TIDMPHSC

16 November 2023

PHSC PLC

("PHSC", the "Company" or the "Group")

Unaudited Interim Results for the six months ended 30 September 2023

PHSC (AIM: PHSC), a leading provider of health, safety, hygiene and

environmental consultancy services and security solutions to the public and

private sectors, is pleased to announce its unaudited interim results for the

six-month period ended 30 September 2023.

GROUP CHIEF EXECUTIVE OFFICER'S STATEMENT

Financial Highlights

· Group revenue of £1.651m (H1 FY23: £1.679m).

· EBITDA of £174k (H1 FY23: £162k).

· Earnings per share of 1.04p (H1 FY23: 0.90p).

· Cash of £638k following payment of increased dividend and completion of

share buyback programme (H1 FY22: £691k).

· Net asset value (unaudited) of £3.5m (H1 FY23: £3.6m).

· Pro-forma net asset value (unaudited) per share of 32.2p, compared to a mid

-market share price as at market close on 29 September 2023 of 18.5p.

· Interim dividend declared of 0.75p per ordinary share.

Operational Highlights and Business Outlook

Whilst income for the first half of the financial year was approximately £28k

lower than at this stage in 2022, EBITDA for the same period rose by

approximately £12k. Overall, profitability was further boosted by £7.6k of bank

interest, compared with none for H1 last year. All subsidiaries made a

contribution to this improved performance and there is a breakdown of how each

part of the Group has performed provided later in this report.

The Group continued to respond to challenges caused by a shortage of skilled

professional staff, which is not unique to our subsidiaries, and seeks to

mitigate the cost pressures that this shortage is causing. The expectations of

fee-earning personnel in particular have risen markedly, and recruitment of

appropriately qualified staff at sustainable salary levels is proving difficult.

To mitigate this, we have had to increase the fees we charge for many of our

services and ensure that the quality of our service enables us to retain our

existing clients and to attract new contracts.

Although the UK retail sector is still under considerable pressure, our bias

towards more clients in the food sector has helped our Security Division. As

noted later in this report, the profitability of B2BSG Solutions at the halfway

stage represents a great improvement versus H1 2022, and management are

confident that the subsidiary can make a positive contribution over the

remainder of the year.

Across the Safety Division, combined sales were £28k below where they were at

this point in 2022 but EBITDA was circa £12k higher as a result of improved

margins. In last year's interim report, we noted that there had been a marked

improvement in the fortunes of RSA Environmental Health, which predominantly

sells into the education sector. This year we have to report that net profit

growth at this subsidiary was not replicated and fell below where it had been in

the corresponding period. Despite this, it will be seen that the Safety

Division as a whole performed better than before. This demonstrates the

strength of the Safety Division overall and the cyclic nature of its business.

In addition, a decline in the fortunes of one subsidiary can be offset by

improvement in another.

The Management Systems Division of the Group, QCS International, saw some

slippage in both revenue and EBITDA. The subsidiary is seeking to take on more

staff to assist with demand, as current personnel are already working to

capacity.

Looking to the remainder of the current year, the Board believes there are

plenty of opportunities for each of our three Divisions (safety, security and

management systems). With the recruitment of extra personnel of the right

calibre, we firmly believe we will be able to continue to deliver positive

outcomes for shareholders.

Dividend

Based on our projections that the Group will continue to have adequate and

growing cash reserves from trading activities, the Board has declared an interim

dividend of 0.75p per ordinary share to be paid on 12 January 2024 to those

shareholders on the register of members on 22 December 2023. This represents a

50% increase on the 0.5p interim dividend in the previous year.

Any recommendation by the Board for the payment of a final dividend will be

subject to the Group's full year performance, cash reserves, and the outlook at

that time and will be notified in due course.

Cash Flow

Cash at bank on 30 September 2023 stood at £0.638m compared to approximately

£0.7m at the same time last year. The figure shown is net of around £208k,

inclusive of costs, for the successful share buyback programme completed in

August 2023.

Despite no current expectation of having to call upon it, the Group has agreed

to renew its £50,000 banking facility with HSBC.

The cancellation of those shares previously bought back and initially held in

treasury has reduced the total cost of dividend payments. The Group has

sufficient cash reserves to service the proposed interim dividend and all

requirements arising in the normal course of business. There are no additional

calls on the Company's cash. It is noted that authority was obtained at the last

AGM for the Company to potentially undertake a further share buyback

programme(s), however, no decision has been taken on this matter at the present

time.

Discrete Performance by Trading Subsidiaries

Profit/loss figures for the individual subsidiaries below are stated before tax

and inter-company charges (including the costs of operating the parent plc which

are recovered through management charges levied on, and dividends received from,

trading subsidiaries), interest paid and received, depreciation and

amortisation.

Inspection Services (UK) Limited

Invoiced sales of £100,960 yielding a profit of £5,654 (H1 FY23: £95,620 and

£4,962).

Personnel Health and Safety Consultants Limited

Invoiced sales of £393,594 yielding a profit of £158,501 (H1 FY23: £423,253 and

£119,478).

RSA Environmental Health Limited

Invoiced sales of £161,109 resulting in a profit of £17,055 (H1 FY23: £174,625

and £32,767).

Quality Leisure Management Limited

Invoiced sales of £201,985 resulting in a profit of £70,279 (H1 FY23: £192,014

and £67,769).

QCS International Limited

Invoiced sales of £353,647 yielding a profit of £114,889 (H1 FY23: £408,894 and

£138,463).

B2BSG Solutions Limited

Invoiced sales of £439,920 resulting in a profit of £38,901 (H1 FY23: £384,340

and £2,825).

For further information please contact:

PHSC plc

Stephen KingTel: 01622 717 7000

Stephen.king@phsc.co.uk (https://www.investegate.co.uk/phsc-plc--phsc

-/prn/trading-update/20170526111953P8859/null)

www.phsc.plc.uk

Strand Hanson Limited (Nominated Adviser)Tel: 020 7409 3494

James Bellman/Matthew Chandler

Novum Securities Limited (Broker)Tel: 020 7399 9427

Colin Rowbury

About PHSC

PHSC, through its trading subsidiaries, Personnel Health & Safety Consultants

Ltd, RSA Environmental Health Ltd, QCS International Ltd, Inspection Services

(UK) Ltd and Quality Leisure Management Ltd, provides a range of health, safety,

hygiene, environmental and quality systems consultancy and training services to

organisations across the UK. In addition, B2BSG Solutions Ltd offers innovative

security solutions including tagging, labelling and CCTV.

Group Statement of Six months Six months Year

Comprehensive Income

ended ended ended

30 Sept 23 30 Sept 22 31 Mar 23

Note Unaudited Unaudited Audited

£'000 £'000 £'000

Continuing operations

Revenue 2 1,651 1,679 3,438

Cost of sales (758) (804) (1,613)

Gross profit 893 875 1,825

Administrative (743) (744) (1,525)

expenses

Other income - 1 3

Profit from operations 150 132 303

Finance income 8 - 1

Profit before taxation 158 132 304

Corporation tax (36) (26) (61)

expense

Profit for the period 2 122 106 243

after tax attributable

to owners of parent

Total comprehensive 122 106 243

income attributable to

owners of the parent

Basic and diluted 4 1.04p 0.90p 2.05p

earnings per share for

profit after tax from

continuing operations

attributable to the

equity holders of the

Group during the

period

Group Statement of Financial 30 Sept 30 Sept 22 31 Mar 23

Position 23

Unaudited Unaudited Audited

Note £'000 £'000 £'000

Non-current assets

Property, plant and equipment 3 492 462 468

Goodwill 2,235 2,235 2,235

Deferred tax asset 12 16 12

2,739 2,713 2,715

Current assets

Inventories 186 206 200

Trade and other receivables 686 660 674

Cash and cash equivalents 638 691 750

1,510 1,557 1,624

Total assets 2 4,249 4,270 4,339

Current liabilities

Trade and other payables 486 471 531

Right of use lease liability 30 23 25

Current corporation tax payable 92 81 57

608 575 613

Non-current liabilities

Right of use lease liability 27 14 26

Deferred taxation liabilities 62 62 62

89 76 88

Total liabilities 697 651 701

Net assets 3,552 3,619 3,638

Capital and reserves

attributable to equity holders

of the Group

Called up share capital 1,104 1,185 1,185

Share premium account 1,916 1,916 1,916

Capital redemption reserve 507 426 426

Merger relief reserve 134 134 134

Retained earnings (109) (42) (23)

3,552 3,619 3,638

Group

Statement of

Changes

in Equity

Share Share Merger Capital Treasury Retained Total

Capital

Premium Relief Redemption Shares Earnings

Reserve Reserve

£'000 £'000 £'000 £'000 £'000 £'000 £'000

Balance at 1 1,185 1,916 134 426 - (23) 3,638

April 2023

Profit for - - - - - 122 122

the period

attributable

to equity

holders

Purchase of (81) - - 81 - - -

own shares

Cancellation - - - - - (208) (208)

of treasury

shares

Balance at 1,104 1,916 134 507 - (109) 3,552

30 September

2023

Balance at 1 1,468 1,916 134 143 (645) 497 3,513

April 2022

Profit for - - - - - 106 106

the period

attributable

to equity

holders

Cancellation (283) - - 283 645 (645) -

of treasury

shares

Balance at 1,185 1,916 134 426 - (42) 3,619

30 September

2022

Group Statement of Cash Six months Six months Year

Flows

ended ended ended

30 Sept 23 30 Sept 22 31 Mar 23

Unaudited Unaudited Audited

£'000 £'000 £'000

Cash flows generated from

operating activities

Cash generated from 131 62 318

operations

Tax paid - - (55)

Net cash generated from 131 62 263

operating activities

Cash flows used in

investing activities

Purchase of property, (33) (2) (41)

plant and equipment

Disposal of fixed assets - - -

Interest received 8 - 1

Net cash used in investing (25) (2) (40)

activities

Cash flows used in

financing activities

Payments on right of use (10) (18) (4)

assets

Share buyback (208) - -

Dividends paid to Group - - (118)

shareholders

Net cash used in financing (218) (18) (122)

activities

Net (decrease)/increase in (112) 42 101

cash and cash equivalents

Cash and cash equivalents 750 649 649

at beginning of period

Cash and cash equivalents 638 691 750

at end of period

Notes to the cash flow

statement

Cash generated from

operations

Operating profit - 150 132 303

continuing operations

Depreciation charge 24 30 63

Goodwill impairment - - -

Loss on sale of fixed - - -

assets

Decrease/(increase) in 14 (20) (14)

inventories

Decrease in trade and 32 66 52

other receivables

Decrease in trade and (89) (146) (86)

other payables

Cash generated from 131 62 318

operations

Notes to the Interim Financial Statements

1. Basis of preparation

These condensed consolidated financial statements are presented on the basis of

International Financial Reporting Standards (IFRS) as adopted by the European

Union and interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC) and have been prepared in accordance with the

AIM Rules for Companies and the Companies Act 2006, as applicable to companies

reporting under IFRS.

The financial information contained in this announcement, which has not been

audited, does not constitute statutory accounts as defined by Section 434 of the

Companies Act 2006. The Group's statutory financial statements for the year

ended 31 March 2023, prepared under IFRS, have been filed with the Registrar of

Companies. The auditor's report for the 2023 financial statements was

unqualified and did not contain a statement under Section 498 (2) or (3) of the

Companies Act 2006.

The same accounting policies and methods of computation are followed within

these interim financial statements as adopted in the most recent annual

financial statements.

Impairment of goodwill

The Board has considered the carrying value of goodwill and is satisfied that

the assumptions made at the time of the last adjustment remain valid.

2. Segmental Reporting

Six Six Year

months months ended

ended ended

30 Sept 30 Sept 31 Mar

23 22 23

Unaudited Unaudited Audited

Revenue £'000 £'000 £'000

Security division: B2BSG 440 384 830

Solutions Ltd

Health & Safety division

Inspection Services (UK) 101 96 198

Ltd

Personnel Health & Safety 393 423 807

Consultants Ltd

Quality Leisure Management 202 192 402

Ltd

RSA Environmental Health 161 175 366

Ltd

857 886 1,773

Systems division: QCS 354 409 835

International Ltd

Total revenue 1,651 1,679 3,438

Profit/(loss) after

taxation, before management

charge

Security division: B2BSG 32 4 (3)

Solutions Ltd

Health & Safety division

Inspection Services (UK) 1 1 8

Ltd

Personnel Health & Safety 124 102 229

Consultants Ltd

Quality Leisure Management 59 56 116

Ltd

RSA Environmental Health 12 25 61

Ltd

196 184 414

Systems division: QCS 87 107 225

International Ltd

Holding company: PHSC plc (193) (189) (393)

Total Group profit after 122 106 243

taxation

30 Sept 23 30 Sept 22 31 Mar 23

Unaudited Unaudited Audited

Total assets £'000 £'000 £'000

Security division: B2BSG Solutions Ltd 525 178 466

Safety division

Inspection Services (UK) Ltd 89 97 68

Personnel Health & Safety Consultants Ltd 272 289 221

Quality Leisure Management Ltd 134 185 95

RSA Environmental Health Limited 575 619 565

1,070 1,190 949

Systems division: QCS International Ltd 205 395 242

Holding company: PHSC plc 3,038 3,270 3,216

4,838 5,033 4,873

Adjustment of goodwill (591) (765) (536)

Adjustment of deferred tax 2 2 2

Total assets 4,249 4,270 4,339

3. Property, plant and equipment

30 Sept 23 30 Sept 22 31 Mar 23

Unaudited Unaudited Audited

£'000 £'000 £'000

Cost or valuation

Brought forward 969 928 928

Additions 48 2 41

Disposals - - -

Carried forward 1,017 930 969

Depreciation

Brought forward 501 438 438

Charge 24 30 63

Disposals - - -

Carried forward 525 468 501

Net book value 492 462 468

4. Earnings per share

The calculation of the basic earnings per share is based on the following data.

Six months Six months Year ended

ended ended

30 Sept 23 30 Sept 22 31 Mar 23

Unaudited Unaudited Audited

£'000 £'000 £'000

Earnings

Continuing activities 122 106 243

Number of shares 30 Sept 23 30 Sept 22 31 Mar 23

Weighted average number of shares for 11,713,776 11,847,019 11,847,019

the purpose of basic earnings per

share

- ENDS -

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/phsc-plc/r/half-year-report,c3876933

END

(END) Dow Jones Newswires

November 16, 2023 02:00 ET (07:00 GMT)

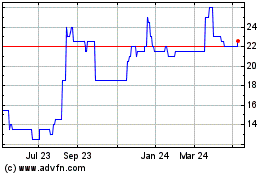

Phsc (LSE:PHSC)

Historical Stock Chart

From Oct 2024 to Nov 2024

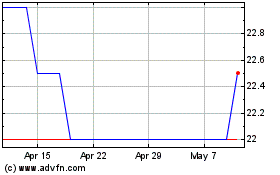

Phsc (LSE:PHSC)

Historical Stock Chart

From Nov 2023 to Nov 2024