PHSC plc Trading Statement

February 01 2013 - 1:00AM

UK Regulatory

TIDMPHSC

1 February 2013

PHSC PLC

Trading Update

PHSC plc ("the Company"), a leading provider of health, safety, hygiene and

environmental consultancy services and security solutions to the public and

private sectors, is pleased to announce an update to the market on its

performance up to the end of the third quarter of its financial year.

Consolidated Group sales and EBITDA (per management accounts, unaudited) for

the nine months ended 31 December 2012 were as below:

Group sales and other income: GBP 3,856,440 (at Q3 2011/12: GBP 3,240,847).

EBITDA: GBP 332,800 after deduction of GBP 30,000 relating to one-off stamp

duty and acquisition legal fees. ( Q3 2011/12: GBP 226,711).

Net assets stood at GBP 5,488,564 (at Q3 2011/12: GBP 5,225,566).

Stephen King, CEO, said: "The benefits arising from our two acquisitions

earlier in the year are beginning to come through. The Group has increased

total revenues by over GBP 600,000 from the levels recorded at this stage in

2011/12, and more importantly has seen an improvement in profits which for the

first nine months stood at GBP 332,800 before depreciation, amortisation of

goodwill and tax. Profits from trading activities, ie before deduction of stamp

duty and legal fees, at around GBP 362,000 are around 60% ahead of where we

were at the end of the third quarter in the previous financial year.

"As explained in my Interim Report statement, our new B to B Links subsidiary

has invested in substantial stock ahead of a large CCTV installation contract.

This work is now in progress. Coupled with payments related to the acquisition

of goodwill and assets of that company, and of QCS International Limited, our

cash reserves were largely utilised by the end of Q3. We have an agreed

facility with our bankers, HSBC, which will be more than sufficient to see us

past this predicted low er than usual cash position. Net proceeds of GBP 71,000

have been received this month from the sale of our vacant property at Raunds

and we had net cash balances of GBP 136,684 in the bank at the close of

business last night.

"The board is encouraged by what has been achieved in the first nine months of

the year. In our last annual report I explained that we were expecting full

year revenues for 2012/13 to be marginally ahead of last year, and for profits

to see a small improvement. We are on track to exceed those expectations.

-Ends-

For further information please contact:

PHSC plc

Stephen King 01622 717700

Stephen.king@phsc.co.uk

www.phsc.plc.uk

Northland Capital Partners Limited

(Nominated Adviser & Broker)

Gavin Burnell / Edward Hutton / Lauren Kettle 020 7796 8800

Alice Lane / John Howes (Broking)

END

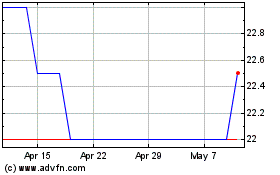

Phsc (LSE:PHSC)

Historical Stock Chart

From Jun 2024 to Jul 2024

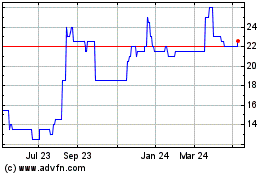

Phsc (LSE:PHSC)

Historical Stock Chart

From Jul 2023 to Jul 2024