Operational Update

May 12 2008 - 2:00AM

UK Regulatory

RNS Number : 1019U

Hambledon Mining PLC

11 May 2008

HAMBLEDON MINING PLC

(AIM: HMB)

Sekisovskoye Exports First Gold

Operational Update

Hambledon Mining plc ("Hambledon" or the "Group" or the "Company"), the

AIM-listed gold mining and processing company operating in Kazakhstan, is

pleased to report its first export of gold from Sekisovskoye and the positive

results of the study into the underground resource.

Highlights:

Sekisovskoye

·32.3 kilogrammes of dore, containing 8.2 kilogrammes of gold, has been

exported and sold

·All aspects of the processing plant operating well

·Study confirms economic viability of underground mining

·Combined annual output (open pit and underground) of around 100,000

ounces per year expected

·Underground mining potential of 2.9 million tonnes at 4.70 g/t (433,000

ounces) based on all resource categories

Ognevka

·Production initially disappointing but outlook positive

Sekisovskoye processing operations

Some 32 kilogrammes of dore, containing 8.2 kilogrammes of gold, have been

poured at Sekisovskoye since the start of operations and these have been

exported to Metallor's refinery in Switzerland and sold.

The plant has been operating well since the restart of processing in April.

Production has been limited by the impact of very wet weather on the clay-like

material, however, for the last few days, weather conditions have been excellent

and the ore has dried out. This problem is not expected to recur once the

clay-containing near-surface ore has been mined and processed. The mills have

now been tested at full capacity and are requiring lower power than expected,

indicating that they are comfortably capable of operating at the planned level.

They are currently being operated at 80% of capacity but will be turned up to

full power as the remaining parts of the plant are fully tested.

All other parts of the plant have been operating normally and metallurgical

recoveries are in the region of 85% - 90%, as expected. Upon the achievement of

steady-state operations, the Falcon concentrator and associated regrind mill

will be started, whereupon recovery can be expected to rise to the planned 92%.

Sekisovskoye underground study and reserve

The Company has completed a preliminary study into the feasibility of

underground mining, using the resource model compiled by the Company's

independent geological consultants, design and costing input from AMC

Consultants and other internally generated inputs.

The underground Resource is made up of over 200 distinct mineralised zones

containing 4.5 million tonnes @ 5.1 g/t. For the purposes of the study, it was

decided to focus on the largest 34 zones only, which contain 74% of the ore

tonnes and 76% of the gold content. The remaining smaller zones will be

incorporated into future mine plans when more detailed mine planning is

undertaken.

AMC developed a mine design system utilizing a twin decline system to access the

western and central mineralized zones. These two zones are approximately 200m

apart and the declines are connected at 100m vertical intervals for operational

simplicity. The geo-technical study showed that it is possible to utilize a mass

mining technique and sub-level open stoping was chosen with stopes subsequently

backfilled to provide long term stability. These methods should allow for an

annual mining tonnage of up to 500,000 tonnes of ore during the peak years of

mining.

Although a detailed mining reserve has not yet been formalised, from the 34

ore-bodies within both Indicated and Inferred categories of resource, an

estimated total of 2.9 million tonnes could be mined at a diluted grade of 4.7

grammes per tonne, for a total of 433,371 contained ounces of gold (plus

additional silver which was not included in the study).

The cost analysis carried out as a part of the study determined that total Mine

Operating Cost (total cost of mining, processing and administration) will be

some $64 per tonne of ore, though this is only partially based on the lower

costs of operating in Kazakhstan compared with Australia. The total cash

investment, including working capital, necessary to get the underground mine

into production, would be $22m, though the Company is working on a development

schedule that will proceed in stages to suit the approvals system operating in

Kazakhstan and will use more local, FSU and Chinese equipment. The likely

up-front investment, including working capital, will be just $3.0 million, which

will be financed by local borrowing and internally generated profits.

At its maximum output of some 500,000 tonnes per year, some 70,000 ounces per

annum of gold could be recovered from the underground mine in addition to any

further tonnages from the existing open pit. If the well established indications

in the open-pit zones of a grade increase of some 20% (compared with Soviet era

exploration) continue underground, this can be expected to increase to some

84,000 ounces per year, giving a total of over 100,000 ounces per year when feed

from the existing open pit is limited to the amount required to fill the mill

capacity of 850,000 tonnes per year. In practice, means of de-bottlenecking the

process plant will be investigated and provision has already been made within

the mill building for an additional leach tank. Production from the open pit may

therefore be maintained at a higher rate and combined production may be higher.

Initial planning work has commenced to produce the documentation required to

obtain approval from the Kazakhstan Government to start the development.

Ognevka

Metallurgical recoveries and resulting concentrate grades from the treatment of

clinkers at Ognevka have been poor, and only limited output of saleable material

has been produced. This was initially attributed to over-activity of the

magnetiser and the already fine-ground physical properties of the clinkers.

However, the results of initial modifications to correct these defects were

disappointing. Further testwork has since been carried out to see why the

initial testwork results are not being replicated and this has lead to further

modifications, involving a further gravity-table separation of the carbon using

the existing shaking tables. These modifications have now been installed and are

being commissioned, though it will take some time before commissioning will be

completed and the results known.

However, improved commercial terms have been provisionally agreed with a Russian

smelter which will have the effect of allowing shipment of lower grade

concentrates. This will both make it easier for Ognevka to meet the required

specification, and enable a higher metallurgical recovery of copper, gold and

silver to be achieved. The sales prices for the main components of the

concentrate are likely to be slightly better than those previously expected.

Negotiations have started with the government owned, special-purpose

organisation for the holding and exploitation of sub-surface rights known as

SPK. The SPK has the power to take the rights to additional government-owned

clinkers with a view to creating a joint venture with the Company that will mine

such clinkers and supply them as raw-material to TOO Ognevka.

TOO Ognevka has obtained the documents proving ownership of some 1.65 million

tonnes of pegmatite tailings from previous operations, containing good grades of

lithium, niobium, tantalum and other high value metals. These tailings have been

surveyed and assayed, and bulk samples sent to a process testing facility in

Ukraine. Customs and other factors have delayed the start of this testwork and

the Company is considering other process testing options. Until such testwork

has been carried out, it is not possible to be certain of economic

recoverability and the Company has therefore decided not to place this resource

on its statement of estimated resources. The Company's pegmatite tailings lie

above much larger quantities of older government-owned tailings that the Company

will seek to obtain rights to if the testwork proves successful. An existing but

shut-down pegmatite mine lies underneath the Ognevka factory, and the Company

may also apply for the rights to this.

In the event that the testwork shows the pegmatite operation to be feasible, the

decision will then be made whether to convert the process plant back into

pegmatite treatment or to create a second product line, for which there is

already adequate space within the factory building.

Nick Bridgen, Chief Executive of Hambledon, said:

"Sekisovskoye is operational and is going very well and we've made our first

gold sales. The underground study looks good and we'll start on the first stage

as soon as we get the required permits.

"The initial production levels at Ognevka are disappointing but steps have been

put in place to upgrade the performance and we've secured a better sales

contract.

"The next two big events for Hambledon to look forward to are the start of

underground development and the proving up of the pegmatite resource at

Ognevka."

12 May 2008

Enquiries

Hambledon Mining plc Telephone: +44 7791 327 180

Nick Bridgen

Bankside Consultants Telephone: +44 20 7367 8888

Michael Padley / Louise Davis

Seymour Pierce Telephone: +44 20 7107 8000

Nicola Marrin

Note to editors

Hambledon Mining plc is an AIM-listed gold mining and exploration company, which

is operating the Sekisovskoye gold mine and the Ognevka processing plant, both

of which are close to Ust Kamenogorsk in East Kazakhstan.

At Sekisovskoye, the Company is mining from an open pit and has constructed an

850,000 tonnes per year treatment plant. Production from the open pit will

average over 40,000 ounces per annum. As soon as steady production has been

achieved, the Company plans to develop the much larger underground resource that

is expected to lead to a combined production rate of around 100,000 ounces per

year.

The Ognevka processing plant is producing concentrates containing gold, silver,

copper, iron and coke from the re-treatment of zinc smelter residues.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUUUCCAUPRGGB

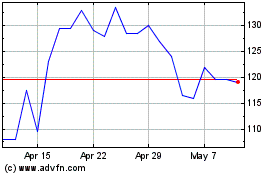

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jul 2023 to Jul 2024