Intuitive Investments Group plc Non-Executive Director’s Share Transfer

July 09 2024 - 4:35AM

RNS Regulatory News

RNS Number : 6957V

Intuitive Investments Group plc

09 July 2024

Intuitive Investments Group

plc

9 July 2024

Intuitive Investments Group

plc

("IIG" or the

"Company")

Non-Executive Director's

Share Transfer

Intuitive Investments Group plc

(SFS: IIG), the closed-end investment company focussed on fast

growing and high potential opportunities in the Technology and Life

Sciences sectors, announces that it has received notification from

Malcolm Gillies, Non-Executive Director of IIG, regarding the

transfer of ordinary shares of 10 pence each ("Ordinary Shares") in

the Company.

The Company was notified on 3 July

2024 that Mr Gillies had transferred off market 145,238 ordinary

shares of 10 pence each in the Company to The Carrachan Trust, his

charitable trust, at a price of 140.0 pence per share.

There is no change to Mr Gillies

beneficial interest in the Company which following this

notification remains at 145,238 Ordinary Shares, representing 0.07

per cent. of the Company's issued share capital.

Enquiries:

|

Intuitive Investments Group plc

|

www.iigplc.com

|

|

Sir Nigel Rudd, Non-Executive

Chairman

Robert Naylor, CEO

Giles Willits, CIO

|

Via FTI Consulting

|

|

Cavendish Capital Markets Limited

James King / William Talkington /

Daniel Balabanoff

|

+44 (0) 20

7397 8900

|

|

|

|

|

SP

Angel Corporate Finance LLP - Financial Adviser

|

+44 (0) 20

3470 0470

|

|

Jeff Keating / David Hignell / Kasia

Brzozowska

|

|

|

FTI

Consulting

|

+44 (0) 20

3727 1000

|

|

Jamie Ricketts / Valerija Cymbal /

Jemima Gurney

|

IIG@fticonsulting.com

|

About Intuitive Investments Group plc

IIG is an investment company seeking

to provide investors with exposure to a portfolio concentrating on

fast growing and/or high potential Life Sciences and Technology

businesses operating predominantly in the UK, continental Europe,

the US and APAC, utilising the Board's experience to seek to

generate capital growth over the long term for

shareholders.

About Hui10

Hui10 is a technology company with

interests in two operating businesses, Huishi Dehua and Huishi

Chunyuan ('Lucky World'), involved in the digital transformation of

the Chinese lottery. Huishi Dehua enables the market expansion of

the Chinese lottery through its proprietary technology platform.

Huishi Dehua is integrated into China's national card settlement

system and payment platform, UnionPay. Hui10 holds a 33% share in

Huishi Dehua. Lucky World is an ecommerce platform which provides

China's existing lottery shops access to a wider fast-moving

consumer goods product offering. Hui10 owns 60% of Lucky

World.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DSHRLMLTMTJMMJI

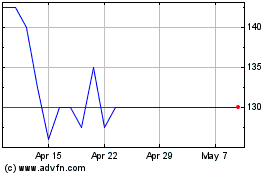

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From Nov 2024 to Dec 2024

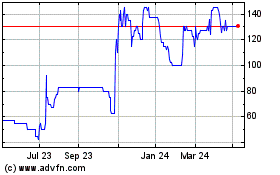

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From Dec 2023 to Dec 2024