Experian Launches New GenAI Solution to Greatly Accelerate the Modeling Lifecycle

October 28 2024 - 8:00AM

Business Wire

Improves data scientist productivity and model

monitoring, empowers data analysts to easily query data and write

code

At this week’s Money 20/20 show in Las Vegas, Experian® today

announced the launch of Experian Assistant, a new generative

AI-enabled solution that greatly accelerates the modeling

lifecycle, slashing model-development timelines from months to days

and — in some cases — hours. Integrated with Experian Ascend

Technology Platform™, this transformative solution empowers users

to further leverage their data for analytics faster and with less

effort than ever before.

The world’s largest financial institutions use Experian Ascend™.

In close collaboration with several customers, Experian Assistant

was developed to offer a deeper understanding of credit and fraud

data and provide criteria and proposals for adding; changing the

weight of; or deleting specific attributes, data, or features to

optimize analytical models. In addition, this innovative solution

helped increase internal team productivity and has resulted in

proven cost savings, improved data visibility and faster product

deployment times.

“With Experian Assistant, there is a lot of efficiency and

improvement in productivity,” said Victor Rwenhumbiza, EVP — Chief

Data Scientist at Continental Finance Company, LLC. “We have

reduced the time spent on data building by almost 75%, so we can

build a model much quicker, and the code being generated by

Experian Assistant is very high quality, enabling us to move

forward much faster.”

With Experian’s Ascend Analytical Sandbox™, Experian Assistant

enables businesses across all sectors to perform data exploration,

build and deploy models, monitor their performance, and increase

speed to market to launch new offerings. The solution increases

productivity for data scientists, helping them work far more

efficiently and faster, and accessibility for data analysts,

allowing them to query data and write code through natural language

conversation.

“Using natural language processing to help with complex use

cases, Experian Assistant radically changes the workflow of data

scientists and data analysts alike, enabling our customers to

garner insights and make business decisions with less staff time

invested and with faster turnaround,” said Scott Brown, Group

President Financial and Marketing Services, Experian North America.

“We are providing a tool that empowers our customers to reimagine

how they engage with their data to do anything they want: enhance

the consumer experience, rapidly test and deploy new offerings,

improve internal productivity, spark collaboration across business

functions, and so much more.”

Why it matters

Experian’s research shows it takes 15 months on average to build

and deploy a model into production.

- Accelerating modeling processes helps avoid delays and

maximizes productivity of scarce, highly trained and critical

internal expertise.

- Improved ease of access to high-quality data accelerates time

to actionable insights and strengthens the capability to build

effective models.

- Efficient resource use and without the need for constant expert

intervention lowers expenses.

- Evolving regulations require transparency and reliability as

modeling technique complexity increases.

- Competition for analytics talent is at an all-time high;

Experian Assistant will help a company’s current data scientists

and analysts work more productively.

Experian’s integrated solution

What to expect from this innovative solution:

- Supports a natural language interface: interactions in a

conversational manner to better understand the data and how to

maximize its use

- Provides fast expert recommendations, coding and technical

support: accelerated tactical insight generation, model

development and deployment

- Provides deep insights into underlining data tables and

metrics: advanced capabilities support quality insights around

Experian datasets, with an emphasis on credit data and transparent

models

- Reduces operational and cloud expenses: minimizes

modeling iterations and compute power by selecting optimal modeling

features

- Empowers users of all experience levels: leverages

Experian Ascend Technology Platform and analytics tools with coding

assistance, recommendations and deployment support

- Reduced risk of penalties: enhanced regulatory

compliance through insights into reporting, identity management,

risk assessment and transaction monitoring

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

Experian and the Experian marks used herein are trademarks or

registered trademarks of Experian and its affiliates. Other product

and company names mentioned herein are the property of their

respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028997991/en/

Michael Troncale Experian Public Relations +1 714 830 5462

michael.troncale@experian.com

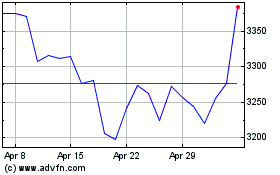

Experian (LSE:EXPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Experian (LSE:EXPN)

Historical Stock Chart

From Nov 2023 to Nov 2024