If

you tender Warrants pursuant to the Offer, you will receive legended Shares and you will generally be entitled to “tack”

your holding period of the Warrants so tendered for purposes of Rule 144 under the Securities Act.

| E. | Extension

of the Offer; Termination; Amendment |

Although

we do not currently intend to do so, we may, from time to time, at our discretion, extend the Offer at any time as provided above. If

we extend the Offer, we will continue to accept validly tendered Warrants until the new Expiration Date.

We

also expressly reserve the right, in our reasonable judgment, prior to the Expiration Date, to terminate or amend the Offer and to postpone

our acceptance of any tendered Warrant upon the occurrence of any of the conditions specified below under “The Offer—Conditions

to the Offer.”

Extension

or amendments to, or a termination of, the Offer may be made at any time and from time to time by an announcement. In the case of an

extension, the announcement must be issued no later than 9:00 A.M., Eastern Time, on the next business day after the last previously

scheduled or announced Expiration Date. Any announcement made pursuant to the Offer will be disseminated promptly to holders of Warrants

in a manner reasonably designed to inform such holders of such amendment. Without limiting the manner in which we may choose to make

an announcement, except as required by applicable law, we have no obligation to publish, advertise or otherwise communicate any such

announcement other than by issuing a press release.

If

we materially change the terms of the Offer or the information concerning the Offer, or if we waive a material condition of the Offer,

we will extend the Offer to the extent required by Rules 13e-4(d)(2), 13e-4(e)(3), and 13e-4(f)(1)(ii) under the Exchange Act. These

rules require that the minimum period during which an offer must remain open following material changes in the terms of the Offer or

information concerning the offer, other than a change in price or a change in percentage of securities sought, will depend on the facts

and circumstances, including the relative materiality of such terms or information.

| F. | Conditions

of the Offer |

The

Offer is subject to the following conditions: no action or event shall have occurred, no action shall have been taken, and no statute,

rule, regulation, judgment, order, stay, decree or injunction shall have been promulgated, enacted, entered or enforced applicable to

the Offer or the exchange of Warrants for Shares under the Offer by or before any court or governmental regulatory or administrative

agency, authority or tribunal of competent jurisdiction, including, without limitation, taxing authorities, that challenges the making

of the Offer or the exchange of Warrants for Shares under the Offer or would reasonably be expected to, directly or indirectly, prohibit,

prevent, restrict or delay consummation of, or would reasonably be expected to otherwise adversely affect in any material manner, the

Offer or the exchange of Warrants for Shares under the Offer.

The

Offer is also subject the condition that all of the Warrants must be tendered for exchange; however, the Company may waive this condition

in its reasonable discretion if all Warrants are not tendered by the Expiration Date.

We

may terminate the Offer if the Conditions of the Offer are not satisfied prior to the Expiration Date. In the event that we terminate

the Offer, all Warrants tendered by a Warrant holder in connection with the Offer shall be returned to such Warrant holder and the Warrants

will expire in accordance with their terms on their respective expiration dates and will otherwise remain subject to their original terms.

| 3. | BACKGROUND

AND PURPOSE OF THE OFFER |

| A. | Information

Concerning SideChannel, Inc. |

SideChannel’s

mission is to make cybersecurity simple and accessible for mid-market and emerging companies, a market we believe is currently underserved.

Our cybersecurity offerings identify and develop cybersecurity, privacy, and risk management solutions for our customers. We target customers

that need cost-effective security solutions. Our growth plan to address the needs of our customers is to provide more effective and cost-efficient

products and tech-enabled services cybersecurity and related including virtual Chief Information Security Officer (“vCISO”),

zero trust, third-party risk management, due diligence, privacy, threat intelligence, and managed end-point security solutions.

Our

growth strategy focuses on these three initiatives: (i) securing new vCISO clients; (ii) adding new Cyber Security Software and Services

(“Cyber Security Software” and “Services”); and (iii) increasing adoption of Cybersecurity Software,

including our new product we are developing known as Enclave.

Our

principal executive offices are located at 146 Main Street, Suite 405, Worcester, MA 01608. Our telephone number is: (508) 925-0114.

| B. | Establishment

of Offer Terms; Approval of the Offer |

The

Company’s Board of Directors has approved the terms of the Offer, including the Paulson Exchange Ratio and the Investor Exchange

Ratio, but are not recommending whether you should or should not tender your Warrants, nor passing upon the fairness of the Paulson Exchange

Ratio or the Investor Exchange Ratio. The Board set the Paulson Exchange Ratio and the Investor Exchange Ratio to provide the holders

of the Warrants with an incentive to exchange the Warrants.

SideChannel

is pursuing growth through organic initiatives and acquisition opportunities. Further, the company is considering an uplist on a national

stock exchange. Successfully executing one or more of these objectives may require the issuance of equity. The warrants issued in the

2021 Private Placement contain anti-dilution clauses that impede the company’s ability to effectively engage the capital markets

in support of these objectives. As such, the company believes the warrants are inhibiting its ability to grow and create value.

Secondarily,

the purpose of the Offer is to increase the public float in the market and reduce the number of Shares that would become outstanding

upon the exercise of Warrants.

The

Offer is being made to all holders of certain classes of Warrants, as more particularly described above.

Since

the current exercise price of the Warrants is significantly higher than the market price of the Shares and the Warrants may expire on

their respective expiration dates “out-of-the-money” according to their terms, the Company’s Board of Directors established

the condition that all of the Warrant holders must tender their Warrants. Holders who tender Warrants will receive Shares with a legend

and holders will generally be entitled to “tack” their holding period for purposes of Rule 144. Therefore, the Board of Directors

expects the number of freely tradable shares will significantly increase as a result of the completion of this Offer.

In

addition, the Company’s Board of Directors believes that by allowing holders of Warrants to exchange their Warrants for Shares

of Common Stock according to the Paulson Exchange Ratio and/or the Investor Exchange Ratio, the Company can potentially reduce the substantial

number of Shares that would be issuable upon exercise of the Warrants, thus providing investors and potential investors with greater

certainty as to the Company’s capital structure.

The

Offer is not made pursuant to a plan to periodically increase a securityholder’s proportionate interest in the assets or earnings

and profits of the Company. The Warrants acquired pursuant to the exchange will be retired and cancelled.

| D. | Interests

of Directors and Officers |

The

names of the executive officers and directors of the Company are set forth below. The business address for each such person is: SideChannel,

Inc., 146 Main Street, Suite 405, Worcester, MA 01608, and the telephone number for each such person is (508) 925-0114.

| Name |

|

Position |

| Anthony

Ambrose |

|

Director |

| Brian

Haugli |

|

Chief

Executive Officer, Director |

| Deborah

MacConnel |

|

Director,

Chairwoman |

| Kevin

Powers |

|

Director |

| Hugh

Regan, Jr. |

|

Director |

| Ryan

Polk |

|

Chief

Financial Officer |

None

of the Directors or Executive Officers possess SideChannel warrants.

Except

as set forth below, there are no present plans or proposals by the Company that relate to or would result in: (a) an extraordinary corporate

transaction, such as a merger, reorganization or liquidation involving the Company or any of its subsidiaries; (b) a purchase, sale or

transfer of a material amount of assets of the Company or any of its subsidiaries; (c) any change in the present Board of Directors or

management of the Company including, but not limited to, any plans or proposals to change the number or the term of directors, to fill

any existing vacancy on the Board or to change any material term of the employment contract of any executive officer; (d) any material

change in the present dividend rate or policy, or indebtedness or capitalization of the Company; (e) any other material change in the

Company’s corporate structure or business; (f) changes in the Company’s Articles of Incorporation or instruments corresponding

thereto or other actions which may impede the acquisition of control of the Company by any person; (g) a class of equity security of

the Company becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (h) the suspension