VAALCO Energy, Inc. Enters Into New $300 Million Revolving Credit Facility

March 05 2025 - 1:00AM

VAALCO Energy, Inc. (NYSE: EGY; LSE: EGY) (“Vaalco” or the

“Company”) announced that it has entered into a new revolving

credit facility (“the new facility”) with an initial commitment of

$190 million and the ability to grow to $300 million, led by The

Standard Bank of South Africa Limited, Isle of Man Branch with

other participating banks and financial partners. This new

facility, which is subject to customary administrative conditional

precedents, replaces the Company’s existing undrawn revolving

credit facility that was provided by Glencore Energy UK Ltd. The

Company arranged the new facility primarily to provide short-term

funding that may be needed from time-to-time to supplement its

internally generated cash flow and cash balance as it executes its

planned investment programs across its diversified asset base over

the next few years.

Key terms include:

- Six-year term with

facility amortization to begin on September 30, 2026;

- Initial commitment of $190 million

with the ability to grow to $300 million through a $110 million

accordion;

- Amounts drawn bear interest of 6.5%

plus SOFR until the Côte d’Ivoire Floating Production Storage and

Offloading vessel ("FPSO") Dry Dock Refurbishment Project is

completed;

- Interest rate will decrease to 6.0%

plus SOFR once the FPSO project is completed;

- Undrawn available amounts incur a fee of 35% of margin per

annum and undrawn unavailable amounts incur a fee of 20% of margin

per annum, with semi-annual borrowing base redeterminations;

and

- Secured with

Vaalco’s Gabon, Egypt and Côte d’Ivoire assets.

“Closing this new credit facility will

supplement our internally generated cash flow and cash balance to

assist in funding our robust organic growth projects,” said George

Maxwell, Vaalco’s Chief Executive Officer. “With $190 million in

initial commitment and the ability to grow to $300 million, this

facility enables us to fund any short-term capital funding needs

that may occur as we execute the significant growth projects across

our assets over the next couple of years. We appreciate the support

shown by our lending group which we believe affirms the strength of

our diverse asset base. We are excited about the major projects

that we have planned which are expected to deliver a step-change in

organic growth across our portfolio.”

The Company entered into the new facility with

The Standard Bank of South Africa Limited, Isle of Man Branch as

the lead bank on the facility. Other participants include Rand

Merchant Bank, The Mauritius Commercial Bank Limited and Glencore

Energy UK Ltd.

About VaalcoVaalco, founded in

1985 and incorporated under the laws of Delaware, is a Houston,

Texas, USA based, independent energy company with a diverse

portfolio of production, development and exploration assets across

Gabon, Egypt, Côte d’Ivoire, Equatorial Guinea, Nigeria and

Canada.

For Further Information

|

|

|

|

Vaalco Energy, Inc. (General and Investor

Enquiries) |

+00 1 713 543 3422 |

|

Website: |

www.vaalco.com |

|

|

|

|

Al Petrie Advisors (US Investor Relations) |

+00 1 713 543 3422 |

|

Al Petrie / Chris Delange |

|

|

|

|

|

Buchanan (UK Financial PR) |

+44 (0) 207 466 5000 |

|

Ben Romney / Barry Archer |

Vaalco@buchanan.uk.com |

|

|

|

Forward Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”) and Section 21E of the Securities Exchange

Act of 1934, as amended, which are intended to be covered by the

safe harbors created by those laws and other applicable laws and

may also include “forward-looking information” within the meaning

of applicable Canadian securities law (collectively

"forward-looking statements"). Where a forward-looking statement

expresses or implies an expectation or belief as to future events

or results, such expectation or belief is expressed in good faith

and believed to have a reasonable basis. All statements other than

statements of historical fact may be forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,”

“may,” “likely,” “plan” and “probably” or similar words may

identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements in this press release may include, but

are not limited to, statements relating to (i) estimates of future

drilling, production, sales and costs of acquiring crude oil,

natural gas and natural gas liquids; (ii) expectations regarding

Vaalco's ability to effectively integrate assets and properties it

has acquired as a result of the Svenska acquisition into its

operations; (iii) expectations regarding future exploration and the

development, growth and potential of Vaalco’s operations, project

pipeline and investments, and schedule and anticipated benefits to

be derived therefrom; (iv) expectations regarding future

acquisitions, investments or divestitures; (v) expectations of

future dividends; (vi) expectations of future balance sheet

strength; and (vii) expectations of future equity and enterprise

value.

Such forward-looking statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements. These risks

and uncertainties include, but are not limited to: risks relating

to any unforeseen liabilities of Vaalco; the ability to generate

cash flows that, along with cash on hand, will be sufficient to

support operations and cash requirements; risks relating to the

timing and costs of completion for scheduled maintenance of the

FPSO servicing the Baobab field; and the risks described under the

caption “Risk Factors” in Vaalco’s 2023 Annual Report on Form 10-K

filed with the SEC on March 15, 2024 and subsequent Quarterly

Reports on Form 10-Q filed with the SEC.

Inside InformationThis

announcement contains inside information as defined in Regulation

(EU) No. 596/2014 on market abuse which is part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 (“MAR”) and

is made in accordance with the Company’s obligations under article

17 of MAR. The person responsible for arranging the release of this

announcement on behalf of Vaalco is Matthew Powers, Corporate

Secretary of Vaalco.

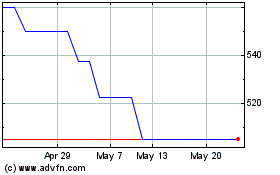

Vaalco Energy (LSE:EGY)

Historical Stock Chart

From Feb 2025 to Mar 2025

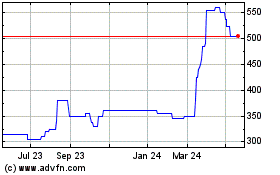

Vaalco Energy (LSE:EGY)

Historical Stock Chart

From Mar 2024 to Mar 2025