Tritax Big Box REIT plc FINANCING OF ASSET PRE-LET TO OCADO (9726S)

July 14 2015 - 3:56AM

UK Regulatory

TIDMBBOX

RNS Number : 9726S

Tritax Big Box REIT plc

14 July 2015

14 July 2015

TRITAX BIG BOX REIT PLC

(the "Company")

FINANCING OF ASSET PRE-LET TO OCADO

Further to the announcement on 29 January 2015 that the Company

had exchanged contracts to forward fund the investment of a new

distribution warehouse facility located inside the M25 at Crossdox,

Bronze Age Way, Erith, pre-let in its entirety to a subsidiary of

Ocado Group Plc, the Board of Tritax Big Box REIT plc (ticker:

BBOX) is pleased to announce that the Company has agreed senior

debt financing secured on the asset. This facility has been agreed

with Landesbank Hessen-Thüringen Girozentrale ("Helaba") to the

value of GBP50.866 million, reflecting a loan to value ratio of

approximately 50%.

The facility has a five year term with an option to extend this

to a maximum of six years exercisable before the second anniversary

of the facility, subject to lender consent. To efficiently match

the terms of the forward funding contract, the facility has been

structured to provide a twelve month loan to facilitate the

construction period which will automatically convert into an

investment loan for the remainder of the term at the point of

practical completion of the building, targeted for the summer of

2016.

Including this loan, the blended margin payable across the

Company's financings post practical completion will be

approximately 1.70% above three month LIBOR.

For further information, please contact:

Tritax Group via Newgate (below)

Colin Godfrey (Partner, Fund

Manager)

Newgate (PR Adviser) Tel: 020 7680 6550

James Benjamin Email: tritax@newgatecomms.com

Alexandra Shilov

Andre Hamlyn

Jefferies International Limited Tel: 020 7029 8000

Gary Gould

Stuart Klein

Alex Collins

Akur Limited Tel: 020 7493 3631

Anthony Richardson

Tom Frost

Siobhan Sergeant

NOTES:

Tritax Big Box REIT plc is a real estate investment trust to

which Part 12 of the UK Corporation Tax Act 2010 applies ("REIT").

The Company invests in and asset manages a portfolio of

well-located, modern "Big Box" assets, typically targeting

buildings greater than 500,000 sq. ft., let to institutional-grade

tenants on long-term leases (typically between 12 and 25 years in

length) with upward-only rent reviews (providing the potential for

inflation linked earnings growth), and with geographic and tenant

diversification throughout the UK. The Company seeks to exploit the

significant opportunity in this sub-sector of the UK logistics

market owing to strong tenant demand in high growth areas of the

economy and limited stock supply. The Company is the first listed

vehicle to give pure exposure to the "Big Box" asset class in the

UK.

Further information on Tritax Big Box REIT is available at

www.tritaxbigbox.co.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLIFETDEISLIE

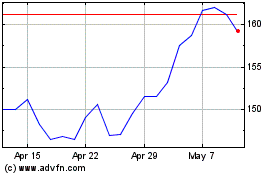

Tritax Big Box Reit (LSE:BBOX)

Historical Stock Chart

From Apr 2024 to May 2024

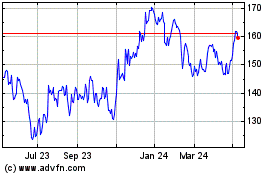

Tritax Big Box Reit (LSE:BBOX)

Historical Stock Chart

From May 2023 to May 2024