Experian’s Latest Fraud Forecast Reveals Viral Crimes, Crypto Scams and More Could Threaten Businesses and Consumers in 2025

January 28 2025 - 5:00AM

Business Wire

The annual report urges businesses and

consumers to be vigilant against five fraud risks

Experian® today released its annual Future of Fraud Forecast,

revealing five emerging fraud threats that could challenge

businesses and consumers in 2025. This year’s predictions show that

fraudsters will continue to double down on the digital landscape

and leverage Generative AI (GenAI) to commit sophisticated crimes

at a rapid pace.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250128252311/en/

Experian's 2025 Future of Fraud Forecast

(Graphic: Business Wire)

According to an Experian report, half of consumers surveyed said

they are concerned about conducting activities online, and

companies are most worried about cybercrime (75%) and GenAI fraud

and deep fakes (70%). This underscores the need for robust

protections against these fraud attacks and other schemes. As

fraudsters continue to evolve and leverage advanced technologies,

Experian’s insights aim to help mitigate new risks. This year’s

threats include:

- Crypto highs and lows:

Recent events have led to cryptocurrency like Bitcoin increasing

dramatically in value. Experian forecasts that criminals will be

more motivated to target consumers and crypto providers, leveraging

tried-and-true schemes like investment and romance scams, as well

as fake websites offering cryptocurrency in an attempt to swindle

money from unsuspecting people hoping to ride the wave. Companies

will need to leverage robust fraud prevention measures and provide

educational resources for consumers to safeguard themselves from

these scams.

- Pig butchering scams get

meaty: A fraudster’s endgame is to make off with as much

money as possible, and pig butchering scams are a prime way of

doing so. Criminals will “fatten up” their victims by enticing them

over time to participate in an investment scheme and then disappear

with the money, leaving their victims with significant financial

losses. This requires the fraudster to build a relationship with

the victim and establish trust so they can convince them to hand

over their bacon. While this type of scam already exists, Experian

forecasts that criminals will find ways to produce results faster

and in more convincing ways that will dupe people more easily and

allow them to elude detection for longer.

- Is it a social media challenge or a

crime? Social media has fueled viral products and trends

that are typically great recommendations or life hacks. However,

last year, a form of check fraud went viral that involved people

recording themselves writing bad checks, depositing them at the ATM

and withdrawing cash before the check bounced. Some participants in

this trend may not have been fully aware of the repercussions. In

reality, consumers were committing check fraud by joining the

bandwagon. Experian predicts that social media users could

perpetuate additional trendy financial fraud schemes with the

fraudsters being everyday people instead of savvy criminals.

- Unhealthy password

spraying: With the amount of personally identifiable

information that healthcare companies have on consumers, Experian

forecasts fraudsters will deploy large-scale password spraying

cyberattacks using GenAI-created bots to attack healthcare

companies at scale to gain access to a company’s systems and the

personally identifiable information of employees and patients.

Password spraying, also known as credential stuffing or credential

guessing, is when an attacker applies a list of commonly used

passwords against a list of accounts to guess the right password.

This used to be done by humans but, as technology has become more

sophisticated, so have the fraudsters. These attacks can now be

fueled by GenAI — making the attacks exponentially larger, faster

and harder to detect.

- A new generation of bots up the

ante: Bot attacks are a well-known tactic used to

defraud people and companies by carrying out repetitive

instructions to perform a variety of fraud schemes. A new

generation of bots has emerged, known as Gen4 bots. Typically built

using AI tools and trained to emulate human behavior, these bots

are notoriously more difficult to detect and have the potential to

bypass firewalls and security with ease. Experian predicts that as

Gen4 bot attacks grow, leveraging behavioral analytics will become

table stakes for companies to identify and mitigate this type of

automated fraud.

“We know technology is accelerating fraud at a rapid pace. The

challenge is clear for businesses — it’s not just about mitigating

risk for known threats but anticipating what’s coming next,” said

Kathleen Peters, Chief Innovation Officer for Experian North

America. “Our 2025 forecast highlights the fight against fraud

requires a comprehensive approach — combining advanced technology,

consumer awareness and a commitment to constantly adapting to

evolving threats. Businesses need to invest in innovative,

multilayered fraud prevention strategies that leverage data,

advanced analytics and technology to thwart risk.”

Experian’s identity verification and fraud prevention solutions

helped clients avoid an estimated $15 billion in fraud losses

globally last year. For more about Experian’s fraud detection

solutions available on the Experian Ascend Platform™, including

NeuroID’s behavioral analytics, please visit

https://www.experian.com/business/solutions/fraud-management. To

learn more, please register for Experian’s 2025 Fraud Trends:

Disrupting GenAI in Fraud webinar scheduled for Feb. 6 at 10 a.m.

PT by visiting

https://us-go.experian.com/2025-fraud-predictions-webinar.

About Experian

Experian is a global data and technology company, powering

opportunities for people and businesses around the world. We help

to redefine lending practices, uncover and prevent fraud, simplify

healthcare, deliver digital marketing solutions, and gain deeper

insights into the automotive market, all using our unique

combination of data, analytics and software. We also assist

millions of people to realize their financial goals and help them

to save time and money.

We operate across a range of markets, from financial services to

healthcare, automotive, agrifinance, insurance, and many more

industry segments.

We invest in talented people and new advanced technologies to

unlock the power of data and innovate. As a FTSE 100 Index company

listed on the London Stock Exchange (EXPN), we have a team of

22,500 people across 32 countries. Our corporate headquarters are

in Dublin, Ireland. Learn more at experianplc.com.

Experian and the Experian marks used herein are trademarks or

registered trademarks of Experian and its affiliates. Other product

and company names mentioned herein are the property of their

respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128252311/en/

Annie Russell Experian 1 949 683 5243

annie.russell@experian.com

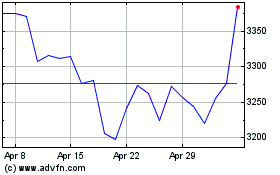

Experian (LSE:EXPN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Experian (LSE:EXPN)

Historical Stock Chart

From Feb 2024 to Feb 2025