Experian Champions Financial Freedom in the Hispanic Community with Debt Relief Initiative

October 18 2024 - 4:57PM

Business Wire

As part of a $10 million debt relief

initiative, Experian Joins Forces with NBCUniversal Telemundo

Enterprises to empower Hispanics across the nation

Effort includes a special collaboration with

Latin Music Superstar Prince Royce

To bring attention to the need to increase financial literacy

and empowerment among Hispanics, Experian is relieving $10 million

in consumer debt to help Hispanics nationwide on the road to

financial freedom. Additionally, Experian is partnering with

NBCUniversal Telemundo at the 2024 Billboard Latin Music Awards to

further promote the debt relief initiative and empower the Hispanic

community. This partnership includes a collaboration with

multi-platinum, award-winning singer and songwriter, Prince

Royce.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241018272269/en/

Latin superstar Prince Royce (Photo:

Business Wire)

During the awards, Latin superstar Prince Royce will spotlight

the initiative and discuss the importance of creative and financial

freedom for the Latino community. Plus, Prince Royce is nominated

for three 2024 Billboard Latin Music Awards including Tropical

Artist of the Year, Tropical Song of the Year, and Tropical Album

of the Year.

As part of Experian’s mission to bring Financial Power to All™,

Experian is helping more than 5,000 Hispanics across the country by

relieving a debt and providing Experian resources to empower and

help them achieve financial health.

Recipients of the debt relief initiative will also receive a

free premium Experian membership for one year, which provides

access to their Experian credit report in both English and

Spanishi, their FICO® Scoreii, bilingual educational content, and

other financial resources that could save members time and money,

including:

- Experian Boost®iii: This is a feature that allows people

to contribute positive payment history for eligible bills such as

rent and utilities directly to their Experian credit file, which

can potentially increase their FICO® Scoreiv.

- Experian Go: For those with limited or no credit

history, this program allows people to enter the credit system by

directly creating an Experian credit report and populating it with

payment history.

- Insurance Marketplace: Consumers can comparison shop for

auto, home, and renter’s insurance to potentially find better

rates. Switching policies with Experian could save consumers more

than $1,100v on an auto and home insurance policy bundle, or more

than $800vi on an automotive insurance policy alone.

- Subscription Cancellationvii: Experian can take the pain

out of canceling unwanted subscriptions by handling the process for

consumers, potentially putting money back in their pocket.

“We’re thrilled to team up with Prince Royce to champion

financial literacy and be a part of a relevant event that

celebrates talented Hispanic artists,” said Dacy Yee, Chief

Marketing Officer for Experian Consumer Services. “Our top priority

is empowering all communities with impactful support and valuable

financial information to help them achieve financial freedom. We

hope that this initiative shows that there are resources available

to help everyone take control of their financial futures with

Experian as their financial co-pilot.”

For more information about the 2024 Billboard Latin Music

Awards, visit Telemundo.com/PremiosBillboard. Follow the coverage

on social media and join the excitement of the biggest night in

Latin music and Experian’s initiatives with

#financialpoweratodos and #Billboards2024:

Experian:

- Facebook: @experian

- X: @experian_us

- Instagram: @experian

- TikTok: @experian_us

Billboard Latin Music Awards:

- Facebook: @PremiosBillboard

- X: @LatinBillboards

- Instagram: @LatinBillboards

- YouTube: @TLMDentretenimiento

- TikTok: @Telemundo

- WhatsApp: @TLMDentretenimiento

Access Experian’s resources in Spanish

For tips on how to manage debt, read our blog post here.

Experian offers a credit e-book and consumers can access a full

suite of articles at the Ask Experian blog here.

For more information about the debt relief program and to enroll

in a free Experian membership, go to www.experian.com/gratis.

Experian delivers Financial Power to All™ by helping consumers

achieve their financial goals through establishing and building

good credit, providing access to personalized financial products,

aiding in taking control of bills and debt, protecting them from

identity theft and fraud, and saving them time and money at every

stage of their financial journey.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

i Only Experian credit reports are available in Spanish. All

other services associated with an Experian membership are available

in English only. English fluency is required for full access to

Experian’s products. ii Credit score calculated based on FICO Score

8 model. Your lender or insurer may use a different FICO® Score

than FICO® Score 8, or another type of credit score altogether.

Learn more. iii Results will vary. Not all payments are

boost-eligible. Some users may not receive an improved score or

approval odds. Not all lenders use Experian credit files, and not

all lenders use scores impacted by Experian Boost®. Learn more. iv

Credit score calculated based on FICO Score 8 model. Your lender or

insurer may use a different FICO® Score than FICO® Score 8, or

another type of credit score altogether. Learn more. v Results will

vary and some may not see savings. Average savings of $1,137 per

year for customers who switched multiple policies and saved with

Experian from Jan. 1, 2022 to Mar. 31, 2024. Savings based on

customers’ self-reported prior premium. vi Results will vary and

some may not see savings. Average savings of $828 per year for

customers who switched and saved with Experian from Jan. 1, 2022 to

Mar. 31, 2024. Savings based on customers’ self-reported prior

premium. Experian offers insurance from a network of top-rated

insurance companies through its licensed subsidiary, Gabi Personal

Insurance Agency, Inc. vii Results will vary. Not all subscriptions

are eligible for cancellation, savings are not guaranteed, and some

may not see any savings. Available with eligible paid memberships

and requires connecting payment account(s) to Experian account.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241018272269/en/

Sandra Bernardo 949 529 7550 Sandra.Bernardo@experian.com

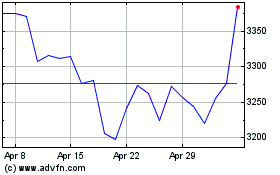

Experian (LSE:EXPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Nov 2023 to Nov 2024